How to Buy Mitie Group Shares UK – With 0% Commission

Following its acquisition of Interserve Facilities Management last November and Covid-19 related contracts with the UK government, outsourcing giant Mitie Group the UK has seen its Q1 revenue shoot to $1.28 billion. So, with this in mind, this article discusses How to Buy Mitie Group Shares UK.

We will explore the services management company in detail, touching on its acquisition drive, showing you how you can buy Mitie Group Shares UK commission-free.

Step 1: Choose a Stock Broker

The first step to buy Mitie Group shares is to create an account with a broker. These brokers will enable you to buy shares of any company from the comfort of your favorite chair. Meanwhile, there are several platforms now, so picking the best one can sometimes be difficult.

To help you through this choice dilemma, we review some of the best stock brokers that will let you buy Mitie Group shares easily. By choosing any of the highlighted brokers, you will be able to buy and trade Mitie Group shares cost-effectively.

1. Fineco Bank – Heavily Regulated Broker to Buy Mitie Group Shares

As per investment offerings, Fineco Bank offers exposure to several top global stocks, alongside indices, FX currency pairs, options, and several others. Fees are fixed at a flat rate of £2.95 per trade for UK traders, while US traders pay £3.95. This could be a negligible amount if you make large trades since the Italian broker does not charge for deposits, withdrawals, inactivity, or monthly fees.

It also does not have a minimum deposit threshold which means you can put as little as you can afford at any given time. However, Fineco Bank lacks multiple payment methods as only bank wire transfers are supported, which can take a few days to reflect on your account.

Pros

Cons

Your money is at risk.

Broker Price Comparison

As we have cover in the section above, we recommend buying Mitie Group shares with Fineco Bank, given their relative safety and reputation in the industry. This section will present major differences between both online brokers in a table format to help you decide which broker to choose.

| Broker | Commission | Account Fee | Deposit Fee |

| Fineco Bank | £2.95 per trade | None | None |

| Libertex | From 0.1% | None | None |

| Hargreaves Lansdown | £11.95 per trade | None | None |

Step 2: Research Mitie Group UK

Before shelling out your hard-earned cash to buy Mitie Group shares, you must conduct in-depth research into the company’s track record. This is important as you will know if it will represent a good investment for the long term. An additional benefit is the ability to make sound stock trading decisions instead of letting your emotions run wild.

This section covers all the finer details you need to know about Mitie Group UK to make an informed investment decision.

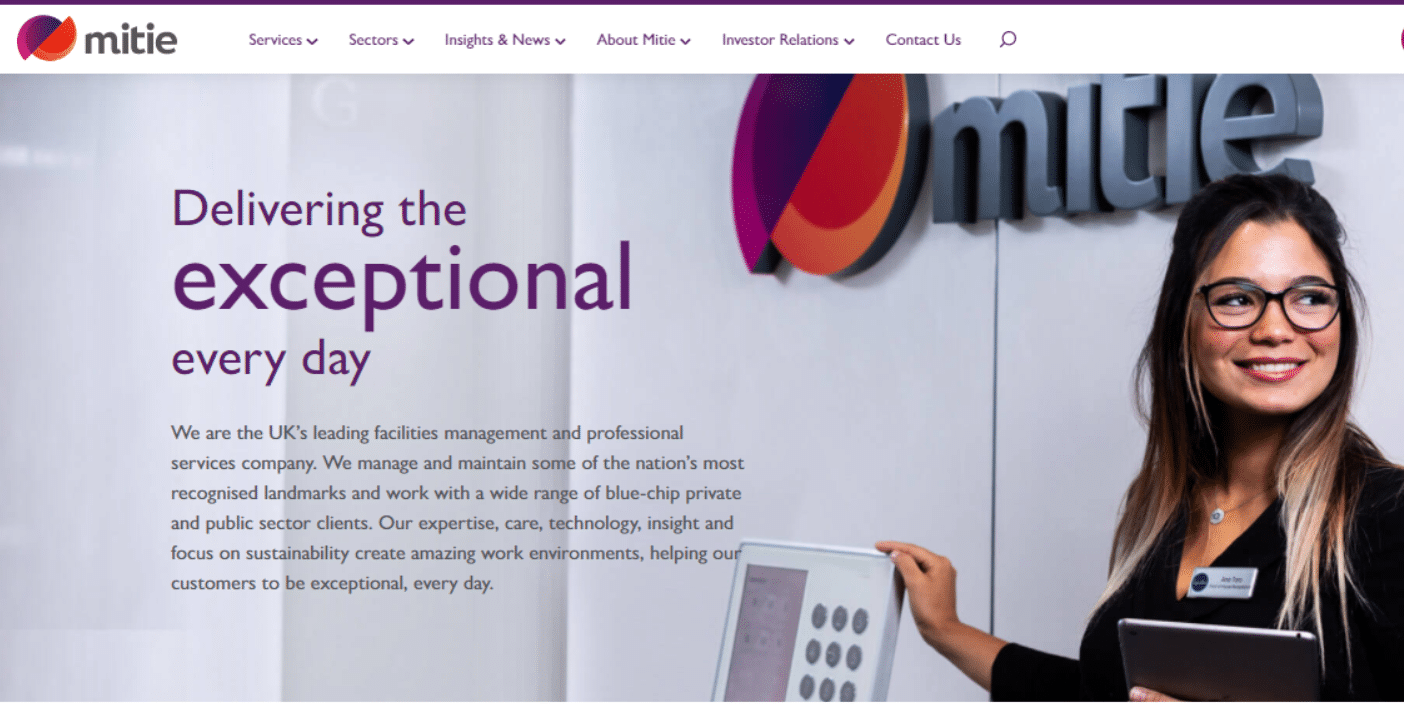

What is Mitie Group?

Essentially, the British company is an outsourcing and energy services company. It offers services in infrastructure consultancy, facilities management, property management, energy, and healthcare services. The headquarters is situated at The Shard in London and has 200 smaller offices scattered across much of the UK and Ireland. It is also a constituent in the FTSE 250 Index.

Mitie Group’s growth has primarily been through the acquisition strategy. In 2006, the company acquired a leading security business, Initial Security, in a deal worth £74.8 million. It subsequently incorporated the specialist plumbing, heating, and mechanical services business into its Property Services division. Another acquisition of Robert Prettie & Co. Ltd saw the company shell out £32.7 million in 2007.

2008 saw Mitie Group continue its expansion drive and bringing DW Tilley into its rapidly expanding umbrella of businesses. This acquisition enabled Mitie Group to extend its roofing services nationwide. In 2009, Mitie Group acquired Dalkia Facilities Management for £130 million to boost its Technical Facilities Management capacity. It also expanded into the Social Housing sector with the acquisition of Environmental Property Services (EPS) for £38.5 million. It also secured the integrated facilities management business of Dalkia in Ireland in 2010.

Entrance to health care sector

Mitie’s acquisition appetite was not satiated, and the company kicked up its engine by acquiring homecare firm Enara in 2012 for £111 million. This saw it make an entrance into the health and social care sector. However, this did not yield the expected returns as Mitie admitted in 2014 that it was finding it difficult to recruit and retain caregivers. Miitie also partnered with the Home Office in February 2014 on an eight-year contract which saw it become the largest provider of immigration removal centers in the UK. It also secured a seven-year cleaning contract with Royal Cornwall Hospitals NHS Trust in June 2014 worth over £90 million.

Mitie was criticized for its immigration management center two years later when the prison inspectorate noted that the facility was generally unkempt and untidy. This streak of bad incidents saw its financials suffer. The firm recorded a four-year low afterwards. This led to its stocks joining the most shorted stocks in the 2015 and 16 fiscal years.

Company CEO McGregor-Smith announced in November 2016 that the company was stepping down from the healthcare business because spending cuts and rising employment costs had made the business unviable. Following a series of run-ins with the Financial Reporting Council (FRC), McGregor-Smith stepped down as CEO and was replaced by the former managing director of British Gas and current CEO Phil Bentley.

Mitie picked up some of its old self and announced the acquisition of Interserve’s 40,000- strong facilities management business in a cash and shares deal worth £190 million in June 2020. An official announcement was released in December 2020 to that effect. In January this year, Mitie was criticized for the Covid-19 site contracted by Inverness to manage after reports aired that several workers contracted the virus.

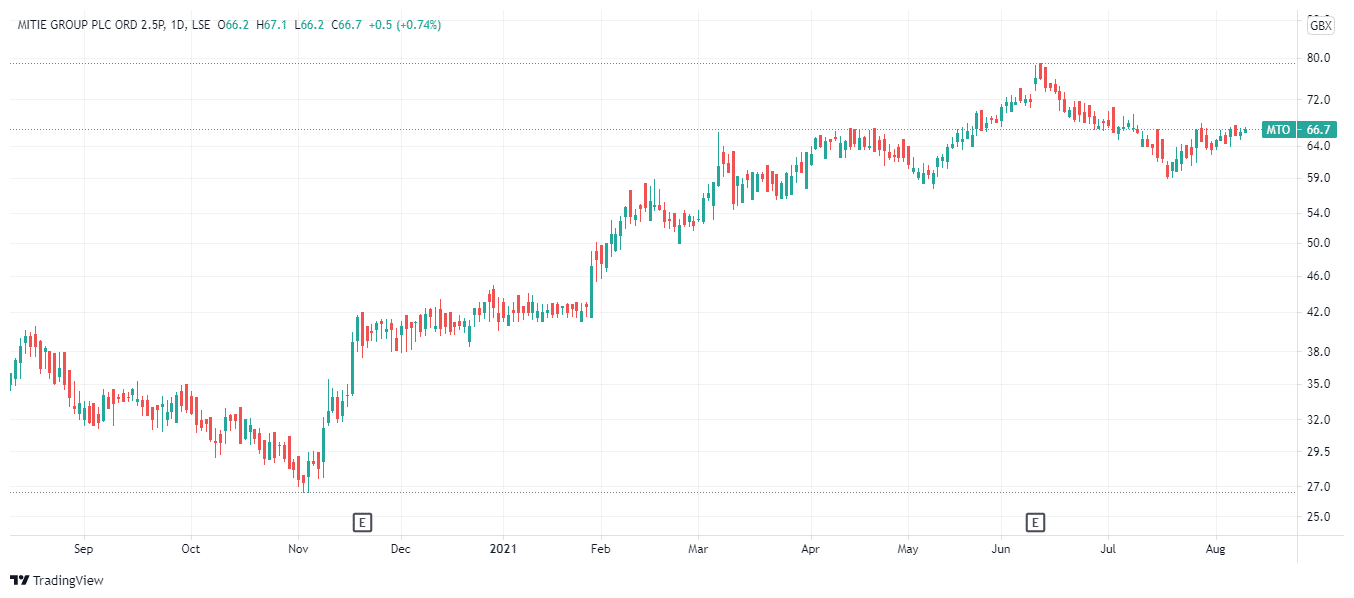

Mitie Group Share Price

The Mitie Group share price currently stands at 66.97 GBX (pence). This represents an increase of 90.78% since the beginning of the year and a growth of 50%, reflecting strong historical performance. Meanwhile, the Mitie Group shares reached a 52-week high of 79 GBX this year, and it has stayed at the high 60s at the time of writing.

The daily price action for Mitie Group shares shows a bullish trend, as there have been major uptrends in the last fortnight. With this momentum building up, there is a possibility that Mitie will likely cross its recent highs and make new price records. Considering its earnings per share (EPS) and price-to-earnings ratio (P/E), Mitie is doing pretty well. According to Hargreaves Lansdown, the outsourcing giant’s EPS stands at 3.50 from 4.28 about a year ago. The P/E ratio is up by 18.00 from last year’s 7.80, which shows that Mitie has been posting a lot of remarkable results this past few months.

However, its EPS growth is 18%, down by 26% from last year’s 44%.

Mitie Group Shares Dividends

If you are an investor on the lookout for a monthly income, dividend-paying stocks are the way to go. Mitie Group is a dividend-paying company and has been doing so up until the global pandemic hit in 2019. The dividends are generally paid quarterly, and the last dividend payout saw investors pocketed 1.33p in February 2020. Before that, Mitie Group spent as high as 4p for its total dividend amount. Given that most businesses have seen their revenue sources dry up due to the lockdown restrictions, Mitie Group has shown resilience in staying in business in a challenging climate.

However, the outsourcing group is expected to resume dividend payout in the coming months as more businesses reopen and return to profitability.

Mitie Group ESG Breakdown

The investing world is evolving, and more investors are looking to add environmentally-conscious companies to their investment portfolios. This has largely fueled the environmental, social, and governance (ESG) sector as more investors now prefer companies who make conscious efforts to adhere to ESG guidelines.

We have researched Mitie’s ESG scores, and the following is how the company is rated by ESG website CSRHub:

- Environmental – 63/100

- Social – 51/100

- Governance – 49/100

Each category is rounded up by 100, and the higher a company scores, the better it is in ESG matters. As the data shows, Mitie is ESG-conscious, and this should be a good indication for you if you are considering buying Mitie Group shares. Mitie is well above average in the environmental category while hovering around average in its social and governance sections. The company’s overall ESG is 42/100, which is just below average compared to other outsourcing companies.

Are Mitie Group Shares a Good Buy?

There are many reasons why we feel Mitie Group shares should be a part of your portfolio for the long haul. We list two of the main reasons why we think Mitie Group shares are worth a second look.

Businesses Are On The Rebound

Businesses have had to battle through one of the most challenging parts of human history following the public announcement of the deadly coronavirus in late 2019 and the subsequent lockdowns in 2020. Several sectors have either gone moribund or received bailouts from the government. Mitie Group’s ability to continue operating despite the odds stacked against it shows the outsourcing company is one for the long term.

Coupled with the fact that health companies are already rolling out vaccines and restrictions are being eased in much of the UK, Mitie Group should be right back where it stopped in 2019. With businesses reopening, Mitie Group will cover lost ground and tap into the gaping hole left by several competitors due to the last economic shake-up.

Mitie Group Making Strategic Move Into Telecoms

Mitie Group is a multi-faceted public company, and this has seen it buy up startup businesses across several key sectors. In its latest release, the outsourcing company announced that it was looking to bolster its telecoms capability with the acquisition of DAEL Ventures UK, including DAEL Telecom, JB Towers, and JISTICS for £15 million.

DAEL Ventures UK, a subsidiary of DAEL Netherlands, is a leading provider of acquisition, design, and construction (ADC) services for telecoms infrastructure. This acquisition will enable Mitie to boost its end-to-end telecom service and allow it to build, upgrade, optimize, and maintain cell sites across the UK. This will likely boost its finances in the long term, given the growing need for 5G infrastructures across Europe.

Mitie Group Shares Buy Or Sell?

For the time being, Mitie Group shares indicate a buy signal for this year. The company shows that it has a lot to prove to investors before the year runs out. Firstly, businesses are gradually opening, which puts Mitie in the driving seat to benefit from a bailout-funded economic initiative. There are so many resources that are up for grabs, and Mitie Group will make good use of the opportunity.

In addition, its recent capacity-boosting acquisition of DAEL UK is a step in the right direction. It indicates that Mitie may still turn up a profit in the unlikeliest of circumstances. This could be a good deal as more countries pivot to a 5G-driven economy. So if you are on the search for an outsourcing group to invest in, then Mitie Group shares should be an attractive option.

Buy Mitie Group Shares UK with 0% Commission

In a nutshell, your decision to buy Mitie Group shares UK will gain you exposure to one of the best-performing UK outsourcing companies in a cost-effective manner. With the company continuing in its acquisition stride with key signings, there is a great potential for growth in the coming months. If you have decided to buy Mitie Group shares, we recommend using the Fineco Bank platform. This is due to the super-low fees that you get to enjoy.