Best Defi Coins to Buy in 2025

First we had cryptocurrencies, then came along non-fungible tokens (NFTs), and now we have DeFi coins. Many commentators believe that the latter will be the next big thing in the blockchain arena – with DeFi coins paving the way for decentralized financial, banking, insurance, trading, and more.

In this guide, we review the best Defi coins for 2022. We also walk you through the process of how to buy DeFi coins online with a commission-free broker.

Best Defi Coins to Buy Right Now

Here’s a breakdown of the 10 best DeFi coins to invest in right now.

- Battle Infinity- Overall Best DeFi Coin To Invest In 2025– Trade Now

- Tamadoge– Best Coin In The Doge Eco-system In 2025– Trade Now

- Lucky Block – Gambling Crypto Platform With Fantastic Potential for Growth – Trade Now

- Uniswap – Exciting DeFi Coin with Great Potential – Trade Now

- AAVE – Decentralized Lending and Investing via a P2P Model – Trade Now

- Chainlink – Market Leader in Smart Contract Oracles

- Yearn.Finance – DeFi Coin Project That Permits Interest-Bearing

- SushiSwap – Decentralized Cryptocurrency Marketplace for Buyers and Sellers

- Orion Protocol – Decentralized Exchange Incorporating Centralized Order Books

- Maker – Governance DeFi Project for DAI Stablecoin

- Compound – DeFi Lending Platform That is Backed by cTokens

- PancakeSwap – Exchange BEP20 in a Decentralized Setting

Best Defi Coins to Invest in

Although the Defi coin phenomenon is still in its infancy – there are already more than 300+ projects in existence. For example you could buy ApeCoin. As such, knowing which Defi crypto coins to buy can be a daunting task.

To help clear the mist, here we review the best Defi coins to consider buying in 2022.

1. Battle Infinity- Overall Best DeFi Coin To Invest In 2025

The Battle Infinity NFT game platform’s native token, IBAT, comes out on top in our rating. Battle Infinity, a brand- new gaming platform, intends to provide gamers with an immersive metaverse experience through multiplayer sports games based on NFTs.

new gaming platform, intends to provide gamers with an immersive metaverse experience through multiplayer sports games based on NFTs.

In the Battle Infinity universe, the IBAT token is used to pay for games, players, and in-game products. Additionally, users will soon be able to stake IBAT tokens on the Battle Swap platform in exchange for rewards. IBAT is based on the BEP20 protocol and was created using the Binance Smart Chain.

There will be a total of 10 billion IBAT tokens available; the presale event will release 28% of this total.

The Battle Swap exchange, a completely decentralised platform within the Battle Infinity eco-system, allows you to buy the token directly.

One of Battle Infinity’s main products in the IBAT Premier League. In the IBAT Premier League, participants form teams and play in a virtual sporting events for prizes. The platform also offers a variety of multiplayer games where users can win tokens in addition to the competition.

The presale event is now over and the token will be listed on PancakeSwap on the 17th of August 2022.

| Min Investment | 0.1 BNB |

| Max Investment | 500 BNB |

| Chain | Binance Smart Chain |

| Presale Start Date | 11th July 2022 |

| Exchange listing | 17th August 2022 |

Your money is at risk.

2. Tamadoge- Best Coin In The Doge Eco-system In 2025

The Tamaverse is the most recent addition to the well-known doge eco-system, and it uses TAMADOGE as its primary form of payment. Users can take care of their dogs, buy virtual goods in the Tamaverse, and engage in combat to win doge points with TAMADOGE.

Through the Tamaverse game, doge enthusiasts can connect with their NFTs in the metaverse. An augmented reality programme that will revolutionise how doge owners can communicate with their NFT dogs is one of the upcoming products from the Tamaverse project.

TAMADOGE is a token that is deflationary. 10% of the coins are burned each time a customer makes a purchase at the Tamadoge store. Over time, this will exert upward pressure on the coin’s price, raising its worth. Furthermore, there are only 2 billion TAMADOGE in existence.

1 billion of these tokens will be made available for purchase during the presale, 400 million will be set aside for exchanges, and the remaining 600 million will be rolled out over the following few years.

After other Doge coins have already experienced phenomenal market growth, TAMADOGE is poised to thrive. Players will be interested in this new coin because it provides entry to the Tamaverse. TAMADOGE is currently available for purchase during the public presale.

Your money is at risk.

3. Lucky Block – Gambling Crypto Platform With Fantastic Potential for Growth

Our number one pick right now when it comes to DeFi coins is Lucky Block. Investors have been eager to buy Lucky Block since it burst onto the scene in January 2021, as the platform looks to leverage blockchain technology to offer a streamlined crypto-lottery experience. Since the Lucky Block platform is built on the Binance Smart Chain, Lucky Block offers consistent daily lotto draws – with greater odds of winning for each participant.

According to the Lucky Block whitepaper, lotto draws will take place through the Lucky Block app, which will be released in March 2022. The Lucky Block ecosystem runs using LBLOCK – the platform’s native token. Aside from being used to buy lotto tickets and distribute prizes to winners, LBLOCK is also used to facilitate dividend payments. A total of 10% of each lotto prize pool is redistributed back to LBLOCK holders as a reward – providing an avenue to generate a passive income stream.

After the LBLOCK pre-sale sold out in January 2021, the token was listed on PancakeSwap early, thanks to exceptional investor demand. After taking a slight dip post-listing, LBLOCK’s price surged an incredible 1200%, reaching an all-time high of $0.0096 on February 17th. Looking ahead, with Lucky Block’s devs setting their sights on a Binance listing and the Lucky Block Telegram group reaching nearly 40,000 members, the future certainly looks bright for this exciting DeFi coin.

If you’re looking to buy Lucky Block today, you can do so by following the four quick steps below:

- Step 1 – Set Up a Crypto Wallet: Set up a crypto wallet that supports BSC tokens, such as MetaMask or the Binance Trust Wallet.

- Step 2 – Purchase BNB: Buy some Binance Coin (BNB) from a reputable broker or exchange.

- Step 3 – Link Wallet to PancakeSwap: Head to the PancakeSwap homepage, click ‘Connect Wallet’, and follow the instructions to link your wallet to the exchange.

- Step 4 – Buy LBLOCK: Head to the LBLOCK page on Pancakeswap. On the token’s listing page, click ‘Trade’, enter the amount of BNB you’d like to exchange for LBLOCK, and confirm the trade.

Cryptocurrency markets are highly volatile and your investments are at risk.

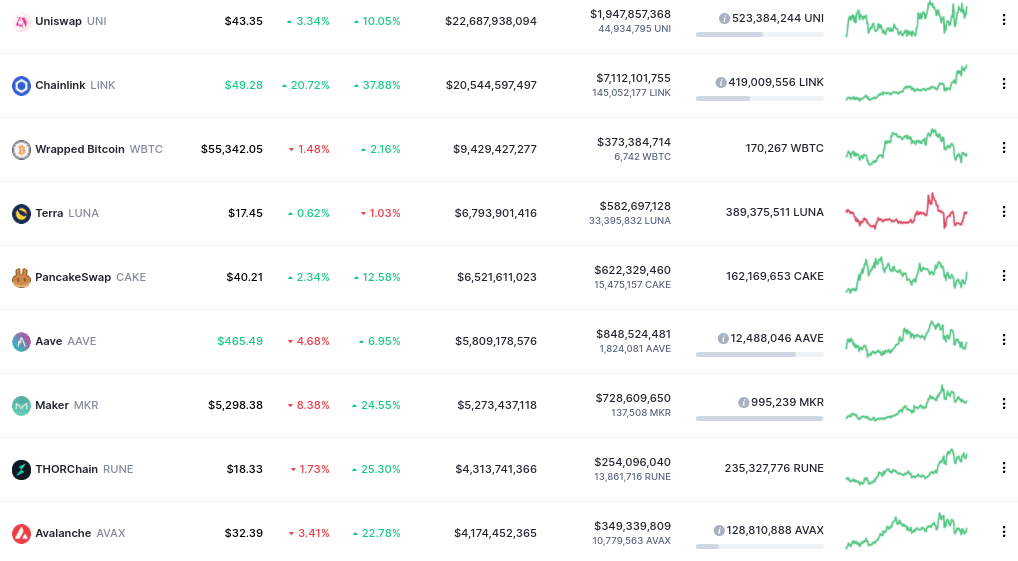

4. Uniswap – Exciting DeFi Coin with Great Potential

You’ll probably want to to look in to how to buy uniswap as it is arguably one of the best DeFi coins in the market right now. This is supported by the project’s huge market capitalization – which has since surpassed $7.2 billion. In fact, at the time of writing, Uniswap is a top-25 digital currency in terms of valuation. For those unaware, Uniswap is both a decentralized exchange and a digital token.

Regarding the former, the Uniswap platform allows you to exchange one digital currency for another without needing to go through a third party. This is decentralized finance in its truest form. The Uniswap token – which is traded as UNI, is the exchange’s native token.

By holding UNI tokens, you will benefit from reduced exchange commissions and increased voting rights within the Uniswap ecosystem. In terms of performance, Uniswap has grown by a considerable amount since the token was launched in late 2020. Going from an initial price of around $0.50 to May 2021’s highs of $43 – that was a rapid increase of over 11,000%!

5. AAVE – Decentralized Lending and Investing via a P2P Model

Aave is a top-rated decentralized finance project that is specifically involved in lending. That is to say, the platform operates on a peer-to-peer style loan website, whereby investors will lend out their capital to borrowers without going through a third-party. In turn, lenders will earn interest on the funds they loan.

Those holding Aave tokens will also benefit from other core perks, such as the reduced APR rates when borrowing funds and the ability to join the staking program. In terms of performance, Aave was trading at $52 in October 2020. Fast forward to February and the same DeFi coin is trading at $146.40 – although it did reach all-time highs of $666 in May 2021!

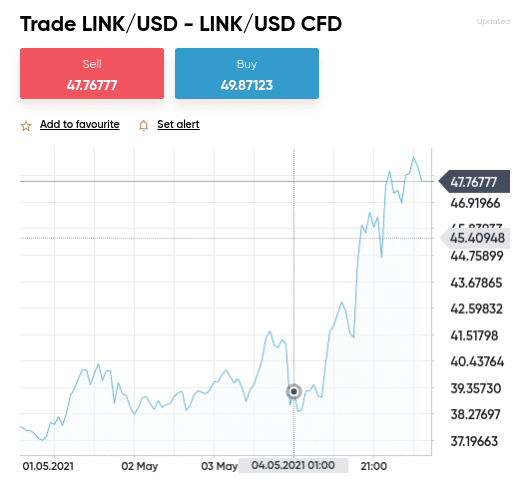

6. Chainlink – Market Leader in Smart Contract Oracles

Chainlink is one of the most established DeFi crypto coins in this marketplace – which is remarkable when you consider the project was founded as recently as September 2017. The project forms the crucial gap between smart contracts of real-world data via its oracle network.

For example, let’s say that a smart contract is responsible for governing a flight insurance agreement. Without an oracle fetching flight departure and arrival times from thousands of independent sources – the smart contract would not know whether or not to execute the insurance payment.

This is where Chainlink and its industry-leading oracle protocol dominates. In terms of its DeFi coin – LINK, this has outperformed the wider cryptocurrency market by some distance. In fact, you would have paid just $0.18 back in late 2017. At the time of writing in February 2022, LINK is trading at $15.22. That’s an increase of over 8350% in four years – although LINK was even higher before its downfall in May 2021.

7. Yearn.Finance – Defi Coin Project That Permits Interest-Bearing

Yearn.Finance is another decentralized project that was launched as recently as 2020. In a similar nature to Aave, Yearn.Finance allows you to increase the value of your digital token holdings by earning interest. Naturally, this takes place through a P2P lending system.

The project’s DeFi coin – which is traded as YFI – is one of the most expensive tokens in terms of monetary value. At the time of writing, one YFI token will set you back by $19,483. However, this is because there is a very limited supply of tokens in circulation – which sits at just over 36,600.

8. SushiSwap – Decentralized Cryptocurrency Marketplace for Buyers and Sellers

SushiSwap is a growing decentralized marketplace that aims to match buyers and sellers across a number of core services. This includes a swapping service, whereby users can exchange one digital currency for another without needing a centralized actor. There is also the ability to earn a competitive yield by proving liquidity for the SushiSwap exchange.

In order to remain decentralized, SushiSwap utilizes an order book system called automated market-making – or AMM. In its most basic form, this matches buyers and sellers and ensures the respective market has sufficient liquidity via smart contract technology. Since its launch in late 2020 – SushiSwap has gone from lows of $0.99 to highs of $23.35 – although price has dipped down to $3.50 at the time of writing in February 2022, providing scope to buy the coin at a discount.

9. Orion Protocol – Decentralized Exchange Incorporating Centralized Order Books

In a similar nature to Uniswap, Orion Protocol is an online exchange that allows you to trade digital currencies from the comfort of your home. Although Orion Protocol is a decentralized project, the platform has the ability to incorporate centralized order books into its exchange.

In simple terms, this will ensure that users of the Orion Protocol benefit from significant levels of liquidity. After all, although the decentralized exchange arena will continue to grow organically over the course of time – liquidity levels are still on the low side. By incorporate order books and broader trader activity into the exchange – Orion Protocol solves this issue.

The Orion Protocol token – traded as ORN, first hit public exchanges in August 2020. Back then, a single ORN token would have set you back just $0.67. The project hit all-time highs of $28 in March 2021 – representing growth of over 4,000% in just 7 months of trading. This top-rated DeFi coin has since dropped to $3.41 – so now could be a great time to enter the market on the cheap.

10. Maker – Governance Defi Project for DAI Stablecoin

Maker – which is traded as MKR – is also one of the best performing digital currencies of the past few years. The project fuels DAI – which is a stablecoin. Maker itself is used to govern the DAI protocol – meaning token holders have a say in how the project should be run.

In terms of its market value, MKR initially traded on public exchanges in early 2017 at around the $22 level. Since then, there has been no stopping Maker in the open marketplace – with the DeFi coin constantly breaking new all-time highs. At the time of writing, one MKR token will cost you over $1998 – although the coin did reach a high of $6329 before plummeting in May 2021.

11. Compound – DeFi Lending Platform That is Backed by cTokens

Compound is an additional decentralized lending platform that has taken the DeFi arena by storm. Investors have the chance to earn interest on their digital currency holdings by depositing tokens into a select ‘pool’. In turn, you will receive cTokens – which is an in-house digital coin that fuels the Compound economy.

The number of cTokens that you hold reflects the amount you have invested in a particular pool. The Compound token itself – which trades as COMP, was priced at just over $71 when it was launched in June 2020. At the time of writing in February 2022, the COMP token is trading at $125.90. Although this is nearly double its initial price, COMP was trading at $908 at recently as May 2021.

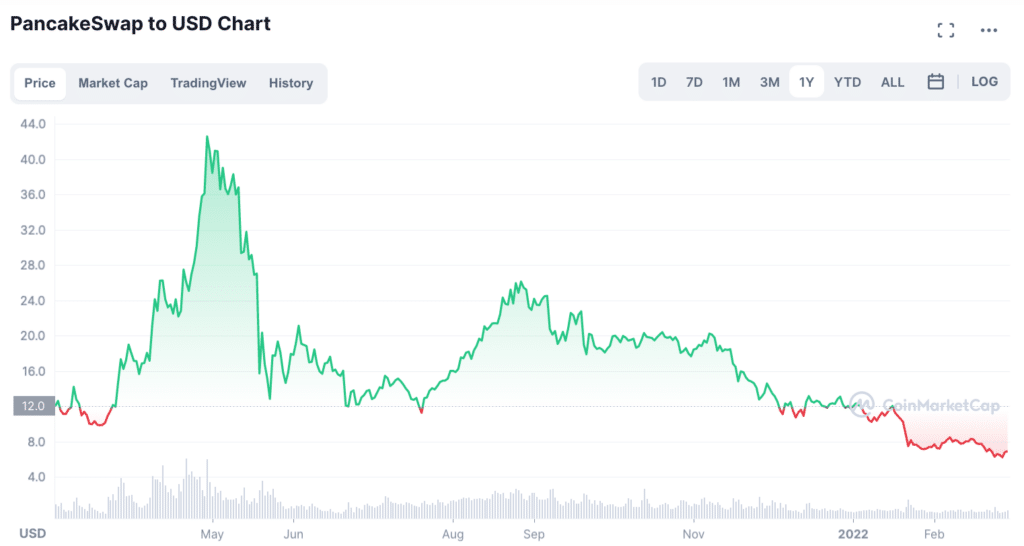

12. PancakeSwap – Exchange BEP20 in a Decentralized Setting

PancakeSwap is an online platform that enables users to exchange BEP20 – which is associated with the Binance Smart Chain. This offers a cost-effective way to obtain your chosen BEP20 without needing to go through the cumbersome process of using a centralized operator.

Instead, through its AMM protocol – you can swap your BEP20 tokens at the click of a button directly with other market participants. At the time of writing, the PancakeSwap – which trades as CAKE, carries a market capitalization of over $1.8 billion. This translates into a market price of over $6.94 per CAKE token.

What are Defi Coins?

All of the best Defi coins discussed in the sections above have one thing in common – they all field a decentralized finance project. The wider Defi scene aims to take traditional financial services – whether that’s banking, insurance, trading, or day-to-day transactions, away from centralized operators.

Instead, it aims to allow services to function in a fully decentralized manner – meaning that people can transact directly with other market participants.

A prime example of this is Uniswap – which allows users to swap digital currencies without needing a conventional exchange or broker. Naturally, not only are the fees involved much lower – but there is no requirement to trust the other party. After all, the vast bulk of Defi coins and platforms are backed by autonomous smart contracts.

Are Defi Coins a Good Investment?

Like all investments, Defi crypto coins do come with their pros and cons. At one end of the scale, the world of decentralized finance does have the potential to become a multi-trillion dollar industry within the next decade. This super-positive market sentiment on this innovative industry is evident in how quickly the best Defi coins have grown in recent months.

- Uniswap was priced at just $0.50 in late 2020 but it has since breached a value of $43.

- This means that those purchasing UNI tokens when they first hit a public exchange are now looking at gains of over 11,000%.

- In comparison, it took companies like Amazon and Apple many decades to reach this feat. In the case of Uniswap – and many of the best Defi coins discussed today, it took just months.

On the flip side, the best Defi coins are highly speculative – just like traditional cryptocurrency trading markets. In other words, just because a Defi coin has generated huge returns over the past few months – this isn’t to say that this will be the case indefinitely.

On the contrary, there is every likelihood that the best Defi coins are being propped up by the success of leading digital currencies like Bitcoin, Ethereum, and Ripple. Ultimately, both the upside potential and risks are high with Defi crypto coins – so just make sure you keep your stakes modest and that your investment portfolio is well diversified.

Where to Buy Defi Coins UK

If you want to buy the best Defi coins discussed today – you will first need to find a trusted broker or cryptocurrency exchange. You’ll need to research the platform before signing up with respect to key metrics, surrounding fees, commissions, supported Defi markets, safety, payments and more.

To point you in the right direction – below we review a small selection of platforms that allow you to trade or buy the best Defi coins.

1. Binance – Best Cryptocurrency Exchange for Buying the Best Defi Coins

If you are wanting to invest in Defi coins then you might consider Binance. The super-popular cryptocurrency exchange allows you to buy Defi coins in the traditional sense. Binance is home to a huge selection of Defi coins – so you can easily diversify.

If you are wanting to invest in Defi coins then you might consider Binance. The super-popular cryptocurrency exchange allows you to buy Defi coins in the traditional sense. Binance is home to a huge selection of Defi coins – so you can easily diversify.

The key problem is that most Defi coins on Binance are traded via a crypto-to-crypto pair. For example, many need to be exchanged for another digital currency like Bitcoin. Nevertheless, trading fees at Binance cost just 0.10% per slide – which is really competitive.

You can buy cryptocurrency and deposit funds into Binance without needing to provide any personal information or ID. But, if you want to deposit with a debit/credit card or bank account – you’ll need to go through a standard KYC procedure.

- Largest cryptocurrency exchang in terms of trading volume

- Hundreds of cryptocurrency pairs supported

- Trading commission of just 0.1%

- Supports UK debit/credit cards and bank transfers

- Great reputation in the cryptocurrency scene

- Ideal for advanced traders that seek sophisticated tools and features

- Not great for newbie investors

- A standard charge of 2% on debit/credit card deposits

Your capital is at risk.

Conclusion

The decentralized finance industry is growing at a rapid pace – so it makes sense that market sentiment surrounding Defi coins has followed suit. This guide has reviewed the best Defi coins currently in the market, albeit, there are now over 300 to choose from.

If you’re ready to start trading Defi coins, we recommend Battle Infinity as the number one token to invest in today – click the link below to get started!

Your capital is at risk.