How to Buy Oxford BioMedica Shares UK – With 0% Commission

After recently hitting all-time highs, Oxford BioMedica has had a fantastic year thus far. The rollout of the COVID-19 vaccine has generated vast streams of revenue for the company, with further exciting developments yet to come. So, with this in mind, this article discusses How to Buy Oxford BioMedica Shares UK.

We’ll explore the company in detail, providing all the information you need to make an effective investment decision and showing you how to invest without paying any commissions at all!

How to Buy Oxford BioMedica Shares UK – Step by Step Guide 2021

Step 1: Choose a Stock Broker

Before you buy Oxford BioMedica shares, you’ll have to create an account with a broker to facilitate your investment. These brokers essentially pair buyers and sellers together and allow users to buy shares from the comfort of their own home. However, there are a significant number of brokers available to choose from these days – so narrowing down the options can be tricky.

To help streamline this process, this section presents the best stock brokers that allow you to buy Oxford BioMedica shares. By using one of these brokers, you’ll be able to trade the stock market safely and cost-effectively.

1. Fineco Bank – Heavily Regulated Broker to Buy Oxford BioMedica Shares

Fineco Bank has an exceptional reputation worldwide and is regulated by the Bank of Italy. Moreover, Fineco Bank even has a banking license and is listed on the Italian Stock Exchange! These factors ensure Fineco Bank is one of the safest places to invest in stocks.

Fineco Bank has an exceptional reputation worldwide and is regulated by the Bank of Italy. Moreover, Fineco Bank even has a banking license and is listed on the Italian Stock Exchange! These factors ensure Fineco Bank is one of the safest places to invest in stocks.

The great thing about Fineco Bank is that they offer a flat fee structure for traders. UK-based traders are charged only £2.95 per trade, regardless of trade size. If you are using more significant amounts, this tends to be less of a fee than other brokers. What’s more, Fineco Bank does not charge any deposit, withdrawal, inactivity, or monthly account fees.

The account opening process with Fineco Bank is super-quick and can be completed online. Notably, Fineco Bank does not have a minimum deposit threshold – meaning you can deposit as much or as little as you want! However, Fineco Bank only accepts bank transfers for deposits, taking a few days to arrive.

Pros

Cons

Your money is at risk.

Broker Price Comparison

As you can see from the section above, we recommend using Fineco Bank to buy Oxford BioMedica shares. The table below compares these platforms with other platforms in the industry, allowing you to compare the fee structures of each.

| Broker | Commission | Account Fee | Deposit Fee |

| Fineco Bank | £2.95 per trade | None | None |

| Libertex | From 0.1% | None | None |

| Hargreaves Lansdown | £11.95 per trade | None | None |

Step 2: Research Oxford BioMedica Shares

Before you buy Oxford BioMedica shares, you must research the company in-depth and determine whether it represents a good investment opportunity. This process is critical when stock trading, as it allows you to make better trading decisions over the long term. With this in mind, the sections below present all of the crucial information you need to know about Oxford BioMedica, ensuring you can make an informed investment.

What is Oxford BioMedica?

Oxford BioMedica PLC is a pharmaceutical and biotechnology company based in Oxford in the United Kingdom. The company specialises in gene and cell therapy, aiming to produce medication that can help treat diseases or repair damaged genetic material. Oxford BioMedica was established in 1995 as a spin-off from the prestigious Oxford University and has grown remarkably over the past 16 years.

Oxford BioMedica has explored gene therapy techniques over the past decade to help alleviate symptoms from diseases such as Parkinson’s and Cancer. More recently, Oxford BioMedica has been in the public eye due to its involvement in developing the COVID-19 vaccine. The company is currently part of a consortium of biopharmaceutical companies that have constructed the Oxford-AstraZeneca vaccine, led by the Jenner Institute.

John Dawson is the current CEO of Oxford BioMedica, with Lorenzo Tallarigo acting as Chairman. The company is listed on the London Stock Exchange (LSE) under the ticker symbol ‘OXB’ and is a constituent of the FTSE 250 index. According to Yahoo Finance, Oxford BioMedica has a market cap of £1.13 billion.

Oxford BioMedica Share Price

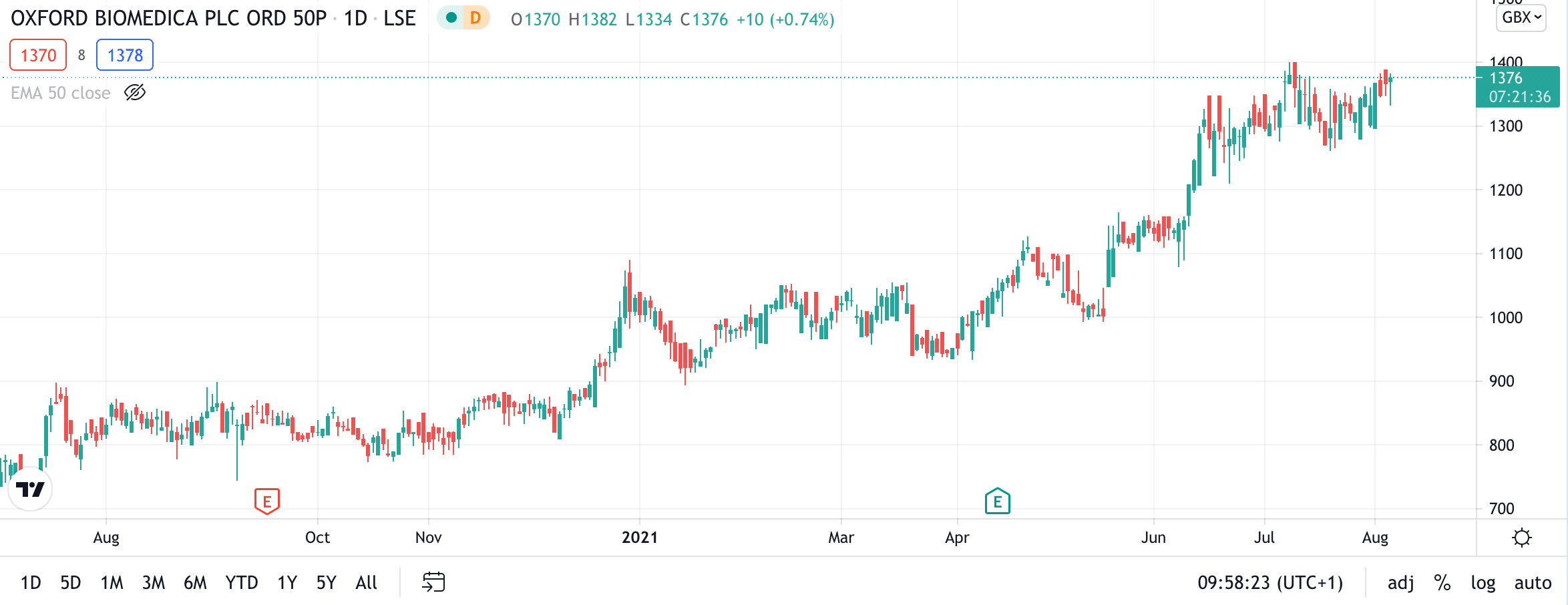

At the time of writing, the Oxford BioMedica share price is currently sitting at 1376 GBX (pence). This represents an increase of 32.53% since the start of the year and an increase of 61% from this date last year, highlighting strong past performance. Notably, the Oxford BioMedica share price actually reached an all-time high of 1400 GBX as recently as July 2021 and is hovering around this level at the time of writing.

The daily price chart for Oxford BioMedica makes for good viewing for investors, as there’s a clear and strong uptrend overall. With momentum this strong, there’s certainly scope to breach the recent all-time highs and post new ones.

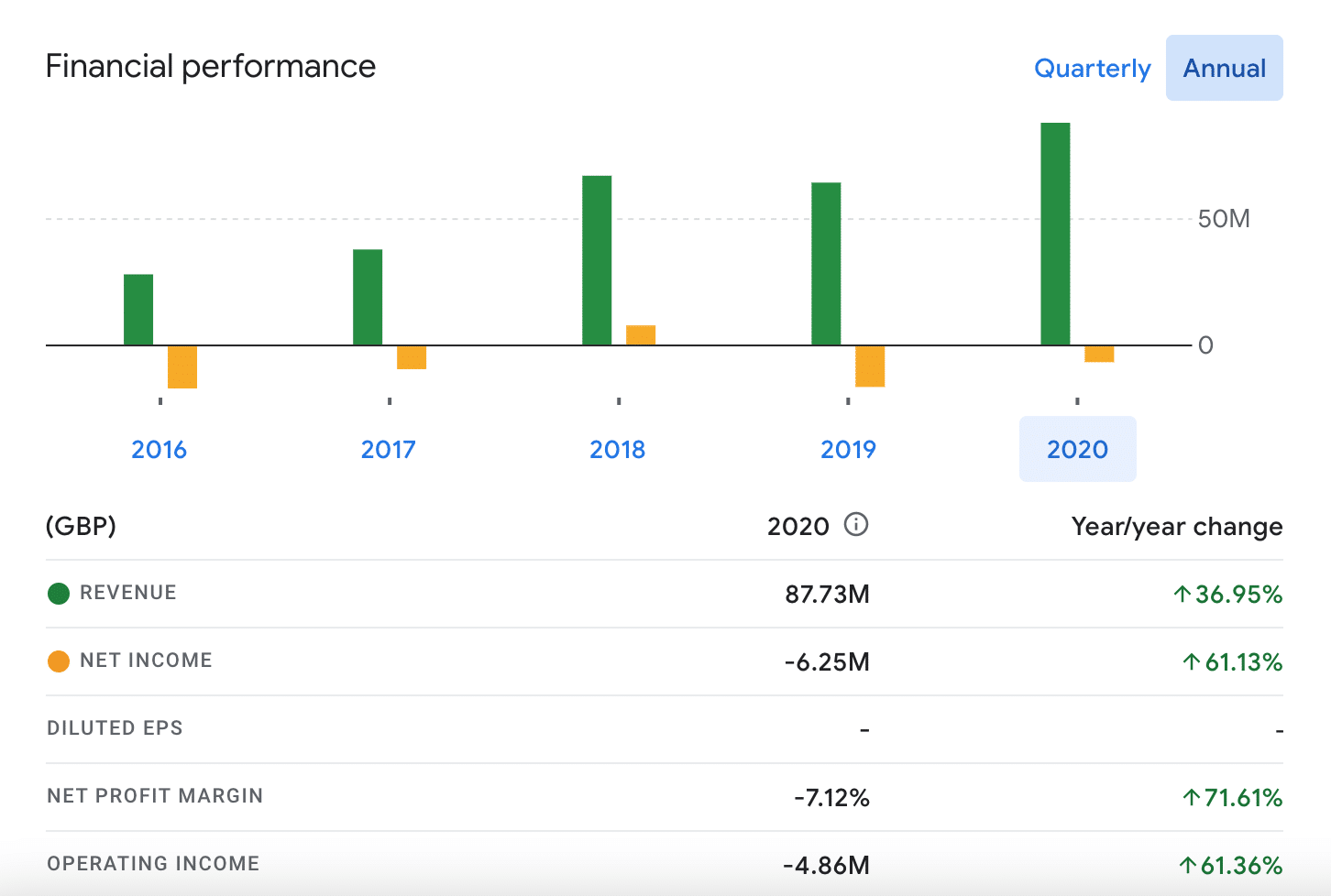

If you were to look at the company’s earnings per share (EPS) and price to earnings ratio (P/E), it would make for grim reading – but those don’t tell the whole story. According to the Financial Times, the company has an EPS figure of -£0.0817. This may look bad, but the reality is that pharmaceutical companies are rarely profitable initially, as much of their products tend to be caught up in clinical trials and do not generate revenue until years down the line. Due to this, the company does not have a positive PE ratio at present.

The good news is that losses are narrowing, so the company is definitely nearing profitability. Pre-tax losses for the most recent fiscal year were only £6.6m, much less than the year before. With revenues increasing due to the vaccine, the signs look promising that Oxford BioMedica will turn a profit in this fiscal year.

Oxford BioMedica Shares Dividends

If you are interested in investing for monthly income, then dividend-paying stocks are a great way to facilitate this. At present, if you were to buy Oxford BioMedica shares, then you wouldn’t receive a dividend yield as the company do not currently pay one. This is due to the company not presently being profitable, as profits are where dividend payments come from.

However, as Oxford BioMedica is nearing profitability, there’s always scope for this to change in the future. Many pharmaceutical firms will use their free cash flow to fund research, but some do not. So, it’s wise to keep an eye on this element going forward.

Oxford BioMedica ESG Breakdown

More and more people are becoming interested in ethical investments. These offer a way to create a portfolio of companies responsible in an environmental, social, and governance sense. To provide insight into how moral Oxford BioMedica is, we’ve researched the company’s ESG rating thoroughly.

Presented below are Oxford BioMedica’s ESG ratings which were gathered from prominent data analytics firm CSRHub:

- Environmental – 63/100

- Social – 51/100

- Governance – 49/100

Each category is scored out of 100, with a higher score representing a better performance in that category. As you can see, Oxford BioMedica is performing admirably in an environmental sense, whilst they are around average for social and governance factors. The company’s overall ESG score comes out at 42/100, making them just below average compared to other biotech companies.

Are Oxford BioMedica Shares a Good Buy?

There are many reasons why it’s a good idea to buy Oxford BioMedica shares right now. Presented below are two of the main ones to get an idea of the logic behind this investment idea.

Vaccine Revenues

As you can imagine, the revenue being generated by vaccine sales is helping out Oxford BioMedica’s bottom line drastically. The company recently stated that it is estimating that sales will breach the £100m mark this year, with “significant growth” in metrics such as operating earnings. Furthermore, numerous analysts predict that the company will generate a pre-tax profit this year, with estimates ranging around the £6.9m level.

Further Innovations

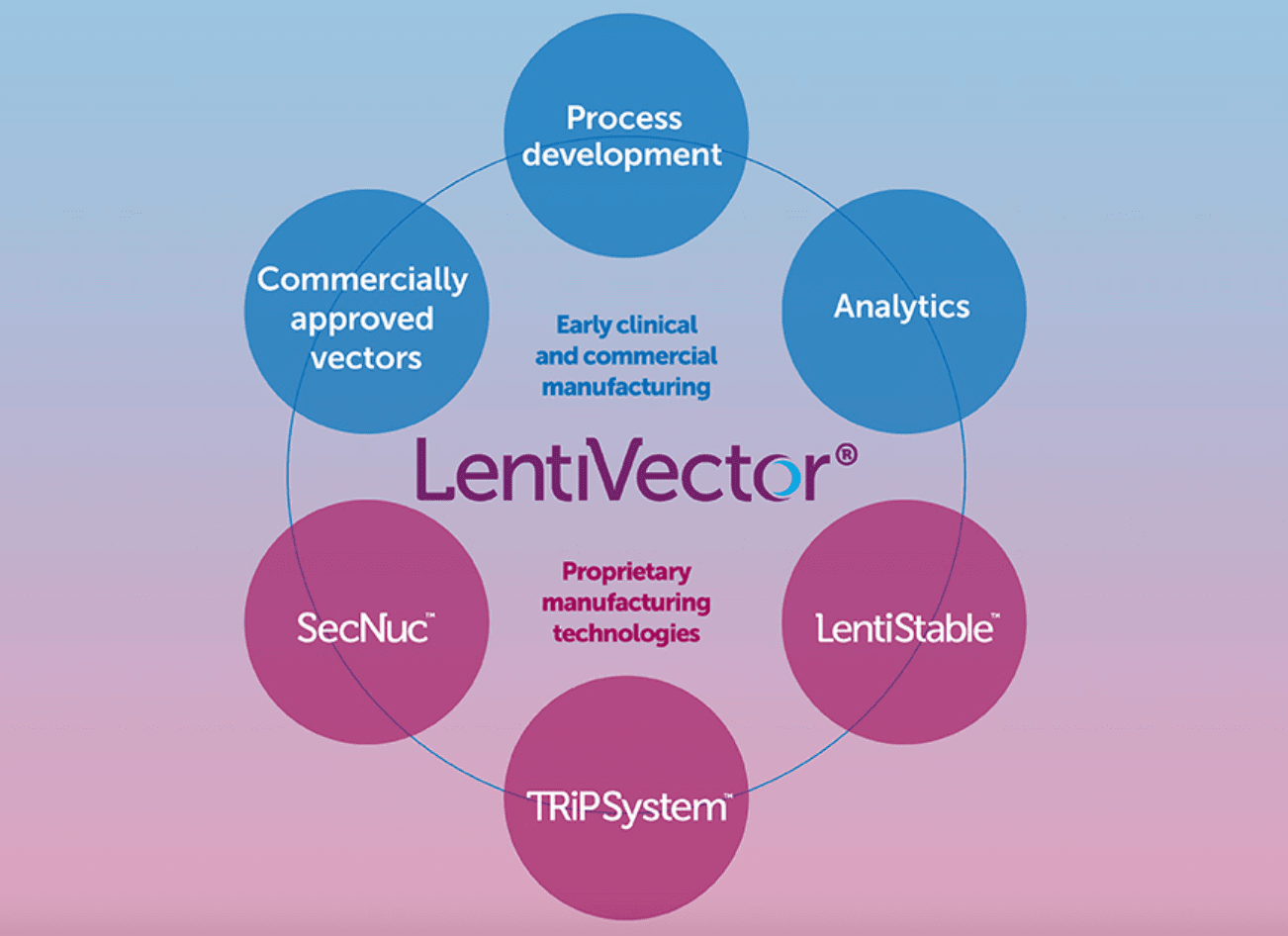

According to their website, Oxford BioMedica has its own technology called LentiVector, which is the first commercially approved lentiviral-based gene delivery system. This platform enables the development of revolutionary drugs and treatments for a range of diseases. Furthermore, this platform can also be used by other, larger companies (for a fee), which will generate enormous revenues for Oxford BioMedica.

The combination of vaccine revenues, plus the LentiVector technology’s potential, put Oxford BioMedica in a strong position going forward. For that reason, we believe this company is an excellent addition to equity portfolios for the months and years to come.

Step 3: Open an Account & Buy Shares

If you are interested in pharmaceutical shares, Oxford BioMedica represents an excellent opportunity to gain exposure to this sector. Notably, very few brokers allow you to directly invest in Oxford BioMedica at present.

Step 1: Create a broker Account

Head to the broker’s website and click ‘Join Now’. Enter a valid email address and choose a username and password for your account.

Step 2: Verify your Account

Before you can begin trading, you’ll need to verify your new account. Simply enter the required information for the KYC checks and upload proof of ID (a copy of your passport or driver’s license) and proof of address (a copy of a bank statement or utility bill).

Step 3: Fund your Account

The broker requires an initial deposit of $50, which can be made through the following options:

- Credit card

- Debit card

- Bank transfer

- PayPal

- Skrill

- Neteller

- Trustly

- Klarna

Step 4: Search for Pharmaceutical Shares

To gain exposure to the Oxford BioMedica share price, it’s best to buy shares in AstraZeneca, as this company are partnered with them. Type ‘AZN.L’ into the search bar and click ‘Trade’ next to the first option.

Step 5: Buy Shares

An order box will now appear, which will allow you to enter your position size and choose leverage if you wish. Once you are happy with everything, click ‘Open Trade’.

And that’s it! You’ve officially gained exposure to the Oxford BioMedica share price – without paying any commissions!

Oxford BioMedica Shares Buy or Sell?

Overall, Oxford BioMedica looks set to be one of the breakthrough companies in the pharmaceutical industry this year. The company falls firmly in the category of growth stocks, as it has fantastic potential due to its innovative technology. Furthermore, the revenues that the vaccine rollout has brought in will undoubtedly be put to good use in terms of research and development.

The signs are looking good for Oxford BioMedica to become profitable this year, which would be a landmark moment for the company. So, if you want to gain exposure to the pharmaceutical industry by investing in an exciting and growing company, Oxford BioMedica represents a fantastic way of doing so.

Other Vaccine Shares

Interested in investing in other pharmaceutical companies that are involved in developing a coronavirus vaccine? Check out the list below.

Buy Oxford BioMedica Shares UK with 0% Commission

Overall, the decision to buy Oxford BioMedica shares UK will allow you to gain exposure to the pharmaceutical industry efficiently and cost-effectively. With the company still growing rapidly, there’s enormous potential for positive returns in the months and years to come.