Best Technology ETFs UK to Watch

As the tech market is exploding in recent years, investing in technology ETFs in the UK might be a popular decision for some investors. In this guide, we’ll list some leading technology ETFs and review each one of them.

List of 10 Popular Technology ETFs UK 2022 Based on Trading Volume

If you are looking for technology ETFs in the UK, below you can find a list of 10 tech ETFs based on trading volumes:

- Vanguard Technology ETF (NYSE: VGT)

- The Technology Select Sector SPDR ETF (NYSE:XLK)

- Invesco QQQ ETF

- Invesco China Technology ETF (NASDAQ: QQQ)

- ARK Autonomous Technology & Robotics ETF (BATS:ARKQ)

- ProShares Ultra Technology (NYSE: ROM)

- The ARK Fintech Innovation ETF (NYSE: ARKF)

- The Amplify Transformational Data Sharing ETF (NYSE: BLOK)

- Fidelity MSCI Information Technology Index ETF (NYSE: FTEC)

- ProShares UltraShort Technology (NYSE: REW)

As you can see from our list above, there’s a wide variety of technology ETFs to choose from in the US stock market. In that aspect, it can be a challenge to analyze each one of the ETFs and choose the one ETF that meets your investment goals.

To help you get more information about each technology ETF, we have reviewed and analyzed each one of them, including the price-past performance, the impact of the Covid-19 pandemic crisis, the expense ratio, and the dividend payout.

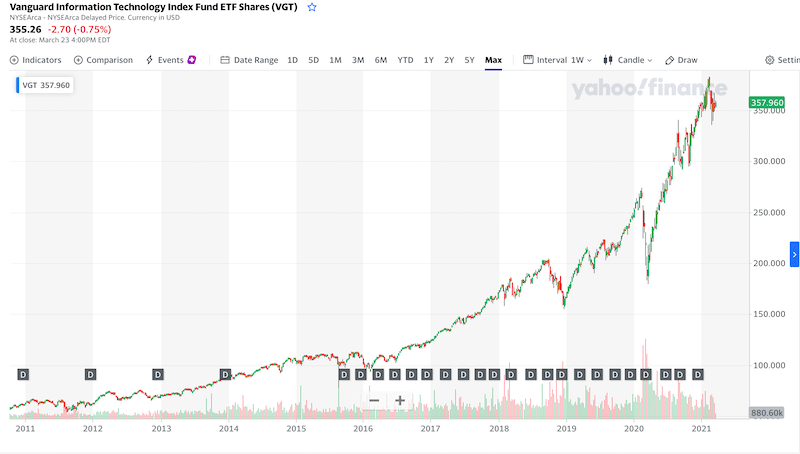

1. Vanguard Technology ETF

The Vanguard Technology ETF is one of the most popular ETFs in financial markets with total net assets of nearly $48 billion. VGT has major holdings in Apple (19.64%), Microsoft (15.90%), and some minor holdings in NVIDIA, Visa, Mastercard, PayPal, Intel, Adobe, etc. Overall, the fund has holdings in 343 tech-related companies. Additionally, the fund has a low expense ratio of just 0.10% and an annual dividend yield of around 1.2%.

The ETF is listed on the New York Stock Exchange under the ticker symbol VGT. It is a liquid ETF with an average volume of 600K, which makes it a underlying asset for day trading investment strategy.

In terms of market performance, the Vanguard Technology ETF has generated a 1-year total return of over 80% since the Covid-19 pandemic started in March last year.

Sponsored ad. Your capital is at risk.

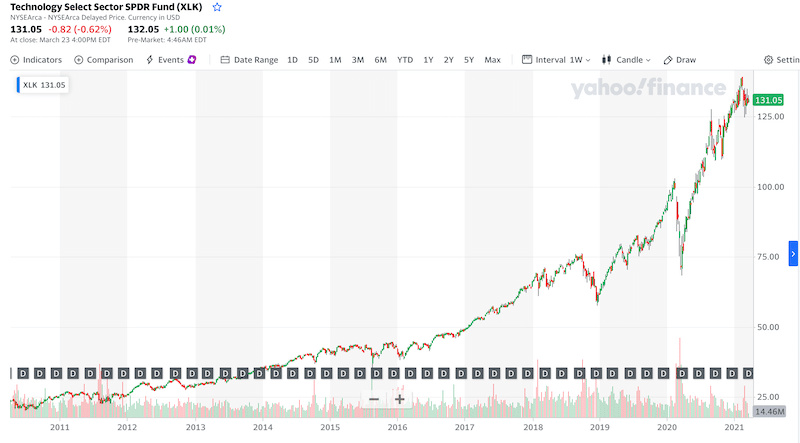

2. The Technology Select Sector SPDR ETF

Another technology ETF to consider is the Technology Select Sector SPDR ETF (NYSE: XLK). This fund simply tracks the market performance of the Technology Select Sector Index, which is comprised of big semiconductor technology and telecom companies of the S&P 500. The fund was founded way back in 1998 and has similar holdings to the Vanguard Technology ETF but it is more focused on large-cap technology companies. When we compare the two ETFs, XLK holds only 75 companies while the VGF has a number of 343 technology stocks. Nonetheless, the market performance of XLK is very similar to VGT with a 1-year return of 75%.

In terms of the specifics, the Technology Select Sector SPDR ETF has a market valuation of around $37 billion, and the fund charges 0.12% per year to manage the portfolio. Also, it pays an annual dividend of 1.3%.

Sponsored ad. Your capital is at risk.

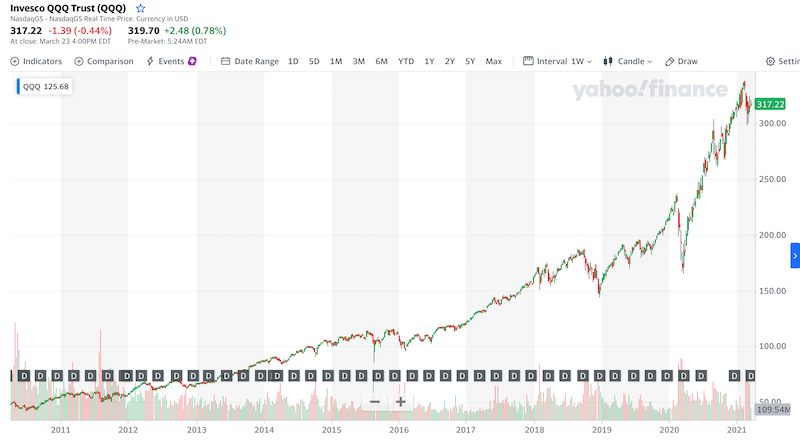

3. Invesco QQQ ETF

With about $150 billion in assets under management, the Invesco QQQ ETF is one of the largest Investment Trusts in the world. The idea of this fund is simple – the Invesco QQQ tracks the Nasdaq 100 index, so it basically invests in all the 100 largest technology companies in the world. This includes Apple, Microsoft, Amazon, Tesla, Alphabet, Facebook, PayPal, NVIDIA, Intel, and more.

The expense ratio of 0.20% is a bit pricey when compared to other ETFs on our list, however, it is still a fairly low management fee, in particular when taking into consideration an annual dividend payout of around 0.6%.

Sponsored ad. Your capital is at risk.

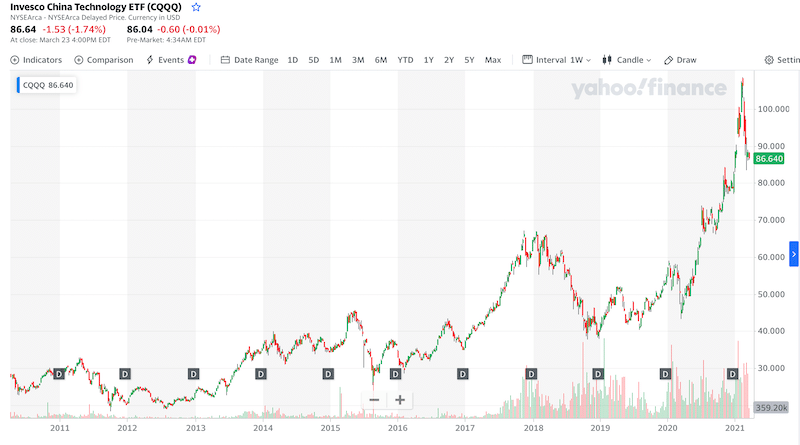

4. Invesco China Technology ETF

Like many other sectors, China is a technology leader. And, in recent years, Chinese companies have been further expanding their influence in the global economy, particularly in the eCommerce market.

This fund was established in 2009 and trades on NYSE under the ticker symbol CQQQ. Overall, it has 108 Chinese technology stocks and offers a way to get exposure to the Chinese tech industry. As a matter of fact, this fund outperformed the vast majority of other ETFs in our list, including the Invesco QQQ (NASDAQ100). The fund’s 1-year return stands at 90%, rising from 48 to around 84 at the time of writing.

Sponsored ad. Your capital is at risk.

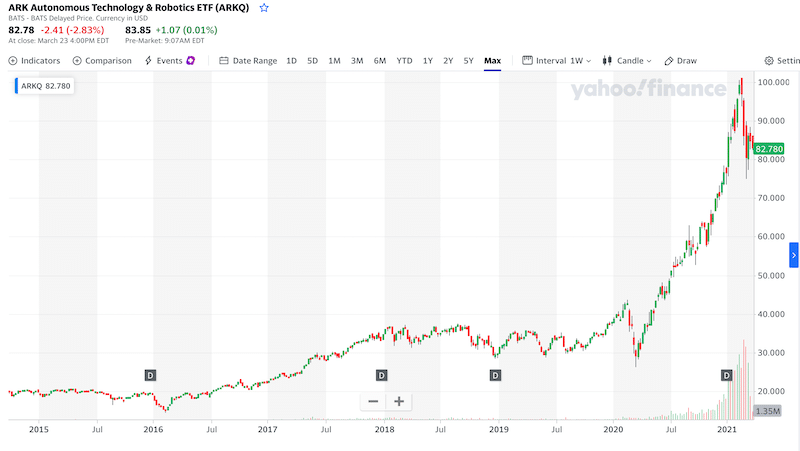

5. ARK Autonomous Technology & Robotics ETF

Different from most of the ETFs in our list, the ARK autonomous Technology & Robotics ETF is very unique in terms of vision and future goals. This ETF invests in companies associated with autonomous transportation, robotics and automation, 3D printing, energy storage, and space exploration.

Generally, if you are thinking to invest in autonomous cars, then this ETF is perhaps one option available in the market. The fund holds companies like Tesla, Baidu, Trimble, JD.com Inc ADR, Deere & Co, Kratos Defense & Security Solutions Inc, Alphabet Inc Class C, Teradyne Inc, etc. From the previous year, the fund’s 1-year return stands at 188.08%, largely due to the incredible surge of the TSLA stock of 507% (1-year return).

Sponsored ad. Your capital is at risk.

6. ProShares Ultra Technology

The ProShare Ultra Technology ETF seeks a return that is 2x the return of its underlying benchmark, the Dow Jones U.S. Technology Index. By using leverage with an ETF, you can increase your returns but also your potential losses. This means that while it offers high rewards it also carries high risk.

The fund has a total number of 158 companies and a modest net asset of nearly 700 $million. Crucially, this ETF is a bit more expensive than some of the other technology ETFs out there with an expense ratio of 0.95%. Nonetheless, with a potential annual return of around 235%, the expense ratio is obviously not a big issue.

Finally, investing in ProShare Ultra Technology ETF enables investors to get a yearly dividend yield of 0.8%. Additionally, if you decide to invest in this fund via eToro, which is one of the few online trading platforms in the UK allowing users to trade this ETF, you’ll be able to trade with additional leverage of 5:1.

Sponsored ad. Your capital is at risk.

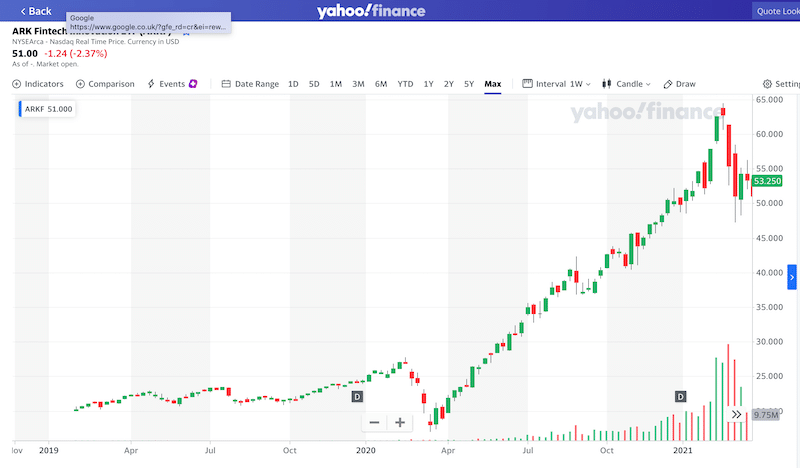

7. The ARK Fintech Innovation ETF

The ARK Fintech Innovation ETF is a very interesting fund that invests at least 80% of its assets in financial services technology innovation companies. As such, it holds stocks like Square Inc A, PayPal, Zillow Group Inc C, Silvergate Capital Corp Class A, Intercontinental Exchange Inc, Tencent Holdings Ltd ADR, Sea Ltd ADR, Pinterest, Shopify, and more.

As a result of the e-Commerce boom since the coronavirus pandemic emerged, the fund has gained an outstanding return of over 192% since March 2020. It also has an expense ratio of 0.75%, and an annual dividend yield of 0.37%. Like many other ARK funds, the ARK Fintech is known as an aggressive fund and is most suited for investors that want to get exposure to Fintech solutions and online applications. All in all, it holds 47 stocks in its portfolio and provides investors with a diversification of risk in this fund.

Sponsored ad. Your capital is at risk.

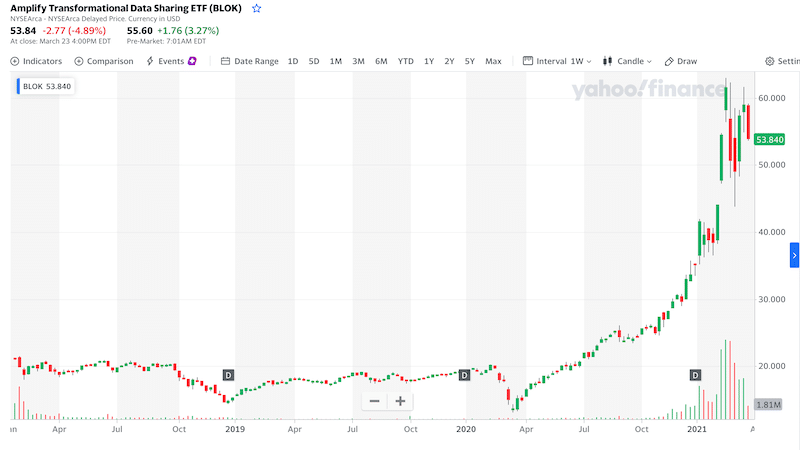

8. The Amplify Transformational Data Sharing ETF

This ETF offers investors a way to get exposure to companies that are engaged in blockchain technology development. The BLOK fund is listed on NYSE and has a market valuation of around $1.1 billion. Some of the ETF’s holdings include MicroStrategy Inc Class A, Argo Blockchain PLC, HIVE Blockchain Technologies Ltd, Riot Blockchain Inc, Grayscale Bitcoin Trust (BTC), and more.

With the hype around bitcoin and blockchain technology, it might be worth considering the Amplify Transformational Data Sharing ETF. The fund has generated a 1-year return of over 300% and its YTD return currently stands at 55%. Further, the fund offers a 1.23% annual dividend yield and carries an expense ratio of just 0.71%.

This fund provides investors the opportunity to invest in bitcoin and Blockchain-related companies.

Sponsored ad. Your capital is at risk.

9. Fidelity MSCI Information Technology Index ETF

The Fidelity MSCI Information Technology Index ETF (NYSE: FTEC) has an extremely low expense ratio of just 0.08% and a 1-year return of over 90%. This MSIC world index ETF tracks the performance of the MSCI USA IMI Information Technology index, which is designed to capture the large, mid, and small-cap US technology companies.

The fund is somewhat similar to NASDAQ 100 – it has major holdings in Apple, Microsoft, NVIDIA, Visa, Mastercard, PayPal, Intel, Adobe, Salesforce.com, Cisco Systems, and more. Overall, the FTEC has a total of 332 stocks in its portfolio.

Sponsored ad. Your capital is at risk.

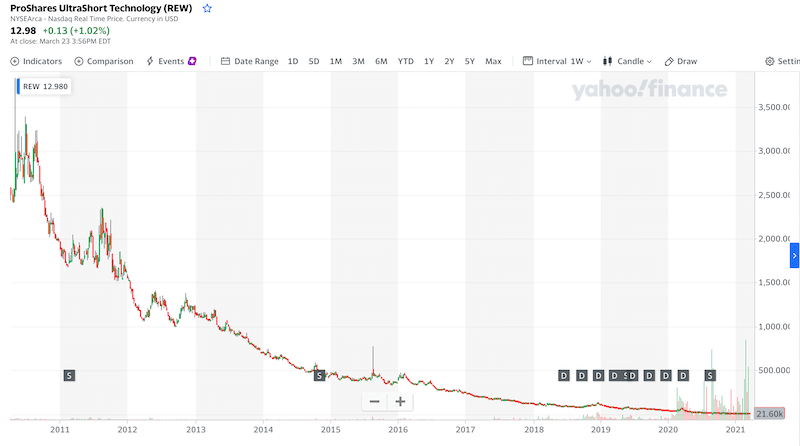

10. ProShares UltraShort Technology

Opposite to the ProShare Ultra Technology, this ETF corresponds to two times the inverse (-2x) of the daily performance of the Dow Jones U.S. Technology Index. This means that not only you’ll make a profit when tech stocks fall but you are actually invested in a leverage position.

For those unaware, short selling is the practice of selling an asset that you do not own, with the intention to buy it back at a lower price and hence make a profit when the value of an asset drops. In that regard, there are two options to short sell the tech sector – the first is by buying put options on one of the tech-related indices and the second option is to buy an inverse ETF like the ProShares UltraShort Technology ETF.

What’s more? The ETF is listed on the NYSE under the symbol REW. It has an expense ratio of 0.95% and a total net asset of approximately $7 million. Obviously, the fund has had a negative return over the past year of around -80%.

Sponsored ad. Your capital is at risk.

Fundamentals of Technology ETFs

Technology stocks have always been the most dynamic of all the sectors and typically, technology ETFs offer investors a lot of opportunities. We very often hear stories about people who made a investment by buying tech stocks like Apple, Google, Microsoft, Tesla, and many other technology companies. And, this trend is still going strong.

In general, technology public traded companies can be everything from small start-up companies, to mid-size and large-cap firms like Amazon, Alphabet, Apple, and Tesla.

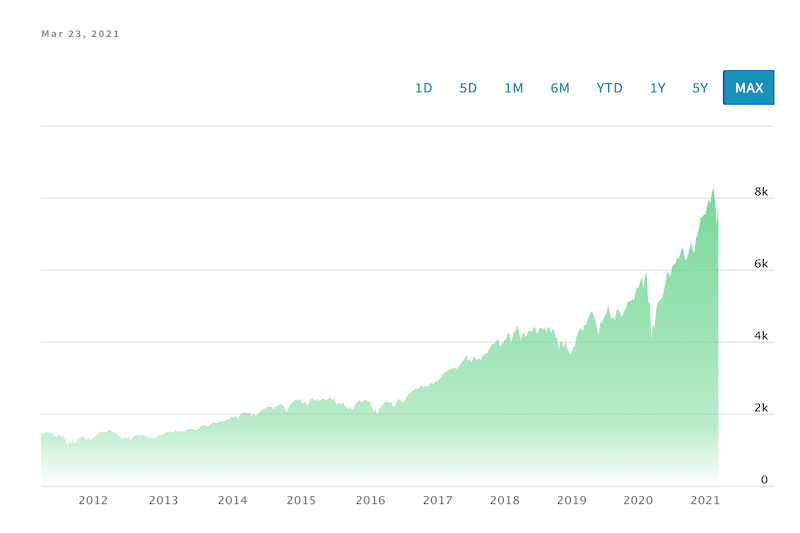

As for tech stocks – many analysts are trying to figure out the tech boom in recent years, particularly since April 2020 when the coronavirus pandemic emerged. Some even believe that there’s currently a bubble in US tech stocks, much like the famous dot.com bubble in 2000. A look at the chart below of the NASDAQ-100 Technology Sector Index (NDXT) shows that tech stocks are indeed in an incredible run.

Ironically, the coronavirus pandemic has changed the behavior toward online channels and increased the sales of most technology companies around the world.

Obviously, you can find many generic ETFs to invest in like the S&P 500 ETFs, oil ETFs, gold ETFs, and silver ETFs. However, despite the high volatility, the tech sector is the most valuable and dominant of all other sectors.

ETF Brokers

As we mentioned previously in our guide, you need to find a reliable and trusted trading platform in order to invest in technology ETFs. There are many factors to consider when you look for a stock broker or stock app such as the selection of assets, the fees and commissions, and the tools and platform provided by the brokerage firm.

To narrow down your search results, below we review two online trading platforms in the UK to buy and sell technology stocks and ETFs.

1. eToro

When it comes to technology ETFs at eToro, the broker offers a selection that includes Vanguard Technology ETF, Invesco QQQ, Invesco China Technology ETF, the Technology Select Sector SPDR ETF, ARK Autonomous Technology & Robotics ETF, the Amplify Transformational Data Sharing ETF, and more. Crucially, eToro offers leverage of 5:1 on ETFs and stocks, so you’ll be able to invest in these ETFs with a portion of just 20% of the total value of the transaction.

Being a CFD platform, eToro also does not charge any trading fees like traditional brokerage firms. Also, there are no account management fees, rollover fees, and no ticket fees. Instead, it only charges the buy and sell spread.

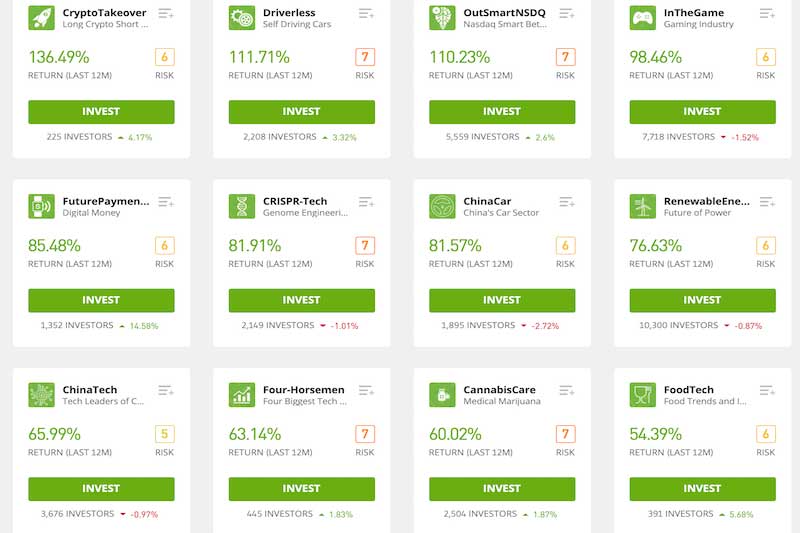

Besides ETFs, eToro also offers trading on FX currency pairs, commodities, stocks indices, cryptocurrencies, and stocks. But another unique way to get exposure to technology stocks on eToro’s platform is by buying built-in managed portfolios offered by the broker’s analysts. For example, you can invest in the following portfolios: Driverless, Crispr, FoodTech, DroneTech, BigTech, and FourBiggestTech.

Furthermore, eToro’s popular feature is the social trading tools that are useful for beginner investors. By using the famous CopyTrade tool, users at eToro can basically share trading ideas and essentially apply ‘social trading’ activity.

In terms of getting started with eToro, you need to meet a minimum deposit requirement of £140 if using the Standard account or a minimum of 5000 USD (which is around 3600 GBP) if you want to use the CopyPortfolio service. The FCA regulated broker supports a range of payment methods including PayPal, credit and debit card, bank wire transfer, Skrill, and Neteller.

Sponsored ad. 78% of retail investors lose money trading CFDs at this site

Conclusion

Tech stocks have always been a huge part of that revolution and in the center of the stage. As such, investing in technology ETFs could be a long-term investment. Otherwise, if you have concerns about a tech stock bubble coming soon, you can use an ETF that enables you to make a profit when prices of tech stocks fall.