Best Vanguard ETFs UK to Watch

If you’re thinking about investing in an exchange traded fund (ETF) – Vanguard is an option. Here, we will cover 5 ETFs that are offered by Vanguard to UK investors.

5 Popular Vanguard ETFs UK

Here’s a list of popular Vanguard ETFs based on trading volume. If so, below you will find out which funds made the cut. For a full analysis of each Vanguard ETF – scroll down.

- Vanguard S&P 500 ETF

- Vanguard Small-Cap Growth ETF

- Vanguard Total Bond Market ETF

- Vanguard FTSE All-World ex-US ETF

- Vanguard Short-Term Bond ETF

Vanguard ETFs UK Reviewed

Vanguard offers 74 funds to those based in the UK. This covers a variety of ETF markets – such as dividend stocks, fixed-income, and UK equity index funds.

As always, each Vanguard ETF will come with varying risks and potential rewards – so always do your homework before taking the plunge.

To help clear the mist, below you will find the ETFs in the Vanguard ETF market.

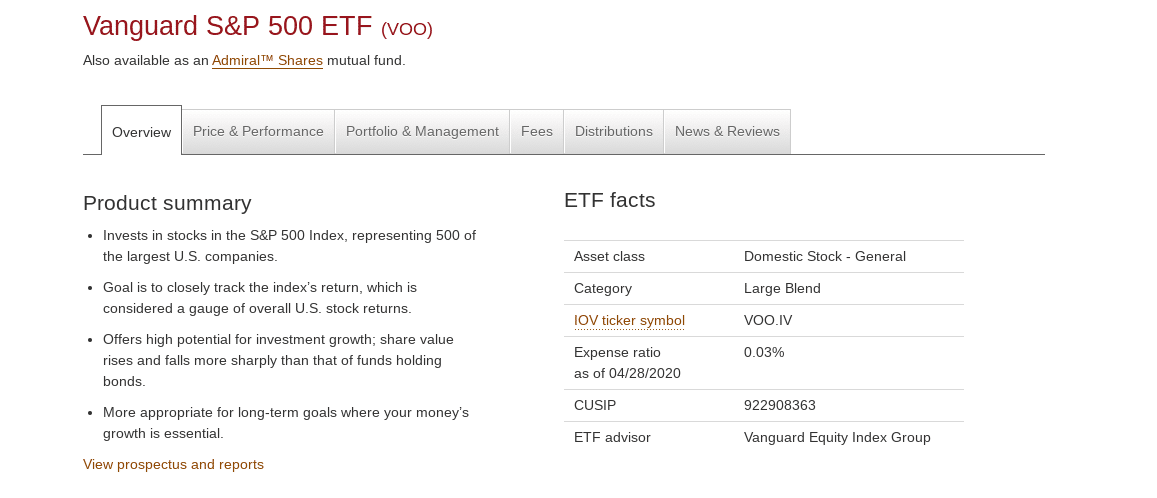

1. Vanguard S&P 500 ETF

Make no mistake about it – if you’re looking to diversify into the US stock markets. As the name suggests, the ETF tracks the S&P 500 like-for-like. If you’re unfamiliar with the S&P 500 – it is the largest and most liquid stock market index in the world.

Put simply, this index fund will track the performance of the largest 500 companies from the NYSE and NASDAQ. To give you an idea of some of the companies you will be gaining exposure to – think along the lines of Amazon, Paypal, Visa, Johnson & Johnson, Apple, Facebook, and Disney. In other words, the biggest and most recognized brand globally.

Like all index funds, this Vanguard ETF will weigh its portfolio to mirror the S&P 500. For example, at the time of writing, Amazon and Tesla have a weight of 4.4% and 1.90%. This means that if you invested £5,000 into Vanguard S&P 500 ETF – you would indirectly own £220 worth of Amazon stocks and £95 in Tesla stocks.

The remaining £4,685 will be allocated across the other 498 companies that form the Vanguard S&P 500 ETF – at a proportionate rate. Crucially, this means that through a single investment into the Vanguard fund – you will buy shares in 500 US-listed firms. In terms of performance, this Vanguard fund has generated exceptional returns – fully in line with the index itself.

For example, over the past 10 years, the Vanguard ETF has seen average annualized returns of 13.39%. During the same period, the index benchmark grew by 13.43% per year – which is virtually like-for-like.

As an investor in the ETF, you will be entitled to your share of any dividends that are paid by the S&P 500 companies.

When it comes to fees, the provider charges an expense ratio of 0.03%. That’s just £3 for every £10,000 invested.

2. Vanguard Small-Cap Growth ETF

Vanguard doesn’t just give you access to large-scale index funds like the S&P 500 and FTSE 100. On the contrary, the fund provider also allows you to indirectly invest in small-cap companies that are still growing.

As the name implies, you will be investing in companies with a small market capitalization. These are all listed in the US – so again, this ETF is an option for those of you that wish to gain exposure to the American stock markets. To give you an idea of some of the stocks held by this Vanguard ETF, this includes the following 10 holdings:

- Plug Power Inc.(PLUG)

- Enphase Energy Inc.(ENPH)

- MongoDB Inc.(MDB)

- Catalent Inc.(CTLT)

- Zendesk Inc.(ZEN)

- Horizon Therapeutics plc(HZNP)

- Penn National Gaming Inc.(PENN)

- Monolithic Power Systems Inc.(MPWR)

- Avantor Inc.(AVTR)

- PTC Inc.(PTC)

Now, you might not have heard of all of the above companies – as many are still up and coming in their respective sector or industry. In fact, the company with the largest valuation – Plug Power, has a market capitalization of less than $500 million USD.

For example, in the 10 years prior to writing this page, the Vanguard Small-Cap Growth ETF was priced at just over $80 per share on the NYSE Acra. Fast forward to early 2021 and the same ETF has since surpassed $304. This equates to 10-year returns of over 280%.

In terms of fees, this particular fund is ever-so-slightly more expensive than the previously discussed Vanguard S&P 500 ETF at 0.07% per year. With that said, this still amounts to just £7 for every £10,000 invested.

3. Vanguard Total Bond Market ETF

Bonds are often underappreciated with newbie investors in the UK – perhaps because of the thrill of not picking and choosing the next big stock. With that said, buying bonds in the UK as a retail client can be difficult.

This is because the minimum lot size of bonds is often very high. The good news is that the Vanguard Total Bond Market ETF allows you to invest in this marketplace with ease.

Most importantly, you won’t be investing in a small selection of bonds. On the contrary, this Vanguard ETF gives you access to over 10,000 bond instruments. This covers a wide variety of bond types – ensuring that you are well diversified. For example, 42.4% of the portfolio is held in Treasuries and T-Bills.

You then have 20.8% in other government bonds and 18% from the industrial sectors. Other sectors include finance and banking, mortgage-backed securities, and foreign-owned bonds.

The fund has averaged annualized returns of 3.51% over a 10-year period. Investors also receive regular bond coupon payments in the form of dividends. But, unlike most other Vanguard funds – which make distributions quarterly, this is paid every month.

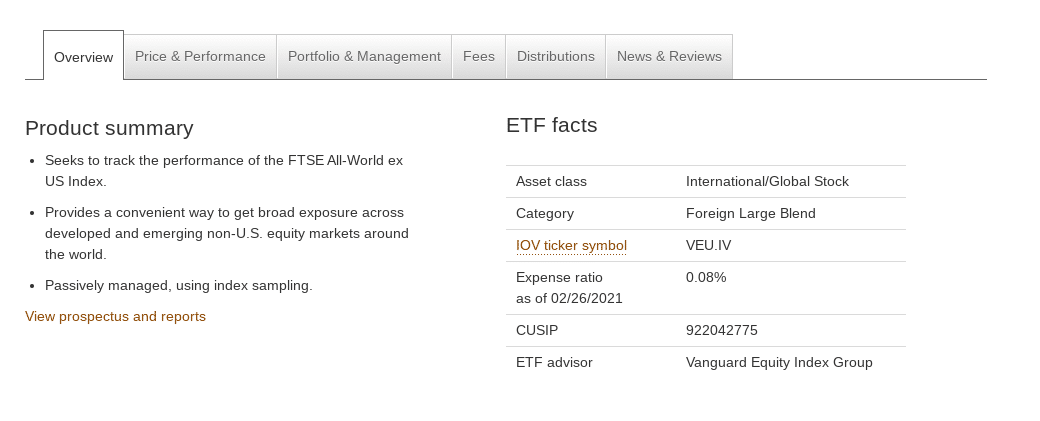

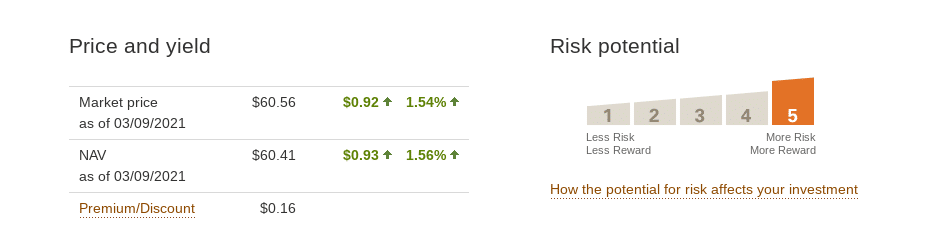

4. Vanguard FTSE All-World ex-US ETF

The Vanguard FTSE All-World ex-US ETF offers the ability to build a diversified portfolio of stocks without gaining exposure to the US markets. In a nutshell, the Vanguard FTSE All-World ex-US ETF will give you indirect access to over 3,400 stocks from every corner of the world. This includes regions in Europe, Asia, Australia, and heaps of emerging markets.

For example, 16% and 12% of your portfolio will be held in stocks listed in Japan and China, respectively. While 9% is held in UK stocks, 6% and 5% are allocated to France and Germany. There is also an allocation of funds into companies listed in India, Canada, Taiwan, South Korea, Brazil, Thailand, South Africa, and more.

To give you an idea of some of the stocks you’ll be buying – this includes Taiwan Semiconductor Manufacturing, Samsung, ASML Holding, Alibaba, Tencent, and Roche Holding. When it comes to performance, this Vanguard ETF has made gains of over 26% in the 12 months prior to writing this page.

Looking further afield, the ETF has managed average annualized gains of over 5% per year. Although you will be gaining access to otherwise difficult-to-reach markets – the annual expense ratio on the Vanguard FTSE All-World ex-US ETF is just 0.08% – which amounts to £8 per for £10,000 invested.

5. Vanguard Short-Term Bond ETF

This Vanguard ETF is not an investment aimed at outperforming the market. On the contrary, the Vanguard Short-Term Bond ETF is aimed at hedging against the wider stock markets.

With a Vanguard risk rating of 1/5 (lowest risk possible), this ETF consists of short-term bonds of the highest quality. Think along the lines of US government bonds, high-grade corporate bonds, dollar-backed bonds. As short-term bonds, none of the instruments in this ETF have a maturity date of more than 1-5 years.

To give you an idea of just how stable this Vanguard ETF is, it was priced at $79.98 in the five years prior to writing, Today, the ETF is worth just over $82. That’s a five-year upswing of just 2.5%.

Important Features of Vanguard ETFs

As we briefly mentioned earlier, there are over 74 Vanguard funds offered to UK investors. This gives you ample choice. However, you can’t invest in all of them – so you need to do some homework.

Fund Objective

One thing to consider in your search for Vanguard ETF UK is the fund objective. This is essentially what the ETF is looking to achieve. As you likely know, ETFs are different from mutual funds because they are only tasked with ‘tracking’ a specific asset, or group of assets.

Mutual funds, however, will look to outperform the respective market. Nevertheless, you can head over to the Vanguard website to read what the objective of the fund is. As an example, the Vanguard S&P 500 ETF is tasked with tracking the index of the same name. This means that it will try to replicate the S&P 500 as closely as possible by buying all 500 shares at the correct weight.

Asset Classes

Once you have an understanding of what the fund objective is, it is then time to think about which assets you want to gain exposure to. In most cases, this will be a choice between stocks, bonds, or a combination of the two.

Markets

One of the things about Vanguard ETFs is that you will have access to a broad range of markets. For example, if you want to invest in the UK stock market – you might consider a Vanguard ETF that tracks the FTSE 100. There is also a Vanguard ETF that includes stocks from and therefore allows you to invest in the FTSE 250 and AIM.

If it’s American stocks that you are interested in, there are dozens of potential Vanguard ETFs to choose from. As we covered earlier, the Vanguard Small-Cap Growth ETF tracks hundreds of US-listed companies with a valuation of less than $500 million.

If you have a slightly higher appetite for risk and wish to access the merging markets, Vanguard also has you covered. This includes the Vanguard FTSE All-World ex-US ETF, which covers over 3,400 stocks from dozens of fast-growing economies. All in all, have a think about which countries and regions you want to inject money into.

Past Performance

Past performance can never guarantee future returns. But, it at the very least gives you an indication of what might be possible.

What we really like about Vanguard is that it breaks down its past performance statistics by the average annualized return. This takes the total returns over a set period and then divided it down by the number of years. For example, the Vanguard S&P 500 ETF made gains of 90% over 10 years, meaning that the average annualized return is 13.39%

Risk

In choosing Vanguard ETFs UK for you and your financial goals – you must also consider how much risk is involved. For example, it goes without saying that the Vanguard Short-Term Bond ETF offers the least amount of risk in terms of what we have discussed today.

This is because you are investing in a fund that focuses on high-grade corporate bonds and US Treasuries. In turn, Vanguard gives the fund a risk rating of 1/5.

At the other end of the spectrum, the Vanguard FTSE All-World ex-US ETF carries a risk rating of 5/5. This is because the fund holds hundreds of stocks from the emerging markets – including regions such as Thailand, South Africa, Taiwan, and Brazil. In other words, although the Vanguard FTSE All-World ex-US ETF has performed really well since its inception – the risks are high.

Expense Ratio and Brokerage Fees

When searching for Vanguard ETFs UK – Don’t forget to check what fees are applicable. After all, you might need to pay a fee of three fronts.

This includes:

- Expense Ratio: This is the fee charged by Vanguard fund managers. The expense ratio covers all related costs involved with running the ETF and it is passed on to you as the investor. The good news is that Vanguard ETFs UK cost less than 0.1% per year. In the case of the Vanguard S&P 500 ETF – this comes with an expense ratio of 0.03% – or 30p for every £1,000 invested!

- Dealing Fee: Many stock brokers in the UK will charge a dealing fee every time you buy and sell an ETF. This is usually a flat fee that remains the same irrespective of how much you invest.

- Annual Fee: As well as a dealing commission, many UK brokers and stocks apps will also charge you an annual platform fee when you hold ETFs. For example, Hargreaves Lansdown will charge you 0.45% per year on fund investments – which is significantly more than Vanguard itself charges.

Trading Platforms that Offer Vanguard ETFs in the UK

So now that you have chosen a Vanguard ETF UK for your needs – we are now going to talk brokers. This is because although Vanguard allows UK retail clients to invest directly through its website, there is a major stumbling block – the minimum investment per fund is £500.

Not only is this somewhat high – but it prevents you from being able to diversify with ease. Plus, some Vanguard ETFs are not available on the UK-version of the platform, which is where a trusted ETF broker can help.

With this in mind, below we review a small selection of trading platforms that allow you to access Vanguard ETFs UK.

Conclusion

In summary, Vanguard offers a huge number of ETFs that allow you to diversify across heaps of financial markets. This includes everything from index funds, dividend stocks, high-grade bonds, and emerging markets.

No two Vanguard funds are the same – in terms of both risk and potential rewards. As such, make sure you research on a DIY basis before choosing an ETF.

Once you know which Vanguard fund interests you – you’ll then need to choose a trusted FCA-regulated broker.