Impact Investing in the UK

Impact investments have two key goals. Firstly – and much like any other investment type, the objective is to grow capital through financial gains. Secondly – and perhaps more importantly, impact investments are those that are made to create positive change. This might be in the form of environmental or social change, for example.

If you’re looking to blend capital growth with stocks that strive for a positive impact on society, this guide will review Impact Investing in the UK.

-

-

What is Impact Investing?

Impact investing is the process of selecting stocks that not only have the potential to increase in value. In addition to this, the respective company must have some form of social or environmental impact. For example, this might be in a stock that is focused on tackling climate change by bringing renewable energy to UK householders.

Similarly, this could include a stock that is involved in sustainability and clean agricultural technologies. Either way, impact investing allows you to get both financial gain and positive social change. Other key industries that impact investing can cover includes healthcare, education, and electric vehicles.

In terms of where impact investing originated from, the phenomenon dates back to the start of the financial crisis of 2008. The overarching concept at the time was that it is feasible to invest in ethical and socially responsible companies while at the same time enjoy the fruits of financial gain, and the last decade or so has seen many entrepreneurs have set up start-ups with sustainable and responsible business models and received venture capital funding.

Impact investing has proved popularly among a wide range of investors, ranging from large financial institutions and commercial banks to private wealth fund managers, family offices and individual investors.

All in all, adding some impact investing stocks to your wider portfolio allow you to “do your thing” for society by injecting capital into rewarding projects and societal goals that equally – represent viable long term investments. We should also note that there are several impact investing ETFs that allow you to buy a full basket of suitable stocks through a single trade. More on this later.

Some impact investors screen potential investments according to Environmental, Social and Governance (ESG) criteria, to assess their social and environmental benefits and whether they are a valid impact investment.

Social Impact Investing

There is often a misconception that socially responsible investing (SRI) and impact investing are one of the same things. However, while there are many similarities between the two investment streams, some key differences apply. In fact, impact investing is a sub-division of SRI, insofar that the latter is somewhat broad.

For example, SRI – which is often referred to as green investing, is concerned with investments that meet particular ethical requirements. In its basic form, this might be stocks and shares that fall outside of the ‘SIN’ sectors.

These are sectors involved in alcohol, tobacco, gambling, or defence. For those looking to take more of an ethical leap, SRI looks to focus on companies and social enterprises that actively promote the avoidance of harm. This might be harm related to the environment or society as a whole.

On the other hand, impact investing is specifically related to investments that seek measurable and verifiable social and environmental change. In other words, the money that is invested in these organizations must help facilitate the specified societal goals.

For example, an impact investment into a solar energy stock must see the company in question use its share capital to meet its goal of bringing renewable energy to the masses.

Characteristics of Impact Investing

There are several characteristics that must be met and exceeded in order for a stock to fall under the umbrella of an impact investment.

This includes:

1. Intentionality

All impact investments must possess a characteristic that centres on ‘Intentionality’. Put simply, this means that the stock in question must use investment funds to directly improve social and environmental challenges.

2. Financial Gain

It goes without saying that the impact ‘investment’ must strive to generate a financial return for those injecting money into the company. With this in mind, impact investing is clearly a different kettle of fish to conventional philanthropy, insofar that impact investors not only expect to get their money back – but with growth.

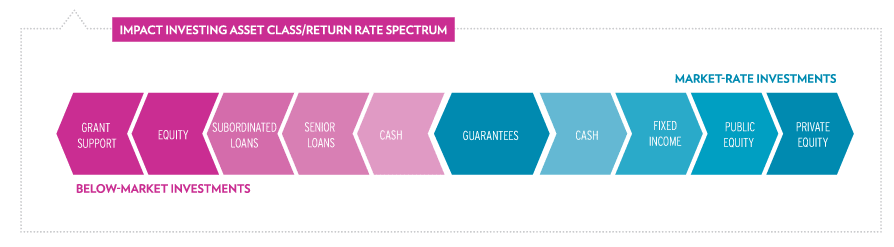

3. Asset Diversity

Impact investments come in a range of shapes and sizes. Although this guide thus far focused on traditional stocks, there are many other ways that this area of the investment scene can be accessed. This includes everything from loans, private equity funds UK, and fixed income instruments like bonds or fixed income funds.

With that said, if you’re an everyday retail investor in the UK – the chance that you will have the access to the impact investing scene is via stocks and shares. This is because you can complete the investment process from the comfort of your home with small stakes. Other impact investing assets that as the aforementioned are traditionally reserved for institutional investors.

4. Measurable Change

Unlike the wider SRI arena, a core characteristic of impact investing is that social and/or environmental change must be quantified.

That is to say, there must be a way to measure how effective the invested funds were in reaching the stated goals of the said organization. This could be something as simple as increasing the number of electric vehicles on the road by 0.5% before 2025.

Impact Investing Example

There are many examples of successful impact investing projects. But, to give you a clearer idea of how things work, the example below is based on Ecotrust Forests Management (EFM).

Ecotrust Forests Management (EFM)

Ecotrust Forests Management (EFM) is an equity fund that strives to make measurable changes to forestlands. The overarching objective is to actively manage over 13,000 acres of forest land. In turn, this forestland will be used to provide financial returns, while at the same time improving social and ecological processes.

In order to achieve this, impact investment funds are used to provide low-cost loans to those managing the forestland. In terms of generating growth, harvested timber is subsequently sold on the secondary market. The fund notes that taking an environmentally friendly approach to forestry provides long-term valuer for investors.

When it comes to measurable targets, Ecotrust Forests is responsible for tracking a set of key metrics – all of which must be reported on a regular basis. This includes the number of acres being managed, the percentage of pulp sold, the amount of carbon being stored, and more.

Global Impact Investing Network

The Global Impact Investing Network (GIIN) is a nonprofit organization that is tasked with promoting impact investing. Launched in 2009 and based in the US, the organization seeks to reduce the barriers of making impact investments and thus – increasing the amount of capital injected into this segment of the financial scene. The Global Impact Investing Network seeks to achieve this through education.

Impact Investments UK

So now that you know the ins and outs of what impact investing is, we are going to discuss some possible investments that some traders could research. As always, ensure you perform lots of research on the stocks listed below, paying close attention to their financial performance, especially when it comes to ensuring that they meet your personal impact investing requirements.

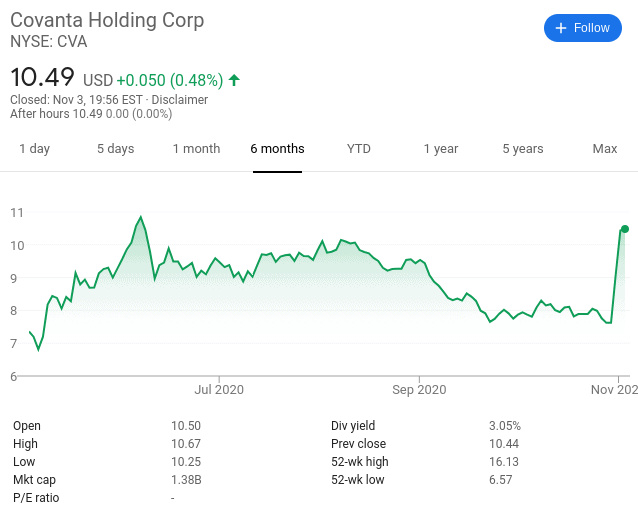

1. Covanta Holdings

Covanta sits well within the scope of an impact investment. The firm has sustainable development goals as it is the largest waste-to-energy provider globally. As the name suggests, this means that Covanta is involved in cutting-edge processes that have the potential to convert consumer and commercial waste into energy for people’s homes.

Additionally, the technology is also able to generate steam from waste and export it to various industries. In terms of measurable goals, Covanta is looking to reduce 21 million tons of greenhouse gas emissions, alongside recycling over half a million tons of metal.

The firm also aims to continuously generate power for over 1 million homes. When it comes to the financial side of this impact investment, Covanta shares are listed on the New York Stock Exchange. The stocks took a major tumble earlier in the year as per the restrictions put in place by the covid pandemic.

But, recovery has been impressive over the past six months. For example, Covanta shares were priced at $7.36 in the six months prior to writing this page. And today, the same stocks are worth $10.49 – respecting an increase of 42%. At present, this cutting-edge company has a market capitalization of just $1.3 billion.

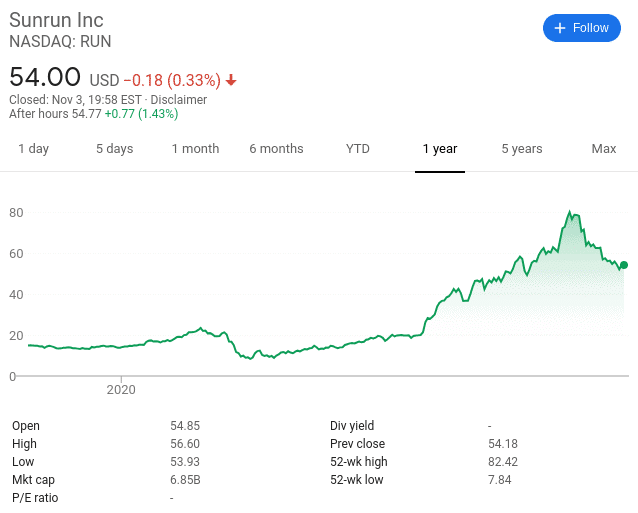

2. Sunrun

Launched in 2007, this impact investing stock is involved in the residential solar energy space. Sunrun has a simple, but hugely effective business model that makes solar panel installation affordable to the average consumer. It is able to achieve this by offering homeowners to chance to lease solar panels and subsequently pay for the energy usage.

In turn, this allows consumers to lower the cost of their energy bills, as they are using what the solar panels generate. Sunrun eases the process further for consumers as it takes care of installations, repairs, and monitoring. It wasn’t until 2015 that Sunrun went public, with the firm opting for the NASDAQ exchange in the United States.

During its IPO, the firm priced its stocks at $14 each – valuing the company at over $1.3 billion. At the time of writing in November 2020, the shares are worth $54 each. This represents a growth of 285% in just five years.

With that said, after hitting all-time highs of $82 in October 2020, the shares have tailed off since.

3. SGL Carbon

SGL Carbon is a Germany-based manufacturer of carbon-based products. The firm is active in almost 30 countries globally – with regions including Europe, Asia, and North America. SGL Carbon is a Germany-based manufacturer of carbon-based products.

In terms of the specific products offered by the company, this includes fibres, textiles, composites, and prepregs. SLG Cabon is also involved in graphic materials and systems.

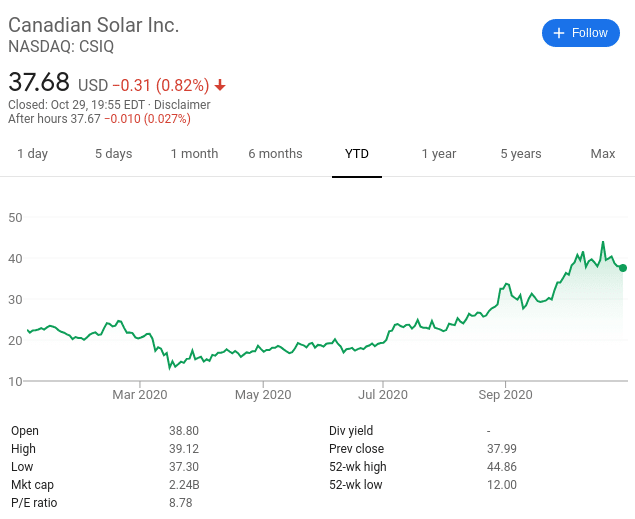

4. Canadian Solar

Candian Solar is yet another solar-focused impact investment that makes our list. The firm is involved in bringing solar energy to everyday consumers through modules. These modules have the potential to minimize the amount of energy being used at home – subsequently cutting costs for consumers along the way.

This ensures that Canadian Solar as an entity is making both social and environmental changes. While the firm is continuously looking to expand into new markets, it is also present in 23 countries. Looking at the company’s stock market presence, its shares are listed on the NASDAQ with a current market capitalization of just over $2 billion.

5. Waste Management

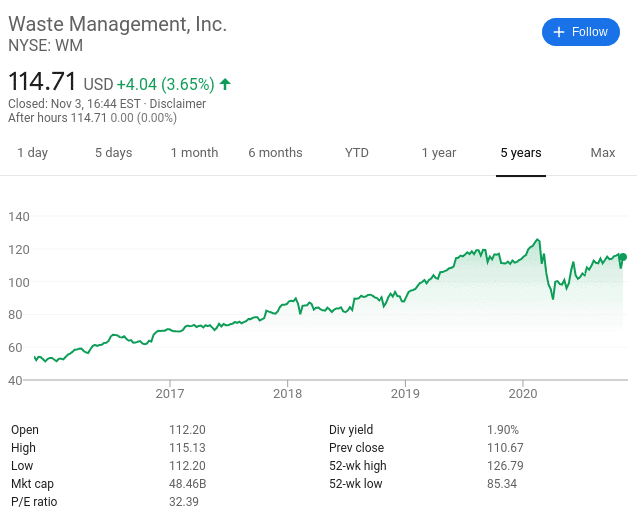

Waste Management Corporation is a US-based company that is involved in environmental technologies in addition to waste management. The firm offers environmental services to millions of consumers on commercial sites across the US and Canada. In terms of its environmental credentials, Waste Management has achieved a number of measurable goals.

For example, it has transitioned almost 500 of its trucks from diesel to natural gas. The firm has also introduced a plant that is capable of generating more than 13,000 gallons of clean LNG fuel each and every day. In addition to this, Waste Management was recently named one of the world’s most ethical companies by Ethisphere – reaching this feat for the 11th time.

Looking at the financials, Waste Management is listed on the New York Stock Exchange with a market valuation of £48 billion. Over the course of time, the stocks have performed very well. In the five years prior to writing this page, Waste Management shares were priced at $54.

Platforms Offering Impact Investing

Once you have found an impact investment that you like the look of, your next port of call is to find a suitable broker. Before taking the plunge, you need to ensure that your chosen broker offers competitive fees, and support for your preferred payment method.

1. IG

At IG you can trade over 17,000 CFD markets with this platform, as well as gain access to a fully-fledged spread betting facility. The former allows you to trade and not be liable for capital gains tax on your profits.

But, we really like IG for its traditional share dealing platform. This covers over 12,000 stocks, ETFs, investment trusts, and mutual funds. In particular, IG offers heaps of funds that are tasked with making an impact and ethical investments. On the other hand, IG is more expensive than the other platforms we have discussed thus far. This is because it charges a dealing fee of £8.

You can reduce your dealing fee to £3 if you trade actively. This will, however, require you to place at least 3 trades in the previous calendar month. IG also stands out for its reputation in the UK brokerage scene. First launched in 1974, it is listed on the London Stock Exchange. It is also heavily regulated, with licenses including the FCA and ASIC. You will need to deposit £250 to open an account at IG, which you can via a debit/credit card or bank transfer.

Sponsored ad. Your capital is at risk.

Conclusion

In summary, impact investments are more than just a buzzword. In fact, more and more investors in the UK and looking to take this innovative approach to financial investments. After all, some traders can combine the fruits of financial gain and at the same time – help make societal and environmental changes for the better by sustainable investing.

FAQs

Is impact investing the same as socially responsible investing?

Technically, no – but the two investment streams are very similar. In a nutshell, socially responsible investing focuses on stocks and ETFs that do not cause harm. It can also cover assets that are involved in sectors that strive to improve the environment or society as a whole – such as renewable energy or electric cars. However, impact investing goes one step further. This is because the respective company must use its investment capital to directly make measurable improvements to society. ‘Measurable’ is the key word here, as the aims and objectives of the impact investment must be quantifiable.

Where does impact investing come from?

It is believed that the term ‘impact investing’ was first coined in 2007 in the midst of the financial crisis.

How big is the impact investing market?

As of Q2 2020 it was estimated that the impact investing industry is worth in excess of $700 billion. This number is expected to increase rapidly over the next decade.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up