Best 5G Stocks to Buy UK – Invest with 0% Commission

Delivering groundbreaking solutions across connected devices, 5G is reshaping the way that we live our lives. From real-time data to prevent road collisions, to connected sensors that warn of natural disasters, to downloading a full-length HD movie to your phone in seconds – the possibilities are endless. Spearheading the innovation, the companies below have invested heavily in building out their networks. As a result, if you’re looking for the Best 5G Stocks to Buy UK in 2021, you’ve come to the right place!

Top Best 5G Stocks to Buy 2021

If you’re looking for the best 5G stocks to buy UK, consider the names below. For in-depth analysis of each, you can also scroll down for more information:

- Apple – Overall Best 5G Stock To Buy UK

- Qualcomm – One of the Best 5G Stocks To Buy Now

- Verizon – Best US Telecom 5G Stock

- American Tower – Best 5G ETF Stock

- Ericsson – Best 5G Stock to Buy in Europe

- Nokia – Invest in 5G Stocks with a Global Network

- T-Mobile – America’s Largest 5G Network Stock

- Skyworks – Best 5G Stock to Invest in for Diversification

- Intel – Best 5G Microprocessors Stock

- Advanced Micro Devices – 5G Stock for Gaming and Connectivity

Best 5G Stocks UK Reviewed

With the coronavirus pandemic accelerating digital trends across nearly every industry, several 5G companies have outperformed since the March 2020 bottom. However, before making an investment decision, it’s prudent to analyze the company’s fundamentals to determine whether or not the risk is worth the reward. Here is a run down of the best 5G stocks to buy UK right now:

1. Apple – Overall Best 5G Stocks To Buy UK

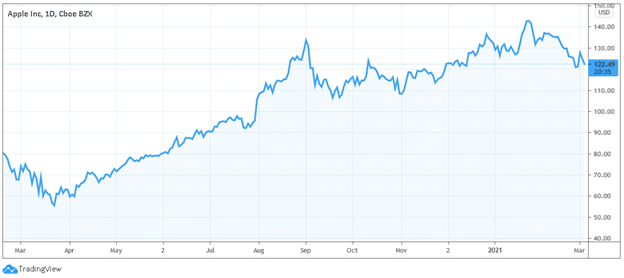

As one-fifth of the FAANG gang, Apple has seen its share price surge by more than 113% since the March 2020 bottom. Outperforming the NASDAQ Composite – which has risen by nearly 92% over that same stretch – the iPhone maker launched its M1 5‑nanometre chip on Nov. 10 and its immunity to COVID-19 was on full display in the fourth-quarter.

In Q4, Apple recorded revenue of $111.4 billion, up 21% year over year. However, the performance was more of an outlier, as prior to the print, Apple’s compound annual revenue growth rate (CAGR) averaged 1.67% over the previous two years.

In addition, Apple’s price-to-earnings (P/E) ratio is now 28% higher than it was before the coronavirus pandemic struck. Moreover, this 5G stock has declined significantly from its 52-week high, as investors reassess the technology behemoth’s valuation.

2. Qualcomm – One of the Best 5G Stocks To Buy Now

Also outperforming the NASDAQ Composite (and Apple), Qualcomm shares have rallied by nearly 128% since the March 2020 bottom. And with COVID-19 minimally impacting the business model, Qualcomm outperformed Wall Street analysts’ revenue and earnings per-share (EPS) estimates in two of the last three quarters since the pandemic struck.

Headlining the gains, Qualcomm’s successful foray into 5G phones makes the chipmaker one of the best 5G stocks to invest in. With Qualcomm’s first-quarter 2021 revenue increasing by 62% year over year, Chipset (CPT) sales (up 81%) were boosted by Apple’s 5G iPhone 12 – equipped with a Qualcomm modem – while its sub-6 GHz transceiver also exhibited strong demand.

From a valuation perspective, Qualcomm’s current price-to-sales (P/S) ratio is nearly 26% above its pre-pandemic peak. However, its P/E ratio is roughly 9% below its 2020 high. As a result, Qualcomm’s growth, performance and valuation help cement its position as one of the best 5G stocks to invest in.

3. Verizon – Best US Telecom 5G Stock

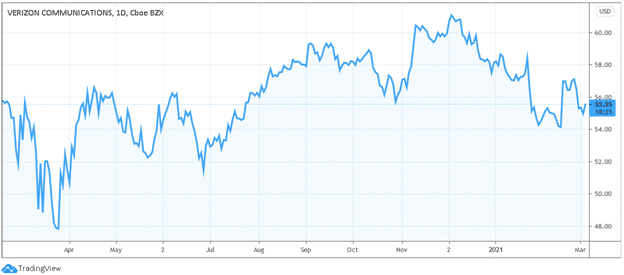

With a 5-year beta of 0.48, Verizon is a low volatility 5G stock that offers less upside, but more protection on the downside. Since the March 2020 bottom, Verizon shares have rallied by more than 11%, but they’re still down from their 52-week high.

However, amidst the pandemic, Verizon continued its fiber optic rollout and its 5G investments continued uninterrupted. As a result, Verizon now has 64 U.S. cities on its Ultra Wideband 5G network, with nationwide 5G now covering 230 million point of presence (PoP) locations across 2,700 cities.

And because the telecommunications giant offers a 4.44% forward dividend yield and its current P/E ratio is 0.50% below its pre-pandemic peak, Verizon is one of the best 5G stocks to invest in.

4. American Tower – Best 5G ETF Stock

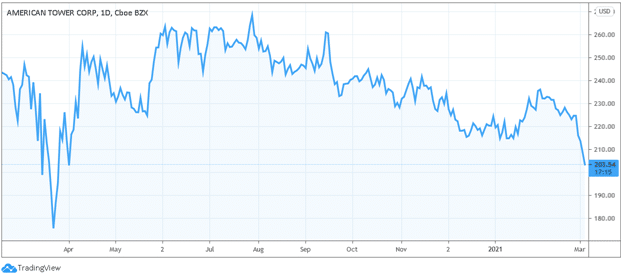

Even less volatile than Verizon – with a 5-year beta of 0.22 – American Tower is a low volatility REIT that offers exposure to the 5G revolution. Bouncing by nearly 13% since the March 2020 bottom, American Tower offers a 2.15% forward dividend yield.

However, after missing Wall Street analysts’ revenue and/or EPS estimates in each of the last three quarters, expanding its 5G infrastructure remains a challenge. Despite its business not seeing a material impact from COVID-19, the work-from-home revolution hasn’t been enough to support its top and bottom lines.

In the fourth-quarter, American Tower’s property sales growth declined by 10% year over year, with the U.S. market already saturated and foreign markets unable to pick up the slack. Likewise, the 5G infrastructure giant recorded $181 million in impairment charges in the quarter, as assets across several markets were no longer considered worth their previous value.

But on the bright side, American Tower’s Organic tenant billings rose by 7% in Q4 and its current P/E ratio is nearly 16% below its 2020 peak. As a result, the 5G STF stock could offer an attractive opportunity for investors with a long-term time horizon.

5. Ericsson – Best 5G Stock to Buy in Europe

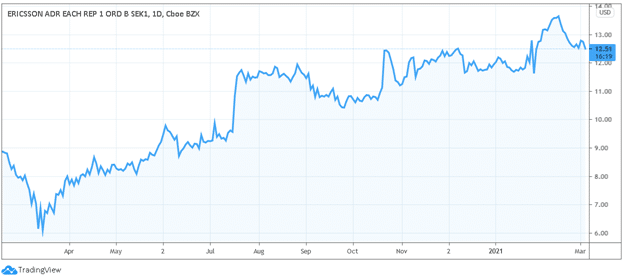

With its networks business buoyed by 5G connectivity and broad-based market share gains, Ericsson’s 5G investments are clearly paying off. The company’s shares have risen by more than 87% since the March 2020 bottom, and in mid-October, the European telecom was actually outperforming the NASDAQ Composite.

Side-stepping the pandemic, Ericsson ended the second-quarter with 127 customer contracts and 79 live 5G networks. And with strong growth in Asia and expectations of more 5G rollouts across Europe in 2021, Ericsson provides a prudent pathway to invest in 5G stocks.

Delivering 5% year over year revenue growth in the fourth-quarter, 5G buildouts were accelerated in China, the U.S. and Australia. The company’s 15.8% operating margin also grew by 9.2% year over year, as its networks and cloud infrastructure investments continue to bear fruit. In addition, Ericsson is gaining market shares across several geographies and Europe’s lagging adoption of 5G infrastructure provides opportunities for further growth.

Furthermore, keeping its pedal to the metal, Ericsson has topped Wall Street analysts’ revenue and EPS estimates in each of the last three quarters. As a result, Ericsson is one of the best 5G stocks to invest in.

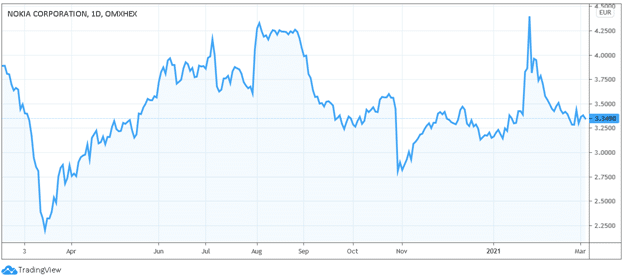

6. Nokia – Invest in 5G Stocks with a Global Network

As a case of ‘she loves me, she loves me not,’ Nokia shares have been extremely volatile since the March 2020 bottom. Rising by more than 140% at one point, Nokia’s stock has rallied by nearly 48% to date.

When the pandemic struck, Nokia’s services business was significantly impacted in China. The weakness forced the telecommunications company to reduce its capital investments by more than 8%, while each of its four reportable segments – networks, software, technologies and group common – declined by double digits.

Continuing to sputter, Nokia’s revenue declined by 5% in the fourth-quarter, with the company suffering 5G market share losses in North America. However, similar to Ericsson, Nokia views Europe’s sluggish rollout of 5G infrastructure as an opportunity to reinvigorate its network infrastructure revenue and offset its mobile weakness. Conversely, fierce industry competition has the ability to further erode Nokia’s pricing power. Thus, if you invest in 5G stocks, you should be careful with Nokia.

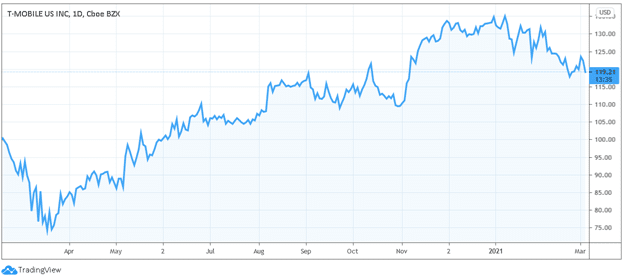

7. T-Mobile – America’s Largest 5G Network Stock

After merging with Sprint in 2020, investors clearly loved the move. T-Mobile’s stock is up by nearly 61% since the March 2020 bottom and the company spent more than $11 billion in 2020 streamlining its 5G infrastructure.

When the pandemic struck, T-Mobile booked $341 million in COVID-19-related costs in the second-quarter, with customer growth stunted by roughly 2% due the pandemic.

However, quick to cite data from Opensignal and umlaut, T-Mobile, the “Largest 5G Network in America is Now the Fastest Too.” In the fourth-quarter, the company revealed that its 5G networks “covers 280 million people across 1.6 million square miles – nearly 4x more than Verizon and nearly 2.5x more than AT&T.”

Moreover, the company told investors that its “Ultra Capacity 5G covers 106 million people, over 50x more than Verizon’s 5G Ultra Wideband,” and that T-Mobile expects “to cover 200 million people nationwide by the end of 2021.”

However, amid the banner year for the company in 2020, its current P/E multiple is more than 72% higher than its pre-pandemic peak and its P/S ratio is nearly 31% above its pre-pandemic median. Thus, while T-Mobile is one of the best 5G stocks to invest in, it’s more of a high-risk, high-reward play.

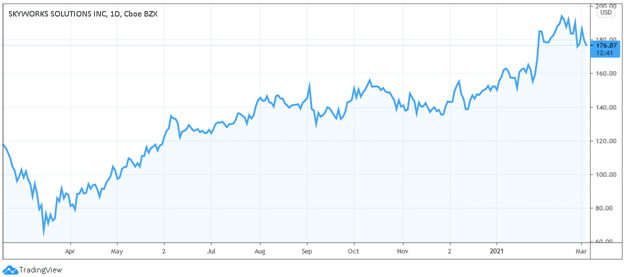

8. Skyworks – Best 5G Stock to Invest in for Diversification

Surging by nearly 150% since the March 2020 bottom, the coronavirus pandemic was no match for Skyworks’ best-in-class technology. After reducing its second-quarter revenue estimates by $45 million at the outset of the pandemic, Skyworks’ consolidated revenue declined by 5% year over year in Q2.

However, with the weakness short-lived, Apple’s iPhone 12 upgrade cycle and the 5G radio frequency boon led to 68% year over year revenue growth in the fourth-quarter, with sales of 5G smartphone chips outpacing managements’ own guidance (of 50% year over year growth).

However, Apple – the company’s largest customer – accounted for roughly 70% of Skyworks’ fourth-quarter revenue. And while analysts estimate that Skyworks sells roughly 20% more dollar content in this year’s iPhone relative to the previous model, the sales concentration is a cause for concern. For example, if Apple were to struggle and witness a decline in smartphone sales, the negativity will directly affect Skyworks.

Conversely, non-smartphone revenue accelerated in Q4 and because the remote working renaissance requires faster and more reliable connectivity, Skyworks remains one the best 5G stocks to invest in.

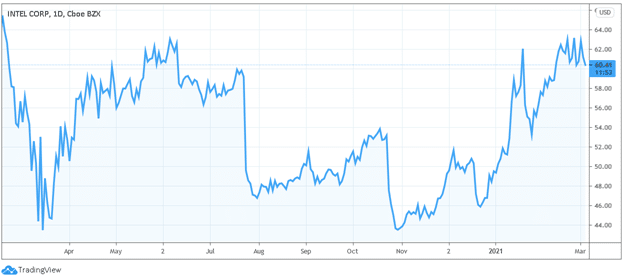

9. Intel – Best 5G Microprocessors Stock

Unlike its peers, Intel has struggled mightily since the pandemic struck. Despite rising by more than 37% since the March 2020 bottom, Intel shares traded in the red briefly in October.

On the bright side, the coronavirus pandemic created a work-from-home renaissance. And able to take advantage, chip sales for personal computers (PCs) and servers outperformed their historical averages, helping fuel Intel’s vision of “a smart and connected revolution.”

Conversely, in July, supply chain issues led Intel to delay its 7 nanometer processors until 2022 for PCs and until 2023 for servers. As a result, then Intel CEO Bob Swan told investors that he was unsure whether or not Intel would manufacture its own chips or rely on third-parties.

With the weakness persisting, Intel announced on Jan. 13 that Swan would step down as CEO, with Pat Gelsinger, CEO of VMware, serving as his replacement. Thus, while prior investments have positioned Intel to capitalize on artificial intelligence (AI), 5G network transformation and cloud computing, the company deserves a wait-and-see approach.

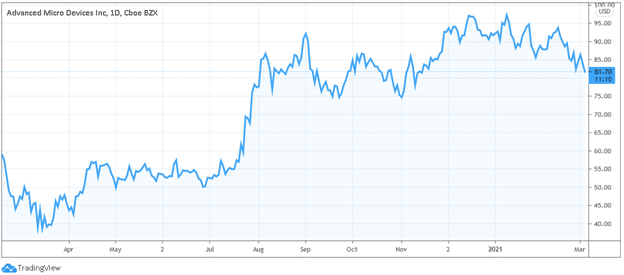

10. Advanced Micro Devices – 5G Stock for Gaming and Connectivity

Rocketing higher until Intel announced its CEO change, Advanced Micro Devices (AMD) has still rallied by more than 112% since the March 2020 bottom. Benefiting from the coronavirus pandemic, working-and-schooling from home led to the highest quarterly chip sales in over 12 years. Notebook chip revenue and shipments also hit a record in the second-quarter, with Ryzen 4000 revenue outpacing every other AMD chip in history.

With its recent acquisition of Xilinx, AMD has boosted its 5G Street cred. Because Xilinx’s programmable gate array (FPGA) chips can be reprogramed and reconfigured even after they’ve been constructed, they have the ability to adapt to 5G functionality as technology is rolled out. As a result, AMD’s chips will have a leg-up over other competitors that need to overhaul their research and development (R&D) strategies to avoid falling behind.

Are the Best 5G Stocks a Good Investment?

To determine whether or not you should invest in 5G stocks, you first need to assess your time horizon. If you’re a long-term investor, then you have time to wait for widespread adoption of 5G. Conversely, if you want to cash out in less than one year, the equation becomes somewhat different.

With the coronavirus pandemic pulling-forward digital growth, a lot of 5G stocks’ multiples are trading above their historical norms. As a result, if their multiples were to decline to their historical averages, revenue growth is unlikely to offset the contractions.

Conversely, if you can stomach the volatility and look beyond the short-term, 5G is the future. And because of that, future returns from 5G stocks should also be fruitful.

To conduct your valuation, pay close attention to 5G companies’ P/S ratios. Because technology companies are a little light on profits – due to heavy R&D investments – investors value them by applying a multiple to their sales. When you compare that multiple to its historical average, you can decipher the probability of it falling, remaining constant, or rising. Thus, before you make an investment, track the company’s P/S ratio and expected revenue growth rate to determine the most attractive entry point.

Best Stock Brokers to Buy The Best 5G Stocks UK

So you’ve done your research and you’ve identified a 5G stock that’s right for you. The next step is finding the right stock broker or stock trading app that gives you access to invest in the best 5G stocks listed above.

With so much competition, it can feel overwhelming trying to determine the advantages and disadvantages of seemingly monotonous brokerages. However, because not all brokers are created equal, we included information on two UK trading platforms that offer the best bang for your buck.

Best Broker to Buy 5G Stocks UK with 0% Commission

Building the future today, investing in 5G stocks puts your portfolio at the forefront of digital innovation. However, because not all companies will succeed in the new economy, it’s important to choose your positions wisely.

While there is inherent risk in owning 5G stocks, for long-term investors, they offer prudent exposure to one of the fastest growing industries.

FAQs

Is it risky to trade the best 5G stocks?

Due to the unpredictable nature of financial markets, short-term trading is always risky. Stocks that rise quickly have the potential to perform in a similar fashion on the way down. However, when companies’ fundamentals are strong and management is focused on executing their strategy, success is achieved over the long-term. As a result, extending your time horizon can reduce short-term risk.

Are some 5G stocks less risky than others?

Yes. Companies like Verizon provide telecommunications services and their stocks behave akin to utilities. Though it offers less growth potential, the company pays an above average dividend and has inherently less risk. Thus, if you’re an older investor or are more risk-averse, Verizon provides exposure to 5G with much less volatility.

Which company has a diversified business model?

Given its dominant position in the PC chip market, combined with its recent acquisition of Xilinx, AMD’s business model prevents the company from putting all of its eggs in one basket. Because Xilinx’s FPGA chips can be reprogramed and reconfigured, they remain functional even as 5G technology advances. Moreover, with AMD’s processors and graphics chips powering some of the most well-known brands in Big Tech, the company offers the best of both worlds.

What separates 5G from 4G?

1. 5G can connect more devices than 4G 2. 5G has much greater data capacity, allowing for more transmission at much faster speeds 3. 5G supports VR, AR and extended reality (XR) with much greater realism

Will 5G benefit the environment?

Yes. Because 5G preserves battery power more efficiently than 4G, it has the ability to limit charging and extend the life of devices. Also by analyzing the health of ecosystems – like monitoring the behavior of fish or conducting soil analysis – 5G can help increase sustainability in rural areas.

Which country is leading the 5G revolution?

As the first country to deploy a 5G network, South Korea remains the leader of the pack. According to Statista, by 2025, almost 60% of mobile subscriptions in South Korea are expected to be for 5G networks.