Best Asian Stocks UK to Watch

Most investors in the UK will stick with FTSE 100 stocks. However, the FTSE is worth less today than it was five years ago. As such, those focusing exclusively on domestic stocks are not getting the sort of returns that are available elsewhere. With that in mind, some UK investors are watching Asian stocks.

In this guide, we explore some popular Asian stocks in 2024 that many investors have added to their watchlists.

List of Popular Asian Stocks in 2022.

Here’s a breakdown of 10 popular Asian stocks based on trading volume:

- Alibaba

- Tencent

- Nintendo

- OCBC Bank SGX

- Kunlun Energy

- Sony

- Melco Resorts & Entertainment

- Pinduoduo

- Meituan

- Hong Kong Exchanges and Clearing

Asian Stocks UK Reviewed

Make no mistake about it – there are thousands of stocks listed in the Asian markets – most of which you can access from the UK. This can make it a daunting process when deciding which shares to buy.

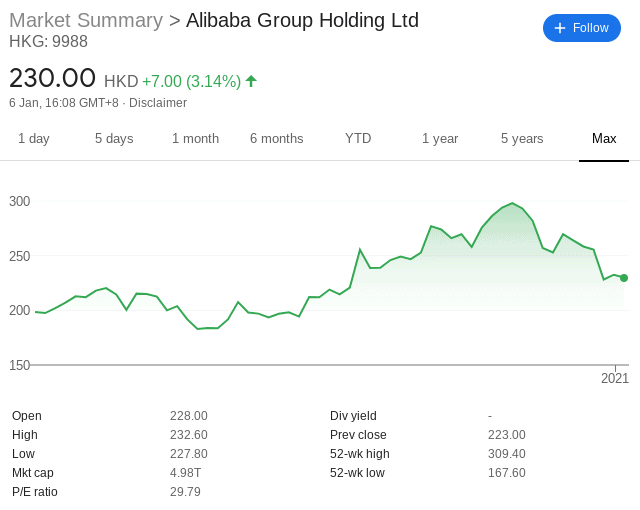

1. Alibaba

Alibaba is a Chinese company that is involved in a range of tech-based projects. At the forefront of this is its online marketplace which matches Chinese wholesalers with international buyers.

Founded by well-known figure Jack Ma, Alibaba now generates more online profits than the likes of Walmart and eBay. In terms of its stocks, Alibaba is actually listed in several countries. However, you will find a lot of trading activity on the Hong Kong Stock Exchange.

Alibaba joined the exchange in late 2019 at a stock price of $198 HKD. Less than 12 months later, the stocks hit all-time highs of $298 HKD. This represents an increase of 50%.

Since then, the stocks have tailed off slightly – owing to an ongoing investigation by Chinese authorities regarding anti-monopoly regulations. As such, at current prices of around $230 HKD.

2. Tencent

Tencent Holdings is another Chinese company that is listed on the Hong Kong Stock Exchange. Launched in 1998, the firm specializes in video game brands. In fact, it owns some of the largest gaming subsidiaries in the world.

This includes the developer behind titles such as League of Legends, Clash of Clans, and Path of Exile. It also has stakes in gaming powerhouses such as Ubisoft, Parabox Interactive, and Activision Blizzard.

In terms of its stock price action, early backers of Tencent have been rewarded handsomely since the firm went public in 2004.

In more recent times, Tencent shares have enjoyed a very fruitful 2020 – illustrating that the stocks are somewhat immune to the wider coronavirus restrictions. For example, this Asian stock was priced at $385 HKD in early January 2020. Closing the year at $559 HKD translates into 12-month returns of 45%.

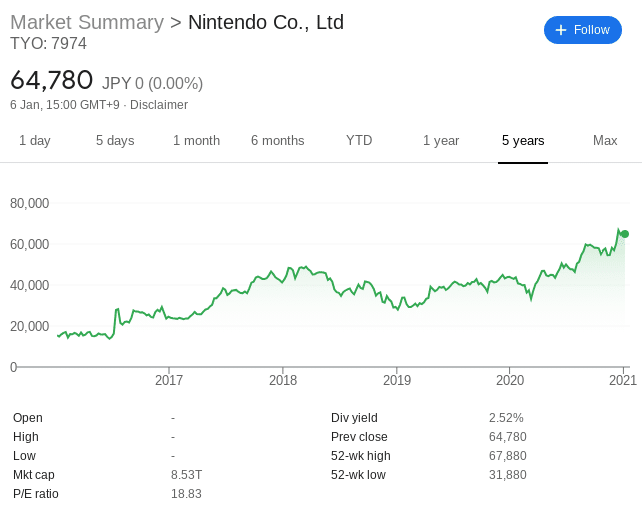

3. Nintendo

Nintendo is one of the largest gaming companies globally. The Japan-based company is publicly listed on the Tokyo Stock Exchange with a current market capitalization of just over 8.5 trillion yen.

The firm enjoyed huge success in the 1980s and 1990s – especially in the video gaming console sector. However, the firm was unable to fend off competition from the likes of Sega and Sony – subsequently impacting Nintendo’s revenues for many, many years.

With that said, Nintendo has since increased its market share of the global gaming industry – which is fully evident in its stock price action over the past five years. For example, Nintendo stocks were priced at just 15,000 yen each in 2016.

The same stocks are priced at almost 65,000 yen on the Tokyo Stock Exchange. This means that Nintendo stockholders have enjoyed returns of over 330% in just five years of trading. Much like in the case of Tencent, Nintendo was not impacted by the coronavirus pandemic. On the contrary, the stocks increased by 54% in 2020.

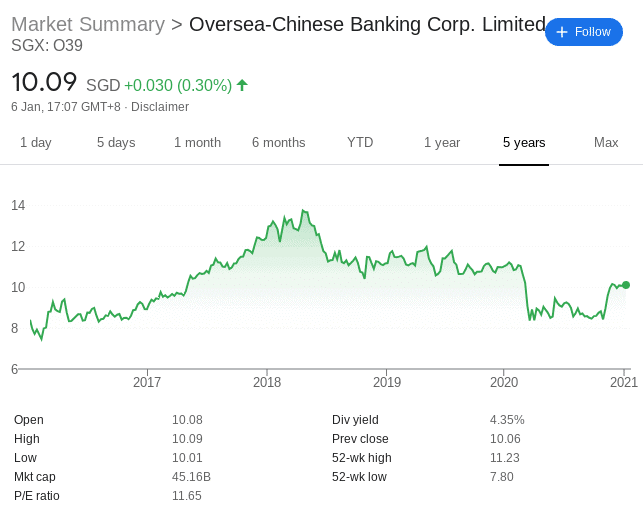

4. OCBC Bank SGX

The Chinese bank is headquartered in Singapore and thus – has its shares listed on the Singapore Exchange.

In its most recent distribution, OCBC paid a rather healthy dividend yield of 4.35%. When it comes to the stock price action of OCBC, the shares were relatively stable before the coronavirus pandemic came to fruition.

However, OCBC stocks collapsed in early 2020 – going from $11.23 SGD to $7.80 SGD – representing a 30% downswing. Since then, the shares have actually recovered quite nicely. At the time of writing in early 2021, OCBC shares are holding their own just above the $10 SGD mark.

This means that since the $7.81 SGD lows of March 2020, the shares have grown by 30%.

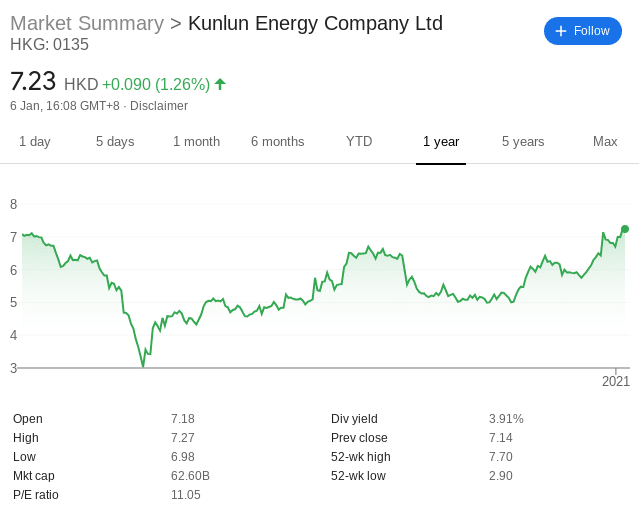

5. Kunlun Energy

For clarity, the UK defines a penny stock as a company with a share price of less than £1.

Kunlun Energy – which is owned by the China National Petroleum Corporation, is involved in both crude oil and natural gas. This covers everything from exploration and development to production and distribution. Its key markets cover Thailand, Indonesia, Oman, Kazakhstan, and Peru. In terms of its stock price history, Kunlun Energy was first listed in Hong Kong in 1998.

Since then, this popular Asian stock has gone through several peaks and troughs. This was especially the case in 2020. Much like the rest of the oil and gas industry, Kunlun Energy shares capitulated in early 2020 – going from $7 HKD to down to just $2.90 HKD in the space of two months. This represents a decline of 58%.

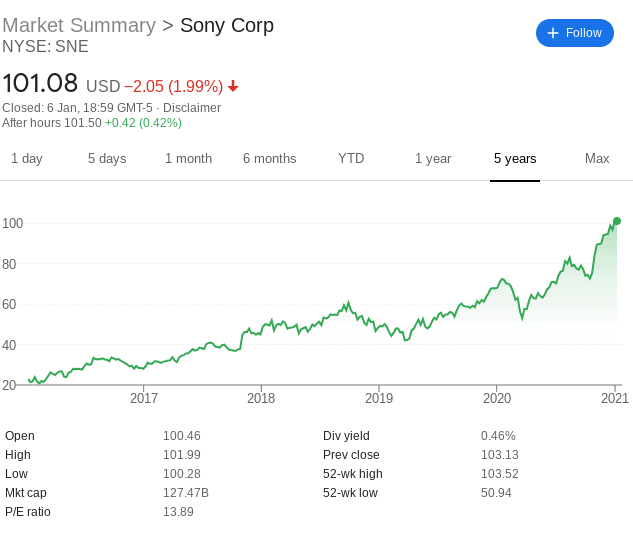

6. Sony

Sony is a Japan-based technology company that is dominant in a full range of industries. At the forefront of this is its video game production line – where it is behind the Playstation series. Not only does this include consoles, but video game titles.

Additionally, Sony is now the world’s second-largest record label. Some of the biggest names signed to Sony include Zara Larsson, Outkast, Alicia Keys, and Mariah Carey. Sony also has a major presence in other sectors – including but not limited to televisions, image sensory, and online media.

Although Sony is listed in its home country of Japan, the shares have a secondary listing on the New York Stock Exchange.

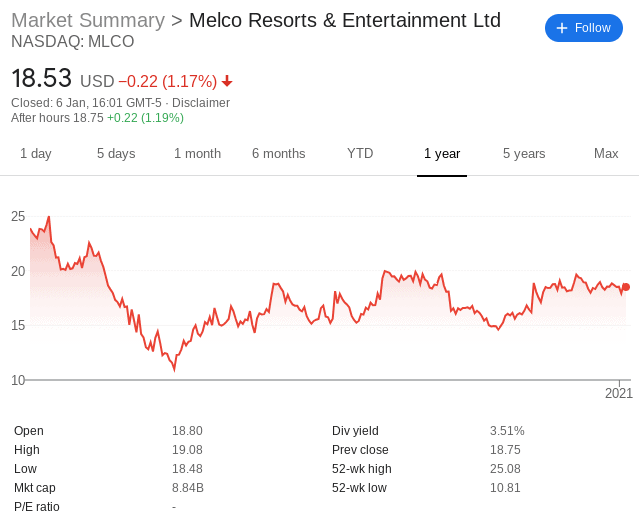

7. Melco Resorts & Entertainment

Melco Resorts & Entertainment is a large-scale casino and hotel developer and operator. Its largest market is based in Macau – which is often described as the Asian Las Vegas. This is because Macau is the go-to destination for Chinese residents looking to gamble. Crucially, Melco Resorts & Entertainment purchased the last six remaining casino licenses in Macau back in 2006.

This allowed it to build and operate some of the largest casino brands in the city. This includes none other than the City of Dreams – a project that cost Melco over $2.4 billion. Although Melco Resorts & Entertainment is headquartered in Hong Kong, the firm decided to list its stocks on the NASDAQ.

As you might know, the hospitality industry – which includes casinos and hotels, was and still is, heavily impacted by the coronavirus pandemic. In turn, Melco Resorts & Entertainment crumbled from $24 in January 2020 to just $11 two months later. This represents a sharp decline of over 50%.

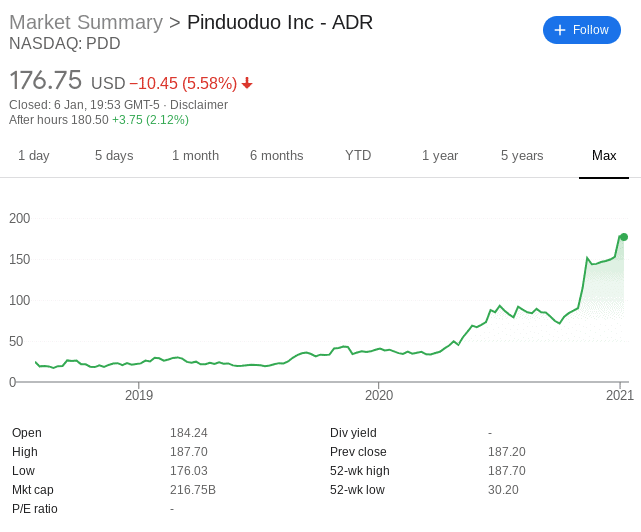

8. Pinduoduo

Although you might not have heard of the company, it is actually the largest interactive e-commerce platform in China. More specifically, Pinduoduo has a focus on rural Chinese locations.

This is a market that fellow e-commerce giant Alibaba has failed to capitalize on. Once again, although Pinduoduo is a Chinese company, it is opted to list its shares in the US. Crucially, this growth stock was launched as recently as 2015 – and only joined the NASDAQ in December 2018.

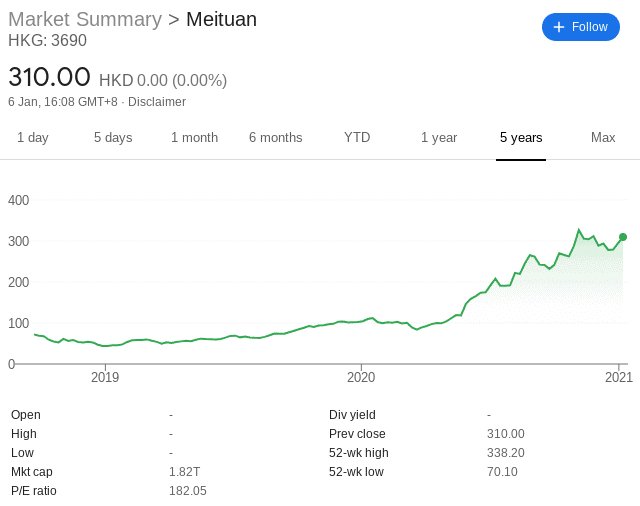

9. Meituan

Meituan is yet another up-and-coming Chinese e-commerce company that is looking to take advantage of ever-changing consumer attitudes. In a nutshell, Meituan offers a range of mobile apps that are designed to help Chinese residents make informed decisions with respect to dining, travel, and entertainment.

For example, if somebody is looking for a restaurant review, they might come across the Meituan platform. There are also Meituan apps that offer discounts and vouchers in a similar way to that of Groupon.

However, unlike Groupon, Meituan has a significant customer base in the Chinese market that now exceeds 600 million. When it comes to its shares, Meituan is listed on the Hong Kong Stock Exchange. It initiated its IPO as recently as September 2018 – where the stocks were priced at just over $72 HKD.

Ultimately, the firm now carries a market capitalization of $1.82 HKD trillion.

10. Hong Kong Exchanges and Clearing

Much like the London Stock Exchange Group – which facilitates the UK stock markets, Hong Kong Exchanges and Clearing takes care of all buy and sell orders in the country.

As such, this Asian stock benefits from increased trading volume. After all, it doesn’t matter if the Hong Kong stock markets are up or down, the company will still collect fees related to clearing and commissions.

Unlike the vast majority of the domestic stock market, Hong Kong Exchanges and Clearing benefited from the covid pandemic and lockdowns. Once again, this is because the more trading activity there is, the more the firm makes. At the start of 2020, the shares were priced at $269 HKD. 12 months later the shares closed at $425 HKD – representing gains of 57%.

Important Features of Asian Stocks

Although we have discussed some popular Asian stocks – this is, of course, the result of our subjective analysis. In other words, there are thousands of Asian stocks to choose from – meaning that the ones we have discussed on this page might not necessarily be suited for you and your financial goals.

As such, we would suggest reading through the following sections to ensure you are able to do your own research and thus – find Asian stocks that suit your risk tolerance and financial goals.

Specific Asian Market

First and foremost, you need to think about the specific Asian market you are interested in making an investment in. After all, there are heaps of stock exchanges based on the continent – each of which comes with its own potential risks and rewards.

To give you an idea of where UK investors have been known to inject capital into – check out the main Asian stock exchanges below.

- Hong Kong Stock Exchange

- Korea Exchange (South Korea)

- Shanghai Stock Exchange (China)

- Shenzhen Stock Exchange (China)

- Singapore Exchange

- Taiwan Exchange

- The Stock Exchange of Thailand

- Tokyo Stock Exchange (Japan)

Although the exchanges listed above are the most liquid, you can buy shares in other Asian markets too. This includes everything from Vietnam and Indonesia to the Philippines and Cambodia.

However, as a retail client in the UK, access to these less popular Asian markets is going to be somewhat limited. The main workaround to this is investing in an ETF that tracks hundreds of different Asian stocks from several marketplaces. More on this shortly.

Industry or Sector

You then need to think about which industry or sector you plan to invest in. For example, a lot of up-and-coming technology stocks are based in Asia. Additionally, e-commerce and online retail platforms are becoming more and more popular in the region – especially in China.

Most importantly, you need to have a firm understanding of the stock you are investing in. Not only does this include the niche area that the company sells its products and services, too, but how it compares to competitors that are already in the market.

Growth or Dividends

Much like any investment decision, you need to determine how you plan to increase the value of your money. In the case of Asian stocks right now, this means focusing on companies that are likely to return capital growth via an increased stock price.

Or, you might want to buy stocks that pay a competitive dividend yield. In some cases, you might be able to locate a stock that offers both. Most of the Asian stocks that we discussed on this page offer returns in the form of capital gains, as opposed to dividends.

Risk

Although Asia is one of the fastest-growing regions globally, you are taking on an extra bag of risk by targeting this segment of the investment space. This is because there is less capital in these markets in comparison to the UK and US stock exchanges. In turn, this means that investing in Asian stocks can be the most volatile stocks to buy.

At one end of the spectrum, buying shares in large-scale Japanese firms like Toyota, Softbank, or Sony is relatively low-risk. After all, these are highly established global brands with a considerable market capitalization.

But, at the other end of the spectrum, buying shares in emerging Asian markets like Thailand, Vietnam, and Indonesia can be extremely risky. As such, just make sure that you understand how much risk you are taking by buying your chosen Asian stocks.

Brokers and Fees

Although we cover a handful of brokers to trade Asian stocks from further down, we can’t stress enough just how important this is. In other words, you might find an Asian stock that you are interested in adding to your portfolio. But, you need to make sure that you have access to a broker that allows you to purchase it.

After all, the Asian markets are nowhere near as popular with UK investors as those based in the US. In addition to this, you can be all but certain that your chosen stock broker charges a premium to invest in stocks. This might come in two forms. Firstly, you’ll likely need to pay a flat commission that is charged when you buy the shares and again when you cash out.

Secondly, the broker will usually charge an FX fee that is multiplied by your stake. For example, Hargreaves Lansdown charges a 1% FX fee in addition to its £11.95 share dealing commission. This means that by buying £500 worth of Asian stocks at the broker, you’ll pay £16.95 (£11.95 + £5).

ETFs

There are heaps of ETF providers that now concentrate partly, or fully on the Asian markets.

For example, For example, the iShares MSCI EM Asia UCITS ETF has a basket of over 880 different Asian stocks. Breaking the portfolio down further, you’ll have 43% of your investment allocated to Chinese stocks, 17% in South Korea, 15% in Taiwan, and the rest split between India and Thailand.

Taking the ETF route also eliminates the need to research prospective stocks to invest in.

How to Find Asian Stocks

So now that you know how to find Asian stocks yourself, we are now going to discuss some UK stock brokers and stock trading apps that give you access to this high-growth marketplace. Our pre-vetted selections all offer competitive fees and a fully-regulated status.

1. DEGIRO

This is because the broker is home to tens of thousands of stocks from dozens of marketplaces. This includes stocks listed in Singapore, Japan, and Hong Kong. You can also access a huge selection of ETFs at Degiro that track Asian stocks.

Degiro is popular with UK investors because of its low-cost pricing structure. For example, you will pay just £1.75 + 0.014% when buying shares that are listed on the London Stock Exchange, and even less when investing in US companies. However, Asian stocks are slightly on the high-side.

This is because Degiro charges €10.00 + 0.06% per trade – which you will need to pay when you buy your chosen Asian stock and again when you sell. Additionally, you also need to pay an annual fee of €2.50 for each Asian stock exchange that you buy shares from.

| Stock Broker | Minimum Deposit | Fractional Shares? | Pricing System | Non-trading Fees |

| Degiro | $0 | No | Low commissions on stocks and ETFs | None |

Sponsored ad. Investing at this trading platform involves risk of loss.

How to Open a Brokerage Account

If you’ve made it this far through our guide, you should now know which Asian stocks take your fancy. You should also have a firm idea of which UK stock broker you wish to use to buy your chosen stocks.

If you’re ready to invest right now but you want a little guidance, the steps below show you how to buy Asian stocks in the UK with a FCA broker of your choice.

Step 1: Open an Account and Upload ID

The end-to-end registration process at most brokers takes less than 10 minutes to complete. First, head over to the broker’s website and click on the ‘Join Now’ button.

You will then be asked to enter some personal information – such as your name, home address, date of birth, national insurance number, and email.

Step 2: Confirm Identity

Brokers that are authorized and regulated in the UK by the FCA are legally required to collect some verification documents from you.

This includes the following:

- Valid passport or driver’s license

- Utility bill or bank account statement

Step 3: Deposit Funds

The majority of trading platforms nowadays usually support a range of popular UK payment methods, including:

- Debit cards

- Credit cards

- E-wallets

- Bank transfer

Step 4: Search for an Asian Stock

Now it’s time to find your chosen Asian stock. Click on the ‘Trade Markets’ button, followed by ‘Stocks’. You will then be presented with a full breakdown of what stocks are on offer.

If you already know which Asian stock you want to buy, simply search for it. In our example, we searching for Hong Kong-based Meituan.

Step 5: Research and Buy Asian Stock

Finally, traders can make a choice as to whether to place an order to buy a specific Asian stock.

To complete your commission-free stock investment click on the ‘Open Trade’ button.

Conclusion

In summary, UK investors are being starved of growth on the FTSE 100. As such, many are turning to Asian stocks. Experienced traders conduct extensive research and market analysis before investing in any type of stocks and shares.