eToro Review UK – Fees, Features Revealed

You might have come across the FCA broker eToro. This multi-asset platform in question is popular with first-time buyers, as you can open an account, deposit funds, and buy shares and cryptocurrencies in a matter of minutes.

In this eToro review UK, we cover everything you need to know about eToro in United Kingdom. This includes the types of shares you can buy, fees and commissions, trading tools, payment methods, ease-of-use, regulation, and more. Let’s find out whether eToro is the right broker for you.

| Our rating | 5/5 |

| 📈 Available assets | Stocks, ETFs, crypto, forex, commodities, indices |

| 💸 Fees | Low commissions for stocks & ETFs, 1% spread for crypto |

| ⚖️ Licensing | FCA, CySEC, ASIC |

| 💳 Minimum deposit | $50 |

| 📊 Leverage | x30 for forex, x10 for commodities, x5 for stocks and ETFs |

| ✅ Unique features | Social trading, copy trading |

Introduction to eToro UK

eToro is an online brokerage firm that was first launched by a group of fintech entrepreneurs in 2007 in Israel. The platform offers a range of asset classes and allows eToro users to buy assets in the traditional sense as well as trading contracts for difference (CFDs).

In the traditional ownership department, eToro allows you to buy shares, ETFs, and cryptocurrencies, while it offers CFDs for stocks, indices, hard metals, energies, and more

One of the most popular aspects of eToro is its industry-leading pricing structure, as it’s one of the few platforms in the space that allows you to buy shares on a commission-free basis.

This is because it takes just minutes to get set up with a trading account, and you can deposit funds with an e-wallet, or bank account. Then, you simply need to choose which shares you want to buy, how much you want to invest, and then confirm the transaction.

We should also make reference to the social and copy trading features hosted at the eToro trading platform, which are among the main reasons behind eToro’s rapid rise in popularity. These allows you to interact with other investors in a Facebook-esque format, and even copy the trades of other users, adding a new dimension to traditional trading.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

Who Is eToro Suitable For?

eToro is suitable for both less advanced and experienced traders in the UK. For less advanced traders, eToro offers a range of educational resources, analysis tools and copy trading features that can help to inform decision making. The platform also provides a free demo trading account which can be used to practice new strategies and to get used to the various platform features before putting any real money at risk. Furthermore, eToro has a low minimum deposit which means that it is possible to trade on a budget. However, traders should be aware of the fees involved with using eToro before depositing any funds.

For experienced traders, eToro provides price charts with a variety of indicators and analysis tools that can be used to spot emerging patterns and trends. eToro also has an active news feed that can be used to stay on top of events and announcements in the financial space. As a result, eToro is compatible with a variety of trading strategies and styles.

For traders who ae trying to work out whether or not eToro is suitable platform to use, the demo account provides a realistic simulation of using the platform. Through the demo account, users can access all features of eToro including copy trading, crypto trading and investing in smart portfolios.

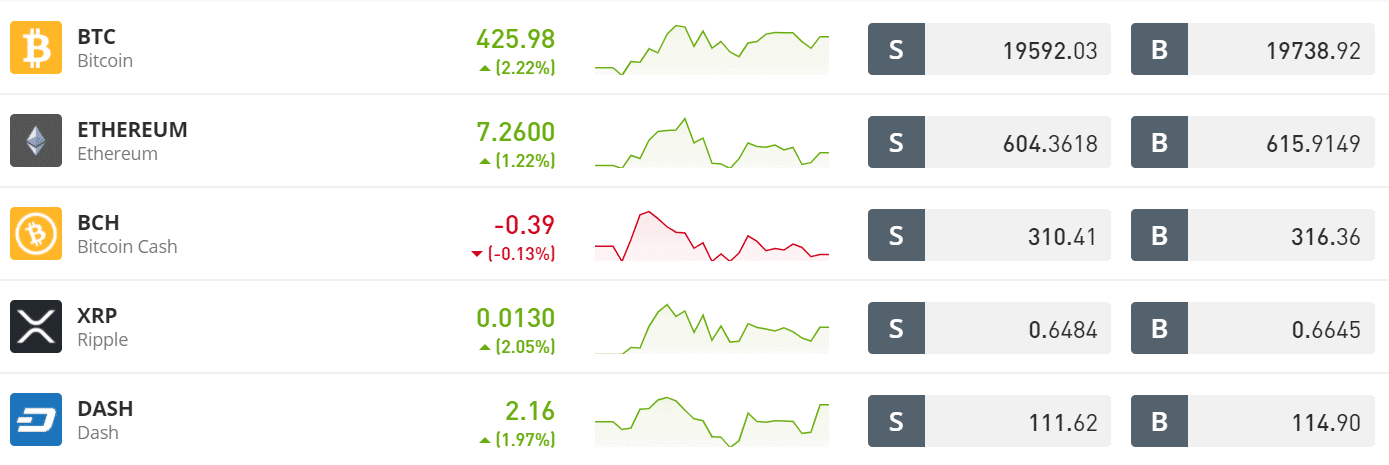

Crypto Trading on eToro Review

One thing that really sets eToro apart from other brokers is that it’s one of the few to offer cryptocurrencies. You can see this when compared to other brokers, like in our eToro vs Trading 212 comparison. While the FCA has banned crypto CFDs, meaning most UK brokers no longer offer crypto, eToro allows you to buy, and invest in the likes of Bitcoin, Ethereum, Ripple and many more.

You can invest in crypto with a minimum investment of just $50, and eToro even offers its own crypto wallet in which you can safely store your coins. This means you can invest in Shiba Inu from the comfort of your own home.eToro is considered to be a safer and cheaper alternative to buying crypto through cryptocurrency exchanges. However, this does not mean that thee is no risk involved with using the platform.

Also, as eToro offers copy trading, it is possible to copy the trades of experienced crypto investors.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

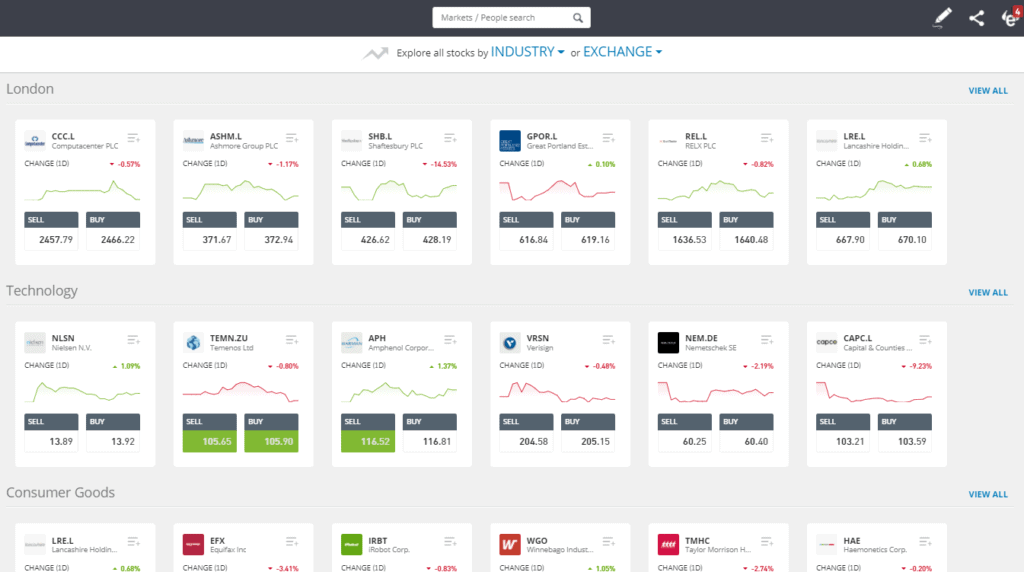

What Shares Can You Buy on eToro?

eToro lists over 1,700 companies from various stock markets. Although this is less than brokers such as IG or Hargreaves Lansdown, you still have a good number of companies to choose from, including many of the most popular shares in 2021. For example, if you are looking to invest in UK companies such as BP, Royal Mail, Tesco, or HSBC, you can do this with ease at eToro.

Additionally, if you are looking to add international stocks to your portfolio, eToro also gives you ample choice. At the forefront of this is the US markets. Across the New York Stock Exchange (NYSE) and NASDAQ – eToro gives you access to hundreds of well-known American firms.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

The international stock exchanges that eToro allows you to access are as follows:

- Amsterdam

- Brusells

- Copenhagen

- Frankfurt

- Helsinki

- Hong Kong

- Lisbon

- Madrid

- Milan

- NASDAQ (US)

- NYSE (US)

- Oslo

- Paris

- Saudi Arabia

- Stockholm

- Zurich

Disclaimer: The tools are not guaranteed over slipages

This includes the likes of Apple, Amazon, Facebook, IBM, Ford Motors, Nike, Disney, and more. As we cover in much more detail further down in our eToro review, you can access all of the above exchanges in a 100% commission-free basis.

When it comes to the specific types of stocks that you can buy, this includes everything from tech stocks, retail stocks, banking stocks, food and beverage stocks, and even cannabis stocks. This also includes a good selection of dividend stocks.

You can keep track of your favourite stocks via eToro’s customisable watchlists.

Fractional Shares at eToro

eToro is one of the few UK brokers that allows you to take advantage of ‘fractional ownership’. As the name implies, this allows you to buy a ‘fraction’ of a stock. This is hugely beneficial for a number of reasons. For example, let’s suppose that you plan to add some US stocks to your eToro portfolio.

Unlike the London Stock Exchange – which prices companies in pennies, the US markets are denominated in dollars (as opposed to cents). As such, some of the most traded companies on the NYSE and NASDAQ have a share price that runs into the hundreds – and often thousands, of dollars.

Let’s take Amazon as a prime example, At the time of writing this eToro review, the retail giant has a stock price of $3,184. In pounds and pence that equates to roughly £2,400. For most of us, we wouldn’t be looking to spend that much money on a single share. Not only does this hinder your ability to create a diversified portfolio of stocks – but it might be much more than you had planned to invest.

But, by buying Amazon shares at eToro, you would only need to meet a $50 minimum. This fractional ownership offering at eToro is available across all 1,700+ shares at the platform.

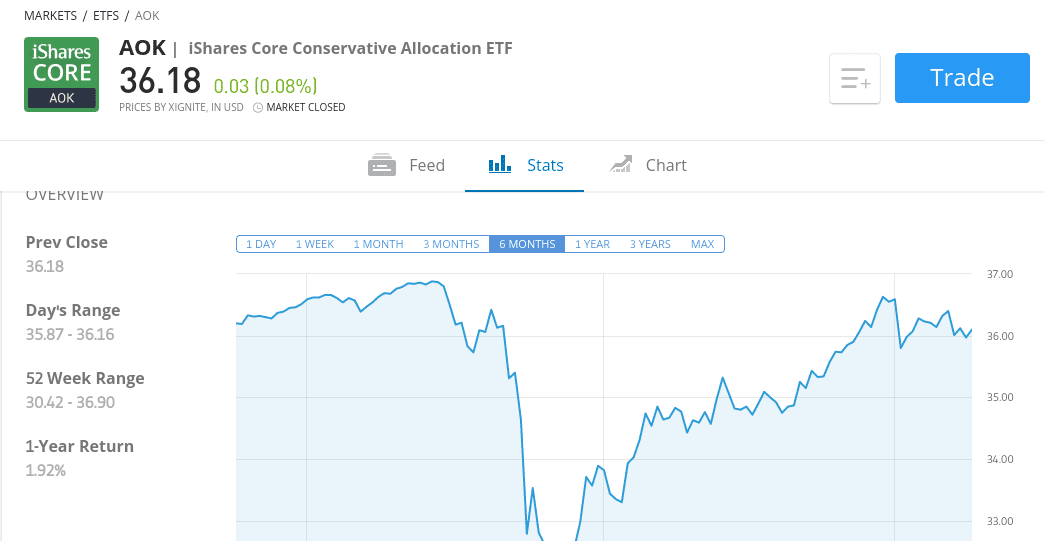

Buy ETFs on eToro

eToro is also an ETF broker that offers a wide range of funds to choose from. This will allow you to invest in a basket of different stocks through a single investment.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

Once you allocate funds into an ETF at eToro, you won’t need to do anything else until you decide to cash your investment in. This is because the ETF provider will buy and sell shares on your behalf. In total, eToro hosts 153 ETFs from a range of different sectors.

In particular, eToro offers ETFs from three of the largest providers in this segment of the financial scene – Vanguard, iShares, and SDPR. This allows you to invest money into some of the most popular ETFs globally. For example, all three of the aforementioned providers offer an ETF that tracks the S&P 500 with ease.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

This is the most traded stock market index in the world and it tracks 500 large-cap companies listed in the US. In other words, by making a single investment into an S&P 500 ETF at eToro, you are buying shares in 500 different firms.

If you want to take your diversification strategy to the next level. For example, the Vanguard Total International Bond ETF contains over 6,000 bond instruments from a variety of markets. Once again, you can invest in the entire basket of assets by making just a single ETF trade.

In terms of minimum investments, ETFs at eToro can be purchased from just $50. In fact, if you were to go direct the ETF provider itself – the likes of Vanguard requires a minimum investment of £500.

Other Assets at eToro

If you want to diversify into a range of asset classes, eToro has you covered.

Here’s a break down of what else you can trade at the platform:

- Indices: eToro offers 3 indices that you can buy or sell at the click of a button. This includes the FTSE 100, Dow Jones 30, France 40, S&P 500, NASDAQ 100, Japan 225, and more.

- Commodities: You can also trade commodities at eToro. This covers various oil and natural gas markets, gold, silver, copper, and several agricultural products.

- Currencies (FX): eToro also offers an in-depth currency trading facility that covers over 40+ pairs.

It is important to note that apart from stocks, ETFs, and cryptoassets, all other asset classes at eToro are traded via CFDs (contracts-for-differences). This means that you can trade the future value of the asset in question without needing to store or own it. In particular, this would be condusive for gaining exposure to hard assets like gold, silver, or oil. The amount of assets on offer at eToro really is vast when compared to other platforms such as Plus500 who offer only CFD investment options, you can see more on this in our eToro vs Plus500 comparison.

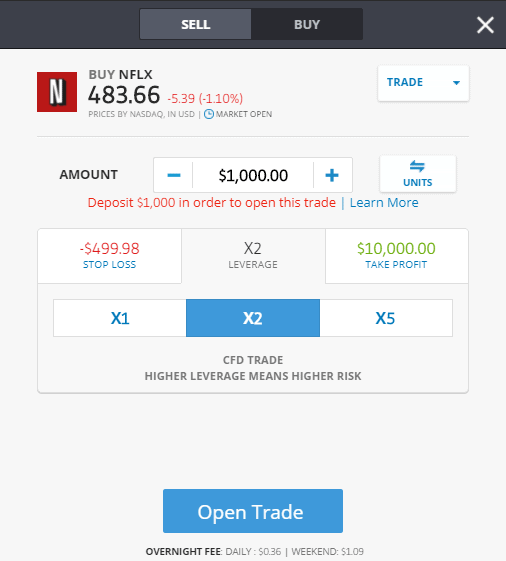

Although you won’t own the underlying asset, CFDs at eToro provide you with two key benefits that you won’t find when investing in the traditional sense – leverage and short-selling.

Just remember that CFDs are complex instruments with a high risk level, particularly if you’re using leverage, so make sure you do your research and have a sound understanding of how CFDs work before trading with real money.

eToro Leverage

Leverage allows you to trade with more money than you have in your account. At eToro, the broker follows all regulations imposed by the European Securities and Markets Authority (ESMA). As such, those of you based in the UK (and mainland Europe) will be capped by the amount of leverage that you can apply.

This stands at 1:5 on stocks, 1:20 on gold, and 1:30 on major currency pairs.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

If you’re not sure how leverage works at Toro, you are essentially multiplying your stake by your chosen factor. For example, let’s suppose that you staked the equivalent of £100 on gold. If the price of gold increased by 10% and you applied the maximum leverage of 1:20 – then your £10 profit would be amplified to £200.

eToro Short-Selling

One of the most popular features at eToro is that of its short-selling facilities. Put simply, this allows you to speculate on the value of an asset going down.

For example, let’s suppose that you have performed some in-depth research on HSBC shares. As per your findings, you believe that the shares are heavily overvalued. While most UK investors will simply avoid making a purchase, the shrewd traded will look to short-sell HSBC shares to profit from falling prices.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro Dividends Review

One of the most common questions that we are asked if whether or not eToro pays dividends. The simple answer to this is yes – by investing in shares and ETFs at eToro you will be entitled to dividend payments as and when they are distributed by the respective organization.

In the case of shares, the company will transfer your dividend payment to eToro. In turn, the broker will add the funds to your cash balance. You can then withdraw the money out or reinvest the funds into other assets. This will give you a chance of taking advantage of compound interest.

When it comes to ETFs, providers like Vanguard and iShares typically make a payment every three months. This is because the respective basket of assets will generate dividend payments throughout the month – so it would make it unviable to keep making individual payments.

Instead, your quarterly payment will cover all dividends received by the ETF provider in the relevant period. Once again, the ETF dividends will be reflected in your eToro account and available for immediate withdrawal.

eToro Fees

One of the most important metrics that you need to look in to before joining a UK stockbroker is that of its fee policy. This doesn’t include just share dealing charges, as there are other fees that might be applicable.

As such, below we give you a full breakdown of what fees you will pay at eToro.

eToro Trading Fees

| Asset | Spread or commission? | Example |

| Stocks | Free | Free |

| ETFs | Free | Free |

| Crypto | Spread | Bitcoin 1% |

| Forex | Spread | GBP/USD 2 pips |

| Commodities | Spread | Oil 5 pips |

| Indices | Spread | 1.5 points UK100 |

eToro Non-Trading Fees

| Deposit fee | Free |

| Withdrawal fee | $5 |

| Inactivity fee | $10 per month after 12 months |

No Share Dealing Fees

The headline offering at eToro is that of commission-free stock trades. This is the case with each and every stock that eToro lists, whether that’s in the UK or overseas. Such a generous fee policy is in stark contrast to some of the larger UK share dealing sites, which is one of the main reasons why eToro has since amassed a customer base of over 12 million investors.

For example, popular UK broker Hargreaves Lansdown charges an entry-rate of £11.95. You need to pay this when you buy your chosen shares and then again when you sell them. With that in mind, let’s suppose that you wanted to buy £50 worth of Royal Mail shares. At a rate of £11.95, you would end up paying a nominal-rate of 23.9%. At eToro, that very same trade would cost you £0.

Take note, you will only avoid share dealing charges at eToro on the proviso that you:

- Do not apply leverage

- Do not short-sell the company

Either of the above actions would mean that you are trading stock CFDs, meaning that you are trading the asset as opposed to investing in it.

Buying £1,000 Worth of Shares at eToro vs Other UK Brokers

If you were to buy £1,000 worth of shares at eToro, IG, or Hargreaves Lansdown – below we list the fees that you should expect to pay.

| eToro | IG |

Hargreaves Lansdown

|

|

| UK Shares | £0 | £3 or £8 | £5.95 to £11.95 |

|

International Shares

|

£0 | £0 or £10 |

£11.95 or 1% (min £20 / max £50)

|

Longing £1,000 Worth of Share CFDs at eToro for 1 Week vs Other UK Brokers

If you were to enter a £1,000 long stock CFD position at eToro, Plus500, or MarketsX – below we list the fees that you should expect to pay.

| eToro | Plus500 | MarketsX | |

| S&P 500 | £1.20 | £1.05 | £1.30 |

| Europe 50 | £1.35 | £0.65 | £1.25 |

| Apple | £3.15 | £4.45 | £3.20 |

No Stamp Duty

In addition to a 100% commission free share dealing service, eToro has taken things one step further by waving all stamp duty fees. Ordinarily, all UK investors are required to pay a 0.5% stamp duty tax on all share purchases. For example, if you bought £10,000 worth of GlaxoSmithKline shares you would need to pay £50 in stamp duty.

Other eToro UK Fees Review

There are some fees to look out for when using eToro.

The Spread

In the world of stocks and shares, the spread is the difference between the ‘bid’ price and ‘sell’ price of a company. This is an important concept to understanding, as it is an indirect trading fee that must be included in your end-to-end ROI (Return-on-Investment).

eToro does not have a specific structure on spreads, insofar that it will change depending on market conditions. In other words, if you trade during standard market hours then you will benefit from the most competitive spreads. To give you an idea of what you will pay, the bid and ask price on Royal Mail shares at the time of writing (during standard UK trading hours) is 174.24p and 174.80p. This translates to a spread of approximately 0.32%. This is actually very reasonable when you consider there are no share dealing charges in play.

Inactivity Fee

eToro charges an inactivity fee of $10 per month after one year of inactivity.

Deposit Fees and Withdrawal Fees

eToro does not charge a specific deposit fee per-say. But, there is an underlying currency conversion fee that you need to take into account. This is because all account balances at eToro are denominated in US dollars. So, when you fund your eToro account with an e-wallet, or bank account, you will incur a 0.5% currency conversion fee.

When it comes to withdrawals, eToro charges a flat fee of just $5 – which is about £4.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

eToro Stocks and Share Dealing Platform Review UK

In terms of buying and selling shares at eToro, the process is extremely simple. In order to find your chosen investment, you have two options.

- You can either search for the specific company to be taken straight to its respective investment page

- You can browse the eToro stock library and then filter-down by the exchange or sector of the company

Stock Orders

lnvestors have access to several orders when placing a trade. This includes:

- Market Order: This allows you to place a stock trade at the next available price. If the respective stock exchange is open, your share trade will be executed in a matter of seconds.

- Limit Order: If you want to buy your chosen shares at a specific price, eToro allows you to set up a limit order. Take note, your order will only be executed if and when the trigger price is met. If it isn’t, your share trade will remain pending until you cancel it.

- Stop Loss Order: This particular order is more suited for those of you that wish to buy and sell shares on a short-term basis. Essentially, you can elect to have your trade closed automatically when your investment goes down by a certain amount.

- Take Profit Order: This particular order is also more suited for short-term traders. This allows you to close your trade automatically when a pre-defined profit target is met.

In effect, if you are looking to buy shares at eToro and hold on to them for a number of years, a market order is likely to suffice. However, the tools are not guaranteed over slipages.

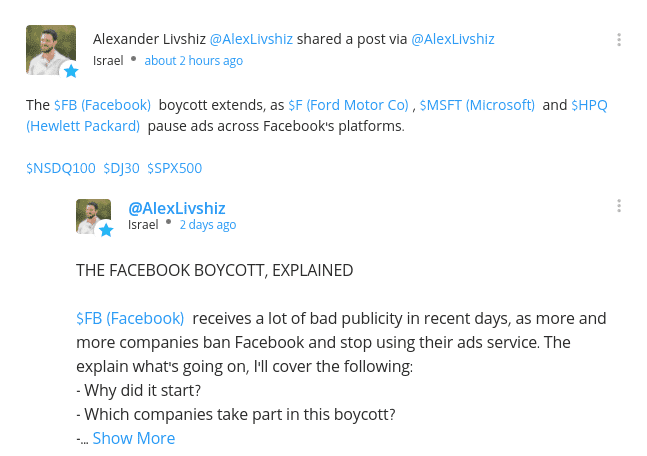

eToro Social and Copy Trading Review

eToro is often referred to as a ‘social trading platform’ – and for good reason. For those that are new to the social trading phenomenon, this works much like a social media platform but for the stocks and shares investment space. In other words, you have the opportunity to discuss and shares trading ideas, and even get investment advice, with your fellow eToro members in a public setting.

You can then add your chosen eToro members to your ‘friend list’, which then allows you to follow the user’s activity at the platform.

Copy Trading

As popular as social trading at eToro is, nothing quite matches its copy trading feature. As the name suggests, this allows you to pick an eToro popular investor and then copy their trades like-for-like. You can copy the trader’s entire portfolio, as well as all future investments,

This means you can essentially invest in stocks and shares without doing any of the research you would otherwise have to. So if you’re a beginner learning how to invest in stocks but want to invest at the same time, you can back do so by using eToro’s CopyTrader.

Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

The popular thing about it is that you can invest an amount that you feel comfortable with – as long as you meet a $200 minimum.

- For example, let’s suppose that you copy a trade that has £100,000 invested across 30 different stocks.

- Of this figure, the trader has 5% in Facebook stocks – amounting to £5,000

- You, however, invest just £1,000 into the copy trading portfolio

- As everything is proportionate, your 5% investment in Facebook will amount to a holding of £50.

There are no additional fees to utilize the copy trading feature at eToro, and you can exit your position at any given time. In fact, you can manually cancel individual orders from within a portfolio, which gives you 100% control of your money.

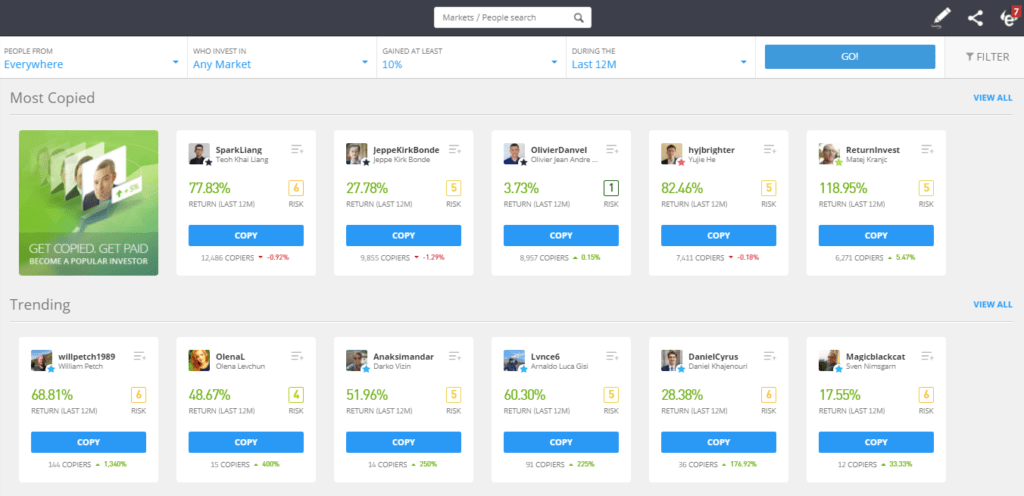

Most Popular eToro Traders to Copy

At the time of writing, there are just under 710,000 traders that you can copy at eToro. Fortunately, the platform offers a full range of filters that ensures you are able to find a trader that not only meets your long-term financial goals.

To give you an idea of the types of things you could look for when choosing eToro traders to copy, check out the list below:

- Overall returns since the trader joined eToro

- Month-by-month returns

- Risk rating (1 being the lowest and 10 the highest)

- Preferred asset class (shares, ETFs, etc.)

- Average trade duration (indicates whether they are a short, medium, or long-term investor)

- Number of traders copying them and total assets under management

Finding a trader to copy at eToro can be a time-consuming process. After all, you have thousand upon thousands of potential investors to choose from.

With this in mind, below we have listed three eToro copy traders to consider.

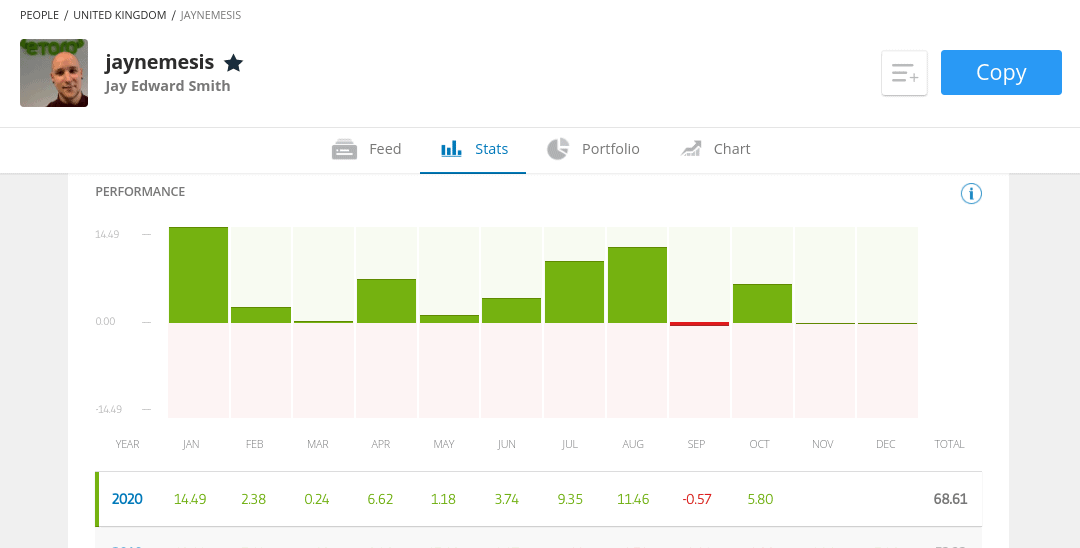

1. Jay Edward Smith – Jaynemesis – Trader With 68% Returns in 2020 YTD

Make no mistake about it – Jay Edward Smith, who goes under the username ‘Jaynemesis’, is one of the hottest eToro copy traders of 2021. First and foremost, the trader is looking at 2020 gains of just over 68% (as of mid-October 2020).

This is unprecedented when you consider the wider market uncertainties of COV-19 – and the fact that many stocks are still worth less than pre-pandemic levels. Even more impressively, apart from a small 0.57% loss in September 2020 – Jay Edward Smith finished each of the prior 14 months in the green. In 2018, the trader returned investors just over 52%.

Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

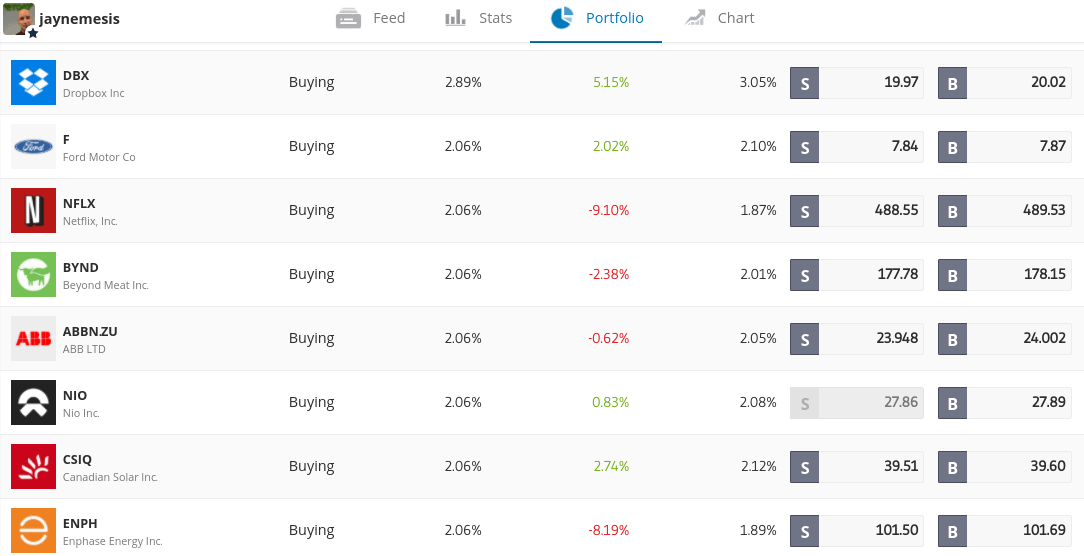

Taking a closer look at the trader’s portfolio, Jay Edwards Smith has a diversified basket of stocks. This includes everything from Microsoft and Etsy to UPS, Canadian Solar, and Beyond Meat. Although 95% of the trader’s portfolio is in shares, he also has a small allocation of Bitcoin and ETFs.

Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

Previously, Jay Edward Smith has also dabbled in indices and commodities. Nevertheless, the trader has an eToro risk rating of 5/10, which is up from the 2/10 he had in April 2020. Currently, this copy trader has over 26,000 followers and more than $5 million worth of assets under management.

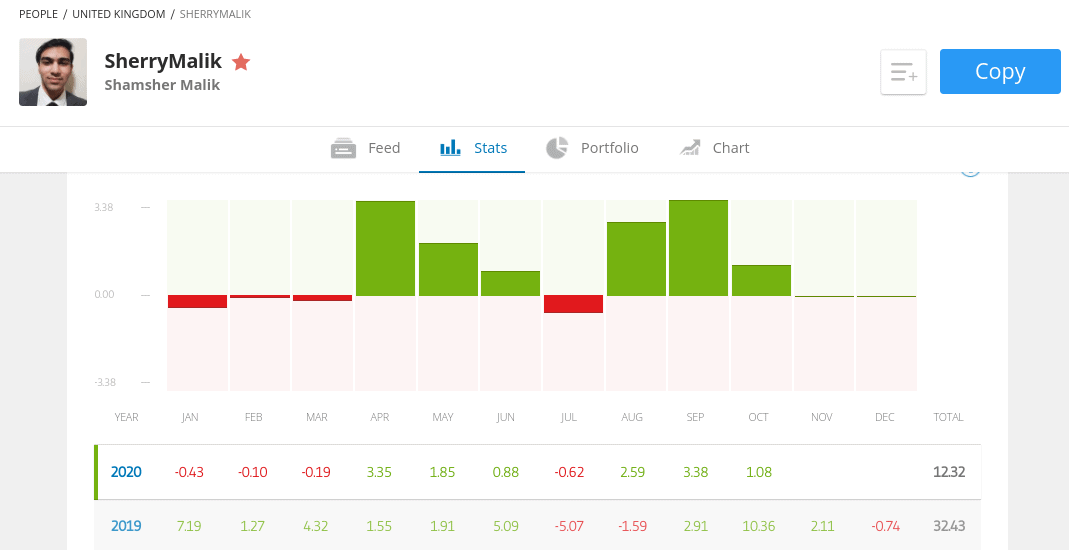

2. Shamsher Malik – ShamsherMalik – Low-Risk Share and Forex Trader (55% Gains 2020 YTD)

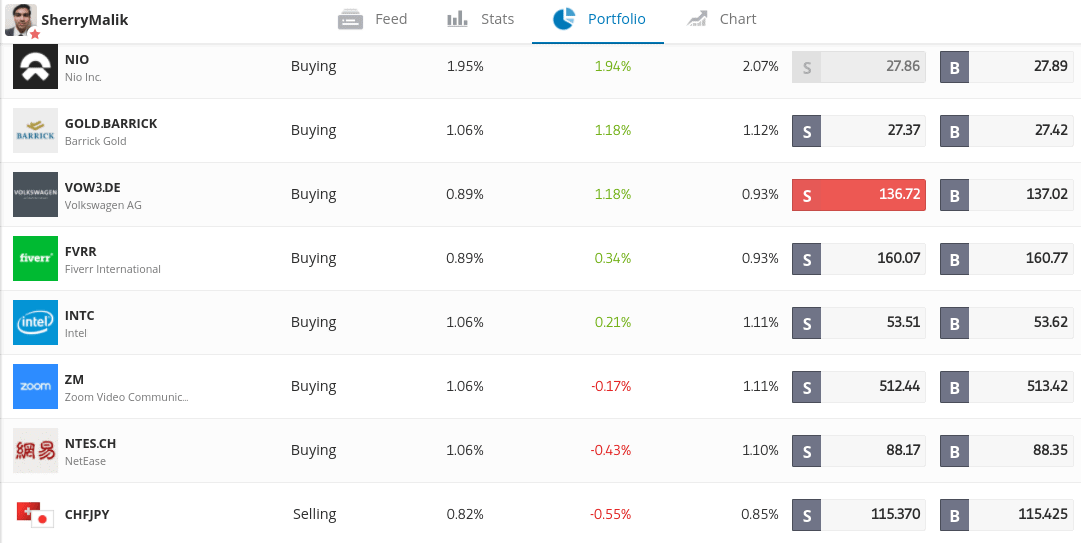

If you don’t feel comfortable backing a copy trader with a risk rating as high as Jay Edward Smith (5/10) – it might be worth considering Shamsher Malik. This UK-based trader – which specializes in fundamental analysis, likes to take a low-risk approach to investing. In particular, most of the traders’ focus is on shares and forex.

Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

On average, Shamsher Malik will keep a position open for 2 weeks – illustrating that he likes to follow short-term trends. Although the trader has a low risk-rating score of 3/10 – his returns to date have been good. For example, in the first 10 months of 2020 alone, Shamsher Malik is looking at returns of 12.32%. Sure, this is much lower than Jay Edward Smith.

Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

But, it is important to remember how the risk vs reward ratio works. After all, the more risk your chosen copy trader takes, the more you should expect in terms of profit. Nevertheless, in 2019 the trader made even higher returns at just over 32% for the year. Shamsher Malik also has an impressive drawdown percentage rate – which currently amounts to an average of 10.45% annually.

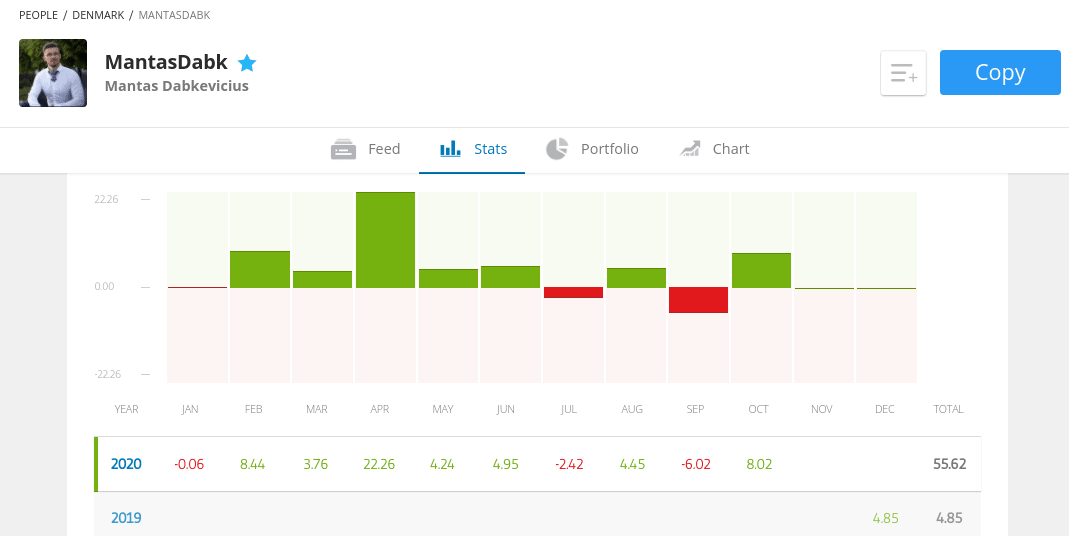

3. Mantas Dabkevicius – Mantasdabk – Up and Coming Swing Trader (55% Gains 2020 YTD)

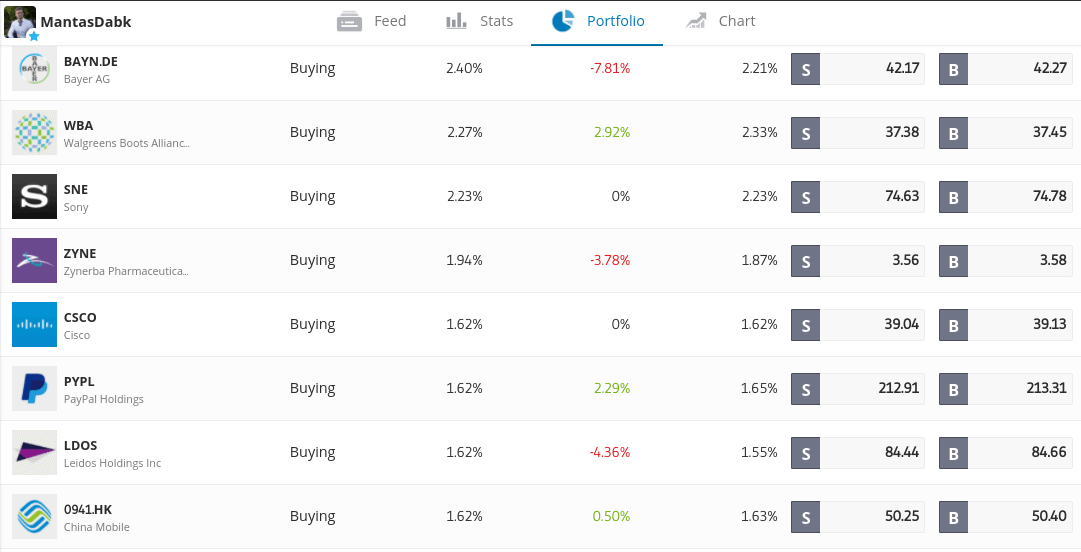

Based in Denmark and going under the username ‘Mantasdabk’, this eToro copy trader like to buy and sell assets on a regular basis. In fact, he has an average trade duration of just 1.5 weeks.

Furthermore, Mantasdabk places just under 20 trades per week on average – so he’s active. In terms of asset classes, this eToro copy trader has a 60% exposure to stocks. After that, the trader likes to access everything from commodities, forex, cryptocurrencies, and ETFs.

Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

This ensures that you are able to trade multiple markets around the clock in a 100% passive-free manner. In terms of performance, Mantas Dabkevicius only joined the eToro platform in December 2019. Nevertheless, the trader made 4.85% in his first month and is now looking at 2020 YTD gains of 55.62%.

Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

This translates into 58.70% profitable weeks since he joined eToro. Although such large returns might give you the impression that Mantasdabk is a high-risk trader, he actually has a very respectable risk rating score of 4/10. This is down from the 6/10 average risk score that Mantasdabk has in March 2020 – which is good.

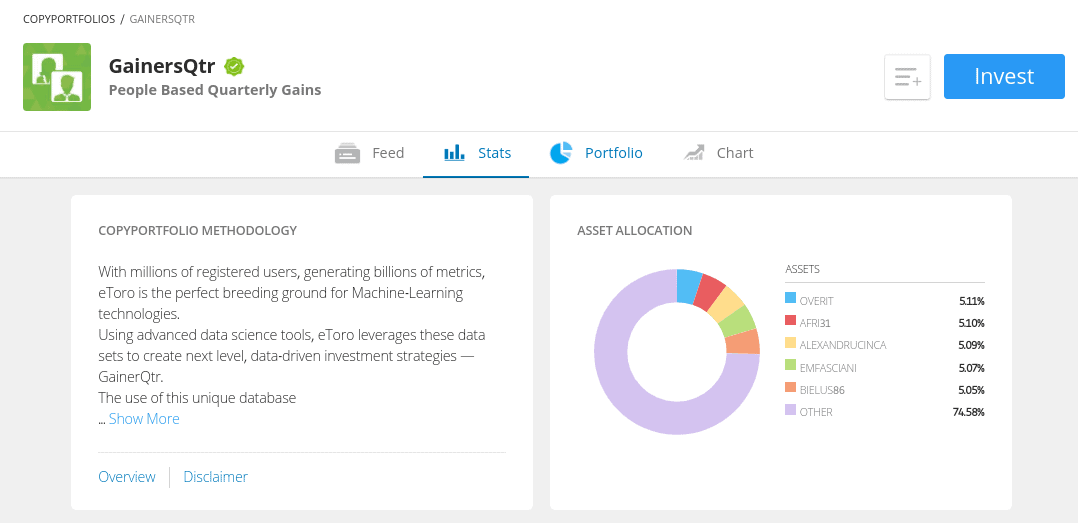

CopyPortfolios

eToro also offers more advanced copy trading tools called CopyPortfolios. These are professionally managed portfolios that utilise artificial intelligence and algorithmic trading, and there are two types. Top Trader Portfolios are made up of the best performing traders on eToro, while Market Portfolios bundle together a number of assets under one chosen market strategy.

Top Trader Portfolio

Regarding the former, one of the most popular Top Trader Portfolios available on the platform is that of ‘GainerQtr’. This CopyPortfolio is currently up just under 20% in 2020. In the previous year, it returned just over 14%. The portfolio is well-diversified, with 5 traders making up just over 25% of its weighting. The remainder is split across a vast number of traders from a variety of target markets.

Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

While these are more advanced than the standard CopyTrader tool, you need to invest at least $5,000 into a CopyPortfolio. On the flip side, this is the most passive investment option at eToro, as everything is managed for you. There is no requirement to personally choose which investors to copy do you need to worry about constantly rebalancing your portfolio.

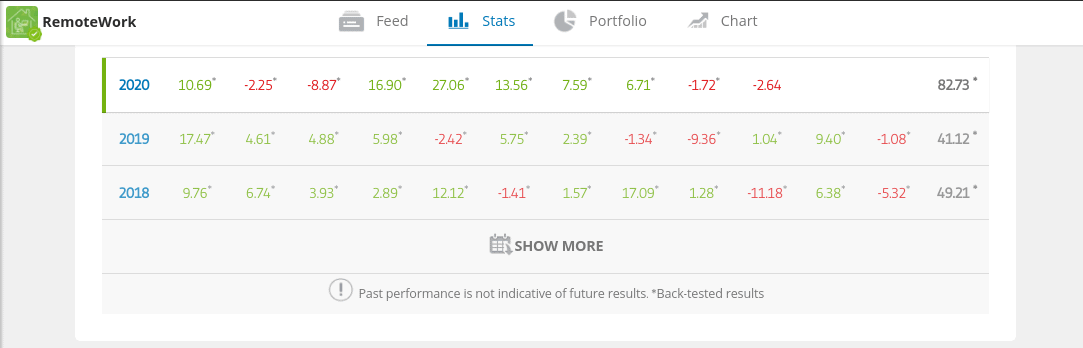

Market Portfolios

When it comes to Market Portfolios, this allows you to target a specific segment of the financial markets. One such example is that of the ‘RemoteWork’ portfolio. As the name suggests, this gives you exposure to companies associated with the work-from-home space. This includes the likes of Twilio, Zoom, Shopify, Adobe, Salesforce, and more.

Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

This eToro Market Portfolio has performed extremely well since its inception at the platform in 2018. Over the past three years, it has returned 82% (2020 YTD), 41% (2019) and 49% (2018) – which is huge. Other niche sectors that are covered by the eToro Market Portfolios feature includes Renewable Energy, Driverless Cars, Mobile Payments, Food and Tech, and Gaming.

Unlike Top Trader Portfolios – which requires a minimum investment of $5,000 – some Market Portfolios can be accessed from just $1,000. The specific amount will, however, depend on your chosen portfolio -so be sure to check this for yourself.

eToro ISA Review

One of the newest features that has been introduced by eToro is the eToro ISA. The stocks and shares ISA allows traders to invest in a ready-made portfolio of various stocks and shares that are offered by the eToro platform. The ISA is provided by MoneyFarm, which will manage traders’ accounts on their behalf.

The eToro ISA allows less experienced traders to diversify their portfolios with the guidance of a seasoned financial institution. However, investing in the ISA limits the variety of assets that users can access. The ISA is managed by MoneyFarm which means that, unlike some other ISA options, eToro ISA investors will not be able to choose which stocks and shares their money is invested in to.

The ISA is the newest feature of the eToro trading platform. The company has hinted to further developments that could improve the ISA and make it more appealing to a wider range of investors.

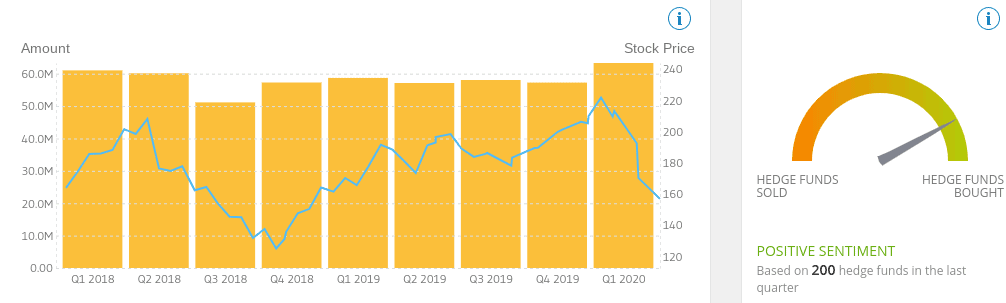

Charting, Research and Analysis at eToro

eToro is slightly lacking when it comes to research and analysis. Although the eToro web platform has integrated its stock research page with TipRanks, this doesn’t provide an abundance of information. For example, you are unable to view earnings reports, published accounts, or in-depth expert analysis.

Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

You can, however, view a range of analytical data surrounding your chosen stock. This includes a plethora of charts and graphs around the stock’s historical pricing action, as well as what the general consensus is from leading hedge funds. In terms of a fundamental news feed, this again is lacking at eToro. This is limited to the ‘sharing’ of news developments by users of the platform.

As such, you are advised to seek your research material from an external source such as Yahoo Finance or Morningstar.

eToro Web Trader

eToro Web Trader is the platform that you will use to manage your trading portfolio online. The Web Trader platform has been designed to make trading simple and accessible to even the most inexperienced traders. Web Trader makes it possible to use the eToro platform on your desktop to execute trades and conduct research.

Traders can familiarize themselves with the Web Trader function with the demo account. This is an account that will mirror the real trading environment without putting any real money at risk. You can simply practice making traders on the eToro Web Trader until you feel comfortable with the interface.

The current version of the function is eToro Web Trader 2.0. This version includes copy trading, social trading and paper trading features. You do not have to download the Web Trader platform, simply create an account online.

eToro Mobile App

If you’re the type of trader that likes to keep tabs on your investments at all times, eToro offers a free stock trading app. The mobile trading app is available to download on both iOS and Android devices. If you don’t have one of the aforementioned operating systems, you will be able to access eToro from your standard mobile web browser.

Both the investment app and the mobile browser-based versions allow you to perform the same account features as the main desktop website. Whether that’s buying and selling shares, checking the value of your portfolio, or depositing and withdrawing funds – everything can be facilitated via your mobile phone.

Crucially, the trading experience when using the eToro mobile app is not hindered by smaller screens. This is because the application has been fully optimized for mobile usage – making the remote investment process seamless. If you are looking to take your investment endeavours to the next level – we would suggest taking full advantage of what the eToro app offers.

For example, you can check the value of your stock positions at the click of a button no matter where you are. You can also make last-minute investments without needing to wait until you get home. This also rings true when it comes to closing a losing position. After all, needing to wait hours on end until you have access to your desktop device could be extremely costly.

eToro Demo Account

If you’d like to get a feel for eToro and practice your trading before putting your money on the line, you can do so courtesy of the eToro demo account. This provides $100,000 of paper trading money and offers the full functionality of the eToro platform, including its copy trading tools, so it’s a popular way to learn more about the platform.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

Payments at eToro

One of the popular things about eToro is that it offers a wide selection of payment methods to choose from. These include:

- Skrill

- Neteller

- Unionpay

- UK Bank Transfer

- Wire Transfer

The above payment methods offer much more in the way of flexibility, as a lot of traditional brokers in the UK will only allow you to deposit funds via bank transfer. Degiro is an example in this respect – with the end-to-end deposit process often taking days on end. This can be frustrating if you want to buy shares instantly.

At eToro, however, as long as you use an e-wallet to make the deposit – your funds will be credited instantly and thus – you can start investing straight away.

In terms of account minimums, eToro requires a minimum deposit of $50. You might notice that everything at eToro is denominated in US dollars. This is because the platform offers over 1,700 shares across 17 international markets. By sticking to one currency – it means that you do not need to keep worrying about constant FX fluctuations.

As a result of this, all deposits at eToro do some with a 0.5% currency conversion charge. So if you’re depositing in GBP, EUR, AUD or any other currency that isn’t USD, you’ll pay a small fee For example, if you were to deposit $1,000 – the fee would amount to $5. With that being said, eToro waves the 0.5% stamp duty fee that you would ordinarilly pay when you buy UK shares. As such, the FX fee is effectively countered.

eToro Withdrawals

When it comes to making a withdrawal, you simply need to head over to your account dashboard, elect to make a withdrawal, and enter the amount that you want to take out. As per anti-money laundering laws in the UK, you will need to withdraw at least the deposit amount back to the same funding source.

The minimum amount that you can take out from the platform is $30. There is a flat fee of $5 on all withdrawal requests – irrespective of the amount. We should also note that eToro charges the 0.5% FX fee on withdrawals. This will be taken at the current GBP/USD at the time of the withdrawal request.

Is eToro Safe?

In the case of eToro, the platform holds three regulatory licenses:

- Financial Conduct Authority (FCA)

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

If you are a UK investor, then you will fall under the remit of the FCA. The good news is that eToro (UK) Limited is a member of the UK’s Financial Services Compensation Scheme (FSCS). Although its advisory document states that UK investors are covered by up to £50,000, this has since been increased to £85,000 by the FSCS.

Can You Really Make Money on eToro?

It is possible to make money on eToro through investing, copy trading and using smart portfolios. However, returns are not guaranteed. To make money through eToro you will need to conduct thorough market research and analysis. It is also important to develop a risk management strategy that will minimize your losses. It is a good idea to practice trading with te demo account before live trading on eToro. This way, you can practice trading without putting any real money at risk and learn how to use the eToro platform to make money from the financial markets.

Is eToro Good For UK Users?

Yes, eToro is a broker for UK users that is regulated by the Financial Conduct Authority. However, your money is always at risk when trading the financial markets and returns are not guaranteed. It is important to conduct thorough market research and analysis before using eToro to make any investments or trades. For UK users, eToro offers exposure to a variety of UK and European stocks and shares. This makes it possible t take advantage of the UK financial markets and to diversify your portfolio with a number of different UK companies.

eToro Reviews UK

Of course, we’re not the only publication to review eToro. As one of the UK’s most popular stock brokers, it’s been reviewed by many sources across the internet.

In summary, it is clear to see why eToro has amassed a customer base of over 12 million investors. Not only is the platform simple to use, but you can buy shares without paying any commissions or dealing charges. There is no annual fee to take into account either, and supported payment methods include bank accounts, and e-wallets.eToro also supports leverage and short-selling. This is available on its 1,700+ stocks, as well as indices, forex, and commodities.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

FAQs – All your questions about eToro answered

What are eToro fees UK?

What are the eToro supported countries?

What shares can you buy at eToro?

What is the minimum deposit for eToro?

How do you withdraw money at eToro?

Disclaimer:

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk.Other fees apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not

expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

What was your experience with this trader?

Post a review and you'll automatically be entered into this month's £500 draw.