Best Bitcoin ETFs in the UK to Watch

Cryptocurrency ETFs and Bitcoin ETFs are are fairly new type of ETF in the market. The funds are fairly easy to access and provide exposure to the cryptocurrency market. What are some of the risks and where you can invest in crypto ETFs?

Bitcoin ETFs available in the UK 2022

Bitcoin ETFs are relatively new to the market which makes them lesser-known by beginner investors. Here are some examples of Bitcoin ETFs that are available in the UK.

- Purpose Bitcoin ETF

- CI Galaxy Bitcoin ETF

- Evolve Bitcoin ETF

- QR Capital Bitcoin ETF

- VanEck Bitcoin ETF

- Ark Bitcoin ETF

Not all of these Bitcoin ETFs will be available to individual retail investors, with some only available to institutional investors. However, further down this guide, we go through several ways you can access ETFs as well as some alternative ways to invest in crypto ETFs.

Bitcoin ETFs UK

Let’s have a look at Bitcoin ETFs in more detail and then look at some alternatives.

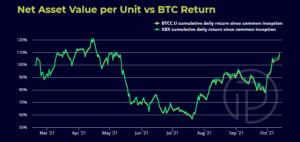

1. Purpose Bitcoin ETF

The Purpose Bitcoin ETF was the first Bitcoin ETF to be created. It only began trading on the Toronto Stock Exchange in February 2021, showing just how new crypto ETFs are. The fund is the first crypto fund to be physically settled in Bitcoin.

This means you do not need to have any wallet or digital keys to store. The fund is also backed by real Bitcoin, rather than Bitcoin futures contracts. The management fee of the fun is 1.00% and the fund trades on the Toronto Stock Exchange in Canada.

Currently, the fund holds 21,712.117222 Bitcoins.

2. CI Galaxy Bitcoin ETF

CI Global Asset Management offers the CI Galaxy Bitcoin ETF as well as the CI Galaxy Ethereum ETF. The fund has a low management fee of just 0.400% and is audited by Ernst & Young LLP.

The fund holds Bitcoin in US dollars (BTCUSD) which is stored in a cold wallet. At the time of writing, the total net asset value of the fund was CAD $466,219,964.02. The company aims to help investors gain exposure to Bitcoin but does state it is only suitable for those that can tolerate high risk.

3. Evolve Bitcoin ETF

Evolve is one of the smallest ETF providers with only $2 billion in management. They provide a simple way to access the price of Bitcoin through their ETF with a management fee of 0.75%.

The fund itself holds real Bitcoins with the fund tracking the price of Bitcoin against the US dollar. The holdings are priced based on the CME CF Bitcoin Reference Rate which is a once a day benchmark index price for Bitcoin denominated in US dollars.

4. QR Capital Bitcoin ETF

QR Capital is a blockchain investment firm based in Brazil. In June 2021, the company launched the QR Capital Bitcoin ETF which is also backed by real Bitcoins. There are also plans for a QR Capital Ether ETF.

The funds follow the same index used by the Chicago Mercantile Exchange (CME) and will have custodial services provided by Gemini, the crypto exchange founded by the Winklevoss twins.

5. VanEck Bitcoin ETF

VanEck has more than $60 billion in assets under management. Currently, the asset management company provides investors access to the VanEck Bitcoin Tracker Fund LP.

However, this partnership fund is only available to accredited US investors and qualified offshore investors with a minimum $100,000 investment. Redemptions can also only be made quarterly so it’s only for those with a long-term view.

VanEck has submitted proposals to the SEC to convert this LP fund into an ETF that can trade on regular exchanges in the US and be made available to retail investors. So far, the SEC has not authorised any crypto funds in the US but it may just be a matter of time.

Alternatives to Bitcoin ETFs

Most of the world’s current cryptocurrency ETFs are located on exchanges in Canada and Brazil, making them difficult to access for some investors.

However, there are some great alternative ways to capitalise on the growth in Bitcoin and other cryptocurrencies through ETFs and other ETF-style products.

1. ARK Fintech Innovation ETF

The ARK Fintech Innovation ETF is an exchange traded fund that trades on the New York Stock Exchange ARCA. It is an actively managed fund from the ARK Invest team, led by famed investor Cathie Woods.

The goal of the fund is to pick winning investments in financial technology including the blockchain technology that underpins Bitcoin and all other cryptocurrencies.

One of the firms biggest holdings is in Coinbase – the world’s biggest cryptocurrency exchange.

What is a Bitcoin ETF?

A Bitcoin ETF is a security that tracks the underlying price of Bitcoin. ETFs are investment products that help investors to buy a single security that tracks a basket of many securities following a certain theme.

You can buy ETFs just like stocks buying and selling with ease (depending on the ETF in question). Most ETFs track some type of index. For example, a Global Mining ETF may track the Bloomberg Global Mining Index.

In the case of Bitcoin ETFs, the ETF would track the underlying price of Bitcoin. So, as the price of Bitcoin rises, the price of the ETF would also rise. If the price of Bitcoin falls, the price of the ETF would also fall.

It’s important to note that most ETF applications will have a disclaimer that will state you do not own the underlying securities the ETF holds. For example, in a Bitcoin futures ETF, you do not own any of the Bitcoin futures contracts held inside of the ETF but rather a portion of the ETF entity.

Important Features of Crypto ETFs

Crypto ETFs are still very new. Most Bitcoin ETFs and crypto ETFs won’t be accessible to retail investors just yet but there are a few in Brazil and Canada.

One thing to bear in mind is that most of the crypto ETFs available now are based offshore or in low regulated jurisdictions. So, choosing whether or not to invest really does depend on your risk appetite.

However, as discussed earlier there are some alternative ways to invest in crypto ETFs. For example, the ARK Innovation ETF can provide investors exposure to the blockchain technology that underpins cryptocurrencies. The fund can be bought through a regulated broker.

Many institutions, mutual fund managers and Bitcoin Trust providers such as Grayscale, Gensler, Invesco, VanEck and other financial institutions are waiting for Bitcoin ETF approval.

Many applications have been submitted to the U.S Securities and Exchange Commission (SEC) for a Bitcoin ETF or crypto ETF in USD.

Buying Bitcoin vs Investing in Bitcoin ETFs

Another alternative to investing in Bitcoin ETFs is buying Bitcoin directly. After all, this is what the ETF provider will do for you but you won’t own any of the Bitcoins the ETF holds. The Bitcoins held in the fund are owned by the ETF provider and are usually put in cold storage.

In fact, fractional ownership of Bitcoins is great for people with low investment funds as on platforms you can start buying crypto with just $50. Even though one Bitcoin is worth more than $60,000 (at the time of writing).

Bitcoin ETFs, Coins & Alternatives

Below is a list of brokers that can provide you access to alternative Bitcoin ETFs and cryptocurrencies for direct investment.

Conclusion

Crypto ETFs offer exposure to the cryptocurrency market. Currently, the only available Bitcoin ETFs are located in offshore jurisdictions and lack safety, accessibility and transparency for investors.

However, there are still opportunities for investors to capitalise on the growing trend. Investors could buy Bitcoins directly from a crypto exchange, buy crypto-related stocks and ETFs as discussed above or access Copy Portfolios to invest in crypto themes.

FAQs

Is there a cryptocurrency ETF?

Where are some Bitcoin ETFs?

What is the most popular Bitcoin ETF?