Forex Trading UK 2025

The forex market is one of the largest financial markets in the world. Every single day, more than £5 trillion in currency changes hands.

We’ll explain how forex trading in the UK works plus, we’ll review five of the most popular UK forex brokers in 2022.

What is Forex Trading?

Forex trading involves exchanging one currency for another. If you’ve ever exchanged pounds for dollars or euros while on vacation outside the UK, you’ve taken part in forex trading. Of course, when we talk about forex trading in the UK we’re specifically talking about exchanging currencies with the intent to profit off changes in their value.

Forex trading involves exchanging one currency for another. If you’ve ever exchanged pounds for dollars or euros while on vacation outside the UK, you’ve taken part in forex trading. Of course, when we talk about forex trading in the UK we’re specifically talking about exchanging currencies with the intent to profit off changes in their value.

One of the exciting things about trading forex is that the market is global. That’s a big difference from stock trading, where individual exchanges typically only host shares of companies from a single country. When you trade forex, you’re involved in a market that’s used by governments, banks, and traders around the world.

The forex market is also enormous, with more than £5 trillion in currency exchanged each day. The size of this market comes from the fact that it’s essential not just to forex traders, but to the flow of the global economy. If you want to purchase clothing that’s made in Italy, say, you’ll pay an import company in pounds that in turn pays the Italian manufacturer in euros. Currencies are constantly exchanged by major banks as well.

Forex trading hours are 24 hours a day, five days a week – from 9 pm on Sunday night to 9 pm on Friday night. When you trade forex, there isn’t a central exchange like for buying stocks. Instead, a forex order is placed onto a global computer network and can be fulfilled by a forex broker, a bank, or anyone else trading on the global network. Since online forex trading takes place around the world, the market can be very active at any time of day.

Forex Trading Pairs

One of the key things beginners need to know about UK forex trading is that all currencies are valued relative to one another. This is another key difference from buying shares.

The pound doesn’t have a set value all to itself. Instead, the value of the pound is measured relative to, say, the dollar or the euro. The value of the pound can rise in value relative to the dollar and the euro by different amounts, or it could rise relative to the dollar and fall relative to the euro at the same time.

As a result, all forex trading in the UK takes place through currency pairs. There are three types of forex trading pairs:

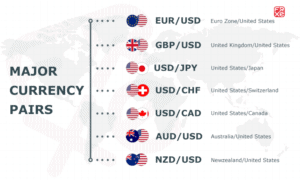

Major Pairs

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- USD/CAD

- AUD/USD

- NZD/USD

These seven pairs make up the majority of forex trading on a daily basis, in the UK, and around the world. Beginner forex traders should start out trading these major currency pairs since they are always available to buy and sell and typically entail lower fees than less common forex pairs.

Minor Pairs

There are more than 20 different minor currency pairs. These either pair the non-USD currencies from the major pairs or pair the US dollar with other global currencies. For example, JPY/AUD and GBP/EUR are considered minor currency pairs.

Exotics

The exotics involve pairs of currencies that aren’t frequently traded. For example, JPY/ZAR and EUR/HUF are considered exotic forex pairs. Exotics can be very illiquid – that is, there aren’t many people buying or selling them at any given time – so they’re generally better for more advanced forex traders.

Forex Trading Fees

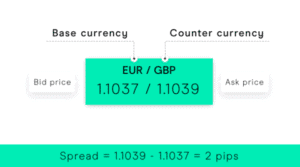

One of the things about forex trading in the UK is that it is almost always commission-free. Instead of charging a flat fee of several pounds per trade, most forex brokers charge what’s known as a spread.

The spread is the difference between what you can buy a currency pair for and what you can sell it for at the same time. Spreads vary by forex pair and by the broker, and they can range from as low as 0.05% to as high as 1% or more. Generally, you’ll find the lowest spreads on major currency pairs and the highest spreads on exotics.

One important thing to keep in mind is that if you trade with leverage, you’ll likely have to pay additional fees. Most forex brokers charge overnight interest rates if you hold a leveraged forex position after the close of business in the UK, even though the forex market never sleeps.

UK Taxes on Forex Trading

When thinking about forex trading fees, it’s also worth thinking about your tax liability. Unfortunately, figuring out what you’ll be taxed for forex trading in the UK can be complicated.

If you trade forex through spread betting, your profits will be completely tax-free. With forex spread betting, you simply speculate on the direction of the change in the value of a currency pair.

Most forex trading in the UK takes place as CFD trading, though. With CFD trading, you purchase a contract with your broker that changes in value at the same rate as the underlying currency pair. Importantly, CFD trades are subject to capital gains taxes in the UK. So, you could end up paying a tax rate as high as 20% on your profits depending on your individual tax situation.

Forex Trading UK Risks

Forex trading, like all types of trading, comes with risk. There is always a chance that a trade will go against you and the value of your position will drop. If that happens, you can sell your forex position for a loss. Alternatively, you can hold the position in the hope that it will rise in value – but there’s no guarantee that will happen, and you could end up taking a greater loss.

It’s important to keep in mind that using leverage increases your risk when forex trading in the UK. First, any losses are multiplied. Just as a 1% gain in a currency pair’s value translates to a 10% return when trading with 10:1 leverage, a 1% loss in value will mean a 10% drop in the value of your position.

On top of that, you’re borrowing money from your broker when trading with leverage. Most forex brokers require that you cover more of your position’s value with cash in your account if it starts to lose value. So, you may be forced to add money to your account or else your broker will sell your position for a loss.

Given these added risks, beginner forex traders should be very careful about using leverage.

Forex Trading Strategies

If you want any chance of getting rich by trading forex, it’s vital to have a sound forex trading strategy.

There are as many forex trading strategies as there are forex traders. Every trader has to develop their own personalized strategy that matches their goals, risk tolerance, and trading style.

Scalping

Scalping is a very short-term trading strategy that involves buying and selling a currency pair throughout the day. The goal of scalping is to profit off of very small price changes that happen on the scale of a few seconds to minutes. Scalpers closely follow technical indicators to identify potential entry and exit points.

The price changes involved in scalping are small, so the returns from any individual trade maybe just a fraction of a percent.

Swing Trading

Swing trading is a medium-term forex trading strategy. Typically, swing traders look for momentum in the value of a currency pair. Ideally, you’ll enter a forex trade after a strong reversal as the value starts to rise or fall on high trading volume. Aggressive swing traders can then speculate on a trend in the reverse direction if one develops.

Trading the News

Much of the volatility in the forex market is driven by news. Global events, politics, weather, trade agreements, and economic reports can all cause the value of a currency to go up or down. One powerful forex trading strategy is to watch market news to see gauge whether a country’s currency is poised to gain or lose value in the short-term or long-term. Then, open a forex trade based on the news and your own analysis.

Automating Forex Trades

Many intermediate and advanced forex traders choose to automate their forex trading. Automating your trades can not only take some of the work out of day trading but also remove the psychological element of trading that often leads to poor decision-making.

There are two main methods you can use to automate your forex trading: forex signals and forex robots.

Forex Trading Signals

Forex signals are sets of technical indicators and news scanners. With forex signals, you receive an alert on your computer or smartphone when a specific set of parameters are met. For example, if several indicators align, you can receive an alert on your phone that offers information about the forex pair, the current price, and potential entry and exit points.

Forex signals can either be created manually, or they can leverage artificial intelligence to improve over time. You can also purchase professionally made forex signals through your broker or another online forex trading platform.

Forex Trading Robots

Forex robots take trading signals to the next level by fully automating your trades. These bots use forex signals to not just identify and alert you to potential forex trading opportunities, but to also trade on your behalf. Trading robots can operate 24/7.

Popular Forex Trading Platforms

In order to start trading forex in the UK, you’ll need a forex trading platform. Look for one that offers low spreads, high leverage, and access to a wide range of currency pairs.

1. IG

IG offers traders two options for forex trading: ProRealTime and MetaTrader 4. Both charting platforms are customizable and enable you to create your own personalized technical studies. MetaTrader 4 also comes with a marketplace where you can purchase forex signals or forex robots from professional traders.

Another benefit to IG is that your brokerage account comes with access to market news feeds and expert analysis. The broker offers webinars, podcasts, and strategy sessions so that you can constantly improve your approach to forex trading.

There is no guarantee you will make money when trading CFDs with this provider.

2. FXCM

FXCM also stands out for offering a wide selection of trading platforms. You get access to MetaTrader 4 and NinjaTrader, both of which are forex trading platforms that offer custom indicators and forex signals. You can also access ZuluTrade through your FXCM account, which offers social trading.

Leverage at FXCM is somewhat limited, to just 30:1 for major currency pairs and 20:1 for all other pairs. However, spreads are relatively low for most pairs, which is nice given the wealth of trading tools.

Sponsored ad. There is no guarantee you will make money when trading CFDs with this provider.

Conclusion

Forex trading gives you access to a fast-moving, global market that operates 24 hours a day. With forex trading, you can speculate on the price of one currency relative to another. The forex market is widely accessible since it’s global in nature and only requires a small initial investment.