Best Value Investments UK to Watch

Value investing involves finding companies that are worth more than their current stock price would suggest. Long-term investors like Warren Buffett, Benjamin Graham, Charlie Munger, David Dodd, Seth Klarman, and others have long used value investing to minimize risk and maximize gains.

In this guide, we’ll explore value investing in the UK.

What is Value Investing?

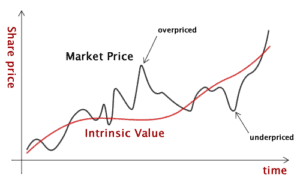

Value investing is a style of investing that involves buying stocks that are undervalued. Typically, value investors look at a company’s intrinsic value and compare that to the market. When the intrinsic value of a stock is less than its market value – that is, the share price – then value investors swoop in to buy.

Value investing in the UK is a contrarian way to approach the stock market. Fundamentally, it relies on the idea that the stock market is bad at valuing stocks appropriately. The market may overreact to bad news, driving the price of a company below its true value for a period of time. For value investors, that overreaction is a chance to buy shares at a discount on the assumption that the share price will eventually rise to meet the intrinsic value.

Key to any value investing strategy, then, is an understanding of exactly what a stock is worth. This intrinsic value can be calculated in a number of different ways – even famous value investors like Benjamin Graham and his student, Warren Buffett, now CEO of Berkshire Hathaway, went about calculating companies’ valuations in different ways.

Deep Value Investing

Deep value investing is another term for value investing. However, it is often used to describe a more extreme value investing strategy in which investors look specifically for companies that are beaten down. These companies often have very low stock prices relative to their historical average price and to their intrinsic value.

Deep value investing can be somewhat riskier than typical value investing. Beaten down companies may be struggling financially or may be losing their competitive edge. While this might not be reflected in intrinsic value calculations, it is important for value investors to look closely at what it will take for a company to turn around and reach its projected valuation.

Value Investing vs Growth Investing

Value investing and growth investing are two long term investment strategies based on a company’s fundamentals.

Value investors look at whether a stock is priced below its historical average and below the broader stock market. Ideal value stocks should also be priced below similar companies in their industry, at least in terms of price-to-earnings ratio.

Growth investors, on the other hand, look for companies that are rapidly growing their earnings per share year over year. Often, these companies are priced at a premium to the broader market rather than priced below competitors. Growth stocks tend to be high risk investments compared to value stocks because their valuation can fall sharply if earning growth slows down.

Key Features of Value Investing

UK value investing is widely praised by long-term investors who see this strategy as relatively low risk and high reward.

Reduced Risk

Value stocks are, at least in theory, low risk investments. That’s because cheap stocks that are already undervalued relative to their sector and their historical average likely don’t have much further to fall. By buying low, you effectively minimize your downside risk.

Of course, this isn’t always the case. Keep in mind that some stocks are priced low for a reason, like ongoing financial troubles. There is a fine line between undervalued stocks and stocks that are poised to nosedive.

Passive Investing

One nice thing about value investing strategies is that they don’t take much work once you’re invested. Much of the legwork comes before you buy into a stock, as you try to decide what company to invest in and set entry and exit targets. This hands-off approach means that value investing doesn’t require you to spend every day watching the stock market like you might for day trading.

Compounding Returns

If your value investing strategy is focused on dividend stocks, you can also take advantage of compounded returns. Value investors automatically reinvest dividends, giving you an even greater position in your value investment over time. That in turn means more dividends, more reinvestment, and greater returns as the share price rises.

Types of Value Investments

Value investments can be grouped into several different categories.

The classic value investment in the UK is a well-established company that has a massive market share and complete control over its brand and pricing. For example, take Apple.

Another type of value investment focuses on cyclical industries like oil and gas. These industries fall on hard times every 10-20 years on average, but that is almost always followed by a boom period when share prices rise. Companies like BP don’t sell any capital equipment or drilling rights during the bust, so their intrinsic value doesn’t change even if the share price drops for a few months or years.

Value investors may also be interested in companies that are known as ‘antifragile.’ These stocks, like those of utilities or bargain retailers like Walmart, tend to perform well during recessions. As a result, traders pile into them during recessions and drive up the price – resulting in a windfall for value investors who bought shares during periods of economic growth, when antifragile companies tend to lag the broader market.

Value Investing Example

To understand value investing, let’s take a look at an example. We’ll focus on McCormick & Company, a food company that manufactures spices and condiments in the US.

To start, this company is an excellent value prospect simply because of its industry. McCormick is antifragile – demand for home cooking ingredients is likely to go up during recessions, not down. McCormick is a brand that’s been around for over 130 years and is known to virtually every consumer in the US. McCormick is extremely durable and controls its own product.

Another benefit to McCormick is that it pays out a dividend. At the current share price of $188.52, the yield is around 1.3% per year.

McCormick shares have risen rapidly in recent years, so the company has a price-to-earnings ratio of 33.3. That’s in line with the average for the S&P 500 index fund, but slightly higher than the average for the food and beverage industry in the US.

So, value investors might want to keep an eye on McCormick. Shares aren’t selling at a value. But if the stock dips more than 10%, it could be an excellent value stock that will see long-term dividend payouts and steady demand.

Value Investments UK

Let’s take a closer look at five popular stocks to watch:

1. Walmart

Walmart is one of the biggest companies in the US stock market. This retailer trades at a price-to-earnings ratio of 22.9, compared to 89.6 for its rival Amazon. That’s despite the fact that Walmart still has a larger market share and has caught up to Amazon in online sales and distribution. Walmart also pays out a dividend yield of 1.50%.

2. BP

Oil and gas giant BP is in a cyclical industry that’s in a severe downturn. The stock is trading more than 50% below the level it’s held for the past two decades. While it might not regain its prior glory, the oil and gas downturn isn’t likely to be permanent. Value investors can pick up BP shares at a significant discount and watch them rise when the global economy emerges from the COVID-19 pandemic.

3. Philip Morris

Philip Morris, the tobacco company, has grown more slowly than competitors like Altria, which some analysts have suggested that it might be undervalued within its industry. It also sports a low price-to-earnings ratio of 14.7, down from 28.5 in 2018, and pays a whopping dividend yield of 6.8%.

4. CVS Health

CVS has faced reduced in-store traffic from the coronavirus pandemic, which has led investors to flee from the shares. CVS offers an ultra-low dividend price-to-earnings ratio of 9.5 and a dividend yield of 3.4%.

5. NatWest Group

NatWest Group owns the Royal Bank of Scotland, which has been heavily beaten down thanks to low interest rates. The stock is down by more than 50% from the start of the year and its price-to-earnings ratio has fallen to 20.4. Low interest rates won’t last forever, though, and NatWest Group is poised to rise as soon as interest rates are allowed to increase again.

Value Investing Strategy

Putting together a value investing strategy relies on diligence and patience. The hard work comes before you ever invest, as you need to find value stocks that offer low risk and potentially promising returns.

One place to start is to pick an industry to focus on. Then look across that industry for stocks that have underperformed over the past year or more and that have a lower price-to-earnings ratio than their competitors. You’ll also want to take a close look at dividend payouts to determine what your potential returns are – value investors want to be paid while waiting for the stock to turn around.

Before you invest, make sure you know exactly what you’re investing in. Study the company’s strategic plan and its revenue and earnings projections. If everything checks out, plan to hold onto the stock for several years or longer.

Platforms for Value Investing

In order to get started with value investing in the UK, you’ll need a high-quality stock broker. There are dozens of brokers that offer stock trading, but they differ in the number of stocks you can invest in, the fees you’ll pay, and what tools are available for finding value stocks.

1. Fineco Bank

This platform doesn’t charge trade commissions or spreads when you buy shares, and there’s no inactivity fee to worry about. Instead, you pay an annual fee of 0.25% of your total account value. Depending on how frequently you invest in shares and how much money you have in your account, this can work out to be more or less expensive than fee-free brokers.

One of the things that’s nice about investing with Fineco Bank is that you get access to a set of portfolio management tools. These can help you decide whether you’re overexposed to a single industry and help you achieve diversification of your value stocks portfolio across the market. It’s also simple to track the performance of your investments over time and to reinvest dividends for compound growth.

The only downside to Fineco Bank is that it doesn’t have a huge selection of stocks. However, you’ll still find several hundred potential investments from across the UK, US, and Europe, including a wide of investment funds and mutual funds managed by expert fund managers. Fineco Bank also offers a fair amount of investment research from its expert advisors, which can help you make investment decisions.

Sponsored ad. Your capital is at risk.

Conclusion

Value investing is a popular investing strategy espoused by well-known investors like Ben Graham, the father of value investing, and Warren Buffett. This investment style limits your investing risk and enables you to benefit from the stock market’s overreactions, without having to follow the day-to-day volatility of the market. At any given time, there are dozens of potential value stocks on the market – it’s up to you to do the work needed to find them.