How to Buy Moderna Shares Online in the UK

Moderna is a US-based pharmaceutical company that specialises in biotechnology. Its main focus is on the development of vaccines – including that of COV-19.

Much like many other pharmaceutical companies that claim to be inching closer to a COV-19 vaccine, Moderna shares are booming in 2020. Although the stocks are listed in the US, making a purchase from the UK can be completed in less than 10 minutes when using the right broker.

In this guide, we’ll walk you through the process of how to buy Moderna shares online in the UK. On top of exploring the best UK share dealing sites to do this with, we’ll also run you through some background information on Moderna as a company.

-

-

Step 1: Find a UK Stock Broker to Buy Moderna Shares

Moderna is an American company that is publicly-listed on the NASDAQ. There are hundreds of UK-based brokers that give you unfettered access to this stock exchange, which is great.

However, you then need to consider other factors associated with your chosen platform – such as how much it charges to buy US-based shares and what payment methods are supported. And of course – your chosen broker needs to hold a license with the FCA.

To point you in the right direction, below you will find a small selection of stock brokers that allow you to buy Moderna shares online in the UK.

Step 2: Research Moderna Shares

Moderna shares have performed very well in 2020, largely because of its progress with a potential COV-19 vaccine. However, the biotechnology company isn’t the only firm active in the race to find a treatment – meaning that you need to consider the risks of making an investment.

In other words, if Moderna is unable to bring its vaccine to the wider markets – the value of your investment is likely to suffer greatly. With this in mind, you need to perform some broader research on the company before proceeding with a share purchase.

Below you will find some important considerations that you need to make to help clear the mist.

What is Moderna?

Launched as recently as 2010 – Moderna is a US-based biotechnology company that focuses on a specific niche on vaccine development. This is based on inserting mRNA into human cells with the view of developing immunity to a specific virus. Although the company went public in late 2018 – you might not have heard of it until recently.

This is because Moderna is one of many companies that is actively looking to develop a vaccine for COV-19. In fact, the firm was one of the first to begin trials. As of late July, Moderna entered phase three of its clinical trial process – which is evident in the speed in which its shares have increased over the past 10 months.

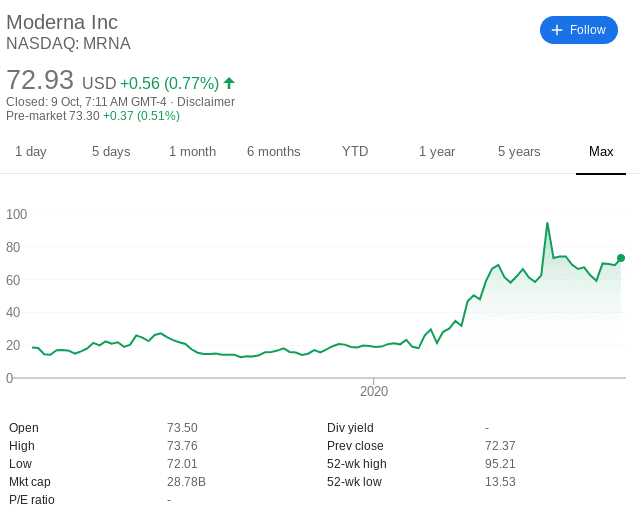

Moderna Share Price History

Moderna made the transition from a start-up to a fully-fledged PLC in just 8 years. It held its respective IPO in December 2018 – opting for the NASDAQ. The firm priced its shares at $23 each – which gave it an initial valuation of approximately $7.5 billion. This made it the most successful IPO for a biotechnology company in terms of the amount raised.

Fast forward to October 2020 and Moderna carries a market valuation of over $28 billion. It is important to note that it hasn’t been all plain sailing for Moderna – as its share price remained somewhat flat until March 2020. This is, of course, when the firm announced that it was working on a vaccine for COV-19.

Since then, the shares have been on a strong upward trajectory. In fact, they hit highs of $95 in July – representing a YTD increase of almost 400%. At the time of writing, Moderna shares have tailed off slightly to $73, albeit, this still translates to 2020 gains over 280%.

Moderna Shares Dividend Information

If you are looking to add some dividend stocks to your investment portfolio – Moderna won’t be for. To date, it has never paid a dividend does not plan to do so for the foreseeable future. After all, not only is Moderna is still a young company – but it is investing most of its incoming cash flows into research and development.

Check out our page on the best dividend stocks of 2020 if you’re looking to invest in some income-generating companies.

Should I Buy Moderna Shares?

Make no mistake about it – investing in Moderna shares in this current economic climate is a high-risk gamble. This is because investor appetite is primarily focused on a vaccine for COV-19. Sure, the firm was one fo the first pharmaceutical entitles to begin clinal trials – which is a great sign.

However, there are dozens of other companies out there that also claim to be inching closer to a potential treatment. As such, if Moderna is not the one to reach this feat – it is all-but-certain that its share will move in the opposite direction. In fact, this is likely to be the case the very moment the markets get whim of a potential delay or regularly stumbling block.

Here’s what you need to know before you buy Moderna shares.

Everything Lies on its Phase 3 Results

As noted above, investors have been pumping money into Moderna shares because of its progress with its COV-19 vaccine trials. As it stands, the firm is now in the crucial stage of phase 3. We won’t know how the trial will pan out until Moderna publishes its results – which is imminent.

What we do know is that the FDA has already put a temporary hold on other clinical trials owing to concerns about safety. In particular, this includes biotechnology counterpart Inovio, as well as pharma-giant AstraZeneca.

Consistent Losses and a Major Drop in Revenue

Putting the ongoing COV-19 clinical trials to one side momentarily, it is important to make reference to Moderna’s financials – which do anything but paint a good picture. For example, the firm has lost more than $200 million in each of its prior four quarters. This is monumental when you consider the firm’s market capitalisation.

Sure, Moderna is currently worth $7.5 billion, but it was valued at just a fraction of this figure this time last year. Additionally, stockholder should also be concerned about the sheer size of its revenue decline.

For example, while Moderna reported sales of $135 million in 2018, this figure stood at just $60 million in the following year. This represents a decline of 55%.

Moderna Shares Buy or Sell?

Buying Moderna shares is somewhat of a gamble – as much of your ability to make money is dependent on the firm’s phase 3 vaccine trials for COV-19. Crucially, this means that both the upside and downside potential is huge. Scenario 1 is that the results of phase 3 are positive – and the share price of Moderna follows suit. Scenario 2 is that the results were not as expected – or a regulatory hurdle comes into play. If this is the case, then expect the shares to drop – and quickly.

The Verdict?

Moderna shares offer a high-risk/high-return proportion. With this in mind, you are best to keep your stakes to a minimum. You can invest from just $50 when using our top-rate broker – which is about £40. In addition to this, the platform offers several other pharmaceutical stocks that are also working on a COV-19 vaccine.

Other Vaccine Shares

Interested in investing in other pharmaceutical companies that are involved in developing a coronavirus vaccine? Check out the list below.

FAQs

What does Moderna do?

Moderna is a biotechnology company that is focused on finding vaccines to viruses. It is based in the US and has been operational since 2010.

What stock exchange are Moderna shares listed on?

Moderna shares are listed on the NASDAQ exchange in the US.

Do Moderna shares pay dividends?

No, Moderna does not and has not ever paid a dividend. It is a loss-making company that has been public for just under two years – so don’t expect a dividend any time soon with this stock.

How close is Moderna to a COV-19 vaccine?

As of October 2020, Moderna is in phase 3 of its clinical trials.

How do you buy shares in Moderna in the UK?

You simply need to open an account with an online broker that allows you to buy shares in NASDAQ-listed companies.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up