How to Buy ASOS Shares UK – With 0% Commission

ASOS is one of the best-known brands in the UK, famous for its low-cost clothing line and speedy delivery options. With lockdowns easing and consumer demand rising, now could be a fantastic time to invest in ASOS shares to generate some positive returns in the months to come.

In this guide, we discuss How to Buy ASOS Shares in the UK, covering everything you need to know about the company and its financials and showing you how to buy ASOS shares – without paying a penny in commissions.

Choose a Stock Broker

Firstly, you’ll need a reliable stock broker to facilitate any investment you make in ASOS. There are hundreds of stock brokers to choose from these days, which can make narrowing them down pretty tricky. To help smooth this process, this section presents our recommendation for the best broker to buy ASOS shares with.

Broker Price Comparison

To provide further context, the table below presents the cost to buy ASOS shares in the UK for a selection of top UK brokers.

| Broker | Commission | Account Fee | Deposit Fee |

| Fineco | $3.95 per trade | None | None |

| Libertex | From 0.1% | None | None |

| Hargreaves Lansdown | £11.95 per trade | None | None |

Research ASOS Shares

To ensure that you have a firm understanding of what ASOS is and the company’s business model, the sections below cover all of the critical points to be aware of before investing. By reviewing the information below, you’ll have all you need to make an informed investment decision.

What is ASOS?

ASOS PLC is a British-based online fashion retailer founded back in 2000. The company sells a vast range of clothing and accessories through the ASOS website, including over 850 brands. At present, ASOS ships to 196 countries around the globe through various distribution centres located in the United Kingdom, US, and Europe. The company’s CEO is Nick Beighton, who has been in the role since 2015.

ASOS is best known for the speedy delivery options offered to customers and the low cost of their products. The company popularised the ‘next day delivery’ shipping method, ensuring customers can receive their items as fast as possible. What’s more, ASOS have developed their own brand of clothing, which aims to imitate current trends but at a fraction of the price point that designer brands charge.

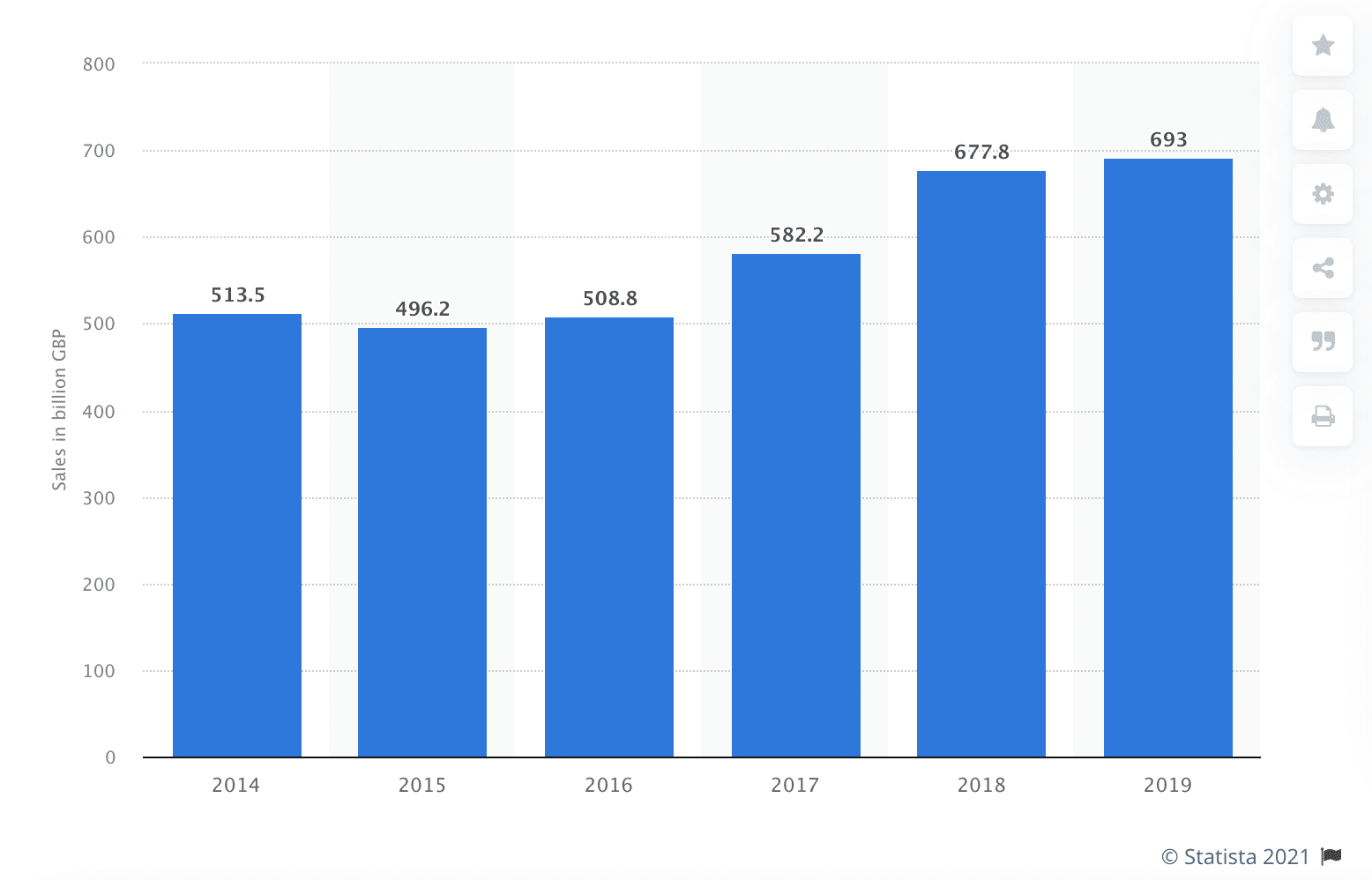

According to Yahoo Finance, ASOS has a market cap of £3.86 billion. The company is listed on the London Stock Exchange (LSE) and trades under the ticker ‘ASC’. Furthermore, ASOS is a constituent of the FTSE 100 index. ASOS generated £3.26 billion in revenue in 2020, with revenue growing year on year for ASOS over the past decade. This growth is expected to continue thanks to the prevalence of e-commerce channels in the current day.

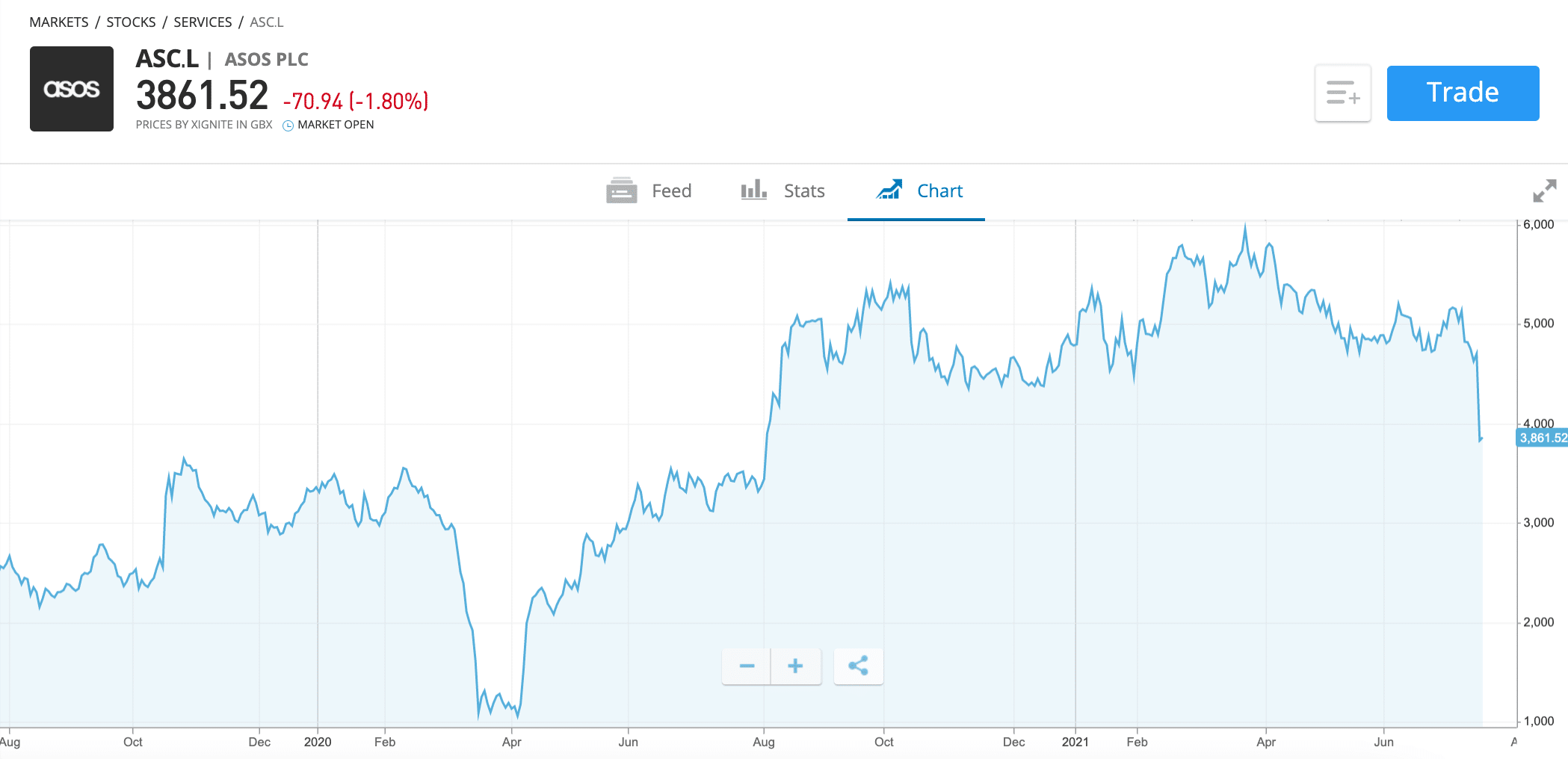

ASOS Share Price

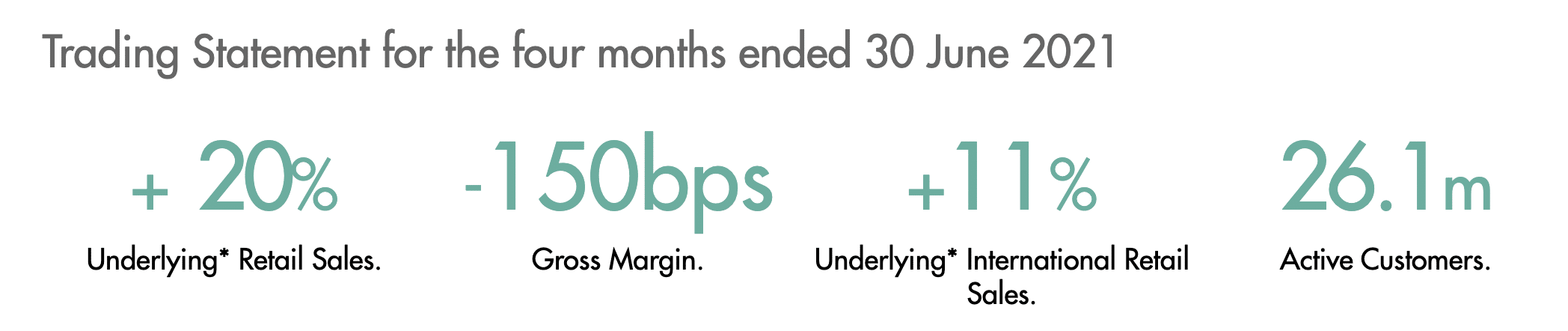

At the time of writing, the ASOS share price is sitting at 3876 GBX. This represents a 15.43% decrease since the start of the year – yet shares are still up 13.64% since this date last year. Much of late 2020 and early 2021 saw the ASOS share price trade sideways, as the company found its feet following the COVID-19 pandemic. However, July 2021 saw the share price take a nosedive after the company’s financial results stated that investors need to be cautious as we go forward.

When equity trading, it’s also a good idea to look at earnings per share (EPS) and the price to earnings ratio (P/E) to get an idea of the company’s value. EPS estimates for ASOS are currently £1.26 based on figures from 2020, representing a considerable increase from 2019’s EPS. The ASOS P/E ratio is currently 21.41, which is higher than rivals such as eBay and JD Sports – but still slightly less than Boohoo.

The current ASOS share price may be experiencing some volatility over the short term; however, the financial metrics presented above show that the company is still in a great financial position. This is a confidence booster for people looking to invest over the long term.

ASOS Shares Dividends

At present, ASOS does not pay a dividend to shareholders. Although this may be seen as a negative for people investing for income, it can actually be seen as a positive if you look at it from another perspective. ASOS opts to reinvest their dividends back into the company, purchasing smaller brands and expanding their product line. Over the longer term, this will provide scope for more considerable capital gains for investors.

ASOS ESG Breakdown

If you are interested in ethical investments, then it’s a good idea to check out a company’s ESG score to measure its impact on the environment and society as a whole. ESG stands for Environmental, Social, and Governance, and top stock analysts use this metric to determine how ethically a company is operating.

Found below is a breakdown of the ASOS ESG score for this year:

- Environmental – 6/100

- Social – 6/100

- Governance – 6/100

As you can see, ASOS ranks in the 6th percentile for all ESG factors. This essentially means that the company is in the top 6% of companies operating in the same sector for environmental, social, and governance elements. Overall, this highlights that ASOS are performing admirably when it comes to their environmental and social impact, which is excellent news for people interested in ethical companies.

Are ASOS Shares a Good Buy?

So, are ASOS shares a good buy? We believe so – especially if you are in the market for long term investments. Here are some of the main reasons why it’s a good idea to buy ASOS shares in the UK today:

Growing e-Commerce Sector

According to Statista, the e-commerce market in the UK is projected to reach £91.4 billion in 2021 – and is expected to grow by 3.46% annually between now and 2025. This growth would put the market’s valuation at £104.7 billion by 2025 – a colossal figure compared to other markets. The excellent news for ASOS is that fashion is the largest segment of the e-commerce market, which the company primarily focuses on.

These figures serve to highlight the fantastic opportunities ASOS has going forward. Due to the Coronavirus pandemic, physical retail stores have fallen by the wayside, prompting more people than ever to do their shopping online. This is fantastic news for ASOS, as the company has a household name and an efficient delivery network – putting them in pole position to benefit from any increases in consumer demand.

Smart Reinvestment Strategy

As noted earlier, ASOS does not currently pay a dividend to shareholders. This contrasts with other companies that do pay dividends, making them ideal for high yield investments. However, this is a calculated move by ASOS as they instead reinvest their profits back into the company to improve operations and expand their reach.

Recently, ASOS has acquired well-known brands such as Topshop and Miss Selfridge, intending to grow their portfolio of ASOS brands to offer to customers. Furthermore, the company has also partnered with the famous US-based company Nordstrom. Through this partnership, ASOS will look to expand their reach in the US – which represents a vast untapped market for the company. With active customers increasing every quarter, ASOS is in a great position to continue this expansion and generate substantial profits.

ASOS Shares Buy or Sell?

Wrapping everything up, are ASOS a buy or a sell opportunity? In our opinion, it is the former. Although the ASOS share price has taken a hit in recent weeks, the company’s foundations are solid – which is excellent news for people looking to invest over the long term.

The growing nature of the e-commerce market puts ASOS in pole position to benefit from increased consumer demand. As ASOS does not have any physical stores, they don’t need to worry about high rent fees or retail employees – the online nature of the company’s business model allows them to operate in a lean manner.

Revenue for ASOS is growing every year, which is a great sign. Although many companies experienced adverse effects from the pandemic, ASOS managed to use it as an opportunity to strengthen their online service and offer further product lines. The company is placing great emphasis on cosmetics in 2021, which complements its fashion segment well.

Overall, ASOS represent a great addition to your equity portfolio if you are interested in exposure to the fashion sector. Analysts are estimating that the company’s share price will continue to increase over the next year – and we are inclined to agree. The recent pullback may seem worrying at first, but when you consider its strong financial position, it can actually be viewed as an excellent opportunity to buy ASOS shares in the UK at a low price.

Buy ASOS Shares With 0% Commission

In summary, ASOS are a fantastic company to invest in if you are looking to gain exposure to the e-commerce sector. The company’s excellent distribution network and vast product line make ASOS the go-to destination for people looking to buy clothes or accessories. With revenue increasing year on year, now might be an exciting time to add ASOS to your investment portfolio.