Tokenised Shares – What are They & How to Invest

Tokenised shares are a new and exciting financial instrument that allows you to invest in stocks from the comfort of your home. The shares are backed by digital tokens that are transparently and safely stored via blockchain technology.

The benefits of trading tokenised shares include super low fees, fractional ownership, high levels of leverage, and the opportunity to profit from both rising and falling stock prices. In this guide, we discuss everything there is to know about tokenised shares so that you can assess whether this investment product is right for your financial goals.

How to Invest in Tokenised Shares – Quick Guide

Already interested in buying tokenised shares and looking to invest right now? If so, follow the steps outlined below to buy tokenised shares from the comfort of your home!

- Step 1: Open an account with Currency.com – Currency.com is the market leader in the tokenised shares arena – as the platform offers a simple and low-cost way to invest. To get the ball rolling, open an account with the provider.

- Step 2: Deposit Funds – Once you’ve opened an account – you can proceed to deposit some funds. Currency.com supports a variety of payment methods – including Visa, MasterCard, Bitcoin (BTC), bank transfers, and much more.

- Step 3: Search for Tokenised Share – Now that you’ve got funds in your Currency.com account – you can search for the tokenised share that you wish to invest in.

- Step 4: Buy Tokenised Shares – You can now invest in your chosen tokenised share by entering your stake and placing a buy order.

As we discuss in more detail shortly, platforms like Currency.com also allow you to short-sell tokenised shares. This means that you can attempt to make a profit by speculating on the value of the stocks going down.

What are Tokenised Shares?

In its most basic form, tokenised shares allow you to invest in stocks in the form of a digital coin. For example, let’s suppose that you wanted to purchase a single Apple stock – which is priced at $125 per share. By investing $125 into a tokenised share that tracks Apple stocks, you can gain exposure to the company without needing to actually own the underlying asset.

Instead, tokenised shares are financial derivatives. In more simple terms, this means that the tokenised share will simply track the value of Apple stocks in real-time. That is to say, if Apple stocks move from $125 to $130 – as will your tokenised share investment.

On the one hand, as you won’t own the actual equity itself, tokenised shares do not give you access to conventional stockholder perks – such as being able to vote in annual general meetings. They do, however, offer a number of core benefits that traditional shares cannot rival.

For example, tokenised shares allow you to invest in stocks with a very small amount of money. This is because you are not required to purchase a full stock. Instead, you can invest in just a fraction of a single share. Tokenised shares can also be traded with leverage. Platforms such as Currency.com offer up to 1:20, which is four times higher than the standard UK limit of 1:5.

How do Share Tokens Work?

So now that we have covered the basics, we can expand on how share tokens work in a little more detail. After all, this investment scene is still relatively new, so it’s important that you have a firm grasp of how things work before risking any capital.

Tokenised Share Tracking

First and foremost, tokenised shares are tasked with tracking the real-world price of the stock that you invest in. For all intents and purposes, this operates much in the same way as a CFD trading instrument.

For example:

- Let’s suppose that you want to purchase share tokens in HSBC

- At the time of the trade, HSBC shares are priced at 445p on the London Stock Exchange (LSE)

- You decide to invest £50 into tokenised HSBC shares – which are also priced at 445p each

- A few weeks later, HSBC shares have increased to 500p on the LSE

- Your tokenised shares are also worth 500p

- You decide to cash your tokenised share invest out – making a 12.3% profit

- On a stake of £50 – that’s gains of £6.15

The fact that tokenised shares are simply tasked with tracking the real-world price of a stock means that platforms will often give you access to thousands of companies. For example, at Currency.com, you can trade over 2,000 stocks from a wide variety of markets.

Not only does this include the LSE, but exchanges in the US, Hong Kong, Italy, Japan, Russia, Spain, Canada, and more. Not only does this allow you to create an international portfolio of stocks with ease – but in a super low-cost manner.

In other words, attempting to buy a small number of shares from several different marketplaces in the traditional sense would be both cumbersome and expensive when you factor in stock dealing fees.

Making Money From Share Tokens

When it comes to making money from tokenised shares, this actually works much in the same way as a conventional stock investment. This is because you stand to make money in two forms – capital gains and dividends.

Capital Gains

When you invest in tokenised shares, the primary way of making money is through capital gains. This simply means that you sell your share tokens at a higher price than you originally paid.

- For example, let’s say that you decide to purchase 10 tokenised shares in BP at £2 each.

- This amounts to a total outlay of £20

- A few months later, BP shares are worth £3 each

- You hold 10 shares, so your investment is now worth £30

- As a result, your capital gains on this trade amount to £10

It is important to note that you can also make capital gains by short-selling tokenised shares – which we cover shortly.

Dividends

On the one hand, you won’t be entitled to dividends from the company you invest in when you complete the purchase via a tokenised share. However, in the vast majority of cases, you will still receive the equivalent dividend payment. This is because platforms offering tokenised shares also permit short-selling.

Those that are short on a tokenised share will need to cover the dividend payment themselves – which is then forwarded to those that are long on the stock.

For example:

- Let’s suppose that you buy 100 tokenised shares in AstraZeneca

- We’ll say that AstraZeneca pays a dividend yield of 3% – which amounts to 24p per share

- You have 100 share tokens in AstraZeneca – so you receive a payment of £24 (100 shares x 24p)

- At the other end of the trade, somebody is short-selling AstraZeneca shares

- As such, £24 will be taken from their account balance to cover the dividend

As the above example highlights, whilst you are not a stockholder in the respective company, you can still earn quarterly dividends when you invest in tokenised shares.

Long and Short Markets on Share Tokens

One of the main benefits of choosing tokenised shares over traditional stocks is that you have the opportunity to go long or short on your chosen company. This means that you can attempt to profit from both rising and falling markets.

For example, if you think that the value of the stocks will rise – you simply need to place a buy order at your chosen tokenised shares platform. Alternatively, if you think that the stocks will go down in value, you will need to play a sell order.

Short-selling might be completely new to you – so here’s a quick example of how it works in practice:

- You think that at £8 per stock, Next PLC shares are overvalued and thus, you expect them to decline in value

- As such, you place a sell order on Next PLC via your chosen tokenised shares platform

- You decide to stake £1,000 on this trade

- A few weeks later, Next PLC shares have fallen to £6 each

- This translates into a decline of 25%

- On your stake of £1,000 – you made a total profit of £250 upon closing the position

As you can see, short-selling works in exactly the same way as a conventional long order – but in reverse. Just remember, if you have an open short-selling position and the company pays a dividend – the respective amount will be taken from your trading account.

Leveraged Share Tokens

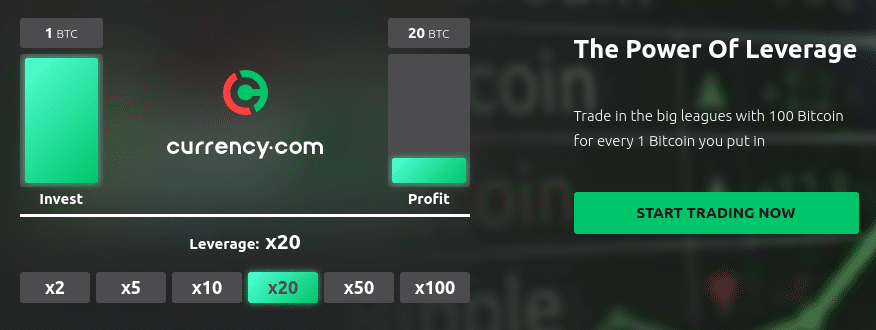

Another major benefit of trading tokenised shares is that you will likely have access to leverage. This means that you will be able to enter long and short positions with much more than you have in your account. In the UK, retail investors are limited to leverage of 1:5 – as per FCA rules.

However, by using a tokenised shares platform such as Currency.com – you’ll be able to obtain leverage of up to 1:20. In simple terms, this means that you can multiply your stake by a factor of 20 times.

Here’s how a leveraged trade would work in practice when going long on a tokenised share:

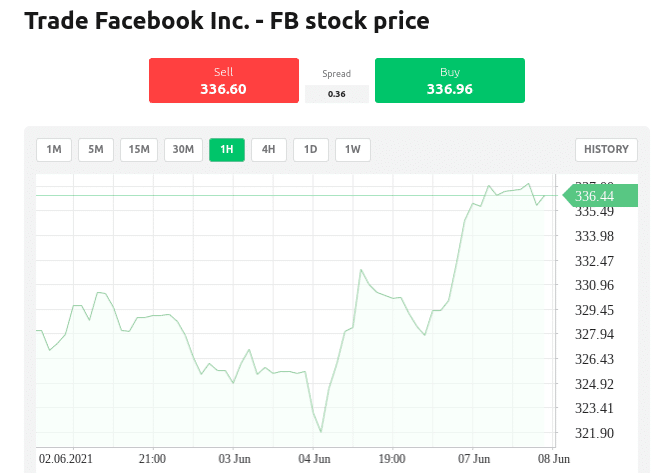

- Let’s suppose that you are bullish on Facebook stocks – meaning you think the shares will rise in value

- At the time of the tokenised trade, Facebook stocks are trading at $336 each

- You decide to allocate £1,000 to this trade

- You also decide to apply leverage of 1:20 – meaning that your stake is effectively boosted to £20,000

- A few days later, Facebook stocks have increased to $386 – which is an increase of 15%

On a stake of £1,000 – your 15% gains would have netted you £150 in profit. However, you applied leverage of 1:20 – so your £150 profit is boosted by 20 times – which equates to £3,000.

If you are new to leveraged tokenised shares, it’s absolutely fundamental that you understand the risks. Crucially, in the above example, your losses would have been multiplied by 20 had the trade gone the other way. In fact, there is every chance that you will be liquidated by the tokenised shares platform in question – meaning you would have lost your entire stake.

For example:

- By trading with leverage of 1:20 – this means that you can enter a position worth £3,000 with a stake of just £150.

- This means that your margin on the trade amounts to just 5%

- If Facebook stocks had gone against your prediction and declined in value by 5% – the platform would have automatically closed your trade

- In turn, you would have lost your £150 stake in its entirety

In most cases, the platform will send you a margin call in the form of an email. This simply tells you that you are getting close to your liquidation point. At this stage, you can ignore the margin call and hope for the best or add more funds to your account to give you additional breathing room.

Note: While you will be capped to 1:20 when buying and selling tokenised shares at Currency.com – the platform offers up to 1:500 on major forex trading markets. This will turn a £100 stake into a potential trade value of £50,000.

Are Tokenised Shares a Good Investment?

If you’re wondering whether tokenised shares are right for your investment goals – we are now going to explore some of the pros and cons of this innovative asset class.

Cryptocurrency Meets the Traditional Investment World

If you currently own a cryptocurrency like Bitcoin (BTC) or Ethereum (ETH), tokenised shares offer a superb way to diversify. This is because platforms like Currency.com allow you to deposit funds with digital assets.

- Ordinarilly, if you wanted to access the traditional financial markets with your cryptocurrency holdings, you would first need to cash this out to pounds and pence.

- Then, you would need to open a share dealing account, deposit funds, and proceed to make an investment.

- It goes without saying that this is an extremely time-consuming process.

- But, by using Currency.com – you can simply deposit funds with a cryptocurrency and then proceed to purchase the tokenised shares of your choosing.

Similarly, if you then decide to increase your exposure to digital currencies, you can sell your tokenised shares and purchase more crypto at the click of a button.

Micro Investing

If you are new to the world of stocks and shares – you might want to start off with small investments until you get more comfortable with how things work. However, if you got through a traditional brokerage firm like Hargreaves Lansdown – you’ll need to purchase at least one full share.

This won’t be feasible for a small investment strategy – especially if your chosen stocks are pricey. For example, popular US stocks like Apple, Google, Tesla, and Facebook will cost you hundreds of pounds just to buy a single share. The likes of Amazon and Booking Holdings are even more costly – as the shares regularly trade for more than £2,000 each.

This is why more and more people are turning to tokenised shares, as in most cases, you can invest as little as you like. After all, the share is represented by a digital security token that can be fractionated.

For example:

- Let’s say that you are interested in Amazon stocks – which are priced at USD $3,100 each (about £2,200)

- You have allocated £220 to your tokenised investment account

- You use this £220 to invest in Amazon share tokens

- This means that you own 10% of one share

Your profits and losses work much the same as buying a full stock – as this is proportionate to the amount you invest. For example, if Amazon shares increase by 20% – you will make gains of £44 (20% of £220 investment). Additionally, you will still be entitled to your share of any dividends that your chosen tokenised stock pays.

Diversification

This particular benefit is directly correlated to the above section on fractionated investments. That is to say, by purchasing a small fraction of a tokenised share, you can diversify in a simple and low-cost way.

For example, let’s suppose that you have £1,000 to invest. By investing £10 into each tokenised stock, you can gain exposure to 100 different companies from a variety of markets and industries. As we noted earlier, Currency.com supports more than 2,000 stocks from multiple UK and international. exchanges, making diversification a breeze.

Budget Investing

In a time not so long ago, investing in shares was somewhat difficult for the Average Joe. This is because stock brokers required a very high minimum investment amount – which was often out of reach for casual traders. But, with the growth of tokenised shares, it’s now possible to gain exposure to the stock markets with just a few pounds.

In fact, when you go through Currency.com – you only need to meet a minimum deposit of £10. Irrespective of how much your chosen tokenised share costs – this £10 deposit is sufficient to invest in multiple companies.

And of course – when you factor in the high leverage limits offered on tokenised shares, this gives you the opportunity to target above-average market gains with a small amount of capital. For example, if you only have £50 to invest in tokenised shares, this translates into trading capital of £1,000 when applying leverage of 1:20.

Share Tokens vs Regular Shares

If you have read this guide up to this point – then you will know that there are many similarities between share tokens and regular stocks.

If you’re still unsure about how the two differ – read on.

Ownership

Perhaps the most fundamental difference between tokenised shares and regular stocks is with respect to ownership. Crucially, when you invest in a tokenised share – you do not own the underlying stocks. More specifically, you are not a shareholder in the respective company and thus – you have no stockholder rights.

Whether or not this is an issue is ultimately down to you. For example, if you have no intention of voting in annual general meetings, then being a stockholder offers little benefit – other than being able to make money. If profit is your main driver, then tokenised shares offer exactly the same opportunities.

Dividends

As we covered earlier, both tokenised shares and regular stocks allow you to earn dividends. The key difference is how the dividend payment is funded.

- When you are a shareholder of a dividend-paying company, you are legally entitled to your share. When the company in question makes a payment – this is usually forwarded to your brokerage provider. Then, the broker will update your cash balance to reflect the dividend.

- If you invest in a tokenised share, the dividend payment that you receive is not paid by the respective company. On the contrary, this is covered by those that are short-selling the tokenised share.

With that said, from your perspective as an investor, you still receive the same dividend benefit. It’s just the way in which the dividend payment is covered that differs.

Short-Selling

There is also a difference in how short-selling orders are facilitated. For example, if you were to try and short-sell a stock with a traditional UK share dealing site – this likely wouldn’t be an option. This is because the art of conventional short-selling is typically reserved for institutional investors.

The process is overly cumbersome, as it requires the short-seller to borrow the shares from a brokerage firm and then agree to buy them back at a later date.

At the other end of the spectrum, short-selling via a platform offering tokenised shares could not be easier. Once again, this is because the underlying stocks do not exist and thus – there is no requirement to borrow any shares from a broker. Instead, all you need to do is place a sell order and you are good to go.

Where to Buy Tokenised Shares?

If you like the sound of tokenised shares, you now need to think about which broker meets your needs. There are many considerations to make in this respect – such as the type of tokenised shares on offer and how much the platform charges in fees. You also need to consider factors surrounding regulation, deposit methods, customer support, and user-friendliness.

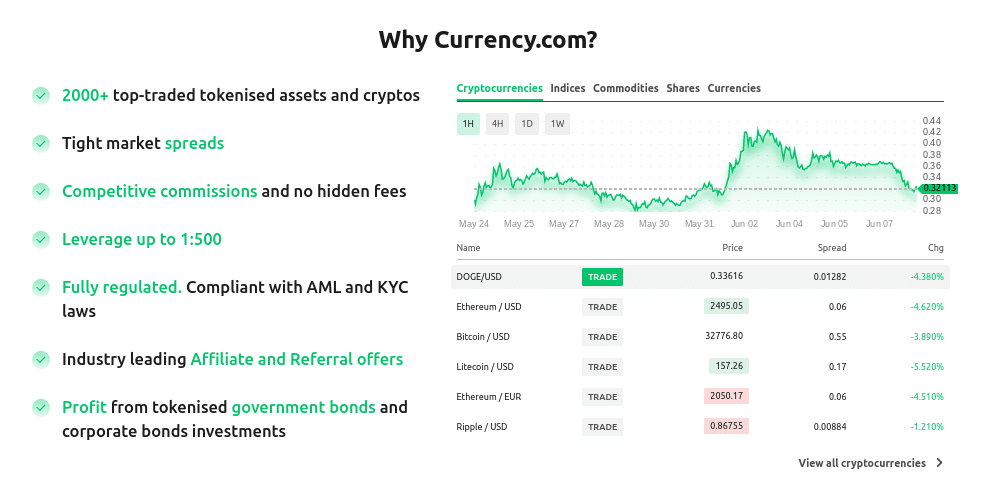

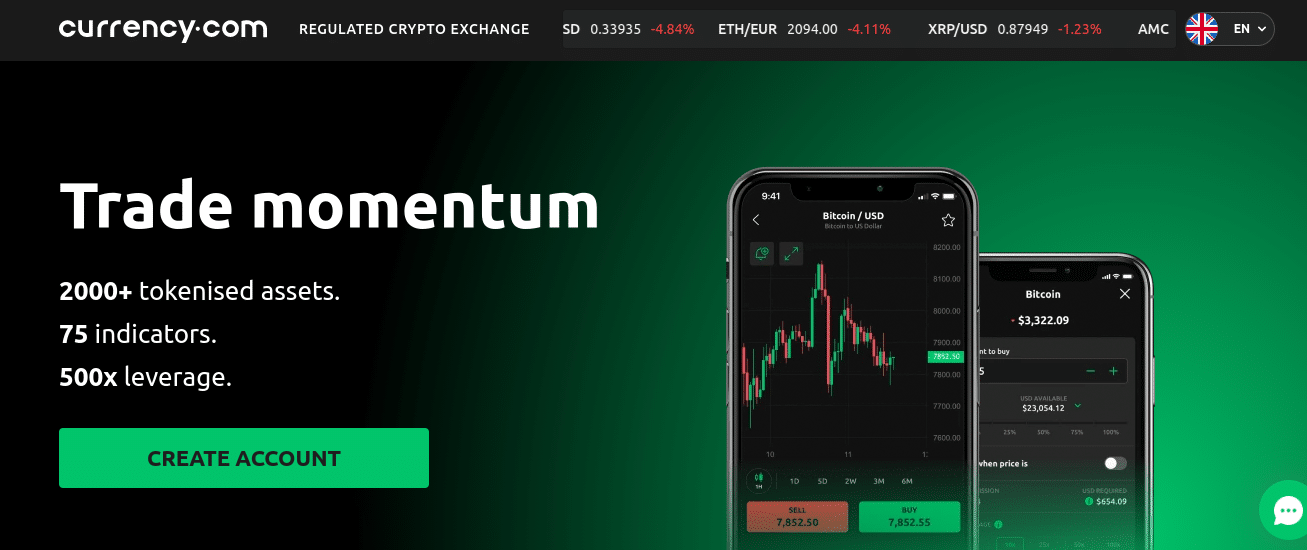

Whilst there are a small number of platforms to choose from – we found that Currency.com dominates the tokenised shares arena.

Here’s why:

Currency.com – Overall Best Broker to Buy Tokenised Shares UK

If you want to create an international portfolio of stocks,Currency.com also offers markets in the US and Canada, Hong Kong, Japan, and many European exchanges. All tokenised shares can be fractionated, meaning that you can invest really small amounts and diversify without needing to break the bank. When it comes to fees, this is where Currency.com really stands out from the crowd. This is because you can trade tokenised shares without paying any commission.

As you are not purchasing the underlying stocks, there is no stamp duty tax, either. Currency.com does charge a very small exchange fee on tokenised shares – but this amounts to just 0.05% per slide. As such, for every £100 invested, this amounts to just 5p. If you are completely new to tokenised shares, you’ll be pleased to know that the minimum deposit is just £10 on debit/credit cards.

This is, however, charged at a deposit fee of 3.5%. If opting for a Faster Payments deposit via your UK bank account, the fee is just 0.10% (£2 minimum). With that said, you can start buying and selling tokenised shares on Currency.com without needing to make a deposit. This is because as soon as you register, you will have access to a demo trading facility. This will mirror actual market conditions – so you can speculate on your chosen shares without risking any money.

Pros

Cons

Your capital is at risk when trading tokenised assets with this provider.

How to Invest in Tokenised Shares Tutorial

If you’re ready to start investing in share tokens from the comfort of your home – we are now going to walk you through the process step-by-step.

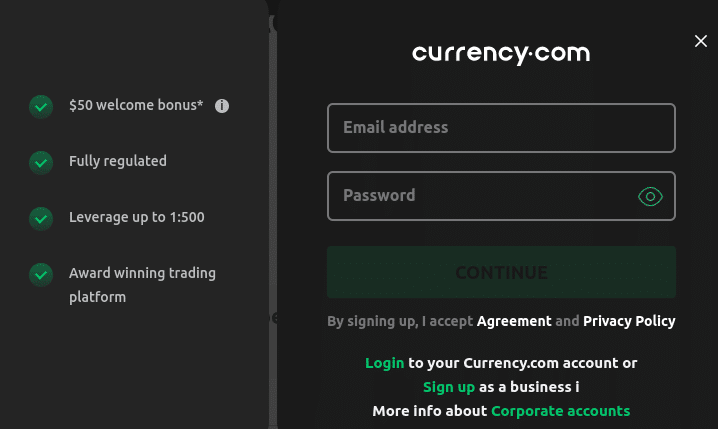

Step 1: Register an Account at Currency.com

In a similar nature to opening a traditional share dealing account, you will first need to register at Currency.com. You can get the ball rolling by visiting the Currency.com website and clicking on the ‘Join Now’ button.

Next, you will be asked to enter some personal information – which includes:

- Email Address

- Mobile Number

- Full Name

- Nationality

- Home Address

- Date of Birth

You’ll also need to verify your email address.

Step 2: Upload Documents

Before you can start buying and selling tokenised shares at Currency.com – you will need to upload some identity documents. This is because the platform is regulated and thus – it must comply with regional KYC laws. The process shouldn’t take you more than a couple of minutes, as Currency.com is able to verify your documents automatically.

The documents required are:

- Photo ID: This can be a valid passport or driver’s license

- Address: This can be a bank account statement or utility bill. Statements issued by a government agency are also suitable – such as a tax letter from HMRC.

Step 3: Deposit Funds

If you want to start off with the free demo account at Currency.com – there is no requirement to make a deposit at this stage. If, however, you want to start trading with real money – you can choose from a variety of deposit methods.

This includes:

- Debit Cards

- Credit Cards

- UK Bank Transfer via Faster Payments

- Cryptocurrency

The cheapest option is to go with a Faster Payments deposit, as the fee amounts to just 0.10% (£2 minimum). Debit and credit cards will cost you 3.5%.

Step 4: Choose Tokenised Shares to Buy

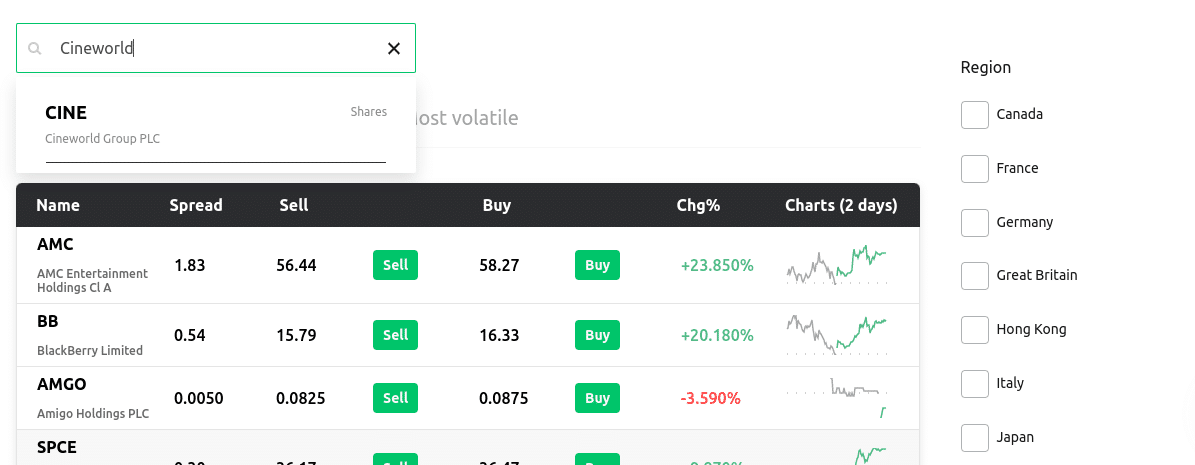

With a funded account at Currency.com, you are now ready to buy some tokenised shares. If you already know which share tokens you want to purchase, you can use the search facility.

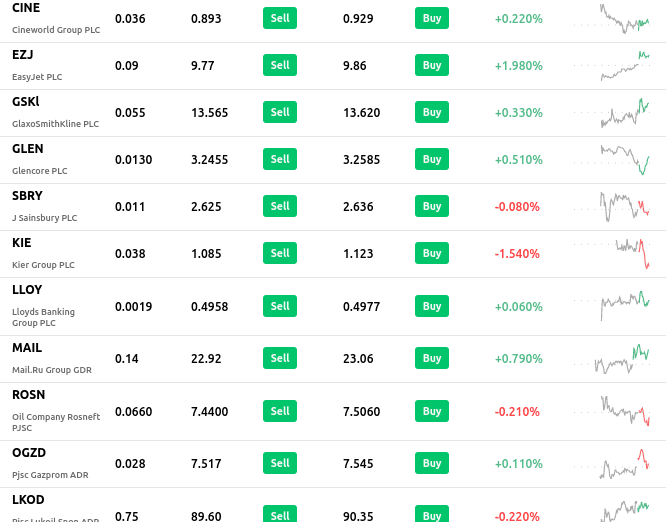

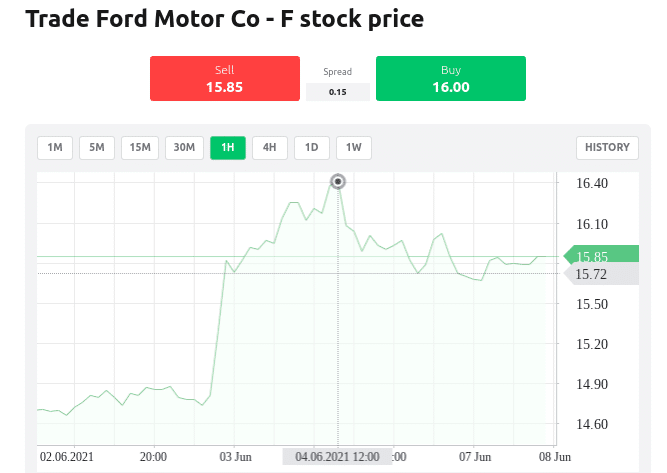

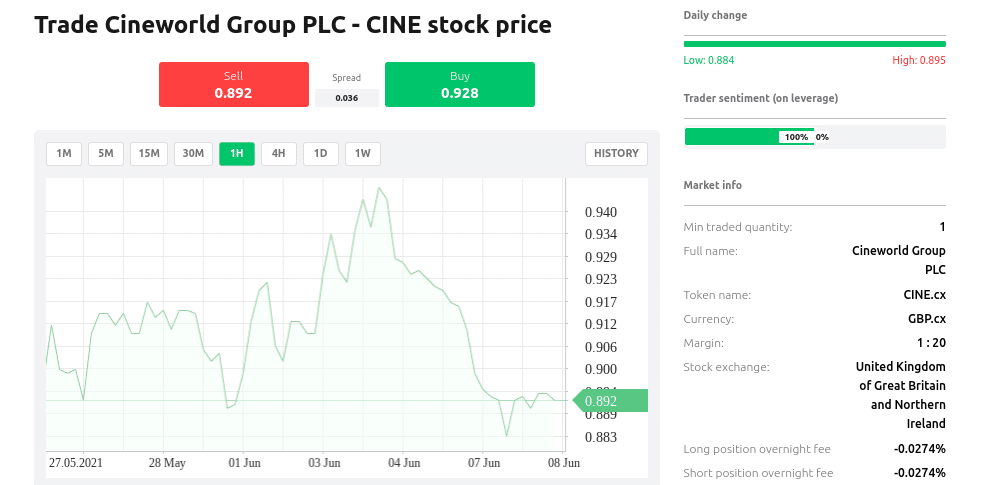

In the example above, we are searching for Cineworld shares. You can also hover over the ‘Markets’ button at the top of the page and click on ‘Tokenized Shares’. In doing so, you can see what share markets the broker offers.

Step 5: Buy Tokenised Shares

You can now proceed to complete your tokenised shares investment. Assuming that you think the shares will rise in value, click on the ‘Buy’ button. If you think the shares will decline in value, click on the ‘Sell’ button.

Either way, you will need to enter your stake. For example, if you want to buy £50 worth of Cineworld shares, simply enter £50 into the ‘Amount’ box.

Finally, confirm your order and Currency.com will execute this for you instantly.

Step 6: Sell Tokenised Shares

Once you have completed your tokenised share purchased, you can view the value of your investment from within your Currency.com portfolio. You can sell your tokenised shares back to pounds and pence at any given time during standard market hours. If you entered your position with a buy order, you can close it by placing a sell order – and visa-versa.

Currency.com – Best Platform to Buy Tokenised Shares

This guide has explained everything there is to know about tokenised shares UK. Although you won’t own the underlying stocks, tokenised shares allow you to apply leverage and choose from a long or short order.

You can also invest really small amounts, not least because the shares can be fractionated. This makes tokenised shares ideal for those looking to invest on a budget.

If you’re ready to invest in tokenised shares right now – Currency.com allows you to get started with a minimum deposit of just £10. You will have access to over 2,000 stocks from a wide range of UK and international markets – and be able to apply leverage of up to 1:20.

Your capital is at risk when trading tokenised assets with this provider.

FAQs

What are tokenised shares?

Tokenised shares allow you to invest in stocks without owning the underlying equities. Instead, the value of the tokenised share will be tied like-for-like with the stock in question. For example, if Facebook stocks are trading at $336 each on the NASDAQ - the tokenization shares will also be priced at $336. The tokenised share will be stored transparently on distributed ledger technology. It's also possible to invest in assets that tokenize real estate, ETFs, bonds, currencies, and more.

Do tokenised shares pay dividends?

In many cases yes - but this will depend on the platform you are using. For example, Currency.com allows you to earn dividends when you are long on a tokenised share. The dividend payment is covered by short-sellers of the stock in question.

How do you buy tokenised shares?

The best way to buy tokenised shares is with a regulated platform like Currency.com. The minimum to get started with is just £10 and you will have access to over 2,000 tokenised shares at leverage of up to 1:20. Other platforms that have since entered this space include crypto exchanges Binance and Bittrex Global.

What are leveraged tokenised shares?

If you buy tokenised shares with leverage, this means that you are amplifying the value of your investment. For example, if you stake £100 on tokenised Apple stocks and apply leverage of 1:20 - your capital investment is multiplied to £2,000.