Best ARK ETF UK To Watch

ARK’s range of innovative ETFs has taken the market by storm, producing returns that far exceed many market indices. Through smart investments in innovative technologies, ARK ETFs are being used as a way to diversify funds as well.

This guide will review some of the popular ARK ETFs UK and also review some of the popular platforms that allow users to begin investing in this asset class.

Popular ARK ETF UK 2022 List

The list below highlights eight popular ARK ETFs available in the markets. In the section that follows, we will discuss each of these ETFs in detail.

- ARK Innovation ETF ]

- ARK Fintech Innovation ETF

- ARK Next Generation Internet ETF

- ARK Genomic Revolution ETF

- ARK Autonomous Technology & Robotics ETF

- ARK Space Exploration & Innovation ETF

- ARK 3D Printing ETF

- ARK Israel Innovative Technology ETF

Popular ARK ETFs UK Reviewed

Before investing in any asset, you must perform your due diligence before investing your money.

In the section below, we review eight ARK ETFs available on the market.

1. ARK Innovation ETF

The flagship product of Ark Invest, the ARK innovation ETF invests in a selection of some of the popular companies that are included in other ETFs in ARK’s range. These companies are all thought of as innovative and disruptive in terms of the products and technologies they are developing. Some examples of the industries that these companies operate in are Fintech, Genomics, and Next-Generation Internet.

With over $22 billion worth of assets under management, the ARK Innovation ETF has experienced high returns in the last few years. Over the past one-year period, this ETF has produced a return of 175.20% for investors. In terms of these fees, the ARK Innovation ETF charges a modest expense ratio of 0.75% each year.

2. ARK Fintech Innovation ETF

A recent report by Deloitte noted that, although Fintech companies’ growth is slowing down, the amount of investment into the Fintech sector remains robust, even amid the Coronavirus pandemic. The ARK Fintech Innovation ETF aims to provide long-term growth to investors through an active management style that involves investing in domestic and foreign equities of fintech companies. These companies tend to be involved in areas such as blockchain technology, transaction innovations, and frictionless funding platforms.

Much like other ETFs in ARK’s range, this fund has performed strongly, returning 107.91% to investors in 2020 alone. Furthermore, the fund is already up 11.20% in 2021. Similar to the ARK Innovation ETF, this fund also charges an expense ratio of 0.75% per year.

3. ARK Next Generation Internet ETF

Next-generation internet technologies are poised to become the norm over the next decade, with companies involved in this sector predicted to grow at a rapid rate. The ARK Next Generation Internet ETF holds a portfolio of these companies. With over $6.9 billion of assets under management, this ETF is a popular ARK ETF in the sector.

A large portion of this fund’s investments focuses on cloud-based technology. Due to these investments, this ETF has produced some high returns in recent years. It returned 157.07% in 2020 alone and has previously returned 87.17% in 2017. Also, the fund has not produced a negative return in any of its six years of existence. Finally, this ETF even offers a small yield of 1.18% each year.

4. ARK Genomic Revolution ETF

The rate of medical innovation is increasing each year, with more advanced technology being developed which can extend and enhance human life. One ARK ETF which invests in this industry is the ARK Genomic Revolution ETF. The companies that this ETF focuses on are involved in areas such as CRISPR research, Targeted Therapeutics, and Stem Cell research.

Looking at this ETF’s holdings, some of the largest weightings are given to companies such as Teladoc, Exact Sciences, and Pacific Biosciences of California. Through investments in these companies, the ARK Genomic Revolution ETF produced a remarkable return of 180.56% for investors in 2020. This is in addition to the 44.06% return it made in 2019. Finally, this ETF charges an acceptable expense ratio of 0.75% each year, similar to other ETFs within ARK’s range.

5. ARK Autonomous Technology & Robotics ETF

The ARK Autonomous Technology & Robotics is one-of-a-kind when it comes to the exchange-traded funds available in the market currently, as it focuses on companies that operate in exciting sectors such as robotics, 3D printing, autonomous transportation, and even space exploration. Looking at its holdings, the ARK Autonomous Technology & Robotics has significant stakes in Tesla, Trimble, and NVIDIA, amongst other innovative companies.

Looking at annual returns, this fund produced 106.73% for investors in 2020 alone – meaning that if you’d invested at the beginning of the year, you would have more than doubled your investment. Also, this ETF has produced a positive return in four of the six years it has been in existence.

6. ARK Space Exploration & Innovation ETF

With companies such as SpaceX raising awareness of space exploration’s potential in the coming years, more and more companies are launching within the industry to try and get ahead of the curve. The ARK Space Exploration & Innovation ETF invests in a diverse selection of these companies. This fund is extremely new, having only been incepted on the 30th March 2021. However, it already has $63 million of assets under management.

This ETF is already up 2.15% since inception – although this figure seems small, the ETF has been in operation for just a few weeks. Following the standard set by other funds in ARK’s range, this ETF charges an expense ratio of 0.75% each year to investors.

7. ARK 3D Printing ETF

The 3D printing industry was valued at approximately $11.58 billion in 2019. The ARK 3D Printing ETF aims to track a benchmark index composed of companies involved in the 3D printing industry to generate consistent capital growth for investors.

This ETF invests in countries from across the globe, including the US and Taiwan. With $557 million of assets under management, the ARK 3D Printing ETF has produced high returns in the past few years, generating 39.48% for investors in 2020 and 12.90% in 2019. In addition, it has made a positive return in three of the four years the ETF has been in existence. Furthermore, this ETF has a slightly smaller expense ratio than the other ARK ETFs, stated at only 0.66% per annum.

8. ARK Israel Innovative Technology ETF

The last fund we will discuss on our list is the ARK Israel Innovative Technology ETF. This ETF is designed to track an index composed of Israeli companies that display innovative or disruptive characteristics. These companies come from various sectors, including genomics, healthcare, biotechnology, industrials, and more.

Much like the other funds on this list, the ARK Israel Innovative Technology ETF is equity-based. This ETF produced a return of 32.41% in 2020 and 21.98% in 2019, with both returns comfortably beating indices such as the FTSE 100. Furthermore, this ETF has the lowest expense ratio on our list of only 0.49% per year.

What are ARK ETFs?

ARK ETFs are exchange-traded funds provided by Ark Invest, an investment management firm based in New York City. The firm was founded by Chief Investment Officer Cathie Wood in 2014 and currently has over $50 billion in assets under management. Ark Invest is popularly known for its innovative investment options, showcased by its range of ARK ETFs.

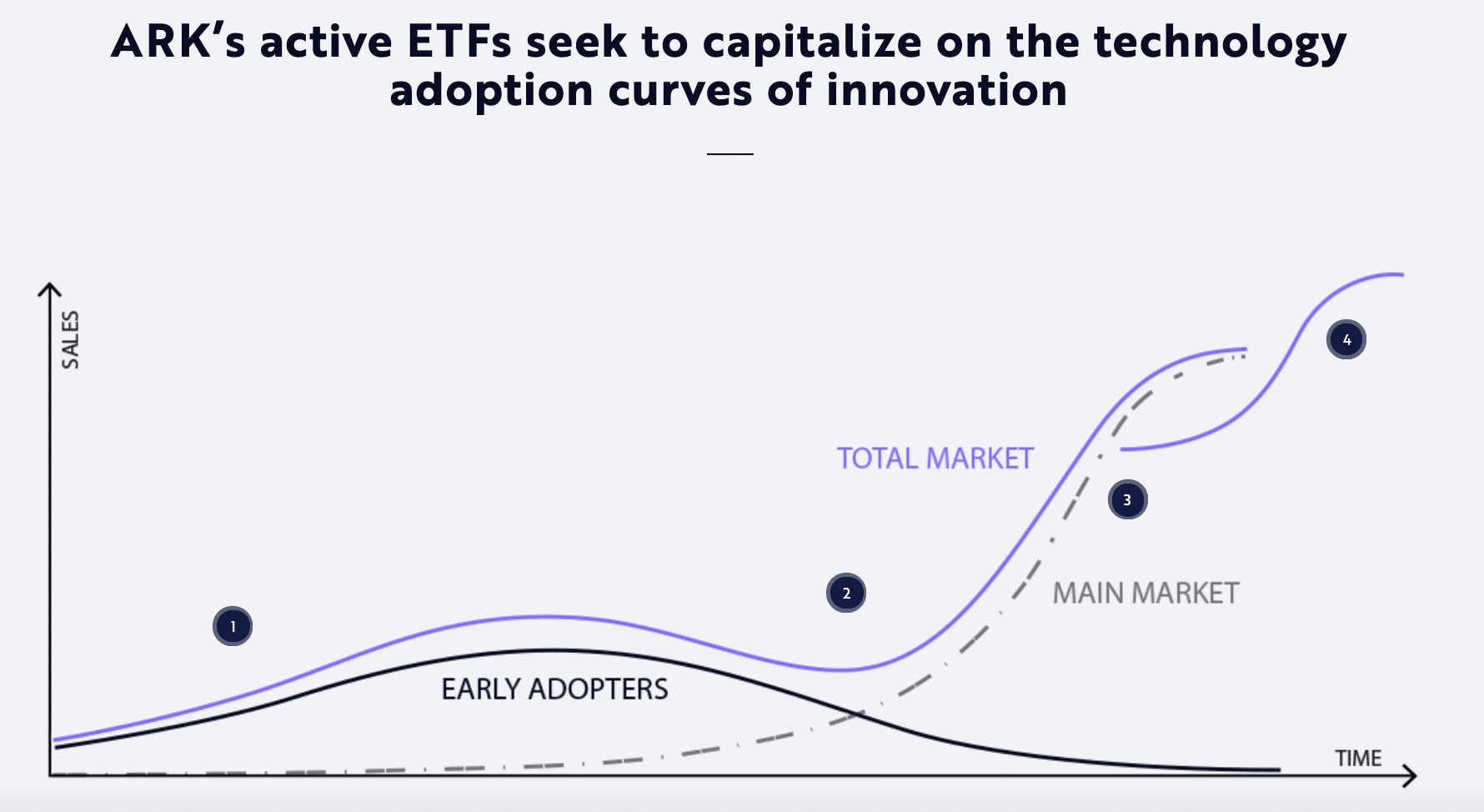

These ETFs mainly focus on investing in companies that display extraordinary innovation levels and look to disrupt the industry they currently operate in. This investment strategy sees ARK ETFs invest in companies in the ‘growth phase’ of their development.

In terms of the industries that ARK ETFs invest in, there is a multitude of sectors on offer that focus on various ground-breaking technological inventions or exciting new services. Some examples of industries that ARK ETFs invest in are space exploration, 3D printing, Robotics, and Genomic Revolution.

Through investments in these companies, ARK ETFs offer an aggressive growth strategy via a fund set rather than investing in individual stocks. The fund managers who are in charge of ARK’s range of active ETFs are constantly researching and analysing companies that might benefit the fund’s overall performance.

Are ARK ETFs a Valuable Investment?

The previous section has explained what ARK ETFs are and the type of assets that they invest in. In the section below, we examine if these ETFs are a valuable investment.

Exposure to High Growth Industries

The nature of the companies that ARK ETFs invest in means that investors get direct exposure to various industries that exhibit high-growth characteristics. Industries such as space exploration and robotics are typically not a focus of the majority of popular ETFs in the market today. As such, the options for investors who wish to gain exposure to these industries are pretty limited.

ARK ETFs invest directly in companies within these industries. It is worth noting that high-growth industries are theoretically much riskier to invest in; this is because companies will tend to be in the growth phase.

Diversification

ARK ETFs may offer diversification opportunities as well.

In addition, ARK also offers an Israel Innovative Technology ETF. This exchange-traded fund focuses on disruptive companies based in Israel, which can provide investors with a significant degree of geographical diversification if this ETF was included in their portfolio.

Furthermore, combining the geographical diversification with the diversification factors based on the industries invested in will ensure an asset that can optimise an investment portfolio’s correlation coefficient. However, users should make sure to conduct their own research and analysis prior to any investments.

How to Purchase ARK ETFs UK

If users are looking to invest in ARK ETFs in the UK, you may want to to do so with a broker that can provide you with low fees, multiple stock options and additional tools & features.

After choosing your preferred brokerage, here is how you can begin investing in 4 steps:

Step 1: Open Your Trading Account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Step 2: Identity Verification

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Step 4: Invest in ARK ETFs

Once your account has been funded, proceed to search for any ETFs or stocks you wish to purchase on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

Throughout this guide, we have taken a detailed look at some of the popular ARK ETFs available on the market, discussing each one in detail and examining their future prospects. Since this asset class has risk associated with it as well, users should properly research and analyse the available ETFs before making an investment.

Should you choose to begin trading in ARK ETFs, you may want to do so with a reputable stock broker that caters to your investing needs and requirements.