Best NFT Lending Platforms UK 2024 – With Lowest Fees

NFT lending platforms enable you to borrow crypto using your NFTs as collateral. These platforms can help you get crypto or even cash without selling your NFTs. However, since NFTs are relatively new, NFT loans often come with high interest rates and low borrowing limits compared to crypto loans.

In this guide, we’ll reveal the best NFT lending platforms in the UK for 2022 and explain everything you need to know about NFT lending.

Key Takeaways on NFT Lending Platforms

- NFTs (non-fungible tokens) are making all the headlines as some have sold for astronomical prices in recent months.

- Most DeFi platforms now offer NFT loans which means users can leverage their NFT holdings in exchange for cryptos and fiat currencies.

- With the majority of NFTs on the market suffering from a lack of liquidity some DeFi projects have realized both the necessity and demand for greater NFT liquidity. This is where NFT lending comes in.

- We rank Nexo as the best NFT lending platform and Crypto.com as the best for crypto lending.

The Best NFT Lending Platforms UK for 2022 List

Here are the 4 best NFT lending platforms you can use to borrow money today:

- Nexo – Overall Best NFT Lending Platform in 2022

- NFTfi – Marketplace for NFT Loan Offers

- Arcade.xyz – Lowest Fees for NFT Borrowing

- Drops.co – Borrow up to 30% of Your NFT’s Value

Top NFT Lending Sites in the UK Reviewed

We’ve put together reviews of our favorite NFT lending sites to help you find the best NFT lending platform for you.

1. Nexo – Overall Best NFT Lending Platform in 2022

Nexo handles all loans directly, which makes it much easier to get approved quickly compared to NFT lending platforms that create a marketplace for individual lenders. The drawback, though, is that Nexo only accepts Bored Ape Yacht Club or CryptoPunks NFTs as collateral at this time. The value of your NFT must be at least $500,000 in order to qualify for a loan.

One of the advantages of Nexo NFT lending is that your loan won’t be liquidated even if the value of your NFT fluctuates. This is important because it means that you can rely on the liquidity you get from your loan no matter whether the NFT market goes up or down. You also get a dedicated account manager who can answer any questions you have about your loan. If you’re wondering how to buy NFT tokens in 2022, you can read our comprehensive guide for everything you need to know.

Nexo typically charges 12-15% APR for NFT loans. There is no credit check required to take out an NFT loan.

- Borrow up to 20% of your NFT’s value

- No loan call if your NFT value fluctuates

- Dedicated account manager

- No credit check required

- Only accepts Bored Ape Yacht Club or CryptoPunks NFTs

- NFTs must be worth at least $500,000

Cryptoassets are highly volatile unregulated investment products.

2. NFTfi – Marketplace for NFT Loan Offers

The advantage of this marketplace model for borrowers is that you can solicit offers. There is no maximum loan-to-value ratio you can get for your NFT – that is determined by individual lenders who offer to give you a loan. Interest rates for borrowing are also set by individual lenders, and you can choose to accept or reject an offer if you think the interest rate is too high.

For lenders, NFTfi offers a way to earn interest on your crypto as well as an opportunity to collect NFTs at steeply discounted prices in the event a borrower defaults. However, it’s up to you to determine how much an NFT is worth and what interest rates and loan-to-value ratios to offer. Lending with NFTfi can be risky, especially if the value of the NFT you have as collateral is volatile.

NFTfi doesn’t charge any origination fees for borrowers. For lenders, the platform charges a 5% fee on the interest paid for successful loans only. If the borrower defaults, NFTfi doesn’t charge any fee.

- Marketplace enables you to collect multiple loan offers

- Lenders can set their own rates and loan amounts

- Accepts any NFT as collateral

- No platform fees for borrowers

- Risky for borrowers and lenders

- No tools for researching NFT values

3. Arcade.xyz – Lowest Fees for NFT Lending

Arcade.xyz makes the lending process as simple as possible. You can put up any wrapped NFT as collateral and borrow in wrapped Ethereum, USD Coin, or Maker. Loan rates and loan-to-value ratios are set through an offer system rather than a one-sided application.

Arcade.xyz doesn’t charge any fees for lending out crypto, which is good news if you want to use this platform for crypto farming. Borrowers pay an origination fee of 2% on every loan in addition to the interest charged by the lender.

Arcade.xyz currently supports any NFT as collateral. There is no minimum value or specific collections required for use as collateral.

- Marketplace for borrowers and lenders

- Accepts any NFT as collateral

- No fees for lenders

- Operates on Pawn protocol

- 2% origination fee for borrowers

4. Drops.co – Borrow up to 30% of Your NFT’s Value

This means that when you want to borrow against your NFT, you’re only soliciting loan offers from lenders who are interested in the specific NFT you have. For lenders, it’s easy to find NFTs that you’re interested in owning in the event the borrower defaults.

Drops.co has several important protections for lenders. First, the maximum loan-to-value ratio on the platform is 30%. That prevents lenders from offering too much for NFTs with volatile prices. Second, Drops.co can automatically liquidate a loan if the value of the NFT falls below a specific borrowing threshold. This can be problematic for borrowers, however, since it means you have to carefully manage your account balance and monitor the value of your NFT.

All loans are provided in DOP, which can be traded for alternative cryptocurrencies on crypto exchanges like Uniswap and Gate.io.

- Individual marketplaces for different NFT collections

- Maximum 30% loan-to-value ratio

- Lenders set their own interest rates

- Platform is very easy to use

- All loans provided in DOP

- NFTs can be liquidated if value falls

Best NFT Lending Platforms UK Compared

Wondering which of the top NFT lending platforms is right for you? The table below shows you how they stack up against one another:

| Available Coins | Interest Rates | Maximum Loan Size | |

| Nexo | ETH, USDC, USDT | 12-15% APR | 20% of NFT value |

| NFTfi | ETH, DAI | Varies by lender | Varies by lender |

| Arcade.xyz | ETH, USDC, DAI | Varies by lender | Varies by lender |

| Drops.co | DOP | Varies by lender | 30% of NFT value |

What is a NFT Lending Platform?

An NFT lending platform is a site that enables you to borrow cryptocurrency using an NFT you own as collateral. These platforms are designed to help you get liquid crypto without selling your NFT.

Many NFT lending platforms, including NFTfi, Arcade.xyz, and Drops.co, support both borrowing and lending. So, if you own cryptocurrency, you can lend it out to individuals who want to borrow against their NFTs.

NFT lending platforms require the borrower to put their NFT in a collateral account. Both the borrower and lender have claims on this account. The borrower will get their NFT back when the loan is fully repaid, while the lender will claim the NFT if the borrower defaults on the loan.

Most NFT loans are distributed in wrapped Ethereum (wETH), but many NFT lending platforms support stablecoins like USDC, USDT, and DAI. Interest rates and loan sizes vary by platform and by offer.

Importantly, since the value of an NFT can change over the course of a loan, NFT lending platforms may liquidate an NFT or close out a loan before its term is up. Platforms like Nexo stand out for NFT lending because they do not liquidate loans if the value of your NFT falls.

How NFT Lending Works

NFT lending works similarly to cryptocurrency lending or traditional lending. The borrower offers their NFT as collateral for the loan and it is placed in an escrow account. The amount you can borrow is based on the current value of your NFT. When your loan is fully repaid on time, the NFT is returned to your wallet.

NFT lending rates vary by platform. On NFT lending sites like Nexo, rates are set based on the value of your NFT, the amount you’re borrowing, and the length of your loan term. On sites like Arcade.xyz and NFTfi, lenders can set their own rates and terms and it’s up to borrowers whether to accept those terms.

Importantly, NFT lending is somewhat different from traditional lending in that there is no grace period for missed payments. As a borrower, if you miss a repayment, your NFT is automatically transferred to the lender. There is no way to restart payments on your loan and get your NFT back.

How to Choose an NFT Lending Platform

When it comes to choosing the best platform for lending NFTs, there are a few key things to consider:

Direct Lending vs. Marketplace

Nexo stands out as the top NFT lending platform because it is one of the only direct lenders in this market. You can apply directly to Nexo for an NFT loan and get approved or denied.

At other NFT lending sites, you must solicit offers from individual lenders. You may be able to get better rates by comparing multiple offers, but the process is somewhat more involved.

Loan-to-value Ratio

In most cases, you cannot borrow the full value of your NFT. Rather, your loan-to-value ratio is capped at 20-30%. A higher loan-to-value ratio means you can borrow more money for the same NFT, although higher loan amounts may also carry higher interest rates.

Interest Rates

At lending platforms that offer set interest rates, it’s worth directly comparing rates. For marketplace sites, you may want to compare offers across multiple lending sites to get the most competitive rates.

Loan Terms

The length of time you can borrow money varies across NFT lending platforms. At some sites, NFT loans must be repaid in just a few months. At other sites, you can make smaller payments over the course of a full year or longer.

Accepted NFTs

Not all lending platforms accept all NFTs. For example, Nexo only accepts NFTs from the Bored Ape Yacht Club or CryptoPunks collections as collateral. Make sure that the platform you choose accepts the NFT you want to use as collateral.

Crypto Lending vs NFT Lending

While you can borrow or lend against NFTs, crypto lending is more popular, more widely available, and less risky.

With crypto lending, you can borrow fiat currency against the value of your cryptocurrency. Both crypto lending and NFT lending rely on collateral. However, in the case of crypto lending, that collateral is cryptocurrency – for example, Bitcoin, Ethereum, or another popular token.

As a borrower, you can typically borrow a higher loan-to-value ratio against cryptocurrency than you can against an NFT. You’ll also typically find lower interest rates and more flexible loan terms for borrowing against crypto compared to borrowing against an NFT.

If you default on your loan, only the value that you owe will be transferred to the lender. With NFT lending, if you default, your whole NFT will be transferred to the lender regardless of how much you owe.

As a lender, crypto lending is typically safer than NFT lending. If the borrower defaults, you can easily convert cryptocurrency collateral into another token or fiat currency. With NFT lending, you have to sell the NFT you receive on an NFT marketplace in order to convert it into liquid cryptocurrency.

Thanks to the simplicity and safety of crypto lending, there are many more crypto lending platforms than there are NFT lending platforms. This competition means you can typically find lower interest rates and fees.

Top Crypto Lending Platforms

Interested in crypto lending? Let’s take a closer look at the 2 best crypto lending platforms in the UK today.

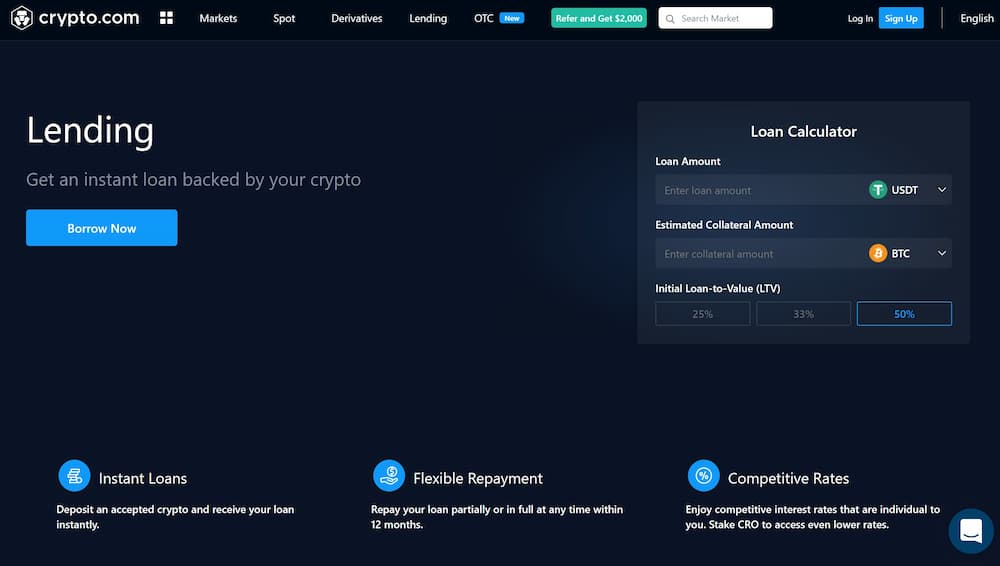

1. Crypto.com – Overall Best Crypto Lending Platform in the UK

What makes Crypto.com stand out for crypto lending is its flexible loan options. You can choose a repayment period up to 12 months for your loan, as well as a loan-to-value ratio of 25%, 33%, or 50%. You can borrow as little as $100 or as much as $500,000.

One thing to keep in mind is that to get the best rates at Crypto.com, you must stake CRO. You’ll receive a discounted rate if you have at least 100,000 CRO staked in your account. Rates start from as low as 1.00% APR and the maximum rate is 8.00% APR.

Check out our full Crypto.com review for more details.

- Rates from 1.00% APR

- Choose from 20+ cryptocurrencies for your loan

- Borrow up to $500,000

- Repayment periods up to 12 months

- Must stake 100,000 CRO to get lowest rates

Cryptoassets are highly volatile unregulated investment products.

2. Celsius – Crypto Loan Rates as Low as 1% APR

Celsius offers loans in several stablecoins including USDT, PAX, GUSD, USDC, and MCDAI. You can also opt to borrow in US dollars with no additional fees if your loan is at least $1,000. The platform accepts more than 40 popular cryptocurrencies as collateral.

One of the best things about Celsius is that refinancing your loan to extend it is simple. You can also pay off your loan early with no fees to save on interest payments. Celsius doesn’t charge origination fees and you can get approved for a loan in minutes.

- Rates from 1.00% APR

- Borrow in stablecoins or US dollars

- Use 40+ popular cryptos as collateral

- Easily refinance your crypto loan

- High rates for 50% loan-to-value loans

Conclusion

The best NFT lending platforms allow you to borrow against the value of your NFT or to loan money to NFT owners. While these platforms can unlock liquidity for NFT investors, they are very risky compared to other types of crypto loans.

For most crypto users, we recommend using a crypto lending platform. These platforms are safer, often charge lower rates, and offer more options for lending and borrowing. Check out Crypto.com today to get rates as low as 1.00% APR.

Cryptoassets are highly volatile unregulated investment products.