How to Invest in iShares UK Property UCITS ETF

Certain ETFs such as the iShares UK Property UCITS ETF allow investors to gain exposure to the real estate market in a straightforward and cost-effective way.

In this guide, we show you How to Invest in iShares UK Property UCITS ETF.

How to Invest in iShares UK Property UCITS ETF

The steps below show you how to invest in iShares UK Property UCITS ETF in as little as ten minutes:

- Step 1: Open an account with a iShares UK Property UCITS ETF broker of your choice

- Step 2: Fund your account through one of the available deposit methods

- Step 3: Search for the iShares UK Property UCITS ETF using the search bar

- Step 4: Open a position in the iShares UK Property UCITS ETF

- Step 5: Keep track of your position and collect dividend payments

Research iShares UK Property UCITS ETF

The iShares UK Property UCITS ETF is one of the property funds to invest in for a whole host of reasons. In this section, we dive into this ETF in detail, covering all of the bases so that you have the information you need to make an informed investment decision.

What is iShares UK Property UCITS ETF?

The iShares UK Property UCITS ETF is an exchange-traded fund that invests in several UK real estate companies and REITs, with the investment objective of providing diversified exposure to the real estate sector within the UK. This UK REIT ETF is provided by iShares, which is an element of BlackRock’s product range. BlackRock is an investment management company based in New York and is currently the world’s largest asset manager with around $8.67 trillion of assets under management! With a NAV of just over £695 million, this fund is a GBP-denominated ETFs for investing in the real estate industry.

As the iShares UK Property UCITS ETF is an exchange-traded fund, it works by pooling capital from various investors and then investing in a basket of securities to replicate the performance of a benchmark index.

In terms of the iShares UK Property UCITS ETF, the type of assets this fund invests in are all related to the UK real estate sector. As the ETF invests in a selection of real estate companies and real estate investment trusts (REITs), investors will tend to benefit most when this sector experiences positive growth across the board. Capital gains and current income through dividend payments are the two main ways investors will receive a return on their investment through this ETF.

Finally, the iShares UK Property UCITS ETF charges an annual fee referred to as the fund’s expense ratio. This ETF requires an expense ratio of 0.40% of your investment each year, which will help cover the fund’s annual operating expenses.

iShares UK Property UCITS ETF Current Price

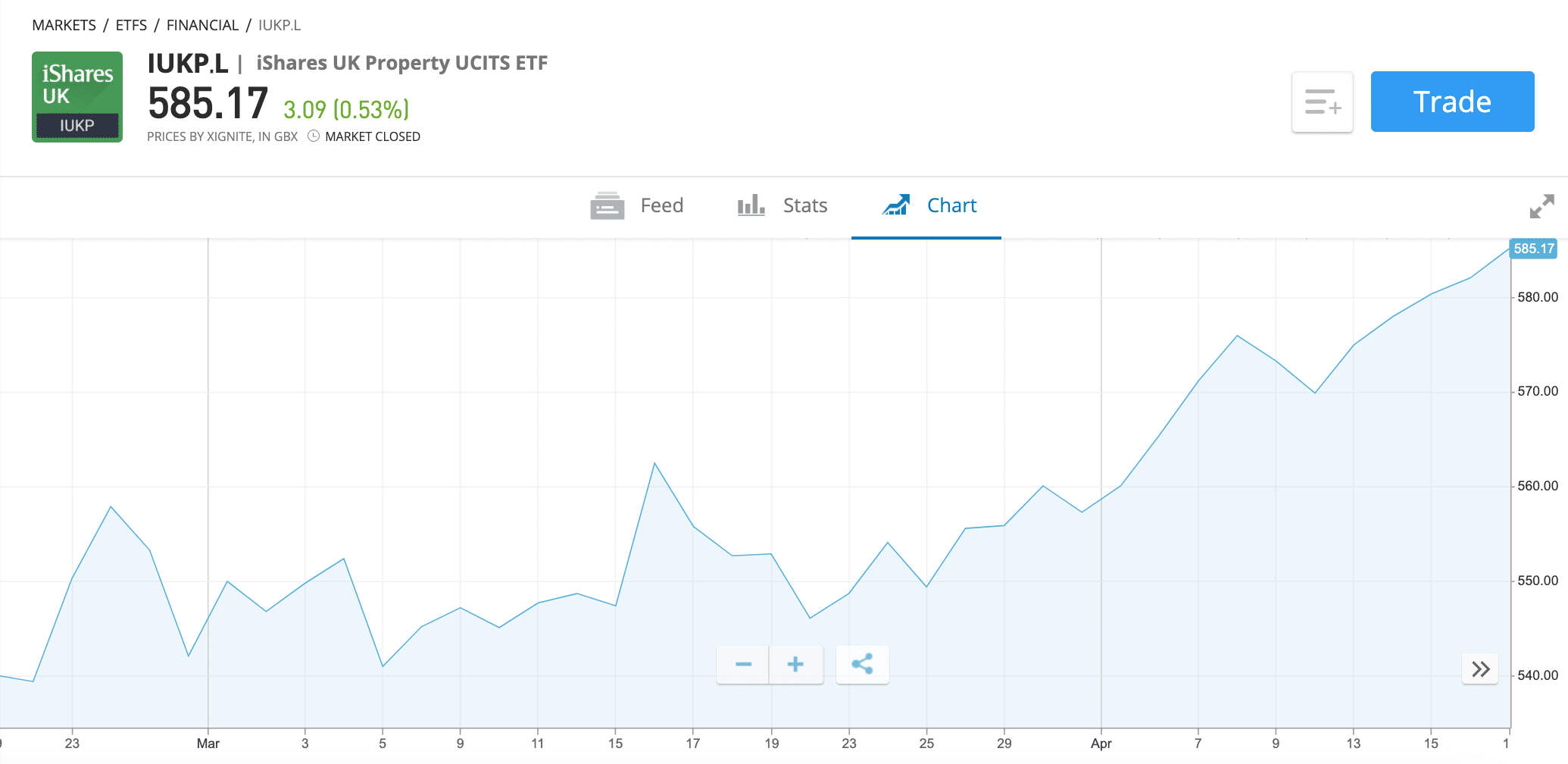

Now that you’ve got an idea of what the iShares UK Property UCITS ETF is and how it works let’s take a look at its current price. After a large crash in February and March of 2020 due to the volatility brought about by the Coronavirus pandemic, the fund has recovered remarkably well and is currently heading back to previous highs. The highs from mid-February last year sit around the 672 price point.

Currently, this ETF is consolidating around the 585 region. Still, with a solid upward trend on various timeframes. A recent report by the ONS stated that house price growth in the UK rose sharply towards the end of last year to the highest rate it has been since 2016.

Important Features of iShares UK Property UCITS ETFs

There are many key benefits of investing in this fund that will appeal to investors of various types and risk tolerances, making it one of the investment funds to add to investment portfolios. Most notably, it provides cost-effective exposure to the UK real estate sector, allowing investors to profit from the growth of companies operating within this industry.

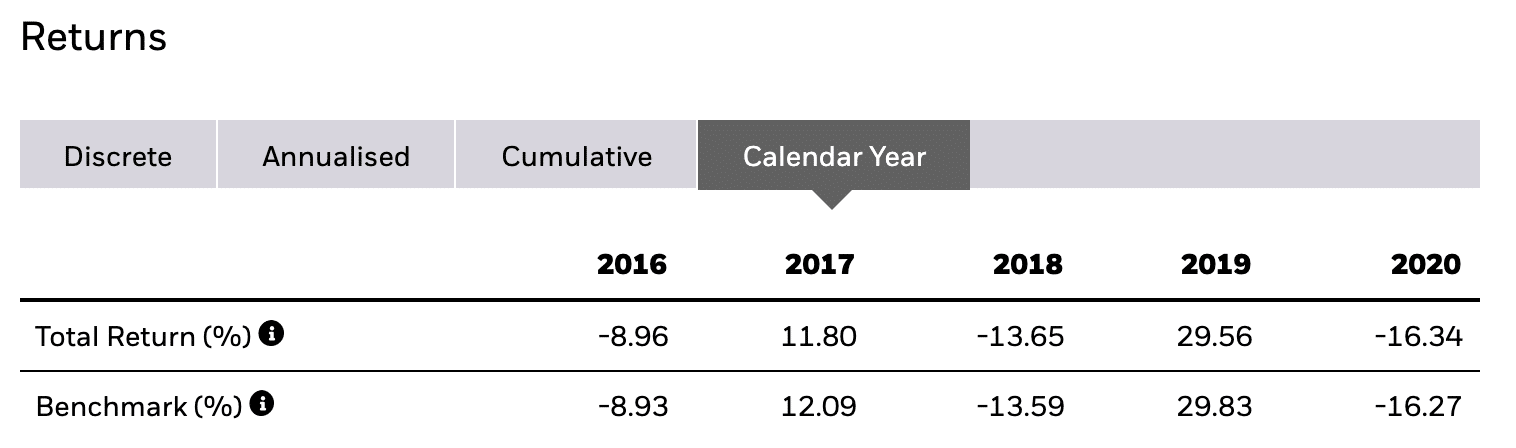

It’s important to note that the fund has experienced a negative return in three of the past six years; however, each time the fund produced a negative return, it bounced back strongly the following year with an even bigger positive return.

Currently, this ETF offers a yield of 1.79% each year, distributed every quarter. This yield is significantly higher than the various ISAs available on the market, which are usually capped around the 1.1% range. So, when you combine this yield with the additional capital gains.

Typically, real estate is not highly correlated with other asset classes such as equities, meaning that an investment in an ETF such as this will help diversify your portfolio if it is more equity-based. In turn, a more diversified portfolio will help optimise your portfolio’s risk/reward profile, leading to less overall risk and a better chance at total returns.

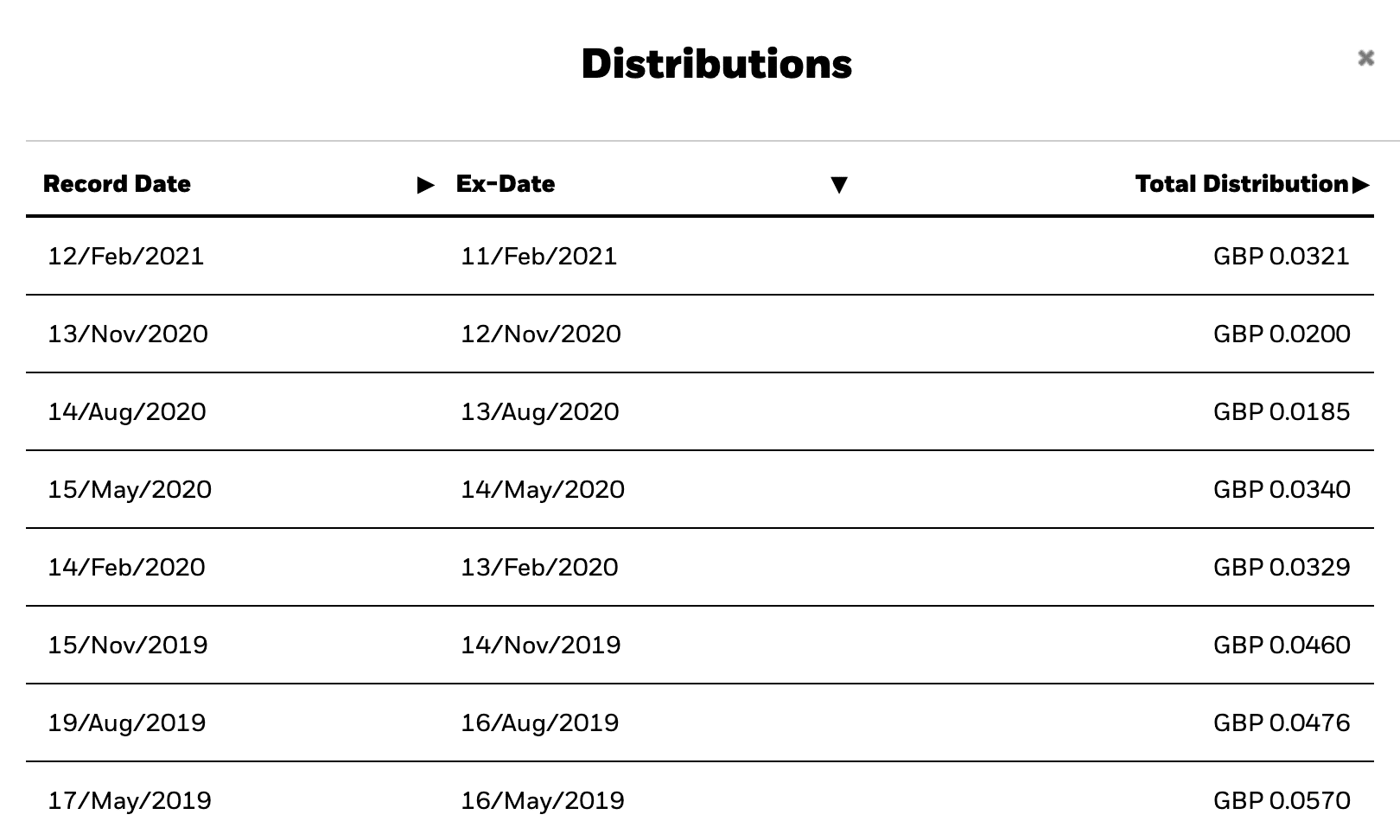

iShares UK Property UCITS ETF Dividend History

As touched on in the previous section, the iShares UK Property UCITS ETF provides a passive income stream through quarterly dividend payments to investors. Currently, this ETF is delivering an annual yield of 1.79% to investors, which is a solid level of current income. This has risen over the past year from 2020 levels, which were considerably lower due to the fund producing a negative return brought about through market volatility.

The most recent dividend payment came in February, where the fund distributed £0.03 per share to investors. This is around the same level paid last February, just before the crash in price occurred. However, looking at previous dividend payouts, it can be seen that the level of yield has decreased since 2018 when the fund was offering a yield of around 2% to investors on an annual basis.

With the iShares UK Property UCITS ETF recovering well over the past year, we could see dividends return to the levels they were at between 2017 and early 2020. Dividend yields tend to be affected by an asset’s performance; if an investment does well, it’ll have more capital to distribute back to investors, thereby increasing yield.

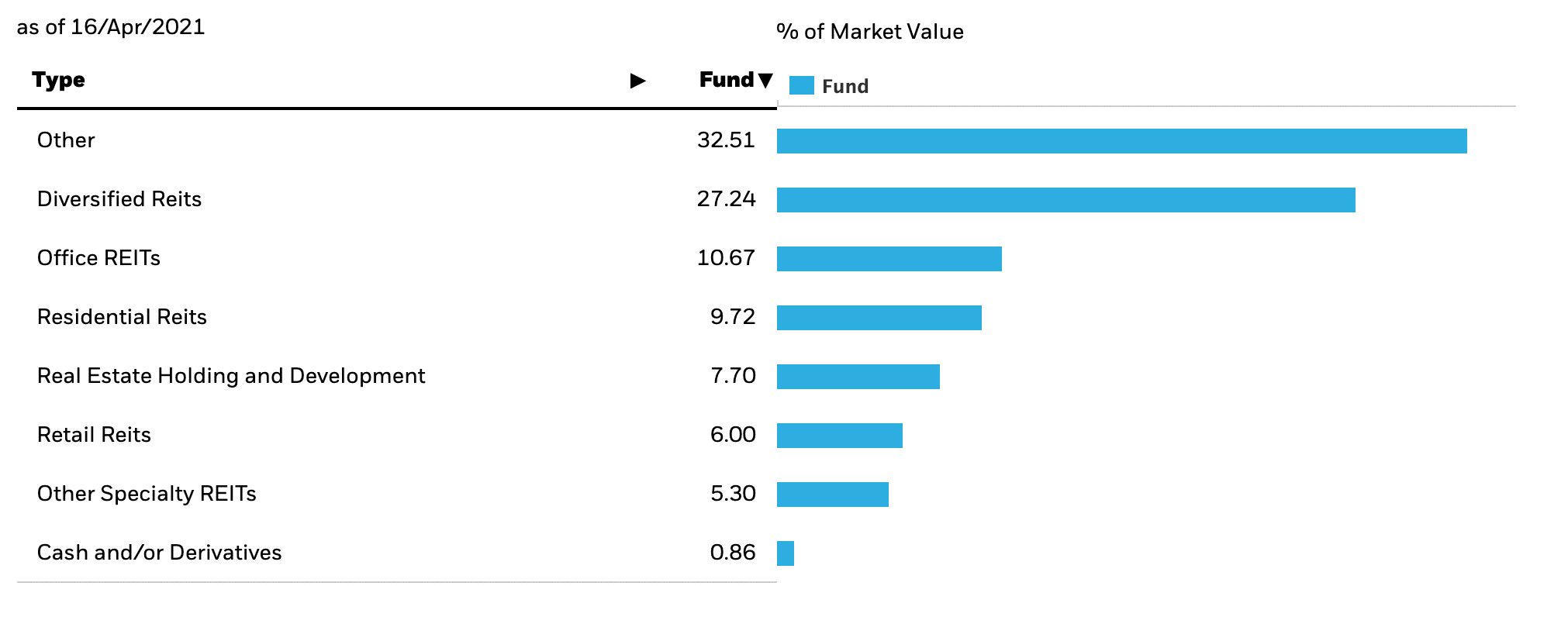

iShares UK Property UCITS ETF – Exposures and Sectors

As mentioned previously, the iShares UK Property UCITS ETF is primarily exposed to the real estate sector in the UK. To generate this exposure, the fund invests in a selection of listed real estate companies and REITs that are domiciled within the United Kingdom. Some of the fund’s holdings are as follows:

- SEGRO REIT PLC – 19.08%

- LAND SECURITIES GROUP REIT PLC – 8.36%

- BRITISH LAND REIT PLC – 7.76%

- UNITE GROUP PLC – 5.84%

- DERWENT LONDON REIT PLC – 5.50%

The above allocations represent a snapshot of the type of companies this ETF invests in. These companies and trusts derive most of their income from areas related to the real estate sector, such as generating cash flow from financing properties or the sale of land to property developers.

The majority of real estate equities that the fund invests in are mid-cap and constitute a blend of growth and value. Furthermore, the iShares UK Property UCITS ETF will appeal to investors concerned with ESG factors, as this ETF does not place capital in any companies that are morally or ethically unsustainable as stated by the MSCI.

In addition to equities, the fund invests in Real Estate Investment Trusts (REITs). These companies differ from typical real estate companies as they pool money from various investors (similar to the mutual funds) and then use that money to finance income-generating real estate projects. These projects could include the construction of apartments, hotels, office buildings, warehouses, and many other property types. In return for their investments, REITs will typically receive income through rent payments received from the properties.

Finally, in terms of geographic exposure, the vast majority of this ETF’s assets are based in the UK. Approximately 1.36% of the fund’s assets are based in the Channel Islands (Jersey), with 0.86% of assets being held as cash or other derivatives.

iShares UK Property UCITS ETF Key Facts

If you’re looking for a quick snapshot of the key facts related to the iShares UK Property UCITS ETF, then look no further. The table below showcases the most important information about this fund, allowing you to understand its current situation at a glance.

Key Facts:

[table] [tr][td]Ticker Symbol[/td] [td]IUKP[/td][/tr] [tr][td]Market[/td] [td]London Stock Exchange[/td][/tr] [tr][td]Domicile[/td] [td]Ireland[/td][/tr] [tr][td]Net Assets (£ Millions)[/td] [td]695[/td][/tr] [tr][td]Number of Holdings[/td] [td]40[/td][/tr] [tr][td]Expense Ratio[/td] [td]0.40%[/td][/tr] [tr][td]Asset Class[/td] [td]Real Estate[/td][/tr] [tr][td]Price Yield (last 12 months)[/td] [td]1.79%[/td][/tr] [tr][td]Distribution Frequency[/td] [td]Quarterly[/td][/tr] [tr][td]Year High[/td] [td]590.00p[/td][/tr] [tr][td]Year Low[/td] [td]430.65p[/td][/tr] [tr][td]YTD Return (as of 19/04/2021)[/td] [td]8.44%[/td][/tr] [/table]How to Invest in iShares UK Property UCITS ETF – Conclusion

As the UK real estate market keeps growing, ETFs such as the iShares UK Property UCITS ETF are becoming increasingly popular thanks to retail and institutional investors wishing to gain exposure to the sector.