How to Buy Pennon Shares Online in the UK

In times of economic uncertainty, shares of utility companies are extremely attractive. Demand for services like water, sewage, gas, and electricity don’t change much no matter what’s happening in the broader market. So, utility shares often provide a defensive safe haven for investors with the promise of modest long-term returns.

One utility company that stands out today is Pennon Group, which owns South West Water along with several waste management divisions in southwest England. This company’s share price has grown a whopping 60% over the last year thanks to soaring investor interest and a rock-solid bottom line. Demand for water isn’t changing anytime soon, either, so investors are looking to Pennon Group shares as a safe bet for the future.

If you want to buy Pennon shares but don’t know where to start, this guide is for you. We’ll explain how you can buy Pennon shares online in the UK and review top brokers you can invest with. We’ll also take a closer look at Pennon’s history and outlook to help you decide whether shares of this utility company are right for you.

Step 1: Find a UK Broker That Offers Pennon Shares

You’ll want to be picky about choosing an online broker, though. Some brokers offer commission-free stock trading while others charge a flat fee every time you buy and sell shares. On top of that, your broker controls whether you’ll have access to diversified assets like ETFs, mutual funds, and investment trusts.

In order to help you find the best broker for buying Pennon shares, we’ll highlight two of our top recommended services in the UK:

Step 2: Research Pennon Shares

Before you buy Pennon shares, or other shares like National Grid shares, it’s important to know what you’re getting into. This Pennon share price is trading at a premium right now, so you need to evaluate whether it still has room to grow. To help, we’ll take a look at Pennon’s share price history, this company’s dividend payout, and its prospects for the future.

Pennon Share Price History

Pennon Group PLC, originally South West Water PLC, was founded in 1989 when the water industry in the UK was privatised. The company, headquartered in Exeter, took over much of the water system that had previously been managed by the public South West Water Authority. It controls around 20 reservoirs in southwest England and, through a charitable trust, manages around 50 more small lakes and rivers.

Pennon acquired a number of waste management and recycling companies during the 1990s and 2000s, making it an important player as both a water and waste utility in southwest England. It also purchased Bournemouth Water in 2016, then sold off a significant portion of its waste management holdings (in the form of a subsidiary called Viridor) in July 2020. The Viridor sale was worth £4.2 billion.

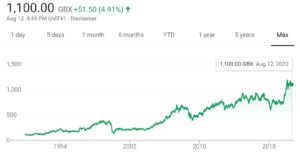

The share price of Pennon Group has grown steadily since the company listed on the London Stock Exchange in 1989, with major dips only around recessions in 2000 and 2009. The shares took off in 2019, when Pennon announced that it was negotiating for the sale of its Viridor waste management subdivision – eventually moving from 705p per share in August 2019 to 1292p per share in February 2020. The Pennon share price has since dropped as a result of the coronavirus pandemic, but it has not been affected nearly as badly as blue chip stocks across the FTSE 100.

Pennon Shares Dividend Information

One of the reasons that investors are most excited about Pennon is that it’s a high paying dividend stock. The company pays out a 3.58% dividend yield, and that’s been going up year after year. In fact, just as many other top dividend stocks were slashing their payouts in response to the coronavirus pandemic, Pennon announced a 6% increase in its dividend. That’s extremely reassuring at a time when companies with lengthy dividend histories suddenly look risky.

Should I Buy Pennon Shares?

Investors and analysts alike are bullish about Pennon Group shares, which has driven the stock up to a pretty high price. At 1,100p per share, the company is trading at a whopping 40 times earnings!

However, there are several reasons to believe that Pennon’s share price could hold steady or even increase going forward:

Streamlining and Managing Debt

On top of that, the £4.2 billion price tag on the sale is a huge windfall for Pennon. The company is carrying a net debt of more than £1.8 billion, which is one of the main concerns that investors had about Pennon shares. But with cash streaming in from the Viridor sale, Pennon should have no problem getting its debt under control while also having money left over for reinvestment in its water business and rewarding shareholders.

Slow and Steady Growth

In its latest earnings announcement, Pennon’s CEO noted that the company is targeting 2% revenue growth per year, adjusted for inflation. That might not sound like much, but for a defensive utility it’s huge news. A 2% growth rate means that Pennon will slowly and steadily increase its bottom line, generating more profits that can then be paid out to shareholders through a burgeoning dividend yield.

The fact that this growth rate is adjusted for inflation is also good news. Even if the coronavirus pandemic drives up inflation and diminished the value of the pound, Pennon’s bottom line will continue to grow in real terms.

Pennon Shares Buy or Sell?

Pennon shares are currently trading at a premium relative to the company’s earnings, which will give value investors pause. However, if you are okay with the fact that Pennon isn’t exactly a bargain, there’s a lot to like about this stock.

First of all, Pennon Group shares have been virtually unaffected by the coronavirus pandemic even as other FTSE 100 companies have slashed dividends and experienced diving share prices. The company should continue to ride high even if the pandemic causes a longer recession.

In addition, Pennon pays out a respectable 3.5% dividend. The dividend payout has increased year after year, and with cash from the Viridor sale Pennon should have no problems continuing to make payments to shareholders.

Pennon likely isn’t much of a growth stock, so returns might not exceed the dividend payout by much over the next few years. However, a reliable 3 to 5% return in a volatile market is more than welcome, particularly for income and retirement investors.

The Verdict

Pennon has done a lot right in the past year, and it’s been rewarded by investors with a more than 60% increase in its share price. The company probably doesn’t have much more room to grow, but that doesn’t mean it’s not a worthwhile investment.

Pennon shares are relatively insulated from economic turmoil – a major advantage in the midst of uncertainty around the coronavirus pandemic – and it pays out a reliable 3.5% dividend. Given that, Pennon shares are an attractive investment for long-term investors who want to generate fixed income or compound their portfolios over time by reinvesting dividends.

FAQs

What cities does Pennon supply with water service?

Pennon serves a large swath of southwest England, including Cornwall, Devon, Plymouth, Avon, Dorset, and Bournemouth. The company provides water for more than 2.2 million people.

What regulator oversees Pennon?

Pennon’s water utility, South West Water, is overseen by the Water Services Regulation Authority (also known as Ofwat). Ofwat has approved Pennon’s current five-year plan for expanding its service.

Does Pennon still have a waste management business?

With the sale of Viridor, Pennon’s business is largely focused on water. The company treats wastewater and manages sewage, but it no longer has a trash and recycling subdivision.

Can I set up automatic dividend reinvestment in Pennon shares?

Some brokers offer automatic dividend reinvestment, by which dividends paid out by Pennon are automatically used to buy more Pennon Group shares. However Plus500 and most other commission-free brokers in the UK do not offer automatic dividend reinvestment.

Can I collect dividends when trading CFDs?

Yes, you are eligible to collect dividends when trading CFDs. You must own the CFDs by the ex-dividend date in order to collect the next dividend payment.