10 Popular Managed Funds Among UK Investors

If you’re looking to gain access to a fund manager’s experience and knowledge, then investing in a managed fund is an efficient and cost-effective way of doing so, due to more and more funds employing an active management style.

In this guide, we examine the Most Popular Managed Funds UK, discussing the key points you need to be aware of when researching your investment and showing you how to invest in one of these funds with an FCA-regulated broker.

10 Popular Managed Funds UK List

The list below displays ten popular managed funds UK available in 2022. In the section that follows, we dive into each of these funds in detail, providing you with the need-to-know information about these assets:

- ARK Innovation ETF

- PIMCO Active Bond Exchange-Traded Fund

- GlobalETF

- Amplify Transformational Data Sharing ETF

- PIMCO Enhanced Short Maturity Active ETF

- ARK Next Generation Internet ETF

- Baillie Gifford Managed Fund

- Jupiter Global Managed Fund

- Standard Life Assurance Managed Pension Fund

- M&G Managed Growth Fund

Managed Funds UK Reviewed

When deciding which managed fund to invest in, there are various criteria you must consider to make an effective investment decision. Metrics such as past performance and yield should be researched thoroughly so that you have a comprehensive overview of the options available in the market.

In this guide, we’ve picked out ten popular managed funds UK. In the section that follows, we will examine these funds individually:

1. ARK Innovation ETF

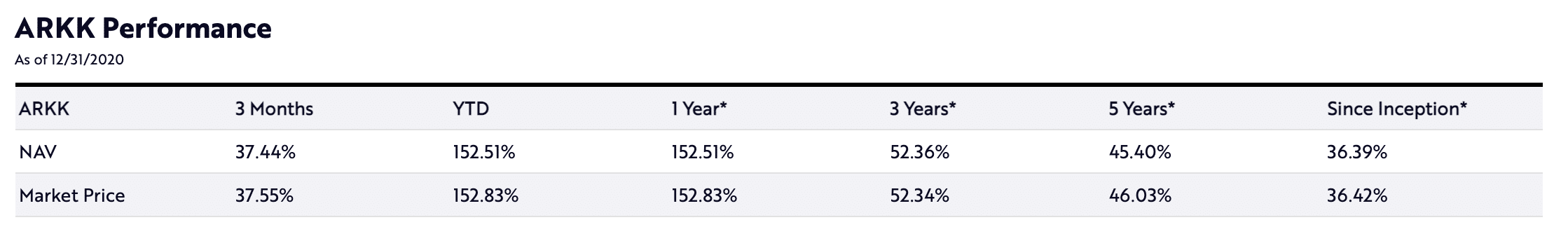

A popular pick when it comes to managed funds is the Ark Innovation ETF. This fund is actively managed and primarily invests in equities of companies leading the way in technological innovations. Examples of companies that this fund is currently invested in include Tesla, Square, Roku, and Teladoc. Through these investments, the ARK Innovation ETF aims to provide high total returns for investors.

This fund has performed well in recent times and is one of the most popular managed funds available on the marketplace today. In 2020 alone, the fund returned an exceptional 152.52% for investors – so if you’d invested £5000 at the start of the year, you’d have a final amount of £12,626 (minus fees). Furthermore, the fund has only produced a small negative return once in the past six years. It also charges a modest expense ratio of 0.75%, putting it in line with many other managed funds.

2. PIMCO Active Bond Exchange-Traded Fund

If you’re looking for one of the most popular managed investment funds UK for bond investing, then the PIMCO Active Bond Exchange-Traded Fund is worth considering. This fund invests in a range of high-quality, intermediate-term US bonds. Through these investments, the fund aims to provide solid returns regardless of the current market environment.

One of the features of this fund is that it provides a solid passive income level for investors. With an annual yield of 2.65% distributed monthly, the PIMCO Active Bond Exchange-Traded Fund offers investors the opportunity to earn a current income that is higher than many Shares ISAs. Furthermore, this fund has shown consistent performance, making a positive return in each of the past seven years.

3. GlobalETF

Although it may be different from the other funds on this list, one of the most popular managed funds for getting broad exposure to the global market is the GlobalETF. Featuring a selection of ETFs domiciled in various countries, the GlobalETF is actively managed by an investment professional, with assets being changed and rebalanced depending on market conditions.

With this CopyPortfolio, there are no management fees attached, meaning you get access to a professionally managed asset that does not cost you an annual fee. What’s more, the GlobalETF has performed pretty well in recent times, returning 20.52% in 2019 and 4.48% in 2020. Also, at the time of writing, the fund was up 2.21% for 2021 already.

4. Amplify Transformational Data Sharing ETF

The emergence of blockchain technology has prompted many funds to add blockchain-based companies to their portfolio. One of the funds that focus on these companies is the Amplify Transformational Data Sharing ETF. This fund invests in a wide range of firms located in North America, Asia, and Western Europe, intending to provide exposure to the high returns that can be expected from companies that utilise blockchain technology.

With over $1 billion of assets under management, this fund has had a increase in popularity in recent years. It returned 88.18% in 2020. Also, the fund produced a return of 29.18% in 2019 and is currently up 44.74% since the beginning of January. Furthermore, the expense ratio charged by the fund clocks in at 0.71% per year, meaning that if you invested £1000 in this fund, you’d only have to pay £7.10 in fees each year.

5. PIMCO Enhanced Short Maturity Active ETF

If you are more risk-averse and seek a managed fund that offers consistent returns with low volatility, then the PIMCO Enhanced Short Maturity Active ETF is a fund worth considering. This fund is managed by PIMCO’s veteran management team, who utilise their expert knowledge to construct a portfolio of short-term investment-grade bonds which appeal to risk-averse investors.

With an expense ratio of only 0.36%, this fund is one of the most inexpensive on our list. Looking at its performance, the fund has produced a positive return in each of the last 11 years. Furthermore, the fund even offers a small yield of 1.02% per year, which can provide an additional income source to add to the capital growth.

6. ARK Next Generation Internet ETF

With the ever-increasing level of technological innovation, more and more companies are becoming involved in sectors such as cloud-based tech and cybersecurity. One of the managed funds that focus on these sectors is the ARK Next Generation Internet ETF. This fund aims to provide long-term growth to investors by investing in equities related to the theme of next-generation internet services.

Due to this investing strategy, this fund has proven itself capable of producing market-beating returns consistently. In fact, in 2020 alone, the fund returned 157.07% to investors. Furthermore, the fund has also made positive returns in 2019 and 2017, returning 35.81% and 87.17%, respectively. Finally, the fund also charges a yield of 0.79% annually.

7. Baillie Gifford Managed Fund

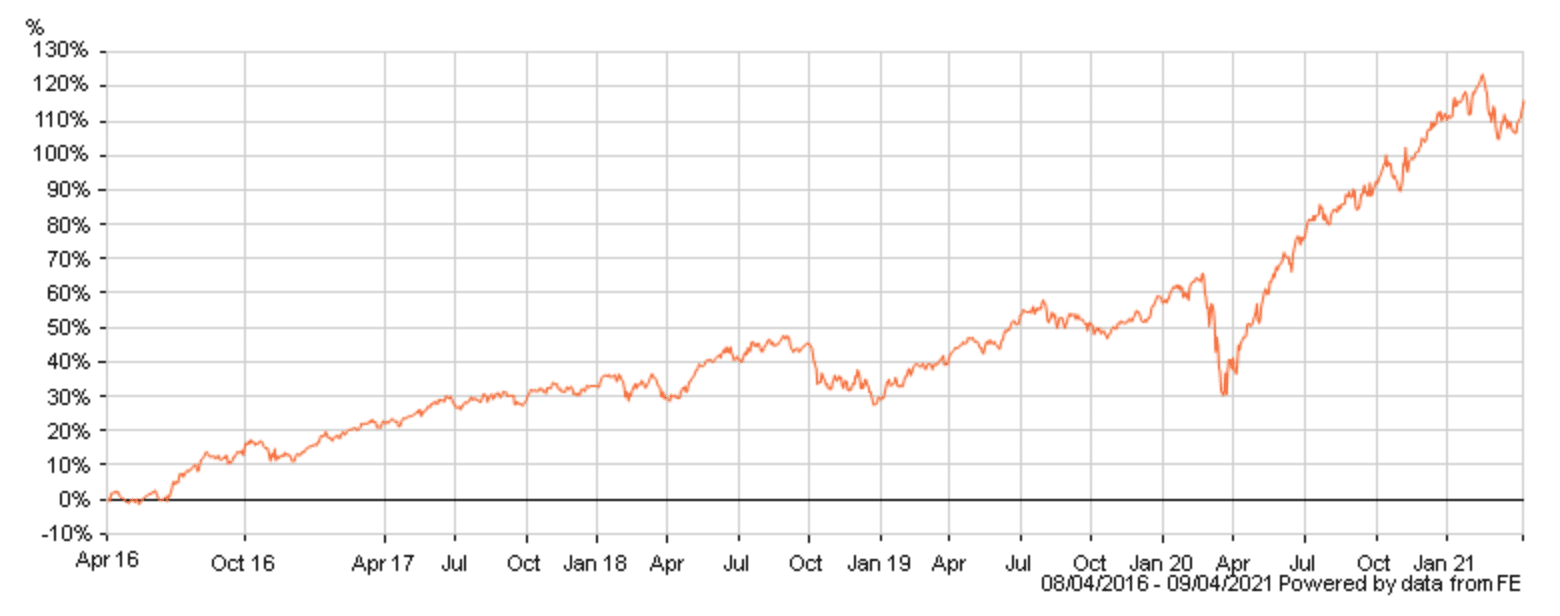

One of the most popular multi-asset funds that are actively managed is the Baillie Gifford Managed Fund. This fund invests in a combination of bonds, shares (including Amazon and Tesla), and cash to achieve capital growth over rolling five-year periods. The multi-asset nature of the fund’s portfolio means that investors get access to a diversified asset, which can help to optimise their risk/return ratio.

With exposure to the tech, financial, and real estate sectors, this fund looks to achieve above-average returns through the equity side of its investments. In terms of performance, the fund has produced a positive return in each of the last five years, even returning 47.86% in the past year alone. Furthermore, the fund has achieved a cumulative return of 116.21% over the previous five years. Finally, the Baillie Gifford Managed Fund is also one of the most cost-effective UK funds on our list, offering an expense ratio of only 0.24% per year.

8. Jupiter Global Managed Fund

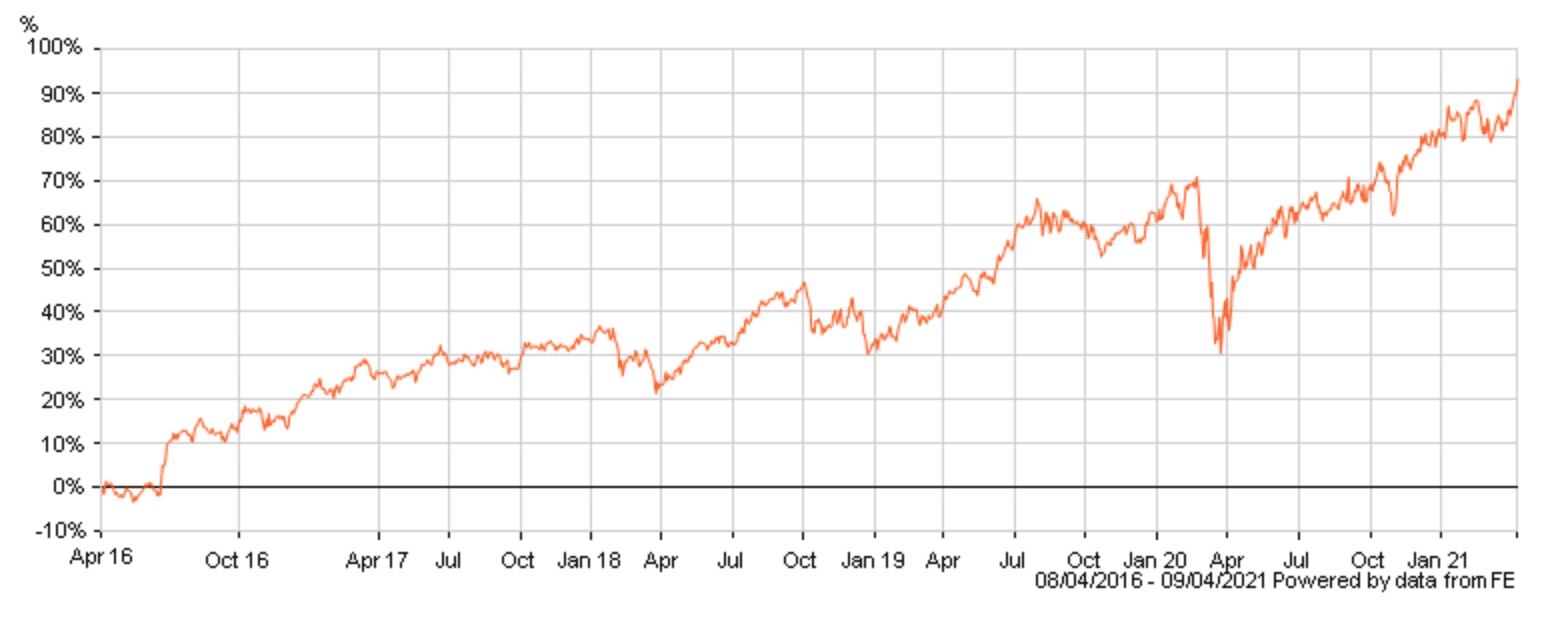

The Jupiter Global Managed Fund is an accumulation fund, which means that any current income generated through dividends or interest payments is automatically reinvested back into the fund, thereby increasing your overall position size. Alongside this, the fund invests in equities worldwide, providing an overarching exposure to the global stock market. The main countries the fund invests in are the US, Japan, and France.

Looking at returns, the most popular Jupiter fund has performed well in recent times, returning 31.48% for investors over the past year. In addition, the fund has only produced a negative return in one of the past five years. With the consistent positive returns, combined with automatic reinvestments back into the fund, the Jupiter Global Managed Fund is undoubtedly one of the most popular funds available on the market.

9. Standard Life Assurance Managed Pension Fund

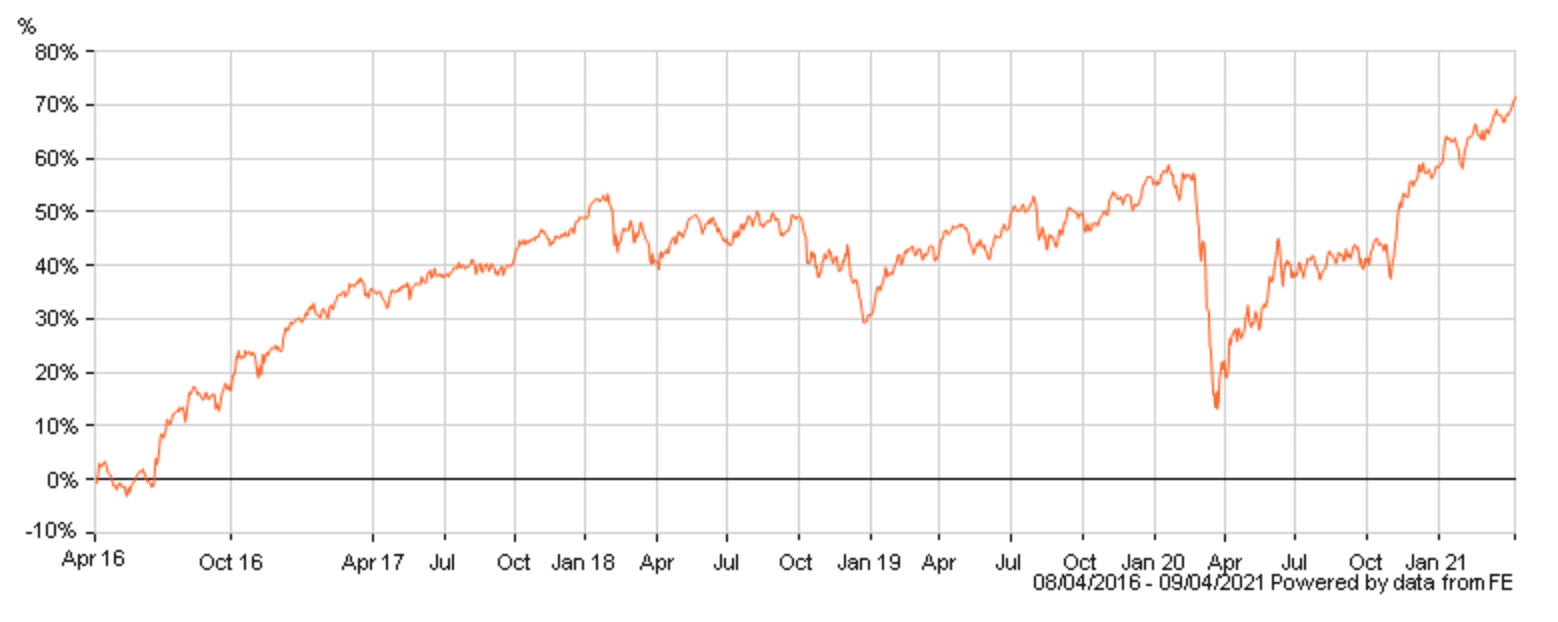

If you’re looking for a managed fund that can provide steady, long term growth, then the Standard Life Assurance Managed Pension Fund might be a great option. This fund invests in various assets, including equities, bonds, and property, intending to provide consistent returns in a risk-optimised manner. Furthermore, the fund also includes a significant diversification element through investments in various developed and emerging markets.

This fund has produced a positive annual return for investors in four of the last five years, even returning a healthy 4.39% in 2020. With over $22.84 billion worth of assets under management, the fund managers make sure to rebalance consistently and consider market conditions when choosing investments. Finally, the fund has also shown comeback power – after the huge crash in March 2020, this fund recovered well over the year and even surpassed the previous highs.

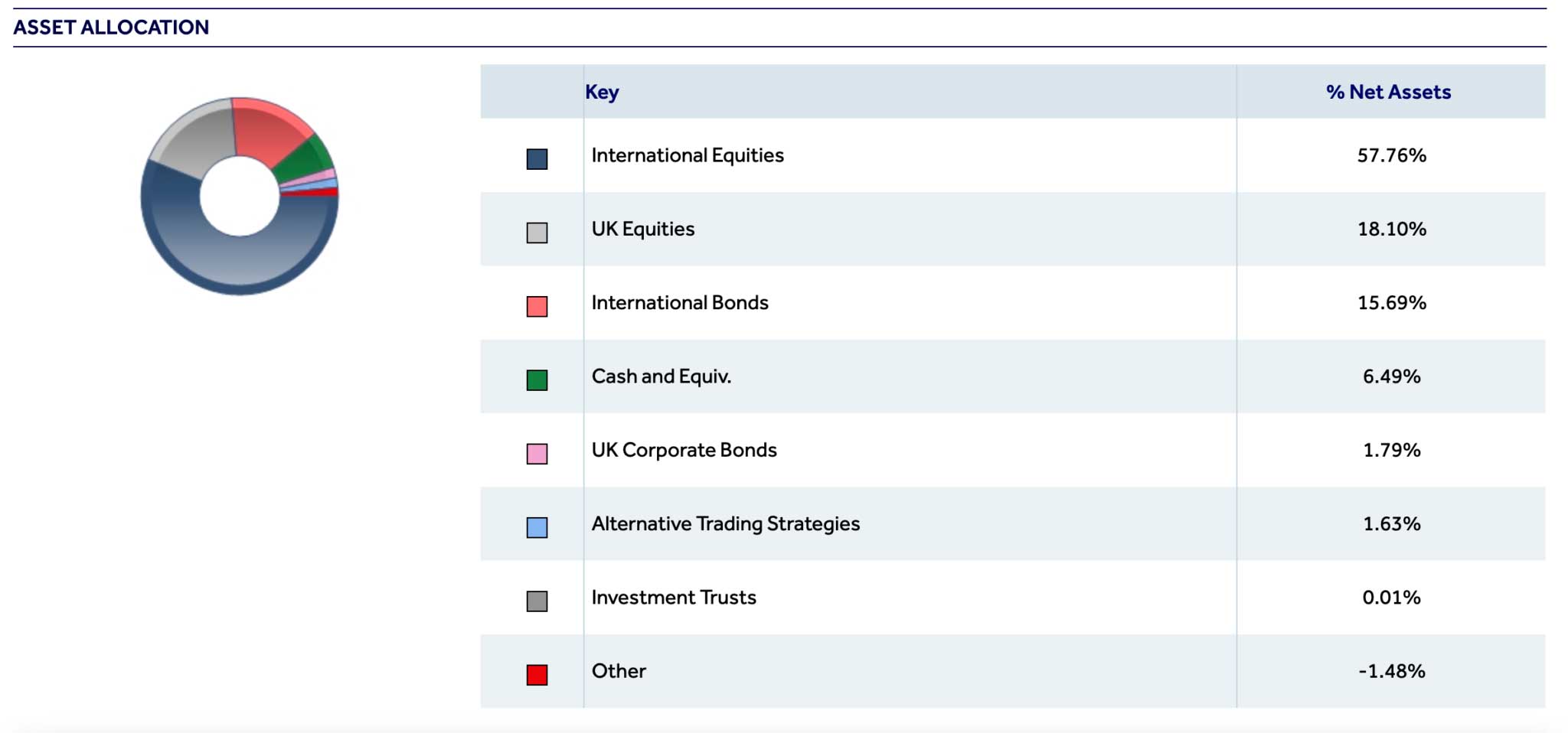

10. M&G Managed Growth Fund

The last fund we will discuss on our list of the most popular managed investment funds UK is the M&G Managed Growth Fund. This is one of the most popular ETFs for investors who wish to add a passive income element to their portfolio, as the fund provides an annual yield of 1.94%. On top of this, the M&G Managed Growth Fund has performed well in recent years when it comes to capital growth, which adds another benefit for investors.

Looking at returns, the fund has produced 35.34% for investors over the past year alone. This capital growth has been driven by intelligent investments in equities and bonds from all over the world, focusing on North America and Europe. Also, the fund distributes income to investors bi-annually – meaning you get two cash payments each year which would go straight into your brokerage account.

There are many other managed funds available on the market, including from providers such as BlackRock, Fidelity, and Fundsmith. However, the funds listed in this guide are some of the most popular on the market.

What are Managed Funds?

Managed funds are a suitable investment prospect for a wide range of people. The key characteristic of managed funds is the fact that they are ‘actively’ managed by either a fund manager or a team of fund managers. Through this management, the fund can be optimised and rebalanced regularly.

Due to their active management style, managed funds differ from the most popular index funds because they do not operate passively. Index funds tend to track the performance of benchmark indices such as the FTSE 100, and rarely rebalance or pick different assets. However, managed funds are constantly in motion, ensuring that they are adapting to ever-changing market conditions.

As the most popular managed funds are actively managed by a fund manager or a team of fund managers, this offers investors exclusive access to the knowledge and expertise of whoever is in charge of investment decisions. This expertise is invaluable when it comes to investing, as it can help reduce overall risk and promote consistent returns. This access to management knowledge is often highly cost-effective – managed funds charge an annual expense ratio, which only tends to be between 0.1% and 0.9% of your position size per year.

Overall, managed funds are a popular way to invest in an actively managed asset that provides a solid platform for positive performance. As these funds are ever-changing in their asset composition, they can give significant diversification levels as an additional benefit.

Why do People Invest in Managed Funds?

Managed funds are becoming an increasingly popular proposition for many investor types, as they provide a whole host of benefits in a cost-effective manner. In this section, we will discuss three of the main reasons why people choose to invest in a managed fund.

Access to Fund Managers

Managed funds provide access to fund managers’ experience and knowledge who actively manage the portfolio of assets. These managers are often savvy when it comes to asset picking and portfolio rebalancing, and fund providers ensure they hire quality managers so that investors experience solid performance.

With managed funds, the fund managers or management team will buy shares in assets based on market conditions – meaning you don’t have to do any of the hard work. They do all of the research, all of the scenario planning, and all of the legwork, meaning that you simply have to invest and let them do their thing. Furthermore, all of this is provided cost-effectively, as the fund’s expense ratio is typically a modest percentage and should not eat into profits too much.

Above Average Returns

According to Vanguard, managed funds actively attempt to outperform their benchmark rather than match it – meaning that they often provide above-average returns for investors. Through intelligent management, these funds can generate returns that are consistently higher than some market indices. To give an example of this, look at the returns experienced by the ARK Innovation ETF in recent years, shown in the image below.

It is worth noting that, although managed funds often attempt to beat the market, this does come at the cost of additional risk. In beating the market, these funds must include assets with high returns potential – but are also riskier than other asset types. Due to this, investors must be aware of the potential for loss and make investment decisions based on their risk preferences.

Diversification Benefits

A key theme in many the most popular managed funds is that they often invest across various asset classes, sectors, and geographical areas. This provides diversification which, according to the CME Group, is one of the essential characteristics of any investment portfolio. Diversified portfolios are much more risk-optimised than non-diversified portfolios.

The most popular managed funds are constantly being rebalanced to maintain an adequate diversification level, which can protect investors in case of market shocks. Fund managers and financial advisers will research and complete advanced calculations which will enable them to choose the correct assets and allocate an efficient weighting to each asset. Through this process, investors gain access to an inherently diversified investment, which can provide a level of comfort in times of market uncertainty.

Managed Funds Brokers

Now that you know what the most popular managed funds UK are, it’s time to examine the broker options available in the market today. Choosing a reliable broker is a crucial part of the investing process, as it ensures your capital is protected, which allows you to trade with confidence.

In the section below, we review two of the most popular stock brokers that allow you to invest in managed funds, discussing their features and highlighting their fee structures.

How to Invest in Managed Funds

If you’re wondering how to invest in the most popular managed funds, look no further. This section will provide a step-by-step guide that shows you how to invest with an FCA-regulated broker.

Open an Account

The first step involves opening your brokerage account. Simply head to your broker’s website and sign up. Once the process has begun, you’ll need to provide some personal details and choose a username and password.

Verify your ID and Address

To invest, you must verify your identity and address. This can be completed online. Simply upload proof of ID (a copy of your passport or driver’s license) and proof of address (a copy of a bank statement or utility bill), and click confirm.

Fund your Account

Before placing a trade, you’ll need to deposit into your account. Your broker will offer various ways to do this, such as credit/debit card, bank transfer, or e-wallet.

Search for your chosen Managed Fund

Click into the search bar at the top of the screen, and type in the name of the fund you wish to invest in (you can also type in its ticker symbol if you know it). Once you see your desired fund, choose to trade.

Invest in Managed Fund

In the order box that appears, simply enter your position size, check that everything is correct, and confirm the transaction.

Conclusion

Throughout this guide, we have examined the managed funds industry in detail, discussing some of the most popular options available on the market and analysing why this fund type has become so popular. Due to their ability to provide an actively managed asset in a cost-effective manner, managed funds are a popular option for many investor types.

If you’d like to invest in managed funds, it’s wise to do this with an FCA-regulated broker, due to the investor protection they offer.