8 Popular Investment Funds Among UK Investors

If you’re keen to invest in the financial markets but lack the know-how to place trades yourself – you might want to research an investment fund.

In doing so, your chosen fund will determine which assets to buy and sell, meaning that you can enjoy a passive stream of income. Investment funds come in a verity of different forms – from ETFs and mutual funds to investment trusts and index funds.

In this guide, we discuss some popular investment funds available to UK residents in 2022. We cover a variety of fund types – and walk you through the process of making an investment from the comfort of your home.

8 Popular Investment Funds in the UK

Below you will find 8 popular investment funds in the UK based on trading volumes. You will find more information on each fund by scrolling down.

- iShares Russell 1000 ETF

- SPDR Gold ETF

- MI Chelverton UK Equity Growth Fund

- S&P 500 Index

- iShares MSCI Hong Kong ETF

- iShares FTSE China 25 Index ETF

- BMO Responsible UK Income 2 Inc

- Vanguard Pension Investment Fund

Investment Funds UK

On the one hand, UK investors have thousands of investment funds to choose from. After all, this ensures that there is a fund to suit all investor types.

iShares Russell 1000 ETF

The iShares Russell 1000 ETF is a investment fund offering access to 843 individual stocks.

The iShares investment fund manager seeks to select US firms that it believes are undervalued. This covers both large and mid-cap stocks from every sector going. In terms of major players, the investment fund is currently holding 2.76% in Berkshire Hathaway and 2.27% in Johnson and Johnson. Then you have the likes of Walt Disney, Intel, Verizon, and JPMorgan Chase & Co.

SPDR Gold ETF

As the name suggests, this investment fund is focused exclusively on gold.

In fact, the SPDR Gold ETF is up 25.99% from the 12 months prior to writing this page.

Mutual Investment Funds UK

Our two selections listed above both come in the form of ETFs. This means that the provider is tasked with tracking a specific marketplace – such as the Russell 1000 or gold. Mutual funds, on the other, are slightly different. This is because the fund manager will personally decide which assets to buy and sell – and when.

In other words, although it might be focused on FTSE 100 stocks, it might decide to remove a number of constituents if it believes the company does not add value to investors. This is something that ETFs cannot do. Nevertheless, below you will find UK mutual investment funds.

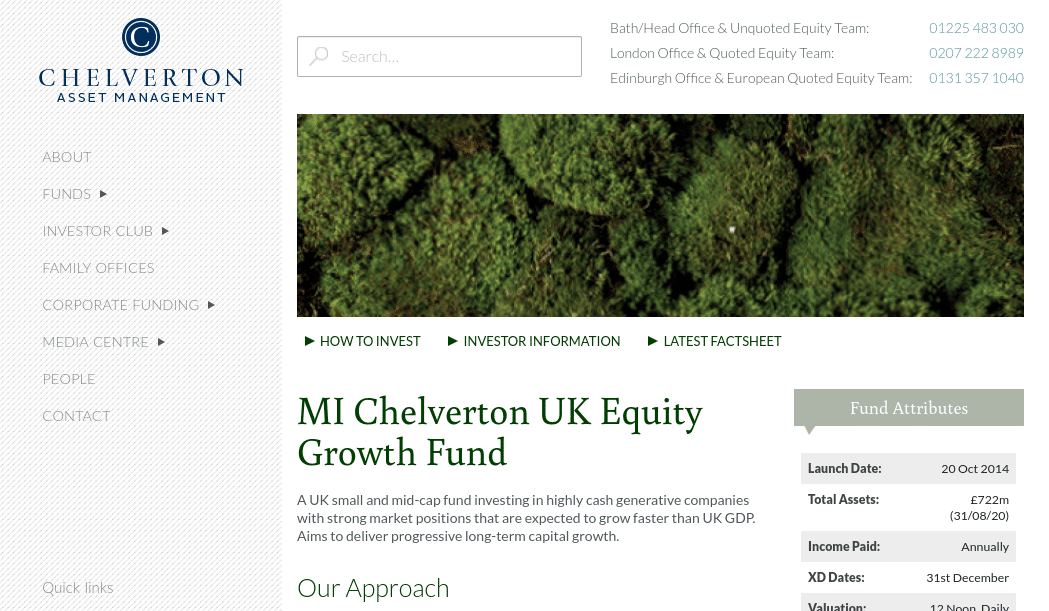

MI Chelverton UK Equity Growth Fund

While most investors focus on large-cap stocks listed on the London Stock Exchange, some look to gain exposure to up and coming firms. Such companies will typically be found on the Alternative Investment Market (AIM) – which is the UK’s secondary stock exchange.

This particular marketplace carries a much higher risk/reward ratio in comparison to established blue-chip stocks, as many AIM-listed firms are yet to truly prove their business model. Or, they might be established but simply possess a small market valuation. Either way, if you do want to allocate some of your capital to small UK companies – then this is left to a mutual fund like the MI Chelverton UK Equity Growth Fund.

After all, the investment fund in question will personally determine which UK stocks are worth backing, and which aren’t. The experienced fund manager will also determine when the right time is to buy or sell. The MI Chelverton UK Equity Growth Fund consists of was first launched in 2014 and had just over £722 million in assets as of August 2020.

Led by James Baker and Edward Booth, its portfolio contains 127 individual stocks. This comes from a variety of sectors – with a lot of focus on technology, healthcare, support services, and consumer goods. Some of its holdings include Future, Clingen, SDL, Premier Foods, Gamesys, and dotDigital.

Other popular UK mutual investment funds are:

- Blackrock UK Fund: This mutual investment fund focuses on large-cap UK stocks. This might be more suitable if you wish to take less risk – as the fund consists of established firms with larger market valuations.

- ASI Global Smaller Companies: This is another mutual investment fund that targets up and coming UK stocks. The fund has performed well since its inception so it might be worth diversifying between this fund with that of the MI Chelverton UK Equity Growth to balance out your risk levels.

S&P 500 Index

Even if you’ve never placed a single trade before, there is every chance that you have heard of the S&P 500. For those unaware, the S&P 500 is a US-focused stock market index. It tracks the performance of 500 large US companies – from both the NYSE and NASDAQ. This includes the likes of IBM, Google, Twitter, Disney, Berkshire Haway, Verizon, Apple, Amazon, and many more.

Since it was launched in 1926, the S&P 500 Index has returned an average of just over 10% per year – weighted out over the course of time.

That is to say, the largest US stocks in terms of market value will contribute a larger percentage to the index. In terms of gaining exposure, there are plenty of investment funds in the UK that track the S&P 500. At the forefront of this is Vanguard – which has its S&P 500 ETF

To ensure you are able to find an S&P 500 investment fund that meets your needs, below you will find some other options:

- iShares Core S&P 500 ETF

- SPDY S&P 500 ETF

- Portfolio Plus S&P 500 ETF

Exchange Traded Investment Funds

We’ve already discussed a number of investment funds that come in the form of ETFs. To recap – this includes the Vanguard S&P 500 Index, SPDR Gold ETF, and iShares Russell 1000 ETF. However, there are many other ETF investment funds that are worth researching.

iShares MSCI Hong Kong ETF

As the name implies, this investment fund focuses on the Hong Kong markets. In particular, the fund contains 41 individual shares that are listed on the Hong Kong stock exchange.

Although the portfolio is reasonably weighted, two companies collectively make up just over 36%. This consists of AIA Group (23.95%) and Hong Kong Exchanges and Clearing (12.14%).

After that, you have the likes of Sun Hung Kai Properties, Techtronic Industries, and CK Hutchinson.

iShares FTSE China 25 Index ETF

An additional overseas ETF to research is that of the China 25 Index. Backed by heavyweight fund provider iShares, this will get you access to 25 large-scale Chinse companies.

This includes the likes of Tencent Holdings, Meituan Dianping, China Construction Bank, Alibaba, and China Mobile. As one of the fastest and most-powerful economies globally – this investment fund is well worth keeping an eye on.

Ethical Investment Funds UK

By investing in this type of investment fund, there will be certain ethical codes in play. At one of the end spectrum, this might be a case of avoiding certain industries and sectors – like gambling, alcohol, tobacco, or defence.

In some cases, an ethical investment fund will focus purely on companies that are involved in socially beneficial areas. For example, this might include a firm that is looking to develop clean energy.

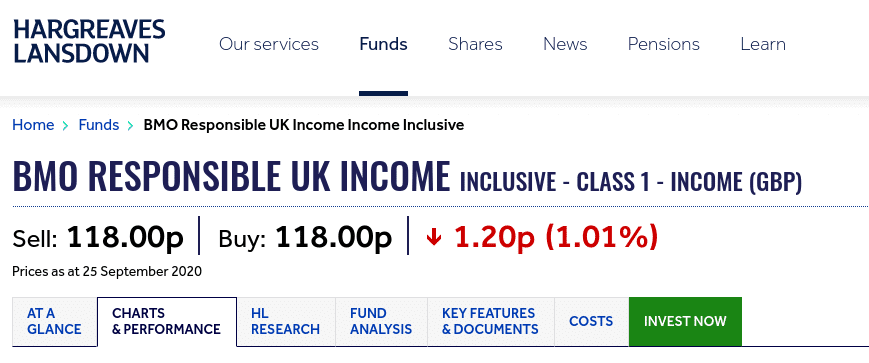

BMO Responsible UK Income 2 Inc

This ethical investment fund is a UK-based option that focuses on British stocks. The key point with this fund is that each stock must not only meet a range of ethical considerations, but they must carry a small-to-medium market cap. In terms of performance, the fund has outperformed the wider FTSE All-Share index in 4 out of the past 5 years.

When going direct with this fund provider, you’ll need to invest at least £500,000. As such, you are advised to go through a third-party broker. For example, Hargreaves Lansdown requires just £100, or a minimum direct debit or £25 per month. In terms of fees, this fund will cost you 0.91% per year.

Jupiter Responsible Income – Invest in Large UK Shares That are Actively Managing Social Responsibilities

This investment fund focuses on companies that are actively managing their social and environmental issues. The portfolio contains 45 stocks in total – with the likes of GlaxoSmithKline, RELX, Vodaphone, Teso, and Aviva leading the way.

Once again, going through Hargreaves Lansdown will require a minimum lump sum of just £100 or £25 per month. The ongoing charge is 0.93% with no upfront fee.

ISA Investment Funds

When you open an account with an online stock broker that offers ISAs – you will be able to invest up to £20,000 without paying any capital gains or dividend tax. Your annual allowance will reset once the 2021/22 tax year kicks in – with a further £20,000 on offer.

In terms of what you can invest in, most asses classes are eligible. This includes all investment fund types – such as ETFs, index funds, mutual funds, and investment trusts. Additionally, stocks, bonds, and cash are also included. The most important thing is that you choose an investment platform that not only offers ISAs – but your chosen fund.

Some ISA brokers in the UK include Hargreaves Lansdown and IG. Both of these platforms offer thousands of ISA-eligible funds, and fees are reasonable.

UK Pension Investment Funds

Some investment funds are tailored to those of you that want to build a pot for your retirement years. In fact, there are hundreds of options in the market – most of which will take a sliding risk approach. In simple terms, this means that the provider will decrease the amount of risk taken as you get closer to your retirement age.

In most cases, you’ll find that your portfolio will focus on stocks, with a small allocation of bonds. As the years go on, the focus on high-grade bonds will increase to ensure the risks are reduced.

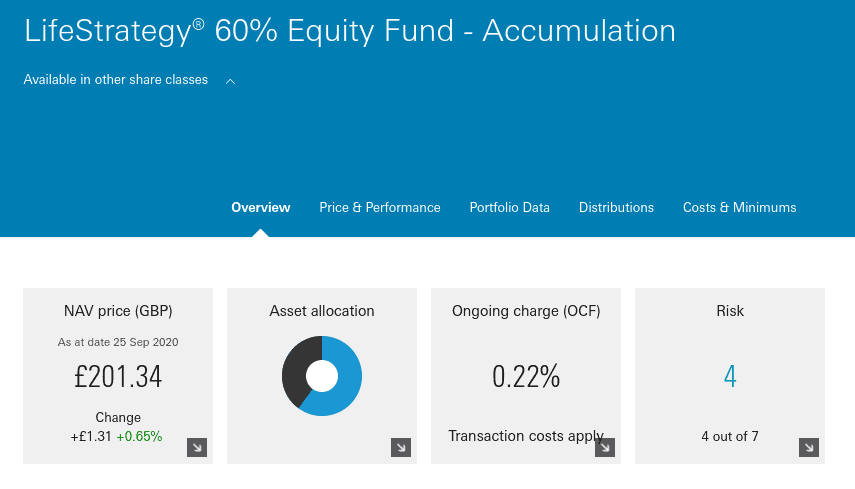

Vanguard Pension Investment Fund – Choose Your Target Retirement Date

Vanguard offers a variety of pension fund options – all of which centre on a target retirement date. At the time of writing, this runs from 2025 to 2065 – in increments of 5 years. For example, let’s say that you plan to retire in 2035 – which is 15 years away. By opting for Vanguard, the fund provider will hold 69% in stocks and 30% in bonds.

Then, 5 years later, Vanguard will rebalance your portfolio so that it contains a stock/bond split of 64%/36%. If you like the sound of Vanguard for your pension investment fund needs, you can get started with a lump sum injection of £500 or more. You can also elect to set up a direct debit, as long as you meet a £100 minimum.

What Are Investment Funds UK?

Investment funds allow you to inject money into the financial markets in a passive nature. You don’t need to have any experience or knowledge of how the markets work – as the fund manager will take care of all investment-related decisions. That is to say, your chosen investment fund will buy and sell stocks, bonds, and other assets on your behalf.

This particular investment scene actually covers several asset classes. For example, investment funds can refer to ETFs like REITs, mutual funds including property funds, investment trusts, money market funds or index funds. The key point is that each of the aforementioned fund types allows you to gain exposure to a full basket of assets through a single trade.

For example, let’s suppose that you invest in an income fund that focuses on small UK companies. By investing just a few hundred pounds, your portfolio might consist of 200+ small-call firms listed on the AIM. Similarly, by investing in a fund that tracks the FTSE 100, you’ll be purchasing a basket of 100 large-cap UK stocks.

In terms of the fundamentals, investment funds are run and managed by large-scale financial institutions. Some of the biggest players in the space include iShares, SDPR, and Vanguard. Your money will be pooled together with thousands of other investors – meaning that the fund will often have billions of pounds under management.

How do Investment Funds Work?

Whether you opt for an ETF, mutual fund, or trust – the investment process is largely the same. To help clear the mist, let’s look at a quick example of how investment funds work.

- You invest £10,000 into an investment mutual fund

- The fund manager focuses on large-scale UK stocks

- In total, the investment fund purchases shares in 150 companies listed on the London Stock Exchange

- In theory, you will own a small proportion of each stock purchased by the fund – based on the amount you invested

- For example, if the fund has 4% of its portfolio in HSBC, your £10,000 investment will consist of £400 worth of HSBC shares

When it comes to making money, most UK investment funds pay dividends. This will be a share of any stock dividends or bond coupon payments that the fund has received on behalf of its investors. Your share will typically be distributed every 3 months, albeit, some funds payout every 6 or 12 months.

Types of Investment Funds

As we discussed above, there are many types of investment funds. Most operate in the same way, insofar that you will get to invest in a basket of assets in a passive manner. The fund will make asset purchases on behalf of its investors, and determine the right time to sell.

With that said, there are some slight differences between each investment fund type, which we list below:

- Mutual Funds: This type of investment fund will determine which assets to buy and when. The fund manager has the flexibility to choose which assets to invest in, as they are not tied to a specific market. As this fund type is actively managed, the fees are slightly higher than ETFs.

- ETFs: This investment fund will track a specific marketplace. For example, if the objective of the ETF was to track the NASDAQ 100, it will look to replicate the NASDAQ exchange like-for-like. ETFs are often the most cost-effective option as they are passively managed.

- Investment Trusts: Trusts are similar to mutual funds. This is because your capital will be actively managed by the fund – insofar that they will make all investment decisions. Trusts are not tied to a specific market, which comes with flexibility.

- Index Fund: As the name suggests, index funds will track a specific stock market index like the FTSE 100 or Doe Jones. The fund will buy shares in all companies that make up the index at the same weighting system.

Some investment funds for UK investors can be explored below:

- Index Funds

- Mutual Funds

- Tracker Funds

- Vanguard Funds

- Money Market Funds

- Income Funds

- Ethical Investment Funds

- Investment Trusts

- Property Funds

- REITs

- Gold Funds

- Technology Funds

- Absolute Return Funds

- Multi Asset Funds

- Private Equity Funds

- Fixed Income Funds

- Alternative Investment Funds

- Global Income Funds

- Managed Funds

- Irish Funds

- Renewable Energy Funds

- Passive Funds

- Emerging Market Funds

- Jupiter Funds

- European Funds

Investment Trusts vs Funds

Investment trusts are one branch of the wider investment fund spectrum. They are popular in the UK, as over the past decade trusts have generally outperformed mutual funds.

One of the main differences between trusts and funds is that the former has the capacity to borrow money. Known as ‘gearing’, this gives the trust much more in the way of purchasing power. In turn, they can trade with much more than they have in working capital.

Fundamentals of Investment Funds

- No Experience Needed: The process of picking shares or bonds can be challenging. After all, you need to have a good understanding of technical and fundamental research and be able to read and interpret company reports. This is why so many newbies opt for UK investment funds, as you don’t need to have any knowledge of how the financial markets work.

- Passive Income Steam: Once you inject money into an investment fund, you can sit back and allow the provider to buy and sell assets on your behalf. This is for earning passive income, as you will likely receive a dividend payment every three months.

- Low Investment Amount: You can now invest in funds with a small amount of capital. In most cases, you can get started with just a couple of hundred pounds.

- Low Fees: Most of the investment funds for 2022 will charge an ongoing fee of less than 1% per year. Some are much closer to 0% – especially ETFs and index funds. Even at the higher end of the scale, this offers some value as you will be investing on a passive basis.

- Diversification: Diversification allows you to reduce your overall exposure to risk by investing in heaps of assets across multiple industries and markets. Achieving this goal as a DIY investor can be both costly and time-consuming. This isn’t the case with investment funds, as you can often gain exposure to hundreds (if not thousands) of assets via a single injection of capital.

- Difficult to Access Markets: Some financial markets can be difficult to access for the everyday UK investor. An example of this is stocks and shares listed in the emerging markets. Investment funds, on the other, often have billions of pounds under management. This means that there is no marketplace inaccessible for them. As such, investment funds offer a backdoor into a specific asset or sector that you’ve been trying to gain exposure to.

Investment Fund Brokers in the UK

If you want to invest in an investment fund you will need to find a reliable online broker that is regulated by the FCA. Although some fund providers allow you to invest directly through their website, you will often find that fees and account minimums are higher. As such, we would suggest sticking with a third-party platform.

1. Plus500

This trading platform specialises in CFDs – meaning that you can place buy and sell orders on your chosen fund. This gives you much more flexibility, as you attempt to profit irrespective of which way the markets go.

All CFDs at Plus500 can be traded on a commission-free basis – and we find that spreads are typically very tight. Supported payment methods include a debit/credit card, Paypal, and bank transfer. The minimum deposit amount is £100 and there are no transaction fees. This CFD platform is licensed by the FCA and its parent company is listed on the London Stock Exchange.

Plus500 fees:

| Commission | 0% |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | $10 per quarter after 3 months inactivity |

2. IG

IG offers over 10,000 traditional shares and funds – all of which you can access as a UK investor. This covers mutual funds, ETFs, and investment trusts. Fees will vary at this platform, but IG notes that on average UK investment funds will cost you about 0.14% annually. Expect to pay more when investing in mutual funds.

IG also offers ISA accounts that let users shield the first £20,000 that is invested from capital gains and dividend tax. This FCA broker requires a minimum deposit of £250 and supports debit/credit cards and a bank transfer.

IG fees:

| Commission | 0% commission on all CFD instruments apart from shares. Fees vary depending on the exchange. |

| Deposit Fee | Free (0.5%-1% fee on credit cards) |

| Withdrawal fee | Free |

| Inactivity fees | £12 a month after 2 years inactivity |

Sponsored ad. Your capital is at risk

3. Hargreaves Lansdown

You can get started with a minimum investment of £100 or sign up for a monthly direct debit of £25 or more. If you opt for a lump sum, then debit card and bank account transfers are supported. You won’t pay any fees to fund your account, but your chosen investment fund will come with an annual charge. Additionally, Hargreaves offers ISA accounts.

Hargreaves Lansdown fees:

| Commission | Average of 0.45% per year for investments less than £250k |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | N/A |

Sponsored ad. Your capital is at risk

4. Fineco

What we also like about Fineco is that you will not pay any dealing fees. This means that you can invest in as many funds as you like without getting hammered by flat charges. The minimum investment amount per fund is £100 and you will need to deposit cash from your UK bank account. Fineco is highly trusted in the UK trading space – with that all-important FCA license and FSCS protection.

Sponsored ad. Your capital is at risk

Conclusion

The investment fund space is getting more and more popular with UK traders, as the end-to-end process is passive. All you need to do is select a fund, meet the minimum investment amount and that’s it – there is nothing more to do.

On top of growing your capital as the net asset value of the fund increases, you can also earn dividends. This is your share of stock dividends or bond coupon payments – and is typically distributed every three months.