Options Trading UK Guide 2025

Options trading in the UK is an advanced, but extremely flexible way to get into the market. With options, you can speculate on the timing of price changes for stocks, forex, commodities, and more. Plus, trading options allows you to craft custom strategies that limit your risk or that let you profit when the market moves sideways.

Interested in jumping into options trading in the UK? We’ll explain how options trading works and highlight binary options trading, which is increasingly popular in the UK. We’ll also offer some binary options trading strategies and tips, plus review popular trading brokers in the UK.

What is Options Trading?

Options trading in the UK involves buying a contract that gives you the right to purchase an underlying asset at a predetermined price on a certain date.

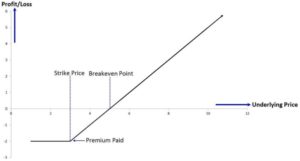

There are three key components to an options contract: the premium, the strike price, and the expiration date. The premium is the cost of options contract itself, which you pay to enter any options trade. The strike price is the price at which you agree to purchase the underlying asset if you decide to exercise your option. The expiration date is the date by which you are allowed to exercise your contract. After this date, the options contract expires and becomes worthless.

A suitable way to understand how options trading works is with an example. Let’s say you want to buy options to buy AstraZeneca shares, which are currently trading at £84. If you think the price of AstraZeneca will rise in the future, you might pay a premium of £10 for an options contract that gives you the right – but not the obligation – to buy AstraZeneca shares for £86 per share in the future (the strike price).

If the price of AstraZeneca remains below £86 share, you can simply allow your options contract to expire. You only lose the £10 per contract you paid in premiums. If the price rises above £86 per share, you now have the option to buy shares of AstraZeneca for less than they cost on the open market. You might not make a profit initially since you still need to recoup your £10 per contract. But if the share price rises significantly beyond £86 per share, you can make enough money to cover the premium you paid plus an additional profit.

It’s also important to note that UK options traders don’t have to hold their contracts to expiration. You can also sell your options contracts to another trader in exchange for the current premium price. This allows you to exit your trade and turn a profit or loss based on whether the options contract has increased or decreased in value since you purchased it.

Binary Options Trading

Binary options trading is similar to traditional options trading, but it operates on an all-or-none basis. When trading binary options, you pay a premium and agree on a strike price and expiration date. Importantly, you also agree on a potential payout if your trade is successful – say, 70% of the value of your premium payment.

If the price of the underlying asset is above its strike price at the expiration of the binary options contract, you win that trade. You get your premium back, plus the agreed-upon 70% return. However, if the price of the underlying asset is below the strike price, you lose all of the premiums you paid. In that case, you lose 100% of your initial investment.

There are different types of binary options, including some that only require the underlying asset to reach its strike price at any time before expiration. Binary options trading is somewhat easier to understand than traditional UK options trading, but it can be significantly more risky.

What Assets Can You Trade as Options?

UK options trading covers a wide variety of assets, including stocks, forex, commodities, and more. Stock trading and forex trading through options are particularly popular since these assets are relatively volatile and prices can trend strongly in one direction. Options can also be used to trade other types of assets, like ETFs, bonds, and cryptocurrencies.

It’s worth noting that oil trading, gold trading, and other types of commodity trading typically happens through futures instead of options. Futures trading and options trading in the UK are very similar, except that you are obligated to exercise your futures contract on the expiration date when you hold futures contracts.

Features of Options Trading UK

Options trading offers a number of key features. Let’s take a look at some of these features in detail:

Cost Efficiency

The main reason many UK traders turn to options is that they are cost-efficient. If you want to take a £1,000 position in, say, Tesco shares, you would need to commit £1,000 to buy those shares directly. To take a £1,000 position through options, however, you might only need to pay £50 in options premiums. The options contracts you buy for that price can give you the right to buy £1,000 of Tesco down the line.

Cost efficiency might not sound like a big deal, but it’s important. The less money you have to commit to any single trade, the more trades you can make with a small trading account.

Flexible Trading Strategies

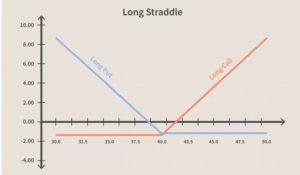

Another element when trading options is that you can develop highly custom trading strategies. For example, you can buy two sets of options contracts at different strike prices to hedge your bet about the future price of a stock or forex pair. Alternatively, you can buy options contracts that have different expiration dates to bet that a stock will go down in the short-term, but up in the long term.

Another element when trading options is that you can develop highly custom trading strategies. For example, you can buy two sets of options contracts at different strike prices to hedge your bet about the future price of a stock or forex pair. Alternatively, you can buy options contracts that have different expiration dates to bet that a stock will go down in the short-term, but up in the long term.

These types of complex trading strategies are difficult to achieve when buying assets outright or through CFDs.

Defined Risk

When trading options in the UK, the maximum amount you can lose from any single trade is very well-defined. Typically, it is limited to the amount you paid in premiums to open your trade.

Since you’re not obligated to exercise your options contract, you can simply allow it to expire worthless if a trade doesn’t work out in your favour. This is also true for binary options trading – the amount you lose in a losing trade is simply the amount you paid in premiums.

Benefit from Price Increases

Options trading in the UK has leveraged baked into every position. You only put down a small amount of money – the premium – to open a position. Yet your return is still based on the difference between the asset price at expiration and the strike price in your contract.

Is Options Trading a Good Idea?

To explore this question in detail, let’s look at an options trade for BT shares.

Let’s say you pay £50 in premiums for the option to buy 1,000 shares of BT stock at a strike price of £1.12. If BT shares only rise to £1.12, you have still lost £50 in premiums since there’s no discount relative to the market. However, if BT shares rise to, say, £1.20, you earn £0.08 per share for a total of £80. After accounting for the £50 you paid in premiums, you turn a £30 profit – a return of 60%.

There are some other things to keep in mind when trading options, though. If you are trading stock options, it’s important to think about dividends. You won’t be eligible for a payout if you only own options contracts, but dividends can cause the price of a stock to move up or down temporarily. That can have a big impact the price of an options contract or the value of an existing position.

Options trading in the UK also comes with tax implications. Options traders must pay capital gains tax on any profits at the end of the year.

Risks of Options Trading

Options trading also comes with some significant risks. First and foremost, while your maximum loss is limited to the premiums you paid for your options contracts, it is easy to lose this entire investment.

Using the example above, let’s say that the value of BT shares drops from an initial price of £1.10 to £1.08. If you owned 1,000 shares of BT outright, you would lose £20 on your trade. But since your options contracts are worthless at £1.08, you lose your entire £50 in premiums.

Trading binary options amplify this risk. You cannot recover part of your premiums if the trade goes against you since the trade is designed to be all-or-none.

It’s also important to keep in mind that options trading operates on a specific timeframe, which is dictated by the expiration date of your contract. It’s not enough to be correct about the direction or magnitude of an asset’s price move. You must also be correct about when that move will happen. This is significantly more difficult to predict, which makes it more trading binary options and traditional options riskier.

Options Trading Strategies

Approaching UK options trading with a clear strategy in mind is essential to your success. Trading options allows you to adapt to any market conditions, but it’s important to know what market conditions you expect in order to formulate an appropriate trade.

So, let’s take a look at some popular options trading and binary options trading strategies:

Flat Market Options Trading

There are many times that the market simply moves sideways with little volatility. While this might not seem exciting, binary options trading allows you to profit off of a flat market.

This binary options trading strategy simply involves buying binary options that are already in the money. That is, you will be trading binary options that will pay out if the price of the underlying asset doesn’t change between when you open your position and when it expires.

These contracts typically carry high premiums. However, those premiums can be worthwhile if you believe the market will continue trending sideways.

Volatility Options Trading

Another binary options trading strategy revolves around high volatility. If the market is bouncing up and down without a clear direction, trading binary options can lower your risk relative to trading traditional options.

Another binary options trading strategy revolves around high volatility. If the market is bouncing up and down without a clear direction, trading binary options can lower your risk relative to trading traditional options.

To trade volatility with binary options, purchase binary options with a short timeframe and a strike price that is just above the current price. The premium on these options should be cheap, so the amount of money you’re risking relative to the potential payoff is low.

This binary options trading strategy is frequently used for day trading when the market is choppy. Just keep in mind that trading volatility can be a bit of a gamble, so you shouldn’t place huge bets when using this strategy.

Momentum Options Trading

If an asset’s price is trending with strong momentum, it can be a popular candidate for trading options. Evaluate the timeframe of the price movement to choose an expiration date or time for your options contract along with a strike price. Keep in mind that premiums for strongly trending assets may be high since the options appear likely to be profitable if the trend continues.

Options Trading Tips

Mastering options trading takes time, practice, and dedication. To help you get started, here are five popular tips for options trading in the UK.

- Take an Options Trading Course

This guide is a great place to start learning about UK options trading. But if you really want to understand the ins and outs of trading options, take an options trading course. These online courses are taught by professional traders with decades of experience. Many instructors will help you build your own options trading strategy.

- Read an Options Trading Book

There are tons of good books explaining how to trade options, with highly detailed strategies and examples. Two options trading books we recommend are ‘Options Trading: QuickStart Guide – The Simplified Beginner’s Guide to Options Trading’ from Clydebank Finance and ‘Option Volatility and Pricing: Advanced Trading Strategies and Techniques’ by Sheldon Natenberg.

- Use an Options Trading Demo

Most popular options trading brokers in the UK offer free demo accounts where you can practice options trading risk-free. Using an options trading demo can help you try out new strategies or get a better handle on the options market before committing your own money to trades.

- Try Options Trading Signals

Trading signals can play an important role in helping you identify options trading opportunities. With options trading signals, you can get alerts whenever a particular setup appears or automatically set entry and exit points for your trades. Trading signals can also help remove some of the emotion from trading..

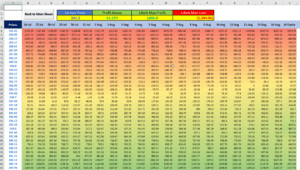

- Use an Options Trading Calculator

Figuring out your potential profit and loss from an options trade – or even the breakeven price of an options trade – can be difficult. Thankfully, there are online options calculators that do most of the work for you. Just enter the details of an options contract and the current asset price, and the calculator will figure out the rest.

Figuring out your potential profit and loss from an options trade – or even the breakeven price of an options trade – can be difficult. Thankfully, there are online options calculators that do most of the work for you. Just enter the details of an options contract and the current asset price, and the calculator will figure out the rest.

Popular Options Trading Platforms

Choosing the right UK options trading platform is another important piece of options trading. Your UK options trading broker will determine what options you can trade and whether you can engage in binary options trading. Your trading platform will also be your main source for research and analysis.

There are lots of options trading brokers in the UK to choose from. Let’s review three of the most popular:

1. AvaTrade

AvaTrade is a popular options trading broker in the UK for forex options. This broker offers options trading on more than 40 different currency pairs. While AvaTrade is a CFD broker for most other asset types, the broker allows you to buy and sell options contracts directly – so you have the option to exercise your contract, not just to speculate on premiums.

AvaTrade is a popular options trading broker in the UK for forex options. This broker offers options trading on more than 40 different currency pairs. While AvaTrade is a CFD broker for most other asset types, the broker allows you to buy and sell options contracts directly – so you have the option to exercise your contract, not just to speculate on premiums.

One of AvaTrade’s features is that it offers a dedicated options trading platform called AvaOptions. You can evaluate different options trading strategies using the platform as well as calculate your profit, loss, and breakeven price. AvaOptions also offers professional risk management tools, including stop loss orders for options trades.

AvaOptions is available for desktop, web, and mobile. All options trades through AvaTrade are 100% commission-free. Just beware that the spreads can be somewhat high if you’re planning to sell your positions rather than exercise your contracts.

| Options Trading Fees | 0% commission + spread |

| Deposit Fees | No |

| Withdrawal Fees | No |

| Inactivity Fees | $50 (£40) per quarter after 3 months of inactivity |

| Monthly Account Fees | No |

Sponsored ad. 71% of retail investor accounts lose money when trading CFDs with this provider.

2. IG

IG offers two ways to trade options: CFD trading and spread betting. Each of these trading methods lets you speculate on changes in options premiums rather than buy and sell options directly. This can reduce your overall risk.

IG offers two ways to trade options: CFD trading and spread betting. Each of these trading methods lets you speculate on changes in options premiums rather than buy and sell options directly. This can reduce your overall risk.

IG offers a huge selection for options traders. You can speculate on US and UK stocks, global indices, commodities, forex, and more. The vast selection is important because it allows you to trade in multiple markets depending on conditions. CFD trades and spread bets are commission-free, although you will have to pay the spread.

IG also allows you to get access to the MetaTrader 4 and ProRealTime trading platforms. These two software packages offer extremely powerful tools like custom indicators and strategy backtesting. While the learning curve can be somewhat steep, these trading platforms are popular with intermediate and advanced options traders.

| Stock Trading Fees | Commission-free (plus spread) |

| Deposit Fees | No (0.5% – 1% for credit cards) |

| Withdrawal Fees | No (£15 for international bank transfers) |

| Inactivity Fees | £12 per month after two years |

| Monthly Account Fees | No |

Sponsored ad. There is no guarantee you will make money when trading CFDs with this provider.

3. Plus500

Plus500 offers commission-free options trading on stocks, indices, and commodities like gold and oil. Most of the stock options are for popular US tech companies like Amazon and Facebook. However, you can still get exposure to the UK market through options for the FTSE 100.

Plus500 offers commission-free options trading on stocks, indices, and commodities like gold and oil. Most of the stock options are for popular US tech companies like Amazon and Facebook. However, you can still get exposure to the UK market through options for the FTSE 100.

All options trading is through CFDs, so you don’t own options contracts outright. Rather, you’re speculating on price changes in the options premiums for these assets. There is a wide range of expiration dates and strike prices available, so you still have flexibility when trading options with Plus500. Plus500 doesn’t currently offer binary options trading.

Plus500 doesn’t have a dedicated options trading platform to help you see how your options strategy might play out. That said, the broker does have a convenient charting interface, which boasts dozens of built-in technical indicators and drawing tools. Plus500 also has a mobile trading app, which you can use to monitor the stock market on the go.

| Options Trading Fees | 0% commission + spread |

| Deposit Fees | No |

| Withdrawal Fees | No |

| Inactivity Fees | $10 (£7.60) per month after three months |

| Monthly Account Fees | No |

Factors to Consider when Options Trading UK

- Cost-efficient method for opening large positions

- Highly customizable trading strategies

- The risk of any trade is clearly defined

- Built-in leverage offers potentially high returns

- Potential for profit in sideways or bear markets

- Trade traditional options or binary options

- Potentially large risk of losing your entire initial investment

- Can be difficult for beginners to fully understand

- Requires correctly predicting the timing of a price movement

How to Start Options Trading in the UK

Ready to jump into trading options? We’ll show you how to get started with UK options trading using an FCA-regulated broker

Sign Up for an Options Trading Account

To get started, head to your broker’s website and sign up. Then enter your details along with a username and password to create a new brokerage account.

You will also have to verify your identity in order to comply with UK regulations. You can complete the verification step online by uploading a copy of your passport or driver’s license along with a copy of a recent financial statement.

Fund Your Account

Before you can start trading, you need to fund your account. You can usually deposit funds by debit or credit card, bank transfer, or e-wallet (Skrill or PayPal).

Place Your First Options Trade

Now you’re ready to open your first options trade. Search for the asset, expiration date, and strike price that are right for you, click on it to open a detailed page for that option. Then click ‘Buy’ to open an order form.

In the order form, enter how many options contracts you want to purchase. You can also enter a stop loss or take profit level, or add leverage to your trade. When your order is ready, confirm the position to open your first UK options trade.

Conclusion

Options trading is an advanced form of trading that gives you the right to purchase an asset at an agreed-upon price at a future date. UK options trading is popular among traders because it’s cost-efficient and offers potential upside profit.

However, it’s important to be cautious when trading options because it’s easy to lose your entire initial investment if a trade goes against you.

If you’d like to begin trading options, it’s wise to partner with an FCA-regulated broker that offers investor protection within the UK.