How to Buy Rightmove Shares UK – with 0% Commission

Although Rightmove (RMV) was founded as recently as 2000 – the property website has already attracted a huge multi-billion pound market cap on the London Stock Exchange. With that said, Rightmove shares are still yet to fully recover from the wider impact of the coronavirus pandemic – so there is every chance that you can still invest at a discount. In this guide, we show you how to buy Rightmove shares UK with a commission-free FCA broker.

-

-

Step 1: Find a UK Stock Broker to Buy Rightmove Shares

As noted above, Rightmove shares are listed on the London Stock Exchange. This means that you will have dozens of potential brokers to choose from when it comes to making an investment online.

To save you from having to research the best stock brokers that give you access to Rightmove shares – below you will find a selection of top-rated trading platforms to choose from.

Step 2: Research Rightmove PLC Shares

As is the case with any investment you are considering, you should research the ins and outs of Rightmove shares before making a financial commitment. This will ensure that you are investing in a company that has a good chance of making you money in the long run.

In the sections below, we offer a wealth of information that will help you decide whether or not Rightmove shares should be added to your investment portfolio.

Rightmove Share Price History & Market Capitalisation

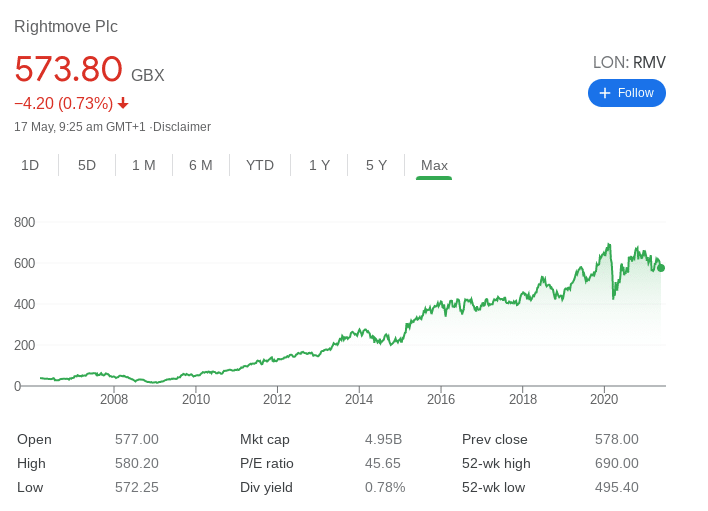

Rightmove is the UK’s largest real estate website – with the platform listing properties that are currently available to buy and rent. The website also provides a good source of information on market trends, house prices, and wider real estate developments. Founded in 2000, Rightmove first went public in 2006 – a mere 6 years after the website was launched. This illustrates just how quickly the company has grown.

Opting for the London Stock Exchange, Rightmove shares initially floated at £3.35 per stock. However, this amounts to an actual price of 33.5p – as the firm initiated a 1-to-10 stock split in 2018. This means that for every 1 share held before the split, an additional 9 were distributed to stockholders. Taking the split into account, Rightmove shares have performed exceptionally well since the company became a PLC in 2006.

For example, Rightmove shares hit new all-time highs in early 2020 – breaching the 690p level. This means that in just 14 years of trading, early Rightmove shareholders were looking at gains of almost 2,000%. Naturally, and much like the rest of the real estate industry, Rightmove was heavily impacted by the pandemic. In terms of its share price, lows of 420p were hit in March 2020. This is a decline of 39% from the prior highs hit just two months earlier.

With that said, the recovery of Rightmove shares since the pandemic has been very good. In fact, Rightmove shares hit 683p in October 2020 – just 7p short of their previous highs. Since then, the stocks have been somewhat flat, with the shares priced at 574p at the time of writing. This means that there is a potential short-term upside of 20% – based on pre-pandemic levels. Ultimately, Rightmove was on a strong upward trajectory before the first lockdown measures – so this is the longer-term target.

Rightmove EPS and P/E Ratio

When it comes to key accounting ratios, Rightmove reported an EPS of 12.60p for its fiscal year ending 2020. This is down from the 19.57 EPS achieved in the previous year. Additionally, Rightmove shares are currently trading with a P/E ratio of 45.65.

Rightmove Shares Dividend Information

Rightmove is a dividend-paying company, so this a way of growing your money in addition to a share price increase. For the year ending 2020 – Rightmove paid a dividend of 4.5p per share. For the year ending 2019, dividends were canceled. Based on prices at the time of writing, Rightmove shares are paying a trailing dividend yield of 0.78%.

Should I Buy Rightmove Shares?

There are many factors to consider before you buy Rightmove shares UK. After all, when deciding whether or not to invest in a company, you need to ask yourself whether the shares offer value. In order to do this, you need to look at the fundamentals surrounding the firm’s performance in recent months and years.

Below you will find a number of core metrics that should be considered before buying Rightmove shares.

Pre-Pandemic Performance and Post-Recovery

It is fair to say that the impact of the coronavirus lockdown measures was no fault of Rightmove. As such, the way in which its shares capitulated in early 2020 should in many ways be overlooked. In fact, it would be more logical to evaluate how the shares were performing before the pandemic came to fruition.

So, in 12 months prior to Rightmove shares peaking in February 2020, the stocks were trading at 479p. When the shares hit all-time highs of 690p just 1-year later, this amounted to an increase of 44%. This illustrates that there was a strong upward momentum and so it remains to be seen where the stocks would have reached been without the pandemic.

Nevertheless, we should make it clear that Rightmove shares did recover very quickly after the rapid collapse in Q1 2020. In fact, the property website managed to recover most of its pandemic-related losses by October 2020.

Market Share

Rightmove holds by far the lion’s share of the UK property website arena – with recent figures putting this at 80%. During the lockdown, the platform saw a year-on-year increase of 31% in website traffic. In terms of the financials, net profit margins have averaged 58% over the past five years – which is very healthy indeed.

Crucially, the Rightmove business model is expected to continue growing in the long-term, with more and more people moving away from conventional brick and mortar real estate agents.

Rightmove Shares Buy or Sell?

The general market sentiment on Rightmove shares is positive. The firm experienced a rapid stock price loss in the midst of the pandemic last year. But, the shares have recovered well.

Furthermore, and perhaps most importantly, Rightmove shares were on a solid upward trajectory before the coronavirus came to fruition, so there is no reason to believe that this will not resume in the medium-to-long term. As always, just make sure you perform your own independent research before you buy Rightmove shares UK.

Buy Rightmove Shares With Zero Commission

This guide has explained how to buy Rightmove shares UK from the comfort of your home. When using top-rated broker, you’ll be able to complete the investment process without paying a single penny in dealing commissions or stamp duty tax.

FAQs

What is Rightmove?

Rightmove is a UK-based website that lists properties that are for sale or rent. You can view a wealth of information about listed properties, which allows you to find a suitable home without initially needing to go through a third-party agent. As of Q2 2021, Rightmove has an 80% market share in the UK property website arena.

What stock exchange are Rightmove shares listed on?

Rightmove shares are listed on the London Stock Exchange (LSE) - as they have been since 2006. Rightmove is also a constituent of the FTSE 100 Index.

Does Rightmove pay dividends?

Yes, Rightmove does pay dividends. Although it canceled its 2019 payment, Rightmove recently paid a 2020 year-end dividend of 4.5p per share.

How does Rightmove make money?

Rightmove makes money in several key areas. At the forefront of this is the fees it charges to real estate agents that wish to list their properties on the Rightmove website.

Has Rightmove done a stock split?

Yes, Rightmove initiated its first and only stock split in 2018. The firm opted for a split at a ratio of 1:10.

Who is the Chief Executive Director of Rightmove?

Peter Brooks-Johnson is the current CEO of Rightmove and has been in the position since May 2017.

Can I invest in Rightmove shares via an ISA or SIPP?

Yes, like all equities, Rightmove shares are eligible for both ISAs and Sipps.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up