How to Buy Standard Chartered Shares UK – With No Commission

Having traded sideways for the best part of seven months, Standard Chartered’s share price has not provided the bullish momentum needed to generate positive returns for investors. However, with economies reopening around the world and positive signs coming from Asia, Standard Chartered could be in for an encouraging end to 2021.

In this guide, we’ll discuss How to Buy Standard Chartered Shares UK, exploring the company and its financials, and showing you how to invest without paying any commissions or transaction fees.

When you buy Standard Chartered shares in the UK, it’s crucial to partner with one of the best share dealing accounts or brokers to ensure your investment is both safe and cost-effective. These days there are hundreds of brokers to choose from, each one vying for your attention, so it can seem tricky to decide which one to go with.

Not to worry – the section below presents our top two brokers when it comes to buying Standard Chartered shares UK. By partnering with one of these brokers, you’ll be able to invest safely and efficiently from the comfort of your own home.

Research Standard Chartered Shares

Before you take the plunge and buy shares in a company, it’s always a good idea to thoroughly research the company’s business model and underlying finances to get an idea of whether they are a good investment opportunity. Numerous factors can influence a company’s share price, so it’s essential to get a comprehensive overview.

To help you with this, we’ve researched Standard Chartered in-depth and presented everything you need to know in the sections below.

What is Standard Chartered?

Before you buy Standard Chartered shares in the UK, it’s a good idea to examine the company and find out who they are and what they do. In terms of Standard Chartered, they are a banking and financial services company with more than 1200 offices worldwide. Standard Chartered PLC operates in 60 different countries and offers services in various financial areas, including retail banking, corporate banking, institutional banking, and more.

Although Standard Chartered is headquartered in London, the company does not offer retail banking services in the United Kingdom; most of its profits from this area are derived from Asia, Africa, and the Middle East. This is because the company was formed by a merger in 1969 of two other companies who had established themselves in the area: Chartered Bank and Standard Bank.

Over the past 50 years, Standard Chartered has purchased many smaller firms to become the huge company it is today. Many of the firms that have been acquired are located in countries in Asia or the Middle East, such as Korea, India, and Pakistan. This has allowed Standard Chartered to gain a foothold in these areas that other banks do not have.

As mentioned previously, Standard Chartered offers a whole range of banking services, ensuring they cater to various demographics. The retail banking arm offers consumers financial solutions, such as current accounts and personal loans. The private banking section of operations caters to high net worth clients, whilst the corporate banking section deals with larger companies and helps them conduct business globally.

According to the LSE, the company currently has a market capitalisation of £15.73 billion – making it the 37th largest company in the UK. Notably, the company does have a smaller market cap than competitors such as Lloyds, HSBC, and Royal Bank of Scotland.

Finally, Standard Chartered has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index. Along with this listing, the company is also listed on stock exchanges in Hong Kong and India. At the time of writing, the company’s largest shareholder is Temasek Holdings (a holding company owned by the Singaporean government), which own 16% of the total shares outstanding.

Standard Chartered Share Price

One of the most important things to do before you buy shares in a company is look at its past performance in the stock market and its current financials. In terms of the Standard Chartered share price, shares are trading at 505 GBX (pence) at the time of writing. This represents a 7.9% increase from the beginning of the year; however, the Standard Chartered share price is down just over 28% since this date last year.

Between the end of January 2020 and the end of April 2020, the share price fell over 44%, with much of this decline attributed to the Coronavirus pandemic. Since then, the Standard Chartered share price has recovered slightly, but it has not yet reached pre-pandemic levels. The daily and weekly timeframes show signs of bullish momentum, which is a good sign going forward.

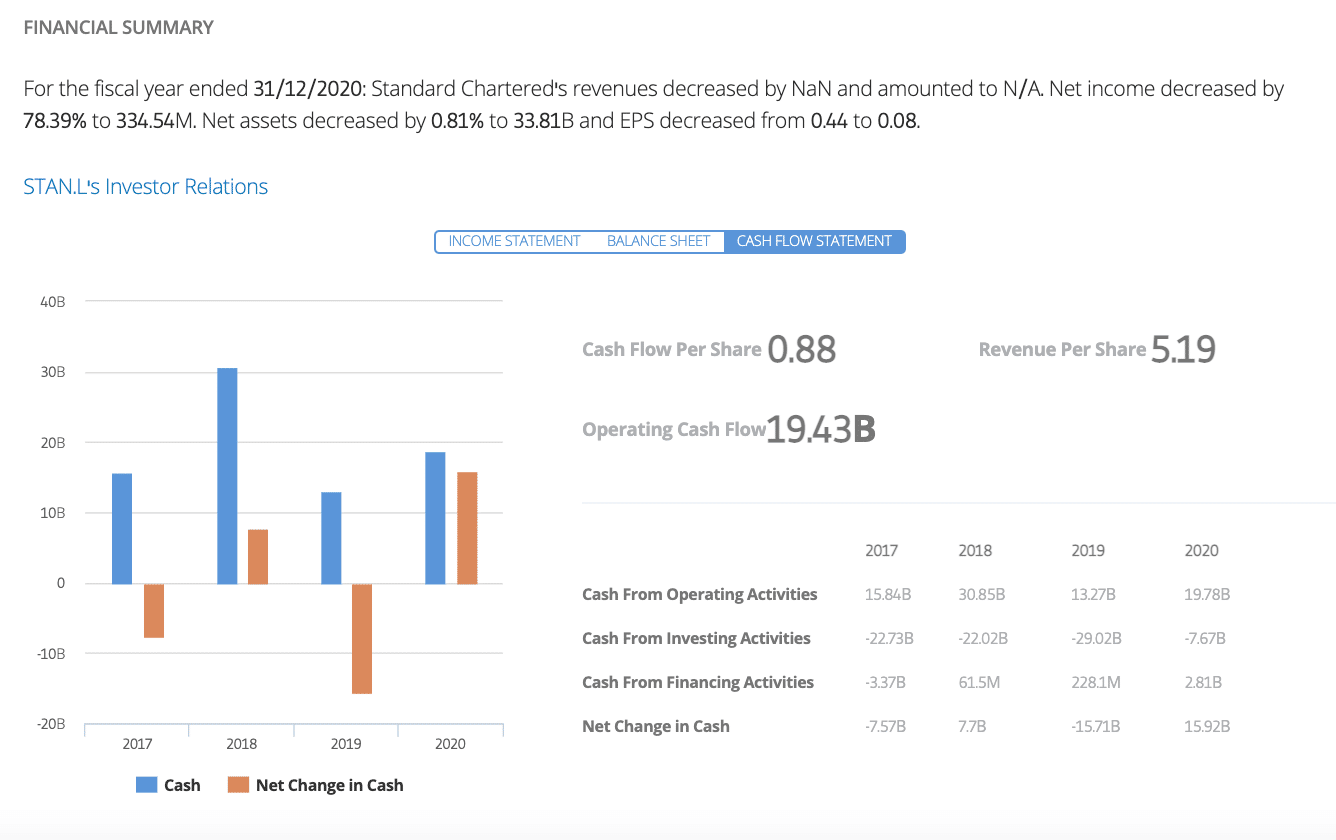

Looking at the company’s financials, data from Hargreaves Lansdown reports that the company generated $14.75 billion in revenue for 2020 – down from $15.41 billion in 2019. This led to a post-tax profit of $751 million, which was significantly less than the $2.34 billion in post-tax profits made in 2019. Although these figures make for grim reading, it’s essential to put them in the context of the lockdown; slow economies and low interest rates have had a significant impact on the banking sector.

To get some further insight into the company, it’s always a good idea to look at a company’s earnings per share (EPS) and price-to-earnings ratio (P/E). In terms of the former, Standard Chartered’s EPS figure for Q1 2021 was $0.24. Although it doesn’t seem like much, it’s a substantial rise from the EPS figure for Q4 2020, which was -$0.13. This change from positive to negative highlights the positive outlook for the Standard Chartered share price and the company’s financials going forward.

Moving on to the P/E ratio, the most recent data from YCharts notes this as 27.03. To put this in perspective, this ratio was sitting around 69.03 back in March, so it has taken a pretty significant decline in recent months. However, it is still higher than the level it was at for the majority of 2020. Notably, the Standard Chartered P/E ratio is still higher than Lloyds Bank (24.99) and HSBC (21.75).

Overall, if you’re interested in stock trading and are considering whether to buy Standard Chartered shares in the UK, it’s important to take the information presented here into account. The company has undoubtedly been hampered by the uncertainty of last year; however, the positives of a growing EPS figure and a better P/E ratio than the competition means this stock is worth some further consideration going forward.

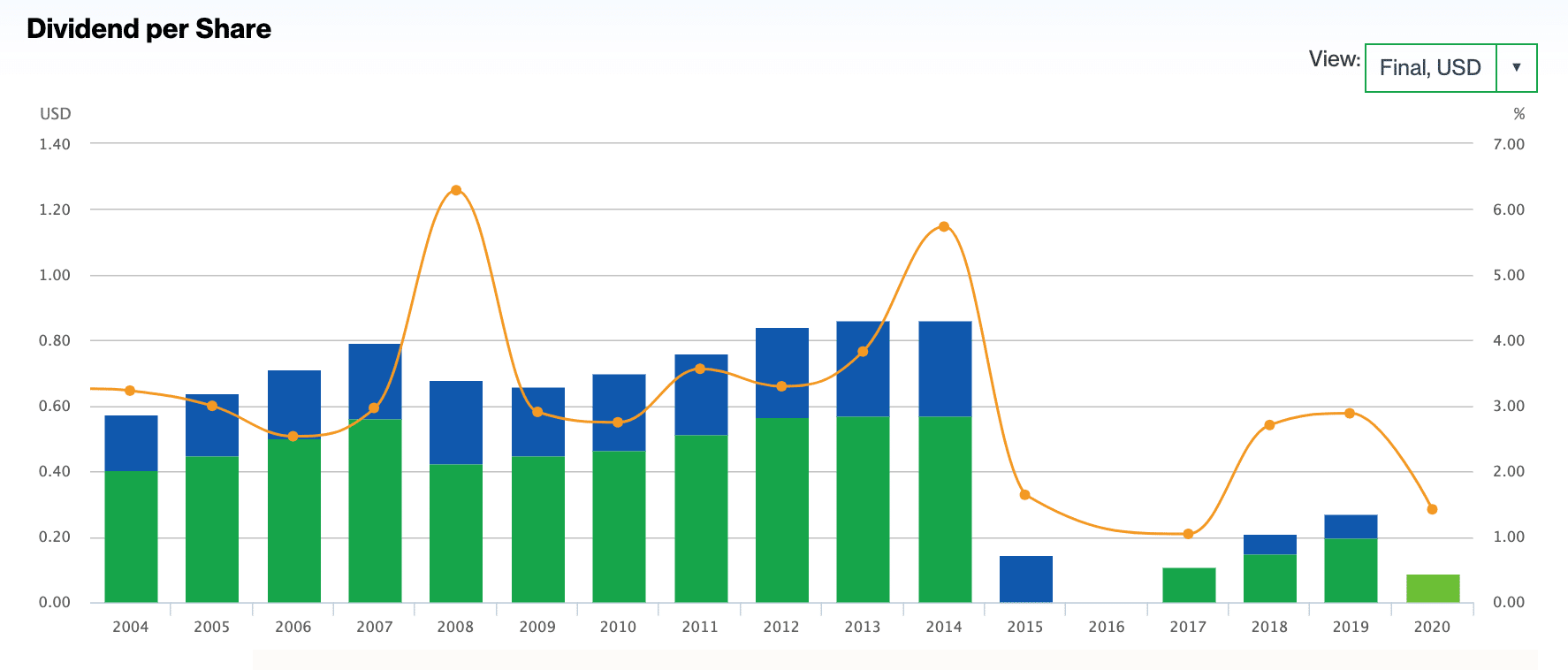

Standard Chartered Shares Dividends

Standard Chartered recently restarted dividend payments after temporarily halting them in 2020. With all of the volatility and negative impacts on the company’s finances, no dividend payment was made last year, with the one before that coming in May 2019. The company also didn’t pay a dividend in 2016 or 2017 but did in the years previous – this highlights an element of unpredictability in Standard Chartered’s dividends.

In terms of amount, data gathered from Fidelity puts the current yield in 2021 at 2.70%. This is considerably lower than the 4.37% paid in 2019 and the 7.86% paid in 2015. Although this may seem like a negative, the fact that the company has made payouts of that size before hints at the possibility of reaching those levels again once the economy is back up and running.

With only one payment made so far, judging by previous years, Standard Chartered may make another one in October, with the ex-dividend date coming in August. Although this is just speculation at this point, if the ex-dividend date is announced and you purchase shares in Standard Chartered before that date, then you’ll be eligible to receive a payment.

Are Standard Chartered Shares a Good Buy?

So, considering everything, are Standard Chartered shares a good buy? We feel that they are, especially if you are in the market for a long term investment. Although conditions have been harsh recently, there is definitely scope for the company to recover.

Market Conditions Easing

As economies around the world reopen, Standard Chartered has begun faring better in recent times. Profits rose 113% in Q1 2021 compared to Q1 2020, which indicates that the recovery has started. Much of Standard Chartered’s business is conducted in Asia, so if these economies can continue improving, it will mean bottom-line growth for the company.

Furthermore, the company’s executives have predicted revenue growth of between 5% and 7% by the end of the year, a sign of confidence from people inside the firm. Notably, interest rates are still incredibly low, which is a major issue when it comes to banking stocks. However, if there is any scope in future to increase interest rates, it’ll allow Standard Chartered to generate much more income and improve price performance.

Reinstated Dividend

As noted earlier, the company has announced that dividends will be reinstated – which is another sign of confidence because these dividends are derived from a firm’s profits. This is great news, primarily if you invest for income, as Standard Chartered has historically made two dividend payments per year.

Attractive Share Price

Finally, it’s worth noting the level that shares are currently at. Although they have taken a significant decline in recent times, it could be seen as a good buying opportunity if you flip your perspective. The Standard Chartered share price all-time high of 1880p came back in 2010; although it may not reach those levels again anytime soon, this highlights the room to the upside that price has got.

Even looking at the most recent highs of 740p experienced in December 2019, reaching these levels again would represent a 48% increase in price. If Standard Chartered can capitalise on economies reopening, and if interest rates were to rise over the next year, there’s certainly a chance that we could see some bullish momentum push price back towards these levels.

Standard Chartered Shares Buy or Sell?

In summary, can Standard Chartered shares be considered a buy or a sell opportunity? We believe it is the former. With the level that price is currently at, combined with the potential for growth once economies reopen, Standard Chartered could well be considered an undervalued stock at present.

The recovery of both the US and China could play a significant role in how well Standard Chartered does going forward. As the company derives most of its revenue from overseas, the performance of these countries is pivotal in determining how much revenue Standard Chartered will generate. If lockdowns ease and demand for loans and credit lines increase, it will mean more income overall for the company.

In addition, interest rates will have to rise at some point – however, this probably won’t happen until economies return to a sense of normality. Considering the positive impact that interest rate increases have on banking stocks, it may be worth adding Standard Chartered to your portfolio in anticipation of a rate increase down the line.

Overall, although the past year has been challenging for Standard Chartered (and banking stocks generally), the outlook is beginning to look more positive. Management has reinstated dividends, profits are increasing, and executives are making positive statements about the future – all things that positively benefit the share price. So, if you’re looking for a banking stock to add to your portfolio in 2021, a decision to buy Standard Chartered shares UK might be worth considering.

Buy Standard Chartered Shares With 0% Commission

As this guide has highlighted, Standard Chartered shares are a potentially lucrative buying opportunity if economies continue reopening and countries emerge from lockdowns. With interest rates at very low levels, banks are undoubtedly suffering; however, if Standard Chartered can capitalise on growth in Asia, then there’s undoubtedly gains to be made by adding this to your portfolio over the longer term.

FAQs

Does Standard Chartered pay a dividend?

Yes – although the company did not pay a dividend in 2020, they have recently made their first dividend payment of 2021 in May. The current dividend yield for Standard Chartered shares is 1.40%.

Are Standard Chartered shares a buy?

If you are looking to make a quick return, then these shares might not be best suited for you. However, if you're looking for a long-term investment that could generate capital returns, then Standard Chartered might be worth adding to your portfolio.

How much do Standard Chartered shares cost?

At the time of writing, one Standard Chartered share costs 505p. S

How much should I invest in Standard Chartered shares?

This comes down to your unique financial situation and goals.

What is the minimum amount I need to invest in Standard Chartered shares?

One whole share in Standard Chartered costs 505p. Some traditional brokers will require you to buy at least one share when you place a trade.