How to Buy AstraZeneca Shares UK – With 0% Commission

AstraZeneca is known widely as one of the world’s largest pharmaceutical companies and the maker of a COVID-19 vaccine. However, the drug developer has also run into trouble in recent months with rolling out its vaccine, which has caused volatility in the stock price.

In this guide, we’ll show you how to buy AstraZeneca shares online in the UK and take an in-depth look at the stock’s price and fundamentals.

Find a UK Stock Broker That Offers AstraZeneca Shares

The easiest way to buy or sell AstraZeneca shares in the UK is to use a registered online stock broker. With a stock broker, you can buy shares of not just AstraZeneca, but also other popular stocks like Amazon, Netflix, easyJet, and more.

The easiest way to buy or sell AstraZeneca shares in the UK is to use a registered online stock broker. With a stock broker, you can buy shares of not just AstraZeneca, but also other popular stocks like Amazon, Netflix, easyJet, and more.

Choosing the right UK share broker is critical since this will impact everything from what companies you can trade to how much it costs. To help you find the right one, let’s take a closer look at two of the most popular UK brokers.

1. Plus500

This CFD broker enables you to trade shares with leverage up to 1:5. So, you can take a large stake in a company with relatively little money in your account. You’ll find shares for around 500 companies available through this broker, most of them based in the UK or US.

This CFD broker enables you to trade shares with leverage up to 1:5. So, you can take a large stake in a company with relatively little money in your account. You’ll find shares for around 500 companies available through this broker, most of them based in the UK or US.

This brokerage comes with an online trading platform that includes price alerts, an economic calendar, and built-in charting. The technical charts are aimed more at beginner investors. You get access to nearly 100 different technical studies, but you won’t get access to the customization features that more experienced traders demand. For trading on the go, Plus500 also offers a mobile stock trading app.

Plus500 is fully regulated by the UK’s Financial Conduct Authority along with regulators from other European nations. In addition, all accounts are backed by the Financial Services Compensation Scheme, up to a total of £85,000.

Sponsored ad. 72% of retail investors lose money trading CFDs at this site

Research AstraZeneca Shares

AstraZeneca is a household name, but does that mean it’s a good time to buy shares? In order to determine whether you should add AZN shares to your portfolio, it’s important to do some background research about this drug maker and the AstraZeneca share price. We’ll cover all the basics you need to know, along with a review of the company’s price history.

AstraZeneca Share Price History

AstraZeneca is a gigantic corporation with a market capitalization of more than £110 billion. But this pharmaceutical company is also a relatively new one – it was formed in 1999. Before that, Astra was a Swiss drug manufacturer. Zeneca was the pharmaceutical division of UK agrochemical manufacturer ICI, but it was broken off from its parent company in 1993. Astra and Zeneca merged in 1999 to become one of the largest pharmaceutical companies in the world at the time.

AstraZeneca has grown enormously since the merger. It has acquired a number of medium-sized drug companies, including UK firms like Cambridge Antibody Technology. In addition, AstraZeneca has poured money into research and development to create treatments for cancer, cardiovascular disease, infections, respiratory illnesses, and gastrointestinal problems.

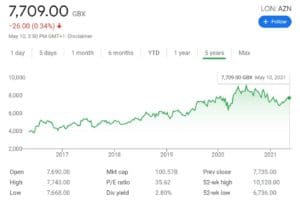

The AstraZeneca share price has reflected its growth over the past two decades. When AstraZeneca first listed on the London Stock Exchange, shares sold for around 2,500 pence. Today, AstraZeneca shares are priced at over 7,0000 pence. Much of that growth has come in the past several years after the company announced a restructuring in 2013 and rejected a takeover bid from Pfizer in 2014.

AstraZeneca’s share price reached new all-time highs in the summer of 2020 thanks to the coronavirus pandemic. The company announced in late April that it partnered with Oxford University to develop a vaccine candidate. By July, AstraZeneca was moving its vaccine candidate into a combined Phase 2/3 trial, and the company’s vaccine received approval from the EU in January 2021.

However, the rollout has been anything but smooth. The EU initially paused the Astrazeneca vaccine distribution because of fears over blood clots, but restarted the rollout in March after finding no link between the vaccine and clots. At the same time, the EU has been publicly fighting with Astrazeneca over the number of doses being manufactured. Limited supply of the Astrazeneca vaccine and shipments out of the EU to other countries have badly hurt the company’s image.

As a result, the share price currently sites at just over 7,700 pence – down from an all-time high of 10,120 pence last year.

AstraZeneca Shares Dividend Information

AstraZeneca has long been a favourite stock for UK dividend investors. This blue chip stock pays out a dividend of 218 pence, which equates to a yield of around 2.8%.

That yield won’t top the list of UK dividend shares, as it’s below the FTSE 100 average. Notably, the AstraZeneca shares dividend has been pushed ahead with even as many other companies in the UK and around the world have cut back on their payments to shareholders during the coronavirus pandemic.

Why Do People Invest in AstraZeneca Shares?

Numerous analysts remain bullish on AstraZeneca, for a myriad of reasons. Despite the fact that AstraZeneca’s public image has suffered in recent months, this company has shown strong financial performance and is still one of just a few companies with an approved COVID-19 vaccine. So, is it a good idea to buy AstraZeneca shares?

COVID-19 Vaccine

The main thing that’s impacting the AstraZeneca share price right now is the production and rollout of the COVID-19 vaccine. This hasn’t gone well for the company. Although the vaccine is approved in the EU, it’s widely mistrusted after the halt related to blood clot fears. The vaccine isn’t approved in the US, even though the country has stockpiled millions of doses.

This has hurt the share price – AstraZeneca shares are down nearly 25% from their high last fall. AstraZeneca may face an uphill battle in the EU, but the demand for its COVID-19 vaccine is global. From the beginning, AstraZeneca sought to provide its vaccine at a cost that was accessible to developing nations. So as it ramps up production, its vaccine could become the leading shot in countries in Africa, South America, and South Asia.

In the long run, AstraZeneca has also gotten a taste of how vaccine development and manufacturing works.

Cancer Treatments are Taking Off

Even better, sales of the company’s blockbuster cancer treatments are on the rise. Tagrisso, a drug for treating lung cancer, brought in more than £770 million last year – a year-over-year revenue increase of 58% for that treatment alone.

Expect to see AstraZeneca continue to dominate this market.

Dividend Growth is Likely

Those growing profits, in turn, means that AstraZeneca is likely to provide even greater rewards for shareholders in the future. The company’s 2.8% dividend yield is below average for the FTSE 100, and in fact the yield has been falling as the AstraZeneca share price appreciation has outpaced dividend growth.

While nothing is certain, it’s likely that AstraZeneca is aware of this trend and may look to remedy it in the future. That could mean a one-time special dividend, particularly if the coronavirus vaccine is successful. Or it could be that the company will slowly ratchet up its dividend payouts in order to better reward shareholders.

Many Drugs in the Pipeline

AstraZeneca has poured money into research and development in recent years, and the fruits of that effort are likely to be borne in the next few years. The company currently has 167 projects in different stages of completion.

Open an Account and Deposit Funds

Now that you’ve done your research on AZN shares, the next step is to open a brokerage account. It’s vital to partner with an FCA-regulated broker, as these platforms provide the highest level of investor protection for UK-based traders.

To get started, navigate to your chosen broker’s website and create an account. You’ll usually be prompted to pick a username and password for your account and provide a few personal details, including your name, address, birthdate, and contact information.

To comply with government regulations, most brokers require that you verify your identity. This involves uploading a copy of your driver’s license or passport along with a utility bill or bank account statement that shows your address. Verification happens automatically online once your documents are uploaded.

Most brokers require a minimum deposit to start trading with your new account. You can make a deposit in a variety of ways, with popular methods including:

- Debit card

- Credit card

- PayPal

- Skrill

- Neteller

- Bank transfer

- Wire transfer

If you fund your account with a debit card, credit card or e-wallet, your funds will usually be available for trading instantly.

How to Buy AstraZeneca Shares

Once your account is funded, you’re ready to buy AstraZeneca shares. From your account dashboard, enter ‘AstraZeneca’ into the search box. When the company appears in the drop-down menu, click on it.

An order will will then appear, where you can buy or sell AstraZeneca shares in any amount as long as your transaction meets the broker’s minimum investment threshold. If you want to set a stop loss or take profit level for your trade, you can also do that using the order form. You also get to choose whether or not you want to apply leverage to your trade.

When your order form is ready, confirm the trade, and your position will be opened.

Conclusion

AstraZeneca shares have been the darling of traders, investors, and analysts alike in recent years. This pharmaceutical giant has seen massive share price appreciation in recent years while offering an attractive dividend yield of 2.8%.

AstraZeneca has been in the news most recently for its COVID-19 vaccine and the poor rollout in Europe has driven the share price lower. But the company’s bread and butter lies in cancer treatments and other high-revenue drugs. With more than 160 candidate drugs in various stages of development, AstraZeneca’s business model still has the potential to bounce back.

Other Vaccine Shares

Interested in investing in other pharmaceutical companies that are involved in developing a coronavirus vaccine? Check out the list below.