Equity Trading UK Guide 2025

Equity trading is one of the most common ways for individuals in the UK to enter the market. Equities are simply stocks, or shares of publicly traded companies. So, equity trading in the UK involves buying and selling shares of companies to make a profit.

If you’re interested in trading equity, this guide is for you. We’ll explain how equity trading works in the UK and cover strategies for trading on equity. We’ll also highlight five UK equity brokers you can start trading with today.

What is Equity Trading?

Equity trading involves buying and selling stocks to try to make a profit. In many ways, it’s very similar to stock trading.

Equity trading involves buying and selling stocks to try to make a profit. In many ways, it’s very similar to stock trading.

In fact, the terms stocks, shares, and equities are often used interchangeably. All three refer to shares of publicly traded companies. The main difference is that equity trading includes not just stock trading, but also ETF trading.

The goal of UK equity trading is to buy low and sell high. Equity trades can last anywhere from a few minutes to a few weeks depending on your equity trading strategy. If you think the price of, say, Tesco shares will go up, you can buy shares and sell them once the price appreciates realizing a profit.

In addition, it’s possible to trade equities when prices are falling. This is known as short selling, and it involves selling shares at a high price and then buying them back at a lower price. Thanks to short selling, you can trade on equities in the UK regardless of whether the stock market is going up or going down.

Cash Equity Trading

Cash equity trading is a specific term used to refer to trading by large financial institutions like banks and investment firms. These firms may buy and sell equities using their own money or on behalf of clients like mutual funds and investment trusts.

When large financial institutions buy shares of a company, they often purchase millions of pounds worth of shares at a single time. In some cases, cash equity trading orders are big enough that they drive up the price of the shares being purchased as the trades are happening.

It’s important to note that cash equity trading isn’t a specific type of trading that individuals can do. All equities are bought and sold using cash from your trading account.

Ways of Trading Equity

There are three main ways to trade equity in the UK: by trading shares or ETFs outright, through CFD trading, and by trading options. It’s important to understand how each of these financial instruments works and why you might want to choose one over the others.

UK Equity Trading with Shares

Buying and selling shares outright is a simple way to start trading equity. With this type of trading, you own any equities you purchase for as long as you hold them.

The downside to trading on equity with shares is that it doesn’t give you much flexibility for trading. You cannot leverage your trades, which limits your buying power with a small account. In addition, short selling requires borrowing money from your broker, which comes with additional fees.

UK Equity Trading with CFDs

CFD trading is a powerful way to trade equities in the UK. CFDs (contracts for difference) are contracts with your broker that allow you to speculate on the future price of a stock without actually owning it.

What’s nice about equity CFD trading is that you can buy or sell CFDs to bet on price movements in either direction. Another benefit is that you can apply leverage to your trades with CFDs, which multiplies the effective size of your position. For example, if you trade £100 of AstraZeneca share CFDs with 10:1 leverage, you are actually trading £1,000 worth of shares.

UK Equity Trading with Options

Options trading is significantly more complex than trading shares or CFDs. With equity options, you buy a contract that gives you the right to buy or sell a stock at a predetermined price on a specific date. In effect, you are speculating on not just the direction of a price movement, but also the magnitude and timing of that movement.

Trading equity with options gives traders a lot of strategy flexibility and purchasing power. However, options are suited for more advanced traders.

Advantages of Equity Trading UK

There are several major benefits to equity trading in the UK, especially compared to traditional stock investing.

Profit Potential

First, your potential for profit is higher. When you invest in stocks for the long-term, you are exposed to all of the ups and downs in the share price. While the market might eventually move higher, it can take a while to get there.

With equity trading, you can profit repeatedly from trading all the ups and downs in a share’s price. With every profitable trade, you add more money to your trading account – which can then be used to increase your buying power for your next trade. Compounding your account balance through repeated winning trades can yield extremely high returns over the long term.

Short Selling

Another benefit to trading on equity as opposed to investing is that you can profit not only when the price of a stock drops, but also when it falls. This is thanks to short selling.

Short selling is important because it means that you can find trading opportunities regardless of which direction the market is trending. It also allows you to hedge your trades to some extent, which is important for reducing risk.

Leveraged Trades

When trading equity in the UK, it’s also possible to leverage your trades. As we noted, leverage allows you to increase the effective size of your equity position.

That’s important for two reasons. First, it means that you don’t need to have a huge amount of money in your trading account to make real profits with equity trading. With just £100 in your trading account, you can apply 10:1 leverage to open equity positions worth up to £1,000. If the price of the underlying share moves by 5%, you would earn £50 instead of just £5.

Second, since you only need to commit a small amount of money to each trade when using leverage, you can open more equity trades. This allows you to take advantage of multiple simultaneous trading opportunities and diversify your trading portfolio, which reduces risk.

Market Access

One more benefit to equity trading in the UK is that you’re not limited to trading UK equities. Many equity brokers allow you to buy shares in the UK, US, Europe, and beyond.

This is particularly true for CFD brokers since they don’t actually need to go out and buy shares from a foreign stock exchange. Instead, they can simply issue a CFD contract that tracks the price of an equity, regardless of what exchange it trades on.

Risks of Equity Trading

Equity trading carries risks just like all types of trading. If you buy equity through shares, CFDs, or options and the price falls, you could be forced to sell the equity for a loss. Losses are okay and inevitable when trading, but it’s important to keep them as small as possible so that they don’t wipe out profits from all of your successful trades.

Another thing to keep in mind is that trading with leverage increases your risk. Just as using leverage multiplies your potential return, it also multiplies your potential loss. We recommend using stop losses with every trade, and especially with leveraged trades, to limit the amount that you can lose if the trade goes against you.

Equity Trading Strategies

The key to success with UK equity trading is to approach the market with a clear trading strategy in mind. Many advanced traders will craft custom strategies that have been honed over years of use. But you can also get started trading equities right away using these popular and easy to understand strategies:

Scalping

Scalping trading is a fast-paced day trading strategy that involves opening and closing equity trades in just a few minutes each. The idea behind scalping is to profit from a price movement when it is at its strongest, and then to get out before conditions can change. This trading strategy is meant to yield very small profits from each trade, but you will place dozens to hundreds of trades each day.

There are multiple ways to approach scalping, but a good place to start is to look at moving averages. When a short-term 5-minute moving average crosses above the longer-term 20-minute moving average, open an equity trade.

Swing Trading

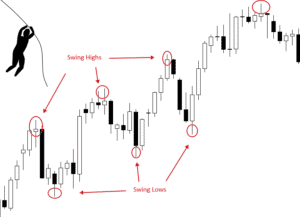

Swing trading is a multi-day trading strategy that seeks to capitalize on changes in price momentum. With swing trading, the goal is to open a trade after a big event like a breakout or reversal. Swing traders will then ride the ensuing momentum to return profits of several percent or more.

Swing trading equity successfully requires being able to recognize breakouts and reversals. Use technical indicators like MACD (moving average convergence-divergence) to spot shifts in momentum and RSI (relative strength index) to identify overbought or oversold levels.

Range-based Trading

Range-based trading is an equity trading strategy that works across multiple timescales. This type of trading is when prices are moving sideways and bouncing between an upper resistance level and a lower support level.

To trade on equity in a range, identify the support and resistance levels defining the range and trade the movements between them. Keep an eye on technical indicators like MACD and RSI that could indicate a breakout from the range, which can happen suddenly and explosively.

Popular Equity Trading Platforms

Choosing the right equity trading platform is important. Your broker will determine what equities you’re able to trade and whether you’re able to trade shares, CFDs, or options. Different equity trading platforms also have different fees, which can impact the profitability of your trading.

With that in mind, let’s take a look at five of the most popular UK equity brokers you can start trading with today:

1. Plus500

Plus500 is one of the lowest-cost equity trading platforms in the UK. All trades with this broker are 100% commission-free, and spreads on CFD trading are lower than almost any other CFD broker.

Plus500 is one of the lowest-cost equity trading platforms in the UK. All trades with this broker are 100% commission-free, and spreads on CFD trading are lower than almost any other CFD broker.

Despite being inexpensive, Plus500 doesn’t skimp on assets. You can trade CFDs or options for hundreds of UK and US shares, as well as CFDs for dozens of ETFs. The broker also stands out for offering leverage of up to 1:5 for equity trading, compared to just 5:1 at most other UK brokers.

Plus500’s trading platform is straightforward to use, offering complimentary web and mobile apps. You can access nearly 100 built-in technical indicators and drawing tools. The equity trading platform also supports price alerts, which are helpful for staying on top of your watchlists during busy trading days.

2. Hargreaves Lansdown

Hargreaves Lansdown offers share dealing accounts, ISA accounts, and CFD trading. This broker has a massive selection of assets, including more than 3,000 ETFs from the UK, US, and Europe. It also offers account holders a chance to invest in UK IPOs, which can create exciting opportunities for equity traders.

offers share dealing accounts, ISA accounts, and CFD trading. This broker has a massive selection of assets, including more than 3,000 ETFs from the UK, US, and Europe. It also offers account holders a chance to invest in UK IPOs, which can create exciting opportunities for equity traders.

Hargreaves Lansdown’s trading platform is built for investing more than trading, but it does have some handy features. You can access capable charts with a variety of popular technical indicators on both web and mobile platforms. Plus, the broker offers insight into popular equities by releasing frequent analyst reports.

The downside to Hargreaves Lansdown for equity trading in the UK is that buying and selling can be expensive. The broker charges commissions based on how many trades you place in the prior month, and they can be up to £11.95 per trade. These commissions don’t apply to ETF trades, but you will have to deal with an account management fee of around 0.45% if you buy funds.

3. IG

IG offers clients access to the ProRealTime trading platform, which includes chart trading, strategy backtesting, and custom indicators. It has a bit of a learning curve when you start out, but ProRealTime is one of the most powerful trading platforms on the market.

offers clients access to the ProRealTime trading platform, which includes chart trading, strategy backtesting, and custom indicators. It has a bit of a learning curve when you start out, but ProRealTime is one of the most powerful trading platforms on the market.

IG is also a choice if you want a very wide range of assets to trade. The broker offers thousands of shares and ETFs from markets around the world, and you can trade either through share dealing or through CFDs. In addition, IG supports options trading through CFDs.

All trading at IG is commission-free, but you’ll want to watch out for the CFD spreads at this broker. They can be much higher than at many other UK CFD brokers, although this is somewhat justified by the fact that you get such a powerful equity trading platform.

Sponsored ad. Your capital is at risk.

| Equity Trading Platform | Commission | Deposit Fee | Inactivity Fee | Withdrawal Fee |

| Plus500 | Variable spread | £0 | £8 after 3 months | £0 |

| Hargreaves Lansdown | £5.95 to £11.95 | £0 | £0 | £0 |

| IG | £0-£10 if buying and selling, variable spread for CFDs | £0 (0.5% on credit cards) | £9 after 2 years | £0 |

Tips for Equity Trading

To help you get started with equity trading, here are a few of our favourite tips:

- Start with a Demo Account

Developing a successful equity trading strategy takes practice. Rather than risk real money to practice, you can use a paper trading account. These demo accounts let you trade on live market data with simulated money, so there’s no risk if you make a bad trade.

- Use Stop Losses

Stop loss orders tell your broker to automatically sell your position if the price drops below a certain level. Placing a stop-loss with every trade can help limit the maximum amount you can lose if a trade goes against you.

- Keep an Eye on Volume

The number of shares of an equity being traded is an important indicator of what the price will do next. Often, price movements that are accompanied by strong trading volume are more reliable than price movements that happen when few people are trading. Volume is particularly important if you are doing price action trading.

Conclusion

Equity trading in the UK involves trading stocks and ETFs to make a profit. In contrast to traditional equity investing, equity trading offers potentially higher rewards in exchange for greater risk. You can hold equity trades for as short as a few minutes or as long as a few weeks, depending on your trading strategy.