Best Crypto Stocks UK to Watch

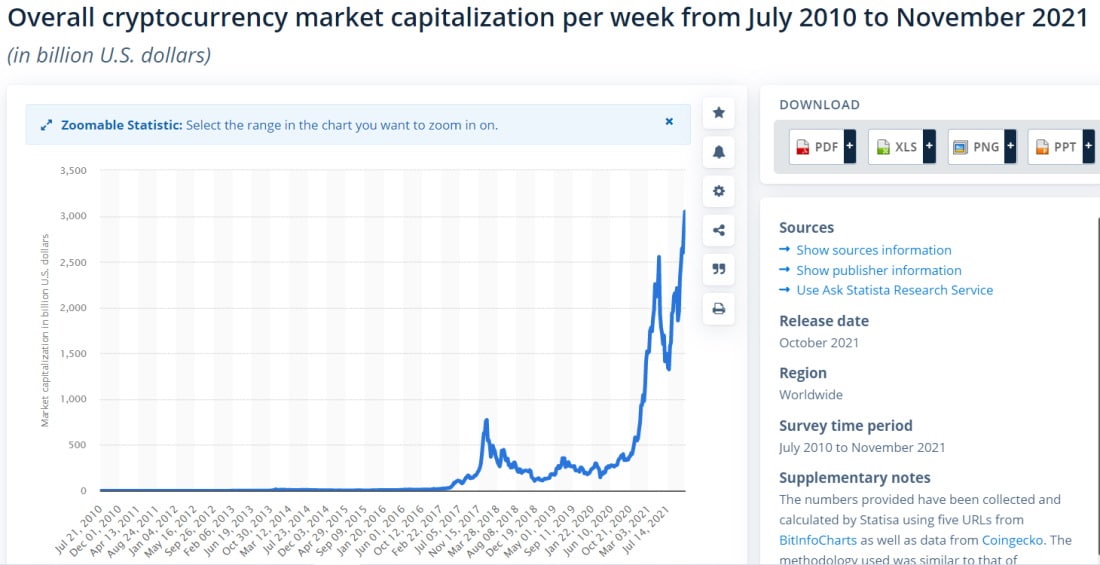

Cryptocurrencies have fast become the most popular investment experiencing mainstream use. Ten years ago, markets for cryptocurrencies like Bitcoin and Ethereum were essentially unknown. Fast forward to 2021 and the crypto sector is worth over $3,048.57 billion.

In this guide, we’ll review 10 crypto stocks in the UK and review reputable brokerages that allow users in the UK to trade in crypto stocks.

Crypto Stocks UK List 2021

If you are looking for various crypto stocks to invest in, below is a list of 10 popular crypto stocks available in the UK.

- Coinbase Global (NASDAQ: COIN)

- Square (NYSE: SQ)

- PayPal Holdings (NASDAQ: PYPL)

- Canaan (NASDAQ: CAN)

- Hut 8 Mining (NASDAQ: HUT)

- Nvidia (NASDAQ: NVDA)

- AMD (NASDAQ: AMD)

- Meta Platforms (NASDAQ: FB)

- Shopify (NYSE: SHOP)

- CME Group (NASDAQ: CME)

UK Crypto Stocks List

Let’s dive a little deeper into each crypto stock, to understand more about each asset. Below is a comprehensive guide on 10 separate crypto stocks which are available in the UK markets in 2021.

1. Coinbase Global (NASDAQ: COIN)

- Industry: Financial Services

- Current price: $342.12

- Market cap: $73.63B

- Dividend yield: N/A

- YTD return: +4.22%

Coinbase Global, a leading cryptocurrency exchange platform, debuted on the NASDAQ exchange in April 2012 during its initial public offering (IPO). The crypto exchange is popular for buying and selling 50+ major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Dogecoin, Shiba Inu, and Solana (SOL).

Thus far, the success of this cryptocurrency exchange has been triggered by the rise in cryptocurrency prices. This has resulted in a huge upsurge of new trading accounts. Every time a trader purchases or sells a digital asset, Coinbase charges a transaction fee. However, the company has plans to expand beyond the limits of a conventional crypto trading platform. It also offers a debit card that lets clients to use their digital wallet balance to make purchases. It also introduced a new cloud platform that businesses can use to store cryptocurrencies.

Features of Coinbase

The goal of the Coinbase project was twofold. The first involves making crypto loans more accessible to the general public, which was previously solely available to wealthy investors. This eliminates the need for investors to liquidate their assets in the event of an emergency, enabling their principal to multiply.

The second commitment is getting governments and financial authorities to adopt its blockchain analytics. Since many blockchains use a public ledger, Coinbase can use this information to track down unauthorised transactions.

For example, let’s say that hackers infiltrate a victim’s PC and demand Bitcoin as ransom to relinquish control of the computer. In these circumstances, Coinbase could correlate the criminal’s crypto wallet address against its database of KYC data. In theory, this could allow law enforcement to track and arrest the hackers, leading to a more secure crypto ecosystem.

2. Square (NYSE: SQ)

- Industry: Software & Tech Services

- Current price: $240.00

- Market cap: $110.84B

- Dividend yield: N/A

- YTD return: +8.64%

At the core of all decentralized crypto payment protocols is the lack of centralized intermediaries such as central banks. As a result, there are cheaper expenses for both companies and customers. Therefore, the next move for Square to expand its business was to allow clients to purchase and hold cryptocurrencies via a digital bitcoin wallet.

By 2018, the company’s Cash App began facilitating Bitcoin trading. By 2021 BTC was a main source of revenue for the company.

Moreover, Square is promoting the adoption of Bitcoin with its corporate users, giving it the potential to become a leading platform for transferring cryptocurrencies between businesses and their clients. This has particular promise for disrupting conventional global transactions, in which banks frequently charge exorbitant foreign exchange rates. However, for the time being, Cash App is primarily used as a platform for crypto trading, as well as basic banking functionality.

3. PayPal Holdings (NASDAQ: PYPL)

- Industry: Software & Tech Services

- Current price: $208.04

- Market cap: $244.48B

- Dividend yield: N/A

- YTD return: -10.30%

PayPal’s Venmo digital wallet and peer-to-peer payments platform, which enabled crypto trading in early 2021, can be compared to Square’s Cash App. Initially, Bitcoin, Bitcoin Cash (BCH), Ethereum, and Litecoin were supported by Venmo (LTC).

With this new feature, Venmo, which has the most users of any peer-to-peer money transfer software, has the potential to become a prominent cryptocurrency platform. It provides a secure entry point for investors who wish to purchase large amounts of cryptocurrency and then use them to purchase more cryptocurrency or use decentralised finance apps.

After speculators and newspapers speculated that PayPal might acquire Pinterest before the end of 2021, the fintech corporation just announced that it will not. Despite the fact that the announcement was only temporary, it piqued traders’ interest and created a flurry of discussion on the benefits and drawbacks of a potential merger.

4. Canaan (NASDAQ: CAN)

- Industry: Tech Hardware & Semiconductors

- Current price: $10.36

- Market cap: $1.77B

- Dividend yield: N/A

- YTD return: +55.12%

Bitcoin mining, the phenomenon known as energy intensive, has evolved tremendously in recent years. Companies like Canaan now construct cutting-edge, ASIC (application-specific integrated circuit) devices. Canaan’s new Avalon ASICs can generate large numbers of calculations per second to verify blocks on the BTC blockchain.

This crypto stock gained over 40% last month, thanks to new buyback authorization and robust bullish trends for Bitcoin. Canaan offers specialized hardware for crypto mining, with bullish trends in the crypto sphere typically driving the crypto mining stock to all-time highs.

Last month, the price of a Bitcoin token increased by around 48.7%, allowing the cryptocurrency mining company’s stock to gain a significant amount of ground.

5. Hut 8 Mining (NASDAQ: HUT)

- Industry: Tech Hardware & Semiconductors

- Current price: $10.36

- Market cap: $1.77B

- Dividend yield: N/A

- YTD return: +55.12%

Hut 8 Mining, which is headquartered in Canada, has a significant minority stake in the Bitcoin blockchain and generates very high cash flows when pinned against revenue.

Hut 8 Mining maximises shareholder returns by loaning Bitcoins and cultivating yields, rather than selling them on the open market. This results in compounded returns. Investors can also be certain that the firm will not be involved in any environmental issues related to the practise. Hut 8 Mining gets its electricity from renewable energy sources.

What does this mean moving forward?

Hut 8 Mining stock jumped by just under 60% in October which analysts presume has been driven by Bitcoin’s strong market performance. Last month saw unprecedented gains for the leading cryptocurrencies, with Ether and Bitcoin surging by more than 45%. Hut 8 Mining specializes in crypto mining for these two large-cap digital assets, and robust bullish momentum helped the crypto mining stock to wrap up a month of record gains.

Just last month, Hut 8 Mining announced its acquisition of 12,000 new MicroBT miners with a price tag above $50 million. The new crypto mining hardware is set to be distributed next year, with an estimated delivery of approximately 1,000 units every month. According to seasoned analysts, investors should be aware that this crypto mining stock’s price movements are closely pegged to the market trends of Bitcoin and Ethereum.

6. Nvidia (NASDAQ: NVDA)

- Industry: Tech Hardware & Semiconductors

- Current price: $292.61

- Market cap: $731.52B

- Dividend yield: 0.055%

- YTD return: +123.13%

Although Nvidia is not directly involved with cryptocurrencies, it is a popular manufacturer of graphics processing units. GPUs are renowned for powering cutting-edge video game visuals, but they’re also used in data centres, AI, and the production of digital assets.

Graphics processing units are ideal for cryptography and blockchain development, which require heaps of computing power. As crypto miners (those who use PCs to generate new cryptocurrency units) hurried to get their hands on GPUs in 2018, soaring cryptocurrency prices spurred Nvidia’s stock price hikes.

GPUs have a key role to play in the development of digital assets. Earlier this year, Nvidia introduced a new range of chips designed specifically with crypto mining at their core.

7. AMD (NASDAQ: AMD)

- Industry: Tech Hardware & Semiconductors

- Current price: $151.34

- Market cap: $182.76B

- Dividend yield: N/A

- YTD return: +63.97%

Much like Nvidia, AMD is a semiconductor company that’s trying to cement its position in the cryptocurrency industry. AMD recently announced plans to acquire Xilinx, a chip manufacturer based in California.

AMD and Nvidia are well-positioned to continue gaining market share in the semiconductor sector while also paving a path for the development of innovative technologies like blockchain.

Advanced Micro Devices (NASDAQ: AMD) gave a positive Q3 earnings report, with key areas including personal computing, video gaming, and data centers performing above average. All of these segments experienced significant growth, allowing the company to outperform Wall Street forecasts and generate stunning third-quarter results.

Furthermore, AMD increased its full-year guidance due to strong demand for its CPUs.

AMD’s Q3 revenue increased by 54% in the past year to $4.3 billion, thanks to strong sales in computing and graphics, as well as the enterprise, and semi-custom markets. Moreover, the crypto stock’s non-GAAP gross margin increased by 440 basis points to 48 percent over the previous year.

8. Meta Platforms (NASDAQ: FB)

- Industry: Media

- Current price: $340.77

- Market cap: $947.94B

- Dividend yield: N/A

- YTD return: +26.71%

Meta Platforms has been working on an innovative digital asset dubbed ‘Diem’ for quite some time. Diem was designed as a worldwide financial services platform that is open to all users, as well as almost 33% of the world’s population who do not have access to a bank account. Diem has experienced some obstacles, including the withdrawal of Visa, PayPal, and Mastercard from its pool of institutional investors.

Because cryptocurrency is still mostly unregulated, financial authorities have voiced concerns about Diem, with some sources implying Diem may need to be tethered to the USD or other such fiat currency. Despite this, research and development related to the Diem project is ongoing. Diem is expected to be rolled out in 2022.

Meta Platforms released its third-quarter earnings late last month. The social media company jumped 35% over the last year to just over $29B with earnings rising by just below 20% to $3.22 per share, beating Wall Street expectations.

As for Q4 2021, Meta Platforms forecasts revenue to grow by 12 percent which would be the slowest rate of growth in over 12 months. Yet, despite the recent controversy with whistle-blowers and its rebranding from Facebook to Meta Platforms, the social media giant is committed to developing its metaverse business with state-of-the-art VR headsets, and innovative AR devices. The company also announced a $50B addition to its crypto stock buyback plan.

9. Shopify (NYSE: SHOP)

- Industry: Software & Tech Services

- Current price: $1,637.81

- Market capitalization: $205.67B

- Dividend yield: N/A

- YTD return: +49.93%

Shopify, an e-commerce infrastructure and software provider, allows businesses to take digital assets as payment. Lately, it improved this payment option by partnering with Bitcoin payment processor CoinPayments.

For the past five years, Shopify stock has skyrocketed by 3,618.07%. Another reason why many investors are adding this crypto stock to their portfolios this year is that it’s the most popular e-commerce company in America, boasting a market share of 29%.

To bolster that market advantage, Shopify is creating the Shopify Fulfillment Network (SFN), a nationwide network of robot-powered warehouses. This emerging infrastructure will enable Shopify to choose, package, and send products on behalf of its merchants while harnessing data generated throughout its platform to enhance supply chains and improve logistics.

10. CME Group (NASDAQ: CME)

- Industry: Financial Services

- Current price: $226.42

- Market cap: $81.37B

- Dividend yield: 1.59%

- YTD return: +26.28%

CME Group runs the world’s biggest financial derivatives exchange, enabling traders to access futures trading, which wager or secure an asset’s future price. Investors can also trade options, which allow you to purchase or sell an asset at a fixed price in the future.

CME Group’s derivatives exchange supports a wide range of tradable securities, such as commodities, energy, equities, and digital currencies.

Crypto Penny Stocks

Crypto penny stocks are trending as crypto investors are left buzzing over Bitcoin’s unprecedented rally. However, with so many penny stocks entering the market, let’s get a better idea of what these kind of stocks are.

What are crypto penny stocks?

To begin with, some companies mine digital currencies. These crypto mining stocks are typically directly influenced by the performance of the crypto sector. However, it’s worth mentioning that these crypto penny stocks come with high risks because of the overall volatility of the crypto market.

Crypto stocks that focus on cryptocurrency-related technology are also worth considering. This could include the production of crypto mining machines, as well as mining-related technology. Finally, some companies work on implementing and developing blockchain technology.

While blockchain technology has a range of uses, including decentralized banking and other decentralized projects, cryptocurrency was designed to revolutionize the existing, traditional financial ecosystem.

Are Crypto Stocks a Valuable Investment?

Not all crypto stocks are pegged to the crypto industry, offering investors both exposure to the crypto market and portfolio diversification. Cryptocurrencies are extremely volatile, causing acute price swings in revenue and earnings for enterprises with exposure to the sector.

Source: Statista.com

Nevertheless, cryptocurrencies are quickly winning public acceptance. With companies like Nvidia, PayPal, Shopify, and Meta Platforms committed to the crypto cause, expect crypto stocks to gain even more traction.

How to Purchase Crypto Stocks UK

After choosing a suitable broker that will provide you with competitive fees and multiple features to facilitate your trade, users can begin investing in crypto stocks in 4 simple steps.

Step 1 – Open an account

To start trading, head to the website of your trusted platform and begin the sign-up process. Enter your personal details, and create a username and password for the account.

Step 2 – Verification

As part of the KYC process, new traders are required to upload confirmation of residence and proof of identity. These can be in the form of a valid utility bill dated to the last three months and a valid passport or driving licence.

Step 3 – Deposit funds

Funding your brokerage account is a simple process. There are several payment methods users can use from credit cards and debit cards to electronic wallets and bank transfers.

Choose a preferred payment method that your trading platform offers, and enter the amount you wish to begin investing with.

Step 4 – Purchase Crypto Stocks

Once your account has been credited, users can begin the investing process. Search the name of the crypto stock you choose to invest in and click enter. You will need to insert the amount of cash you wish to deposit into the trade, and then confirm the transaction.

Conclusion

Crypto stocks are making headlines as Bitcoin prices continue to surge. When you purchase crypto stocks you’re investing in companies that are working on developing the crypto industry as we know it. However, users should only invest after researching the stocks properly. Since there is a possibility of high volatility that is associated with crypto stocks, make a detailed investment plan before trading any stocks.