Best Gold Mining Stocks UK to Watch

Gold has been valued throughout history and today is widely seen as a safe haven when the stock market and other assets like currencies lose value. Notably, you don’t have to purchase gold to invest in the gold market.

In this guide, we’ll review 10 popular gold mining stocks which investors can purchase in 2021.

Gold Mining Stocks 2021

Here are 10 popular mining stocks available in the UK in 2021.

- Newmont Corp

- Barrick Gold

- Freeport-McMoRan

- Newcrest Mining

- Kinross Gold

- Kirkland Lake Gold

- Agnico Eagle Mines

- Anglo Gold Ashanti

- B2Gold

- Royal Gold

Gold Mining Stocks UK Reviewed

Now, we are going to carry out an in-depth review of the 10 popular mining stocks which users can invest in the UK.

1. Newmont Corp

Newmont is the world’s largest gold producer, producing around 6.4m and 5.8m ounces of gold in 2019 and 2020 respectively, and also having one of the biggest gold reserves in the industry with a total of 94m ounces. This gives Newmont a relatively dominant position in the market in terms of size. Its purchase of GoldCorp for a total of $10bn in 2019 solidifies Newmont’s position as the leading gold company.

Newmont’s revenue grew strongly by 33.9% from 2018 ($7.3bn) to 2019 ($9.7bn), continuing to grow by 17.4% in 2020 ($11.4bn). Its net profits grew even more, with a 10x improvement from $280m in 2018 to $2.7bn in 2020. As a result, its profitability improved drastically to 29.6% and 23.4% in 2019 and 2020 respectively. For historical context, Newport took losses in 2016 and 2017 before recovering slightly in 2018.

Trading at a price of $62.2 and price earnings ratio of 17.7 times, Newmont does seem to be trading at a fair value. But there are actually significant upsides to Newmont’s future prospects. Newmont projects that it will be producing about 6.5m ounces of gold in 2021, and around 6.2m to 7.0m ounces of gold from 2022 to 2025.

2. Barrick Gold

Barrick Gold is another mega-cap gold mining company, and one you’ll find in many gold investment funds. Barrick Gold produced around 3.4m ounces of gold in 2020 and an average of 3.5m ounces of gold per year over the last 5 years. Barrick Gold’s proven and probable gold reserves are also at a sizeable 68m ounces, representing almost 20 years’ worth of production. Its business remains focused on the United States with almost half of its revenue derived from here.

Barrick Gold’s revenue has been bullish in the past 2 years, growing by 32.9% and 29.2% in 2019 and 2020 respectively, effectively weathering the Covid-19 pandemic smoothly. It has also reversed its $1.5bn loss in 2018 to profits of $4.0bn and $2.3bn in 2019 and 2020 respectively. This resulted in a peak profit margin of 40.8% in 2019 before declining to 18.6% in 2020. Profit margin declined due to the fact that 2019 saw contributions from non-operational segments ($3.1bn) and impairment reversals ($1.4bn) to the company profits.

The stock is currently trading at a price of $20.2.

3. Freeport-McMoRan

While Freeport-McMoRan is primarily a copper mining stock, it does have a sizeable gold reserves of 28.9m ounces of gold as of Dec 2020. A whopping 98% of Freeport-McMoRan’s reserves are located in Indonesia. It currently only produces about 0.8m ounces of gold but plans to ramp up its production to an average of 1.6m ounces of gold from 2021 to 2025. With a revenue of $13.9bn in 2020, Freeport-McMoRan is the biggest precious metal company here, deriving 80% of its revenue from copper and 12% from gold.

While Freeport-McMoRan’s financial performance has been declining since its peak in 2018, it still remains one of the biggest players in the industry. Revenue has been on a downward trend from its peak of $19.0bn in 2018 to $13.9bn in 2020 currently where it was impacted by the Covid-19 pandemic. It made a loss in profits in 2019 of $245m, but has since recovered to a profit of $596m in 2020.

Trading at $32.1 per share and price earnings ratio of 78.3 times, Freeport-McMoRan is slightly expensive to purchase. However, this needs to be contextualised with the fact that its current trailing earnings per share of $0.41 is significantly below the earnings per share estimate of $2.91.

4. Newcrest Mining

While Newcrest Mining’s production of gold did decrease due to Covid-19, it still produced a sizeable 2.2m ounces of gold in 2020 compared to 2.5m ounces of gold in 2019. It also has the largest gold reserves at 110m ounces as of 31 Dec 2019 and represents about 50 years’ worth of production.

In terms of financial performance, Newcrest Mining has been growing quite robustly in the past 2 years, with revenue growing by 13.8% and 11.8% in 2019 and 2020 respectively. Net profits have also been the highest this year coming in at AUD965m, resulting in a healthy profit margin of 16.5%. Recall earlier that its production of gold is actually lower in 2020 and even then, profits are at its highest levels. This is primarily due to the increase in realised gold price for Newcrest Mining from $1,269 per ounce in 2019 to $1,530 per ounce in 2020.

Trading at a price of AUD24.7 per share and price earnings ratio of 20.6 times.

5. Kinross Gold

Kinross Gold is one of the bigger players in the market, producing about 2.5m and 2.4m ounces of gold in 2019 and 2020 respectively. In terms of gold reserves, it has about 30.0m ounces as of 31 Dec 2020, giving it about 14 years worth of production left. In 2020, its exploration programs in Lobo-Marte PFS yielded the largest addition of reserves of 5.7m ounces.

Revenue has been growing well in a bull gold market, at 11.5% and 21.8% in 2019 and 2020 respectively. For context, this marks a reversal for Kinross Gold as its revenue has been declining in 2017 and 2018. 2020 also marks the highest profits that it has obtained with about CAD1.8bn, culminating in a solid profit margin of 31.9%. This was due mainly to achievement in economies of scale for Kinross Gold and also higher average realised gold price from $1,392 per ounce in 2019 to $1,774 per ounce in 2020.

Kinross Gold now trades at a price of $6.7 per share and price earnings ratio of 6.3 times.

6. Kirkland Lake Gold

Kirkland Lake produced about 1.4m ounces of gold in 2020, with significant gold reserves of 20.1m ounces from its gold mines mainly in Canada. In total, Canada contributes close to 90% of total gold reserves while its Australian operations contribute the remaining 10%.

The COVID-19 pandemic has been valuable for Kirkland Lake. Revenue soared by 80.2% to CAD3.3bn from only CAD534m in 2016. Profits followed the same trend, growing from only CAD62m in 2016 to CAD1.1bn in 2020, with profit margins reaching 40.6% in 2019. As for the other companies we highlighted, average realised prices of gold increased from $1,405 per ounce in 2019 to $1,772 in 2020, driving the increase in revenue.

Kirkland’s share price fell from $45.1 in Jan 2020 to its lowest of $25.2 in Mar 2020, but experienced a sharp upward trend to $55.6 in July 2020, which is the highest price in 3 years. With the rollout of the vaccines and the gradual recovery of the global economy, share price eventually trended downwards to $40.75 now trading at a price earnings ratio of 14.6 times.

7. Agnico Eagle Mines

Agnico Eagle’s gold production seems to have taken a slight hit in 2020 during the Covid-19 pandemic, declining from 1.8m ounces in 2019 to 1.7m ounces in 2020. However, its exploration activities have been fruitful with gold reserves increasing by 12% to 24.1m ounces of gold as of Dec 2020.

In terms of financials however, even with the decline in gold production, revenue grew strongly in 2020 by 25.8% to register its highest ever revenue of $3.1bn in the past 5 years. Consistent with most gold companies here, Covid-19 pushed many investors and buyers into the gold market pushing up gold prices. Agnico Eagle’s average realised price for gold increased by 27.2% from $1,406 per ounce in 2019 to $1,788 per ounce in 2020. This in turn pushed up profits to $512m in 2020 where Agnico Eagle Mines actually made a loss of $327m in 2018.

Before the Covid-19 pandemic, Agnico Eagle was trading around $60.0 during Jan 2020, before declining to as low as $36.8. Similar to other gold companies, share price shot up to as high as $84.2 before declining to $57.5 currently trading at a price earnings ratio of 27.4 times.

8. Anglo Gold Ashanti

Anglo Gold has a decent gold reserves of 29.7m ounces of gold in 2020 but experienced a significant decline from 43.9m ounces in 2019 due to the disposal of gold mine assets in South Africa and Sadiola. The Covid-19 pandemic also had an impact on the gold production of Anglo Gold, albeit a very small one. Gold production declined slightly from 2.9m ounces in 2019 to 2.8m ounces in 2020, where Anglo Gold reported positive cases of Covid-19 in Mponeng Mine, South Africa back in May 2020. Gold mines in Argentina, Brazil and South Africa closed during the pandemic.

In spite of the pandemic in 2020, Anglo Gold’s revenue actually grew strongly by 43.1% to ZAR72.9bn. The Average realised gold price for Anglo Gold increased from $1,394 per ounce in 2019 to $1,778 per ounce in 2020, driving financial performances higher. However, Anglo Gold suffered tremendously in 2018, when revenue declined by 26.3% to ZAR44.2bn, resulting in losses of ZAR2.5bn. Anglo Gold did recover in 2018 with profits tripling into ZAR15.6bn in 2020. It seems to be achieving big improvements in economies of scale with profit margins improving from 10.3% in 2019 to 21.4% in 2020.

Anglo Gold’s share price declined from $22.5 in Jan 2020 to as low as $14.1 during the pandemic, before increasing significantly to $34.6. It eventually declined to around $21.6 now trading at a relatively low price-earnings ratio of 9.5 times. Assuming that Anglo Gold would eventually trade upwards to about 15.0 times price-earnings ratio similar to its peers, it stands to gain about 57.8% in share price. The fundamentals to support this are quite sound with Anglo Gold aiming to increase its production of gold by 5% every year until 2025.

9. B2Gold

B2Gold is one of the few gold mining companies here whose gold production actually increased during the Covid-19 pandemic, from 0.98m ounces of gold in 2019 to 1.04m ounces of gold in 2020. This was attributed to a massive increase in production from Fekola Mine in Mali, where the number of Covid-19 cases has been relatively lower than in other countries. Profits more than doubled from CAD380m in 2019 to CAD842m in 2020, resulting in a very healthy profit margin of 35.1% currently.

B2Gold’s share price did suffer a hit from the Covid-19 pandemic. The price declined from $4.00 in Jan 2020 to as low as $2.70. However, the share price increased sharply to $7.20 in August 2020, before declining to about $4.30. It is currently trading at a low price-to-earnings ratio of 7.1.

B2Gold currently has about 13.4m ounces in gold reserves, which is about 13 years’ worth of production at the current pace.

10. Royal Gold

Royal Gold is the smallest gold mining company in this list and has a slightly different business model than other gold mining companies. It mainly acquires and manages stream and royalty interests, and does not conduct many mining and extraction mining operations. This is unique in the sense that it doesn’t take many risks in the exploration process, and instead hires operators to mine for resources.

During the Covid-19 pandemic, Royal Gold weathered the crisis quite well. The company saw revenue grow 17.9% to $500m. Profits more than doubled from $93.8m in 2019 to $199.3m in 2020, translating to a very strong profit margin of 40.0% currently. Due to its different business model, Royal Gold also has the advantage of being lighter on assets with assets only totalling $2.8bn compared to other players.

Still, the Covid-19 pandemic caused the share price to fall from $120.20 to as low as $71.60 in the first 3 months of 2020. Share price subsequently rose to as high as $143.50 in July and August 2020, and gradually declined to $105.3.

Are Gold Mining Stocks A Valuable Investment?

If your are thinking about investing in any gold mining stocks, let’s take a look at some features and factors that may affect your decision.

Gold as a Safe Haven Investment

Gold is less often traded as a commodity like copper and other metals, and more as a hedge against market volatility. Investors purchase more of gold and gold mining stocks as a way to hedge themselves in times of recession and crisis. It is traditionally considered a safe haven investment when the stock market is falling and currencies are losing value to inflation.

We saw this happen in 2020. As the stock market crashed and investors grew concerned about a long-term recession caused by COVID-19, the price of gold soared. In 2019, gold was trading for around $1,500 per ounce. In the summer of last year, gold traded over $2,000 per ounce. As the global economy recovered and vaccines from Pfizer, Moderna, and Johnson & Johnson began rolling out, gold prices have been steadily falling.

However, this should not be taken on face value. Users should ensure that they properly analyse and research the companies properly prior to making any new investments.

Increasing Production

Most gold mining companies are expected to increase their production over the next 5 years. In such a case, users should take into account the possibility of supply and demand issues.

While an increased production does not confirm the price of gold to go down, it is important to keep track on all the data and analyse your investment accordingly.

Gold Mining Stock Brokers in the UK

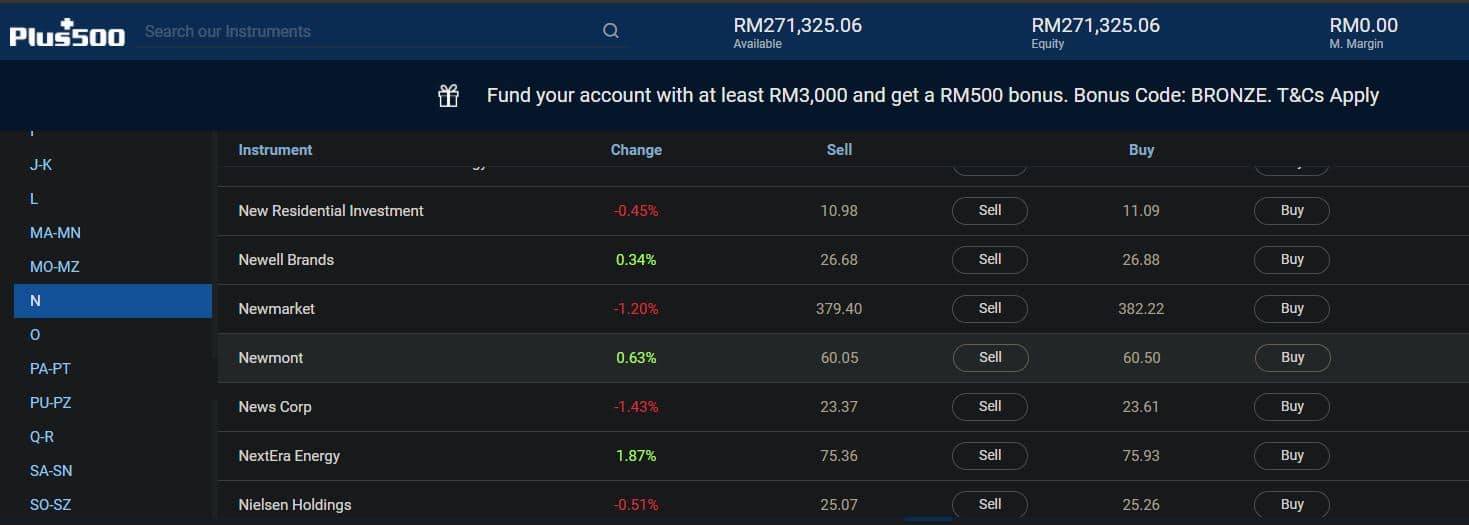

1. Plus500

Plus500 is a Contract for Difference (CFD) trading platform with access to more than 2000 trading instruments. CFD trading allows you to speculate on the rise and fall in the price of rapidly moving trading instruments, without owning the underlying asset. So, you can speculate on the share price of companies like Newmont without actually buying the shares outright.

Plus500 covers a diverse set of financial assets, including stocks, indices, foreign exchange, commodities, options, cryptocurrencies and ETFs. All trading is 100% commission-free and Plus500 charges a spread fee of only 0.75% per trade.

The Plus500 web and mobile interface is straightforward. Users may execute orders quickly without any complications. The platform also includes a news feed and economic calendar to help you analyse the various markets.

Plus500 is regulated by the UK FCA and offers negative balance protection to all UK customers. The platform currently serves over 50 countries in the world and offers 24/7 customer support.

Sponsored Ad. 72% of retail investor accounts lose money when trading CFDs with this provider.

How to Buy Gold Mining Stocks in the UK

If you are looking to purchase gold mining stocks in the UK, you should look to do so with a stock broker that provides users with low fees and. multiple trading tools & features.

After picking a suitable broker to support you in the investment process, here’s how you can begin trading.

Step 1: Open Your Account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Step 2: Complete the Verification Process

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Step 4: Invest in Gold Mining Stocks

Once your account has been funded, proceed to search for your preferred gold mining stocks or any other stock you wish to purchase on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

Gold is often used by investors as a safe haven investment, which means that gold mining stocks tend to rise when the rest of the stock market falls. So, gold stocks can be a potential way to diversify your portfolio and hedge against market volatility. On the other hand, there is an amount of risk involved in every trade you make. This is why users should conduct in-depth research and analyse stocks on their own before making any investments.

FAQs

Should I treat gold mining companies as dividend or capital gains investments?

How can I invest in gold mining stocks?