How to Buy Square Shares Online in the UK

Had you bought £500 worth of Square shares during its 2015 IPO – your investment would now be worth just under £10,000. For those unaware, this NYSE-listed tech stock is involved in the cutting-edge payment processing software. Its core divisions include Dessa, Weebly, and Stich Labs.

Although this fast-growing company is listed in the US, buying Square shares in the UK is a breeze. You simply need to open an account with a UK broker, deposit some funds, and decide how many stocks you wish to purchase.

In this guide, we’ll walk you through the process of how to buy Square shares online in the UK. Our walkthrough includes a discussion on the best UK brokers to do this with, alongside some factors to consider before making an investment.

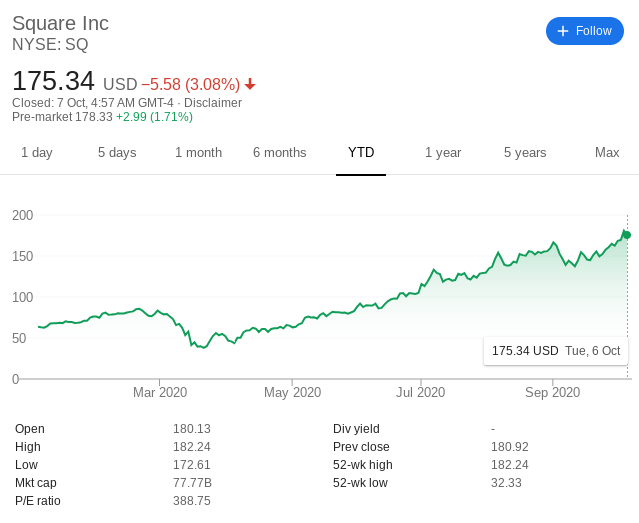

In order to buy Square shares online from the UK, you will need to find a broker that gives you access to the New York Stock Exchange. As the largest stock marketplaces in the world, it makes sense that there are heaps of providers for you to choose from. With that said, need to make considerations for a range of factors before joining a new broker – such as how much the platform charges in fees, what UK payment methods you can use, and whether or not customer support is sufficient. To help point you in the right direction, below you will find two top-rated FCA-licensed brokers that allow you to trade or buy Square shares online. If you are not a professional trader, then this comes with a cap of 1:5. In other words, you can place an order on Square stock CFDs with five times the amount you have in your account. What we also like about the CFD option at Plus500 is that you can choose from a buy or sell position. The former means that you think the price of Square stocks will increase, while the latter means the opposite. This gives you heaps of flexibility and ultimately – the ability to profit from both rising and falling markets. An additional reason why Plus500 makes the cut for us is that it charges no trading commissions on any of its financial instruments. Not only does this include stock CFDs like Square, but other asset classes such as indices, oil, gas, forex, and even digital currencies. On top of super-tight spreads, this ensures that you can access your chosen trading market in a cost-effective ecosystem. In terms of getting started, Plus500 is available online or via a native mobile app (iOS and Android). Opening an account takes just a few minutes and supported payment methods include debit/credit cards, Paypal, and a UK bank transfer. The minimum amount that you can deposit to get started is just £100. There are no fees to get money into or out of Plus500, albeit, a 0.5% FX fee does apply when accessing non-GBP markets. Finally, Plus500UK Ltd is authorised & regulated by the FCA (#509909). Pros: Cons: 72% of retail investors lose money trading CFDs at this site Once you have decided which UK share dealing account provider you wish to go with, you’re likely ready to buy some Square shares. However, we would strongly suggest performing some in-depth research on the company before proceeding. After all, the stock is still relatively new – with its IPO concluding as recently and 2015. With this in mind, below we outline some important data on Square. This includes some background information on its historical stock price action to date, and what factors you need to look out for before making an investment. Founded in 2009 by Twitter CEO Jack Dorset and Jim McKelvey – Square is US-based financial payment provider. In simple terms, the overarching aim of the company is to make the process of accepting debit and credit card payment easier for merchants. Not only does this include online stores, but bricks and mortar businesses, too. Unlike other options in the market, Square claims that its underlying infrastructure offers payment services in the most cost-effective and straightforward manner. For example, the Square Point-of-Sale division allows physical stores to accept and process payments via a smartphone application. This means that there is no requirement for shopkeepers to obtain bulky payment card machines. In terms of the fees that it charges, this works out at 2.6% of the total transaction value alongside a token payment of $0.10. This does, however, increase to 3.5% and $0.15 if the merchant is required to insert the payment details manually. As of Q2 2020 – the Square mobile app has reportedly been downloaded by over 33 million businesses – which is huge. It took just 6 years for the team at Square to take their pipedream from a privately owned company to a public stock. It’s IPO of November 2015 – which was facilitated by the New York Stock Exchange, initially priced the shares at $9 each. In turn, this valued the company at $2.9 billion. This is actually less than the $6 billion that Square valued the company at from previous funding rounds. Nevertheless, it took less than 3 hours of day-one trading for Square shares to reach $13.60 – an increase of more than 51%. Once again, this is why tech-related IPOs are highly sought after by investors – as there are countless examples of stocks amplifying in value in their first day of trading (as well as examples of the opposite happening). Since then, there simply has been no stopping the stocks – other than a short-term blip during the mass-market sell-off of March 2020 that impacted the vast majority of US shares. At the time of writing in October 2020, Square shares are priced at $175. This represents a 5-year increase of over 1,800%. In terms of valuation, this stands at just over $77 billion. Interestingly, one of its main competitors – Paypal, has a market capitalisation in the region of $225 billion – which is approximately three times that of Square. With that said, Square claims to offer a simpler and more cost-effective way of accepting and transferring money than Paypal, so the upside is still potentially lucrative. Although revenues are on the rise and crucially – the firm is generating operating profits, Square is yet to pay any dividends. This is likely to be the case for the foreseeable future, as the board are heavily focused on growth. This includes expansion not only into new global markets but products and services, too. All in all, Square should be considered as a growth stock – much like Tesla, Draftkings, and Nikola. If you’re looking to invest specifically in dividend stocks, you’ll need to focus on blue-chip firms with an established and proven business model. Whether or not you decide to buy Square shares will depend on your personal investment goals. For example, if you’re looking to invest in a company that is still at the very start of its corporate journey and thus – has significant upside potential, then Square is likely to suffice. Alongside this is, however, a much higher risk/reward ratio. After all, Square is still a young company that faces huge competition from entities that have much larger cash reserves at their disposal – notably, Paypal. On the other hand, Square won’t be for you if you are seeking a high-grade stock that that has a long-standing track record in their respective field. Taking all of the above into account, it’s crucial that you do some homework before you buy Square shares. To help you along the way, below we discuss some of the most important factors facing the company right now. We noted earlier how Square investors that backed the firm during its IPO are now 1,800% richer – which is great. However, we would argue that its most recent stock market performance is even more impressive. Why? Well, very few stocks are currently worth more than they were when the coronavirus saga came to fruition. On the contrary, most have failed to get back to pre-pandemic levels. Alongside other notable tech firms like Tesla and Amazon, Square does not sit within this category. Instead, Square’s continue to explode in 2020. For example, the shares began the year at $63 per stock. Fast forward to the first week of October and the same shares are worth $175. This puts the shares just below the all-time figure of $182 that it achieved in September. Ultimately, this highlights that not even a global pandemic can get in the way of Square’s stock market momentum. Any seasoned stock investor will tell you the importance of quarterly earnings reports. After all, this gives you a full bird-eyes overview of not only how the company has performed over the prior three months, but how these results compare to market expectations. In the case of Square and its Q2 2020 release, the results were very, very positive. Firstly, the firm reported sales of just over $1.92 billion for the quarter. This translates into a 64% leap in comparison to the prior 12 months. Square account deposits increased by 250% to $1.7 billion, and active users shot up to well over 33 million. The Square Cash App division, in particular, saw tremendous growth. For example, profits grew 168% in comparison to the previous year, and ‘stored funds’ grew by 86%. The latter refers to the percentage of deposits that remain in the Square Cash App, as opposed to being spent or transferred. All in all, its most recent earnings reported largely smashed through market expectations. In turn, this only amplified the firm’s 2020 upward trajectory. One of the most appealing aspects to Square as a growth stock is that it is continuously adding new products, services, and features to its portfolio. This goes far and beyond just merchant payment processing. For example, the firm has since entered the multi-billion dollar cryptocurrency exchange sector by allowing consumers to easily buy and sell Bitcoin through the app. Additionally, the app can now also be used to trade stocks at the click of a button. Then you have the newly launched short-term loan service, which allows Square users to borrow up to $200. This in itself could lead to a huge marketplace of its own – especially when you consider just how many users have the Square app installed on their smartphone. Interestingly, this is less than half of what Square is currently worth, albeit, it shows that Dorsey has a proven track record of taking a start-up to a multi-billion dollar stock market powerhouse. There has been no impact on the fact that Dorsey is CEO of both Twitter and Square concurrently – and we see no reason for this to change any time soon. Once you have had a chance to digest both the pros and cons of making an investment into Square, the next step is to open an account with your chosen share dealing site. Depending on the broker you opt for, the process shouldn’t take you more than 5 minutes. With that said, getting started with an online trading account can be an intimidating process if you have never done it before. So, to get the ball rolling head over to the broker website and look out for the ‘Join Now’ logo. Initially, you’ll be asked for your full name, email address, and to choose a username and password. Upon clicking on ‘Create Account’, you’ll be taken to the next stage of the application. This is where you’ll need to provide your home address, date of birth, national insurance number, and mobile phone number. Next, the broker will ask you to upload a copy of your government-issued ID (passport or driver’s license). Additionally, the broker needs a copy of a recently issued bank account statement or utility bill. This is to ensure that the broker complies with anti-money laundering regulations. Note: If you do not plan on depositing more than $2,250 – you can upload the above documents at a later date. Finally, you will need to make a deposit. Ensuring that you meet a $200 minimum, you can choose from a debit/credit card, e-wallet, or bank account transfer. As soon as you have opened an account and made a deposit, you can proceed to buy Square shares. All you need to do is enter ‘Square’ into the search box at the top of the page, and click on the first result that pops up (like the below). Then, click on the ‘Trade’ button. In doing so, you will see an order box load up. Here, you simply need to enter the amount that you wish to invest. You don’t need to buy a full share, as the broker allows you to invest from just $50. To complete the investment process, click on the ‘Open Trade’ button. Note: If you buy Square shares outside of standard NYSE trading hours, the order will be processed when the markets reopen. If this is the case, the confirmation will read as ‘Set Order’ as opposed to ‘Open Trade’. It’s difficult to get away from the upside potential associated with this stock. Sure, you’ve certainly missed the opportunity to purchase the stock at sub-$10 – but that isn’t to say that Square shares are anywhere near their ceiling point. On the contrary, the firm is still growing at a rapid pace, with new markets, products, and services being introduced on a regular basis. With that said, you should never purchase shares on the back of somebody else’s viewpoints. Instead, the decision needs to be based on independent research carried out by you. In summary, Square is certainly one of the hottest stocks of 2020. While much of the market has been negatively impacted by the pandemic – it’s been up, up and away for Square. If you plan to jump on the bandwagon with this growing company, the broker allows you to buy Square shares commission-free. It takes minutes to set up an account and deposit funds, and the platform is regulated by the FCA. Simply click the link below to get started!

Square is a financial payment provider that allows merchants to accept debit/credit card payments via its mobile app. The FinTech firm has since moved into heaps of other ventures - such as Bitcoin exchange services and even short-term loans.

Since its IPO in 2015, Square shares are listed on the New York Stock Exchange.

When the company went public in 2015, you would have paid just $9 for a single Square share. Fast forward to October 2020 and the very same shares will cost you $175.

Think that Square is heavily overvalued, or that its stock price is growing just a little bit too fast? If so, you can easily short-sell its stock by opening an account with an online trading platform that supports CFDs.

You'll need to open an account with a brokerage platform that gives you access to the New York Stock Exchange. Then, you simply need to deposit some funds and decide how many shares you wish to buy. Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers. WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy. Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

Step 1: Find a UK Stock Broker

1. Plus500 – Commission-Free Platform for Trading Square Stock CFDs

Step 2: Research Square Shares

What is Square?

Square Share Price History

Square Shares Dividend Information

Should I Buy Square Shares?

One of the Best Performing Stocks of 2020

Fantastic Q2 2020 Earnings

Product Range Continues to Grow

Solid Leadership

Step 3: Open an Account and Deposit Funds

Step 4: Trade or Buy Square Shares

Square Shares Buy or Sell?

The Verdict?

FAQs

What does Square do?

What stock exchange is Square shares listed on?

How much were Square shares originally worth ?

Can you short Square shares?

How do you buy shares in Square?

Kane Pepi