Best Small Investments UK to Watch

In this guide, we explore some popular small investments in the UK. Each and every financial asset that we discuss can be purchased online at a regulated brokerage site with an upfront investment.

-

-

10 Small Investments for 2022

Check out the list below to see 10 popular small investments based on trading volumes:

- Stock

- ETFs

- Mutual Funds

- Index Funds

- iShares Core US REIT

- Cryptocurrencies

- Tesla

- UK Savings Accounts

- Vanguard Total Bond Market ETF

- iShares Treasury 20+ Year Index

1. Stock Markets

The London Stock Exchange – which is home to some of the UK’s biggest companies. Think along the lines of British American Tobacco, HSBC, BP, BT, and GlaxoSmithKline. You also have the Alternative Investment Market (AIM), which is the UK’s secondary exchange. This includes smaller companies or those that are yet to establish themselves.

Outside of the UK, there are dozens of markets that you can access from the comfort of your home. In particular, this includes the two major markets found in the US – the NASDAQ and New York Stock Exchange. This covers companies such as Apple, Amazon, Facebook, Disney, Nike, Twitter, and Coca Cola.

Now, irrespective of which stock exchange you wish to target, shares can be purchased on a fractional basis.

2. ETFs

Even if you’re new to the online investment scene, you have likely come across the term ‘diversification’. In a nutshell, this refers to the process of building an investment portfolio that contains heaps of different assets. Not only this, but your chosen assets must cover a variety of markets, economies, and risks.

The main objective of the ETF is to track a specific area of the financial markets.

This might include:

- Blue-chip stocks

- Dividend stocks

- Emering market stocks

- Emerging market bonds

- Corporate bonds

- Government bonds

- Commodities like gold and silver

- Index funds (see the below)

3. Mutual Funds

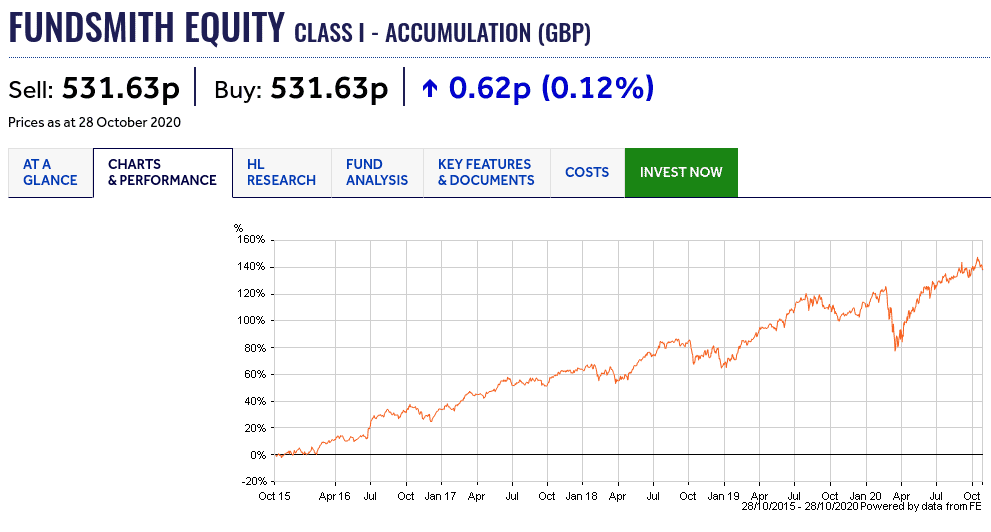

Mutual fund providers have access to vast resources. This ensures that it has the financial means to access any market of its choosing.

In terms of choosing a mutual fund to invest in, this is the only part of the process that requires an element of research. After all, there are hundreds of mutual funds active in the space – many of which can be accessed from the UK online.

Sponsored ad. Your capital is at risk.

4. Index Funds

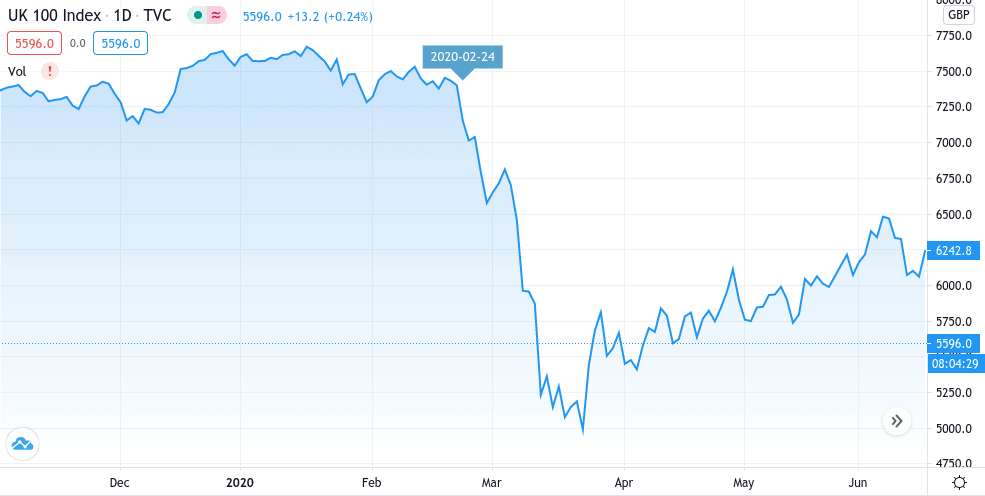

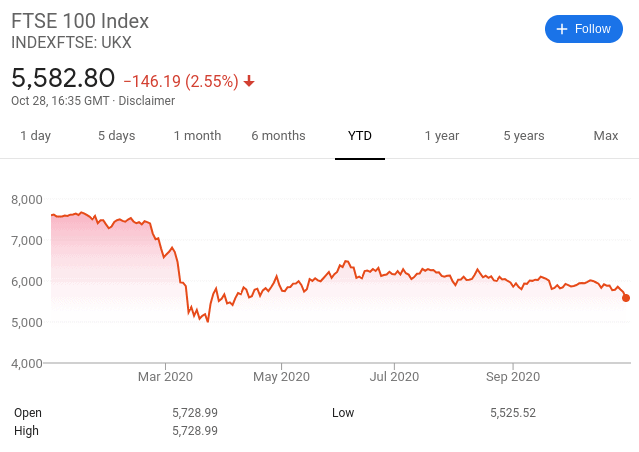

The FTSE 100 is the UK’s primary index as it tracks the largest 100 companies listed on the London Stock Exchange. Then you have the likes of the Dow Jones, which tracks 30 large-cap companies in the US from a variety of sectors.

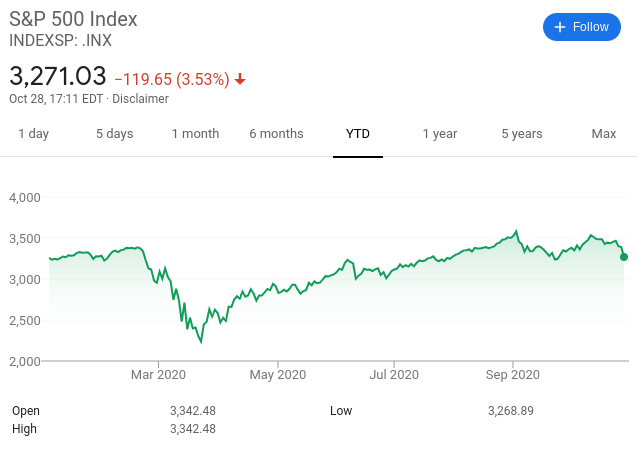

The S&P 500is the world’s largest stock index. It contains 500 large US companies and it is a way to gauge the strength of the wider American economy. Since this index was officially launched way back in 1926, it has returned average gains of 10% per year.

For example, the S&P 500 started the year at 3,257 points. As per the wider impact of COV-19, the index hit lows of 2,237 points in March.

This is in stark contrast to the FTSE 100 which is still valued well below pre-pandemic levels. In fact, the FTSE is 23% down as of early November 2020.

5. iShares Core U.S. REIT

Real estate investment trusts (REIT) are financial products offered by large-scale institutions. The provider in question will pool investor funds together to purchase properties. The REIT will specialize in a particular area of the real estates space – such as commercial, residential, retail, or healthcare.

Either way, you can access this market by making small investments into a REIT ETF online.

In terms of researching a REIT to make small investments, there are many options on the table. With that said, one popular REIT in the market right now is that of the iShares Core U.S. REIT ETF. This gives you the opportunity to invest in the US housing market from the UK.

Some of the main holdings found in the iShares Core U.S. REIT ETF are as follows:

- PROLOGIS REIT INC

- EQUINIX REIT INC

- DIGITAL REALTY TRUST REIT INC

- PUBLIC STORAGE REIT

- WELLTOWER INC

- REALTY INCOME REIT CORP

- AVALONBAY COMMUNITIES REIT INC

- ALEXANDRIA REAL ESTATE EQUITIES RE

- SIMON PROPERTY GROUP REIT INC

6. Cryptocurrencies

At the time of writing, there are a number of exciting new crypto projects that could prove to be excellent investments. In particular, the Chimpzee project is a great new crypto token to watch. The project has recently launched a presale event during which invest can purchase tokens for a very low price and it is selling out quickly.

Chimpzee is appealing because it is a sustainable crypto that will donate a portion of all profits to environmental charities. Furthermore, the platform will provide users with 4 different ways to earn passive income and generate real value for their initial investment.

Your capital is at risk.

7. Tesla

The US eclectic car marker has defied the realms of possibility in 2020 – with the value of its stocks increasing by 400%. Not only is this uncanny when you think of the sheer decline in consumer demand for cars this year, but Tesla’s primary US plant closed for several months during the wider lockdown measures.

Even more interesting is that the stock is now trading at a staggering price-to-earnings ratio of over 804 times. Taking all of this into account, Tesla is now the largest car market globally – outpacing established players like Ford and Toyota by some distance. We should also note that Tesla recently initiated its first-ever stock split at an offering of 5-for-1.

8. UK Savings Accounts

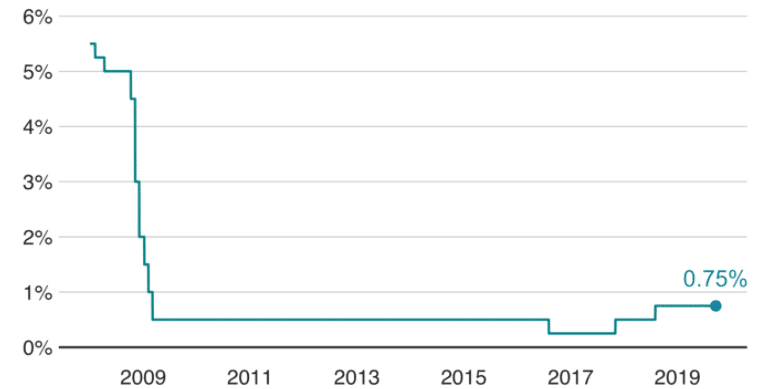

Savings accounts allow you to invest really small amounts.

This means that you can inject a few pounds here and there with the view of building a pot over the course of time. However, the amount of money that you will be able to earn from a savings account investment is minute. In fact, you will be lucky to get more than the current rate of UK inflation.

You then have the likes of Natwest and RBC – which both claim to offer accounts that pay a very generous interest rate of 3.04% annually. But, you only can invest a maximum of £50 per month. Anything over and above this and you will revert back to the standard rate of sub-1%.

Sponsored ad. Your capital is at risk.

9. Vanguard Total Bond Market ETF

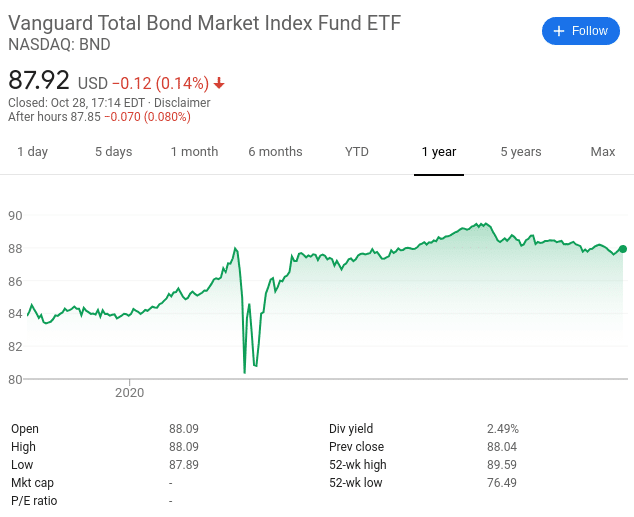

Bonds are hugely popular with seasoned investors for many reasons. Firstly, bonds always come with a fixed rate of interest. In addition to this, bonds distribute payments every 3 or 6 months. This allows you to reinvest your coupon payments into other investments.

Fortunately, if you are interested in gaining exposure to bonds, there is a workaround to this in the form of an ETF. As we uncovered earlier, the ETF will buy and sell assets on your behalf. In this case, it will be a range of different bond types. One popular type of small bond investments available in the UK is that of the Vanguard Total Bond Market ETF.

The Vanguard Total Bond Market ETF is particularly interesting because the fund provider will rarely hold on to its bond instruments until maturity. Instead, the provider will look for short-to-medium trading opportunities. You will, however, still get your share of coupon payments. This is distributed by Vanguard on a quarterly basis.

10. iShares Treasury 20+ Year Index

US Treasuries are bonds issued by the US government. If for whatever reason the US government does not have the required cash flow to meet its bond payments, it can simply borrow more money from the Treasury.

With this in mind, investors will often flock to US Treasuries during times of economic uncertainties. The overarching purpose of the ETF is to track the current yield of long-term US government bonds.

In the 12 months prior to writing this article, the iShares Treasury 20+ Year Index has grown by over 17%.

Sponsored ad. Your capital is at risk.

Platforms Offering Small Investments

If you’re based in the UK and wish to make small investments from the comfort of your home, you are going to need to find a online broker. Not only does your chosen broker need to offer your preferred financial asset, but it needs to support small investments.

1. XTB

XTB is a popular UK stock broker that offers trading on more than 2,100 shares and ETFs – all 100% commission-free. Furthermore, spreads at this broker start at just 0.015% for US-listed stocks, making it one of the cheapest options available for UK traders. XTB doesn’t require a minimum deposit to get started and the broker doesn’t charge deposit or withdrawal fees.

XTB’s custom-built stock trading platform – xStation 5, is also available for the web and mobile devices and it comes packed with research tools. You’ll find technical charts and dozens of studies to start, plus a market news feed that includes actionable trade ideas with annotated price charts. The platform also has a market sentiment gauge which allows users to easily see what other traders think about where a stock’s price is headed.

XTB’s platform also includes a stock and ETF screener, which can be really useful for traders. With this tool, users can easily scan the market for stocks that are taking off or that seem poised for a fall. Using the screener, it’s possible to create watchlists and narrow down your search to find better trading opportunities.

XTB is regulated by the UK FCA and CySEC and offers negative balance protection for all traders. In addition, the broker offers customer support by phone, email, and live chat, available 24/5.

76% of retail CFD accounts lose money.

2. AvaTrade

AvaTrade is a UK CFD broker that offers 0% commission trading on over 600 global stocks. The platform also carries dozens of exchange-traded funds (ETFs), stock indices, commodities, and forex pairs for trading. Notably, AvaTrade also offers trading on forex options – but it doesn’t offer stock options at this time.

AvaTrade has a few different trading platforms you may use to trade stocks. Like Pepperstone, this broker gives all traders access to MetaTrader 4 and 5.

Alternatively, the AvaTrade web trading platform and AvaTradeGO platform are available on iOS and Android devices as well . You get watchlists, a market news feed, and dozens of technical studies. On mobile devices, users can access full-screen charts and enter orders with just a few taps.

AvaTrade also has its own social trading app for iOS and Android, called AvaSocial. Although this isn’t integrated into AvaTradeGO, it’s simple to switch back and forth between sharing ideas and setting up trades. AvaSocial also enables copy trading, so you have the ability to mimic the portfolios of more experienced stock traders in just a few taps.

AvaTrade is regulated by the UK FCA and Australia’s ASIC. The platform requires a $100 minimum deposit to open an account and you may pay by credit card, debit card, or bank transfer. AvaTrader offers 24/5 customer service.

Your capital is at risk.

3. FP Markets

FP Markets is a highly regarded online forex and CFD broker known for its comprehensive trading solutions and customer-centric approach. Established in 2005, FP Markets has built a reputation for providing an extensive range of trading instruments, including forex, indices, commodities, and cryptocurrencies, which cater to a diverse range of trading preferences.

One of FP Markets’ standout features is its commitment to offering competitive pricing with tight spreads, ensuring that traders can maximize their profits. The broker also supports various trading platforms, such as MetaTrader 4, MetaTrader 5, and IRESS, allowing traders to choose the platform that best suits their trading style and needs.

FP Markets strongly emphasizes education and resources, providing traders with access to a wealth of educational materials, webinars, and market analysis. This dedication to trader education helps both beginners and experienced traders enhance their trading skills and make informed decisions.

Customer support at FP Markets is highly responsive and available 24/5, ensuring that traders receive prompt assistance whenever needed. Additionally, the broker is regulated by top-tier authorities like ASIC and CySEC, providing traders with a sense of security and trust.

In summary, FP Markets stands out as a reliable and versatile broker. It offers a robust trading environment supported by competitive pricing, excellent educational resources, and top-notch customer service.

Your capital is at risk

4. Pepperstone

Pepperstone is a popular UK stock brokers for traders who want to use MetaTrader 4 or 5. These popular trading platforms offer unparalleled tools for technical analysis, including the ability to create custom technical studies. You may also backtest trading strategies against historical price data to see how they are likely to perform.

This broker also offers a few extra tools that are built specifically for MetaTrader. For example, there’s a correlation heatmap so investors will be able to see whether the stocks you’re invested in typically move at the same time. There’s also an alarm management tool that lets you create custom alerts based on price changes, trading volume, and more.

Pepperstone carries thousands of share CFDs from the US, UK, Europe, and Australia. The broker’s charges vary based on the market you’re trading – US shares trade commission-free, while UK shares carry a 0.10% commission. So, this broker can be slightly more expensive than some of its peers.

Pepperstone is regulated by the UK FCA and the Australian Securities and Investments Commission (ASIC). The platform doesn’t require a minimum deposit to open an account, which is a major plus if you’re not ready to commit hundreds of pounds to trading just yet.

Your capital is at risk.

5. PrimeXBT

PrimeXBT is an innovative stock broker that caters to a diverse range of traders, from beginners to seasoned professionals. Known for its versatility and user-friendly interface, the platform offers an array of features designed to enhance the trading experience across multiple asset classes.

One of the standout aspects of PrimeXBT is its wide range of available markets. Users can trade in cryptocurrencies, forex, commodities, and indices all from a single account. This flexibility allows traders to diversify their portfolios and take advantage of different market opportunities without needing to switch between platforms.

PrimeXBT offers a suite of trading tools and advanced charting options to help traders make informed decisions. The platform integrates customizable indicators, drawing tools, and multiple timeframes, enabling users to tailor their charts to suit their individual trading strategies. Additionally, PrimeXBT provides leverage trading options, which can amplify potential profits for experienced traders.

The platform’s trading interface is sleek and intuitive, designed to make navigating the markets straightforward. Opening, managing, and closing trades can be done with ease, while the performance of live trades can be tracked in real-time. PrimeXBT also offers an innovative feature known as Covesting, which allows users to follow and replicate the trades of successful strategy managers, providing an educational and potentially profitable experience.

PrimeXBT also prioritizes the security and privacy of its users. The platform employs industry-standard security measures to safeguard user accounts and data, such as two-factor authentication and encryption. Customer support is available to assist traders with any queries they may have, ensuring a smooth and reliable trading experience.

In summary, PrimeXBT stands out as a comprehensive trading platform offering a variety of markets, robust tools, and an easy-to-use interface. Its emphasis on security, diverse asset offerings, and innovative features like Covesting make it an excellent choice for traders looking to explore and capitalize on global market opportunities.

Your capital is at risk.

6. Admiral Markets

Admiral Markets is a globally recognized online trading broker known for its comprehensive range of financial instruments and user-friendly platforms. With a presence in over 40 countries, the company has built a strong reputation for providing a reliable and secure trading environment for both beginner and experienced traders.

One of the standout features of Admiral Markets is its extensive selection of trading instruments, including Forex, stocks, commodities, indices, and more. This variety allows traders to diversify their portfolios and explore different markets with ease. The broker offers competitive spreads and flexible leverage options, catering to various trading styles and strategies.

Admiral Markets is also praised for its robust platforms, particularly MetaTrader 4 and MetaTrader 5, which are equipped with advanced charting tools, technical indicators, and automated trading capabilities. These platforms are available on both desktop and mobile devices, ensuring seamless trading experiences across all devices.

The broker places a strong emphasis on education, providing a wealth of resources such as webinars, tutorials, and market analysis to help traders make informed decisions. Additionally, Admiral Markets is regulated by several reputable financial authorities, ensuring a high level of trust and transparency.

Overall, Admiral Markets stands out as a top-tier broker, offering a comprehensive trading experience supported by excellent customer service and innovative tools.

Your capital is at risk

7. Trade Nation

Trade Nation is a well-established stock broker known for its reliability and comprehensive range of services. As an FCA regulated broker, traders can trust that their investments are in safe hands. Trade Nation offers a diverse selection of trading options, including stocks, CFDs, spread betting, and forex trading. One of the standout features of Trade Nation is its commitment to providing low-cost fixed spreads, starting from an impressive 0.6 pips for CFDs, ensuring traders can navigate the markets without any surprise fees.

In addition to its impressive range of services, Trade Nation offers compatibility with popular trading platforms, including MetaTrader 4 (MT4) and TN Trader. MetaTrader 4 is renowned for its user-friendly interface and advanced charting capabilities. It is a preferred choice for many traders due to its extensive range of technical indicators, customizable charts, and automated trading options through Expert Advisors (EAs). With Trade Nation’s integration of MT4, traders can access a seamless trading experience with all the familiar features they rely on for their trading decisions.

Trade Nation has developed its proprietary trading platform, TN Trader, catering to traders who prefer a platform tailored to the broker’s offerings and user experience. TN Trader boasts a user-friendly interface and is equipped with a suite of tools, including advanced charting, analysis tools, and real-time market data. It is an excellent option for traders who prefer a platform specifically designed to complement Trade Nation’s services and trading conditions.

Trade Nation also provides regulated signals software that can be used to guide stock trading decisions. As well as this, users can also access a variety of educational resources and analysis tools that can be used to improve trading strategies and make informed stock trading decisions. Users can practice different strategies with the free demo account.

75% of retail investor accounts lose money when trading CFDs with this provider.

8. IG

IG is a UK trading site in the market for those that wish to gain access to heaps of different investment classes. Its share dealing department contains more than 12,000+ assets, including but not limited to stocks, ETFs, mutual funds, and index funds. Although the minimum investment at this platform is slightly higher at £250, you can invest much less per asset.

The exact amount will vary depending on the market. IG is also useful for making small investments as it allows you to place your assets into a Stocks and Shares ISA. In terms of fees, you will pay £8 per trade at IG. But, by making 3 or more trades per month you can reduce this to £3. The broker is regulated by a number of tier-one bodies, including the FCA. You can fund your account instantly with a debit/credit card.

Sponsored ad. Your capital is at risk.

9. IUX.com

IUX.com is a forex broker designed to empower traders of all experience levels. They offer a comprehensive suite of trading tools, including a wide range of instruments, flexible account types, and the industry-standard MT5 platform. This combination allows you to tailor your trading experience and pursue opportunities across the forex market.

IUX.com boasts competitive spreads, a key factor for maximizing your profit potential. They also advertise high leverage, which can amplify gains (and losses) for experienced traders comfortable with calculated risks. The MT5 platform is a user-friendly and powerful tool, providing advanced charting functionalities and a robust set of technical indicators to help you make informed trading decisions.

IUX.com understands that every trader has unique needs. That’s why they offer a variety of account types, allowing you to select the option that best suits your capital and trading style. This level of flexibility ensures you can enter the market with confidence, knowing your account is set up for your specific goals.

If you’re looking for a forex broker that prioritizes your trading experience, IUX.com is definitely worth considering. Their diverse platform, competitive offerings, and focus on trader empowerment make them a compelling choice for those seeking to navigate the forex market.

Your capital is at risk.

10. Fineco Bank

Italian financial institution Fineco Bank recently entered the UK stock broker scene. It allows you to purchase and sell shares in a super-competitive manner at just £2.95 per trade. This is also the case for ETFs. If you’re looking to add some international shares to your portfolio, Fineco Bank gives you access to heaps of foreign markets.

Fineco Bank is also popular with UK investors as it allows you to get started with a small investment of £100. If you do feel comfortable investing on a DIY basis, Fineco Bank offers multiple research tools and ongoing market commentary.

When it comes to safety, Fineco Bank is heavily regulated. Your funds are protected by the FSCS and the broker holds that all-important FCA license

Commission Starting from £0 commission on FTSE100, US and EU Shares CFDs, market spread only and no additional markups. Deposit fee Free Withdrawal fee $0 Inactivity fee None Account fee None Minimum deposit £0 Stocks markets Access to 13 stock markets Tradable assets CFDs, Forex, Commodities, Stocks and ETFs, indices, mutual funds, bonds, options, futures, Available Trading Platforms Web-based trading platform, mobile trading app, desktop trading platform Your capital is at risk.

What are Small Investments?

As the name implies, small investments are simply financial assets that allow you to invest small amounts. In a time not so long ago, this was reserved to just a few options. Think along the lines of savings accounts, premium bonds, and other low-level investments.

This was because brokerage firms would only sell stocks and bonds in minimum ‘lot’ sizes. For example, a lot of shares might consist of 1,000 stocks, making it unviable for the average Joe. Bonds were even more costly to access. However, with the evolution of online trading platforms came something called ‘fractional ownership’.

As we have mentioned throughout this guide, this allows you to invest by only buying a fraction of your chosen asset. For example, if a single Amazon stock costs $3,000 but you only invest $300, you effectively own 10% of one stock.

Fundamentals of Small Investments

Some investors in the UK know that they want to invest, but they don’t know where to put their money. This is because there are thousands of financial assets to choose from in the online space.

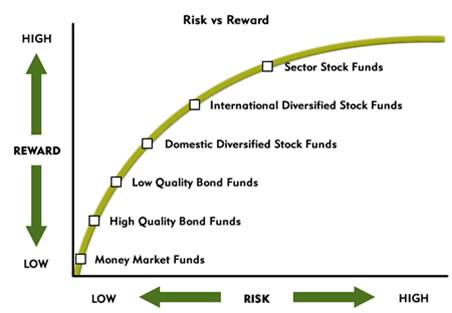

Risk and Reward

Each and every financial instrument has a risk vs reward ratio. Put simply, this means that the higher the potential returns of the asset, the more risk that you will need to take. At the lower end, the likes of government bonds and savings accounts come with the lowest risk.

In turn, the amount you can make on your small investment is going to be tiny. If much higher returns on your small investments are what you seek, then you’ll need to look at other assets.

Current Market Price

Before making small investments into the financial markets, you need to look at the asset’s current market value. One way to gauge this is to look at the health of the wider markets. For example, with the odd exception, stocks made double-digit losses in the month of March.

This was a result of the fear associated with the pandemic. But, a lot of stocks bottomed out, subsequently going on an upward trajectory that in some cases, is still ongoing.

Income or Growth

For example, some UK investors are happy to leave their assets growing over more years. In doing so, they hope to sell the asset for significantly than they paid. This is known as capital gains. On the other hand, some investors seek a more consistent, regular flow of income.

This might come via dividend stocks or a basket of bonds.

Conclusion

Thanks to the age of digitization in online stock brokers, it is now possible to make small investments into a range of financial markets.

This includes everything from stocks and bonds, to ETFs and mutual funds.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

FP Markets is a highly regarded online forex and CFD broker known for its comprehensive trading solutions and customer-centric approach. Established in 2005, FP Markets has built a reputation for providing an extensive range of trading instruments, including forex, indices, commodities, and cryptocurrencies, which cater to a diverse range of trading preferences.

FP Markets is a highly regarded online forex and CFD broker known for its comprehensive trading solutions and customer-centric approach. Established in 2005, FP Markets has built a reputation for providing an extensive range of trading instruments, including forex, indices, commodities, and cryptocurrencies, which cater to a diverse range of trading preferences.

Italian financial institution Fineco Bank recently entered the UK stock broker scene. It allows you to purchase and sell shares in a super-competitive manner at just £2.95 per trade. This is also the case for ETFs. If you’re looking to add some international shares to your portfolio, Fineco Bank gives you access to heaps of foreign markets.

Italian financial institution Fineco Bank recently entered the UK stock broker scene. It allows you to purchase and sell shares in a super-competitive manner at just £2.95 per trade. This is also the case for ETFs. If you’re looking to add some international shares to your portfolio, Fineco Bank gives you access to heaps of foreign markets.