How to Buy National Grid Shares Online in the UK

National Grid plc is a UK-based supplier of gas and electricity. The firm is listed on the London Stock Exchange and with a market capitalization of over £32 billion – forms part of the FTSE 100. As such, you can invest in National Grid with ease.

In this guide, we show you how to buy National Grid shares online in the UK. We cover the step-by-step process required to make a purchase and give you a selection of UK stock brokers to choose from.

-

-

Step 1: Find a UK Stock Broker to Buy National Grid Shares

As a large-cap UK company, there are many online brokers that allow you to buy National Grid shares.

In fact, the process can be completed in minutes – as you simply need to open an account, deposit funds, and decide how many shares you wish to buy.

But with so many UK stock brokers in the market, knowing which platform to go with can be challenging.

With this in mind, below you will find a selection of the best brokers that allow you to buy National Grid shares online in the UK.

1. Plus500 – Commission-Free Stock CFD Trading Platform

While most UK investors prefer to buy National Grid shares in the traditional sense, some prefer to ‘trade’. In simple terms, this means that you will be speculating on the future price of National Grid stocks without taking ownership. When using a CFD provider like Plus500, this does come with several benefits that you won’t find at a traditional stock broker.

For example, Plus500 gives you the option of placing a buy (long) or sell (short) order. This means that you can speculate on the price of National Grid shares going up or down. You also have the option of applying leverage. This means that you can trade with more money than you have in Plus500 account. When trading National Grid stock CFDs, you only need to put down a margin of 20%.

This means that a £1,000 buy or sell order would require a balance of just £200. Plus500 is a commission-free trading platform. The only trading fees that you need to take into account is the spread and overnight financing. The latter comes into play when you keep a CFD position open overnight. This is why Plus500 is more suited for short-term stock trading.

In terms of getting started, Plus500 allows you to open an account online or via your mobile phone. The process takes minutes, and will require a minimum deposit of £100. You can do this with your standard debit/credit card, Paypal, or through a bank transfer. Safety and security at the platform are top-notch, as Plus500UK Ltd is authorized & regulated by the FCA (#509909). Its parent company is also a publicly-listed company, and you can find its shares on the London Stock Exchange.

Pros:

- Commission-free CFD platform – only pay the spread

- Thousands of financial instruments across heaps of markets

- Retail clients can trade stock CFDs with leverage of up to 1:5

- You can short-sell a stock CFD if you think its value will go down

- Takes just minutes to open an account and deposit funds

Cons:

- CFDs only

- More suitable for experienced traders

72% of retail investors lose money trading CFDs at this site

Step 2: Research National Grid Shares

Once you have selected a provider, you are then advised to perform some additional research on the firm, whether you’re looking to buy National Grid shares or invest in other companies like BP shares. Crucially, you need to assess what the short/long term prospect of the company is from an investment perspective. In doing so, this will ensure that National Grid shares are right your personal investing goals.

Below you will find some handy information to help point you in the right direction.

National Grid Share Price History

National Grid is a UK-based supplier of gas and electricity. On top of its domestic market, the firm also supplies parts of North America. The company was founded in 1990, and it is now a PLC listed on the London Stock Exchange. At the time of writing, National Grid has a market capitalization of over £31 billion.

This makes it one of the largest companies in the UK and thus – it is a key constituent of the FTSE 100 index. In terms of its share price history, National Grid stocks were priced at just over 250p in 1995. The stocks have moved in an upward trajectory ever since and are worth 919p as of May 2021. This represents a healthy end-to-end return of 254%.

With that being said, it should be noted that National Grid shares last peaked in 2016. This amounted to a share price of just over 1,200p. The stocks then went on a downward slope for the following two years – hitting lows of 749p in February 2018. Then, the shares reversed in the right direction, subsequently going on an upward trajectory that saw National Grid stocks hit 52-week highs of 1,073p in February 2020.

However – and much like the wider UK stock markets, National Grid shares were impacted by the COV-19 Pandemic. Fortunately, the downfall wasn’t as severe as other sectors on the FTSE 100, not least because National Grid offers core electricity and gas services that will always be in demand.

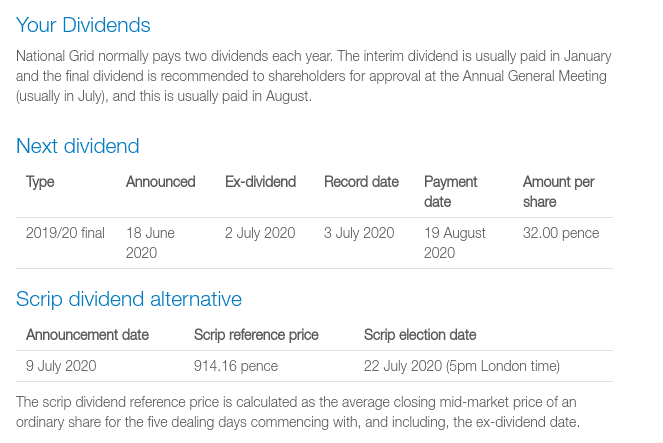

National Grid Shares Dividend Information

National Grid is a dividend-paying company. It typically makes a distribution twice per year. Its interim payment is paid in January and the final payment in August. The latest National Grid shares dividend was announced in June 2020 at 32p per share. At the time of writing, this works out at a trailling yield of over 5%, which in the current economic climate, is welcome news for shareholders.

Although more than 445 FTSE 100 firms have since cut or suspended their dividends as per COV-19, the general consensus is that National Grid should remain on track to meet its dividend targets. After all, the sector it is involved in is largely unaffected by the health of the wider economy.

Should I Buy National Grid Shares?

So now that you have a bit of background information on the National Grid share price history – alongside its dividend policy, we now need to explore what the future holds for the gas and electricity supplier.

Relatively Unaffected by COV-19 Sell-Off

Make no mistake about it – the FTSE 100 took a major beating in March 2020. This was a result of the wider uncertainties of the coronavirus pandemic. The good news for shareholders is that National Grid stocks were largely unaffected by the mass market sell-off of Q1/2.

For example, the shares started the year at a 950p. Although lows of 799p were hit in March, the shares are now positioned at 887p as of August. This means that National Grid shares are down just 6.6% for the year.

Although this isn’t ideal, the downward trajectory was minute in comparison to the wider markets. For example, the FTSE 100 was priced at 7,604 points at the turn of 2020, and worth just 6,154 points at the time of writing. This means that the primary UK index is down 18% during the same timeframe.

Staple Products and Services

It is safe to say that irrespective of how the wider UK economy is performing – consumers will always need electricity and gas.

With this in mind, National Gride is arguably a ‘staple’ company – meaning that its products and services will be in demand even if the economy is performing badly.

This could be crucial during a time where the short-to-medium term future of the economy remains an uncertainty.

Strong and Staple Dividends

If you are looking to get your hands on strong and staple dividend stocks, it might be worth considering National Grid. The FTSE 100 constituent has a long-standing history of paying dividends – including consistent hikes. As of August 2020, the firm has yet to give any indication that it plans to interrupt its dividend policy.

This is in stark contrast to the wider FTSE 100 – with over 445 firms to date announcing a cut or suspension of dividends as a result of the pandemic. Based on current market prices, National Grid is paying a trialling dividend yield of just over 5%.

Predictable Revenues

From an investment perspective, utility shares like National Grid certainly won’t make you rich. Instead, the firm is a defensive stock that has the potential to yield slow and steady returns – both in the form of capital. gains and bi-annual dividends. At the forefront of this is the firm’s predictable revenue model.

In the UK market specifically, electricity and gas suppliers are capped in how much they can charge for their products and services.

However, as National Grid has dedicated vast resources into domestic infrastructure, the national regulator allows it to charge slightly more than some of its competitors. In fact, if the firm is able to meet its targets, it can once again increase the price of National Grid shares.

National Grid Shares Buy or Sell

National Grid isn’t the most exciting stock to invest in. This utility provider offers slow and steady returns, plus a healthy dividend of yield of 5.3%. That put it in the middle of the pack in terms of UK dividend shares.

However, there is a good reason to buy National Grid shares: diversification. It’s no accident that National Grid was one of the few FTSE 100 stocks to weather the COVID-19 pandemic with little damage. The UK will always need electricity and gas no matter what’s happening in the world. So, National Grid shares are a relatively safe option in an alternative market.

As the COVID-19 pandemic comes to a close, most investors are looking to take on more risk, not buy safe haven shares. However, holding National Grid could be a good idea if you’re worried that the market is too hot and could be headed for a correction. If that happens, National Grid shares should be relatively unaffected even as the rest of the market suffers.

So, if you want to diversify your portfolio and hedge your bullish bets on the UK stock market, National Grid is a good option. This stock might not be the biggest winner of the next year, but it offers a dividend and relative safety from the market’s fluctuations.

The Verdict?

In summary, alongside other sectors such as tobacco, food and beverage, medicine, and household products – National Grid supplies products and services that are largely unaffected by the wider economy. As such, the firm could be a good addition to your portfolio if you are looking to invest in defensive stocks.

FAQs

What does National Grid do?

National Grid supplies the UK market with gas and electricity. The firm also has a presence in the North American market.

What stock exchange are National Grid shares listed on?

National Grid shares are listed on the London Stock Exchange. The firm is a major constituent of the FTSE 100. National Grid also has a secondary listing on the New York Stock Exchange. This ensures that institutional investors from the US are able to purchase its shares.

Do National Grid shares pay dividends?

Yes, National Grid does pay dividends. It does so twice per year. The firm is on track to meets its final dividend payment of 2020 - with no signs of a potential cut or suspension to date.

When did National Grid go public?

National Grid first went public in 1995 - opting for the London Stock Exchange.

How do you buy shares in National Grid?

You need to buy National Grid shares from an online stock broker.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

As a large-cap UK company, there are many online brokers that allow you to buy National Grid shares.

As a large-cap UK company, there are many online brokers that allow you to buy National Grid shares.

Make no mistake about it – the FTSE 100 took a major beating in March 2020. This was a result of the wider uncertainties of the coronavirus pandemic. The good news for shareholders is that National Grid stocks were largely unaffected by the mass market sell-off of Q1/2.

Make no mistake about it – the FTSE 100 took a major beating in March 2020. This was a result of the wider uncertainties of the coronavirus pandemic. The good news for shareholders is that National Grid stocks were largely unaffected by the mass market sell-off of Q1/2.