How to Buy Vodafone Shares UK – Invest in VOD with 0% Commission

Had you bought Vodafone shares back in 1988 – you would now be looking at gains of over 688%. Over the same period, the FTSE 100 has returned just 228%. However, Vodafone Group plc shares have been moving in the wrong direction in recent years – which is why you need to perform some research before making an investment.

Nevertheless – as a major UK company – buying Vodafone shares is easy. In fact, you can complete the process in a matter of minutes by using an FCA-regulated online broker.

In this guide, we’ll show you how to buy Vodafone shares online in the most convenient and cost-effective manner. We’ll also discuss the best share dealing platforms to complete the process with – alongside a brief overview of how the company has been affected by coronavirus over the last year, its share price and market capitalisation, and what the future holds for Vodafone.

-

-

Step 1: Find a UK Stock Broker to Buy Vodafone Shares

Vodafone (VOD) shares are listed on the London Stock Exchange (LSE) so there are plenty of online trading platforms that allow you to make a purchase with ease. In particular, you should look for brokers that offer low fees and commissions, as well as support for your preferred payment method (debit/credit cards, for example).

If you don’t have time to find a suitable stock broker yourself, below you’ll find two top-rated platforms that allow you to trade or buy Vodafone shares commission-free.

Step 2: Research Vodafone Shares

Whether you’re looking to invest in Vodafone shares or shares of similar companies like BT Group or Samsung, it’s always important to do your research before you make an investment decision.

In terms of volatility, Vodafone Group plc shares have gone through several peaks and troughs over since the firm went public in the late 1980s. The most concerning aspect of this particular stock is that it last hit its all-time in 2000. This doesn’t bode well for those that invested before the dot.com bubble. Nevertheless, this doesn’t really concern you if you are looking to invest in Vodafone for the very first time – as it’s only what happens next that matters.

Nevertheless, we are now going to delve into the many aspects that need to be considered before you buy Vodafone shares – starting with a brief overview of what the telecom company does, its past performance, the current valuation of its shares and more.

What is Vodafone Group plc?

UK-based Vodafone, ticker LON:VOD (ISIN GB00BH4HKS39), is a global telecommunications and broadband company that is active in over 41 countries. This includes the provision of active telephone network services in 24 nations. In particular, Vodafone Group plc is a stock market leader in the Asian, Africa, and Australian economies. Outside of its core network services, Vodafone also offers mobile money transfers, low-cost phones, and even a health-centric SMS facility.

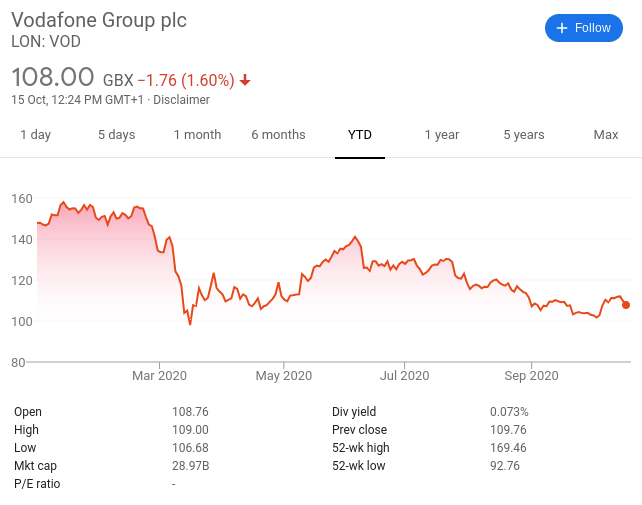

Vodafone Share Price History & Market Cap

Vodafone (VOD) went public in 1986, albeit, this was under its former name Racal Electronics. It wasn’t until 1991 that the firm was rebranded to Vodafone. When the shares first went public, you would have paid in the region of 14p. Vodafone then went on a prolonged upward trajectory – subsequently hitting hits of over 460p in 2000.

This means that IPO investors were looking at 12-year gains in excess of 3,100%. Unfortunately, Vodafone shares then began to move in the wrong direction – with the stocks never regaining their prior peaks.

Instead, Vodafone shares will cost you just 108p as of October 2020. The firm is, however, still a major constituent of the FTSE 100 – with a current market cap of over £28 billion. The surprise for stockholders is that the shares are down 36% in 2020.

Although this is the case with many sectors in the UK, Vodafone operates in a space that is somewhat immune to the health of the broader economy. After all, it offers core mobile network services that will always be in demand. In comparison, the FTSE 100 is around 23% YTD – meaning that Vodafone is performing much worse than the wider stock market.

Vodafone EPS & P/E Ratio

The current Vodafone EPS is -3.13 EUX, with an EPS growth of -11%. The Vodafone p/e ratio is 22.2.

Vodafone Shares Dividend Information

Vodafone has historically been a good dividend payer – at least in terms of its trialling yield. Over the past 10 years, for example, this yield has averaged just over 5% annually. However, it is important to remember that the trialling dividend yield looks at the current share price of a company.

In other words, the reason that Vodafone shares have been so competitive in the dividend yield department is that its stock price continues to fall. As we noted above, VOD shares are 36% down in 2020 so far – meaning that an average yield of around 5% does little to counter these losses.

Vodafone Vantage Towers IPO

Earlier in 2020, Vodafone announced it’s planning to launch its mobile tower business, Vantage Towers, early next year, though there is no set date yet. The company will be listed on the Frankfurt Exchange and is a way for the company to capitalise on the growth of 5G technology. You can trade on the IPO either before or after the listing, depending on whether there is a grey market available.

Vodafone Egypt Sale

Vodafone is currently in talks with Saudi Telecom to sell its 55% in Vodafone Egypt. Vodafone has stated that due diligence has been ‘substantively completed’ and that the parties remain in talks with the aim of securing a deal within the near future.

Should I Buy Vodafone Shares?

Taking the above into account – Vodafone Group plc shares do not seem overly appealing at first glance. With that said, there is every chance that you can enter the market at a huge discount – if you believe that the stocks will eventually get back to pre-pandemic levels.

Let’s look at some of the factors that you should consider before you buy Vodafone shares.

Q1 2020 Earnings Report

At the time of writing, the most recent earnings report that we have to work from is that of Vodafone’s Q1 release. Largely, Vodafone performed below market expectations – with overall revenue dropping to €9.1bn. This represents a slight decline of 1.3%.

One of its worst-performing regions of the quarter was Italy – where sales fell 6.5%. Its UK market also saw declines, albeit, this stood at just under 2%. There were some positives from the results, with fixed-line sales increasing by 2.4% in Germany. However, Vodafone’s mobile revenue in the country dropped by 3%.

Cost-Cutting to Reduce Debt

As per its most recent earnings report, Vodafone’s net debt levels now stand at just over €42 billion. Much of this is related to its recent purchase Liberty Global. However, management at Vodafone has made its cost-cutting endeavours clear – with the impending 55% sale of its Egypt market share.

In addition to this, Vodafone is also planning to offload some of its European-based towers. Although this will raise some much-needed cash, these towers do provide a good source of income from competing networks.

Potential Discount at Current Prices

Based on October 2020 prices, Vodafone shares are trading at 108p. At the start of the year, the very same stocks would have cost you 147p. With this in mind, some would argue that you can now enter the market at a highly favourable price. After all, if Vodafone is able to get back to pre-pandemic levels, it would require an upswing in the region of 36%.

Vodafone Shares Buy or Sell?

The general consensus is that Vodafone isn’t a particularly strong buy at present. This is somewhat surprising, as mobile telecommunication companies are often viewed as staple stocks – meaning they offer a service that is relatively unaffected by the health of the economy.

However, Vodafone shares have not only been dragged down alongside the wider FTSE 100 – but the shares are down over 36% this year. On the other hand, you can enter the market at a discount if you think that recovery is more of a probability than a possibility, so this is another angle to consider.

The Verdict?

As a major FTSE constituent, buying Vodafone shares in the UK can be completed from the comfort of your home with ease. All that is required is an online share dealing account and an instant deposit method like a debit/credit card or e-wallet.

FAQs

Are Vodafone shares a good buy?

Vodafone has been struggling in recent years - at least in terms of its ever-falling stock price. This does make Vodafone as an investment somewhat unattractive.

What stock exchange are Vodafone shares listed on?

Vodafone is listed on the London Stock Exchange it is a leading member of the FTSE 100 index.

Can you short Vodafone shares?

If like much of the wider market - you feel that Vodafone shares are likely to continue to fall, then you might want to consider short-selling the stocks via a CFD broker.

What price are Vodafone shares?

At the time of writing in October 2020 - Vodafone shares are hovering around the 105p-110p region.

How do you buy shares in Vodafone?

All you need to do is open an account with an FCA broker, meet the platform's minimum deposit amount and then select how many Vodafone shares you wish to buy.

Can I invest in Vodafone shares via an ISA or SIPP?

Yes, most UK providers will allow you to invest in Vodafone via an ISA or SIPP account.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up