Best Growth Stocks in the UK to Watch

There are many types of shares that you can invest in. While some are strong and stable companies that have a long-standing history of paying dividends, others are referred to as growth stocks.

In this guide, we discuss some Growth Stocks in the UK.

Key Points on Growth Stocks in the UK

- Growth stocks are stocks of a company that is expected to expand at a faster rate than other companies in its sector or the market as a whole.

- Growth stocks can come from various industries, although sectors that contain a high number of these companies include the electric vehicle, technology, and pharmaceutical sectors.

- Investing in growth stocks can provide higher returns – although these stocks tend to have higher volatility than value stocks.

Buying Growth Stocks in the UK

Looking to buy growth stocks right now? Here are the five quick steps to follow so that you can invest in growth stocks today.

- Choose a stock broker that offers access to growth stocks

- Verify your identity by uploading proof of ID and proof of address.

- Fund your account via credit/debit card, bank transfer, or e-wallet.

- Search for your desired growth stock and click ‘Trade’.

- Choose your position size, check everything is correct, and click ‘Open Trade’.

List of Growth Stocks

Here’s a list of 10 popular growth stocks in more detail:

- Roku

- Beyond Meat

- Zoom

- Block, Inc

- Etsy

- PayPal

- Lucid Group

- Shopify

- Salesforce

- NVIDIA

Growth Stocks To Watch in the UK 2022

So that you know the ins and outs of how growth stocks work, we now need to pinpoint some possible investment opportunities. While there are many growth stocks to choose from, below we discuss some more options in the market right now.

1. Roku

Roku is a US-based tech firm that allows all consumers to benefit from smart TV services without needing to own a high-end device. Instead, you simply need to purchase the Roku device and connect it to your TV. In doing so, you’ll have access to a plethora of streaming services like Netflix and Amazon Prime.

In terms of its stock market offering, this growth share is listed on the NASDAQ. Roku has enjoyed a fruitful time since it went public in 2017. Back then, you would have paid just $23 per stock. Fast forward to December 2021 and the very same shares will cost you $231.06.

This represents a 5-year increase of over 772%.

2. Beyond Meat

Launched in 2009, Beyond Meat is a PLC that has taken the food industry by storm in recent years. The firm is renowned for producing quality meat-substituted products that are 100% plant-based. This is a sector, in particular, that is experiencing rapid growth with health-conscious consumers that are looking to do their bit for the environment.

This sentiment is evident by the speed in which Beyond Meat has grown. For example, the stock only went public in May 2019, where it was initially priced at $89. Opting for the NASDAQ, Beyond Meat shares then exploded to $234 in a matter of weeks. This resembles an increase of over 250%.

The shares have since cooled off, with a current market price of $69.60.

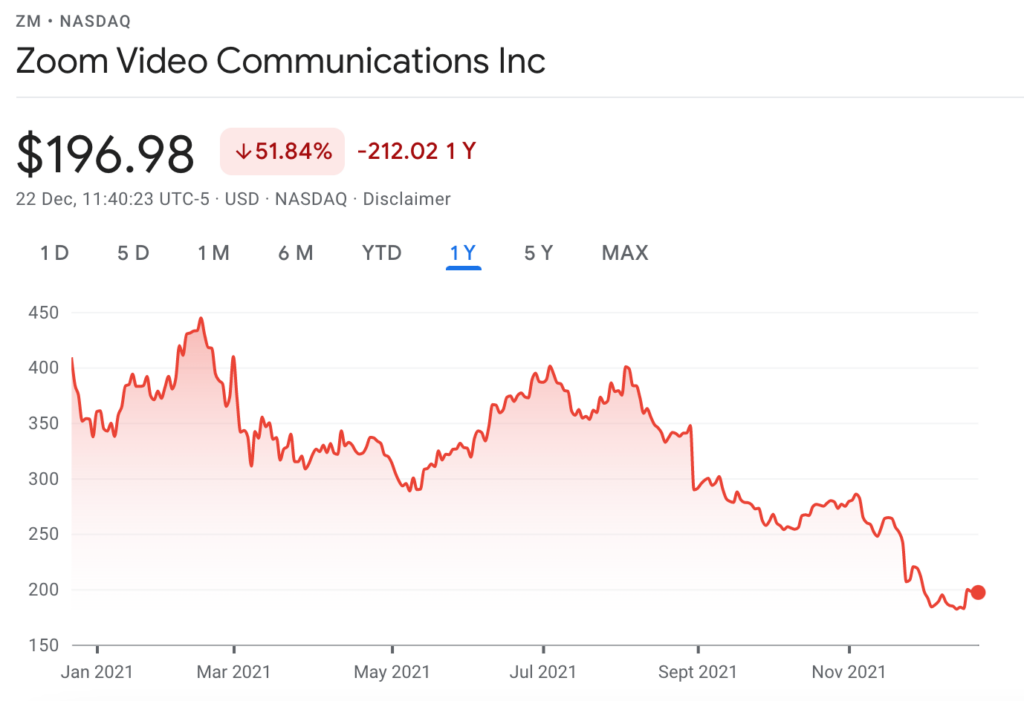

3. Zoom

Zoom is a cloud-based software company that specializes in video conference technology. Although the firm was launched in 2011, it wasn’t until the coronavirus lockdown period that it truly made a name for itself. After all, Zoom was often the bridge between family and friends during a time when travel restrictions were keeping people apart.

It was also the preferred method of communication between workers that were unable to attend their place of employment. In terms of its stocks, Zoom went public in September 2019. Back then, you would have paid in the region of $62 per share. At the time of writing in December 2021, the stocks are worth just over $196.30.

4. Block, Inc

Block, Inc. was formerly called Square and was founded in 2009 by Jack Dorsey – the co-founder of Twitter. The company focuses on financial services and digital payments, providing solutions for small and medium-sized businesses. Furthermore, Block, Inc. also has a popular ‘Cash App’ mobile app that enables people to send and receive money.

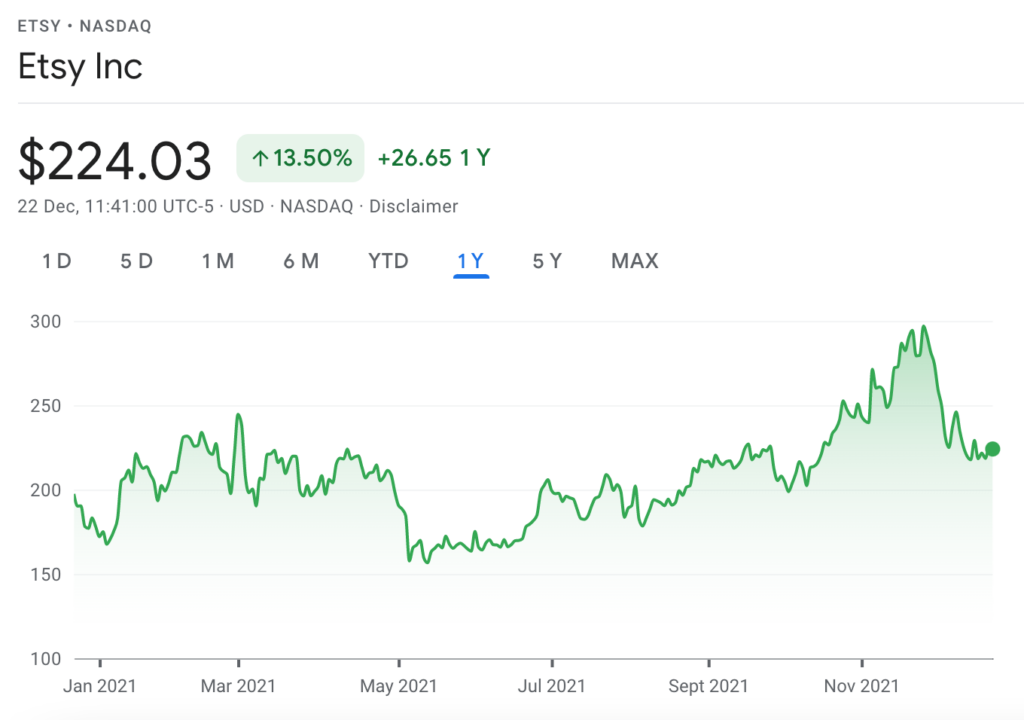

5. Etsy

Etsy is an online marketplace for vintage products and handmade craft designs. This includes everything from clothing to jewelry, to furniture and fine art. Etsy is now worth over $28 billion on the NASDAQ.

When the firm first went public in 2015, investor sentiment was relatively weak in the months to follow. This is because the stocks went from an initial price of $27, down to just $8 in 2016. However, the shares began to explode in the wake of the pandemic lockdown, subsequently hitting highs of $135 in August of last year.

6. Paypal

Although Paypal was founded in 1998 – it wasn’t until 2015 that the firm made the decision to go public. Back then, you would have paid $34 per share. It is somewhat unusual to classify a two-decade-old company as a growth stock, but many would argue that Paypal is still in this phase.

After all, the stocks are now worth $191.14, meaning that they are in the green by 382% in just 5 years of trading.

7. Lucid Group

The company was founded in 2007 and is headed by Peter Rawlinson, who used to be VP of Engineering at Tesla. Lucid Group manufactures luxury EVs and has recently begun making deliveries of its first vehicle, the Lucid Air Dream Edition. At present, LCID is trading at $39.20, up a remarkable 290% since the turn of the year.

8. Shopify

Shopify is a company that provides an e-commerce platform (also called Shopify) that businesses can use to create online stores. The Shopify platform is simple to use, including all the features necessary to market products and take payments. According to various reports, Shopify has over 1.7m businesses across roughly 175 countries at writing.

Shopify’s shares were up around 27% since last year. The company made over $1.14bn in net income during Q3 2021 – nearly $1bn more than they made in Q3 2020! Furthermore, the latest figures show that Shopify has over $7.5bn in cash, meaning the company has scope to invest in high-growth areas, which they are doing through Shopify Fulfilment.

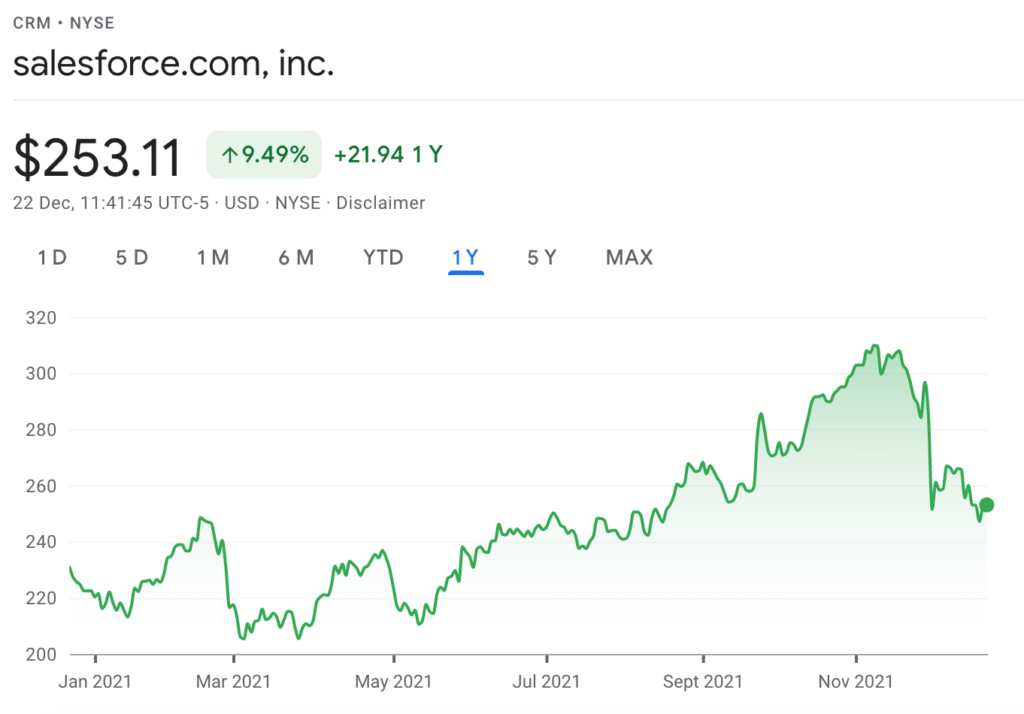

9. Salesforce

Salesforce is yet another growth stock that is involved in cloud-based software. More specifically, the firm is behind high-grade CRM platforms that bridge the gap between companies and clients. Looking back at its historical performance on the NASDAQ, Salesforce shares were initially priced at just under $4 in 2004.

Fast forward to September 2020 and the very same stocks were priced at $246. However, much of this growth occurred in 2020 alone. For example, the shares hit lows of $115 in March 2020. However, with a 52-week high of $284 to follow in August, this represents a growth of 146% in just 5 months.

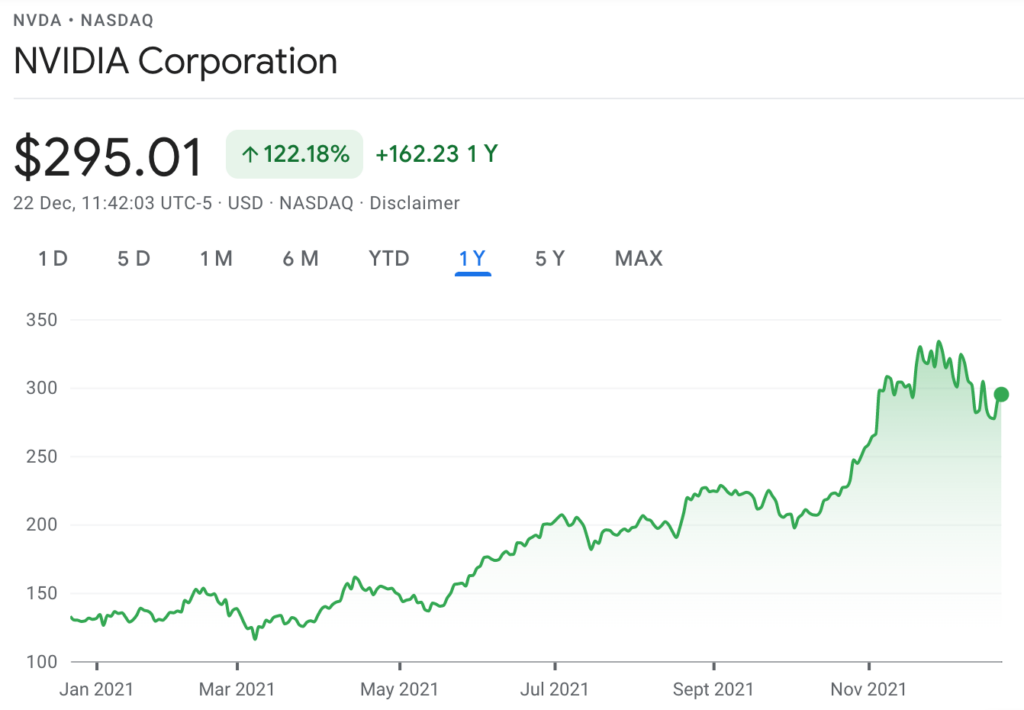

10. NVIDIA

NVIDIA provides consumers with a high-end gaming experience through PCs, laptops, and mobile devices. Although NVIDIA was launched way back in 1993, it is still very much a growth stock. In fact, this particular pick is a run-away winner in terms of end-to-end returns for investors.

For example, NVIDIA was priced at just $1.64 per share in 1999. This put the company firmly within the category of a penny share.

What are Growth Stocks?

In a nutshell, growth stocks are publicly-listed companies that are expected to outperform the wider markets. This might include companies operating in the same sector or industry, or a benchmark index like the FTSE 100.

In a nutshell, growth stocks are publicly-listed companies that are expected to outperform the wider markets. This might include companies operating in the same sector or industry, or a benchmark index like the FTSE 100.

Either way – and as the name suggests, growth stocks are expected to be worth a lot more in the future. As a result, although the company in question might not be making much in the form of profit, a good investment strategy is to invest in high growth stocks because of the expected future cash flows.

Tesla – the electronic car maker, is a fine example of a growth share. This is because the firm has a market capitalization of over $1 trillion – even though it has only recently began making a profit!

The overarching objective of investing in growth stocks is that you expect to see an above-average return in the coming years. For example, those that backed companies like Apple and Microsoft in the 1980s are now looking at unprecedented returns. This is because they took a “punt” that in decades to come, the firms would be market leaders in their respective sectors.

Characteristics of Growth Stocks

Before you invest in growth stocks, it is important that you have a firm grasp of how they differ from more traditional stocks. As such, below you will find some of the main characteristics that growth stocks possess.

High P/E Ratio

A common denominator across most growth stocks is that they carry a high P/E ratio. For those unaware, the price-to-earnings (P/E) ratio looks at the share price of a company against its earnings per share.

The resulting figure gives us an idea of whether the company is potentially over or undervalued. The general rule of thumb is that the higher the P/E ratio, the more chance there is that the stock is overpriced.

As we will uncover shortly, high growth stocks typically have a very high P/E ratio. This is because they may not be making much profit – even though they have a sizable share price and market capitalization.

So, let’s take Tesla as a prime example.

- Tesla has a current share price of $1,007.30

- Its most recent earnings per share were $1.44

- This means that Tesla has a P/E ratio of 325.89

As noted earlier, we need to look at how the P/E ratio of a growth share compares against its fellow industry counterparts. A good way of doing this is to look at the average P/E ratio of the NASDAQ exchange. This is where some of the largest tech stocks in the world are listed – including Tesla.

At the time of writing, companies listed on the NASDAQ have an average P/E ratio of 29.62. In the eyes of a novice, this means that Tesla is heavily overvalued. After all, it is trading at over 11 times the industry average.

Vulnerable Financials

Leading on from the above section on growth stocks having a high P/E ratio, this is typical because the firm is yet to realize its full potential in the profit department. This is why the P/E yields a ratio that makes the company look overvalued. A good growth stocks example is Netflix.

The online content streaming provider has grown to exponential heights over the past few years. Not only in terms of subscriber numbers but its stock price and market capitalization, too. For example, although Netflix is reporting a profit, free cash flow levels are in negative territory.

As a result, the firm will likely need to raise additional cash to meets its long-term goals. With that said, Netflix has a market capitalization of over $270 billion – making it one of the most valuable tech stocks in the US. Once again, this is because investors believe that in the near future, Netflix will be yielding significantly higher profits than it is currently generating.

Innovative Business Models

An additional characteristic that you will often find with growth stocks is that they are typically behind innovative products or services. This might include a form of renewable energy like solar, or even a cutting-edge technology like the blockchain. Additionally, the firm might be involved in electric vehicles or even cannabis-based medicine.

Either way, although these products and services have the potential to make it big in the future, there is no guarantee that this will be the case. Even if the underlying sector does reach the masses, there is no guarantee that your chosen stock will be the one to lead the way.

No Dividends

Growth stocks rarely pay dividends. The overarching reason for this is that growth stocks re-invest most of their profits back into the company. From an investment perspective, this means that you will only be able to make money in the form of capital gains.

Growth stocks rarely pay dividends. The overarching reason for this is that growth stocks re-invest most of their profits back into the company. From an investment perspective, this means that you will only be able to make money in the form of capital gains.

In Layman’s terms, this means that your main objective is to sell the shares at a much higher price than you paid. Interestingly, although Amazon is the most valuable company in the US, it is actually referred to as a growth share.

This is evident by the fact it has a substantially high P/E ratio of over 67 and is yet to pay a single cent in dividend yields. But, it is important to remember that Amazon is involved in heaps of side-ventures that are yet unproven. This includes everything from artificial intelligence, cloud computing, online groceries, and drone-based deliveries.

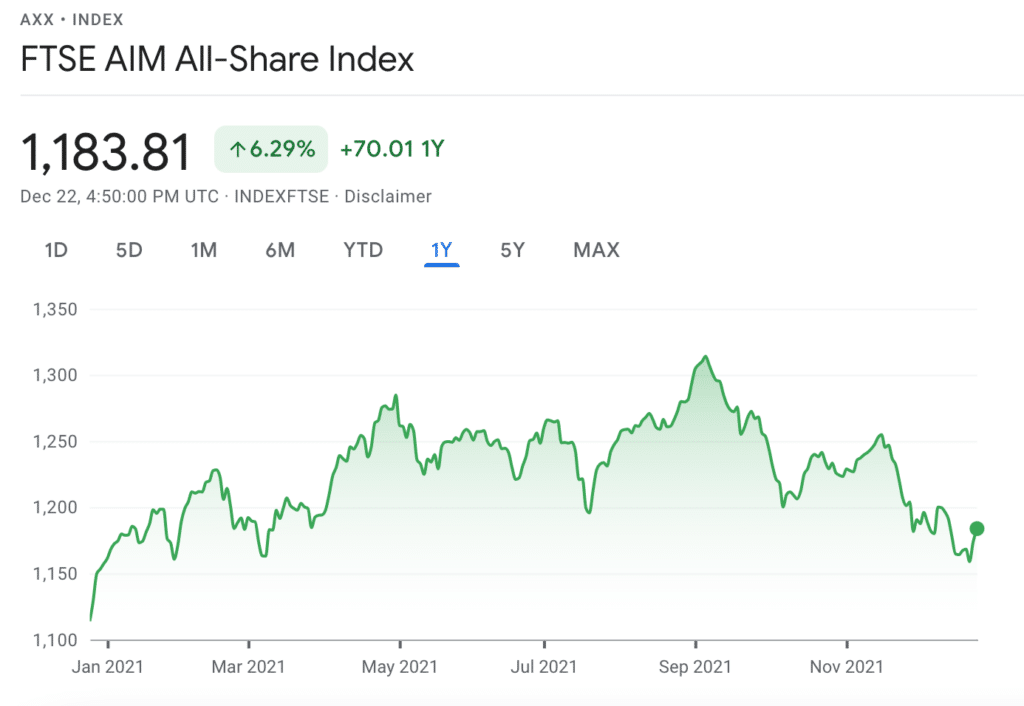

AIM Growth Stocks

Although not an exact science, it should be noted that the vast majority of growth stocks on the UK stock market are listed on the AIM. Only when a publicly-listed company meets certain conditions will it then make the transition to the London Stock Exchange (LSE).

As a result, if you want to get your hands on the best UK growth stocks, you might need to focus on AIM shares. The key problem with this is that most AIM shares never reach their full potential. There are countless examples of stocks that have enjoyed a brief period of success, only to then see their share price capitulate.

The good news for you is that there is a simple solution. That is to say, rather than going through the motions of attempting to find a hidden gem, you can instead invest in the wider AIM markets via an ETF. Put simply, this means that you will be buying shares in each and every company listed on the AIM. That way, you can diversify across the entire market, as opposed to picking a handful of shares.

Why do some traders invest in Growth Stocks?

Put simply, people invest in high-growth stock because they think the underlying stock price is likely to grow over time. More specifically, there is an expectation that the shares will increase in value at a much faster rate than the market average. This is usually because you are investing in a company while it is still young. In other cases, the company might be behind a product or service that is yet to fully take off. Recently with Deliveroo’s reports of sales doubling since lockdown, many are looking at how to buy deliveroo shares, anticipating that this growth will continue to expand

Another growth stocks example of this is the online retailer ASOS.

- The firm was launched in 2000 and went public in 2001 via the AIM.

- Back then, online fashion was still in its infancy are largely unproven with consumers.

- As a result of this, had you invested in ASOS before the platform became a house-hold name, you would have paid an initial price of 24p per share.

- Fast forward to its all-time highs of 2018 and would have been able to sell the shares at 7,630p.

- In doing so, you would be looking at gains of over 31,000%.

Crucially, there was no guarantee that ASOS would make it big back in 2001, which is why the risk vs reward ratio is so high.

Value Shares vs Growth Stocks

Value shares and growth stocks are chalk and cheese in the investment arena.

- Value shares are often referred to as ‘undervalued’, as they are trading at a price below their intrinsic value.

- Growth stocks can be viewed as expensive and overpriced, not least because they carry high P/E ratios.

In the case of value shares, you do stand the potential of buying the shares are a favourable price. This might be because the shares have dropped in value on the back of a negative news story or a below-par earnings report. Either way, the share price drop is usually short-lived in such instances.

The key point is that value shares are typically established organizations. The value not only comes in the form of a reduced share price but also because they often pay dividends.

This allows you to grow your money even faster. On the other hand, growth stocks rarely pay dividends, and they carry overvalued P/E ratios.

With this in mind, seasoned investors will often have a vested interest in both value shares and growth stocks. This diversification strategy ensures that you have a finger in multiple pies. That is to say, while you are in possession of firms that have the potential to grow over time, you also own value shares that can reward you in the short-to-medium term.

Risks of Growth Stocks

While the main attraction of growth stocks is that they offer the potential to earn above-average returns in the long run, they do come with added risks.

This includes:

Unproven Results

Growth stocks are typically behind innovative business models that look great on paper. This is why their shares trade at a premium. However, it is important to remember that there is no sure-fire way of knowing whether or not the firm will succeed with its long-term goals. This became evident during the Dot Com crash of the early 2000s.

During the bubble, dozens of newly launched internet companies on Wall Street acquired a multi-billion pound market capitalization – even though many were yet to report a single penny in profit. Once the crash came to fruition, it was inevitable that many of these firms would eventually get found out by the markets.

In turn, they are no longer here to tell their story. This is the reality with growth stocks, so never assume that an innovative business model is guaranteed to enjoy success in the future.

Overinflated Valuation

As we have discussed throughout this guide, many growth stocks have a multi-billion pound valuation even if when they are generating small profits. In some cases – such as Uber, growth stocks will actually be making a loss. The key problem here is that shareholders will not hang around forever.

That is to say, if the growth share in question releases its earnings report, and the figures are substantially worse than expected, this could result in a mass sell-off. Going back to the case of Uber, its 2019 IPO opened at a share price of $42. As of August 2020, the stocks are priced at just $33. This means that the firm is worth 21% less than its initial listing price.

Competition can be Costly

When up-and-coming growth stocks are working on an innovative product or service, there are often several companies active in the space. This means that competition can be fierce. However, an even greater risk in this respect is that growth stocks also need to contend with established companies that already have vast resources at their fingertips.

A prime example of this is the GPS market. Back in the early 2000s, GPS was billed as the best thing since sliced bread. As you might well remember, TomTom was at the forefront of the market. As a result, its shares grew from 27 Euros in 2005 to 95 Euros in 2007 – representing growth of over 250%.

However, mobile phone providers like Apple and Google then stepped in by making GPS maps a core feature of their devices. In turn, TomTom shares have been on a downward spiral ever since their 2007 peaks, with a current market price of just 7 Euros. This means that the stocks are worth 92% less than their prior highs.

Which Brokers offer access to Growth Stocks?

So now that you know both the advantages and disadvantages of growth stocks, we are now going to explore where you can make a purchase. As most growth stocks are listed on the AIM, you need to find a broker that gives you access to this particular marketplace.

Furthermore, you also need to explore what fees and commissions the broker charges, what shares it actually offers, and whether it is regulated by the Financial Conduct Authority (FCA).

1. IG

IG is also popular with UK investors that are looking to buy growth stocks. After all, the broker gives you access to over 10,000 stocks at the click of a button. This includes hundreds of UK companies listed on the London Stock Exchange and AIM, so there are plenty of opportunities to build a diversified portfolio. IG also gives you access to international stock exchanges.

IG is also popular with UK investors that are looking to buy growth stocks. After all, the broker gives you access to over 10,000 stocks at the click of a button. This includes hundreds of UK companies listed on the London Stock Exchange and AIM, so there are plenty of opportunities to build a diversified portfolio. IG also gives you access to international stock exchanges.

On top of its traditional share dealing services, IG also supports CFD stock trading and spread betting. This is useful if you wish to trade high growth stocks with leverage, or you plan to engage with short-selling. When it comes to fees, IG allows you to invest in shares at £8 per trade. This means that you will pay £8 when you buy the shares and again when you sell them. The amount you invest is irrelevant, as the fee remains constant.

You can, however, get your trading fees down to £3 if you placed more than 3 orders in the prior 30 days. CFD and spread betting fees trading fees are slightly different, as you will pay a commission of 0.10%. This comes at a minimum of £10. In joining 178,000 IG clients, you will be able to invest via the platform’s main website, MT4, or on your mobile phone. This ensures that you are able to buy and sell growth stocks no matter where you are.

In terms of the specifics, IG was launched back in 1974 – making it one of the most established brokerage firms in the space. Its parent company is listed on the London Stock Exchange, with a current market capitalization of £2.7 billion. It does, of course, hold several brokerage licenses – including that of the FCA. This ensures that you are able to trade in a safe and secure environment at all times.

| Stock Broker | Minimum Deposit | Fractional Shares? | Pricing System | Fees & Charges |

| IG | $0 | No | Commissions for real shares | No Deposit fees, $0 withdrawal fee, $12 inactivity fee after 2 years, no account management fees. |

Sponsored ad.Your capital is at risk

Popular Growth Stocks in the UK – Conclusion

Growth stocks come with both their pros and cons. On the one hand, you stand the chance of investing in a company at the very start of its journey.

On the other hand, there is never any guarantee that your chosen growth stocks will reach their full potential. This is why it’s crucial that you perform in-depth research before making an investment.