Best SPDR ETFs UK to Watch

SPDR ETFs, or Standard & Poor’s Depositary Receipts, offer a possible way to gain exposure to a variety of sectors and markets while still benefiting from everything that ETFs (Exchange Traded Funds) have to offer. Today, we will review some of the SPDR ETFs for UK investors for you to research.

10 SPDR ETFs in the UK for 2022 List

Here’s a list of 10 popular SPDR ETFs in the UK based on trading volumes.

- SPDR S&P 500 ETF Trust (SPY)

- SPDR Bloomberg Barclays 1-3 Month T-Bill ETF

- SPDR Dow Jones Industrial Average (DIA)

- SPDR Gold Trust (GLD)

- Energy Select Sector SPDR (XLE)

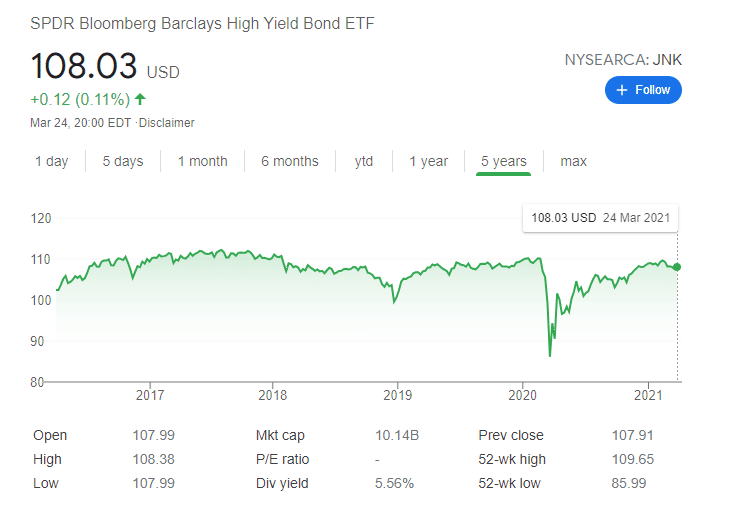

- SPDR Bloomberg Barclays High Yield Bond ETF (JNK)

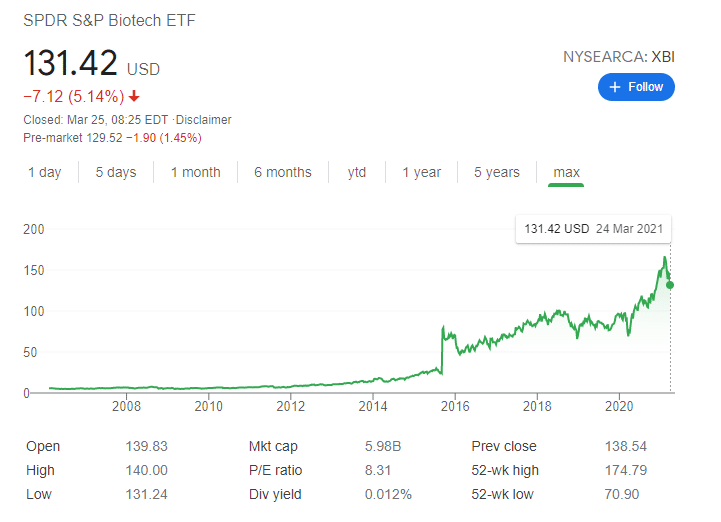

- SPDR S&P Biotech ETF (XBI)

- Technology Select Sector SPDR Fund (XLK)

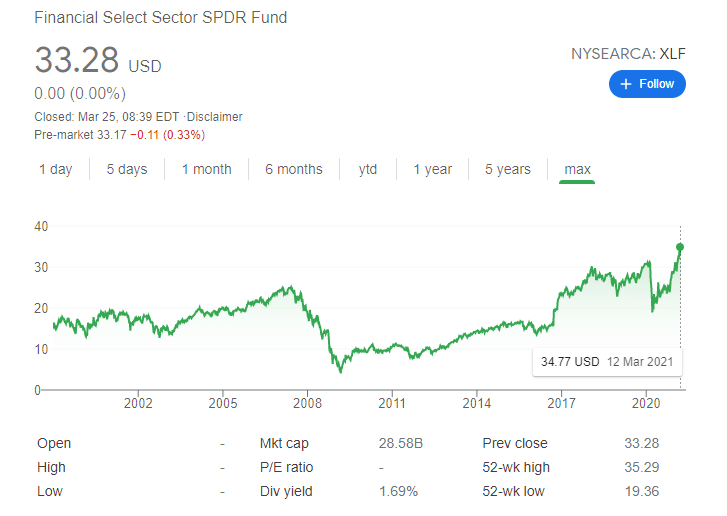

- Financial Select Sector SPDR Fund (XLF)

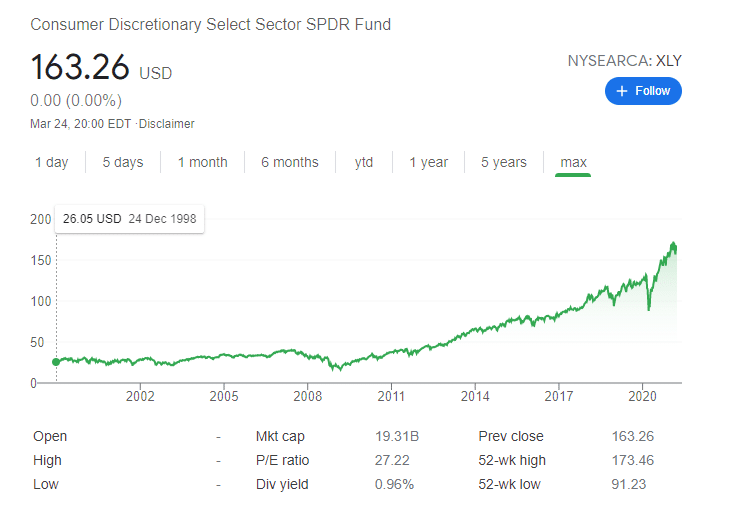

- Consumer Discretionary Select Sector SPDR Fund (XLY)

SPDR ETFs UK Reviewed

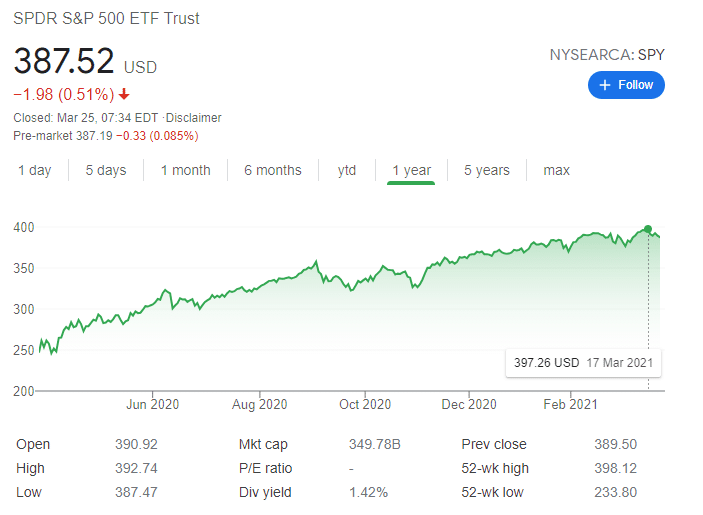

1. SPDR S&P 500 ETF Trust (SPY)

The SPDR S&P 500 Trust ETF, or SPY ETF for short, is said to be the personal favorite of legendary investor, Warren Buffett. This ETF aims to track the Standard & Poor Index, which consists of 500 mid- and large-cap stocks, which are selected by a committee depending on different factors, such as liquidity, industry, market size, and alike.

SPY ETF has been performing well over the last 12 months, going from $250 on March 25th to nearly $400 about a week ago. At the time of writing, it has corrected slightly, although this still seems like its typical fluctuations.

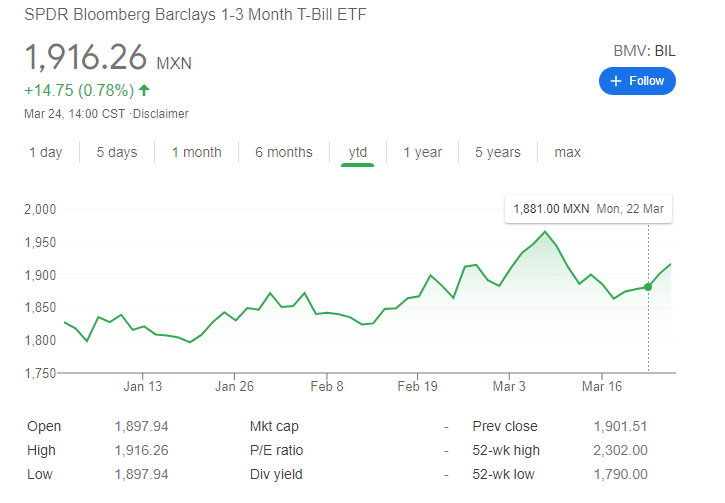

2. SPDR Bloomberg Barclays 1-3 Month T-Bill ETF

SPDR Bloomberg Barclays 1.3 Month T-Bill ETF, or BIL, is an ETF that tracks a market-weighted index of all publicly-issued, zero-coupon US Treasury bills with a maturity between one and three months. BIL takes an extremely short-term take on the Treasury, which is still rather valid, although it disagrees with how many others view the space. But, its approach results in less interest rate risk, while also offering lower yields.

The ETF has certainly performed rather well on a YTD chart, and while it has corrected since its YTD high, reached in early March.

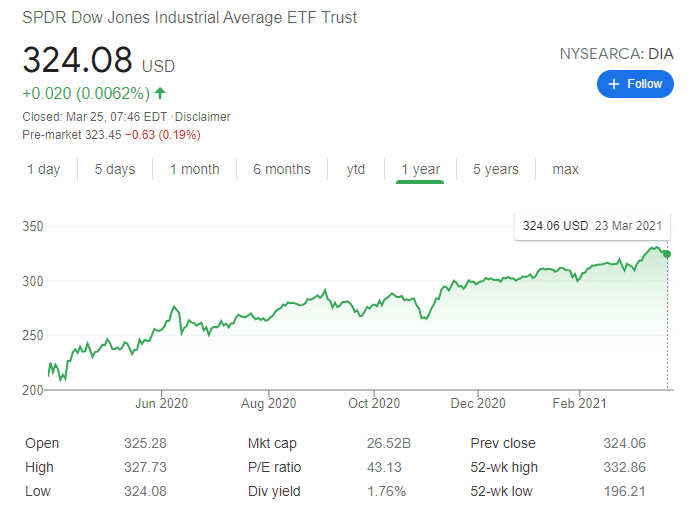

3. SPDR Dow Jones Industrial Average ETF (DIA)

Up next, we have SPDR Dow Jones Industrial Average ETF, trading under the ticker DIA: This is an ETF for those who wish to replicate or invest in the Dow Jones performance, which tracks the stocks of some of the largest firms. This fund is not extremely diversified, unlike most other ETFs, and it holds only 31 stocks, as opposed to 500 that we have seen with SPY. However, these stocks belong to strong and powerful firms, which makes DIA quite reliable.

The proof is its ever-growing price, which started an immediate recovery after the March 2020 stock crash caused by COVID-19 fears. Back then, DIA was trading at only $210. These days, it sits at $324.

4. SPDR Gold Trust (GLD)

In the fourth spot, we have SPDR Gold Trust ETF (GLD), which is another choice that tracks spot prices of gold. As such, it comes with less expenses and liabilities, using gold bars held in London vaults.

The ETF’s structure has reduced the difficulty of buying, storing, and insuring gold for investors by allowing them to invest in a product that behaves exactly like gold, but isn’t gold. This makes it a favourite among gold ETF enthusiasts.

As for its price it seems to be experiencing a bit of a hiccup on a YTD chart, but the 5-year chart shows that the price is still much higher than it was 5, 4,3, or even 2 years ago. In fact, gold reached its highest price in over a decade and a half during 2020, when the COVID-19 pandemic was at its worst.

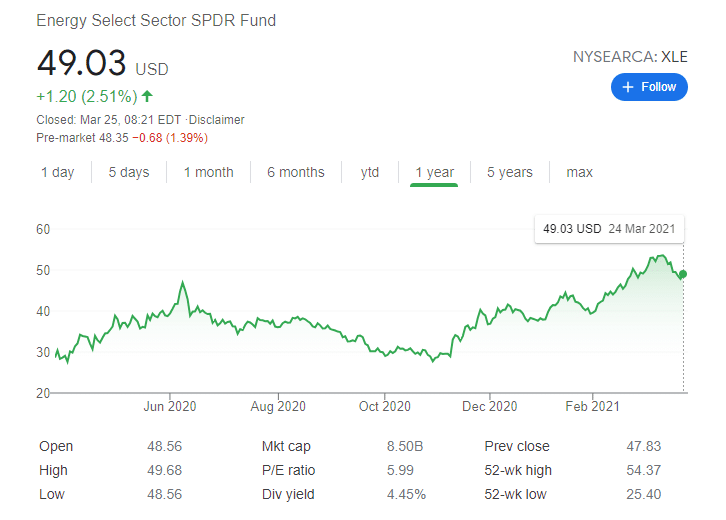

5. Energy Select Sector SPDR (XLE)

Next, there is XLE, also known as Energy Select Sector SPDR ETF, which is a high-yield exchange-traded fund that seeks to provide investment results that correspond to the price and yield performance of the Energy Select Sector Index, before expenses, of course. The Index itself seeks to provide a representation of the energy sector of the S&P 500 index.

The ETF’s goal is to provide exposure to firms in gas, oil, and similar consumable fuel, as well as energy services and energy equipment industries. By investing in it, investors can take strategic positions at a more targeted level.

Price-wise, the ETF is doing rather well, is currently experiencing a small correction after reaching a yearly high. It suffered when the COVID-19 pandemic emerged, but it has since recovered rather well.

6. SPDR Bloomberg Barclays High Yield Bond ETF (JNK)

In the sixth spot, we have SPDR Bloomberg Barclays High Yield Bond ETF, trading under JNK. As the ETF saw a major price crash last March when prices dropped due to coronavirus, only to make a full recovery and return to its previous levels before 2020 even ended, which is more than can be said for most ETFs.

If we take a look at its 5-year chart, we can see that the COVID-19 drop was nothing more than a hiccup and that the ETF is as stable as it has ever been in the last half a decade.

7. SPDR S&P Biotech ETF (XBI)

Next, we have SPDR S&P Biotech ETF, trading under the ticker XBI. This ETF recently reached its all-time high at $174, and since then, it has seen a correction to $131.

Besides, even after this correction, it is still very high, given its 15-year performance.

The ETF seeks to track a modified equal-weighted index, which provides the potential for unconcentrated industry exposure across small-cap, mid-cap, as well as large-cap stocks. Essentially, it allows investors to take tactical positions at a targeted level than traditional sector investing allows.

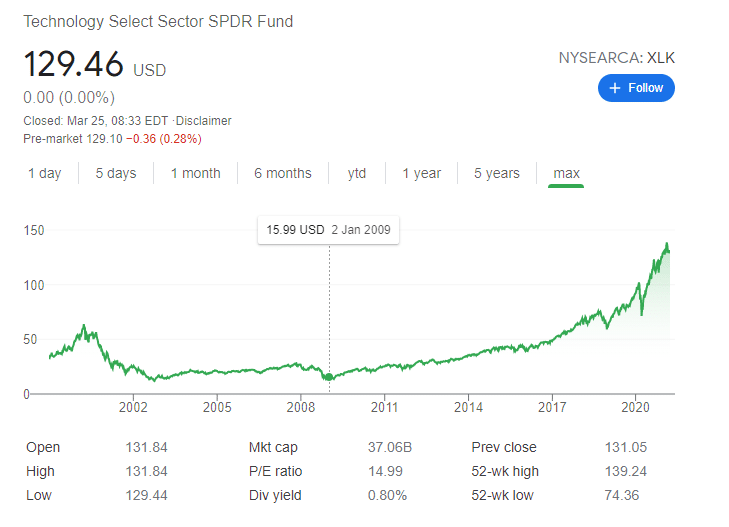

8. Technology Select Sector SPDR Fund (XLK)

Technology Select Sector SPDR ETF, also known as XLK, is an ETF that tries to reflect the performance of the Technology Select Sector Index. The index is comprised of the tech and telecom sector of the S&P 500, meaning that it tracks the stocks of firms that offer tech hardware, peripherals, storage, software, and more. It also focuses on firms offering diversified telecom services, communications equipment, internet software, IT services, semiconductors and related equipment, and alike.

9. Financial Select Sector SPDR Fund (XLF)

XLF is a fund that comprises firms included in the Select Sector Index. It aims to provide investors with exposure to companies related to financial services of any kind, including banks, capital markets, insurance firms, mortgage REITs, consumer finance, and more.

This is a very old ETF that has been around since the late 90s, and it has had two major hiccups over the last 23 years. The first one was in 2008, during the economic crisis that ended up giving birth to the cryptocurrency sector. The second one took place last year in March. However, the fund did not only recover from both — it actually reached its all-time high only about a week ago, on March 18th, 2021.

10. Consumer Discretionary Select Sector SPDR Fund (XLY)

The last on our list is XLY — Consumer Discretionary Select Sector SPDR Fund. This is another sector that has skyrocketed since the economic crisis of 2009, and it found its all-time high in early February of this year.

This is a fund that tracks assets from companies like Amazon, Tesla, Home Depot, McDonald’s, and other corporation giants.

Fundamentals of SPDR ETFs

Yes, as mentioned SPDR themselves are a way to get exposure to many different markets, while SPDR ETFs are an excellent way to use the benefits of exchange-traded funds, simultaneously. In fact, SPDRs are said to have pioneered ETFs with SPY and have an extremely long track record in the industry.

There is risk involved, naturally, as is always the case when investing and/or trading is involved. However, educating yourself on how to invest properly and learning how, when, and why to make a move will generally result in a positive outcome.

SPDR ETF UK Investment Platforms

There are numerous stock brokers and investment apps that allow for a way to access SPDR ETFs and invest, although it still matters which one you choose. Not all of these platforms are equally good, with some having larger or lower fees, some offer wider selections of SPDR ETFs to choose from than others, and alike. But, in order to help you save some time and spare you searching for trading platforms, we did the search for you. That way, you can focus more on studying the SPDR ETFs UK, and less on where to get them.

Conclusion

SPDR ETFs are a way for UK investors and traders to gain exposure to a variety of markets, and at the same time, enjoy all the benefits that SPDR and ETF trading bring, combined.

However, be warned that trading still comes at a risk and that you shouldn’t go in blind. Always study the market, analyze the prices, create forecasts, and make sure that you know what you are doing.