Best Technology Funds UK to Watch

With the increasing ability of technology companies to produce superior alpha (excess return over the broad market) came the proliferation of technology funds worldwide that seek to provide investors with the ability to participate in the movement of various technology sectors and sub-sectors.

In this article, we will go over the list of some Technology Funds in the UK, review each one, and in the end review some of the popular UK brokers that allow users to purchase these funds.

10 Popular Technology Funds UK List

The technology sector encompasses many different sub-groups, giving the investors plenty of options to choose from. In the table below, we have listed 10 popular Technology Funds in the UK.

1. Technology Select Sector SPDR Fund

2. Morgan Stanley Institutional Growth Fund

3. Fidelity Select Semiconductors Fund

4. First Trust ISE Cloud Computing Index Fund

5. Global X FinTech Thematic ETF

6. T. Rowe Price Science And Technology Fund

7. ROBO Global Artificial Intelligence ETF

8. KraneShares CSI China Internet ETF

9. ARK Funds

10. Herald Investment Trust

Technology Funds to Watch Reviewed

1. Technology Select Sector SPDR Fund

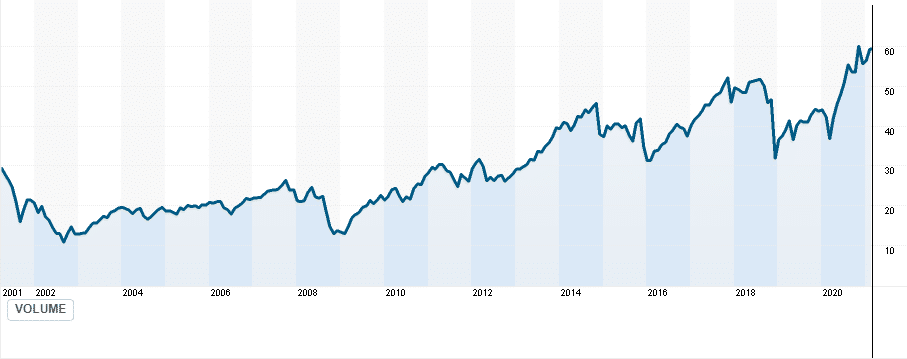

The SPDR Fund (XLK) has $37.4 billion in assets under management. Its focus is on mature and established names of the technology sector and is quite top-heavy with close to 21% off assets invested in both Apple and Microsoft.

Since the fund is U.S.-oriented, larger holdings include companies like Visa, Nvidia, Mastercard, PayPal, Intel, Adobe, and others, and allocates 99.60% to stock with the rest in cash. Such a concentrated approach in turn leads to a stellar performance streak of 68.36%, 27.94%, and 26.10% in the last 1,3 and 5-Year periods

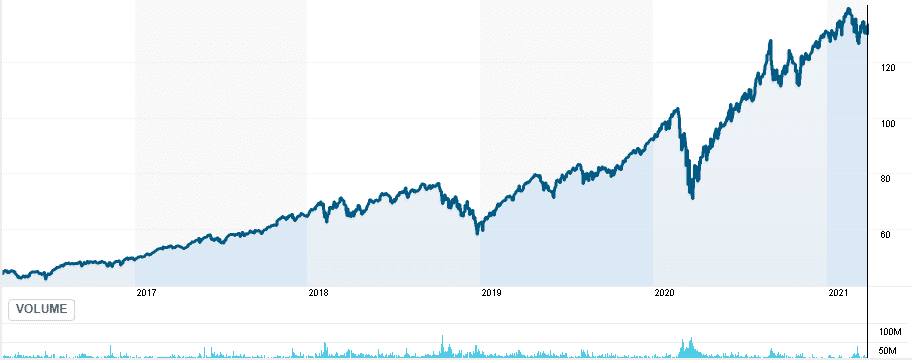

2. Morgan Stanley Institutional Growth Fund

The $19.2 billion fund (MSEQX) invests in established and emerging companies predominately in the U.S., but with an option to allocate up to 25% of its total assets in foreign securities. It was able to beat its benchmark for all of one, three, five and 10-Year periods with average annual returns of 115.6%, 42%, 32.2%, and 23.1%.

The fund’s biggest sector weight as of the end of last year was information technology, at 35%, communications at 21%, and 15% of assets parked in health care and consumer discretionary each.

The largest 10 holdings at the end of the year totalled just over 46% of the 41-stock portfolio. Morgan Stanley Institutional liquidity Treasury was the largest holding with 7.83%, followed by Amazon at about 7.5%, with Square, Shopify, Spotify Technology, and Uber Technologies each around 5% in the rest of the top five.

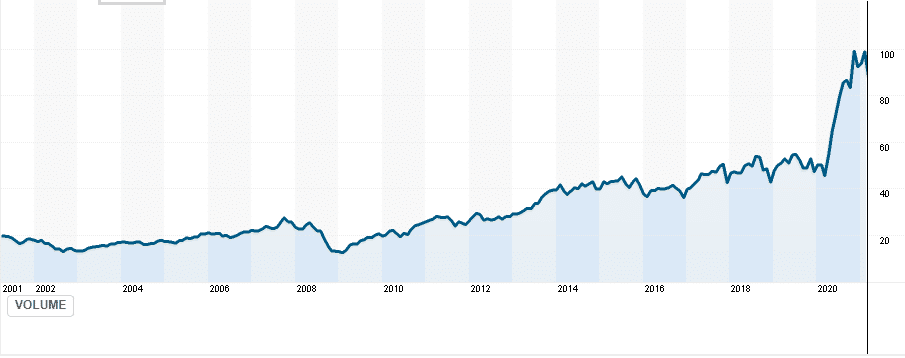

3. Fidelity Select Semiconductors Fund

Semiconductors represent the backbone of the entire new-era economy as they are used in everything from making computers, smartphones, transistors, integrated circuits, cars, machines, data centers, and a variety of other consumer and industrial markets.

Fidelity Select Semiconductors Fund (FSELX) is one of the oldest (started in 1985) and largest ($5.713 billion in assets under management) funds that seek to capitalize on the rising usage of semiconductors. As it invests in growth-type companies, its turnover rate is more aggressive with a 131% turnover rate last year. However, this was justified as the fund has posted a 1-Year return of 70.47%, while also gaining 29.11%, 34.39%, and 21.23% in the last 3,5 and 10-Year periods.

Among its 38 holdings (as of the end of last year) Nvidia is in a top-weighted position with close to 19% of total assets, followed by Qualcomm, Micron, NXP Semiconductors, and Intel, all between 6-7% weight in the portfolio.

4. First Trust ISE Cloud Computing Index Fund

First Trust ISE Cloud Computing Index Fund (SKYY) is the first ETF constructed in a way to offer investors exposure to the cloud computing industry.

Individual stock weight is capped at 4.5% of assets, with all stocks coming from one of 3 groups: Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Currently, its largest holdings include companies like Rackspace Technology, VMware, Oracle, Arista Networks, Microsoft, Alphabet, and others.

The fund has an expense ratio of 0.60%.

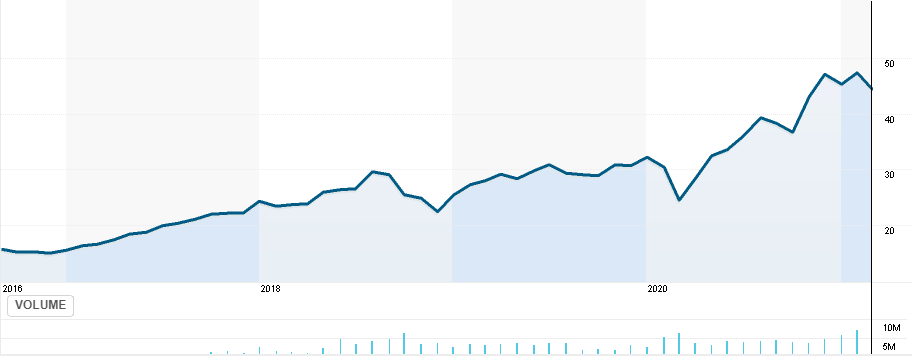

5. Global X FinTech Thematic ETF

This large-cap, financial technology-oriented fund has a 0.68% expense ratio. Founded in 2016, with close to $1.2 billion in assets under management, Global X FinTech Thematic ETF (FINX) invests heavily in the industry disruptors from both U.S. as well as abroad. Among its biggest holdings are leading companies in the industry like Square, Paypal, Afterpay, Adyen as well as Warren Buffett-backed Brazilian payment processing company StoneCo.

Along with these innovative payment companies, tax and accounting-oriented names like Intuit, Bill.com, and Xero Limited are also present at the peak of the FINX portfolio. With around 55% of assets allocated to the largest 10 positions, all of which were strong performers in 2020, this ETF rewarded its investors with a healthy 54% gain last year. This represents a fourth straight year of gains after notching 50% in 2017, 1% in 2018, and 38% in 2019.

6. T. Rowe Price Science And Technology Fund

The PRSCX fund itself (1987) have withstood the test of time and proved themselves over and over again as a reliable investment option for investors seeking long-term capital appreciation.

As stated in the fund prospect, at least 80% of capital allocation goes to companies in industries such as electronics, communications, e-commerce, information services, life sciences, media, environmental services, chemicals, synthetic materials, defense, and aerospace. With the track record of 45.80%, 25.50%, 25,20%, and 18,55% in annual total returns for the last one, three, five, and ten year periods, and an expense ratio of acceptable 0.77%.

7. ROBO Global Artificial Intelligence ETF

Within the 72 holdings in total from 16 countries, the biggest 5 places are occupied by Chinese technological giant Baidu, iRobot Corporation, Illumina, Etsy and HubSpot. ROBO Global charges 0.68% in annual expense ratio.

As the fund came to life in May 2020, it still does not have a longer-term track record or substantial assets under management.

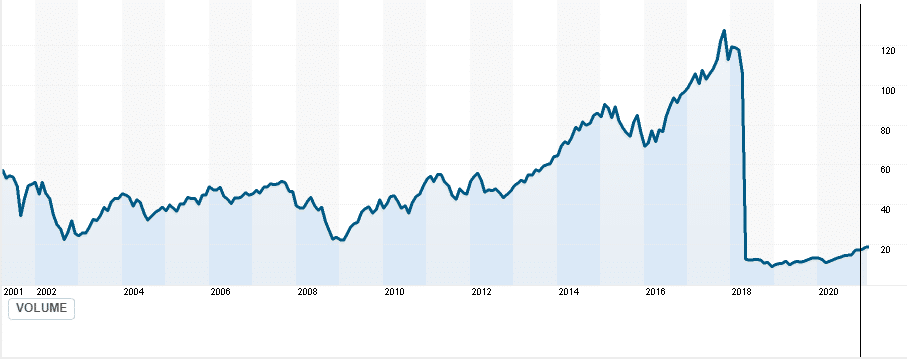

8. KraneShares CSI China Internet ETF

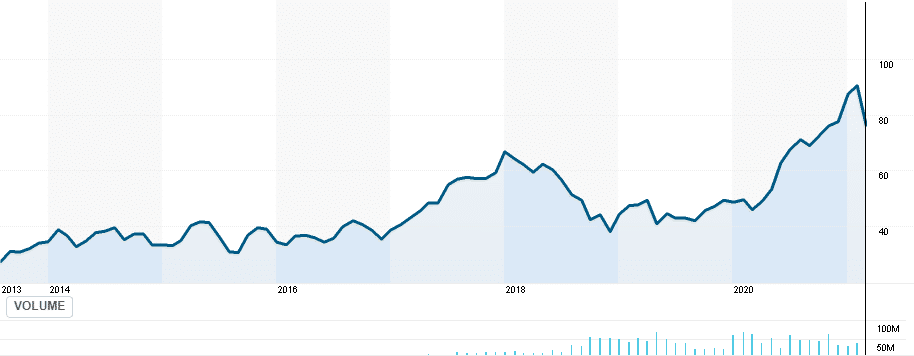

With an 8-year track record under its belt and $4 billion in assets under management, KraneShares CSI China Internet ETF (KWEB) is the only ETF that solely focuses on providing investors with exposure to Chinese high-flying software and IT names.

It gives investors the chance to participate in the moves of companies like Tencent, Alibaba, Baidu, Pinduoduo, JD.com, Bilibili, and others, and was able to beat other China-oriented ETFs like SPDR S&P China ETF and iShares MSCI China ETF by a margin of 25% in the last year, on the back of powerful moves that high-growth tech companies had after global Covid-19 pandemic increased the pace the technological changes and adoption.

The tradeoff in the form of a 0.73% expense ratio is quite reasonable considering 66.38%, 25.16%, and 124.30% return on one, three, and five year period.

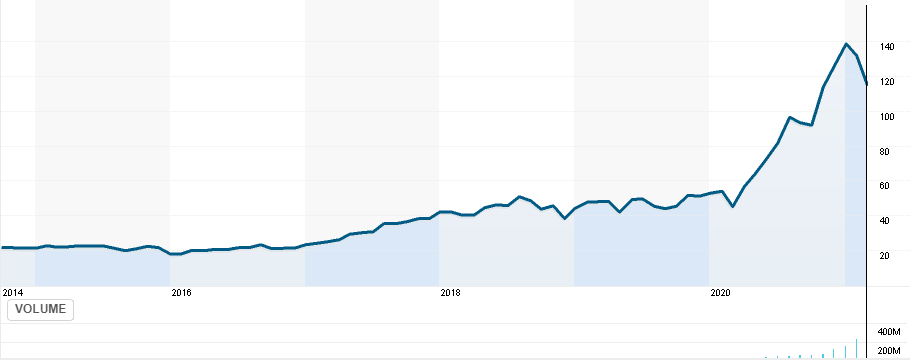

9. ARK Funds

ARK Invest and its founder and CEO Cathie Woods witnessed a meteoric rise in the last several years by offering something completely new to the investing community. It was not only the fact that funds under the ARK umbrella did tremendously well that caught widespread attention; it was also the way how they did it that resonated well especially under the younger generation.

ARK is very transparent about its positions and the underlying reasons and assumptions that it makes about every position that it holds or intends to hold. Amazingly, this has not impeded its performance one bit as evidenced by triple-digit returns in all of their actively managed funds last year and close to 550% gain in a 5-Year period for its flagship $24 billion ARK Innovation Fund.

The line of current 7 ETFs (Ark Innovation, ARK Genomic Revolution, ARK Next Generation Internet, ARK Fintech Innovation, ARK Autonomous Technology & Robotics, 3D Printing, and ARK Israel Innovative Technology) will soon be expanded by space-oriented ETF which would track U.S. and global companies involved in space exploration and innovation.

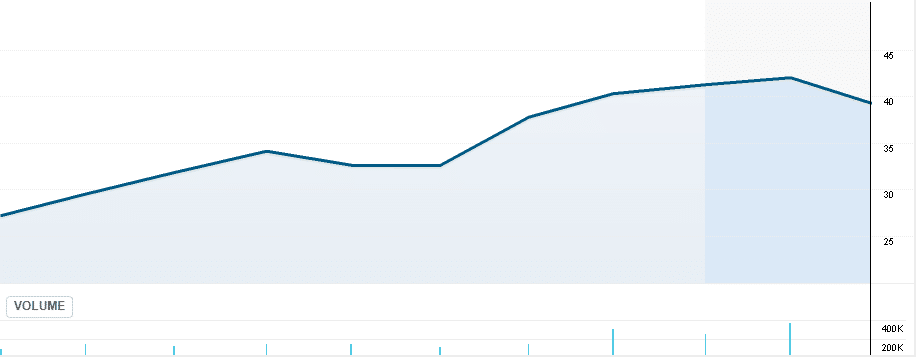

10. Herald Investment Trust

Incorporated in 1993, this £1 billion UK-based fund (LON:HRI) invests primarily in smaller companies from the telecommunications, multi-media, and technology sectors. While the fund has a global investment view, over half of the portfolio (around 53%) is invested in the UK listed companies, and represents a potential option for the investor who wants to focus on the UK market, with large holding companies like GB Group PLC, Diploma PLC, Pegasystems, Five 9 and others.

The fund posted a 1,3 and 5-Year performance of 92.7%, 86.16%, and 207% respectively, and charges 1.74% for its service which is a bit on the higher end of the spectrum.

What are Technology Funds?

Technology funds invest in equities of technology companies. They are focused on finding new and emerging technologies that have the potential to significantly disrupt the existing business models. Most of the companies that find their way into these funds operate in the IT-related sectors like hardware, software, digital transformation, cloud computing, data analytics, artificial intelligence and machine learning, and others.

Given that these funds are invested in specific segments of the market, they tend to be more volatile than broad-based market funds or ETFs that track the movement of entire SP500 or NASDAQ indexes.

Technology Funds Brokers

After choosing the fund you may want to invest in, the next step involves reviewing stock brokers that can allow you to invest in these funds. Factors such as fees and commissions, safety, reliability, financial and technical tools, and selection of assets, should all be taken into consideration when making such a decision.

Conclusion

Investors should make sure to properly analyse and research their possible investments prior to entering any positions in the market.