Best Short Term Investments UK to Watch

Short term investments UK come from across the asset class range but with a particular focus on equities.

A short term investment is usually defined as one that can be liquidated for cash within five years. Often there will be a preponderance of bonds and other lower risk investments in a short term investment portfolio.

-

-

Here’s a list of the asset classes based on trading volumes:

- Equities

- Short term government bonds

- Short term investment-grade corporate bonds

- Money market funds

- Savings accounts/fixed rate bonds

- Alternative investments

5 Popular Short Term Investments

From renewable energy portfolios to UK government debt, we take a balanced approach to assembling a clutch of some short term investments available to UK investors.

- iShares MSCI South Korea ETF

- Renewable Energy Copy Portfolio

- iShares UK Gilts 0-5yr UCITS ETF

- US dollar

- Bitcoin

1. iShares MSCI South Korea ETF

Tracks South Korean large and medium-sized companies. As such it has a bias to technology. The fund has returned 16% year to date, with Korean stocks continuing to be beneficiaries of the country’s relatively successful economic recovery from the Covid pandemic.

2. Renewable Energy Copy Portfolio

The Renewable Energy Portfolio is a short-term ethical investment. Its back-tested performance has lagged in the past couple of years but with green infrastructure spending rising rapidly. The environmental, social, and governance (ESG) space is booming, so this copy portfolio is certainly ‘on trend’. The portfolio currently holds 22 stocks, including First Solar and SolarEdge Technologies.

3. iShares UK Gilts 0-5yr UCITS ETF (IGLS)

This exchange-traded fund (ETF) tracks the performance of an index composed of sterling-denominated UK government bonds dated 0-5 years: the iShares UK Gilts 0-5yr ETF (IGLS). It invests directly in a mix of short and medium-dated bonds.

4. Vanguard UK Short Term Investment Grade Bond Index Fund

This mutual fund from the United States investment management giant Vanguard tracks the Bloomberg Barclays GBP Non-Government 1-5 Year 200MM Float Adjusted Bond Index.

In line with that remit, it invests in investment-grade bonds, excluding government bonds. It is denominated in sterling, with maturities of between 1 to 5 years. A negative screen is applied to remove the more illiquid bonds.

5. US dollar

The US currency has been weakening this year, which led to some commentators suggesting that this was a harbinger of further loss of value down the road as the US economy struggles to extract itself from the coronavirus mire.

The USD has turned higher recently after a period of decline since the March 2020 meltdown.

iShares MSCI South Korea ETF (EWY)

Tech and East Asia

The iShares MSCI South Korea ETF (EWY) combines both our tech and regional requirements, through its tracking of the Korean senior equities markets (benchmark MSCI Korea 20/50 index).

The key holding is Samsung at nearly 25% of the portfolio. South Korea has bounced back from the pandemic. The country’s large and mid-cap companies are well-positioned to benefit from a further pick-up in the global economy as its giant Chinese neighbour’s economy comes fully back online.

EWY has a 1-year total return of 8.39%, as of 26 October. The management fee is 0.59%

2. iShares Barclays 20+ Year Treasury Bond (TLT)

This exchange-traded fund tracks the performance of an index composed of sterling-denominated US government bonds dated 20 plus years: the iShares Barclays 20+ Year Treasury Bond ETF (TLT). It invests directly in long-dated US treasury bonds. Investors sometimes hold bonds to maturity and they can be traded at any time of the investor’s choosing.

Annualised return is 9.7%. Leverage 1:5; Spread 0.19.

Short Term Investment

1. FTSE China A50 Index

This index fund invests in 50 stocks by market capitalisation on Cina’s Shenzhen and Shanghai stock exchanges. As the fund’s key facts information reminds the investor, official data is not as reliable in China, where there is less transparency all round.

2. WisdomTree Palladium 2x Daily Leverage ETP (2PAL)

The palladium market brings to mind the old investment adage “don’t fight the trend”. Since 2016, the price of the metal has been trending relentlessly higher, currently priced at $2,250 per ounce, making it more expensive than gold.

Two variables are at work here – constrained supply and rising demand caused by the ongoing tightening of regulations to reduce emissions from carbon-burning vehicles. Palladium is an essential metal in the manufacture of catalytic converters.

Short Term High Risk Investments

1. Bitcoin

This will be a controversial selection and may not work for those with an ultra-short-term horizon. Bitcoin is the leading cryptocurrency and its notoriously volatile, which ordinarily means it should be the last product to find its way into a short-term investment bucket due to its status as a high risk investment.

CFDs are financial instruments created by banks in which an agreement is made between parties to pay the difference between an underlying asset’s current price and the price when the contract was originally created.

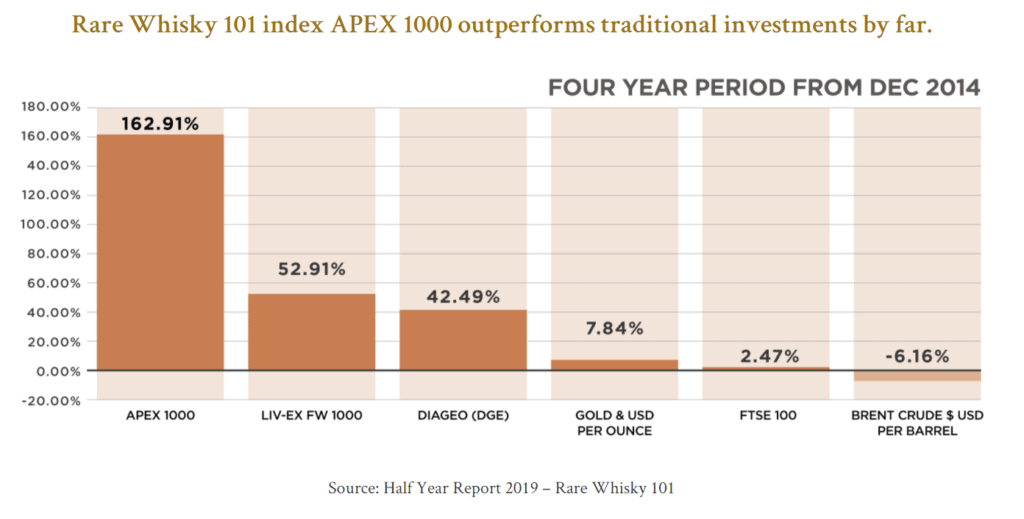

2. The Single Malt Fund

Collectible whisky in bottles or casks has been gaining in popularity in recent years and the trend looks set to continue, particularly among a younger crowd.

There are a couple of choices as to how you go about investing in whisky. You can either buy from a merchant, such as VC Vintners, which stores rare whisky in its bonded vaults in London.

Investors seeking short-term investments will find alternative investments such as this are a place to dig around for returns, depending on your risk appetite and exactly how short-term your investment horizon is.

The fund aims to return 10% a year and you can sell at any time, providing your broker allows you to access the Nordic Growth Market. You may also need to enlist your broker or bank for help with filling in the application and subscription documentation.

The Single Malt Fund claims to be the first regulated rare whisky fund in the world, but to invest you will need to fill out the relevant forms to be accepted as an accredited investor. The fund is regulated by Sweden’s financial supervisory authority, Finansinspektionen.

The minimum investment is €1,000 and the subscription unit price is €100. Rare whisky has returned 162% since 2014.

The fund is euro-denominated, so there is a modicum of exchange rate risk to be aware of for UK investors, although the strengthening of the euro against sterling would mean the euro-denomination is a helpful counterweight to sterling weakness. Having said that, a Brexit deal might see the pound escape from its long period of Brexit-induced volatility.

Hargreaves Lansdown has markets in products listed on Scandinavian exchanges – not all brokers do.

Platforms Offering Short Term Investments UK

We’ve counted down the UK’s short term investments, let’s look at platforms that offer access to these types of investments.

What are Short Term Investments?

A short term investment is defined as one that can be liquidated for cash within five years, in contrast to long term investments, which are held for at least five years.

When people think about short term investments they usually have in mind the returns that can be made over the lifetime of an investment.

Equities

Investing in stocks and shares for short term gains is risky, but the rewards can make it worth it. Investors who want to take a short term position will be minded to make their choice with reference to fundamentals such as sales, revenues, and earnings but also technical considerations such as volatility.

In order to access short term high yield investments, we have no choice but to include some stocks and shares.

Short term investment-grade government bonds

Bonds are debt instruments. When you lend to a government or a company you receive in return a bond entitling you to a fixed rate of return on the amount loaned and the return of the principal upon maturity (the date it has to be paid back).

Short term bonds will have lower interest rates than longer-term ones because your money is tied up for less time, but they have the advantage of being readily liquidated for cash, which is exactly what we want in a short term investment.

Some investors don’t have to hold their bonds until maturity and can instead sell them at a profit if the price of the bond has risen. Bond prices rise when the yield falls. The US government bond market (Treasuries) is a liquid financial market – in other words, it is simple to match orders because of the huge trading volumes.

Bonds are ranked among short term investments because of the security they afford and the income they generate, as well as the possibility of securing a capital return too.

Government bonds can be used tactically to shelter your capital in periods of heightened volatility.

Short-term investment grade corporate bonds and high-yield corporate bonds

Corporate bonds are issued by companies to raise funds for the business. An investment-grade bond is defined as one rated BBB by the rating agencies (Moody’s and S&P). Ratings of BBB- and below are considered non-investment grade and are sometimes referred to as junk or high-yield bonds.

Money market funds

The money market here refers to the credit markets (bonds), and in particular the shortest duration instruments. They are mutual funds that pool the resources of their investors to invest on their behalf in a mix of short-duration sovereign and corporate debt.

Savings accounts/fixed rate bonds

Savings accounts are bank deposits that pay interest.

However, savings rates have plummeted in the past 10 years and more, in the wake of the financial crisis of 2008/09 and the introduction of quantitative easing measures by central banks around the world.

The US Federal Reserve and the Bank of England, to name but two, bought up bonds (the Fed recently added junk bonds to its asset purchases) to push down interest rates.

Alternative investments

Any asset class outside of stocks, bonds, and cash are considered an alternative investment. The advantage of selecting from this bucket is the diversification it can bring because these assets are likely to be relatively uncorrelated to the major asset classes.

Fundamentals of Short Term Investments

Below we group short-term investments by timescale, product, and risk-reward trade-off. Of course, this is just a guide. There are risks associated with short term investments.

Timescale? Product Risk-reward trade-off Two years or less Savings account Instant access savings account 0.6%. Fixed-Rate Bond returns around 1%. Money market funds Around 2.2% which is higher than a savings account at 0.2% to 0.9% Cash Cash Isa 0.65% to 0.75% (2 to 3-years maturities) Two to three years Short-term government and corporate bonds High yield corporate bonds are medium risk. UK Government bonds return: 2-year Gilt 1.75% Money market mutual funds Currently around 2.2% Three to five years Equities Annualised return UK equities, 4.6%. S&P 500 annualised return is around 10%. High-yield bonds Alternative investment

9.5% return. Medium risk, depending on investment type. Returns vary. Bitcoin 390% annualised. Whisky has return around 8% since 2014.

Conclusion

Whatever your reason for investing for the short-term, while doing so you will want to know that your money is in safe hands. All the platforms mentioned are regulated in the UK which means your funds qualify for the Financial Services Compensation Scheme protection of up to £85,000.

FAQs

What is the short-term investment tax rate?

Capital Gains Tax is charged on all gains above your £12,300 annual tax-free allowance: 10% for basic-rate taxpayers and 20% for higher-rate taxpayers.

Gary McFarlane

Gary was the production editor for 15 years at highly regarded UK investment magazine Money Observer. He covered subjects as diverse as social trading and fixed income exchange traded funds. Gary initiated coverage of bitcoin and cryptocurrencies at Money Observer and for three years to July 2020 was the cryptocurrency analyst at the UK’s No. 2 investment platform Interactive Investor. In that role he provided expert commentary to a diverse number of newspapers, and other media outlets, including the Daily Telegraph, Evening Standard and the Sun. Gary has also written widely on cryptocurrencies for various industry publications, such as Coin Desk and The FinTech Times, City AM, Ethereum World News, and InsideBitcoins. Gary is the winner of Cryptocurrency Writer of the Year in the 2018 ADVFN International Awards.View all posts by Gary McFarlane

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2024 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up