Best Bond ETFs UK to Watch

Buying bonds in the UK is somewhat difficult as a retail client. This is because bond issuers typically require a large minimum investment – meaning that this financial instrument is often out of reach for the Average Joe.

Fortunately, ETFs remove these barriers – as through a single trade you can often invest in hundreds of different bonds. Not only does this include corporate bonds in the UK and overseas – but government-backed instruments, too.

Bond ETF UK 2022 List

Here’s a snap-shot list of some UK bond ETFs for UK investors to research in 2022 based on trading volumes. You can read our full analysis of each bond ETF by scrolling down.

- Vanguard Total Bond Market ETF

- iShares Corp Bond UCITS ETF

- SPDR Bloomberg Barclays High Yield Bond ETF

- PIMCO Active Bond Exchange-Traded Fund ETF

- iShares TIPS Bond ETF

Bond ETFs UK Reviewed

In choosing UK bond ETF UK for your needs, you also need to look at the metrics surrounding past performance, fees, and minimum account balances.

1. Vanguard Total Bond Market ETF

The Vanguard Total Bond Market ETF gives you access to more than 10,000 individual bond instruments from a broad scope of sectors.

For example, the ETF holds just over 42% in US government bonds – which are as close as risk-free that you will get in the investment space. To ensure the ETF is able to generate attractive returns, it also holds bonds from the corporate space. In terms of the risk involved, 67% of the bonds held in this ETF carry a credit rating of AAA.

This is the highest rating that bonds can achieve – meaning they issued by rock-solid institutions. At the other end of the scale, there are 12% and 17% held in A and BBB bonds, which come with a higher risk/reward ratio. In terms of performance, this bond ETF has generated steady returns over the past decade.

In fact, based on a 10-year period, the ETF has returned average annual gains of 3.51%. In addition to this, you will, of course, be entitled to your share of any bond coupon payments that the ETF receives. Unlike other options in this space, the Vanguard Total Bond Market ETF makes a dividend distribution every month.

2. iShares Corp Bond UCITS ETF

While the aforementioned Vanguard fund has a heavy focus on US government bonds, the iShares Corp Bond UCITS ETF concentrates exclusively on corporate bonds. This gives you the opportunity to target slightly higher returns, as the yields on corporate bonds are typically much higher than their governmental counterparts.

In total, this iShares ETF will give you access to over 2,300 individual bonds from a variety of sectors. Each and every corporate bond in the ETF has been issued by a US-listed company. This includes the likes of Goldman Sachs, Boeing, Microsoft, CVS Health, and AT&T.

Although corporate bonds come with more risk, this ETF is really well diversified. Not only in terms of the number of bonds held by iShares but the fact the largest weighting in the ETF is just 0.39%. This ensures that you are not over-exposed to a single bond instrument – should the issuer run into financial problems.

3. SPDR Bloomberg Barclays High Yield Bond ETF

If you are the type of investor that has a slightly higher tolerance for risk – then you might want to consider the SPDR Bloomberg Barclays High Yield Bond ETF. As the name suggests, this bond ETF focuses on instruments that attract a higher yield. In turn, this will allow you to target higher financial returns.

It total, this ETF holds just over 1,200 individual bonds. Much like the previously discussed iShares fund, this ETF focuses only on corporate-issued instruments. This covers a variety of sectors – including the likes of energy, telecommunications, capital goods, and technology.

Although these bonds attract a higher yield, the largest holding in the ETF is weighted at just 1.06%. After that, the next largest weight is just 0.54% – so you are well diversified. Some of the bonds that you will be buying include Carnival Crop, American Airlines, Caesars Entertainment, Ford Motors, Tenet Healthcare, and Vodafone.

Taking a closer look at the portfolio, the bonds held within the SPDR Bloomberg Barclays High Yield Bond ETF carry an average coupon yield of 5.92%. However, many of these bonds are now trading at a premium, so the running yield is slightly lower at 5.70%.

Look at the fund’s past performance, this high yield ETF has generated an average annualized return of 5.53% since it was launched in 2007. Over a 5-year period, the average annual gains stand at a more attractive 7.70%. Finally, this bond ETF carries an expense ratio of 0.40%.

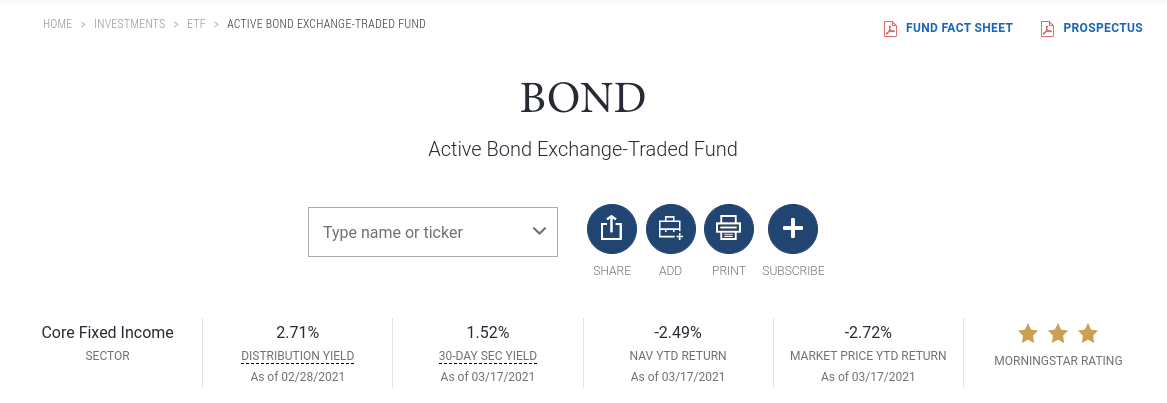

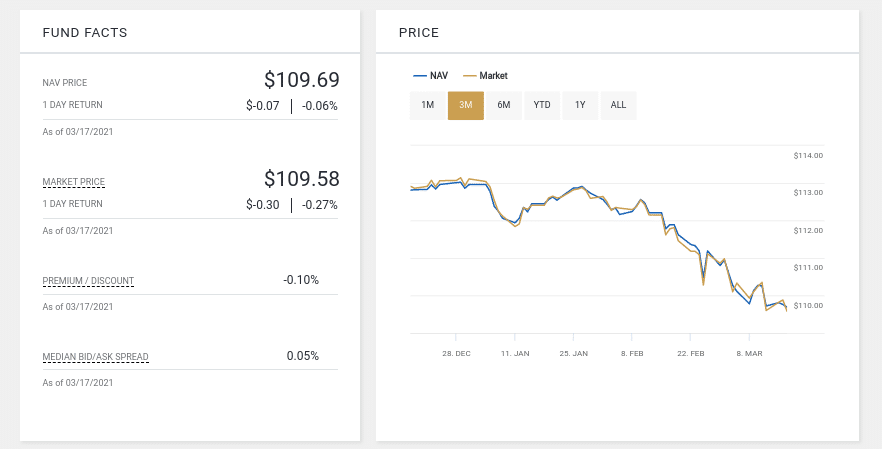

4. PIMCO Active Bond Exchange-Traded Fund ETF

While many bond ETFs focus on a specific market – some of you might want to gain exposure to several international economies. The PIMCO Active Bond Exchange-Traded Fund ETF offers this. Launched way back in 1971, this bond ETF has a strong track record.

It gives you access to a number of bond markets account the world – which includes Canada, Japan, Brazil, Mexico, Germany, France, and the UK. With that said, there is a heavy focus on bonds issued in the US – which accounts for over 90% of the portfolio.

Nevertheless, this ETF holds bonds from both the government and corporate spaces – so there is a blend of risk and reward. Talking of risk, more than 40% of the ETF portfolio is held in US Treasuries. There is then a mix of credit ratings – ranging from AAA down to a small allocation of D’s.

As you will be gaining access to several bond marketplaces, the expense ratio on this ETF is slightly more expensive at 0.57%. With that said, this still amounts to just £11.40 per £2,000 invested. In terms of performance, this bond ETF has generated NAV returns (after fees) of 4.49% since its inception.

In more recent times, the ETF has an average annualized return of 4.43% over a 5-year period. Finally, at the time of writing, the PIMCO Active Bond Exchange-Traded Fund ETF is offering a running distribution yield of 2.71% – which refers to your dividend payments.

5. iShares TIPS Bond ETF

While many of you will be looking to invest in a bond ETF as part of a long-term investment plan, others will simply be looking to protect their wealth against the threat of inflation. After all, if you are not growing your money at a rate that at least mirrors inflation – your purchasing power will continue to decrease.

In other words, if inflation levels rise by 2% – as will the yield on your TIPs. Accessing TIPs as a retail client can be difficult – which is why this iShares ETF fits the bill. In total, the iShares TIPS Bond ETF holds 51 instruments with various maturity dates. This ranges from short-term T-Bills that mature in less than 1-year to US Treasuries with a maturity of over 20 years.

The expense ratio on this bond ETF is a very reasonable 0.19% per year. In terms of performance, the iShares TIPS Bond ETF has grown by an average of 4.35% since it was incepted in 2003. In comparison – the Bloomberg Barclays U.S. Treasury Inflation-Protected Securities (TIPS) Index – has grown by 4.50%. As such, this iShares ETF has served its purpose well for 18 years.

List of Other Popular Bond ETFs UK

There are hundreds of bond ETFs available to UK investors – so naturally, there might be a financial instrument you are considering that we haven’t discussed today.

If you are looking for a bit more choice – check out the list of alternative bond ETFs UK below.

- UltraPro Short 20+ Year Treasury

- SPDR® Bloomberg Barclays UK Gilt UCITS (Sterling)

- ProShares Short 7-10 Year Treasury

- Sound Enhanced Fixed Income ETF

- iShares iBonds 2023 Term High Yield and Income ETF

- Bloomberg Barclays MSCI US Corporate 0-3 Sustainable SRI

As always, make sure you perform lots of research before you invest in your chosen bond ETF.

Fundamentals of UK Bond ETFs

Bond ETFs offer an alternative to the stock markets. After all, you won’t be reliant on the growth of individual companies Instead, you will benefit from a steady flow of predictable income. This is because bond yields are fixed – so you’ll have a round-about idea of what sort of returns to expect.

If you’re still sitting on the fence as to whether or not bond ETFs are right for you – check out the benefits discussed below.

Access Difficult-to-Reach Bonds

As a UK retail client, your ability to buy bonds on an individual basis is going to be extremely limited. As we briefly covered earlier, this is because bonds are issued in minimum lot sizes – which is often out of reach for the everyday investor. Plus, when bonds are issued, they are typically sold directly to institutional investors and banks.

Even if you find a broker that gives you access to the secondary bond market – once again, the minimum investment required is often 5-figures.

This is where UK bond ETFs come in. As you will be investing your capital into a large-scale provider like Vanguard, iShares, or SPDR – you will be able to access any bond market of your choosing. Whether that’s corporate bonds, UK Gilts, US Treasuries, or high-risk emerging market bonds – there will be an ETF for you.

Diversification

Another major advantage of opting for a UK bond ETF – as opposed to buying individual instruments, is that you will benefit from instant diversification. That is to say – through a single investment, you might be purchasing an ETF basket that contains hundreds or even thousands of individual bonds.

For example, the Vanguard Total Bond Market ETF contains more than 10,000 bonds from both the corporate and governmental sectors. Crucially, by investing in such a large number of bonds – you are reducing the risks of being exposed to a potential default.

Fees are Low

Opting for an ETF is a fairly cheap option for buying bonds. Investors rarely pay more than 0.5% per year. In fact, many of the ETFs that we have discussed today charge less than 0.20%.

Not only this but every time your chosen ETF provider buys or sells bonds – this is taken care of behind the scenes. This means that you won’t need to pay a dealing commission on each subsequent trade.

Liquid Investment

Bonds are actually one of the most illiquid asset classes in the investment space. For those unaware, an illiquid investment is one that cannot easily be converted back to cash.

After all, when you buy a bond, you need to wait until it matures before you get your original investment back. Depending on which bonds you bought – this can be several years.

1. XTB

XTB is a popular UK stock broker that offers trading on more than 2,100 shares and ETFs – all 100% commission-free. Furthermore, spreads at this broker start at just 0.015% for US-listed stocks, making it one of the cheapest options available for UK traders. XTB doesn’t require a minimum deposit to get started and the broker doesn’t charge deposit or withdrawal fees.

XTB’s custom-built stock trading platform – xStation 5, is also available for the web and mobile devices and it comes packed with research tools. You’ll find technical charts and dozens of studies to start, plus a market news feed that includes actionable trade ideas with annotated price charts. The platform also has a market sentiment gauge which allows users to easily see what other traders think about where a stock’s price is headed.

XTB’s platform also includes a stock and ETF screener, which can be really useful for traders. With this tool, users can easily scan the market for stocks that are taking off or that seem poised for a fall. Using the screener, it’s possible to create watchlists and narrow down your search to find better trading opportunities.

XTB is regulated by the UK FCA and CySEC and offers negative balance protection for all traders. In addition, the broker offers customer support by phone, email, and live chat, available 24/5.

76% of retail CFD accounts lose money.

2. AvaTrade

AvaTrade is a UK CFD broker that offers 0% commission trading on over 600 global stocks. The platform also carries dozens of exchange-traded funds (ETFs), stock indices, commodities, and forex pairs for trading. Notably, AvaTrade also offers trading on forex options – but it doesn’t offer stock options at this time.

AvaTrade has a few different trading platforms you may use to trade stocks. Like Pepperstone, this broker gives all traders access to MetaTrader 4 and 5.

Alternatively, the AvaTrade web trading platform and AvaTradeGO platform are available on iOS and Android devices as well . You get watchlists, a market news feed, and dozens of technical studies. On mobile devices, users can access full-screen charts and enter orders with just a few taps.

AvaTrade also has its own social trading app for iOS and Android, called AvaSocial. Although this isn’t integrated into AvaTradeGO, it’s simple to switch back and forth between sharing ideas and setting up trades. AvaSocial also enables copy trading, so you have the ability to mimic the portfolios of more experienced stock traders in just a few taps.

AvaTrade is regulated by the UK FCA and Australia’s ASIC. The platform requires a $100 minimum deposit to open an account and you may pay by credit card, debit card, or bank transfer. AvaTrader offers 24/5 customer service.

Your capital is at risk.

3. FP Markets

One of FP Markets’ standout features is its commitment to offering competitive pricing with tight spreads, ensuring that traders can maximize their profits. The broker also supports various trading platforms, such as MetaTrader 4, MetaTrader 5, and IRESS, allowing traders to choose the platform that best suits their trading style and needs.

FP Markets strongly emphasizes education and resources, providing traders with access to a wealth of educational materials, webinars, and market analysis. This dedication to trader education helps both beginners and experienced traders enhance their trading skills and make informed decisions.

Customer support at FP Markets is highly responsive and available 24/5, ensuring that traders receive prompt assistance whenever needed. Additionally, the broker is regulated by top-tier authorities like ASIC and CySEC, providing traders with a sense of security and trust.

In summary, FP Markets stands out as a reliable and versatile broker. It offers a robust trading environment supported by competitive pricing, excellent educational resources, and top-notch customer service.

Your capital is at risk

4. Pepperstone

Pepperstone is a popular UK stock brokers for traders who want to use MetaTrader 4 or 5. These popular trading platforms offer unparalleled tools for technical analysis, including the ability to create custom technical studies. You may also backtest trading strategies against historical price data to see how they are likely to perform.

This broker also offers a few extra tools that are built specifically for MetaTrader. For example, there’s a correlation heatmap so investors will be able to see whether the stocks you’re invested in typically move at the same time. There’s also an alarm management tool that lets you create custom alerts based on price changes, trading volume, and more.

Pepperstone carries thousands of share CFDs from the US, UK, Europe, and Australia. The broker’s charges vary based on the market you’re trading – US shares trade commission-free, while UK shares carry a 0.10% commission. So, this broker can be slightly more expensive than some of its peers.

Pepperstone is regulated by the UK FCA and the Australian Securities and Investments Commission (ASIC). The platform doesn’t require a minimum deposit to open an account, which is a major plus if you’re not ready to commit hundreds of pounds to trading just yet.

Your capital is at risk.

5. PrimeXBT

PrimeXBT is an innovative stock broker that caters to a diverse range of traders, from beginners to seasoned professionals. Known for its versatility and user-friendly interface, the platform offers an array of features designed to enhance the trading experience across multiple asset classes.

One of the standout aspects of PrimeXBT is its wide range of available markets. Users can trade in cryptocurrencies, forex, commodities, and indices all from a single account. This flexibility allows traders to diversify their portfolios and take advantage of different market opportunities without needing to switch between platforms.

PrimeXBT offers a suite of trading tools and advanced charting options to help traders make informed decisions. The platform integrates customizable indicators, drawing tools, and multiple timeframes, enabling users to tailor their charts to suit their individual trading strategies. Additionally, PrimeXBT provides leverage trading options, which can amplify potential profits for experienced traders.

The platform’s trading interface is sleek and intuitive, designed to make navigating the markets straightforward. Opening, managing, and closing trades can be done with ease, while the performance of live trades can be tracked in real-time. PrimeXBT also offers an innovative feature known as Covesting, which allows users to follow and replicate the trades of successful strategy managers, providing an educational and potentially profitable experience.

PrimeXBT also prioritizes the security and privacy of its users. The platform employs industry-standard security measures to safeguard user accounts and data, such as two-factor authentication and encryption. Customer support is available to assist traders with any queries they may have, ensuring a smooth and reliable trading experience.

In summary, PrimeXBT stands out as a comprehensive trading platform offering a variety of markets, robust tools, and an easy-to-use interface. Its emphasis on security, diverse asset offerings, and innovative features like Covesting make it an excellent choice for traders looking to explore and capitalize on global market opportunities.

Your capital is at risk.

6. Admiral Markets

Admiral Markets is a globally recognized online trading broker known for its comprehensive range of financial instruments and user-friendly platforms. With a presence in over 40 countries, the company has built a strong reputation for providing a reliable and secure trading environment for both beginner and experienced traders.

One of the standout features of Admiral Markets is its extensive selection of trading instruments, including Forex, stocks, commodities, indices, and more. This variety allows traders to diversify their portfolios and explore different markets with ease. The broker offers competitive spreads and flexible leverage options, catering to various trading styles and strategies.

Admiral Markets is also praised for its robust platforms, particularly MetaTrader 4 and MetaTrader 5, which are equipped with advanced charting tools, technical indicators, and automated trading capabilities. These platforms are available on both desktop and mobile devices, ensuring seamless trading experiences across all devices.

The broker places a strong emphasis on education, providing a wealth of resources such as webinars, tutorials, and market analysis to help traders make informed decisions. Additionally, Admiral Markets is regulated by several reputable financial authorities, ensuring a high level of trust and transparency.

Overall, Admiral Markets stands out as a top-tier broker, offering a comprehensive trading experience supported by excellent customer service and innovative tools.

Your capital is at risk

7. Trade Nation

Trade Nation is a well-established stock broker known for its reliability and comprehensive range of services. As an FCA regulated broker, traders can trust that their investments are in safe hands. Trade Nation offers a diverse selection of trading options, including stocks, CFDs, spread betting, and forex trading. One of the standout features of Trade Nation is its commitment to providing low-cost fixed spreads, starting from an impressive 0.6 pips for CFDs, ensuring traders can navigate the markets without any surprise fees.

In addition to its impressive range of services, Trade Nation offers compatibility with popular trading platforms, including MetaTrader 4 (MT4) and TN Trader. MetaTrader 4 is renowned for its user-friendly interface and advanced charting capabilities. It is a preferred choice for many traders due to its extensive range of technical indicators, customizable charts, and automated trading options through Expert Advisors (EAs). With Trade Nation’s integration of MT4, traders can access a seamless trading experience with all the familiar features they rely on for their trading decisions.

Trade Nation has developed its proprietary trading platform, TN Trader, catering to traders who prefer a platform tailored to the broker’s offerings and user experience. TN Trader boasts a user-friendly interface and is equipped with a suite of tools, including advanced charting, analysis tools, and real-time market data. It is an excellent option for traders who prefer a platform specifically designed to complement Trade Nation’s services and trading conditions.

Trade Nation also provides regulated signals software that can be used to guide stock trading decisions. As well as this, users can also access a variety of educational resources and analysis tools that can be used to improve trading strategies and make informed stock trading decisions. Users can practice different strategies with the free demo account.

75% of retail investor accounts lose money when trading CFDs with this provider.

8. IUX.com

IUX.com boasts competitive spreads, a key factor for maximizing your profit potential. They also advertise high leverage, which can amplify gains (and losses) for experienced traders comfortable with calculated risks. The MT5 platform is a user-friendly and powerful tool, providing advanced charting functionalities and a robust set of technical indicators to help you make informed trading decisions.

IUX.com understands that every trader has unique needs. That’s why they offer a variety of account types, allowing you to select the option that best suits your capital and trading style. This level of flexibility ensures you can enter the market with confidence, knowing your account is set up for your specific goals.

If you’re looking for a forex broker that prioritizes your trading experience, IUX.com is definitely worth considering. Their diverse platform, competitive offerings, and focus on trader empowerment make them a compelling choice for those seeking to navigate the forex market.

Your capital is at risk

9. Fineco Bank

Fineco Bank is also popular with UK investors as it allows you to get started with a small investment of £100. If you do feel comfortable investing on a DIY basis, Fineco Bank offers multiple research tools and ongoing market commentary.

When it comes to safety, Fineco Bank is heavily regulated. Your funds are protected by the FSCS and the broker holds that all-important FCA license

| Commission | Starting from £0 commission on FTSE100, US and EU Shares CFDs, market spread only and no additional markups. |

| Deposit fee | Free |

| Withdrawal fee | $0 |

| Inactivity fee | None |

| Account fee | None |

| Minimum deposit | £0 |

| Stocks markets | Access to 13 stock markets |

| Tradable assets | CFDs, Forex, Commodities, Stocks and ETFs, indices, mutual funds, bonds, options, futures, |

| Available Trading Platforms | Web-based trading platform, mobile trading app, desktop trading platform |

Your capital is at risk.

10. FP Markets

One of FP Markets’ standout features is its commitment to offering competitive pricing with tight spreads, ensuring that traders can maximize their profits. The broker also supports various trading platforms, such as MetaTrader 4, MetaTrader 5, and IRESS, allowing traders to choose the platform that best suits their trading style and needs.

FP Markets strongly emphasizes education and resources, providing traders with access to a wealth of educational materials, webinars, and market analysis. This dedication to trader education helps both beginners and experienced traders enhance their trading skills and make informed decisions.

Customer support at FP Markets is highly responsive and available 24/5, ensuring that traders receive prompt assistance whenever needed. Additionally, the broker is regulated by top-tier authorities like ASIC and CySEC, providing traders with a sense of security and trust.

In summary, FP Markets stands out as a reliable and versatile broker. It offers a robust trading environment supported by competitive pricing, excellent educational resources, and top-notch customer service.

Your capital is at risk

What are the Drawbacks of UK Bond ETFs?

Although UK bond ETFs serve many purposes – there are a number of drawbacks that also need to be considered.

No Control Over Investments

The main drawback with bond ETFs is that you will have no say in which financial instruments are bought or sold. Instead, the fund manager of your chosen ETF provider will make all decisions on your behalf.

Performance vs Stock Markets

There is no denying that in terms of financial gains – the stock markets have generated significantly larger returns than any bond ETF can provide. For example, even in a year dominated by the coronavirus pandemic, the S&P 500 index has grown by over 62% in the 12 months prior to writing this article.

Over the course of time, the same index has averaged annualized returns of over 10% – which dates back to 1926.

Conclusion

In conclusion, bond ETFs are a way to diversify your portfolio away from the stock markets. Not only will you be able to buy a large basket of bond instruments through a single trade – but you’ll be investing in an asset class with lower volatility levels than traditional shares.