How to Buy Riot Blockchain Shares UK – With 0% Commission

Riot Blockchain was not just one of the top-performing stocks in 2020. It was also one of the only cryptocurrency stocks that outperformed Bitcoin itself last year.

In 2020 alone, Riot Blockchain shares (NASDAQ: RIOT) were up an eye-popping 1,500%. That means that if you had invested just £100 at the start of last year, it would be worth more than £1,500.

With the price of Bitcoin soaring above $50,000 for the first time, Riot Blockchain has already gained another 330% in 2021. The company seems to report good news at every turn, too.

So, how can you get in on Riot Blockchain’s rapid growth? In this guide, we’ll show you how to buy Riot Blockchain shares in the UK and pay no commissions.

-

-

Step 1: Find a UK Stock Broker to Buy Riot Blockchain Shares

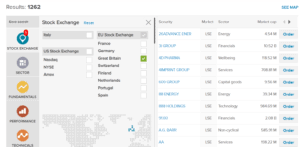

Riot Blockchain is a US company that trades on the NASDAQ stock exchange in New York. And until last year, it was a penny share. So, many UK brokers that offer trading on US shares don’t offer this fast-growing stock.

1. Fineco Bank – Buy Shares or Trade CFDs with Powerful Tools

Fineco Bank is an Italian broker that allows you to choose between buying shares outright or trading CFDs. CFD trading with Fineco is 100% commission-free, but US share dealing costs $3.95 per trade. On the plus side, this broker has no deposit or withdrawal fees and no inactivity fees.

Fineco Bank doesn’t offer any cryptocurrency trading, so this isn’t the best platform for monitoring the price of Bitcoin – which has an outsized effect on the price of Riot Blockchain shares. That said, this platform does have thousands of US, UK, and European shares, and also offers options trading. So, it’s a great platform for traders who want to build a diverse portfolio or use options to trade aggressively around Riot Blockchain stock.

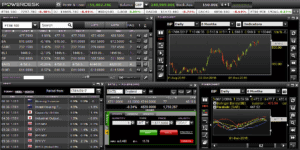

This broker’s trading platform takes different forms depending on whether you’re on a desktop computer or a mobile device. On a desktop, you can access PowerDesk, a fully-featured technical analysis suite that offers dozens of indicators and drawing tools. PowerDesk also offers minute-by-minute price analysis, alerts, and automatic order execution.

The Fineco Bank mobile app is more beginner-friendly. You can still access technical charts, but they’re slimmed down for quick analysis on the go. The app also includes a news feed and stock screener, which are very helpful for discovering new stocks to trade.

Fineco Bank offers customer support by phone 7 days a week. There’s no minimum investment required to start trading. This broker is regulated by the Bank of Italy and is publicly traded on the Milan Stock Exchange.

Pros

- 100% commission-free CFD trading

- No account or inactivity fees

- Supports options trading

- Beginner-friendly mobile trading app

- Customer support 7 days a week

Cons

- No crypto trading or market data

- Commission for share dealing

Your capital is at risk.

Step 2: Research Riot Blockchain Shares

Riot Blockchain was one of the hottest stocks in 2020, and it’s been one of the hottest stocks thus far in 2021, too. But what’s behind this company’s meteoric rise, and is it likely to continue?

Let’s take a deeper dive into Riot Blockchain shares to help you decide whether to buy right now.

Riot Blockchain Stock Price History & Market Capitalisation

Riot Blockchain was founded in 2017, when a veterinary pharmaceuticals company called Bioptix pivoted to Bitcoin mining. Riot Blockchain is not involved in the biotech industry, and instead focuses solely on deploying computing power to mine Bitcoin.

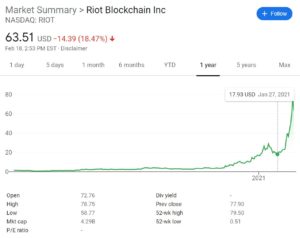

The company saw a brief, sharp spike in its stock price in late 2017 when the price of Bitcoin soared. Prior to Bitcoin gaining momentum, Riot Blockchain shares were trading around $4 per share. At the height of Blockchain’s spike in value, Riot Blockchain shares traded over $28 apiece.

The shares quickly shed value once Bitcoin settled down, and shares traded around $1-$2 each for most of 2018 and 2019. At the start of 2020, Riot Blockchain shares were valued at $1.18 each.

Riot Blockchain shares exploded in the last months of 2020, ending the year at $17 – a full-year gain of more than 1,500%. In mid-January, the stock hit an all-time high of $28.90.

The stock then pulled back nearly 50%, to less than $18 per share. However, in the past week, Riot Blockchain stock shot upwards to a high of $79.50. At the time of writing, the stock is worth $63.51 per share.

At the current stock price, Riot Blockchain has a market cap of $4.85 billion. That’s an enormous valuation when you consider that in July last year, this same company had a market cap of just $167 million.

Riot Blockchain EPS and P/E Ratio

Riot Blockchain was not profitable in 2020. The company reported an earnings per share (EPS) of -$0.42 for the 12-month period ending September 30, 2020.

Still, this is compared to an EPS of -$1.02 in 2019. Analysts expect the company to turn a slight profit this year, although much will depend on whether the price of Bitcoin keeps rising.

Since Riot Blockchain is unprofitable, it does not report a price-to-earnings ratio (P/E ratio).

Riot Blockchain Stock Dividend Information

Riot Blockchain is not profitable and does not pay out a dividend to shareholders. Don’t expect this company to issue dividends in the next few years, either. Riot Blockchain is more likely to use free cash flow to purchase additional computing power to expand its operations.

Should I Buy Riot Blockchain Shares?

Riot Blockchain makes money by mining Bitcoin. The company uses an immense amount of computing power to calculate hash values for blocks that are added to the Bitcoin blockchain. Every time it calculates the hash value, Riot Blockchain is rewarded with Bitcoin as a result.

This business model makes Riot Blockchain extremely vulnerable to the price of Bitcoin. No matter what a single Bitcoin is worth, Riot Blockchain is putting in the same amount of effort – in terms of computing and electricity costs – to mine it.

So, when the price of Bitcoin rises, the reward that Riot Blockchain gets for its investment is greater. When the price of Bitcoin falls, Riot Blockchain is spending the same amount of money to make less money in return.

That’s why Riot Blockchain’s share price has largely mirrored the price of Bitcoin. The company’s shares hit new highs as Bitcoin shot past $40,000 per coin, fell when the price of Bitcoin pulled back in late January, and moved higher again once Bitcoin reached the $50,000 mark.

While there are clear risks in investing in Bitcoin – or a stock whose value depends so much on this cryptocurrency – we think Riot Blockchain is an excellent investment right now. Here’s why.

Untapped Value

The number of Bitcoin that will ever be released into circulation is 21 million. Right now, there are just under 2.4 million Bitcoin left to be mined. At the current price, that equates to nearly $120 billion in untapped value.

Even with its share price at a record high, Riot Blockchain is only worth $4.85 billion by comparison. Of course, there are lots of players competing to mine Bitcoin, so Riot Blockchain won’t receive all of the $120 billion in outstanding Bitcoin. But the fact that there’s such a difference between potential return and Riot Blockchain’s current valuation signals that this stock has tons of room to move higher.

Of course, that assumes that the price of Bitcoin remains steady over the next few years – something that’s unlikely to happen. The amount of value remaining in unmined Bitcoin could be significantly higher if the digital currency continues to gain value (and we’re very bullish on Bitcoin).

Gaining Competitiveness

How high could Riot Blockchain go? That depends on how competitive it is at mining Bitcoin relative to other players in this space.

The good news here is that Riot Blockchain is rapidly bringing more computing power online. The company now has over 9,500 Bitmain Antminer computers at work, and it recently surpassed a hashrate of over 1 exahash per second – a major milestone. By the end of the year, Riot Blockchain expects to more than triple the number of Antminers it operates and to close in on a hashrate of 4 exahashes per second.

That will ensure that Riot Blockchain remains competitive even as interest in mining Bitcoin spreads. The more competitive Riot Blockchain is, the more Bitcoin it will be rewarded with.

More Than Just Bitcoin

The final reason we like Riot Blockchain is that it’s not just limited to Bitcoin. In the not too distant future, all Bitcoin will have been mined and the company will have to turn to another proof of work coin.

Thankfully, many other proof of work-based coins are quickly gaining value. Bitcoin Cash, Ethereum Classic, Litecoin, and Monero all require mining, similar to how Bitcoin works.

Riot Blockchain could easily adapt its massive computing infrastructure to target these blockchains, and be rewarded for doing so. If it’s not clear which cryptocurrency will be the next big hit among investors and users, the company could build a diversified mining portfolio that focuses on several different coins.

Riot Blockchain Shares Buy or Sell?

We think Riot Blockchain stock is a buy right now.

Given that the stock has gained more than 1,800% since last January, this company isn’t a value stock. However, it is an explosive growth stock with plenty of room to keep growing.

Riot Blockchain has done an excellent job of positioning itself to be a leader in mining the 2.4 million Bitcoin that are not yet in circulation. While the company could continue growing even if Bitcoin’s price stays the same, we expect that Riot Blockchain will significantly benefit from a sustained increase in demand for cryptocurrencies – and Bitcoin in particular.

On top of that, Riot Blockchain isn’t restricted to just mining Bitcoin. While that’s the most profitable avenue for now, the company could easily mine cryptocurrencies like Bitcoin Cash, Litecoin, Ethereum Classic, and Monero in the future. So, Riot Blockchain’s growth isn’t limited by the number of Bitcoin remaining to be mined.

Given all of that, we think Riot Blockchain’s growth over the past year is just the start of a longer cycle of appreciation for this stock.

The Verdict?

Riot Blockchain is one of the hottest shares on the market today, with a gain of more than 1,800% since the start of 2020. This stock is highly correlated with the price of Bitcoin, which is a great thing if you’re bullish on cryptocurrencies and want a way to invest in them. Given the upward trajectory of Bitcoin and Riot Blockchain’s growth potential, we think this stock is a strong buy right now.

FAQs

What is Riot Blockchain’s stock ticker symbol?

Riot Blockchain trades on the NASDAQ stock exchange under the symbol ‘RIOT.’

What does Riot Blockchain do?

Riot Blockchain deploys computing power to mine Bitcoin. So, it is paid in Bitcoin, which it can then sell on cryptocurrency exchanges for a profit.

Should I buy Bitcoin or Riot Blockchain stock?

Riot Blockchain’s share price is closely correlated with changes in the price of Bitcoin. We think Riot Blockchain stock is more accessible if you already have a stock portfolio, and this company could have exposure to other cryptocurrencies in the future.

Can I invest in Riot Blockchain with an ISA or SIPP?

Yes, you can invest in Riot Blockchain shares with an ISA or SIPP as long as your broker offers trading on these shares. This is a good way to invest in the cryptocurrency market with your ISA or SIPP.

Who is the current CEO of Riot Blockchain?

The current chief executive of Riot Blockchain is Jeffrey Mcgonegal, who has been at the company’s helm since 2019.

Can I trade Riot Blockchain shares with leverage?

If you are trading Riot Blockchain shares using CFDs, you can use leverage up to 5:1.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

Fineco Bank

Fineco Bank

Riot Blockchain was one of the hottest stocks in 2020, and it’s been one of the hottest stocks thus far in 2021, too. But what’s behind this company’s meteoric rise, and is it likely to continue?

Riot Blockchain was one of the hottest stocks in 2020, and it’s been one of the hottest stocks thus far in 2021, too. But what’s behind this company’s meteoric rise, and is it likely to continue?

The good news here is that Riot Blockchain is rapidly bringing more computing power online. The company now has over 9,500 Bitmain Antminer computers at work, and it recently surpassed a hashrate of over 1 exahash per second – a major milestone. By the end of the year, Riot Blockchain expects to more than triple the number of Antminers it operates and to close in on a hashrate of 4 exahashes per second.

The good news here is that Riot Blockchain is rapidly bringing more computing power online. The company now has over 9,500 Bitmain Antminer computers at work, and it recently surpassed a hashrate of over 1 exahash per second – a major milestone. By the end of the year, Riot Blockchain expects to more than triple the number of Antminers it operates and to close in on a hashrate of 4 exahashes per second.