How to Buy Blackberry Shares UK – Beginner’s Guide

eToro: Buy the Best Shares With 0% Commission

Although not as parabolic as AMC and GameStop, Blackberry shares were caught up in the recent WallStreetBets saga. That is to say, a collective group of Reddit users colluded to buy Blackberry shares with the view of pumping its price northwards. This has since resulted in extremely volatile trading conditions on this US-listed stock.

With that in mind, this guide will explain how to buy Blackberry shares online in the UK.

-

-

Find a UK Stock Broker to Buy Blackberry Shares

Your first port of call is to find a trusted UK stock broker that gives you access to the New York Stock Exchange (NYSE).

Your first port of call is to find a trusted UK stock broker that gives you access to the New York Stock Exchange (NYSE).There are dozens of such providers to choose from – most of which are regulated by the FCA and covered by the FSCS. You do, however, need to explore what fees you will need to pay – as you’ll be purchasing non-UK stocks.

Below we bring you a small selection of UK trading platforms that allow you to buy Blackberry shares in a safe and low-cost manner.

1. Fineco Bank

Fineco Bank is another option to consider when looking to buy Blackberry shares online in the UK. The provider is not commission-free, but prices are competitive nonetheless. For example, UK investors can US-listed stocks like Blackberry from just $3.95. You will pay this fee when you buy Blackberry shares and again when you sell them.

Additionally, you also need to factor in the annual maintenance fee that Fineco Bank charges, which stands at 0.25% of your portfolio amount. For example, if you have £1,000 invested, this amounts to a small payment of just £2.50 per year.

In addition, Fineco Bank also supports CFD markets. Once again, this means that you can trade Blackberry shares in a more sophisticated manner – such as applying leverage or short-selling. If you do take the CFD route, Fineco does not charge any commission. If you’re looking to build a highly diversified portfolio of assets, Fineco Bank can help you do so. For example, the broker gives you access to dozens of stock markets, and thousands of mutual funds and ETFs.

If you decide to use Fineco Bank to buy Blackberry shares, you will be required to meet a £100 minimum deposit. Before you can do this, you’ll need to upload a couple of verification documents – which can take 1-2 working days for Fineco to validate. Further, we should note that Fineco Bank does not accept debit/credit card or e-wallet deposits. Instead, you’ll need to perform a traditional bank transfer. Finally, your capital is safe at Fineco Bank – as the platform is regulated by the FCA and covered by the FSCS.

Stock Trading Fees 0% commission on CFDs; £2.95 per trade on UK shares; $3.95 per trade on US shares Deposit Fees No Withdrawal Fees No Inactivity Fees No Monthly Account Fees No Sponsored ad. Your money is at risk.

Research Blackberry Shares

As we briefly noted earlier in this guide, Blackberry was recently caught in the WallStreetBets saga – with the value of its shares increasing a significant amount in a very short period of time.

With this in mind, it is important that you perform lots of research on the fundamentals of Blackberry before you proceed with an investment.

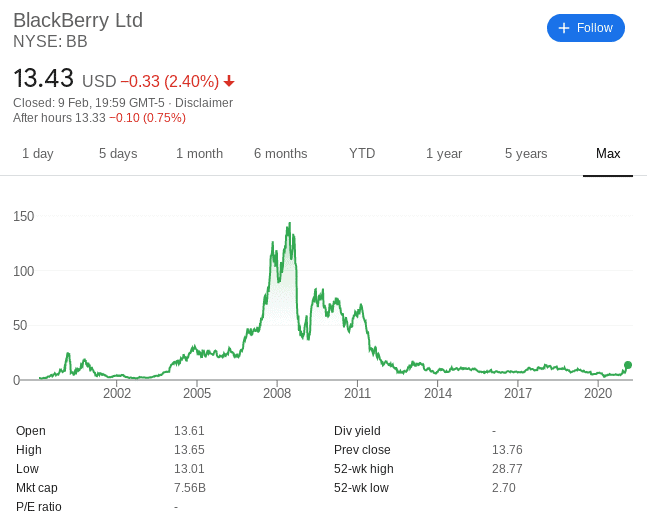

Blackberry Share Price History & Market Capitalisation

Make no mistake about it – Blackberry is now a shadow of its former self. Not only in terms of losing the vast majority of its market share to Samsung and Apple but its stock price capitulation over the past decade. For example, at its peak in 2008 – Blackberry shares were worth over $138 each on the NYSE. Over the course of just a few months, the stocks collapsed to just $40-ish.

However, this decline has been a continuous process, with Blackberry shares hitting 52-week lows of $2.70 in March 2020. To put this into perspective, this low represents a stock market decline of over 98%. In other words, had you invested £10,000 into Blackberry at its peak in 2008, your shares would have been worth just £200 come March 2020.

With that being said, Blackberry shares came to life in early 2021 as per the previously mentioned WallStreetBets saga. As we cover in more detail later, this resulted in the shares going from $6.58 at the start of January to highs of $28 by the end of the month.

This translates into a 1-month stock price increase of over 270%. Naturally, the shares have since cooled off by some distance. At the time of writing in February 2021, Blackberry shares are worth just over $13. That’s a rapid decline of almost 50% since the $25 peak experienced just a couple of weeks ago.

Blackberry EPS and P/E Ratio

As of Q3 2020, Blackberry reported an EPS of negative $0.23. For those unaware, the EPS illustrates how efficient a company is in terms of earnings flowing down to stockholders. But, if the EPS is negative – like it is with Blackberry, this means the firm is losing money.

Another key accounting ratio to look at is the P/E ratio – which allows us to assess whether a stock is potentially over or undervalued. In the case of Blackberry, the firm has a P/E ratio of over 107 based on current stock prices. To put this into perspective, fellow smartphone maker Samsung is carrying a P/E ratio of 76.

Blackberry Shares Dividend Information

If you’re looking to add some dividend stocks to your portfolio, Blackberry won’t fit the bill. The firm has never paid a quarterly dividend to date, and based on the financial difficulties it continues to have, it’s unlikely this will change any time soon. As such, the only way that you will be able to make money by buying Blackberry shares is through capital gains.

Why do People Invest in Blackberry Shares?

When buying shares in a company, you do so because you believe that it represents a good investment opportunity.

In other words, you believe that the shares will increase in value over the course of time – based on the fundamentals of a strong business model and balance sheet.

With this in mind, the sections below will explore why many people decide to invest in Blackberry shares:

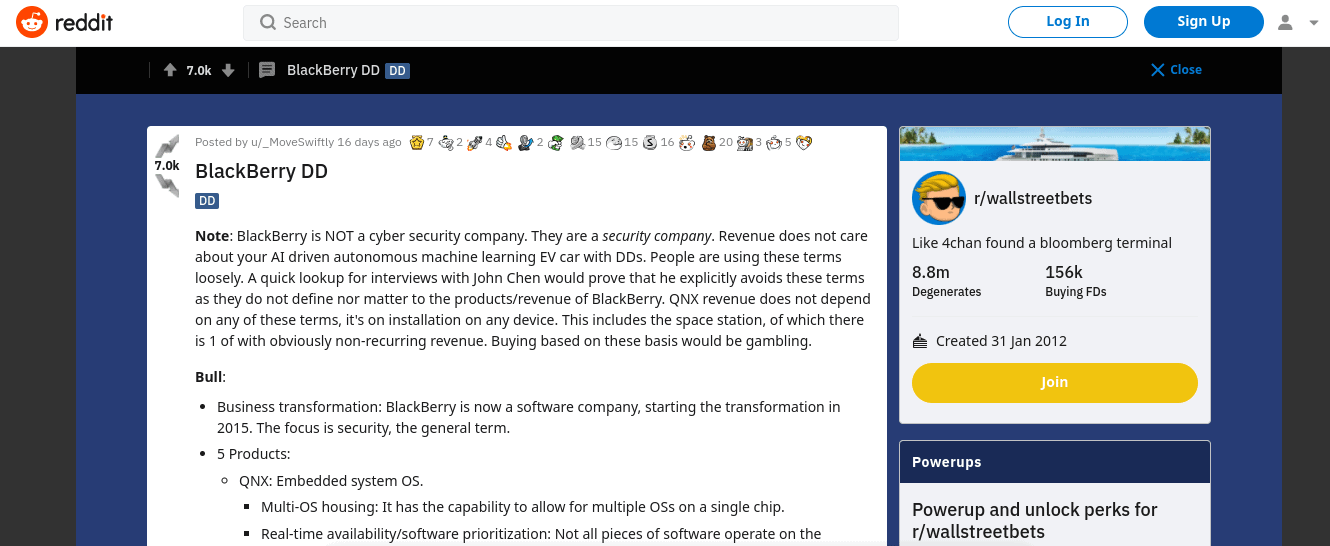

WallStreetBets

WallStreetsBet is a sub-Reddit group that sees investors discuss and share trading ideas. More specifically, the group was recently behind a series of stock pumps. This means that collectively, thousands of WallStreetBets group members decided to buy shares in various companies as a means to increase its stock price.

On top of GameStop and AMC, this also included Blackberry. The result of this was a Blackberry stock price that went from $6.58 to $28 in the space of four weeks.

This translates into a stock price pump of over 270%. Crucially, such a parabolic upward swing in Blackberry’s share price had nothing to do with the fundamentals of the company. Instead, this was a result of large waves of Reddit users deciding to buy Blackberry stocks in and around the same time.

Pre-WallStreetBets

If you’re looking at Blackberry as a long-term investment – then you need to put a line through the WallStreetsBet pump. Instead, it’s worth looking at how the stock was performing prior to January 2021.

In the five years prior to the pump, Blackberry shares were price in the $6.50 region. Fast forward five years to January 2021 and the same shares were priced at $6.58.

This means that by holding on to your Blackberry shares for this five years period, your investment would have stayed completely flat. When you consider how much the wider stock market grew during the same period, you would have effectively lost money.

Q3 Figures Were Woeful

Looking at the financials, in its most recent earnings report for Q3 2020 – the firm published revenues $218 million.

In comparison to the same quarter in the previous year, this amounted to a revenue decline of 18%. Perhaps even more alarming is the fact that Blackberry reported net cash generation from operating activities of just $29 million.

Ultimately, stockholders will be keeping a keen eye on the upcoming earnings report to assess whether or nor CEO John Chen has what it takes to turn things around.

Innovation is Key

There is no getting away from the fact that Blackberry’s market share in the smartphone space is now virtually non-existent. This is why innovation and a strong focus on cutting-edge technologies are key. In particular, this is why the firm is now almost exclusively focus on security and IoT (Internet of Things) software.

Additionally, Blackberry also completed a $1.4 billion acquisition of Cylance in 2019 – further expanded its presence in the AI cybersecurity space.

Unfortunately, the acquisition is yet to really drive revenue performance at Blackberry. Nevertheless, another area that the firm is working on is the growth of 5g technology. This is because it is hoped many operating in this sector will look at Blackberry and its suite of innovative security technologies to keep networks safe.

Open an Account and Deposit Funds

If you still strongly believe that Blackberry represents a good long-term investment and you have fully considered the risks – the next step is to open an account with your chosen broker.

First and foremost, head over to your chosen broker’s website and begin the account opening process.

FCA-brokers are legally required to collect some information from you – which usually includes the following:

- Full name

- Home address

- Date of birth

- National insurance number

- Email address

- UK mobile number

- Username and password

You will also need to upload a couple of ID documents:

- Passport or driver’s license

- Recently-issued bank account statement or utility bill

You will now need to deposit some funds into your newly created trading account, choosing from one of the following popular payment methods:

- Debit/credit cards

- Paypal

- Skrill

- Neteller

- Bank transfer

How to Buy Blackberry Shares

Once you have opened a trading account and made a deposit, you can then proceed to buy Blackberry shares. Simple enter ‘Blackberry’ into the search box and click on the ‘Trade’ button.

Then, an order box will pop up. Enter the amount you’d like to invest, making sure that you are meeting your broker’s minimum deposit threshold.

Finally, click on ‘Open Trade’ to buy Blackberry at the market rate.

Is It a Good Idea to Invest in Blackberry Shares?

As we covered earlier, the shares remained flat in the five years prior to the WallStreetBets event, with virtually no movement whatsoever. In contrast, the wider markets – and particular other stocks in this sector, have enjoyed growth.

Of course, Blackberry has since moved away from the smartphone arena and is now involved in cutting-edge technologies such as 5g, AI, and cybersecurity. All in all, at current prices, the P/E ratio also hints that Blackberry could be overvalued, relative to the other companies in the space.

The Verdict?

Buying Blackberry shares online in the UK is a process that can be completed online using an FCA-regulated stock broker. As always, it’s crucial to do your research beforehand and make sure that you are never investing more than you can afford to lose.

FAQs

Does blackberry still make smartphones?

In August 2020, management at Blackberry announced that it would no longer be selling smartphones. With that said, the firm has not been producing its own models since 2016.

What stock exchange are Blackberry shares listed on?

Blackberry is listed on the New York Stock Exchange (NYSE). If you’re based in the UK, you can still invest in Blackberry stocks by using a broker that supports US-based equities.

Does BlackBerry stock pay dividends?

No, Blackberry has never paid dividends. This is likely to be the case for the foreseeable future – as per its currency financial standing.

How does BlackBerry make money?

Blackberry no longer generates revenue from the sale of smartphone devices. Instead, it now makes money through intellectual property and software.

How do you short Blackberry?

If you’re a retail investor based in the UK and you want to short Blackberry shares because you think they are overvalued, you can do this through a regulated broker that supports CFDs. You do, however, need to keep an eye on overnight financing fees – which are payable for each day that you keep a CFD position open.

Who is the Chief Executive Director of Blackberry?

The current Blackberry CEO is. John S. Chen, who joined the firm in 2013.

Can I invest in Blackberry shares via an ISA or SIPP?

Yes, there are no restrictions on ISAs or SIPPs in terms of buying US-listed stocks like Blackberry.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up