How to Buy Rio Tinto Shares UK – With No Commission

Having recently hit all-time highs, Rio Tinto shares have gained a lot of attention in the financial media as the mining giant ramps up operations in the wake of the pandemic lockdown. With an attractive dividend yield and potential for further capital growth, Rio Tinto shares look set to become increasingly popular with investors worldwide as we progress through 2021.

In this guide, we discuss How to Buy Rio Tinto Shares UK in detail, analysing the company’s shares and showing you how to invest in Rio Tinto with an FCA-regulated broker – all without paying a penny in commissions or fees.

Step 1: Choose a Stock Broker

When you decide to buy Rio Tinto shares UK, it’s essential to choose a broker that has a solid reputation and a low-cost fee structure. There are many brokers on the market these days, all competing with one another for market position – so you must consider all of your options and partner with a broker that is right for you.

With that in mind, the sections below will discuss two of the best trading platforms available in the UK for buying Rio Tinto shares. Both of these platforms are reliable and low-cost and allow you to invest in Rio Tinto quickly and easily.

Research Rio Tinto Shares

When you begin equity trading, it’s essential to research the asset you are interested in to ensure you are making an effective investment decision. Areas such as what the company does, the company’s price history, and whether the company pays a dividend are all things you should look out for.

To make this research process more straightforward, this section will explore all of the key areas you need to be aware of before you buy Rio Tinto shares UK, ensuring you can make an informed investment.

What is Rio Tinto?

Rio Tinto PLC is an Anglo-Australian mining corporation with headquarters in London and Melbourne. Currently the world’s second-largest mining and metal’s company behind rivals BHP, Rio Tinto were initially formed way back in 1873 when a group of investors purchased a mine located on the banks of the Rio Tinto river in Spain.

Over the next 130 years, the company has grown massively and is now one of the main producers of iron ore, copper, diamonds, and uranium globally. At the time of writing, Rio Tinto has a market cap of just over $137 billion.

Rio Tinto’s primary business is in the mining of raw materials such as the ones listed above. According to NS Energy, their main product is iron ore, with the company producing just under 286 million tonnes in 2020. This makes them the second-largest iron ore producer globally, just slightly behind Brazilian mining company Vale.

In addition to the mining of raw materials, Rio Tinto also performs some processing services. These involve taking some of the raw materials that are mined and processing them into more usable or valuable commodities. For example, Rio Tinto will smelt some of the bauxite they mine into aluminium, which is in higher demand. Processing activities take place at dedicated factories that Rio Tinto operate in various locations across the globe.

Also, through their mining operations, Rio Tinto produces other metals as by-products such as gold and silver. Furthermore, minerals including sulphuric acid and zinc are also produced during the mining process. These metals and minerals are then sold to other businesses that use them in the manufacturing process, which creates an additional revenue stream for Rio Tinto.

Currently, Rio Tinto is listed on both the London Stock Exchange under the ticker ‘LSE: RIO’ and the Australian Securities Exchange under the ticker ‘ASX: RIO’. Rio Tinto is also a component of the FTSE 100 index in the UK. In addition to this, Rio Tinto’s shares are also traded on the New York Stock Exchange through American depositary receipts, allowing Americans to trade foreign companies.

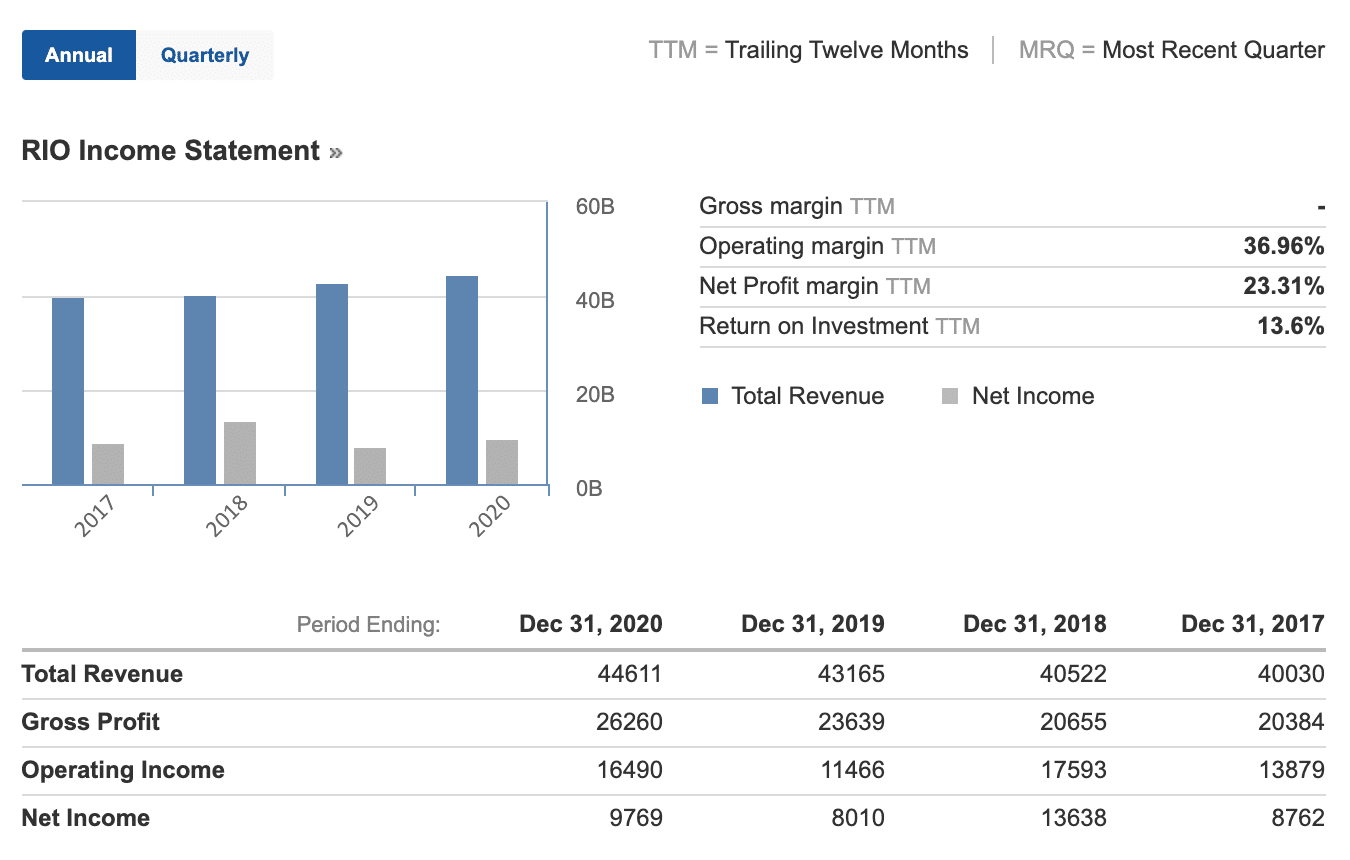

Recently, Rio Tinto has performed admirably in a financial sense and generated $44.6 billion in revenue in 2020. After expenses, Rio Tinto produced a net profit of $9.8 billion for the year, a solid increase from the year previous. Operating margins are currently estimated at 28% (a rise of 4% from 2019).

Rio Tinto Share Price

When stock trading, it’s essential to look at a company’s current price and its past performance to get an indication of the market sentiment surrounding its shares. At the time of writing, the Rio Tinto share price is 6,023p per share, representing a 7.6% increase from the price at the beginning of the year. Price is also up around 49% from this time last year.

Notably, the Rio Tinto share price recently reached an all-time high of 6786p which occurred on the 10th of May 2021. This was the culmination of a solid bullish run that began back in March 2020 – right at the onset of the pandemic. Performing as well as they have during the Coronavirus lockdown shows how robust Rio Tinto are as a company and how their operations can flourish during times of uncertainty.

Digging into the financials a bit more, it’s valuable to take a look at Rio Tinto’s price to earnings ratio (P/E) and their earnings per share (EPS). These two metrics help provide further insight into the value of their shares and how profitable the company is. At the time of writing, Rio Tinto’s P/E ratio stands at 14.37, according to data from YCharts.

This P/E ratio is calculated by dividing the Rio Tinto share price by the company’s earnings per share and provides a way of valuing a company’s shares. Usually, the P/E ratio is compared to previous years or to competitors’ P/E ratios to get an idea of where the company stands. Rio Tinto’s P/E ratio is up around 50% from last year, showing how well the company has performed. However, it is still below BHP’s P/E ratio of 22.09.

In terms of EPS, Rio Tinto’s EPS metric was $5.99 at the end of 2020. This is calculated by dividing the company’s overall profits by the number of shares outstanding. Put simply, it gives an indication of a company’s profitability. Looking at Rio Tinto’s EPS, this shows a solid increase from their EPS of 4.87 at the end of 2019. Furthermore, their EPS is considerably higher than BHP’s, which is only 2.75.

Rio Tinto Shares Dividends

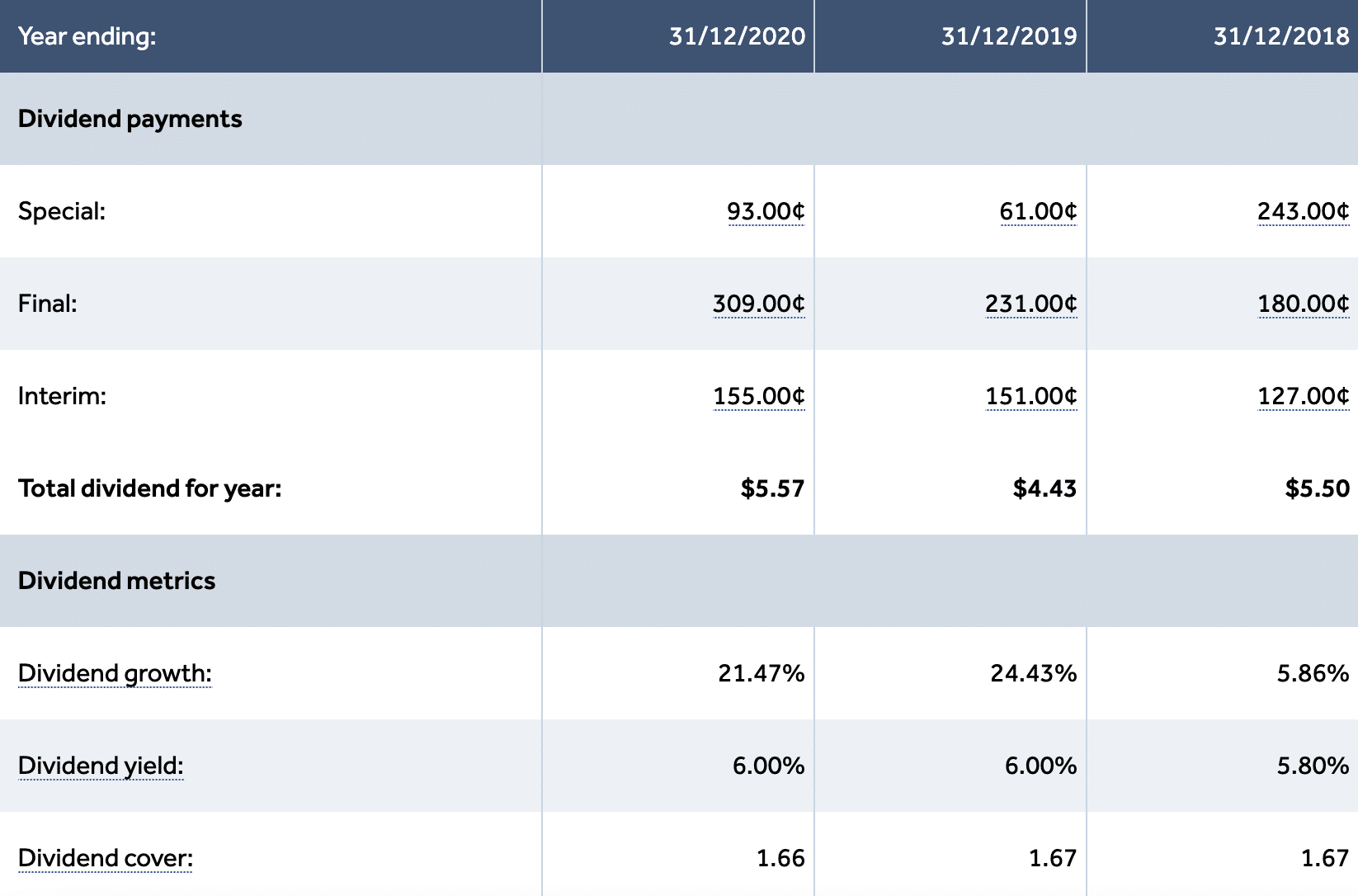

If you are looking for one of the best dividend stocks, then Rio Tinto certainly fit the bill. Typically, the company will make dividend payments twice per year, in the form of an interim payment and a final payment. Interim dividend payments are defined as payments made before a company has calculated its annual net profit; final dividends are those payments that are made after yearly profits have been determined.

Historically, Rio Tinto’s interim payment tends to be made in August, whilst the final payment tends to be made in March. Notably, the last three years have seen Rio Tinto also made a ‘special’ dividend payment – these payments are typically one-off payments when a company has generated substantial profits. So, in the previous three years, shareholders have actually received three dividend payments, which is great news for investors looking for passive income.

In terms of yield, as of the end of 2020, Rio Tinto’s dividend yield was calculated at 6%, according to Hargreaves Lansdown data. Although it remained the same as the previous year, Rio Tinto’s dividend has grown substantially since 2016, when it was only 3.80%. This indicates that a company is prospering financially; if dividends keep growing, it means that profits are increasing, which ultimately is a positive sign for the company’s share price.

Are Rio Tinto Shares a Good Buy?

Now, let’s take a look at Rio Tinto’s prospects and determine whether it’s a good idea to buy shares in the company. As you can see from the previous paragraphs, Rio Tinto has performed very well in a financial sense in recent times and also pay a very attractive dividend yield. These factors combine to make the mining giant an excellent option to consider adding to your portfolio.

Financial Strength

Looking at Rio Tinto’s most recent annual report, you can see how well they performed in 2020. Net cash was up 6% from 2019, sales revenue was up 3%, and net profits were up a staggering 22%. These figures are more impressive given the considerable uncertainty in the world during 2020.

Much of the company’s solid performance can be attributed to rising prices of the metals that Rio Tinto produce – especially iron ore. Hargreaves Lansdown reported that iron ore mining accounted for over 75% of Rio Tinto’s profits in 2020, driven by demand from China and iron ore supply restraints. With iron ore prices recently hitting an all-time high, this is fantastic news for Rio Tinto going forward. If prices continue at the level they are at, it’s not unlikely that the company will showcase similar (or even better) revenues and profits for 2021.

Passive Income Stream

As noted earlier, Rio Tinto is one of the best ways to invest money if you are looking to generate consistent income payments. Their high dividend yield makes them a favourite for investors interested in creating a passive income stream – and there’s scope for yields to grow even further as we progress through 2021.

As economies reopen and businesses worldwide begin ramping up operations, this ultimately means that demand for various metals will inevitably increase. If this happens, it would be fantastic news for Rio Tinto as they will be well-placed to benefit from this increase in demand. Therefore, this would have a positive impact on free cash flow, which is the cash used to make dividend payments – leading to potential yield increases for shareholders.

Rio Tinto Shares Buy or Sell?

In summary, are Rio Tinto shares a buy or a sell? Through our extensive research of the company and its financials, we feel it’s the former. The attractive market conditions, combined with an impressive dividend yield, make Rio Tinto an exciting investment prospect for 2021.

The main reason Rio Tinto shares could represent a solid buy opportunity is the continued rise in the price of iron ore. With most of Rio Tinto’s profits being derived from mining and selling iron ore, this price rise is fantastic news for the company’s bottom line.

Furthermore, demand for iron is not just coming from China, but also from the US too; recent reports have stated that Joe Biden plans to spend up to $3 trillion on improving the country’s infrastructure, which would require a massive amount of metals to complete.

Furthermore, as the lockdown eases, countries such as Brazil will begin opening up, which will allow Rio Tinto to increase production levels around the globe. In turn, this will have a positive impact on revenues. If the company’s financials remain in a similar position to 2020, then the Rio Tinto share price will undoubtedly benefit.

Finally, if you are wondering how to invest in commodities, buying shares in Rio Tinto will provide an indirect way of gaining exposure to this sector. As the company’s share price is affected by commodity prices, an investment in Rio Tinto would offer an alternative way to get involved in that market. This factor, combined with Rio Tinto’s solid financials and impressive dividends, make an investment in Rio Tinto an exciting proposition for investors as we progress through 2021.

Buy Rio Tinto Shares With 0% Commission

As you have seen throughout this article, Rio Tinto’s shares can be thought of as an incredibly attractive buying opportunity for a wide variety of investor types. Whether you’re in the market for capital growth or are looking to generate a passive income stream through regular dividend payments, Rio Tinto shares have the versatility to help you towards your investment goals.

FAQs

Should I buy Rio Tinto Shares?

Ultimately, the decision of whether to buy Rio Tinto shares is yours alone; however, the outlook for the company is definitely positive. If iron ore prices continue to rise and the company's margins remain at the same levels, there's no doubt that profits will continue to increase – which could mean further bullish momentum for the stock price.

Do Rio Tinto shares pay a dividend?

Yes – Rio Tinto offers shareholders a dividend yield of 5.66%. This is usually distributed in semi-annual payments; however, the company has also paid an additional 'special' dividend in the past three years.

How do I buy Rio Tinto shares?

The easiest and quickest way to buy Rio Tinto shares is by using a reliable broker.

How much does it cost to buy Rio Tinto shares?

At the time of writing, it costs 6,023p to buy one share in Rio Tinto. In addition to this cost, some brokers will charge a commission or transaction fee.

What is the minimum amount of Rio Tinto shares I can buy?

Some brokers require you to purchase at least one share.