10 Popular Tracker Funds Among UK Investors

Tracker funds, as the name suggests, track the performance of an underlying asset. Many trackers replicate the performance of major stock indices and will therefore contain a basket of stocks that match the index constituents. There are however many other tracker funds – often simply referred to as index funds – covering all areas of the market besides stocks, taking in different asset classes. Exchange-traded funds (ETFs) are a popular way of accessing trackers, but there are mutual fund tracker products to consider too.

Investing in a tracker fund can often be more profitable than trying to pick stocks individually. As we show below, the advantage of trackers is that they provide instant cheap diversification, which is a key way of mitigating risk and is an alternative way of effectively putting stocks into risk-level buckets.

10 Tracker Funds in the UK

We have selected 10 UK tracker funds based on a number of assumptions on where the economy and market are headed this year. Past performance is not a guide to future performance. Neither are they necessarily the cheapest tracker funds.

The FTSE 100 is an undoubted laggard set against other leading world stock market indices, especially its US counterparts. However, this is a year when we expect a bounce-back from the FTSE 100. Although written off by some as the quintessential ‘legacy’ stock market, because of its domination by energy, metals, and financials, those are all sectors that are expected to benefit from the recovery in the global economy as the pandemic slips into the rear mirror. Our first two choices then, provide a choice of either a mutual fund or ETF fund (Fidelity Index UK Fund or iShares Core FTSE 100 EUCITS ETF.

Ethical, income and commodities tracker funds

ESG investing is in vogue. And contrary to an outdated view, you do not have to forego returns by investing in ESG funds. On the contrary, they provide an element of diversification, so UBS MSCI United Kingdom IMI Socially Responsible UCITS ETF makes an entry in third place.

Vanguard FTSE 250 ETF focuses on the mid-caps. These stocks have more exposure to the UK economy than the larger cap stocks and as such may be better positioned for the beginning stages of the recovery. We have selected three income-focused stocks in order to provide an element of protection combined with solid total returns (reinvested dividends) potential: SPDR S&P UK Dividend Aristocrats ETF, Vanguard FTSE UK Equity Income index fund, and the Legal & General All Stocks Gilt Index Trust mutual fund.

Property (iShares UK Property ETF), small caps (iShares MSCI UK Small Cap ETF), and commodities (WisdomTree Broad Commodities ETF) make up the rest of the selection. The commodities ETF is not strictly a UK-focused ETF but because of the preponderance of mining and energy stocks listed on the London Stock Exchange, we include it here.

Vanguard tracker funds

You will have noticed a couple of Vanguard tracker funds mentioned above and as you continue through this guide, which is because of their excellent product range. Its founder, John Bogle, virtually invented passive investing and tracker fund.

Although some of the picks overlap – as you can see by some of the 5 holdings shown in the tables below – it, therefore, wouldn’t make sense to hold more than one of the overlapping funds. However, generally, taken as a whole our 10 tracker funds for the UK market selection is intended to provide a starting point for building a balanced portfolio.

Also, a fully balanced portfolio in addition to having a mix of asset classes needs to take a regional view, which means looking beyond the UK to other markets.

1. Fidelity Index UK Fund

- Index: FTSE All-Share index

- Ongoing charge: 0.06%

- Minimum initial investment: £500; additional £250

- ISA: Yes

holdings

| Holding | Weightings |

| Unilever | 5.06% |

| AstraZeneca | 4.35% |

| HSBC Holdings | 3.49% |

| GlaxoSmithKline | 3.01% |

| Diageo | 3.00% |

2. iShares Core FTSE 100 UCITS ETF (ISF)

- Index: FTSE 100 index

- Ongoing charge: 0.07%

- Minimum initial investment: £500; additional £250

- ISA: No

five holdings

| Holding | Weightings |

| Unilever PLC | 14.55% |

| AstraZeneca PLC | 5.44% |

| HSBC Holdings PLC | 4.63% |

| Diageo PLC | 3.97% |

| Rio Tinto PLC | 3.67% |

3. UBS MSCI United Kingdom IMI Socially Responsible UCITS ETF (UKSR)

- Index: FTSE 250 Index

- Ongoing charge: 0.10%

- Fund size: £2.6 billion

- ISA: No

five holdings

| Holding | Weightings |

| Unilever | 1.31% |

| Vodafone Group | 1.10% |

| RELX | 1.09% |

| Prudential | 1.07% |

| Reckitt Benckiser Group | 1.05% |

4. Vanguard FTSE 250 UCITS ETF (VMID)

- Index: FTSE 250 index

- Ongoing charge: 0.10%

- Fund size: £2.6 billion

- ISA: No

five holdings

| Holding | Weightings |

| Weir Group | 1.31% |

| F&C Investment Trust Ord | 1.10% |

| Direct Line Insurance Group | 1.09% |

| G4S | 1.07% |

| ITV | 1.05% |

5. SPDR S&P UK Dividend Aristocrats UCITS ETF

Index: S&P UK High Yield Dividend Aristocrats Index

Ongoing charge: 0.30%

Fund size: £95 million

ISA: No

five holdings

| Holding | Weightings |

| Jupiter Fund Management | 5.35% |

| Legal & General Group | 4.87% |

| Phoenix Group Holdings | 4.72% |

| Morrison (Wm) Supermarkets | 4.69% |

| Tate & Lyle | 4.65% |

6. Vanguard FTSE UK Equity Income Index Fund

Index: FTSE UK Equity Income Index

Ongoing charge: 0.14%

Minimum initial investment: £100

ISA: Yes

five holdings

| Holding | Weightings |

| Anglo American | 5.64% |

| BHP Group | 5.13% |

| Rio Tinto | 5.08% |

| Vodafone Group | 4.96% |

| Tesco | 4.74% |

7. iShares UK Property UCITS ETF (IUKP)

Index: FTSE EPRA/NAREIT UK Index

Ongoing charge: 0.40%

Fund size: £653 million

ISA: No

five holdings

| Holding | Weightings |

| Segro | 20.41% |

| Land Securities Group | 7.76% |

| British Land Co | 7.62% |

| Derwent London | 5.66% |

| Tritax Big Box REIT | 5.60% |

8. iShares MSCI UK Small Cap ETF (CUKS)

- Index: MSCI UK Small Cap

- Ongoing charge: 0.58%

- Fund size: £304 million

- ISA: No

five holdings

| Holding | Weightings |

| Intermediate Capital Group | 1.44% |

| Rightmove | 1.43% |

| Smith (DS | 1.41% |

| Weir Group | 1.39% |

| B&M European Value Retail SA | 1.35% |

9. Legal & General All Stocks Gilt Index Trust Class C Inc

- Index: FTSE Actuaries British Government All Stocks Index

- Ongoing charge: 0.10%

- Minimum initial investment: £100

- ISA: Yes

five holdings

| Holding | Weightings |

| UK 4.5% | 2.44% |

| UK 1.62% | 2.31% |

| UK 0.88 | 2.30% |

| UK 3.5% | 2.27% |

| UK 1.5% | 2.24% |

10. WisdomTree Broad Commodities (GBP) ETF

- Index: Bloomberg Commodity Index

- Net expense ratio: 0.54%

- Fund size: £65 million

- ISA: No

five holdings

| Holding | Weightings |

| TRS Bloomberg Commodity TR USD | 100.00% |

Tracker Funds Reviewed

1. Xtrackers MSCI China UCITS ETF (XCX6)

This ETF tracks the performance of the 710 large and medium-sized companies that make up the MSCI China Index, which covers around 85% of the offshore China stocks universe. The ETF fully replicates the index and the 10 holdings account for 47% of the assets. Given the structure of the Chinese equity market, the fund exhibits a certain degree of sector concentration – Consumer Cyclical 33.90%, Communication Services 21.55% and has a fair slug of Financial Services at 12.95%.

- Index: MSCI China TRN Index

- Ongoing charge: 0.65%

- Fund size: £1.67 billion

- ISA: No

10 holdings

| Holding | Weightings |

| Tencent Holdings Ltd | 15.70% |

| Alibaba Group Holding Ltd | 14.94% |

| Meituan | 5.13% |

| JD.Com Inc | 2.38% |

| NIO Inc | 2.27% |

| China Construction Bank Corp Class H | 2.27% |

| Ping An Insurance (Group) Co. of China Ltd Class H | 2.18% |

| Baidu Inc | 1.99% |

| Pinduoduo Inc | 1.96% |

| Xiaomi Corp Ordinary Shares – Class B | 1.68% |

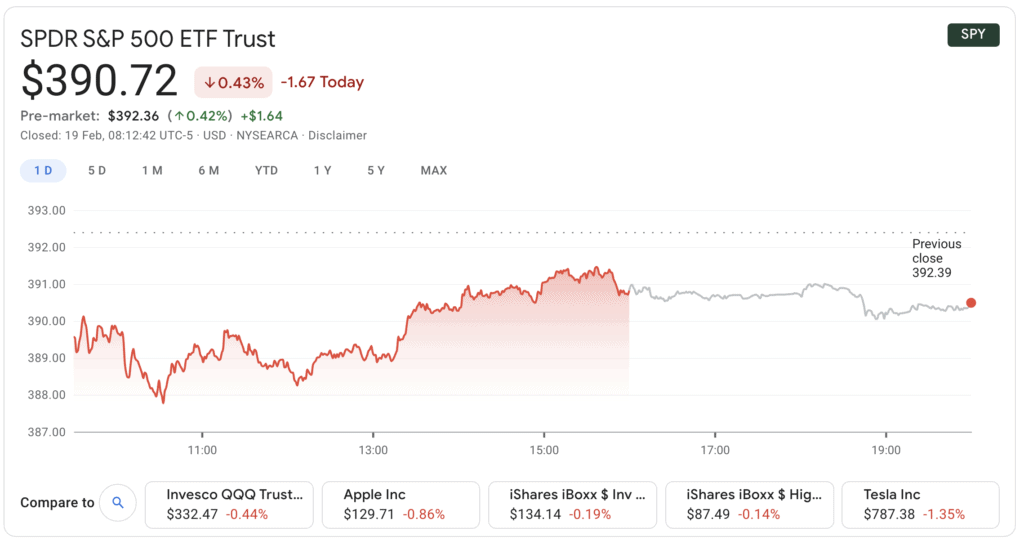

2. SPDR S&P 500 ETF Trust

This fund mirrors the performance of the S&P 500. It has a market cap of $352 billion, making it. the largest ETF in existence. The US stock market is the largest in the world and also lists major tech growth stocks, with an average annualised return of 10%. The dividend yield is 1.4%

- Index: S&P 500 stock market Index

- Net expense ratio: 0.0945%

- Fund size: $352 billion

- ISA: No

10 holdings

| Holding | Weightings |

| Apple Inc | 6.68% |

| Microsoft Corp | 5.29% |

| Amazon.com Inc | 4.37% |

| Facebook Inc A | 2.07% |

| Tesla Inc | 1.68% |

| Alphabet Inc Class A | 1.66% |

| Alphabet Inc Class C | 1.60% |

| Berkshire Hathaway Inc Class B | 1.42% |

| Johnson & Johnson | 1.30% |

| JPMorgan Chase & Co | 1.22% |

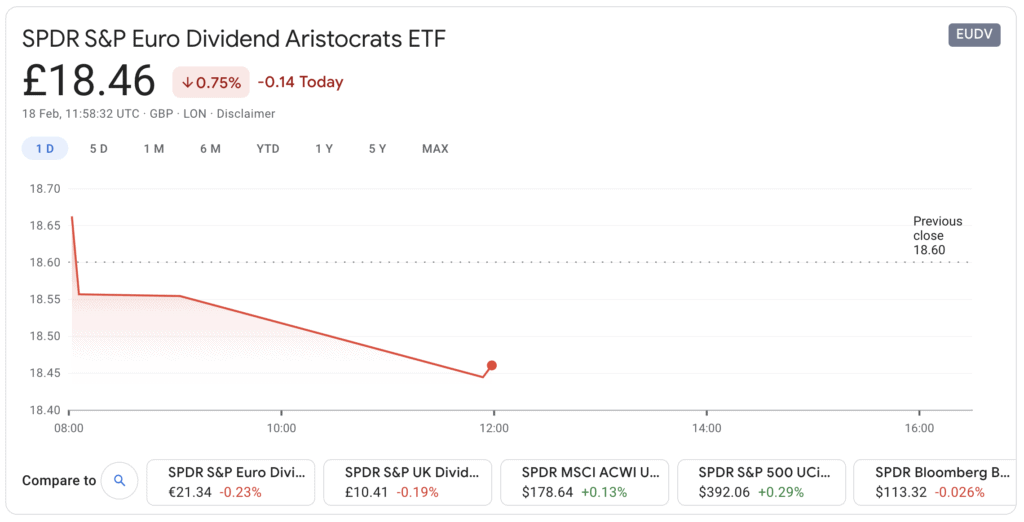

3. SPDR S&P Euro Dividend Aristocrats ETF

This income-focused ETF is designed to track the performance of the 40 eurozone companies in the S&P Europe Broad Market index with the highest dividends that have increased or held their dividends for at least 10 consecutive years. The 10 holdings represent 40% of the portfolio’s total assets. Dividends are paid half-yearly and the current yield is 3.2%. The fund’s ongoing charges are 0.3%. It invests heavily in blue chip large caps from across the continent, with Allianz, Total, and Siemens among its 10 holdings. On a sector basis, it is 20% invested in utilities, 15% basic materials, and 14% in industrials, giving this income-focused ETF a strong cyclical bent.

- Index: S&P Euro High Yield Dividend Aristocrats Index

- Net expense ratio: 0.30%

- Fund size: £1.09 billion

- ISA: No

10 holdings

| Holding | Weightings |

| Fortum Oyj | 5.27% |

| Allianz SE | 4.65% |

| UPM-Kymmene Oyj | 4.64% |

| Total SE | 4.55% |

| EDP – Energias de Portugal SA | 4.44% |

| Bayer AG | — |

| Deutsche Post AG | 4.27% |

| Siemens AG | 4.05% |

| Munchener Ruckversicherungs-Gesellschaft AG | 3.98% |

| EXOR NV | 3.87% |

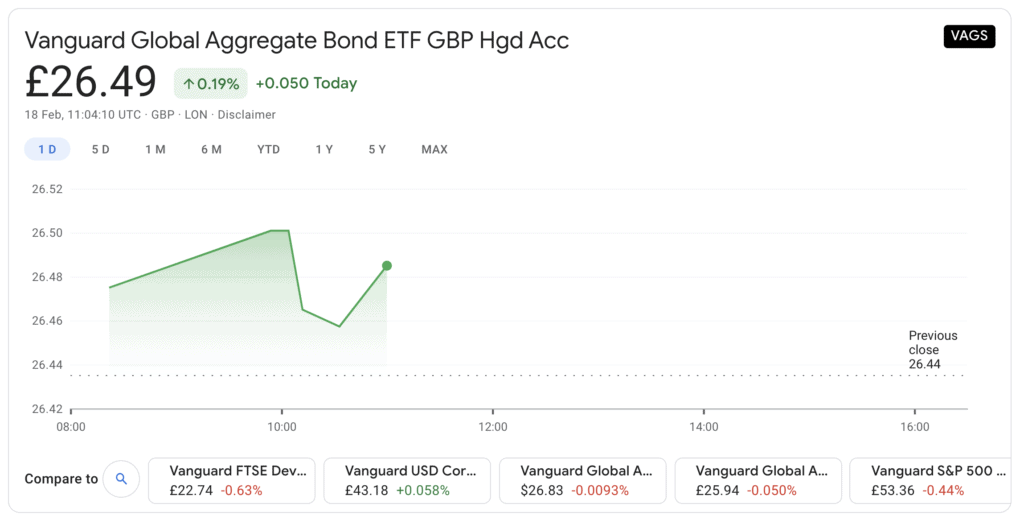

4. Vanguard Global Aggregate Bond Index GBP Hedged

This fund physically invests in investment-grade bonds included in the Bloomberg Barclays Global Aggregate Float Adjusted and Scaled index, hedged back to sterling, so currency risk is removed. Most holdings are government bonds. The income share class pays a quarterly dividend and the current yield is 1.86%. Ongoing charges 0.15%.

- Index: Bloomberg Barclays Global Aggregate Float Adjusted and Scaled Index in GBP

- Net expense ratio: 0.10%

- Fund size: £60 million

- ISA: No

10 holdings

| Holding | Weightings |

| Fannie Mae Or Freddie Mac | 0.94% |

| United States Treasury Notes 0.12% | 0.86% |

| United States Treasury Notes 0.38% | 0.84% |

| Federal National Mortgage Association 3% | 0.66% |

| Federal National Mortgage Association 3.5% | 0.60% |

| Federal National Mortgage Association 2.5% | 0.59% |

| Federal National Mortgage Association 4% | 0.45% |

| United States Treasury Notes 0.62% | 0.37% |

| Italy (Republic Of) | 0.37% |

| United States Treasury Notes 0.25% | 0.35% |

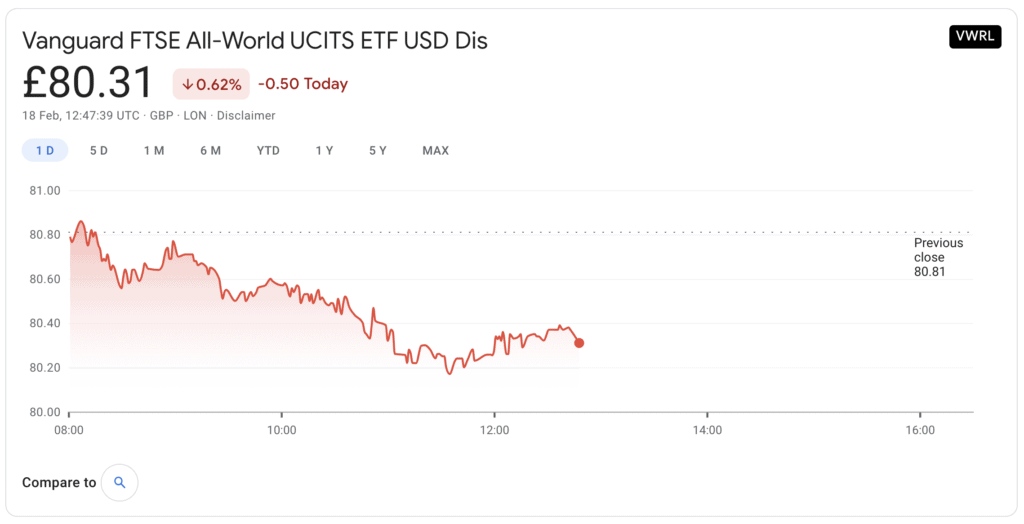

5. Vanguard FTSE All World UCITS ETF

This is one of a number of Vanguard tracker funds we have picked. Vanguard FTSE All World ETF tracks the performance of the FTSE All-World index, which includes more than 3,514 holdings spanning more than 45 countries, including both developed and emerging markets. The ETF invests physically (buys the actual asset and not a derivative) in these securities in as far as possible and the 10 holdings (seven of them US companies) account for around 15% of assets. Dividends are paid quarterly and the current yield is 1.47% (31 January 2021). Ongoing charges 0.22%.

- Index: FTSE All World Index

- Ongoing charge: 0.22%

- Fund size: £6.4 billion

- ISA: No

10 holdings

| Holding | Weightings |

| Apple Inc | 3.62% |

| Microsoft Corp | 2.95% |

| Amazon.com Inc | 2.31% |

| Facebook Inc | 1.05% |

| Tesla Inc | 1.02% |

| Alphabet Inc (Google L class) | 0.96% |

| Alphabet Inc (Google C class) | 0.87% |

| Taiwan Semiconductor Manufacturing Co Ltd | 0.86% |

| Tencent Holdings Ltd | 0.85% |

| Alibaba Group Holding Ltd | 0.76% |

6. Vanguard LifeStrategy 60% Equity UCITS (EUR) ETF

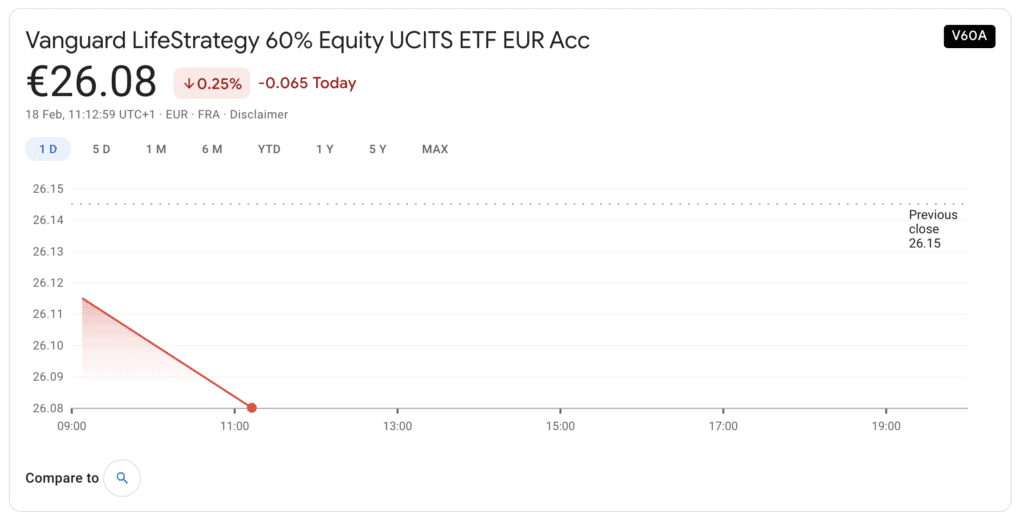

This ETF provides 60% exposure to global equities and 40% exposure to global bonds via several index-tracking funds that are managed by Vanguard so in that respect it a fund of funds product. It could be said to have an element of active management in that the proportions of each fund invested in may vary from time to time, but ultimately it is a sophisticated tracker. The bond content has 13% of assets in the UK and the remainder spread across the US, Europe, and Japan. Equity exposure is mainly via the US, at 27%, and the UK, at 15%. Ongoing charges are 0.22%. The chart below shows the ETF version but there is also an index fund version, which can be purchased directly from Vanguard (the index fund chart is not available on Google Finance).

- Index: Invests in other Vanguard passive funds

- Net expense ratio: 0.22%

- Fund size £12.2 million (index fund £9.6 billion)

- ISA: Yes (index fund version), but not the ETF

10 holdings

| Holding | Weightings |

| Vanguard FTSE All-World UCITS ETF | 19.34% |

| Vanguard FTSE Developed World UCITS ETF USD Distributing | 19.32% |

| Vanguard Global Aggregate Bond UCITS ETF EUR Hedged Income | 19.14% |

| Vanguard FTSE North America UCITS ETF | 11.14% |

| Vanguard EUR Eurozone Government Bond UCITS ETF | 6.13% |

| Vanguard USD Trs Bd ETF EUR H Acc | 6.00% |

| Vanguard USD Corp Bd ETF EUR H Acc | 5.46% |

| Vanguard FTSE Emerging Markets UCITS ETF USD Distributing | 4.75% |

| Vanguard FTSE Developed Europe UCITS ETF | 3.28% |

| Vanguard EUR Corporate Bond UCITS ETF | 2.05% |

7. iShares Global Clean Energy ETF

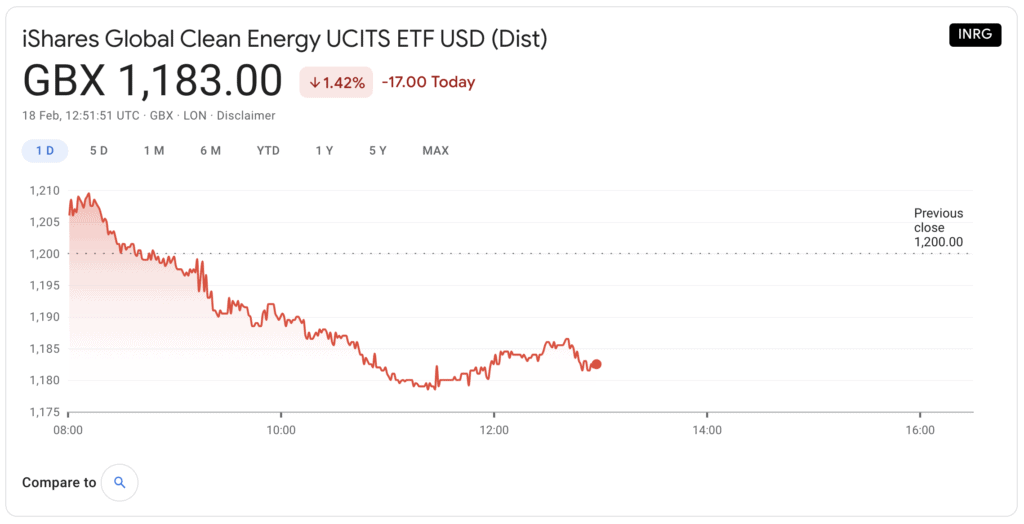

This ETF, rated on Interactive Investor’s ACE 30, seeks to track the S&P Global Clean Energy index, which gives exposure to firms that produce energy from solar, wind, and other renewable sources. It is a highly concentrated fund with the 10 holdings accounting for 51% of total holdings. Altogether there are 30 constituents and the fund is most exposed to the US, China, and New Zealand. Ongoing charges 0.46%.

- Index: S&P Global Clean Energy Index

- Ongoing charge: 0.65%

- Fund size: £4.75 billion

- ISA: No

10 holdings

| Holding | Weightings |

| Plug Power Inc | 10.70% |

| Enphase Energy Inc | 5.62% |

| Daqo New Energy Corp | 5.31% |

| Verbund AG | 4.78% |

| Ormat Technologies Inc | 4.56% |

| Xinyi Solar Holdings Ltd | 4.52% |

| Siemens Gamesa Renewable Energy SA | 4.24% |

| Meridian Energy Ltd | 3.90% |

| First Solar Inc | 3.86% |

| Vestas Wind Systems A/S | 3.73% |

8. UBS MSCI United Kingdom IMI Socially Responsible UCITS ETF (UKSR)

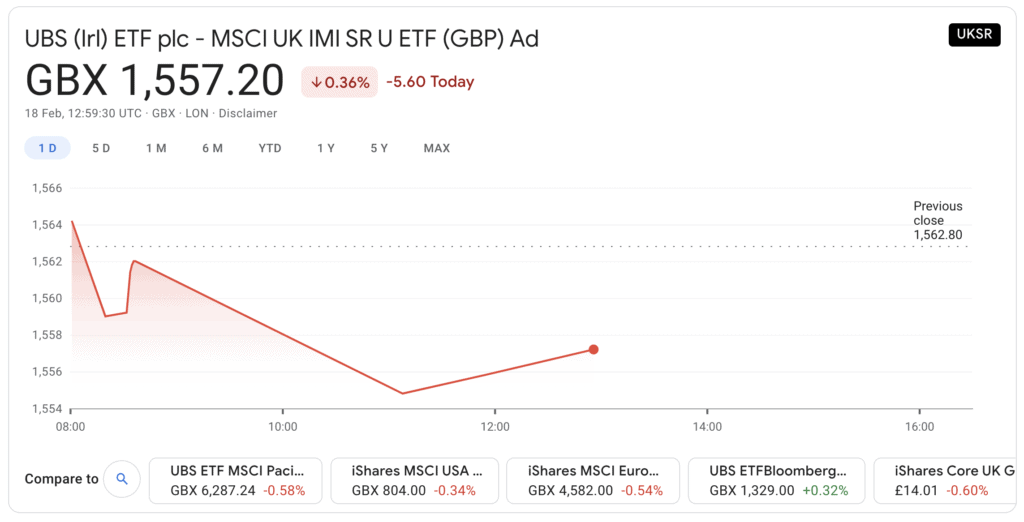

The ETF has outperformed the Large Cap Equity Morningstar category over one, three, and five years, although performance over the past six months has lagged the category average. It has dropped from the first quartile over the longer time periods to the fourth over six and three months. However, with nearly 25% invested in financials and 18.7% in consumer defensives, this fund is relatively safe as well as ticking the SRI boxes. Also, its risk is further moderated by a 3-year standard deviation of 16.3% compared to 20% for the category as a whole, placing towards the lower-risk end of the category spectrum.

- Index: MSCI UK IMI Extended SRI Low Carbon Select 5% Issuer Capped Index

- Ongoing charge: 0.28%

- Fund size: £547 million

- ISA: No

10 holdings

| Holding | Weightings |

| Unilever | 8.95% |

| Vodafone Group | 4.69% |

| RELX | 4.62% |

| Prudential | 4.40% |

| Reckitt Benckiser Group | 4.26% |

| AstraZeneca | 4.08% |

| London Stock Exchange Group | 3.99% |

| Barclays | 3.32% |

| Ferguson | 2.62% |

| Legal & General Group | 2.03% |

9. Invesco EQQQ NASDAQ-100 UCITS (GBP Hedged) ETF

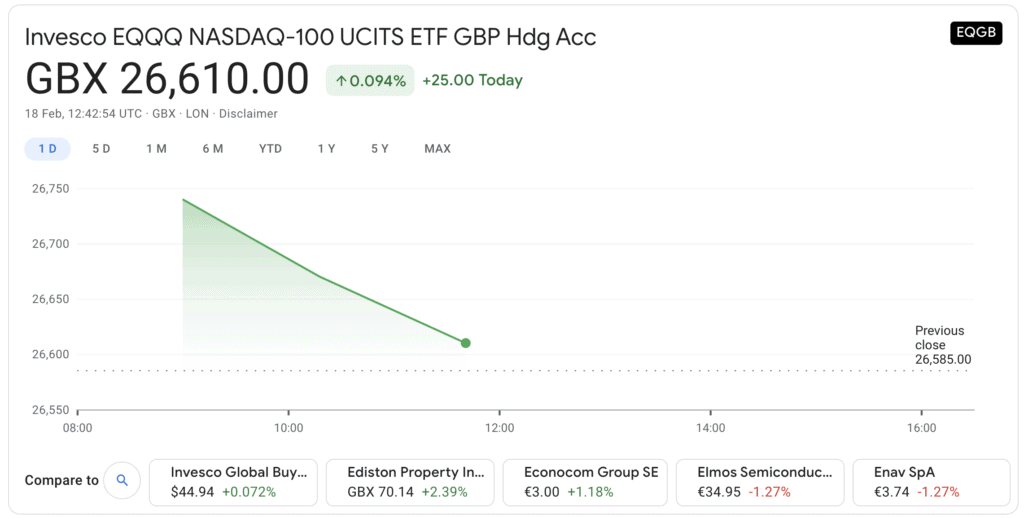

This is the hedged version of the wildly popular Powershares QQQ ETF. It physically invests in all 100 companies that are members of the technology-heavy NASDAQ 100 index. The 10 holdings account for 51.8% of assets. If dividend investing is your thing, then it’s worth noting that dividends are paid quarterly. The ETF is also hedged to control foreign exchange risk. As you would expect, the fund is overwhelmingly invested in the US, at 95.7%. Ongoing charges are 0.3%.

- Index: NASDAQ 100 index

- Ongoing charge: 0.35%

- Fund size: £3.99 billion

- ISA: No

10 holdings

| Holding | Weightings |

| Apple Inc | 11.68% |

| Microsoft Corp | 9.40% |

| Amazon.com Inc | 8.34% |

| Tesla Inc | 4.86% |

| Alphabet Inc | 3.52% |

| Facebook Inc | 3.30% |

| Alphabet Inc | 3.20% |

| NVIDIA Corp | 2.86% |

| PayPal Holdings Inc | 2.69% |

| Intel Corp | 1.95% |

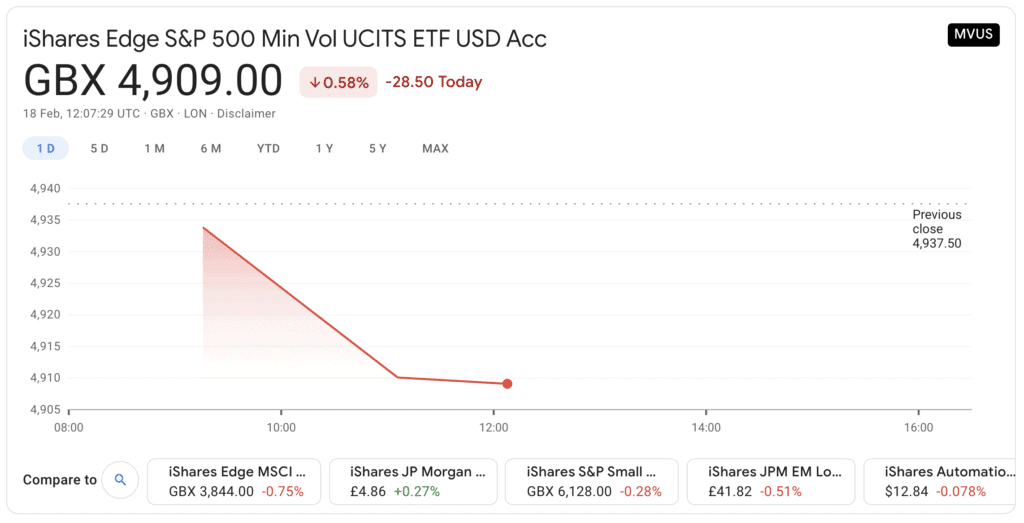

10. iShares Edge S&P 500 Minimum Volatility UCITS ETF

This ETF endeavours to track the performance of selected large US companies, with a factor element that targets those companies that have lower volatility characteristics than other shares in the S&P 500 index. It provides physical optimised exposure to 116 such companies, with the 10 accounting for 20% of assets. Dividend income is capitalised (reinvested) and ongoing charges are 0.2%. Morningstar gives the fund a low-risk rating.

- Index: S&P 500 Minimum Volatility Index

- Ongoing charge: 0.20%

- Fund size: £1.2 billion

- ISA: No

holdings

| Holding | Weightings |

| Microsoft Corp | 2.80% |

| Accenture PLC | 2.58% |

| Berkshire Hathaway Inc | 2.57% |

| Qualcomm Inc | 2.52% |

| Nike Inc | 2.51% |

| CVS Health Corp | 2.50% |

| Chubb Ltd | 2.50% |

| Adobe Inc | 2.46% |

| Texas Instruments Inc | 2.45% |

| Amazon.com Inc | 2.44% |

What Tracker Funds?

Tracker funds cover the full spectrum of the investable universe and have grown in popularity because of their easy access and low fees. Your choice of what tracker fund to choose and how many will depend largely on your risk tolerance and investment goals.

If you do not plan to be hands-on with your investments and don’t want to try and pick winning stocks and prefer to take less risk, then the passive investing approach exemplified by trackers provides plenty of options.

Additionally, if you want to beat an index, then trackers are not the right place to be looking. Instead, you should plump for an actively managed mutual fund or select individual stocks yourself that think are going to outperform the index. These days there are even a number of actively managed ETFs to choose from.

Below is a list of the asset classes in which tracker funds provide exposure:

- equities

- bonds

- commodities

- property

- thematic

- alternative

Types of Tracker Funds

Tracker funds come in two main types: ETFs and index funds. However, investors should bear in mind that ETFs can sometimes be the more expensive pick alongside mutual funds (all other index funds), especially if you plan to trade indices more often – this is because of the brokerage dealing charges involved for ETFs as against mutual funds.

Equities and bonds are the most popular areas in which to find trackers and the major stock indices in particular. But it is perfectly possible to build a balanced passive portfolio using just tracker funds.

Fundamentals of Tracker Funds?

ETFs and index funds are cheap ways to track an index. Warren Buffett that his wife puts their wealth into an S&P 500 tracker, where you’ll find US stocks, when he’s gone, as the way to safely grow your investments. With an endorsement like that, it would be foolish not to investigate further. Trackers are cheap and efficient ways to access a collection of securities all bundled into one product. This makes the tracker funds for achieving diversification and therefore a convenient way of managing risk. Tracker funds come in two main guises: ETFs and index funds. We look at the differences between them below to give you an idea of which are the tracker funds for your needs.

- ETFs trade in the same way as stocks, in that investors, can buy and sell shares throughout the day. Index funds trade once per day after the market closes.

- ETFs tend to have lower minimum investment levels than index funds.

- There is a broader spread of ETF availability than there is for index funds on the typical investment platform.

- ETFs can be traded using different execution methods (such as limit orders).

- Index funds tend to be easier to make repeat investments into than ETFs (including dividend reinvestment plans).

Tracker Funds Brokers

The UK has dozens of investment platforms and stock brokers to choose from. We have narrowed it down to two: Fineco Bank and Hargreaves Lansdown, which belief provide a fair representation of all the market have to offer.

1. Fineco Bank

This trusted provider is backed by an Italian investment bank – and is fully licensed by the FCA. FSCS protections are also in place, so the safety of your funds should not be a concern.

For us, Fineco Bank stands because of the sheer size of its asset library. Via ETFs, there are literally thousands of ETFs and index funds to choose from as well as model portfolios.

If you choose Fineco you can sign up for its regular saving plan in which you pay a monthly fee. The basic plan starts at £2.95 a month. For £19.85 a month you can make 12 trades which represents a considerable saving. But if you are looking for a platform that has a huge range of securities to choose from, then Fineco Bank may be for you. Aside from index funds and ETFs, there are options and futures markets, bonds and of course shares (£2.95 per trade), and CFDs.

Fineco charge 0.6 pips in the spread on FTSE 100 and NASDAQ CFDs.

Fineco is also strongly competitive on exchange rate fees, even beating Revolut:

|

£4.46 | £22.30 |

|

£4.99 | £44.93 |

You also need to factor in a 0.25% annual platform fee. On the flip side, the minimum investment is just £100 on Fineco Bank and you can easily transfer funds from your UK bank account.

Sponsored ad. Your money is at risk.

3. Hargreaves Lansdown

For example, the iShares Japan Equity Index fund normally comes with a fee of 0.51%. However, if you are a Hargreaves client you can buy the H class of the fund with a fee of just 0.08%, a considerable saving.

There are no dealing charges for index funds of the mutual fund type as opposed to ETFs. However, there is an annual charge for holding funds that varies depending on the value of your holdings:

| Value of funds |

From £0 – £250,000 |

Between £250,000 – £1m |

Between £1m – £2m |

Over £2m |

| Charge | 0.45% | 0.25% | 0.1% | No charge |

As with Fineco, there is a huge choice of ETFs and Exchange-traded commodities to choose from. The dealing charges, however, are among the most expensive in the industry at between £11.95 and £5.95 per trade. But Hargreaves is renowned for its customer support, well-designed website, educational, research, and portfolio management tools, including a phone app, in addition to a broad range of other services, which includes advice.

Unlike the other two brokers for tracker funds list, there’s the Hargreaves Lansdown stocks and shares ISA (Individual Savings Accounts) to bring into consideration – a tax-free wrapper for your savings with a government allowance of up to £20,000 a year.

Hargreaves’ clout in the industry also gives its customers access to some IPO subscriptions, which means you can buy into company issues before the shares start trading publicly on the exchange.

Tracker Funds – Conclusion

Tracker funds are convenient and powerful ways for investors to gain exposure to a basket of shares and other instruments. They are also cheap ways to buy a large portfolio of shares without the cost of trading each individual holding.

| Fee for ETF dealing | Share CFD Commission | Annual management charge | Deposit Fee | Withdrawal Fee | |

| Hargreaves Lansdown | £11.95 to £5.95 | N/A | Starts at 0.45% | None | None |

| Fineco | £2.95 | 0% | 0.25% | None | None |

FAQs

How do tracker funds work?

What’s the difference between a mutual fund tracker and an ETF?

What can a tracker fund track?

How much do tracker funds cost?

What companies issue tracker funds?