Best Long Term Investments UK to Watch

Based in the UK and looking for long term investments? If so, there are thousands of financial instruments out there. Whether that’s in the form of shares, bonds, ETFs, mutual funds, or trusts – you need to find investment options that meet your long term financial goals.

We have compiled a comprehensive list of popular long term investments in the UK to watch. This covers a variety of asset classes, markets, and risk levels.

-

-

10 Popular Long Term Investments

Here’s a break down of 10 long term investments based on trading volumes:

- S&P 500 Index

- FTSE 100 Index

- Tesla Shares

- Gold

- Barratt Developments

- Amazon

- Vanguard Total Bond Market ETF

- Bitcoin

- Stanley Black & Decker

- FTSE All-World UCITS ETF

Long Term Investments in the UK

We have spent countless hours researching UK long term investments available in the market. In the sections below, we explain each and these investments in detail so that you have a firm grasp of the potential risks and rewards.

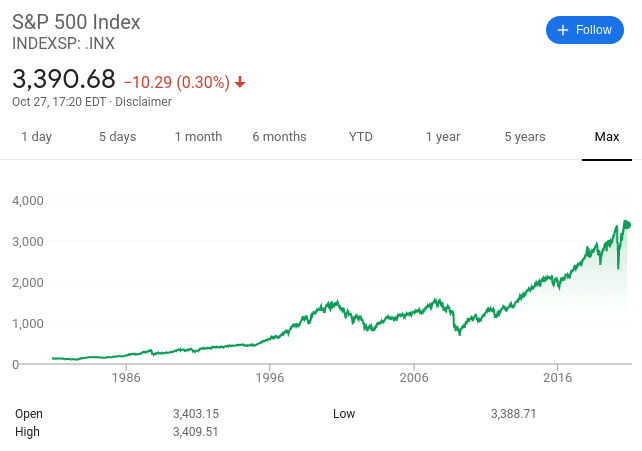

1. S&P 500 Index

This long term investment tracks the value of the 500 stocks that form the S&P 500 Index.

These are large-cap companies listed on the New York Exchange and NASDAQ – so you are essentially investing in the long term success of the US economy. In fact, the S&P 500 Index consists of companies that make up 70-80% of the US stock exchange.

To give you an idea of some of the stocks that you will be backing, check out the list below:

- Apple

- Microsoft

- Amazon

- Alphabet (Google)

- Berkshire Hathaway

- Johnson & Johnson

- Procter & Gamble

In other words, this is going to be a completely passive long investment. The reason for this is that the S&P 500 Index is rebalanced and re-weighted every three months. For example, if a company no longer justifies its listing on the Index, it will be removed.

This is exactly what happened to US department store chain Macy’s earlier this year. Additionally, the actual weighting of the S&P 500 Index constituents will be adjusted. For example, if Apple increases its market capitalization but Facebook goes the opposite way, the S&P 500 Index will take this into account.

The ETF provider (Vanguard) will personally buy the 500 shares that constitute the S&P 500 Index at the correct weighting.

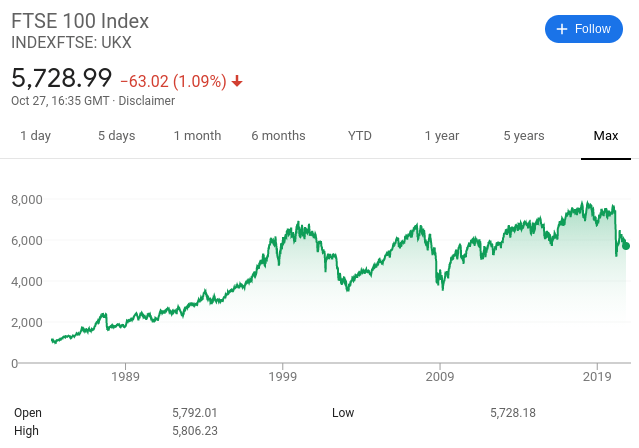

2. FTSE 100 Index

The S&P 500 has been a reliable stock market index over the past century.

For those unaware, the FTSE 100 is the UK’s primary stock market index. It tracks 100 large-scale companies that are listed on the London Stock Exchange. As such, this is a way to gain exposure to the wider UK economy over the course of time. To give you an idea of other types of companies that you will be investing in, check out the list below.

- Royal Bank of Scotland

- Anglo American

- London Stock Exchange Group

- Barclays

- Glencore

- Compass Group

- National Grid

- Prudential

- Lloyds Banking Group

- RELX Group

- Vodafone

- Reckitt Benckiser

- Rio Tinto

- Diageo

We don’t need to go too deep into the underlying operation of the FTSE 100, as this operates much the same as the previously discussed S&P 500. That is to say, by making a single investment, you will be buying 100 different shares. You will also be eligible to receive dividends, and the Index will be rebalanced and re-weighted every three months.

On the flip side, we should note that over the course of time, the S&P 500 Index has performed significantly better than the FTSE 100. This is especially the case in more recent times. For example, over the past five years, the S&P 500 Index has grown by 63%. In the case of the FTSE 100, the Index has declined by 10%.

3. Tesla Shares

Before we get to the fundamentals, let us outline who Tesla is and what is plans to achieve for those of you that might not be familiar.

In a nutshell, Tesla is an electric car manufacturer that was first launched in 2003. Just 17 years later, the California-based company is now the largest automaker in the world – taking over the reins from Toyota in July. Although the firm has been operational for almost two decades, it is still defined as a growth stock by analysts.

This is because Tesla is only just about in profit-making territory. While there are other electric car makers out there, none are anywhere near as innovative as Tesla. At the forefront of this is the firm’s drive for globalized sustainable energy. This includes its cutting-edge battery technology that Tesla says will eventually have a radius of over 1 million miles.

You then have its progress towards consumer-based solar panels. All of this is in addition to its ever-growing Tesla car model range. In terms of its stock price history, Tesla first went public in 2010.

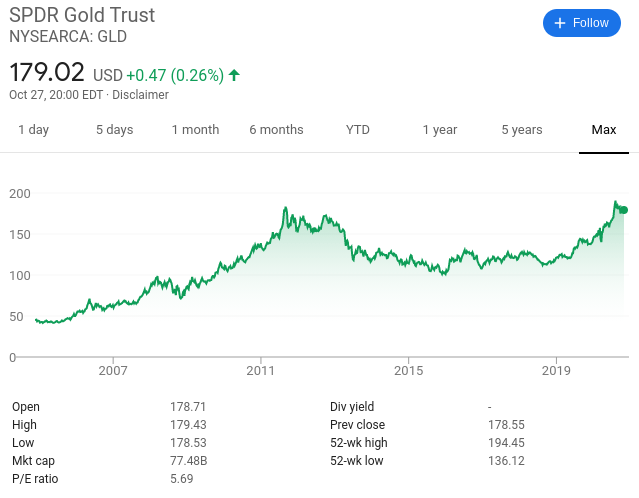

4. Gold

Gold is the oldest ‘form of money’ that these days – can be a store of value to hedge against some markets.

The other option available to you is to use an online platform that allows you to invest in gold – which in turn, is stored by the respective company in a regulated vault.

The SPDR Gold ETF is the largest exchange-traded fund globally to be backed by gold.

As such, when the value of gold goes up or down, this is reflected in the price of the SPDR ETF. There are heaps of benefits of choosing an ETF to gain exposure to this store of value. First, your gold investment is 100% liquid. In Layman’s terms, this means that you can exit your position at any given time during standard market hours.

5. Barratt Developments

The struggles of the FTSE 100 in 2020 have left investors will plenty of ‘cheap’ stocks to ponder over. By cheap, we mean that they are potentially undervalued – and by some distance. After all, the downfall of many UK stocks this year has been a direct result of the pandemic.

Barratt Developments is a UK-based housing developer. The company was founded way back in 1958 and it is listed on the London Stock Exchange. In the last financial year alone, Barrett Developers was behind more than 17,500 new home builds throughout the UK.

It goes without saying that operations were severely impacted by the UK lockdown period. After all, not only could it not fully resume its house building endeavours for several months, but buyers and sellers were left in limbo will the lockdown measures remained in place.

As a result of this, Barratt Developments shares have taken a major hit in 2020. In fact, before the wider FTSE 100 crash that began in March, the shares were priced at highs of 889p. Fast forward just a few weeks and the shares hit lows of 349p. This translates into a complete capitulation in excess of over 60%.

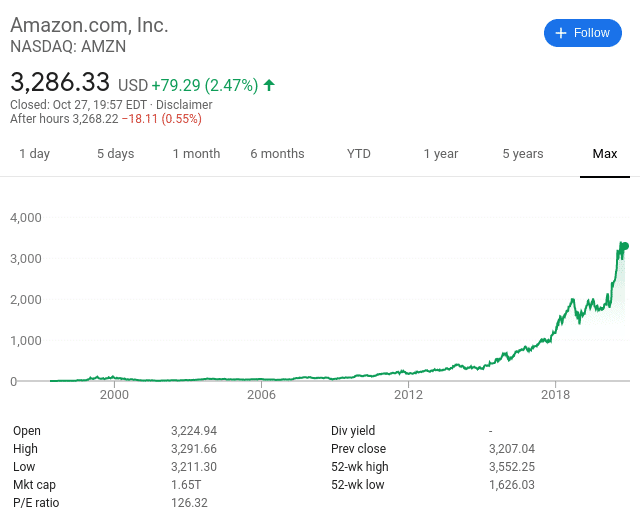

6. Amazon

It is important to note that Amazon is already worth in excess of £1.6 trillion on the NASDAQ. As such, you might be fooled into think that there is only so much further than this stock can go. In the first 10 months of trading in 2020 – the stocks have increased by over 80%.

However, we should stress that Amazon as an organization is about so much more than just its online retail division. In fact, the firm is behind heaps of additional products and services that are performing very well.

This includes:

- Amazon Web Services (AWS): AWS is by far the largest supplier of cloud computing services. At the time of writing, AWS holds a market share in excess of 33%.

- Amazon Prime: Amazon Prime is a subscription-based add-on that gives members enhanced services for a monthly fee. This includes expedited delivery of its online retail offering, unlimited e-books, and access to its content streaming platform. As of mid-2020, Amazon Prime was home to over 112 million monthly subscribers.

- Amazon Prime Video: Not to be confused with its wider Amazon Prime service, this is the TV and movie streaming segment of the organization. While Netflix still dominates this space, Amazon Video Prime is slowly but surely closing the gap. As of Q2 2020, it is estimated that more than 150 million subscribers are paid members of the service.

7. Vanguard Total Bond Market ETF

With gold being the exception – all of the UK investments that we have discussed thus far have centred on the stock markets. However, a lot of seasoned investors in the UK will also allocate some of their capital to bonds and bond funds.

Buying bonds in the UK as an everyday retail investor is no simple feat. This is because many brokerage houses require you to meet a huge minimum investment.

Across nearly $300 billion worth of bonds, this covers instruments from both the corporate and government sectors. 425 of this figure is in the form of safe and secure US Treasuries, while 20.8% is backed by government mortgages. There is also an allocation to foreign-issued bonds.

8. Bitcoin

Over the past 10 years – Bitcoin has seen a significant upside. Starting life at less than $0.01 per Bitcoin, the cryptocurrency is worth almost $14,000 at the time of writing. In simple terms, this represents 10-year growth of over 134 million percent.

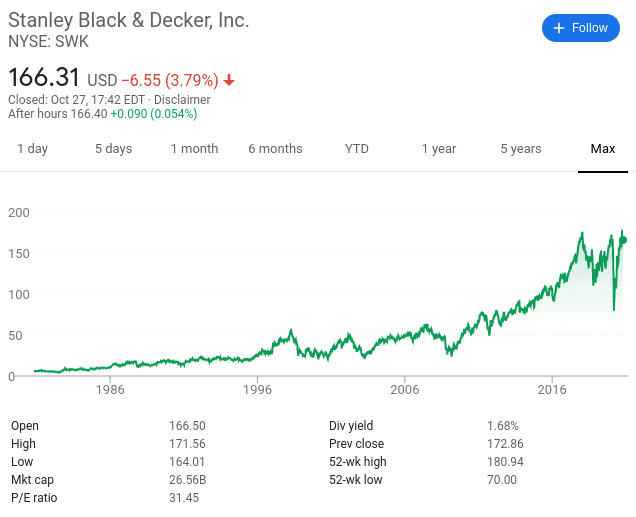

9. Stanley Black & Decker

Stanley Black & Decker is a NYSE-listed stock that has paid a dividend for over 143 years.

For those unaware, Stanley Black & Decker is a major US-based producer and supplier of industrial tools.

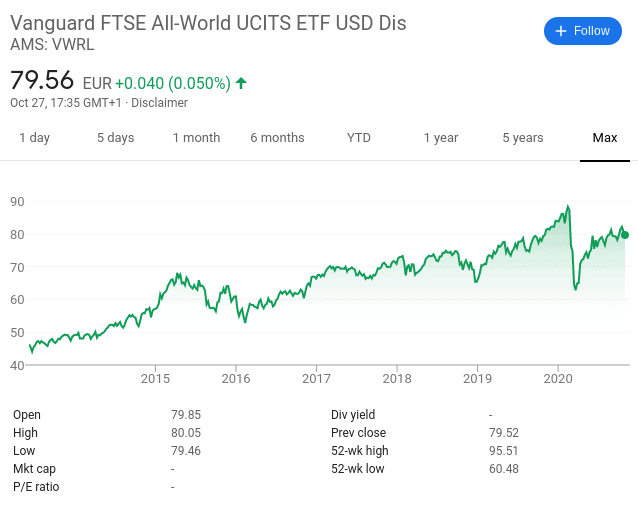

10. FTSE All-World UCITS ETF

In a nutshell, the FTSE All-World UCITS ETF will give you access to over 3,4000 stocks via a single investment.

This covers companies listed in nearly 50 different countries – subsequently giving you exposure to a global portfolio of shares. Just over 50% of this consists of US-listed powerhouses such as Apple, Microsoft, and Amazon. After that, you’ll be getting 7.5% in Japanese stocks, 5.2% in China, and 3.8% in the UK.

Other counties that you will be gaining exposure to include France, Korea, India, Switzerland, Canada, Australia, and many more. Your diversified portfolio also ensures that you are backing a variety of industries. This includes tech, consumer staples, real estate, finance, and health care.

Platforms to Invest in Long Term Investments

So now that we have discussed long term investments in the UK, you can start thinking about which brokerage site you plan to use. There are hundreds of such platforms to choose from, albeit, not all will offer the 10 investments that will have explored on this page. In addition to this, you also need to look at what fees your chosen broker charges and what payment methods are supported.

Below we list three UK share dealing accounts that allow you to make long term investments online.

1. IG

This trusted FCA broker offers over 12,000 traditional assets – which can be added to your ISA. This includes heaps of stocks and shares, ETFs, investment trusts, and even mutual funds. You will pay an entry-level dealing fee of £8. This can be reduced to £3 when you trade regularly.

IG requires a minimum deposit of £250. You can add funds to your account with a debit/credit card or bank transfer. Your money is safe with this broker, as you’ll benefit from the protections of the FSCS.

Your capital is at risk.

What are Long Term Investments?

A long term investment is any investment held for a minimum of 12 months. But, in the case of investing in the financial markets – this is usually for at least 5 years. In opting for a long term investment strategy, you do not need to worry about short-term volatility. You can also pay less attention to market slumps, as you are only interested in the long term prospect of your chosen asset.

A lot of long term investments provide income on two fronts – especially in the case of stocks and ETFs. This is because the value of your investment can grow – meaning that you will make capital gains. Additionally, you also stand the chance of earning regular income via dividend payments.

Below you will find a list of assets that fall under the scope of a long term investment.

- Stocks

- Investment Trusts

- ETFs

- Index Funds

- Mutual Funds

- Bonds

- Real Estate

- Gold

- Bitcoin

Long term investments differ from short term investments not only in the length of time you invest for, but also the types of assets, as short term investments are more restricted to things like bonds and money market funds.

Conclusion

If you want to grow your money over the course of time, long term investments offer a way to do this instead of simply keeping your cash in a bank account. After all, you’ll be lucky to get more than 1-2% these days – even in a ‘high interest’ savings account.

FAQs

What are examples of long term investments?

Long term investments come in a range of shapes and sizes. This includes stocks, bonds, ETFs, mutual funds, investment trusts, and gold.

Do you pay tax on long term investments in the UK?

Irrespective of whether you are investing in the short or long-run – tax on your gains might be due. This covers both income tax via capital gains and dividends. All UK residents get an annual capital gains allowance – which in 2020/21 amounts to £12,300. You also get £2,000 in dividend tax allowance.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2024 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up