Best Dividend Stocks UK To Watch

Dividend stocks allow you to combine the fruits of capital gains and regular income payments. The dividends that you receive are a way for the respective company to share their earnings with stockholders.

In this guide, we explore some of the popular dividend stocks in the UK and review some reputable share brokers that allow investors to purchase dividend stocks.

-

-

What are Dividend Stocks?

As the name suggests, dividend stocks are shares that pay dividends. If you’re unfamiliar with what dividends actually are, they are simply a way for companies to share their surplus earnings with stockholders. That is to say, by holding just a single share, you will be entitled to dividends as and when they are paid by the company.

In order to set the scene, let’s look at a quick example of how a dividend stock works in practice.

- You hold 500 shares in BP

- In Q3 2020, BP announces that it is going to pay a dividend of 12p per share

- The distribution date is set for September 28th, 2020

- You hold 500 shares, meaning that you will be entitled to a dividend payment of £60

- When the dividends are paid by BP, this will be reflected in your stock broker account

As you can see from the above, the respective dividend-paying stock will announce how much it will pay, alongside the date on which it intends to do this. In theory, the better a company performs, the more it will release in dividends. However, this isn’t always the case.

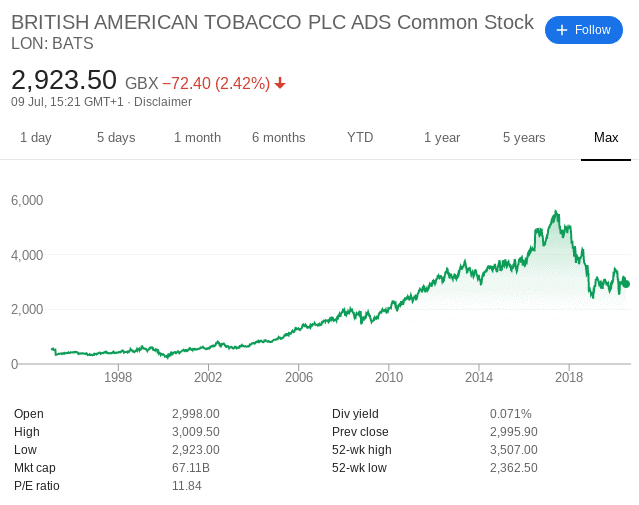

For example, when British American Tobacco shares went through a tough time between 2017 and 2019, it actually increased its dividend. This was to ensure that stockholders were still rewarded.

On the other hand, companies will sometimes suspend dividends when they are not performing well. This became a riff during the coronavirus pandemic, with many, many companies announcing a suspension of dividends until further notice.

Investing vs trading dividend stocks

There are two main methods that allow you to gain exposure to dividend stocks – investing in stocks and trading stocks. Below we outline the main differences between the two.

Investing in dividend stocks

Firstly, the traditional way is referred to as ‘investing in stocks’. This means that users who invest in these stocks will be purchasing them through a share dealing site, and actually own a percentage of the respective firm.

This also means that you will have a right to vote in shareholder meetings, as well as collect dividends when they are paid. This type of trading is suited for long-term investors that simply want to purchase shares and hold on to them for several years. Along the way, the investor will hope to grow their wealth through capital gains and dividends.

Trading dividend stocks

While investing in dividend stocks is suitable for those of you that want to play the long-term game, trading is a completely different kettle of fish. The overarching reason for this is that you will be speculating on the future direction of the dividend stock in question. In order to do this effectively, you will be utilizing stock CFDs.

Put simply, stock CFDs are tasked with tracking the stock price of the company. Crucially, you will not own the underlying stock, as you are speculating on its short-term price movement.

For example:

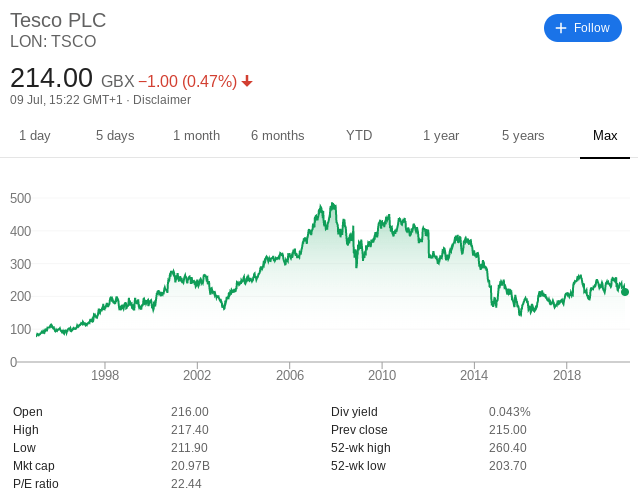

- Let’s suppose that you are trading a dividend stock like Tesco

- The current price of Tesco shares on the London Stock Exchange is 212p

- As such, the price of the Tesco stock CFD is also 212p

- If the price of Tesco shares go up by 1.4% on the London Stock Exchange, the CFD will also go up by 1.4%

Then, you need to determine which way you think the Tesco CFD stock will move.

- If you think the dividend stock CFD will increase in value, you place a ‘buy order’

- If you think the dividend stock CFD will decrease in value, you place a ‘sell order’

While trading dividend stocks, you will be able to apply leverage. This means that you have the opportunity to amplify your stakes, and effectively trade with more than you have in your account. In the UK, stock CFDs can have a leverage of up to 1:5 applied, and even more if you are classed as a professional trader. For example, if you trade Royal Mail stock CFDs at a stake of £300, this would permit a maximum trade size of £1,500 when applying leverage of 1:5. However, there is a lot of risk involved by leveraging your trade, since a loss in the trade could multiply losses by up to 5x as well.

In theory, by trading stock CFDs, you do not own the asset as this – won’t be entitled to dividend payments. However, some CFD brokers in the UK space actually adjust your account balance to reflect a dividend payment.

- For example, let’s suppose that you are long on a dividend stock CFD like Apple

- You have 10 contracts open, meaning you are trading 10 Apple stock CFDs

- Apple announces a dividend payment of $3.80 per share

- As such, your CFD brokerage account will be positively adjusted by $38 ($3.80 x 10 CFD contracts).

Dividend Stocks in the UK for 2021

So now that you know what they are, we are going to discuss some of the available dividend stocks in the UK market. As always, you are strongly advised to perform your own, independent research before buying specific dividend stocks. After all, the online stocks and shares arena is a subjective battleground.

Note: The dividend yield figures are based on the most recent distribution. Dividend yields go up and down depending on various factors, so never assume that you will be entitled to the same amounts as listed below.

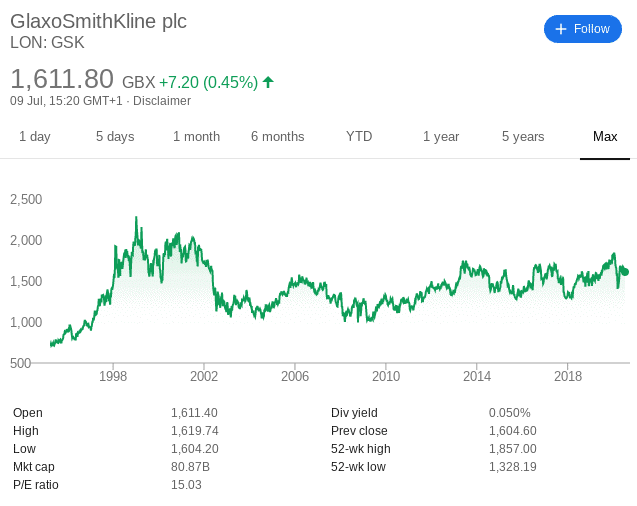

1. GlaxoSmithKline (GBX)

GlaxoSmithKline is a UK pharmaceutical company that has operations across most continents. The firm has a strong track record of paying dividends.

Although this was averaging over 6% in 2015, its most recent distribution stood at 4.5%.

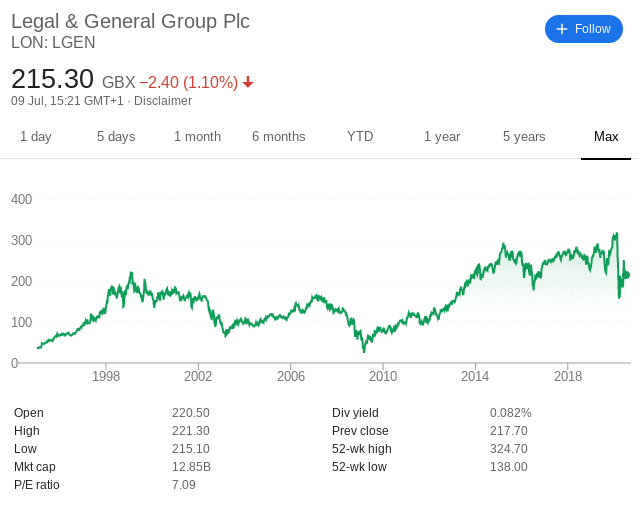

2. Legal & General (LGEN)

This particular dividend stock is a FTSE 100 constituent involved in the financial services space. Legal & General has a market capitalization of just over £13 billion and is behind a strong dividend policy in the UK.

In its most recent distribution, this stood at around the 8%-mark.

3. British American Tobacco (BAT)

We briefly mentioned British American Tobacco’s recent history of paying strong dividends. At a dividend payment of 53p per share, this works at a yield of approximately 6.9% – based on its current share price of just over £30.

At £30 per share, this payment is lesser than its 2017 peaks of £54.

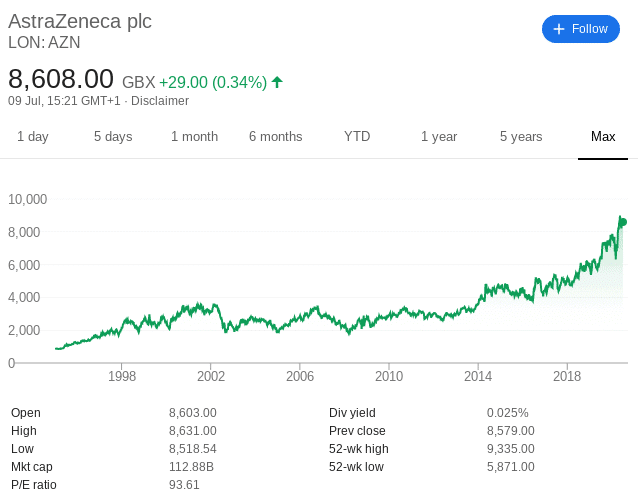

4. AstraZeneca (ANZ)

Much like GlaxoSmithKline, AstraZeneca is a major pharmaceutical company that is a leading player on the FTSE 100. In fact, with a market capitalization of just over £100 billion, this actually makes it the most valuable company on the FTSE as of July 2020.

As a strong and stable defensive stock, AstraZeneca is currently yielding just 2.5%, which is in and around the average of UK health companies.

5. GVC Holdings (GVC) – 2.2% Yield

GVC Holdings is a UK-based company that owns a variety of online and land-based gambling establishments. This includes betting shops like Ladbrokes and Coral, as well as online sportsbooks, casino, and bingo brands like bWin, Sportingbet, and Foxy Bingo.

The firm’s most recent dividend amounted to 18p per share, which, based on today’s stock price of 835p, amounts to a trailing yield of just under 2.2%. GVC Holdings has seen its stock price increase by almost 150% since March 2020.

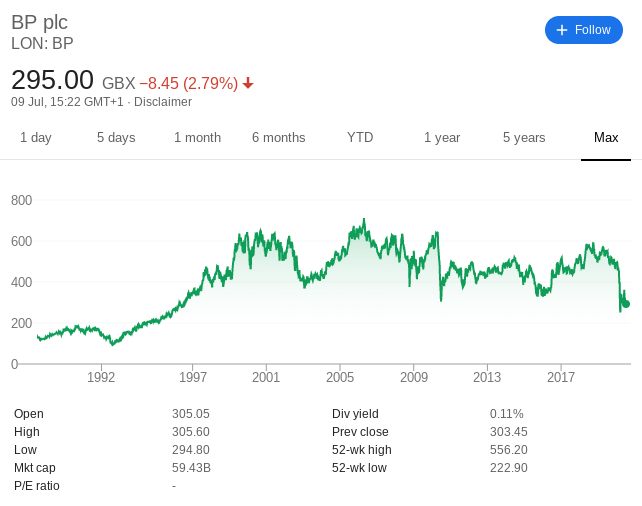

6. BP (BP) – 10.6% Yield

When BP last announced that it would be paying a dividend yield in excess of 10%, the general consensus was this was nothing short of unsustainable. Then, when the COV-19 pandemic brought demand for oil to record lows, the markets were all but certain that a dividend cut was inevitable.

However, while recognizing the wider challenges for the business, management at BP is adamant that a dividend cut will not be the case. As a result, it appears that an upcoming yield of 10.6% is in the making.

7. Tesco (TSCO) – 4% Yield

Supermarket giant Tesco is still the leading player in the UK grocery scene. Its most recent earnings report was super-positive, noting a sales increase of around 8%.

The firm is expected to pay a dividend payment at a trailing yield of 4%.

8. Unilever (ULVR) – 3.5% Yield

Consumer goods firm Unilever is a Jack of All Trades in the product department. The company offers major brands in the beauty, ice cream, energy drink, cleaning, and personal care sectors.

It’s latest dividend yields came at 3.35%.

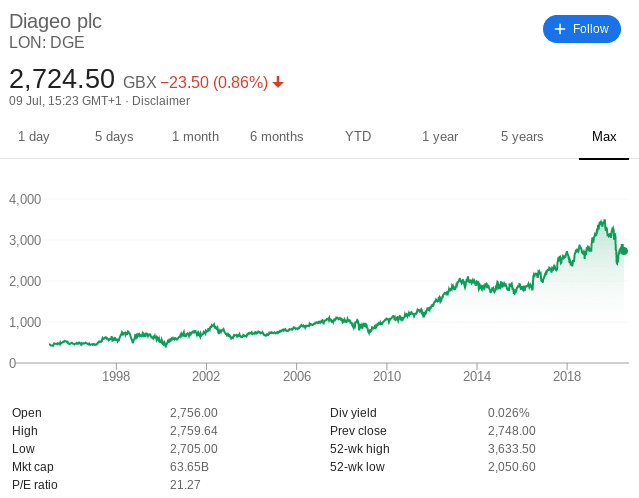

9. DIAGEO (DGE) – 2.7% Yield

DIAGEO is a multi-billion pound company that is behind some of the biggest names in the alcoholic beverage arena. This includes everything from Guinness, Captain Morgan, Jonnie Walker, Smirnoff, and Baileys.

This particular dividend stock is at a trialing dividend yield of 2.7%, based on current prices.

10. Vodafone (VOD) – 6.3% Yield

Vodaphone is one of the largest telecommunication companies globally – so it comes as no surprise to learn that the stock has a market capitalization of over £33 billion.

Vodafone currently pays a dividend yield of 6.3%.

Features of Dividend Stocks

So now that we have run through some of the popular dividend stocks on the FTSE 100, let’s take a look at different features and reasons to factor in while investing Dividend stocks.

1. Look at Historical Dividend Yields

Firstly,a firm’s historical payment policy is one feature which users may want to review prior to their investments. For those unaware, the dividend yield can be calculated by taking the total value of dividends paid through the year, and then divide that into its stock price.

For example, if Barclays paid out a total of 4p per share in dividends in 2020, and the shares are priced at 100p, this would translate into a dividend yield of 4%.

2. Yields Comparison to Market Competitors

Users may also want to compare the recent yields of the company to industry counterparts to get an example of the industry average. This normally would give users an idea of how much higher or lower a company’s dividend is, compared to other stocks in the same sector.

3. Free Cash Flows and Debt Levels

Although it is not an exact science, in theory, the better a company is performing, the more chance there is that you will receive a healthy yield. But, much of this is dependent on the amount of free cash flows that the company in question has.

In other words, if the firm is not planning to use its cash to invest in other business ventures, then it might decide to increase the size of its dividend. Users may want to look at what the firm’s debt-to-equity ratio is like.

Popular Dividend Stock Brokers in the UK

As noted above, there are countless UK stock brokers that allow you to purchase dividends stocks from the comfort of your home. While there are many choices available, this can make it difficult to find a platform that meets your needs.

Below we have listed some popular UK brokers that offer dividend stocks – either as a traditional investment or through stock CFDs.

1. Plus500

Plus500 is a CFD trading platform which is home to thousands of financial instruments, including over 2,000 stock CFDs. This covers both UK and international markets, so you will have access to a wide variety of economies.

Plus500 does not charge any trading commissions, and you will always have the option of placing a purchase or sell order. Leverage for UK retail traders is capped at 1:5 when trading stock CFDs, although higher leverage is available on other CFD asset classes.

You will need to meet a minimum deposit of £100, and supported payment methods include debit/credit cards, bank accounts, or Paypal. There are no fees to deposit and withdraw funds, which is an added bonus. Plus500UK Ltd is authorized & regulated by the FCA (#509909).

Sponsored Ad. 72% of retail investors lose money trading CFDs at this site

3. IG

IG was launched back in 1974, so it has over four decades’ worth of experience in the UK brokerage arena. IG stands out for its stock library of over 10,000 firms. Naturally, this includes companies listed in the UK, as well as several international markets.

Although IG isn’t commission-free, it does allow you to purchase dividend stocks from just £8 per trade. If you find yourself trading regularly throughout the month, this can be reduced to just £3. IG is also useful if you want to trade dividend stock CFDs.

You have the option to do this through its CFD trading platform, or via a spread betting facility. Deposits and withdrawals are facilitated by debit/credit cards or bank transfers, and account minimums start at £250. The broker is regulated by FCA, alongside a number of other licensing bodies. A mobile app is also available on both iOS and Android devices.

Sponsored Ad. Your capital is at risk.

How to Purchase Dividend Stocks in the UK

In this part of our guide, we are going to walk you through the process of purchasing dividend stocks. Although there are many UK stock brokers that offer dividend stocks, make sure to begin trading with a suitable stock broker that caters to all your investing needs.

Here are 4 simple steps to get started on your investment process:

Open Account

Head over to the homepage of your trusted broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Verification

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Invest in Dividend Stocks

Once your account has been funded, proceed to search for any dividen stock or any other stock you wish to purchase on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

Dividend stocks can be a source of passive income, should you manage to identify stocks which cater to your investment needs. You may also have the opportunity to re-invest your dividend payments into other stocks.

There are hundreds of UK-based dividend-paying firms to choose from, and many more located overseas. This can make it challenging to know which dividend stocks to purchase. With this in mind, users can choose to diversify their assets in various dividend stocks.

However, remember to only invest in stocks after conducting your own research.

FAQs

What are some popular dividend stocks?

Some FTSE 100 companies can pay over 10% per year, however many fall within the medium-to-high risk threshold. At the other end of the spectrum, strong and stable stocks with defensive qualities might pay a much lower yield. The important thing is that users must only invest in dividend stocks after conducting their own analysis and research.

Do penny stocks pay dividends?

Penny stocks are typically small companies that are not yet in a position to distribute cash to shareholders. As a result, very few penny stocks pay dividends.

Do CFD stocks pay dividends?

In theory, CFD stocks can pay dividends, but the process is slightly different. So, if you are going short on a dividend stock CFD, the respective dividend payment will be taken from your account. If you are long on a dividend stock CFD, the opposite will happen. As such, most CFD brokers are able to readjust your account, so for all intents and purposes, you will receive a dividend.

What does it mean when a company suspends dividends?

When a company is not performing as well as it would like, it might be forced to suspend dividends. This means that all dividend payments are off the table until further notice.

What are dividend aristocrat stocks?

If a dividend stock is referred to as an ‘aristocrat, this means that it has increased the size of its dividend for 25 years straight.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

Firstly, the traditional way is referred to as ‘investing in stocks’. This means that users who invest in these stocks will be purchasing them through a share dealing site, and actually own a percentage of the respective firm.

Firstly, the traditional way is referred to as ‘investing in stocks’. This means that users who invest in these stocks will be purchasing them through a share dealing site, and actually own a percentage of the respective firm.