Best Most Shorted Stocks UK – Invest with 0% Commission

Shorting a company’s stock involves borrowing shares and betting they will fall in price. This can provide a profitable opportunity for investors who bind together and hold, forcing short-sellers to purchase their shares back at a higher price for what they paid in the first place. In this comprehensive guide, we take a look at the best most shorted stocks UK to buy in 2021, as well as a guide to the best brokers to trade with!

Best Most Shorted Stocks UK List

If you need help finding your Best Most Shorted Stocks UK, below we have provided a list of our top 10 picks for 2021. Scroll down for an in-depth look at each, including share price history, pandemic performance, and future projections.

- Gamestop – #1 Best Most Shorted Stock UK 2021

- AMC – Best Most Shorted Stock UK around the COVID-19 Pandemic

- Cineworld – Best UK Stock to Short in 2021

- Sainsbury’s – Best Supermarket Stock to Sell Short

- Petrofac – Short the Oil and Gas Industry

- Pearson – Best Most Shorted Stock UK In Education Industry

- Hammerson – Best Most Shorted Stock UK In The Real Estate Bubble

- Petropavlovsk – Best UK Stock to Short Gold

- Network International Holdings – Best Overvalued Tech Stock to Short

- Metro Bank – Best UK Bank to Short Sell

Best Most Shorted UK Stocks Reviewed

Now we have shown you our top 10 list, let’s delve deeper into the price history, impacts of the pandemic, and future outlook of these types of shares and most shorted stocks.

1. Gamestop – #1 Best Most Shorted Stock UK 2021

Gamestop (NYSE: GME) is the world’s largest videogame retailer. The company had faced profitability problems, shutting 321 stores in 2019 with further closure plans for 2020. This was reflected by its modest $5 share price throughout nearly all of 2020. The start of 2021 was when things started to get interesting. The company experienced what is known as a short squeeze. In Gamestops case, millions of Reddit retail investors bought up shares, driving up share prices and challenging hedge funds. This forced the hedge funds to purchase their stocks back at a higher price, sending share prices soaring to a peak of $325!

As mentioned, throughout the pandemic Gamestop fluctuated relatively little as it had begun shutting down stores even before the pandemic to cut costs. However, throughout 2021 it has peaked multiple times including another shoot up to $264 in early March. The share price is currently hovering just below the $160 mark.

The firm recently announced its Q4 results, highlighting an encouraging revenue of $2.12bn. This is great for Gamestop’s future. This revenue will be largely due to the high amounts of publicity GME has received in the past few months. Its January short squeeze remains one of the most impressive in history, and this company is likely to remember for a while as a consequence.

2. AMC – Best Most Shorted Stock UK around the COVID-19 Pandemic

AMC (NYSE: AMC) is another US share whose value has skyrocketed in 2021. The firm operates a chain of movie theatres in the US and has the largest market share in America. The share price was affected by the pandemic as the majority of movie theatres had to close. This sent share prices slumping to a low of just $1.91. Prices are currently sitting around $10 per share, marking an encouraging recovery from 2020 lows. However, similar to Gamestop, investors have been anticipating a short squeeze, with the short volume ratio at 20%.

AMC also has a bright future. With much of the entertainment sector due to open up throughout the tail end of 2021, business is set to boom for AMC. Even if a short squeeze didn’t occur, share prices are set to steadily rise anyway as a result of increased sales. Positive 2020 Q4 results have also helped forecasts for a rising share price. Therefore, AMC could be a great shorted to stock to add to your portfolio.

3. Cineworld – Best UK Stock to Short in 2021

Cineworld (LSE: CINE) is a similar share to AMC. However, the movie theatre operates globally. Historical share prices have performed well, with several positive upswings throughout the last decade. The share price has soared over 330% in the last sixth months, and at the time of writing it trades at 103p.

2020 was a challenging year for Cineworld. Information from the Annual Report highlights its monstrous $2.6bn loss as well as the disappointing decrease in revenues of $800m down from 2019’s $4.3bn. This primarily due to pandemic struggles that shut down cinemas worldwide, cutting of business for the firm. However, Cineworld remains confident it will be the “best place to watch a movie” post lockdown.

Cineworld currently has 6.7% of its shares held by short-sellers, including 6 major hedge funds. Polygon Partners are amongst the hedge funds betting against Cineworld, according to the FCA disclosures. However, if share prices keep rising, then these same hedge funds may have to repurchase their shares at higher prices, driving shares up even further. This makes Cineworld a great addition to our Best Most Shorted Shares UK for 2021 list.

4. Sainsbury’s – Best Supermarket Stock to Sell Short

Sainsbury’s (LSE: SBRY) is the second-largest chain of supermarkets in the UK, holding a 16% market share. Since it went public on the London Stock Exchange in 1999, share prices have declined, peaking in 2007 at just under 600p. Prices were falling even before the pandemic struck due to a failed merger with Asda, but the impact of coronavirus pushed prices to an all-time low of 178p. However, prices are up 22% year-to-date proving Sainsbury’s as a good recovery stock.

Sainsbury’s is currently one of the most shorted UK shares, with 7% of shares held in short positions. Asset managers such as Blackrock and KPS are amongst the firms betting on a decline in share price for Sainsbury’s. The share price currently sits at 245p at the time of writing, following a mild positive trajectory. If prices continue to rise, this shorted stock could provide a great investment opportunity, which is why it has made it onto our top 10 list for Best Most Shorted Stocks UK.

5. Petrofac – Short the Oil and Gas Industry

Petrofac (LSE: PFC) is a British company that provides oil and gas internationally. Its main operations occur in oil-rich Asia. Historically share prices have also declined since their peak of 1770p in 2012. The price of oil has fallen steadily since the 2008 financial crash which is a good indicator for Petorfac’s business. The pandemic hit Petrofac’s share price pretty hard, sending prices tumbling from 370p to 183p between February and March 2020. However, it was 2021 that saw Petrofac reach its lowest price of 95p per share, indicating a prolonged impact of the pandemic.

The falling share price has made Petrofac a profitable share to short sellers. 7.73% of shares are currently held by short-sellers like Blackrock and CapeView Capital. These oil shares seem to be a riskier investment as trends indicate the firm is struggling to recover from the pandemic. However, at the time of writing the stock has jumped 10%, largely due to a new agreement for a $700m facility extension which will hopefully drive up prices in the future.

6. Pearson – Best Most Shorted Stock UK In Education Industry

Pearson (LSE: PSON) is a UK educational publisher and assessment service, providing both schools and corporations with educational material and exams. Share prices peaked at 2151p in 2000, and have seen a few smaller peaks since. The pandemic hit Pearson hard, sending prices tumbling all the way down to 425p. However, this stock has since risen to just under 800p at the time of writing, proving itself s a great recovery stock, almost doubling in value.

Pearson has a relatively small short share percentage of 1.3 held by Marshall Wallace and Theleme Partners. However, in early January it saw a huge 12% rise, largely in reaction hype of Reddit daytraders. At the time, Pearson was amongst the most shorted stocks UK, with 8.7% of shares held in short positions. The reduction of short positions indicates that hedge funds believe that prices will not fall lower. This a great indicator to investors that now could be a good time to invest, hence why Pearson has earned a place on our Best Most Shorted Shares UK.

7. Hammerson – Best Most Shorted Stock UK In The Real Estate Bubble

Hammerson (LSE: HMSO) is a UK property investment and development company. Its share price peaked just before the 2008 financial crash, at 540p. Annual house prices decreased over 20% between 2008 and 2009, which drove down share prices in real estate developers such as Hammerson. Hammerson was able to steadily grow for the next 5 years, however, since 2015 share prices have seen a downswing. To make things worse, the pandemic sent prices plummeting reaching an all-time low of 16p. The share price currently sits at 36p.

The downswing of Hammerson has made it a profitable short term investment for hedge funds. Hammerson currently has 6.71% of its shares held in short positions. The UK housing and real estate market is expected to grow around 4% this year, which is encouraging for Hammerson’s share price. However, like Petrofac, this short share comes with risk. Hammerson announced recently it would sell 7 retail parks to Canadian private equity firm Brookfield to raise £350m in capital, indicating the firm is struggling for cash.

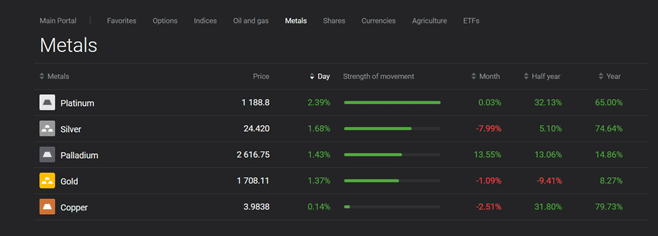

8. Petropavlovsk – Best UK Stock to Short Gold

Petropavlovsk (LSE: POG) is a UK-based gold mining company with primary operations in Russia. Like many of our most shorted stocks list, its share price peaked just before the financial crash at 582p. The crash sent prices tumbling but a quick recovery was seen throughout 2010 and 2011. However, a downtrend then occurred all the way down to $5 per share, which is where prices sat for 5 years, until 2019 when things began to pick up. Since then the stock has risen to 24p per share which is where it sits at the time of writing.

There are currently two firms that have short positions in Petropavlovsk. These are Citadel and Polygon, which have short positions of 0.96% and 4.61% respectively, according to the FCA. These positions are likely to be due to the downtrend in gold prices in the last two years, however, many analysts believe that gold prices will rise post-covid in the same way they did post-financial crash. This could be great news for Petropavlovsk.

9. Network International Holdings – Best Overvalued Tech Stock to Short

Network International Holdings (LSE: NETW) provide international payment solutions to merchants and financial institutions. A relatively new company to go public, Network International’s share price trajectory has been encouraging. However, the pandemic brought problems for the firm, damaging share prices reaching a low of 206p in July 2020. Since then the firm has seen a great recovery- at the time of writing, the share price is 437p.

Gladstone and Kuvari Partners have short positions of 0.76% and 2.35% of shares respectively. Though revenue was down 15% for 2020 compared to 2019, the firm announced in its 2020 Annual Report that it would be expanding its operations into Sudan and other parts of Africa to tap into growing markets. It also is moving towards acquiring DPO, the largest online commerce payments platform in Africa, which is great news for Network International. Therefore, Network International is one of our Best Most Shorted Stocks UK.

10. Metro Bank – Best UK Bank to Short Sell

Metro Bank (LSE: MTRO) is a UK-based retail and commercial bank that went public in 2016 and trades on the London Stock Exchange. Prices peaked in 2018 at 4018p but plummeted in 2019 largely due to the £2.2m pre-tax loss presented in the 2019 Q3 report. In addition to this, the founder Vernon Hill decided to leave the bank, which saw prices drop further. This was all before the pandemic which sent prices lower still, to a low of 60p in November 2020. However, prices have since almost doubled in value sitting at 119p at the time of writing.

Currently, just under 4% of Metro Bank’s shares are held by short-sellers, qualifying it for our Best Most Shorted Stocks UK list. The bullish investment case for this stock is its current value. The company did not raise any new debt in 2020, instead, it raised capital by selling £3.1bn worth of mortgages to NatWest. In addition to this, CEO Daniel Frumkin anticipates that Metro Bank will be become profitable by 2024, which gives the bank a positive trajectory moving forward.

What are Most Shorted Stocks UK?

As we began to explain in the intro, shorted stocks are borrowed from brokers when investors anticipate the share price to fall. Profit is made by selling those shares immediately, then buying them back at a lower share price before returning them to the broker. The broker makes money by charging an interest fee over an agreed timeline. Hedge funds are also required to put down a deposit, called a margin requirement, as a backup if things start to go badly. However, retail investors can make big money when shorted shares hold their price or even rise. This is why shorting shares is risky, as theirs no limit to how high a stock can go. If prices get high enough, brokers can margin call hedge funds as their deposits no longer cover their potential losses. This forces the hedge funds to put down even more money. This triggers what is known as a short squeeze, as the fund managers are squeezed of their capital as the price keeps rising.

The recent Gamestop saga, fuelled by Reddit users, is an excellent example of this. Reddit users banded together and bought millions of shares of Gamestop, which at the time was a failing company (see previous analysis). This had lead capital management firms to open large short positions. The millions of investors who purchased shares drove up the share price, forcing the hedge funds to pay billions in margin calls. This is exactly what happened, raising the share price by nearly 2000%!

Are Most Shorted Stocks UK a Good Investment?

A rise of 2000% is eye-watering to any retail investor. However, there are still risks that need to be considered. Hedge funds employ dozens of professional market analysts when opening short positions, making them heavily calculated. Since the Gamestop saga, Reddit users have tried to trigger a number of other short squeezes with little success. The risk of investing in shorted companies is that you are betting against the research of professional fund managers. This usually means the stock is in fact likely to fall in price, perhaps due to poor revenue forecasts, cash problems, or industry restrictions. Whilst short squeezes have occurred in the past, it requires the systematic coordination of millions of retail investors, which is no easy feat to pull off. However, when this is pulled off, it sends share prices through the roof, making millions for investors. This is a possibility with all of our top 10 Best Most Shorted Stocks UK list, making them all a great potential addition to any investor’s portfolio.

Best Brokers To Buy Most Shorted Stocks UK

Now we have taken a close look at our top 10 Best Most Shorted Stocks UK list, let’s have a look at how you can invest. All of our stocks are listed on either the London Stock Exchange or the New York Stock Exchange. It’s important to choose the correct broker to connect you to these exchanges so you can purchase your chosen shorted stock. To help choose the best stock broker for you, we have provided a closer look at our top 2 best UK brokers, and a step-by-step guide on how to invest in your chosen stock using a stock broker.

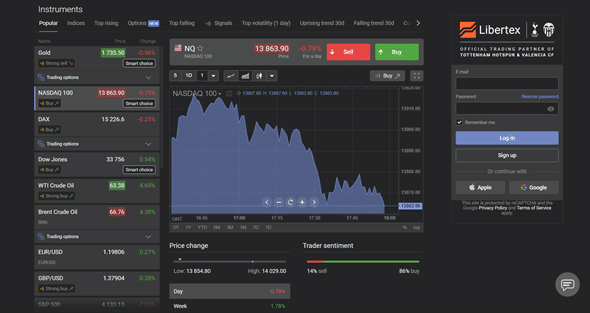

1. Libertex – Trade Most Shorted Stocks UK with Zero Spread

Libertex offers a leverage ratio of 1:5, meaning investors can open positions 5 times larger than their original deposit. This opens the doors to even greater profits for investors but also increases risk. The platform also has zero spreads, making it one of the most competitive and best CFD brokers UK on the market. Traders also receive free market signals from Trading Central experts, giving insight into professional market analysis. There are also free risk management tools including stop-loss and push notifications, which help traders keep their risks and losses low.

To open an account with Libertex simply visit their website and follow the onscreen prompts. You must deposit a minimum of £100, after which you can begin to start purchasing your chosen shorted stocks. You can deposit funds easily using debit and credit cards, bank transfers, and e-wallets. For additional safety, your deposited funds will be protected using industry-leading security protocols like CySEC.

Pros:

- Trade CFDs spread free

- CySEC Regulated

- Fixed commission structure

- Free market signals

Cons:

- Only trades CFD’s

- Limited number of UK stocks

85% of retail investor accounts lose money when trading CFDs with this provider.

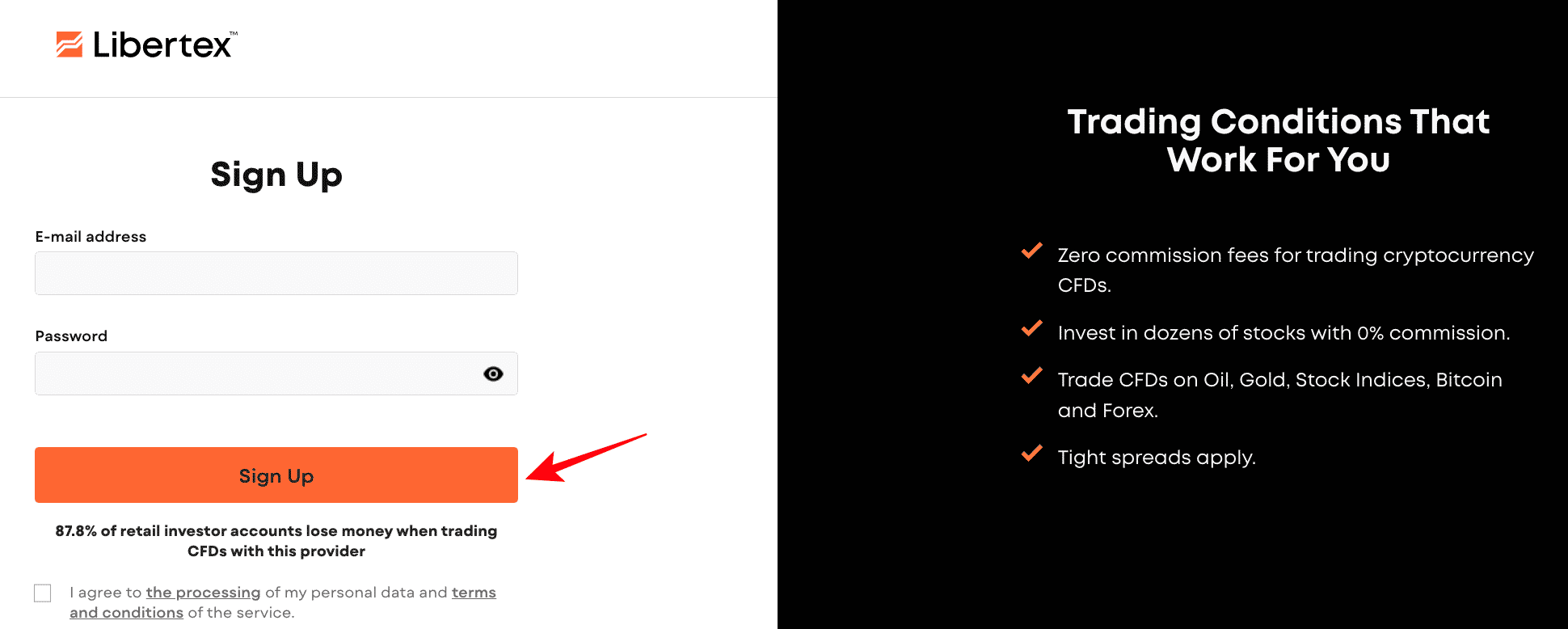

How to Invest in Most Shorted Stocks UK

After running through what shorted stocks are, our Best Most Shorted Stocks UK list, and our top brokers, you should have a good idea of whether you want to invest in shorted stocks. We will now show you a step-by-step guide on how to open a new position using our preferred broker Libertex.

Step 1: Open an account

The first step is to open a new Libertex account. Begin by visiting the homepage on your internet browser or you can download the investment app. Once here, click the ‘join now’ button and follow the onscreen instructions. You will now be asked to fill in some personal information and complete a short financial questionnaire. This will assess your trading knowledge to give to better tailor your experience. A mobile number will also be required for additional authentication purposes.

Step 2: Identity verification

For additional security, users are required to upload some official documents to prove their identity. These documents are either a driver’s license or a passport and a recent utility bill. Normally Libertex will have these documents verified minutes after uploading.

Step 3: Depositing funds

Now you must make a deposit to fund your account. Libertex accepts various payment methods, including debit/credit cards, bank transfers, Paypal, and Skrill. Apart from a bank transfer, these methods are listed on Libertex, meaning the funds will be deposited instantly and you can begin trading your shorted stocks.

Step 4: Trade shorted stocks

Your account is now up and ready to go. You can choose your favorite shorted stock by searching using the onscreen search bar. You can also browse the platform for over 2000 other financial assets, filtering markets, and stock exchanges. Once you have found your stock, you can open a position by clicking on the ‘Trade’ button. You must then fill out an order form, using your funds to set a number of shares to purchase. Click on the ‘Set Order’ form to complete open your trade.

Buy the Best Most Shorted Stocks UK with 0% Commission

In conclusion, shorted stocks can be a profitable investment both by short selling using CFDs and by investing in shorted stocks you believe may raise in value. The recent Gamestop saga in January 2021 has brought to light the massive impact retail investors can have on driving up the share price and squeezing short-sellers/hedge funds.

Whilst this sounds like good news, there are still risks in investing in such shares. Hedge funds leverage the professional experience of thousands of employees who study the markets in-depth daily. Betting against these traders is a risky move, but can be pulled off by banding together. CFD short selling is also a risk as it requires a drop in share price which is never guaranteed. It is therefore important to diversify your portfolio and keep your stakes sensible.

FAQs

What other shorted stocks are there?

Other popular shorted stocks include Blink Charging Co., Second Sight Medical Products, and Lemonade.

What is short selling?

Short selling is where a broker loans shares to a buyer who believes the price will fall. The buyer then sells the shares immediately and repurchases them at a lower price before returning them to the broker. Profit is made in the difference in price.

Is there a most shorted shares ETF?

Yes. Inverse/short ETFs do exist and can be invested in. These aim to provide the opposite return on an asset class for the day, similar to shorting a share. Popular inverse ETFs include ProShares UltraPro Short QQQ and ProShares UltraShort S&P 500.

Where are shorted shares listed?

Any share can be shorted, provided it can be loaned and then sold by a short seller. This means any stock listed on any exchange can be shorted. Most of our stocks in our Best Most Shorted Stocks UK list are listed on either the London Stock Exchange or the New York Stock Exchange.

Why do brokers loan shares to short?

The lender of a stock (usually a broker) charges an interest rate on the loaned shares. They also demand a deposit called a margin to protect their shares. They make a small amount on the interest, but if the stock increases in the price above the original margin then the broker may choose to margin call the short seller, who now has to put up more money as a deposit.