How to Buy Carnival Shares Online in the UK

Carnival Corporation & PLC is one of the world’s largest cruise line companies. Well-known brands under its wings include P&O Cruises, Princess Cruises, and Seabourn. If you want to buy Carnival shares, you will need to use a UK broker that gives you access to the New York Stock Exchange.

In this guide, we explain how to buy Carnival shares in the UK. On top of discussing online share dealing sites to do this with, we also provide step-by-step instructions on how to make a purchase today.

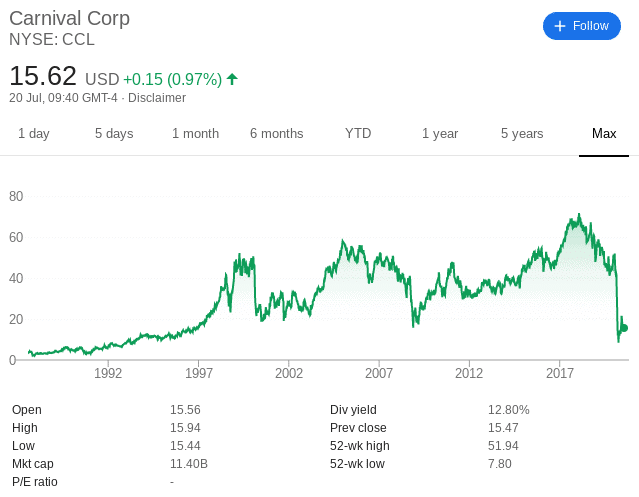

Not only this, but you also need to ensure that your chosen platform offers competitive dealing fees, and that it supports your preferred payment method. To help you along the way, below you will find a selection of popular UK stock brokers that allow you to buy Carnival shares online. More specifically, you will have the option of placing a buy (long) or sell (short) position at the click of a button. Plus500 also offers leverage facilities – which are available on all of its supported financial markets. In the case of stock CFDs like Carnival, this stands at a maximum of 1:5 for UK retail traders. A CFD trading platform like Plus500 is also beneficial from a cost-effective perspective. This is because Plus500 does not charge any trading commissions. This means that it is just the spread that you will need to pay. If you are looking to diversify across other stock CFD markets, you will find dozens of UK and international exchanges hosted at the platform. Plus500 gives you the option of trading via its web-based platform or mobile stock trading app. This ensures that you have access to your trading account at all times. In terms of getting started, you will be able to open an account in minutes. Upon uploading some ID you will then need to meet a £100 minimum deposit. The platform accepts debit cards, credit cards, bank account transfers, and Paypal. All payment options are instant apart from a bank wire. Finally, Plus500UK Ltd is authorized & regulated by the FCA (#509909). Its parent company – Plus500 Ltd, is publicly-listed on the London Stock Exchange. 72% of retail investors lose money trading CFDs at this site Carnival Corporation & PLC operates in an industry that was heavily impacted by the COV-19 pandemic – travel cruise liners. As a result, you need to spend some time researching the company before making a financial commitment. This will ensure that you do not buy Carnival shares in the UK without having first done your homework. Carnival is one of the world’s largest travel cruise companies with over 10 ship liners under its belt. This includes AIDA Cruises, Cunard Line, Holland America, and P&O Cruises. The company first went public way back in 1987 – opting for the New York Stock Exchange. Since then, the firm has initiated two stock splits – both of which were on a two-for-one basis. Carnival shares were originally priced at $3.87 – which is adjusted as per the aforementioned splits. At the time of writing in July 2020, the Carnival share price is $15.47. However, this is worth just a fraction of the company’s previous all-time highs. This feat was last achieved in early 2018 – where the shares were priced at just under $70 each. Based on current prices, this represents a huge decline of over 77%. To no surprise, the vast bulk of this decline occurred in early 2020 in response to the wider COV-19 pandemic. After all, the luxury travel industry came to a halt once governments around the world begun placing restrictions on the free movement of people. The Carnival share price actually stood at around $51 at the turn of the year, and went as low as $7.80 in March. That translates into a near-on three-month drop of 84%. The good news for investors is that Carnival shares have since shown signs of a recovery. Based on today’s price Carnival shares of $15.47, Carnival shares have increased by 98% since its 2020 lows. Carnival shares had a long-standing track record of yielding dividends. That was until the impact of the COV-19 pandemic came to fruition. As such, the firm announced in March 2020 that it was to suspend dividend distributions until further notice. Make no mistake about it – the current COV-19 crisis means that investing in a travel-related stock like Carnival is high risk. After all, there is no knowing how long it will be before the masses feel comfortable travelling again. You also need to factor in a potential re-visit of a wider travel ban. If this is the case, whether or not Carnival has the financial means to survive remains to be seen. Nevertheless, it’s not all doom and gloom for the multi-billion dollar cruise company, so below you will find some of the reasons why Carnival shares could be worth considering. However, the stocks have since increased by over 98%, meaning that shrewd investors that timed the market wisely are staring at huge short-term gains. With that said, there could be further gains ahead for Carnival. We say this because the stock was priced at around the $51-mark at the start of the year. Nobody could have predicted just how severe the pandemic would become, with the subsequent outcome arguably having no correlation to Carnival and its wider business model. As a result, if and when the cruise travel industry returns to pre-COV-19 levels, a medium-to-long-term target of $51 could be reasonable. If it is able to achieve this feat, it would require gains of 229%. According to The Street, management at Carnival has advised that advanced bookings for 2021 “remain within historical ranges at prices that are down in the low to the mid-single-digits range”. This is welcome news for investors – as was illustrated in a 10.8% share price increase from the previous day of trading (July 11th). There is no getting away from the fact that at a monthly burn-rate of $650 million – Carnival is facing a significant cash crisis. With that being said, management at the company has since announced that they have cut operating costs by over $7 billion, with a further $5 billion of expenditures being reduced over the next year and a half. Expect more cost-cutting endeavours in the very near future. Furthermore, and perhaps most importantly, Carnival has also secured over $10 billion in liquidity. This will ensure that the firm is well-prepared for any further disruptions to the wider cruise travel industry. Before investing in Carnival shares in the UK, it is a good idea to understand the fees involved. The exact fees that are charged for buying Carnival shares will depend on the trading platform that you choose to use. Here is a rundown of the different types of fees that you may come across. First and foremost, some trading platforms may charge a fee for deposits and withdrawals. This will usually be deducted automatically when a payment is made or withdrawn from the platform. Deposit and withdrawal fees are typically a percentage of the amount involved in the transaction. For example, a platform that charges a 1.5% withdrawal fee would automatically deduct £1.50 if a trader decided to withdraw £100. Account management fees are charged on active accounts. This type of fee is paid directly to the trading platform and usually goes towards development and the management of assets. Account management fees are usually charged as a percentage of any assets that are under management. For example, an account management fee of 5% would charge a trading account with £1000 of funds invested £50. Trading fees are the fees charged on each individual trade. Some platforms charge commissions and others charge spreads or a flat fee. Trading fees can quickly add up, especially if traders place multiple trades per day. Therefore, it is a good idea to look for platforms that offer low trading fees. Some trading platforms will charge a fee for holding trades overnight. These fees are typically charged as interest and are added automatically when the trade is closed. Overnight trading fees can make it expensive to keep trades open after the market closing. Inactivity fees are charged to accounts that are not active for a prolonged period of time. Every trading platform will have a different criterion for when inactivity fees can be charged. For example, some platforms may charge a fee if an account has not been used for 1 year. It is important to research trading fees that could be involved with buying Carnival shares in the UK before making any investment decisions. In summary, Carnival shares are not likely to be at the top of your list if you are the type of investor that targets strong and stable companies. After all, the travel cruise stock has seen a share price decline of over 70% in 2020 alone. As it remains to be seen if and when the travel industry will get back to pre-COV-19 levels, buying Carnival Cruise Line shares is fraught with risk. However, some would argue that at current prices, you can get yourself some shares at a heavy discount. Based on adjusted prices for its two 2-for-1 stock splits, Carnival shares were initially priced at $3.87. The IPO in question occurred in 1987 on the New York Stock Exchange. The costs involved will vary depending on your choice of broker. In most cases, you will need to pay a currency conversion fee as you will be accessing a non-UK exchange. eToro, for example, charges 0.5% when you first make a deposit. After that, you can buy shares in the UK and overseas without paying any commissions. Carnival was a consistent dividend payer until the COV-19 pandemic came to fruition. It made the decision to suspend Carnival shares dividends until further notice in March 2020. Carnival has undertaken two individual stock splits – both on a 2-for-1 basis. This happened in 1994 and again in 1998. You simply need to find an online broker that gives you access to the New York Stock Exchange. Then, upon depositing funds, and you can buy Carnival Cruise shares at the click of a button. Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers. WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy. Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

Step 1: Find a UK Stock Broker That Offers Carnival Shares

While some UK brokers give you access to international stocks, not all do. As such, your first port of call is to find a reliable UK share trading platform that offers US-listed companies.

While some UK brokers give you access to international stocks, not all do. As such, your first port of call is to find a reliable UK share trading platform that offers US-listed companies.1. Plus500 – Commission-Free CFD Provider

If you looking to gain exposure to Carnival shares on a short-term basis, then you might be more suited for a CFD platform. At the forefront of this in the UK market is Plus500. The online platform gives you access to thousands of financial instruments – including over 2,000 stock CFDs. This means that you can speculate on the short-term direction of Carnival shares.

If you looking to gain exposure to Carnival shares on a short-term basis, then you might be more suited for a CFD platform. At the forefront of this in the UK market is Plus500. The online platform gives you access to thousands of financial instruments – including over 2,000 stock CFDs. This means that you can speculate on the short-term direction of Carnival shares.Step 2: Research Carnival Shares UK

Carnival Share Price History

Carnival Shares Dividends Information

Carnival Shares Benefits

Huge Discounts Available

Advanced Bookings for 2021 Look Promising

Reduction of Operating Costs and Access to Liquidity

Fees Involved with Buying Carnival Shares in the UK

Deposit and withdrawal fees

Account management fees

Trading fees

Overnight trading fees

Inactivity fees

The Verdict

FAQs

How much were Carnival shares when the firm first went public?

How much does it cost to buy Carnival shares in the UK?

Does Carnival pay dividends?

How many stock splits has Carnival undertaken?

How do I buy Carnival shares from the UK?

Kane Pepi