Investing in Commodities UK

After a decade in the doldrums, commodity prices are once again outperforming other asset classes. Commodity prices typically follow very long cycles, sometimes lasting as long as 30 years.

How to Invest in Commodities UK Tutorial

These days investing in commodities, UK commodity shares, and ETFs is a lot easier than it used to be. In fact, with the following steps you can learn how invest in commodities UK in a few minutes:

- Choose a Commodities Broker: First, you need to choose a broker with a broad range of commodities.

- Open an Account: You can set up your account in a few minutes by entering a few personal details.

- Fund your account: There are several ways to fund your trading account, including credit/debit card, e-wallet, and bank transfer.

- Invest in commodities: Once your account is funded you can select any of the commodities on the platform.

Choose a Commodities Investment Platform

Choosing the right trading platform is the first decision you will need to make before you can invest in oil, gold, and other commodities. It’s a particularly important step when it comes to commodities as the range of commodity markets available varies considerably from one platform to the next. These are two of the most popular platforms we have found to invest in commodities in the UK.

1. eToro

eToro is a multi-asset trading platform. You can trade stocks, currencies, cryptocurrencies, and of course commodities. The platform is unique in that you can opt to trade underlying instruments or CFDs on those instruments. eToro is a zero-commission broker, and instead charges via the bid-offer spread.

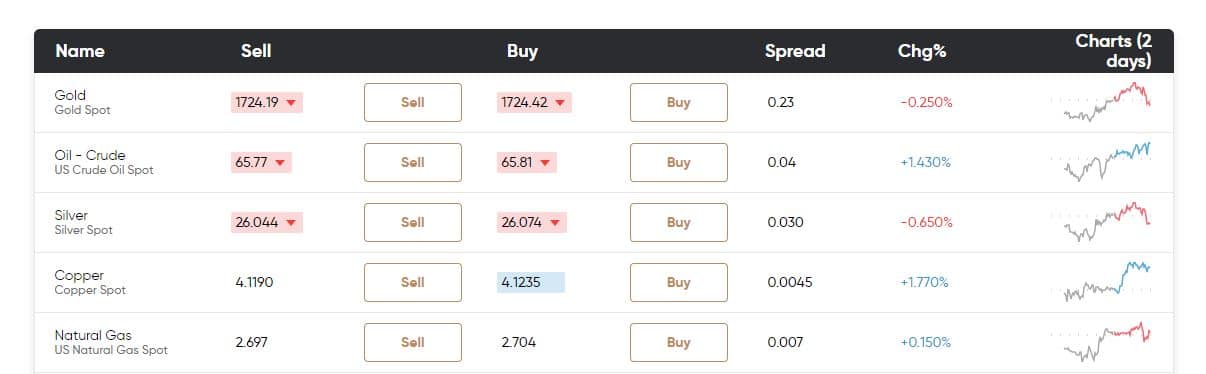

A lot of trading platforms have a focus on forex and list just a few commodities. If you want to invest in commodities you will be looking for a wider range, which eToro provides. In fact, you can choose from at least seven metals, two energy products, and six soft commodities. In the case of commodities, the instruments are CFDs on the underlying commodity or on the price of the commodity futures contract.

Sponsored ad. 68% of retail investor accounts lose money when trading CFDs with this provider. Your capital is at risk.

eToro also offers share trading in the shares of commodity-producing companies like gold miners and oil producers. In addition, the platform offers several ETFs that hold physical commodities and mining shares. If you invest in shares and the most popular commodity ETFs, you have the choice of buying the underlying share or making use of leverage and short selling, you can trade CFDs on the underlying shares.

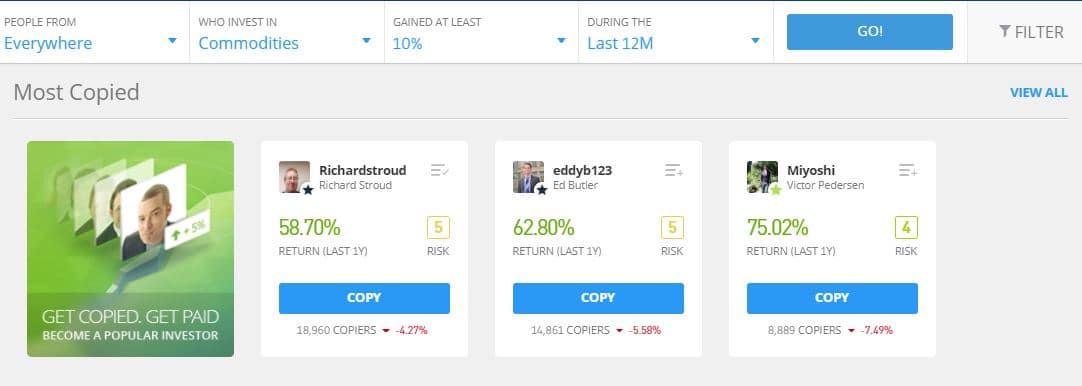

eToro is well known for its social trading tools. You can learn from other traders, share ideas and even copy the trades of experienced traders, after reviewing their performance, by using the Copy Trading tool.

If you are buying shares or ETFs you can start trading with as little as $50. For commodity investments, the minimum value for each trade is $1,000. This would require a margin of between $100 and $1,000 depending on the amount of leverage you choose.

Sponsored ad. 68% of retail investor accounts lose money when trading CFDs with this provider. Your capital is at risk.

In terms of fees, eToro does not charge commission and is known for its competitive spreads. There are also no fees for deposits and withdrawals. eToro is registered with and regulated by, the FCA in the UK and CySEC in Cyprus. These are the leading regulatory bodies in each country.

eToro has a proprietary browser-based web platform and apps for mobile devices. You can also connect to the broker using the popular Metatrader4 platform. If you want to learn more about trading and investing, eToro also offers an extensive number of tutorials. In addition, there’s a mobile app, Investmate, to help you learn more about investing wherever you are.

As a purely CFD broker, eToro does not offer the option of investing in underlying assets. However, for anyone wanting to trade commodities using CFDs, eToro is a solid choice. Remember, CFDs allow you to go long and short, and to use leverage – so they give you flexibility.

67% of retail investor accounts lose money when trading CFDs with this provider.

Research Commodities Investment

When we define a commodity, we are talking about an asset class with two unique characteristics. Firstly, commodities are naturally occurring or agriculturally produced products. And secondly, commodities are fungible, meaning one quantity of a commodity is the same as another quantity of the same commodity.

Commodities, which are also known as resources are the raw materials used to manufacture almost any physical product. This means there is an ongoing demand for them, while supply is constrained in several ways. Commodities like metals and oil exist in finite quantities and become more expensive to extract as reserves are depleted. Agricultural commodities can be produced, but doing so requires land, water and other resources.

Types of Commodities

There are three types of commodities:

- Energy commodities include crude oil, natural gas, other types of oil, and coal.

- Hard commodities include precious metals like gold, ferrous metals, base metals like copper, and other minerals.

- Agricultural or soft commodities include crops like corn and cotton, livestock, and timber.

The commodity market is very diverse and there are lots of ways to invest in them. Commodity investments can be divided into three categories – physical commodities, financial products, and the shares of commodity-producing companies.

Physical commodities are the actual commodities. Investing in physical commodities comes with a number of challenges like storage, transport, and insurance.

Financial products and derivatives are based on the price of physical commodities. Examples are futures, CFDs, options, and exchange-traded funds (ETFs). These products are relatively simple to invest in and provide direct exposure to the prices of commodities. Financial products are available on all the popular commodities to invest in and eliminate the hassle of dealing with physical commodities.

Commodity producers are companies that explore new reserves, extract commodities from the earth, or process and distribute the commodities. Examples are BP shares and Rio Tinto shares. These companies tend to provide geared exposure to the underlying commodity price as their costs are fixed, while income is directly affected by commodity prices.

Fundamentals of Commodities

Commodities have some unique qualities that complement other asset classes. It’s worth knowing these qualities when investing in commodities UK.

- Commodity prices are closely associated with economic growth. When the economy grows, more commodities are needed. So, commodity prices rise and fall with the expectation for economic growth.

- Commodities are cyclical. While demand for commodities is closely linked to economic growth, the supply of commodities is closely related to their prices. When prices rise, producers increase their capacity to take advantage of the higher prices. This eventually leads to oversupply, causing prices to fall. Producers then reduce capacity and production, which ultimately results in the cycle beginning again. These cycles result in strong trends which are good for momentum investors and trend followers. Some commodity trends can last for 15 years or more.

- Commodities can be hedges against inflation. Physical assets like commodities and real estate are less vulnerable to inflation than financial assets like currencies and shares. This makes commodities one of the most popular hedges against inflation. A portfolio of commodities can offset rising prices that affect your day-to-day life. Gold can be a hedge against inflation and stock market volatility as the gold price often rises when stocks fall.

These characteristics make commodities valuable tools for short-term traders and long-term investors alike. Traders can follow short to medium term trends to make a profit. Long term investors use commodities to diversify portfolios.

Popular Commodities to Invest In

The most popular commodities are those that are very liquid (i.e. lots of people trade them) and relatively easy to understand. Some commodities like livestock and certain crops require specialized knowledge, so it’s best to start out by investing in gold, oil, and other bigger markets.

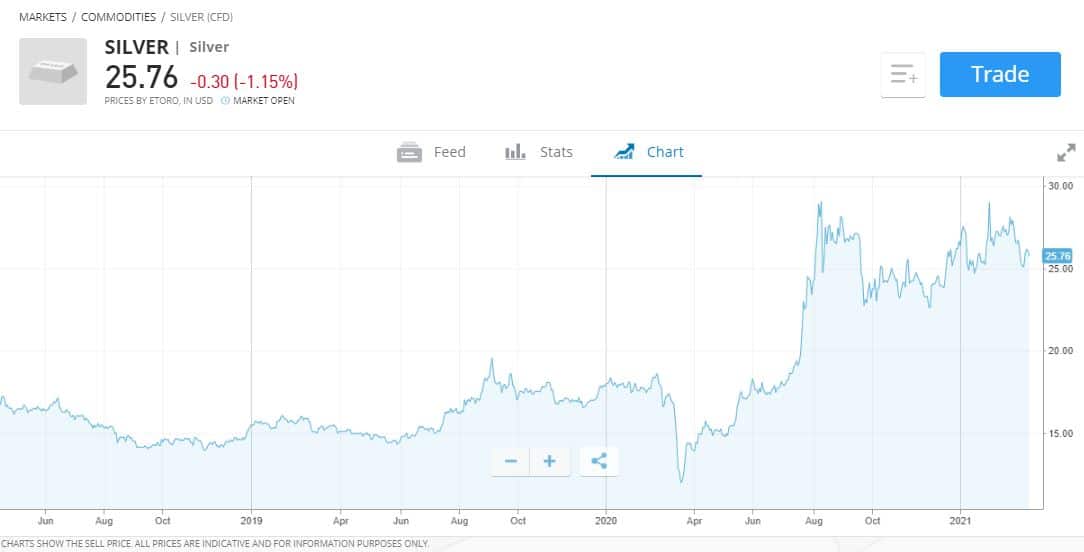

Gold and Silver

Gold and silver are unique in that they are commodities but are sometimes viewed as currencies too. They are regarded as a store of value, and therefore a hedge against inflation which causes other currencies to lose value over time. Gold is also regarded as some investors as a safe haven during periods of volatility and uncertainty.

Besides investing in physical gold, you can also invest in gold by buying shares of gold-producing companies like Newmont Mining Corp or Barrick Gold. The best gold stocks often outperform the gold price by a substantial margin when the gold price rises. Similarly, you can also invest in silver via stocks and ETFs, as well as by trading the actual commodity itself.

Oil

Oil has fueled the global economy for the last 150 years, and while the world is looking for alternatives, oil is likely to remain important for some time to come. In 2020 the price of oil plummeted when traveling restrictions and lockdowns. When investing in oil you will either be trading the Brent Crude price which is the UK benchmark, or the WTI (West Texas) price which is the US benchmark.

One of the factors that affect the oil price is the production levels set by OPEC. Oil trading is closely linked to the futures market, and contracts with different expiry date trade at different prices.

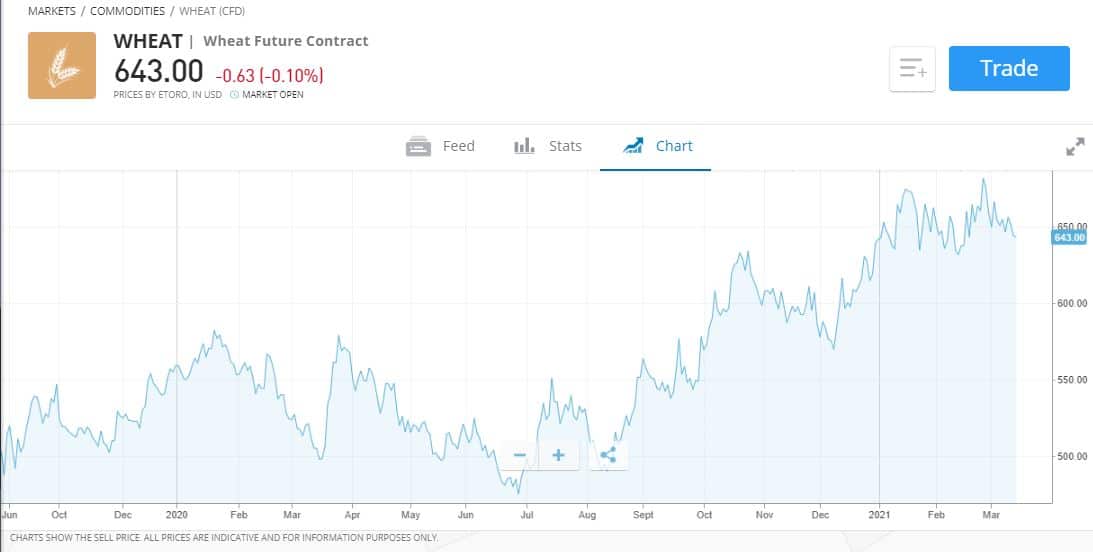

Soft commodities

The most widely traded soft commodities are grains like wheat, corn, and soybeans. These crops have shorter cycles than metals and energy products, with the weather during each growing season playing an important role. Investing in soft commodities requires more specialized knowledge, but it’s worth spending some time researching these markets.

Commodity ETFs

If you want to spread your commodity investments across a basket of different assets, there are several ETFs to research.

- The SPDR Gold ETF (GLD) only holds physical gold.

- The VanEck Vectors Gold Miners ETF (GDX) is a fund that holds positions in the largest gold mining companies in the world. In total, the fund holds 51 different stocks which are weighted according to their market capitalization.

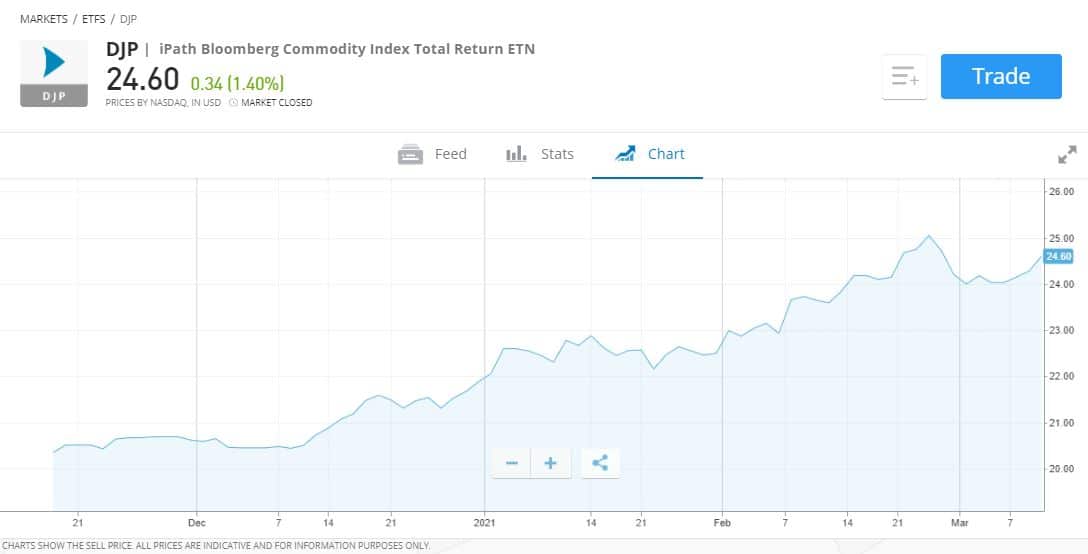

- The iPath Bloomberg Commodity Index Total Return ETN (DJP) is an exchange-traded note that holds most commodities. The largest holdings are oil, natural gas, soybeans, and gold, and another 19 commodities are also included. As an ETN, the fund is exposed to futures contracts rather than physical commodities.

Conclusion

Market analysts are suggesting a global economic recovery is starting to take shape and a new bullish trend is beginning for commodity markets. Stocks have enjoyed a 10-year bull market.

Sponsored ad. 68% of retail investor accounts lose money when trading CFDs with this provider. Your capital is at risk.

FAQs

What Commodities Can You Trade in the UK?

What affects the price of commodities?