Best Halal Investments UK to Watch

Halal investing is becoming increasingly popular around the world. Many investors are now keen to find investments that are ethically sound and comply with Sharia Law but also provide the ability to grow their capital.

In this guide, we cover a range of markets that could be considered halal investments UK for this year which are in accordance with Sharia Law.

Key Points on Halal Investment

- Some halal investment UK and international opportunities are in biotech stocks as they typically reinvest capital rather than hold debt, as well consumer cyclical and technology stocks.

- Foreign exchange investing is a popular way to find halal investment ideas as many brokers now offer Islamic swap-free accounts which have no overnight interest fees.

- Investing in gold and other metals is a traditional way to invest in a manner that is Shariah-compliant.

- Some brokers offer Islamic trading accounts, as well as the ability to purchase real shares for long-term investing.

Halal Investments UK List

There is a range of assets, sectors and markets to choose from when considering halal investment UK. However, to remain Shariah-compliant some investors try to avoid high debt stocks and those involved in gambling, tobacco and alcohol.

Here is a list of what could be some halal investment UK and international options:

- Apple

- Microsoft

- Unilever

- Rio Tinto

- Gold

- US Dollar

- Bitcoin

A Closer Look at Halal Investments UK

Now let’s take a closer look at the individual markets listed above and why they are considered to be Shariah-compliant.

1. Apple

Apple is the largest holding in the S&P 500 Shariah Index which means the stock has passed the test of being Shariah-compliant. The S&P 500 Shariah Index measures the performance of Shariah-compliant companies from the existing S&P Index.

The S&P’s (Standard & Poor’s) team work with London/Kuwait’s Ratings Intelligence Partners which is a team of qualified Islamic researchers who work with the Shariah Supervisory Board which is a board of scholars who interpret business issues and actions for the S&P Shariah-based indices.

Apple is compliant with Shariah standards because only around 0.77% of its income comes from interest or investments (this needs to be below 5% to be considered halal). The company also passes two of the three debt metrics needed to be considered halal.

2. Microsoft

Microsoft is the second-biggest holding in the S&P 500 Shariah Index which means it has passed the suitability test from the qualified Islamic researchers of Ratings Intelligence Partners who work with the Shariah Supervisory Board.

While the gaming and advertising sectors of Microsoft’s business is a grey area from a Shariah perspective, the revenue from non-permissible operating income is less than 5% and the company passes two of the three Shariah-based debt metrics which means Microsoft is considered halal.

Microsoft is another favourite among traders looking for long-term investment opportunities. The stock has continued to make new record highs for the past several years. CEO Satya Nadella is credited with turning the company into a huge growth stock and is continuing to generate revenue from new sources.

Microsoft’s market cap is now well over $2 trillion. Much of this growth has been due to the rise in its cloud computing ecosystem and the launch of more mobile apps. The Microsoft cloud called Azure is now the second-biggest in the world.

The company has also raised its dividend every year for more than a decade. Dividends are considered to be halal because the payment is from profit rather than from charging interest.

3. Unilever

Unilever is a British company founded in 1873 that focuses on consumer goods. They own recognised brands such as Ben & Jerry’s, Wall’s, Comfort, Dove, Cif and many others. The company now counts Asia as its largest market, surpassing the US and Europe over the past few years.

Unilever is considered to be halal as it passes the debt metric ratio tests as well as income sources that are within the permissible range. The company is considered to be a defensive stock as it produces goods that people need no matter what the economy is doing.

This means Unilever can often perform well even if the overall economy is doing poorly. It is also why the stock has large institutional ownership.

The Unilever share price did well at the beginning of the 2020 pandemic. However, as central banks cut interest rates, more capital was invested into growth stocks. This led to global stock market indices surging to record highs.

4. Rio Tinto

Rio Tinto is the world’s second-largest metals and mining company. It produces much of the world’s iron ore, copper, gold, uranium and diamonds. The company was founded in 1873 and its activities of processing natural resources are considered to be Shariah-compliant.

The mining giant passes all of its tests to be considered a halal investment UK. The company’s income from non-Shariah compliant investments is well below the 5% requirement.

Furthermore, the company passed all of its debt metric ratios. The balance sheet shows that the debt is well under the 33% allowed under Sharia finance law and the stock has liquidity.

After the pandemic, Rio Tinto’s share price soared in value. Support from central banks led to a flurry of activity in the construction sector as economies reopened. Supply chain constraints also helped to lift commodity prices which were suddenly in demand.

However, towards the end of 2021, the company announced a $1.15 billion lithium mine acquisition in Argentina. This had a negative impact on the share price in the short term.

5. Gold

Gold is one of the oldest forms of investment. There are a variety of ways to capitalise on the rise of the price of gold or to hold as a safety net in difficult times. Not all ways of buying gold are Shariah-compliant.

Common ways to buy gold include buying gold bullion bars or coins, investing in gold ETFs, investing in gold mining stocks or buying gold CFDs through an Islamic forex trading account.

The traditional route is to purchase gold bullion bars, coins or jewellery. This way of investing in gold is halal. However, it is difficult to scale up such an investment as you then need to think about storage costs, safety and insurance.

Many investors will choose to purchase an ETF (exchange traded fund) that provides exposure to gold. However, many gold ETFs are not Shariah-compliant as some merely track gold futures prices or hold contracts in gold options – two methods that are not halal.

Gold ETFs that actually hold physical gold are considered to be Shariah-compliant. For example, the iShares Gold Trust ETF aims to track the performance of physical gold and has more than 490 tonnes of physical gold in the trust.

The price of gold performed well over the pandemic period. However, in 2021 the price of gold moved sideways as investors preferred the growth prospect of global stock indices.

This is why the iShares Gold Trust is considered to be a halal investment UK.

6. US Dollar

The US dollar surged during the end of 2021. How you choose to speculate on the direction of the US dollar is the defining factor of whether forex trading is halal or haram. If you have no strategy, no system and trade on an interesting charging account then it is considered gambling and haram.

However, if you trade with a proper strategy and system, like a professional, and use an Islamic swap free trading account then it is considered to be halal, as there are no overnight interest charges.

The US dollar was one of the world’s strongest currencies in 2021. Inflation was surging higher which led to the Federal Reserve withdrawing their stimulus measures that were enacted during the pandemic.

The removal of the stimulus measures also brought forward expectations of interest rate hikes – a situation in which the currency usually appreciates.

7. Bitcoin

The cryptocurrency market soared to a global market capitalisation of more than $2 trillion in 2021. The launch of the first Bitcoin ETF has brought credibility to some cryptocurrencies.

However, whether cryptocurrency is considered halal or not has been up to much debate. But, in 2018 scholars from the Sharia Review Bureau in Bahrain stated that crypto investments in Bitcoin and Ethereum are permissible under Shariah law and are considered halal. Many Muslim councils around the world have deemed investing in cryptocurrencies to be Shariah-compliant and some mosques in the UK accept cryptocurrency for donations.

Platforms Offering Halal Investments

Choosing the right trading platform is essential to remain Shariah-compliant. When buying halal investments you also want to make sure you are using the correct halal trading products to do so.

Let’s have a look at two platforms and brokers to invest in halal investments UK.

1. AvaTrade

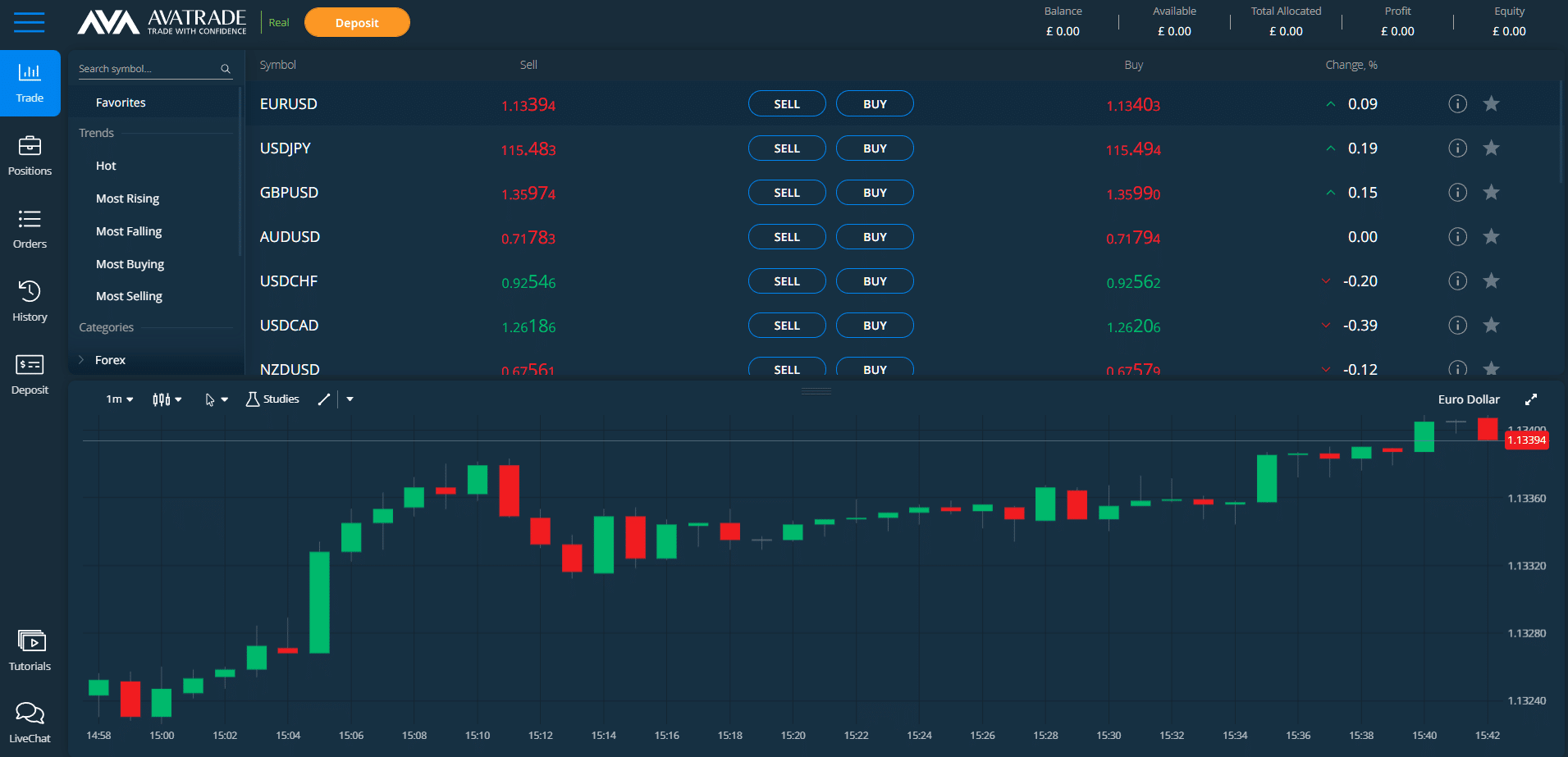

AvaTrade is another CFD broker for halal investments UK as they provide access to an Islamic swap-free account that operates under Shariah Law. When trading foreign exchange for more than 24 hours there is a payment required called swaps. These are interest payments that are prohibited under Sharia Law.

An Islamic account is not subjected to any special fees or interest ensuring it complies with Sharia Law. With AvaTrade, you can trade on more than 1,250+ global markets covering forex, stocks, bonds, indices, ETFs and commodities. Cryptos and some FX instruments such as ZAR, TRYI, RUB and MXN cannot be traded from the AvaTrade Islamic account.

AvaTrade takes its Islamic offering one step further and also provides halal oil trading and halal gold and silver trading solutions. To comply with Sharia Law oil gold and silver trading must also have physical support in the asset. AvaTrade offers a solution to have a gold and silver trading account that complies with Sharia Law.

Furthermore, you can trade oil in a halal way as the price of oil is tied to the futures market around the world with AvaTrade offering zero positive or negative swaps when doing so. You can also access halal index trading via AvaTrade which means there are no overnight interest payments when trading – you just pay the spread.

AvaTrade also offers a high level of safety and security as they are authorised and regulated across five continents by regulators such as the CBI, IIROC, ADGM, ASIC, JFSA and others.

There is also a large range of education and research tools available which cover core trading topics in an article and video format.

Sponsored ad. Your capital is at risk.

What are Halal Investments?

Halal investments are investments that are made in accordance with the principles of Shariah Law. These Islamic principles are based on the idea of using your finances for ethical investing to benefit the Muslim community and society.

The Shariah-compliant investment rules are designed to balance five areas: religion, life, family, intellect and property. While you can invest in asset classes such as stocks, indices, commodities, cryptos, sukuk and property the intention and the way you invest are important.

Islamic Law in finance states that investment opportunities should be made without the expectation of interest in return and that you should avoid unethical investments. There are specific guidelines and limits set out related to Halal investment options UK in the next section.

Islamic Investment Principles

Here are some guidelines and principles for Shariah-compliant investments.

1. Riba-Free Investments

To ensure Sharia-compliant investments you must avoid opportunities or investments that involve the earning of interest or Riba.

2. Avoid Unethical Investments

Shariah Law states that you should avoid investing in areas that harm society. This means avoiding industries such as alcohol, tobacco, gambling and banks (except Islamic banks) and insurance companies involved in interest payments.

3. The 5% Rule

Shariah principles state that you should avoid investing in companies that generate more than 5% of its income from unethical sources (as listed above).

Conclusion – Halal Investments

Halal investing is becoming increasingly popular as a way to ethically perform responsible investing. But, the intention and the way you choose to invest needs to be Shariah-compliant also.