Best Crypto Savings Accounts UK 2025

The growth of the cryptocurrency market has helped launch a variety of facilities that provide similar services to those offered in traditional financial markets. One of those facilities is crypto savings accounts, which can help investors generate interest on their crypto holdings.

In this guide, we discuss the best crypto savings accounts on the market, highlighting which providers offer the highest rates and showing you how to get a crypto savings account set up today – in four quick steps!

The Best Crypto Savings Accounts in the UK

Presented below is a brief overview of the best crypto savings accounts available to investors today. In the following section, we’ll review each of these accounts individually, ensuring you’ve got all the information you need to make an effective decision.

- DeFi Coin – The Best Cryptocurrency Savings Account At Only One Dollar

- AQRU– Overall Best Crypto Savings Account for 2022

- Crypto.com – Top-Rated Crypto Savings Account with High Rates

- BlockFi – User-Friendly Crypto Savings Account with Compound Interest

- Binance – Best Crypto Savings Account for Flexible & Locked Savings

- Coinbase – Respected Crypto Savings Account with High Security Level

Top UK Crypto Savings Accounts Reviewed

If you are looking to buy cryptocurrency and store it long term, you can optimise your returns by partnering with one of the crypto savings account providers mentioned above. With that in mind, let’s dive in and review each of these providers so that you can gain a deeper understanding of your options.

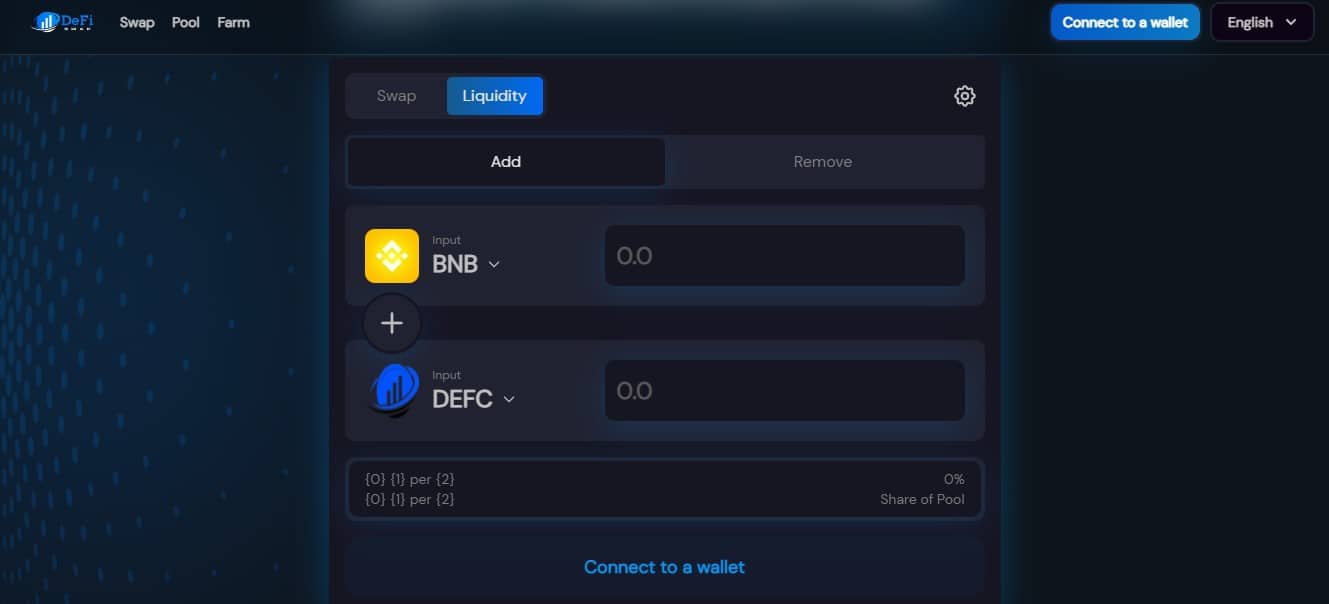

1. DeFi Coin –The Best Cryptocurrency Savings Account At Only One Dollar

The DeFi Swap DEX functions as one of the UK’s best crypto savings accounts; this is a cryptocurrency exchange strongly associated with the decentralized sector (DeFi).

The native token of this project is DEFC. DEFC token holders may also receive a static reward because every time anyone buys or sells DeFi Coins, a 10% collection tax is assessed.

Betting is only possible with this currency on DeFi Swap. Interest rates can also be high on this platform for extended periods compared to other exchanges.

To generate passive income regularly, it is sought that the profit is divided into 50%-50%. The first part will reward users with what is sought to produce the passive income. In addition, liquidity funds are used to support automatic liquidity.

Using the token burning system, it is sought that this is not a way to get rich quickly, but with the tokens that remain that are considered unique, users are motivated to keep them, promoting upward momentum.

A major feature is that it costs only $1 and currently has more than 6000 members on Telegram, assuring it of being completely safe and famous.

Cryptoassets are highly volatile unregulated investment products.

2. AQRU – Overall Best Crypto Savings Account for 2022

If you’re looking for the best crypto savings account this year, our recommendation would be to partner with AQRU. AQRU is a crypto savings platform owned by Accru Finance Ltd, a London-based financial services firm. Launched in December 2021, AQRU looks to be one of the best investment platforms in this burgeoning space by offering high yields and a significant degree of safety.

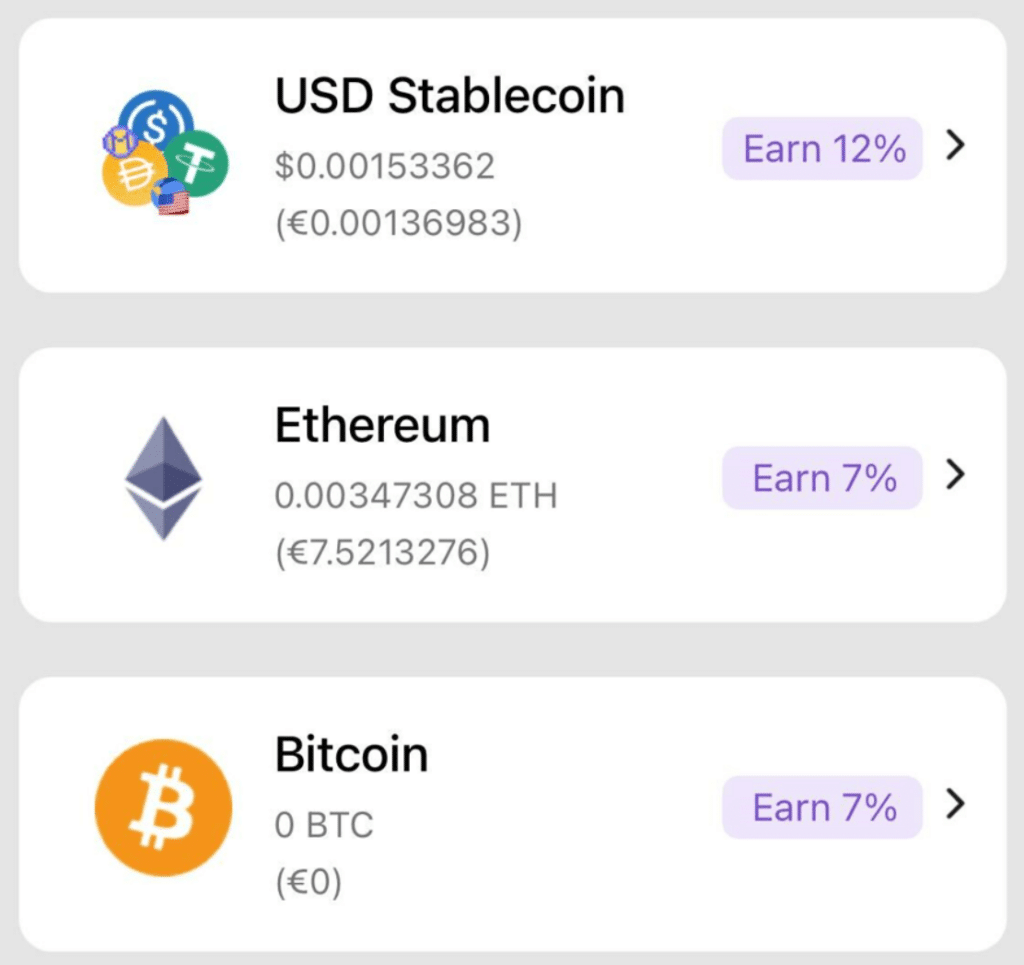

AQRU works by allowing investors to deposit their holdings and generate a solid return. The platform is ideal for crypto investors of all experience levels and accepts stablecoins such as USDC, USDT, and DAI, along with BTC and ETH. Notably, AQRU also accepts deposits in GBP and EUR. Once deposited, AQRU will lend customers’ funds to institutional and retail borrowers – with these loans being 100% collateralised.

Since cryptocurrency is still hard to obtain for certain market participants, AQRU can offer high rates on their crypto savings accounts. AQRU is also one of the best crypto lending platforms offering a 12% return on stablecoin deposits and a 7% return on BTC or ETH deposits. The great thing is that AQRU charges no hidden fees for their service – and withdrawals can be completed at any time.

The only cost to be aware of is a $20 fee when withdrawing crypto, which is charged in the currency being withdrawn. In terms of payment methods, AQRU allows clients to deposit via credit/debit card, bank transfer, or cryptocurrency. Interestingly, the minimum deposit amount is only €100 (£83.44), making AQRU’s services accessible for beginner investors. Finally, all of AQRU’s services can be accessed through the handy mobile app, which allows users to make deposits, check account stats, and secure their accounts with two-factor authentication. AQRU is also one of the best crypto lending platforms offering

For everything you need to know about this crypto savings platform our full AQRU review is a must read.

Cryptoassets are highly volatile unregulated investment products.

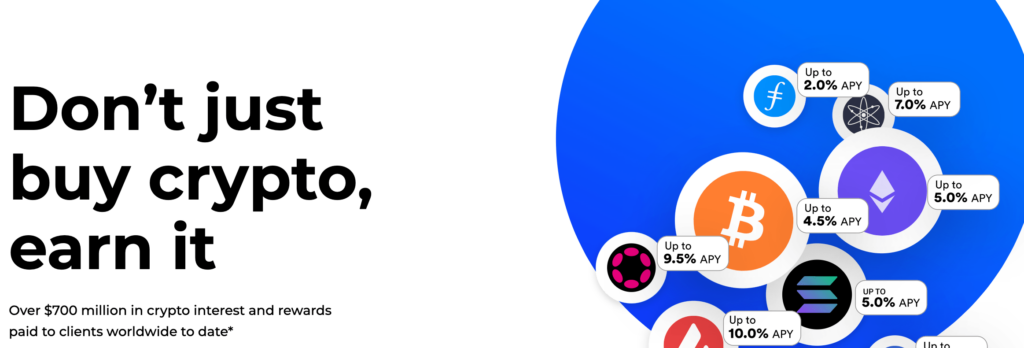

3. Crypto.com – Top-Rated Crypto Savings Account with High Rates

Titled ‘Crypto Earn’, Crypto.com’s savings account allows users to earn up to 14.5% on crypto deposits and up to 14% on stablecoin deposits. Over 40 different cryptocurrencies are supported by Crypto Earn, including BTC, ETH, and USDC. Notably, users can customise different facets of their crypto deposits to suit their specific goals. For example, lock-up periods can be flexible, one month, or three months – ensuring easy access to crypto holdings.

To obtain Crypto.com’s highest savings rates, users will need to stake a specific amount of CRO – the platform’s native token. Staking amounts of 40,000 CRO or more will provide the highest rates, although users who are happy with lower rates can opt to deposit their crypto without staking CRO. Flexible lock-up periods will result in the lowest returns, whilst opting for a three-month lock-up will produce the highest.

Interest is paid on crypto deposits daily, with no compounding, and will be deposited into the attached crypto wallet every seven days. Each supported cryptocurrency has its own minimum deposit amount to be eligible for interest – for example, users must deposit 0.0005 BTC or 0.15 ETH to generate a return. Finally, the Crypto Earn feature can be easily accessed through the Crypto.com app, with deposits able to be made in seconds.

Cryptoassets are highly volatile unregulated investment products.

4. BlockFi – User-Friendly Crypto Savings Account with Compound Interest

BlockFi’s savings accounts support over 15 different cryptos. These include widely-supported stablecoins such as USDC and DAI and lesser-supported coins like ATOM, ADA, and AVAX. Each asset has its own rate of return, which will increase the longer the holdings remain in the account. In addition, the sign-up process with BlockFi is incredibly streamlined, with no hidden fees or minimum balances required to begin saving.

One of the most appealing features of the BlockFi savings account is that interest on crypto deposits is compounded monthly. This feature is only offered by a select few accounts and can help grow deposits exponentially over the longer term. Finally, BlockFi ensures a high degree of safety for all customers by providing two-factor authentication and partnering with Gemini to store the majority of customer holdings in cold storage.

Cryptoassets are highly volatile unregulated investment products.

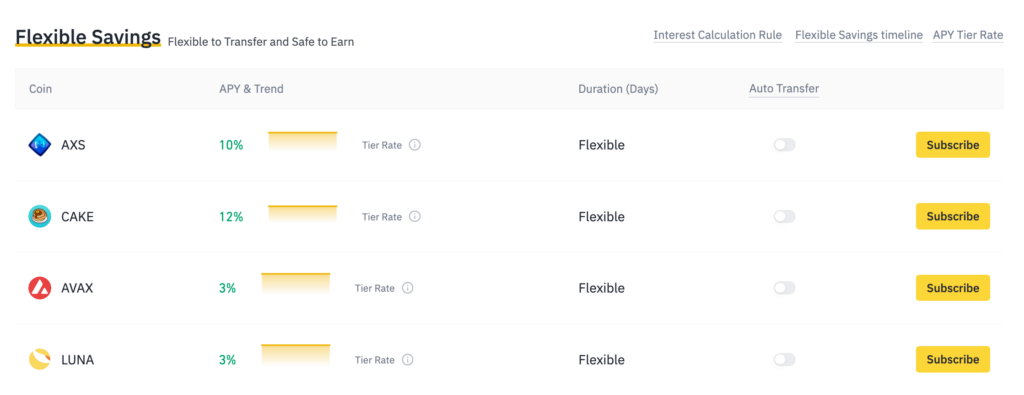

5. Binance – Best Crypto Savings Account for Flexible Lock-Up

Binance supports over 140 coins through its flexible savings accounts, whilst ten coins can be locked up for a specified duration to earn a higher return. Flexible accounts allow users to redeem their funds at any time – and interest is distributed directly to the user’s account every day. In terms of yield, Binance offers some of the highest yields for flexible accounts, with AXS and CAKE deposits netting investors a 10% and 12% APY, respectively!

Opting to lock-up crypto will result in higher yields – with seven day lock-up periods for AXS and CAKE netting users an annualised interest rate of 25%! Notably, Binance also has a section for coins with a limited supply. There is a set amount of cryptocurrency that can be deposited for each of the featured coins, so users must be quick if they wish to get involved. However, the rates on these coins are exceptional – with a prime example being Everipedia deposits that can net users a 70% yield per year!

Cryptoassets are highly volatile unregulated investment products.

6. Coinbase – Respected Crypto Savings Account with High Security Level

Coinbase offers a crypto savings account through the platform’s free crypto wallet app, available on iOS and Android. Users can select which DeFi protocol they wish to earn interest through, with options that include Compound, DyDx, and Fulcrum. Each provider will have its own minimum deposit amount, allowing investors to tailor their savings activities. In terms of supported cryptos, Coinbase currently offers a return on ETH, ATOM, ALGO, DAI, USDC, and XTZ.

Returns through Coinbase are significantly lower than other platforms such as AQRU, with USDC deposits netting investors a 5% APR through Compound. However, although returns are lower, the process to begin earning is incredibly easy and can be facilitated in just a few taps – which is ideal for beginner investors. Finally, besides the crypto savings aspect, Coinbase also offers an array of trading and educational services, providing an ‘all-in-one’ platform for crypto traders.

Cryptoassets are highly volatile unregulated investment products.

Best Crypto Savings Accounts UK Compared

When trying to find the best crypto savings account for your needs, it’s crucial to determine which coins are supported and the returns offered on these coins. The table below presents a clear breakdown of these two aspects for easy reference:

| Platform | Coins Available for Saving | Savings Rates |

| AQRU | USDT, DAI, USDC, ETH, BTC | Stablecoins: 12% per year

BTC & ETH: 7% per year |

| Crypto.com | 40+ (stablecoins and other cryptos) | Stablecoins: Up to 15% per year

Other Cryptos: Varies; up to 14.5% per year |

| BlockFi | 14+ (stablecoins and other cryptos) | Stablecoins: Varies; up to 9.25% per year

Other Cryptos: Varies; up to 10% per year |

| Binance | 140+ (stablecoins and other cryptos) | Stablecoins: Varies; up to 9.25% per year

Other Cryptos: Varies; up to 12% APY |

| Coinbase | ETH, ATOM, ALGO, DAI, USDC, XTZ | Varies depending on the provider and can change regularly – currently 5% per year for USDC deposits. |

What is a Crypto Savings Account?

As the name implies, crypto savings accounts are dedicated accounts where investors can deposit crypto and generate interest. These high yield investments tend to provide much better returns than the traditional financial markets, making them an appealing option for people with substantial crypto holdings. Due to the rapid expansion of the cryptocurrency market, more and more platforms are offering crypto savings accounts – with the competition resulting in favourable terms for investors.

One of the key differences to note between regular savings accounts and crypto savings accounts is that you will relinquish control over your deposits when you use the latter. This is because the crypto that you deposit will be loaned to third parties, such as other retail investors or financial institutions. Since this process is deemed riskier than the traditional banking system, interest rates on crypto deposits tend to be much higher.

Many savings account providers will require users to ‘lock-up’ their deposit for a specified period. Ultimately, this means that users cannot withdraw their holdings until the period ends – although this usually means that yields are higher. However, a selection of providers offer ‘flexible’ accounts that offer lower yields but allow users to access their holdings at any time.

Which Platforms Have the Best Crypto Savings Interest Rates?

If you’re interested in long term investments in the best crypto savings account, you’ll likely want to partner with a platform that offers the highest rates. However, when it comes to these accounts, it’s not as simple as comparing the annual percentage yields (APYs) of the various options – there are also lock-up periods to contend with.

As noted in the section above, these lock-up periods will mean that you cannot access your crypto for a specified period but will earn a higher interest rate. Thus, platforms that provide lock-up opportunities tend to offer the highest APYs. An example of this would be Binance, which currently offers a remarkable 70% APY on Everipedia deposits locked up for 15 days.

With that said, some platforms offer fantastic rates that do not require a lock-up period. Our recommended for the best crypto savings account, AQRU, offers interest rates of 12% per year on stablecoin deposits – with complete flexibility to access your holdings at any time. Furthermore, users can also deposit ETH or BTC with no lock-up period and earn 7% interest per year.

Finally, specific platforms may require staking to achieve higher rewards. An example of this would be Crypto.com, one of the best crypto staking platforms available to traders. With Crypto.com, users can earn higher interest rates by depositing more CRO – with is Crypto.com’s native cryptocurrency.

Presented below is a quick breakdown of how the staking process affects returns on a DAI deposit with Crypto.com with a three-month lock-up period:

- Less than 400 CRO staked = 10% p.a.

- 4000 CRO staked = 12% p.a.

- 40,000 CRO staked = 14% p.a.

What Cryptocurrencies Can You Earn Interest On?

Many of the best cryptocurrencies UK can be deposited into crypto savings accounts to earn interest. These cryptocurrencies tend to be split into two categories – stablecoins and non-stablecoins. Let’s discuss each of these categories individually:

Stablecoins

As defined by the Financial Times, stablecoins are cryptocurrencies pegged to the value of an underlying asset to limit price fluctuations. Tether (USDT) is the world’s largest stablecoin and has a market cap of over $79 billion, although other notable stablecoins include USDC, USDT, and DAI. Due to their volatility-beating features, stablecoins tend to be in high demand from various parties – meaning stablecoin deposits tend to attract the highest interest rates from crypto savings accounts.

Non-Stablecoins

As the name suggests, non-stablecoins refer to any crypto that is not a stablecoin. This category includes popular cryptos such as BTC and ETH, along with a wide variety of altcoins. Since the supply of crypto cannot be artificially increased easily, like central banks do when printing money, certain coins are in high demand. Thus, crypto savings accounts provide a way for specific parties to obtain these coins, with the accounts offering a favourable rate of return to compensate depositors for taking on risk.

How to Setup a Crypto Savings Account in the UK

Thanks to the popularity of crypto savings accounts, the sign-up process has become incredibly streamlined over the past year. As such, making a deposit and earning interest can usually be facilitated in a matter of minutes.

To help you through the process, the steps below will show you how to set up a crypto savings account with our recommended provider, AQRU – all from the comfort of your own home!

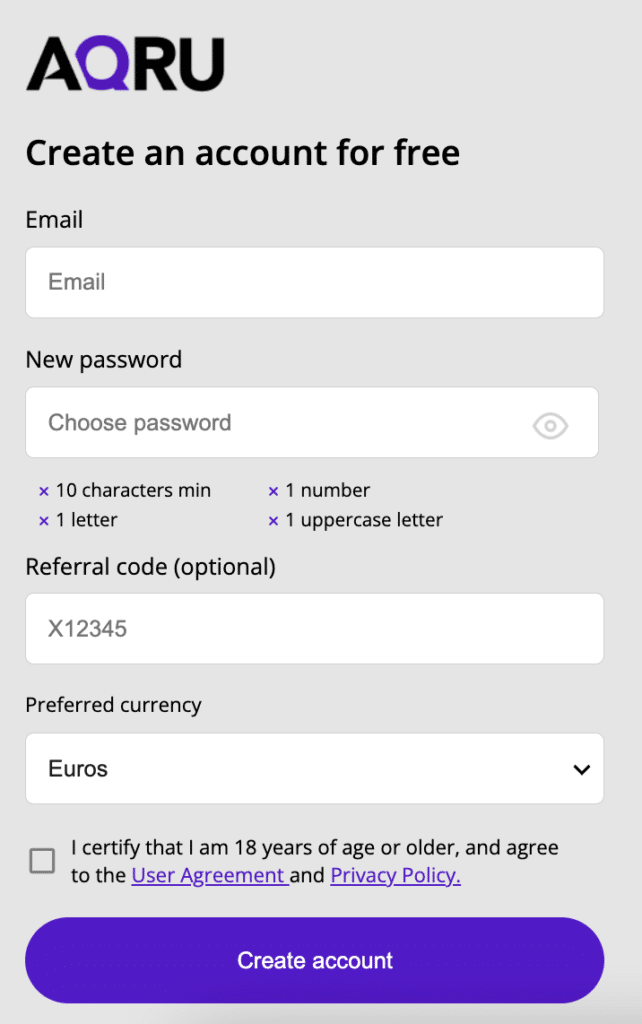

Step 1 – Open an AQRU Account

Head over to the AQRU website and click ‘Sign Up’. Enter a valid email address, create a password for your account, and then choose your preferred FIAT currency to operate in.

Cryptoassets are highly volatile unregulated investment products.

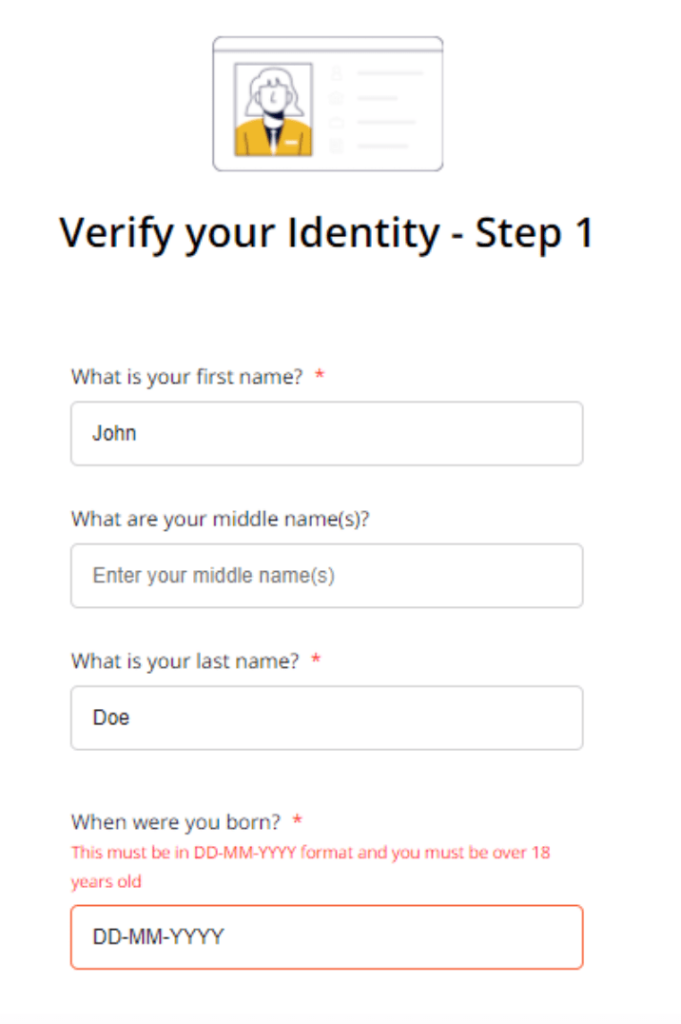

Step 2 – Verify Account

To gain full access to your account, you will have to complete the verification process. Click the ‘Verify your Identity’ banner on the homepage and provide the details needed for AQRU’s KYC checks. You’ll then be asked to take a photo of your photo ID (e.g. passport) and proof of address (e.g. utility bill). Finally, you’ll also have to take a selfie to ensure the provided documents are legitimate.

Step 3 – Make a Deposit

Next, download the AQRU app from the App Store or Google Play and log in using the credentials you created earlier. Click ‘Deposit’ on your account dashboard and opt for bank transfer, card deposit, or crypto deposit:

- Bank transfers – Free to make, although funds can take up to 48 hours to arrive.

- Card deposit – Facilitated through MoonPay and allows you to buy crypto, although third-party fees apply.

- Crypto deposit – Free to make, and AQRU will supply a wallet address to which you can transfer your crypto holdings.

Step 4 – Begin Earning Interest

Click the ‘Buy’ button on your account dashboard and opt for stablecoin, BTC, or ETH – depending on which crypto you will be depositing. You can then decide how much you’d like to invest in the savings account before confirming the investment. Once confirmed, you will begin earning interest on your deposit, which accrues daily and can be withdrawn at any time!

Are Crypto Savings Accounts Safe?

Before we round off our discussion of the best crypto savings account, it’s vital to touch on the safety of these accounts. It’s natural to be wary about operating within the crypto market, as it is still relatively young compared to ‘traditional’ markets.

With that in mind, noted below are two of the main aspects to be aware of when it comes to crypto savings account safety:

No Deposit Insurance

Potential for Deposit Value to Decline

Another element to consider is the value of your deposit – primarily with savings accounts that require a lock-up period. As most crypto market participants will be aware, the market can be highly volatile, with significant price declines not uncommon. As such, if your crypto holdings are in an extended lock-up period and the market turns bearish, the value of your holdings can diminish rapidly – and it can result in defaults that put your deposit at risk.

Best Crypto Savings Accounts – Conclusion

To summarise, this guide has discussed the best crypto savings account in detail, highlighting which providers offer the best rates and how to get set up with an account right away. With the expansion of the crypto market showing no signs of stopping, opening a crypto savings account offers a streamlined way of generating solid yields on your holdings.

If you’re looking to open a crypto savings account today, we recommend partnering with AQRU. AQRU supports a selection of stablecoins and offers yields of 12% per year, with no hidden fees. What’s more, users can even earn interest of 7% per year on BTC and ETH deposits – all through AQRU’s handy mobile app!

Cryptoassets are highly volatile unregulated investment products.