Best Defensive Stocks UK To Watch

Defensive stocks are shares from sectors like healthcare, consumer goods, and utilities that typically fare well during periods when the market is dropping.

In this guide, we’ll review 10 popular defensive stocks in the UK for 2021.

Defensive Stocks UK List

Here are a list of 10 popular defensive stocks available to invest in the UK:

- The Coca-Cola Company (KO)

- The Procter & Gamble Company (PG)

- British American Tobacco (BATS)

- Constellation Brands Inc. (STZ)

- Dollar General Corporation (DG)

- The J.M. Smucker Company (SJM)

- Keurig Dr. Pepper Inc (KDP)

- Monster Beverage Corporation (MNST)

- PepsiCo Inc. (PEP)

- Walmart Inc. (WMT)

Defensive Stocks UK Reviewed

Let’s take a closer look at the 10 popular defensive stocks in the UK by carrying out an in-depth review and analysis.

1. The Coca-Cola Company (KO)

The Coca-Cola Company has been a popular pick in the consumer defensive sector for many years. The firm’s top brands, including Coca-Cola itself, are recognized all over the world and they don’t easily lose value when the market swings lower.

With a market capitalisation of almost $221 billion, Coca-Cola is the third biggest defensive stock on our list. It currently offers a dividend yield of 3.27%, which makes it attractive for income investing. Notably, Coca-Cola had enough cash reserves on hand when the COVID-19 pandemic hit to nearly pay the entire year’s dividend.

Moreover, Coca-Cola has paid its dividends punctually for a total of 58 consecutive years. So, you can rest assured the dividend is safe even during a downturn.

2. The Procter & Gamble Company (PG)

In the US, it’s almost impossible to visit a grocery store without running into Proctor & Gamble products in every aisle. The company owns beloved brands like Tide, Bounty, Duracell, Pantene, Gillette, and Crest.

On top of that, Procter & Gamble stands out for its incredibly high return on equity (ROE). ROE is a financial metric that measures the profitability that a company can produce for every dollar its shareholders have invested. P&G currently has a 30% ROE, plus a 2.4% dividend yield and a one-year stock performance of 28.4%.

Procter & Gamble has managed to maintain its ROE above 20% for 9 of the past 10 years, primarily through stock buybacks. The firm is also conservatively financed, with its long-term-debt-to-equity ratio standing below 0.5 at the moment.

3. British American Tobacco (BATS)

British American Tobacco currently offers a high dividend yield of 8%, which makes it a popular dividend stock in the United Kingdom.

The tobacco industry is in a long-term decline. Cigarette sales have been dropping for many years due to health concerns and tougher regulations, and the Biden administration in the US has proposed banning menthol cigarettes altogether.

Last year, BATS generated £7.3 billion in free cash flow while distributing a total of £4.75 billion in dividends. That is a payout ratio of just 65%.

4. Constellation Brands Inc. (STZ)

Among companies in the US consumer defensive sector, Constellation Brands has been one of the most profitable for investors over the past 12 months. In 2020, it delivered a whopping 85.5% gain.

Despite this strong price appreciation, the firm’s forward price-to-earnings ratio is not as high as one would expect. The P/E ratio is currently at 22, and It’s worth noting that this company also pays a dividend yield of 1.3%.

From a fundamental perspective, analysts expect to see the firm’s earnings per share growing at an average annual rate of 8.8% for the next 5 years. The firm’s revenues have multiplied by nearly three times over the past 10 years. However, this is not indicative of future gains. Every stock has an element of risk associated with it, so only invest after conducting prior research of your own.

5. Dollar General Corporation (DG)

A high level of institutional ownership tends to give a stock an extra layer of defensiveness, as institutions – such as asset management firms, investment funds, endowments, and trusts – tend to think in terms of portfolio management rather than trading.

Furthermore, around 93% of shares of this US dollar store chain are owned by institutional investors.

The firm delivered a 39% return for investors over the past 12 months and analysts expect to see its earnings per share growing at a rate of 15% per year over the next 5 years. Meanwhile, the company’s forward price-to-earnings ratio currently stands at 18. That gives us a price-to-earnings-to-growth (PEG) ratio near 1.

6. The J.M. Smucker Company (SJM)

Among large-cap US stocks, The J.M. Smucker Company is an interesting play for value investors based on the firm’s valuation multiple, dividend yield, and recent performance.

In the past 10 years, SJM has managed to double its sales, operating income, and net income. Additionally, this dividend stock is currently offering a 2.8% yield and has a long-term debt-to-equity ratio below 0.5. Moreover, SJM’s P/E ratio is only 15 despite the fact that earnings have grown at a compound annual growth rate of 8%. That gives us a PEG of less than 2.

7. Keurig Dr. Pepper Inc (KDP)

Another popular value investment is Keurig Dr. Pepper. This company has a strong portfolio of consumer-facing brands, a diversified product line, and extremely strong financials.

In the past three years, KDP has managed to grow its sales from $7.4 billion to $11.6 billion while its net income has nearly doubled. Meanwhile, the firm’s financial structure is fairly conservative with an LTD-to-equity ratio below 0.5.

In the past 12 months, KDP has delivered a 38% gain for investors while offering a decent dividend yield of 2.2% based on today’s closing price. Additionally, the company’s forward P/E ratio stands at 20 with an average annual EPS growth rate of 9, which gives us a PEG ratio of 2.

8. Monster Beverage Corporation (MNST)

Monster Beverage Corporation is almost alone among large-cap stocks in that it has zero long-term debt.

There’s more to like about Monster, too. This company has one of the most profitable operations in the US food and beverage sector, with operating margins above 30% for the past 7 years. Its net margins have progressively grown from 17% in 2011 to almost 30% this year.

During a period of 10 years, Monster sales have grown from $1.8 billion to almost $4.6 billion and it brought in net income of $1.4 billion in 2020. Meanwhile, analysts are forecasting that the firm’s earnings per share (EPS) will grow at least 15% annually. However, these are not indicative of future results.

9. PepsiCo Inc. (PEP)

Typically, volatility is the enemy of defensive stock investors. For that reason, PepsiCo stands out as a stock with among the lowest monthly volatility of any US defensive stocks. PepsiCo’s monthly volatility is just 1.63%, meaning the share price rarely moves more than 2% up or down in a single month.

This stock also offers a 3% dividend yield. In many ways, PepsiCo looks more like a bond than a stock, which makes the company’s shares very attractive as a low risk investment.

Over the long run, PepsiCo has delivered growth, too. The shares have gone up 60% in the past 5 years, which is equal to a 10% compound annual growth rate.

10. Walmart Inc. (WMT)

Walmart shares offer a combination of low volatility, earnings growth, strong brand positioning, and decent performance.

During the pandemic crash of February 2020, Walmart was one of the stocks that experienced only small value losses. That’s in part because most investors could not imagine a scenario in which Walmart would stop earning money. Whether a pandemic, an economic downturn, or a natural disaster, people flock to Walmart for groceries, household items, and whatever else they need.

Walmart offers a dividend yield of 1.6%, and the company is expected to grow at a rate of 6% per year. The firm’s forward P/E ratio of 23 is slightly high. It’s also worth pointing out that Walmart shares have surged 120% in the past 5 years.

Are Defensive Stocks a Valuable Investment?

Here are a few factors that may affect your investment decision in Defensive Stocks.

Steady Dividends

Defensive stocks tend to operate in very mature markets such as consumer staples and health care. Many defensive stocks have strong profit margins and are able to return earnings to investors in the form of dividends.

Low Volatility

Unlike growth stocks or high-risk investments, defensive stocks tend to experience little volatility.

Stable Business Models

Consumer defensive companies usually have sound business models that rely on the sale of essential goods through vast distribution networks. They tend to have minimal, easily forecastable changes in sales from year to year and steady profits. On top of that, many consumer goods companies are household names and big brands.

Popular Stock Brokers that Offer Defensive Stocks

Now that you have a list of potential defensive stocks to invest in the UK, you can purchase shares with the use of a stock trading broker.

In the sections below, we review two brokers that allow users to invest in defensive stocks in the UK.

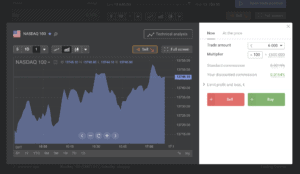

1. Libertex

Libertex offers the popular MetaTrader 4 trading platform, which is typically used by more experienced traders because of its steep learning curve. However, the broker also has its own trading platform that’s simple to use. You can monitor price movements and keep an eye on the broader stock market with a news feed and economic calendar. Libertex’s trading platform is also available as a mobile stock app for iOS and Android.

One catch to Libertex is that the broker has a limited selection of shares – there are only about 50 stocks to trade, mostly from the US. That said, you will find many of the defensive stocks we highlighted available to trade with Libertex.

Libertex is regulated by the Cyprus Securities and Exchange Commission (CySEC), one of the leading regulators in Europe.

85% of retail investor accounts lose money when trading CFDs with this provider.

How to Invest in Defensive Stocks in the UK

If you are looking to invest in defensive stocks in the UK, you should choose a suitable stock broker that caters to your investing requirements.

After selecting a stock broker, you can begin trading in defensive stocks by following these 4 steps:

Step 1: Open a Trading Account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Step 2: Verification Process

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Step 4: Invest in Defensive Stocks

Once your account has been funded, proceed to search for any defensive stocks or any other stock you wish to purchase on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

Defensive stocks are low-risk stock investments that tend to weather market downturns better than other stocks. They offer decent dividend yields, low levels of volatility, and sound fundamentals. However, users should make sure to only invest in stocks are conducting their own prior research and analysis.