FTSE 100 Spread Betting UK

If you’re looking to speculate on the rise and fall of the FTSE 100 index – spread betting is the best way to access this market. This is because you can apply leverage, opt for a long or short position – and all profits are exempt from capital gains tax.

In this guide, we discuss everything there is to know about FTSE 100 Spread Betting UK and how you can get started with a trading account today.

How to Start FTSE 100 Spread Betting UK

If you’re ready to get started with a FTSE 100 spread betting UK account right now – follow the steps below. In doing so, you’ll be spread betting the FTSE 100 commission-free in less than 10 minutes.

- Step 1: You will first need to open an account with an FCA regulated spread betting broker that offers a market on the FTSE 100.

- Step 2: Once you have opened an account, you’ll need to deposit money with either a debit/credit card, e-wallet or any other payment method the platform supports.

- Step 3: Use the search box to go straight to the FTSE 100 indices market.

- Step 4: You now need to select from a long (buy) or short (sell) position – depending on whether you think the FTSE 100 will rise or fall.

- Step 5: Enter your stake and confirm the order.

FTSE 100 Spread Betting Explained

Financial spread betting is very similar to CFD trading – insofar that you may trade stock indices like the FTSE 100, trade DAX Index, and Dow Jones without taking ownership. Instead, all you need to do is determine whether you think the index benchmark will rise or fall in value. If you think the FTSE 100 will increase, you are going long on your spread betting position. If you think the FTSE 100 is likely to fall, a short position is required.

In addition to being able to go long or short on the FTSE 100, spread betting brokers also allow you to trade on margin.

As we cover in more detail shortly, you will be required to speculate on the FTSE 100 in terms of ‘stake per points’. For example, if you go short on the FTSE 100 at a stake of £1 per point and the index falls by 70 points – you will make a profit of £70. Crucially, any profits that you make when spread betting are 100% free of capital gains tax.

How Does FTSE 100 Spread Betting Work?

Most long-term investors in the UK will look to speculate on the FTSE 100 via an ETF. This is because they will indirectly own all 100 FTSE shares and can keep hold of the investment for as long as they wish. However, spread betting the FTSE 100 is a lot more complex – as it is a trading scene more suited for experienced short-term speculators.

With this in mind, the sections below go into more depth about how FTSE 100 spread betting UK works.

Buy or Sell

The first thing that you need to determine when spread betting the FTSE 100 is whether you think the index will rise or fall in value. As you likely know, the FTSE 100 is priced in points – as it will increase and decrease in value throughout the day.

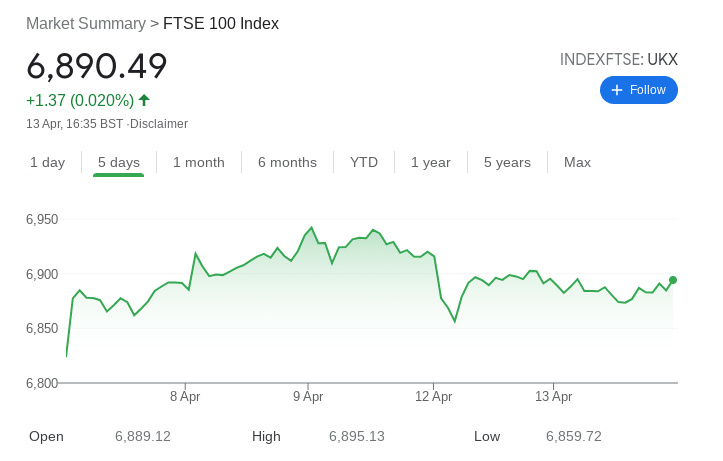

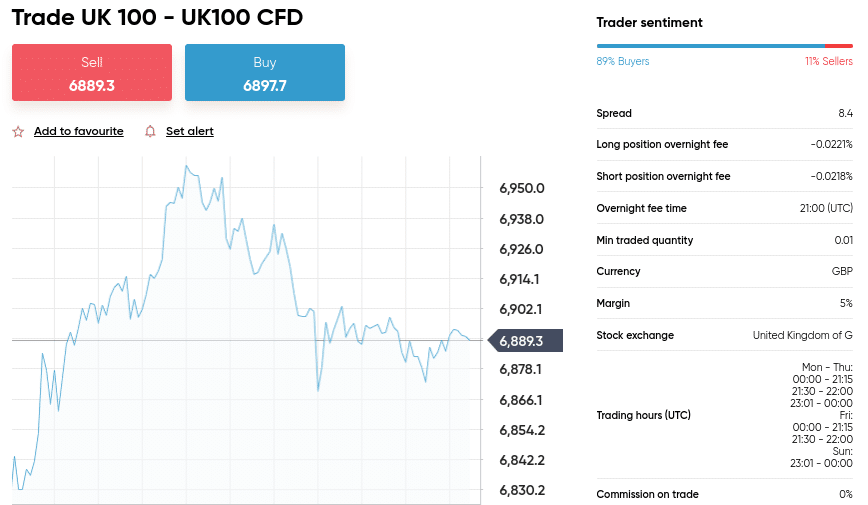

For example, at the time of writing, the FTSE 100 is priced at 6,897 points. One month prior, the index was priced at 6,749 points – meaning it has grown by just over 2%. When spread betting the FTSE 100 – you will always have the option of going long or short.

As we noted above, if you think the FTSE 100 will rise you need to place a long (buy) position or a short position (sell) if you think it will fall. This allows you to profit from both rising and falling markets – meaning there are trading opportunities irrespective of how the FTSE is performing.

Financial Derivative

We also mentioned earlier that when you trade a FTSE 100 spread betting UK market – you do not own the underlying asset. This is no different from spread betting shares or trading gold CFDs.

Instead, you are trading complex financial derivatives that track the value of the FTSE 100 in real-time. That is to say, if the FTSE 100 is priced at 6,904 points – so will the spread betting market you are trading.

Price Unit

We mentioned above that at the time of writing, the FTSE 100 is priced at 6,897 points. However, when you are spread betting the index, there will be an additional digit to take into account.

For example:

- You place a long position on the FTSE 100 at 6,897.7 points

- A couple of hours later, the FTSE 100 is priced at 6,897.9 points

- This means that at your chosen spread betting broker – the index has increased by 2 points

In another example:

- You place a short position on the FTSE 100 at 6,900.5 points

- A few days later, the FTSE 100 is priced at 6,899.2 points

- This means that at your chosen spread betting broker – the index has fallen by 13 points

It is crucial that you get your head around the FTSE 100 point system when trading it via a spread betting market. After all, you will be required to specify your stake for each price movement – which we cover next.

Stakes

This section on stakes leads on nicely from the section above. This is because FTSE 100 spread betting UK brokers will ask you to enter a ‘stake per point’ on your chosen market. In many cases, the minimum stake is just 10p per point when trading the FTSE 100, albeit, this can vary depending on the broker.

Nevertheless, it goes without saying that the more you stake per point – you more you stand to make or lose from the position. This is because your profits and losses are based on the total number of points the FTSE 100 has moved by since you placed the position – multiplied by your stake per point.

Below we provide a couple of simple examples to ensure you understand how FTSE 100 spread betting UK stakes work.

- Let’s say that the FTSE 100 is currently priced at 9,600.7 points

- You think the FTSE 100 will increase over the next few days – so you place a long position

- You decide to stake £2 per point

- A few days later, the FTSE 100 is priced at 9,630.8

- This is a price increase of 301 points

- You staked £2 per point – so your realizable profit is £602

In another example:

- This time, you decide to enter a short position on the FTSE 100 – which is priced at 9,750.5 points

- You think the index will drop in the next couple of hours – so decide to stake £20 per point

- Your prediction was correct – as the FTSE 100 has dropped to 9,740.5 points

- That’s a price decrease of 100 points

- On a stake of £20 per point, you made a profit of £2,000

Once again, it is really important for us to note that there is a disparity in how the FTSE 100 point system works.

- When you hear financial commentators say the “FTSE has dropped by 10 points” – this could be a movement of 6,890 to 6,880..

- But, in the world of FTSE 100 spread betting UK – a 10 point movement could be 6,881.2 to 6,880.2.

In other words, you always need to factor in the digit after the decimal when spread betting the FTSE 100 index.

Trade on Margin

The popular FTSE 100 spread betting UK brokers allow you to trade the index ‘on margin’. This means that you only need to put a small percentage of the position value upfront. In fact, FCA regulations allow retail clients to spread bet the FTSE 100 with a margin requirement of just 5%. This translates into leverage of 20x.

For example:

- Let’s say that you go long on the FTSE 100 at a stake of £1 per point

- You decide to trade on margin at just 5% – which means your trade is leveraged by 20x

- When you place your long position – the index is priced at 6,900.1 points

- You keep your position open for a few days – and the FTSE 100 is being quoted at 6,920.1 points

- This represents a price increase of 200 points

- Had you not applied leverage – your profit on this trade at £1 per point would have been £200

- But, you applied leverage of 20x – so your profit is amplified to £4,000

It is important to remember that spread betting the FTSE 100 on margin can be risky. This is because the spread betting platform has the right to ‘liquidate your position’ if it goes against you by an amount equal (or just under) your margin balance.

For instance, in the example above you traded the FTSE 100 by putting up a margin requirement of just 5%. If, however, the trade went against you and the FTSE 100 dropped in value by 5% – the spread betting platform would close the position automatically.

This would result in you losing your margin balance in its entirety. This is why you should always set up a guaranteed stop-loss order when spread betting the FTSE 100 – with or without margin applied.

Expiry Date

As we cover in more detail – spread betting is defined as ‘gambling’ in eyes of HMRC – meaning no capital gains tax is liable on profits you make. However, for spread betting to retain this status as a tax-free instrument – all markets must come with an expiry date.

This ensures that spread betting is indeed classed as ‘betting’ – at least in the eyes of tax regulators. Depending on your chosen FTSE 100 spread betting UK broker – you will likely have two markets to choose from in this respect. If you are a day trader or a scalper – you might opt for the daily funded betting market.

This will see your FTSE 100 position expire at the end of each day. Perhaps, you might find that there is more liquidity on the daily funded market – as there’s generally more trading activity.

On the other hand, if you are planning to spread bet the FTSE 100 via a swing trading strategy – you will be better off opting for a quarterly betting market. This simply means that the market will remain open for three months before it expires. This gives you much more in the way of flexibility – as trades can be kept open for days or weeks at a time.

Fees

We should also make it clear that the fees associated with FTSE 100 spread betting UK are different from other investment arenas. For example, if you were to invest in an FTSE 100 index fund backed by the likes of Vanguard or iShares – you would likely pay a flat dealing fee and then an annual expense ratio.

- You will, however, need to pay overnight funding fees – as spread betting instruments are leveraged financial products.

- In simple terms, this is a fee charged for each day that you keep your FTSE 100 position open.

- This is why spread betting is preferred by traders that wish to speculate on the FTSE 100 index in the short term

This cannot be avoided no matter which spread betting broker you opt for.

Spread Betting vs FTSE 100 Trading

If you’re confused about the difference between spread betting and FTSE 100 trading – allow us to explain. In the case of spread betting, this is simply the type of financial trading that you are engaging with. For example, you may spread bet the FTSE 100, individual shares, commodities, or forex.

In the case of FTSE 100 trading – this simply means that you are speculating on the future value of the index in question. This can come in the form of spread betting or CFD trading. Either way, the outcome is the same – insofar that you will make a profit if you speculate on the rise or fall of the FTSE 100 correctly.

Features of FTSE 100 Spread Betting

There are many features that FTSE 100 spread betting UK brokers offer – which we explain in more detail below.

FTSE 100 Spread Betting Tax

The most obvious feature of trading the FTSE 100 via spread betting instruments is that all profits are exempt from capital gains. As we covered earlier, this is because spread betting gains are viewed as gambling winnings – which in the UK, are tax-exempt. This is in stark contrast to traditional index fund investments – which are liable for two forms of tax.

- Firstly, you need to pay capital gains tax if you sell your FTSE 100 index fund for more than you originally paid. For example, if you invested £1,000 and the index grew was worth 10% more at the time you cashed out – your £100 profit would be liable for capital gains tax.

- Secondly, as traditional FTSE 100 investments generate quarterly dividends – this would also be liable for tax. In the UK, anything after the first £2,000 per year is liable for dividend tax.

Thankfully – when you trade the FTSE 100 index via spread betting markets – no capital gains or dividend tax is required. This is because the underlying asset does not exist. In turn, you will also avoid paying the standard stamp duty tax of 0.5%. This is required on all investments that are listed on the London Stock Exchange – but not in the case of spread betting.

Spread Betting Risk Management

The popular FTSE 100 spread betting UK sites offer a range of tools that allow you to trade in a risk-averse way. For example, you may install a stop-loss order on each FTSE 100 position that you enter. This will limit the amount you can lose on each trade – subsequently protecting your trading capital.

For example:

- You want to go long on the FTSE 100 – which is priced at 6.700.5 points

- You decide to stake £2 per point

- You have an account balance of £1,000

- You don’t want to risk more than than 2% on this trade – so you set up a stop-loss order

- 2% of a £1,000 account balance amounts to £20

- As such, at £2 per point, you need to set your stop-loss order at 10 points

As per the above example, the most you can lose on this FTSE 100 trade is £20. This is because should the FTSE 100 fall by 10 points – the spread betting platform will close the position on your behalf.

In addition to stop-loss orders, another benefit of FTSE 100 spread betting UK, is that brokers allow you to set up a take-profit order. This works in a similar way to stop-loss orders but in reverse. This is because you have the option to specify how much profit you wish to make from the FTSE 100 trade. If this profit target is hit – the spread betting broker will close the position automatically.

For example:

- You are long on the FTSE 100 and have entered an order at £2 per point

- You have also installed a stop-loss at 10 points (£20 maximum loss)

- You want to trade at a risk-reward ratio of 1:5

- As your risk is 10 points – you need to set your take-profit order at 50 points

- This would result in a profit of £100 (£2 per point x 50 points)

At this stage, you are spread betting the FTSE 100 in a risk-averse manner. This is because you have a clear entry and exit plan in place – meaning that both your profits and potential losses have been clearly identified.

Leverage

Although leverage can be risky, it can also be a useful tool for those of you that don’t have access to a large amount of trading capital. In the case of the FTSE 100, spread betting brokers will offer you leverage of 20x (5% margin). In other words, you can trade the index at 20 times the amount you have in your account.

This is also beneficial if you are a day trader that typically targets smaller profit margins. For example, making 1% gains on a balance of £300 doesn’t sound so appealing when this translates to a profit of £3. But, at leverage of 20x – this translates into a daily profit of £60.

Short the FTSE 100

Newbie investors in the UK will often cash out their index fund positions when the markets are going through uncertain times. But, the smart thing to do is to take advantage of falling markets – which you may easily do when using a FTSE 100 spread betting UK broker.

For example,

- In late January 2020 – the FTSE 100 was priced at 7674 points

- Then, in the space of a few weeks – the FTSE 100 capitulated to 5190 points

- This translates into a decline of 32%

- This was driven by the uncertainties of the coronavirus pandemic

Shrewd investors would have profited from this decline by entering a short-selling position via a spread betting broker

24 Hour Trading

When trade you trade the FTSE 100 in the traditional sense – users can only do so during standard market hours. This is typically Monday to Friday – meaning that seeking trading is prohibited. However, when using a FTSE 100 spread betting UK platform – users can trade 24 hours per day. This is because you are trading a derivative and thus – market hours are irrelevant.

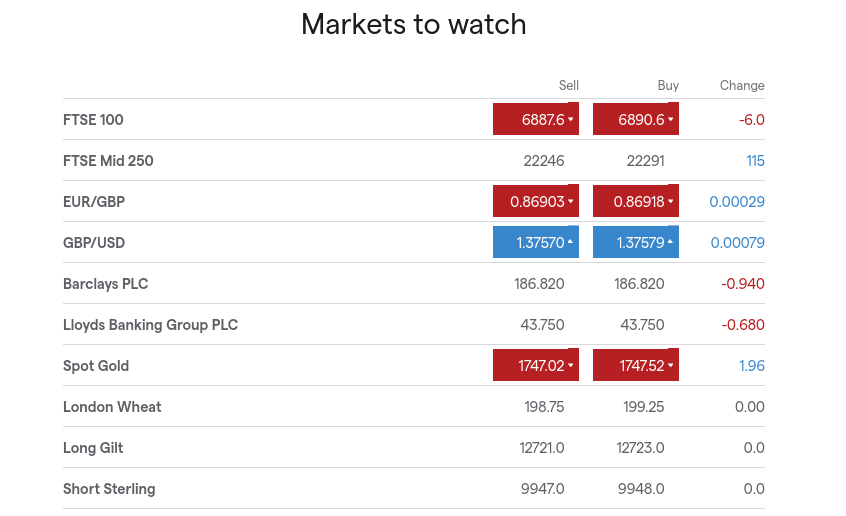

Commission-Free

The vast majority of spread betting brokers in the UK allow you to speculate on the FTSE 100 commission-free. This is valuable for those of you that are trading small amounts – as flat commission fees can make the process unviable. You will also find that the ‘spread’ charged by spread betting brokers is very competitive. During standards market hours, this can go as low as just 1 point.

FTSE 100 Spread Betting Strategies

If you are looking to speculate on the FTSE 100 via a spread betting site – it’s important that you have a strategy in place. This will ensure that you are trading with clear goals and targets – rather than relying on luck.

Crucially, seasoned traders are able to profit from ever-changing price shifts because they have a number of spread betting strategies for FTSE 100 at their disposal.

To help point you in the right direction – below you will find several spread betting strategies for FTSE 100 that you might want to consider.

Keep an eye on Major Political and Economic News

The performance of the FTSE 100 is in direct correlation to the strength of the wider UK economy. For example, when it was announced that the UK had voted to leave the European Union in 2016 – the FTSE 100 went through a prolonged downward trend. This is because confidence in the UK economy was low – as per the uncertainties of how Brexit would unfold.

At the other end of the scale, the FTSE 100 index has been performing very well over the past six months. In fact, during this period, the FTSE has grown from 5,935 points to 6,890 points – an increase of 16%. This is largely because confidence in the UK economy is strong – as per the success of the COVID vaccine rollout and an end to the Brexit saga.

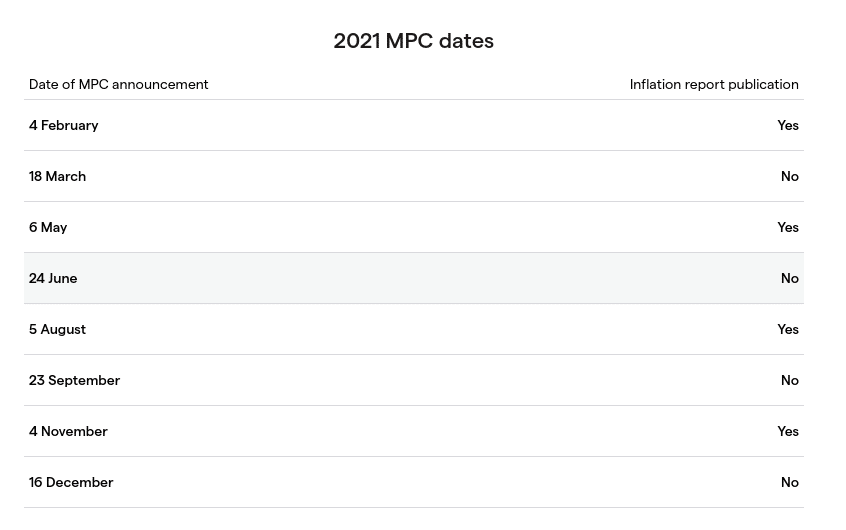

Trade on the Back of Interest Rate Meetings

Interest rates in the UK are set by the Bank and England – and they can have a major say on the performance on the FTSE 100. In theory, if the Bank of England increases interest rates – this will have a negative impact on the FTSE 100. This is because companies on the index will need to pay more interest to service outstanding debt or borrow more money.

Alternatively, if the Bank of England reduced interest rates, then this will usually have a positive impact on the FTSE 100. This is because corporations can borrow money and service debt at a much more favorable rate and thus – this feeds back into the market sentiment of the stock market.

If you’re wondering how to deploy a spread betting strategy on the back of Bank of England interest rate decisions – you’ll want to turn into Monetary Policy Committee (MPC) meetings. The MPC typically meets eight times per year to review current interest rate and whether an adjustment needs to be made.

Get Ready for Major Earnings Reports

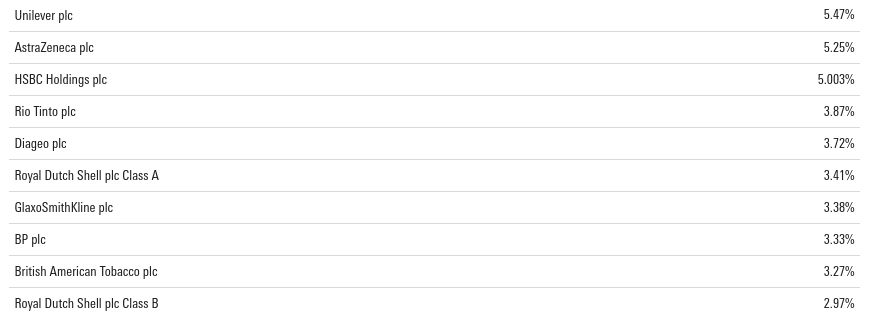

If you are relatively new to the FTSE 100 – you should know that this is a stock market index that is ‘weighted’. In simple terms, this means that companies on the index with a larger market capitalisation will contribute more to the price movement of the FTSE 100 than those with a smaller valuation.

- For example, at the time of writing, Unilver has the largest weighting on the FTSE 100 at 5.47%.

- This is because the firm has a huge market capitalisation of over £108 billion.

- On the other hand, Barratt Developments has a FTSE 100 weighting of just 0.39% – as its market capitalisation is much smaller at £8 billion.

With this in mind, it makes sense to focus on your FTSE 100 spread betting strategies on major constituents. On top of Unilever – this should include the likes of BP, British American Tobacco, GlaxoSmithKline, Royal Dutch Shell, HSBC, and AstraZeneca. One way to do this is to look out for quarterly earnings reports on these companies.

This is where the FTSE 100 company will inform the public how it performed over the prior three months – in terms of revenues, operating margins, profits, and debt servicing. Crucially, if the earnings report outperforms market expectations – you could head to your chosen FTSE 100 spread betting broker and place a long position. If the opposite happens, a short position would be the way to go.

Popular FTSE 100 Spread Betting Platform

If you have a FTSE 100 spread betting strategy ready to go – you first need to choose a suitable broker. The popular FTSE 100 spread betting UK sites are regulated by the Financial Conduct Authority, offer right spreads and zero commissions, and leverage of up to 1:20.

In the sections below, we review two popular brokerages that allow you to trade the FTSE 100.

1. Pepperstone

If opting for the Razar Account – you may often get spreads of 0 points – as you will be trading directly with market participants. This comes alongside a small commission of just £4.59 per £100k traded. The Razar Account is particularly useful for those of you that wish to spread bet the FTSE 100 via a scalping strategy. You have the option to also use Pepperstone if you wish to install an algorithmic trading system.

This is because the platform is compatible with MT4 and MT5. For example, you could install an algorithm that goes long on the FTSE 100 if it increases by more than 1.5% in a single day of trading. Pepperstone offers lots of other indices – such as those based in the US, Germany, France, Australia, and Japan. You will also have access to spread betting markets on stocks, commodities, and forex.

When it comes to leverage, retail clients can trade with up to 1:20 on the FTSE 100. If, however, you are a professional client at Pepperstone, you may spread bet the FTSE 100 with leverage of up to 1:200. In terms of opening an account, this should take you no more than a few minutes. Although Pepperstone recommends a minimum deposit of £500 – you may deposit any amount you wish. Supported payment types at this FCA-regulated spread betting site include debit/credit cards, Paypal, and bank transfers.

| Broker | Commission | Inactivity Fee | Deposit Fee | Withdrawal Fees |

| Pepperstone | £0.02 per 0.01 lot or 0.0035% | None | FREE | $5 (about £4) |

75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

How to Start FTSE 100 Spread Betting

If you want to start spread betting the FTSE 100 from the comfort of your home but need a little guidance – follow the step-by-step walkthrough outlined below.

Create a Spread Betting Account

Getting started takes a matter of minutes. Simply make your way to your brokerage’s website and begin the sign-up process. This will open a sign-up form and you’ll be required to enter your name, email address, as well as choose a username and password for your new trading account.

Verification Process

Users may be required to complete a simple KYC process, if they invest with a regulated broker. Upload a copy of your passport or driving license as proof of identity, and a copy of a recent utility bill or bank statement as proof of address.

Deposit Funds

With a fully verified account, you’re one step closer to start trading a range of assets with the click of a button. Depending on the broker you choose, you can transfer funds using a debit card, credit card, bank wire transfer, as well as e-wallets such as PayPal, Neteller and Skrill.

Choose your preferred payment method and deposit your funds into the account.

Search for FTSE 100 Market

Now that you have a funded spread betting account – you can start trading the FTSE 100. To go straight to the trading arena – enter ‘FTSE 100’ into the search box of your platform.

Confirm Your FTSE 100 Spread Order

You need to specify whether you want to long or short on the FTSE 100. As we covered in this guide, a ‘long’ order should be entered if you think the FTSE 100 will rise and ‘short’ order if you think it will fall.

You need to enter your stake per point. If this is your first time accessing the FTSE 100 spread betting UK market – be sure to keep your stakes conservative. At the very least, you should also enter a stop-loss order so that your potential losses are capped.

Finally, confirm the order to place your FTSE 100 spread betting trade.

Conclusion

Spread betting the FTSE 100 could be a valuable option for experienced and senor traders looking to increase the chances of gaining more money, whilst considerably increasing their risk as well. If you are a trader looking to apply long and short positions and trade on the future prices of the FTSE 100, you may want to do so with the help of a suitable brokerage that can cater to your investing needs.

FAQs

What is FTSE spread betting?

How much money do you need to start spread betting the FTSE 100?

How does FTSE 100 spread betting work?

Is FTSE 100 spread betting really tax-free?

What moves the FTSE 100 in spread betting?

What does FTSE stand for?